FIRE to me is broken up into two parts.

Firstly, you must reach financial independence (FI) where you’ll need to have enough assets generating enough money to cover your expenses forever.

This is pretty straight forward and whilst there are different variations of what people consider financial independence it’s much less convoluted then early retirement (ER).

Which is the second part to the FIRE equation and by far the most important.

I’ve done my fair share interviews for media outlets reaching out to me because they wanted to know more about the FIRE movement and what it’s all about. For some reason, I had quite a few in the last few weeks which you can listen to here, here and here.

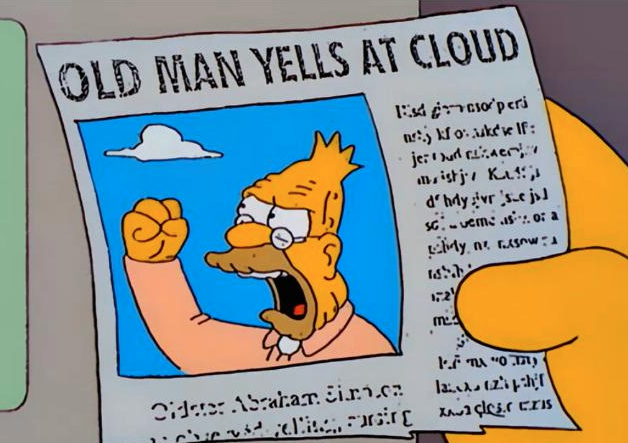

These interviews prompted me to make this post because the question that ALWAYS comes up is why would a bloke who has 50+ (hopefully) years left in the tank want to retire?

Wouldn’t it be boring?

So I’m here to set the record straight as to what I consider ER is and why it’s the more important step!

What Is Early Retirement?

The most misunderstood and important part about FIRE has to be ER.

It’s mostly because the word ‘retire’ has a certain connotation with most people. If you actually look up the definition of retirement you will get different answers depending on which dictionary you are reading.

Retire Early in a FIRE context does not mean you stop working!

I honestly could think of nothing worse than to sit around all day doing nothing for 50+ years and I’ve yet to hear about anyone who achieves FIRE handing in their resignation letter only to sip Pina Coladas by the pool and play golf all day until they die.

Meaningful work that ignites a passion is awesome. I want to do work that brings purpose and meaning to my life forever. But unfortunately, the fact of the matter is the majority of today’s society (myself included) sets an alarm to go to their place of employment to earn money.

We trade time for money.

Are there people out there that would do their job for free?

Sure.

Are there many?

Doubt it.

You cannot do some forms of meaningful work without first having achieved financial independence. Volunteering full time is one example.

Other forms of meaningful work may actually turn a profit. Maybe you always wanted to have a go at that coffee business but could not afford the risk financially. FIRE opens up these doors and allows you to pursue your dreams that you wouldn’t have otherwise had the money to take on.

If you think that people who have achieved FIRE are phonies because they still do paid work I have great news for you! Turns out there is an entire group of you guys dedicated to upholding the semantics of the word retirement called the internet retirement police! At least you’re not the only one…

My interpretation of retire early was never about not working. It was always about retiring from the rat race and having the freedom to pursue meaningful work of my choice whether that is paid or unpaid doesn’t matter.

Retire is probably not the best word but FIRE is a catchy acronym and it’s stuck so just deal with it.

If you don’t like using the word retire that’s understandable. I myself have often thought that it doesn’t quite describe what FIRE is all about.

But what I think we can all agree on is that simply reaching FI should not be the end goal which brings me to discuss…

Why ER Is The Important Part

Think back to when you first discovered FIRE, or even just the concept of financial independence.

If you’re anything like me, the thought of having all the money in the world was not the exciting part. It’s what having that money could do for your life. The freedom that financial independence can grant is something that has never left my mind since I stumbled across it ~6 years ago.

Is there any point in reaching FI without using that freedom to live your dream life?

I know plenty of people at my old job who have reached FI but are still miserable in a job they don’t particularly enjoy!

You know the type.

Been at the same steady job with great benefits for 35+ years. Pretty conservative type operator who has tucked away enough Super to comfortably fund 4 retirements yet has lost all enthusiasm, motivation and what seems to be general happiness in the last few decades but still rocks up every Monday and complains the whole time.

You often wonder to yourself, why the f is old mate still working if he clearly isn’t happy here and has enough money to retire…?

That’s a very good question.

Maybe they are a creature of habit. Maybe they don’t know they are FI yet and think they still need to work. Maybe they are super conservative and are worried they will run out of money.

Or maybe they just don’t know anything else and are scared that they will lose purpose in life.

I have no idea about other peoples situation but if someone was truly FI and too scared to quit their job because they feared the unknown… they have missed the entire point of financial independence and FIRE in my opinion.

Everyone who reaches the end goal will always have to take a leap of faith of some sort. Maybe you have crunched the number for a standard 4% withdrawal rate or maybe you are a little more conservative and have opted for a 3% rate.

Regardless, all of us will reach the point where we will have to make the decision and hand in our resignation letter to start our new careers in the exclusive and more exciting field of ‘whatever makes me happy’. This career is not fueled by monetary gains, status symbols or power but rather what brings the most happiness to your life. If you get paid for this passion, sweet! Maybe you can donate this extra money to a charity which will almost certainly bring you even more happiness.

If you’re one of those lucky ones who thoroughly enjoys their current job and would happily work it for free then hats off to ya, you’ve already reached the end goal in terms of ER! I really wish everyone was in that position but the truth of the matter is they aren’t. And failing to RE to move onto more fulfilling, meaningful and enjoyable work is such a tragedy.

If you reach FI but continue working a job you don’t like and fail to RE, what’s the point?

Don’t Wait Until It’s Too Late

Just one more year…

Let’s tuck away just a little bit more so we definitely won’t run out of money in retirement…

This is a dangerous game to play but completely understandable and something that I’ll almost certainly do as well. But at some point we must trust our planning, numbers, and ability to adapt to the situation should something disastrous happen post rat race.

The biggest risk in life is not taking one!

Once you have reached FI, complete the journey, pull the trigger and RE to start the new chapter in your life.

I’ve haven’t heard too many people ever regretting pulling the trigger early, in fact, most say they should have done it earlier!

Have you retired yet? Did you wish you did it earlier or was it something you regretted? I’d love to know in the comment section below.

Oh and I’ve now decided that every good blog should have a sign-off.

So until next time…

Spark that 🔥

Thanks Firebug, excellent article. That had a lot of resonance, I suspect because the “what will you do?” question is one I need to more systematically fill out.

Travel would form part of it, definitely. It’s probably psychologically such a different task than designing the “how” question, that it’s temptingly easy to defer.

Hi Firebug, as the saying goes find a job you love and you will never work a day in your life.

Have a good day

Hey Mick,

Good on theory, hard to do in practice.

Such is life.

Yeah, good point here. I’m recognising that in myself lately, that I’ve been so geed up over FIRE that I haven’t really thought about what my days would look like post-FIRE. I sort of thought pina coladas by the pool and golf all day, but I appreciate that might get old quick. Not sure I’ll be super-motivated to start my own business or anything either. Need to figure out what my middle ground is so I can be just as excited about that so when the day comes to sign off from the rat race I’m ready to enjoy each day from there on.

Thought-provoking stuff!

Completely agree mate. It’s the end goal but often the part that’s most neglected… Iroinc isn’t it

Thanks for another great article. Had to laugh at this part: ” retiring from the rate race”. Is that a clever pun or just another classic Firebug typo? I think we know the answer 😉 Enjoy your travels mate.

God dam it haha! Wouldn’t be an AFB post with out some spelling and grammar mistakes right?

Thanks for another important post FB. It’s funny I was just reading a blog yesterday about a woman in the states who FIRE’d and she went as far as saying her blog doesn’t make a profit to defend herself against the retirement police.

https://www.thecut.com/2019/03/early-retirement-38-tanja-hester-fire-blogger.html

This notion that someone who has

Reached RE cannot work is ridiculous and needs to be stamped out entirely.

Hope you and Mrs FB are enjoying the UK so far.

The IRP are too busy looking at the trees to appreciate the forest. Screw em!

I was one of those misunderstood people who worked 35 years even though I could fund 4 retirements because it was fun! I did eventually retire earlier than most but I also worked well past early retirement. Now I still work a day or two, now and then for entertainment and volunteer and pursue many hobbies. I find a small amount of challenging work adds to my life. Nice post!

That’s crazy!

Thanks mate, it’s been a blast so far and it’s only just beginning. There’s a lot to look forward to!

Cheers

Great & important article FB👌

For me at the age of 40 nowadays, the golden road to FIRE is to work part time as a preschool educator (still can’t believe that I am getting paid for playing with the children😁), while spending the other half of the week surfing 🏄♂️ and with my partner and our lovely 6 months daughter.

What I have learned along the way is that 🔥doesn’t have to be “all or nothing” – as working till you get the lucky number to retire completely.

You can find your dream job, work part time and have smaller amount in your portfolio to allow this kind of FIRE.

Sounds like an amazing balance mate. I should start surfing 🏄… Looks like great fun

Thank you for bringing some balance to the debate.

My pleasure Serina 😊

Great article. Hoping the travelling have been rewarding and you settle well in London. Your comments truly resonated with me. I am one of those people who stayed in a job long after the passion was gone and having reached financial independence. Why did I do this?

1) Fear of reactions from others – what are you crazy? what are you going to do with your time? maybe you will run out of money? envy (people can relate better to the poor struggling types)?

2) Concern about isolation or feeling that life has a lack of purpose

3) Concern about obtaining future paid employment in IT (my life’s career) if I had a change of heart – I am in my early 50s

Taking the Leap Of Faith

I was encouraged to finally leave my paid job by a good friend – she told me to make it my 2019 New Year’s resolution. She could not understand that I was working in a job that I no longer liked if I did not need the money. So I took the plunge and left my job on good terms (I was terrified). I have been off work for just over a month, but I have been doing a small amount of handover work in that time. To make it easier, I did plan to leave work in the warmer months, as I prefer summer and the longer days.

I am one of those people who do not like to use the word RETIRE, because I want to keep active and do some worthwhile activities (not necessarily paid). My biggest passion is care for the environment.

So far leaving my paid job has been good – I have started on many of those unfinished house projects (even carefully restoring an old garden gnome), engaged in more reading, finance work, gardening and swimming (I have always kept active, but endurance swimming for me is a kind of therapy), enjoyed a small amount of volunteer bush care and have been spending more time with friends. I do intend to have a holiday soon and then try out some more volunteering and find out what suits me best. Ideally I would like to volunteer about three days per week.

When I went back to my old job to do some handover work recently, I felt sad for the people there and had no regrets about leaving. It is still very early days for me and I would like to hear from others who took the plunge some time ago.

The one thing that I have not yet done is to be open about leaving my previous paid job. Only a few close friends and my partner know. My biggest issue is the thought of negative comments and people thinking you are filthy rich! It is much easier to say you left your job because you were sick, or that you were made redundant!

Amazing story mate!

I agree that the word retire doesn’t quite hit the mark. I loved what you’ve transitioned into also! One thing that I hadn’t thought of was the time to reconnect with friends and family.

So underrated!

We only have so many years in life and it’s the relationships and memories that are most important imo.

Good on ya 🤙

This is a timely article. Have been pondering a lot of this myself. I work part time(3 days including 1 from home) and am increasingly finding myself with more free time, even with 3 kids and family commitments and FIRE is not too far away. One thing I struggle with is if I am not reaching my full potential. I know I could pursue promotions at work and make a really good contribution but not sure if it would make me happy. In a different context what would we say if someone is really talented at something but decides to hang up the boots early, eg. just say Buddy Franklin or Patrick Dangerfield decided to stop playing footy to ‘RE’ at the peak of their careers. Would be interested to hear any thoughts on this. Thanks again AFB for good thought provoking content.

Interesting concept.

I guess I’m selfish in that regard, I could be Mozart but if I wasn’t happy playing the piano I’d simply quit.

What does tend to happen is really talented people might go through times of adversity to please their audience or fanbase.

Nikola Tesla died poor and alone in his apartment. He dedicated his life to his work and while I’m convinced he could have found happiness elsewhere or patended his technology… He must have had an inner happiness knowing that he was giving the human race so much or that maybe his legacy lives on…

So in a strange sense, he was doing all that for his own happiness in one way or another.

Similar to philanthropists. They don’t just do good things for nothing. They get something out of the deal… A sense of joy from doing good!

So if you think that pushing through adversity and doing something you’re really good at but don’t really like for could potentially bring you even more happiness and joy through a sense of achievement… Then sure, go for it.

Also I’d imagine that most people who are incredible at something usually loves it.

Thought provoking stuff. Great comment

Timely article for me and my wife. We are nearing FI (probably 12-24 months away). Two things we are really struggling with at the moment – we both really dislike our jobs but know we are so close to FI should we just hang on? Or do we RE and make up the difference in our passive income with paid part-time work where we assume we will be happier but at the expense of not having reached that magical passive income number that we have always dreamed about and are so close to making reality. We are really torn at the moment!

That’s a hard one Lee. How much do you hate your jobs?

It might be worth delaying the retirement date to enjoy your life a lot more now.

It’s a question only you can answer unfortunately.

Good luck!

Well said! For us when we FIRE there will be plenty more leisure, and plenty more travel. But there will still be work. Probably not paid work, but we’ll certainly be volunteering in our community in areas we care about. Sounds like a great life to us.

Cheers,

Alex

Sounds delightful Alex!

Hi. I reached FIRE at 40 and “doubled down” for 8 more years to see how I could grow my portfolio. I quit my job at 48 and spent the last 2 years getting fit and all but got bored so I got a part time job to help give me a routine and purpose. I’m struggling to get a new goal or vision. What do you do when you complete your goals? I tried stretching them but got that too.

Rob

This is something a lot of people who have reached FIRE write about. I’d like to think I’d be busy with a family, healthly living, hobbies and other stuff but no one honestly knows until it happens to them.

From what I’ve read, you try to create a life before FIRE that’s great so when you finish work you can just slip into more of that lifestyle without changing too much.

But I’ll guess we’ll see.

Funny story. My dad retired at the age of 50 and then promptly unretired at the age of 51. He got bored doing not much at home, so decided to re-enter the workforce because he needed the intellectual stimulation. He didn’t care so much for the money.

My father in law on the other hand, retired at 45, and has stayed retired. He keeps busy with a variety of home improvement projects, the grandkids, and so on.

We haven’t hit our FIRE goals yet, but I’m sure when we do, we’ll have plenty to keep us busy – travel, volunteering, and most importantly, spending more quality time with our son.

That’s an interesting story. I wonder if there’s something that effects that outcome during there working life that makes it hard for some to keep busy themselves… I’m sure there is but I’m not sure what.

Hi FB,

Great read; it resonated with my views. I have left my career two years ago following a redundancy.

I liked my job a and career a lot but always craved for more. I have been just as busy as before. Travelled some 500dys on some 50 trips. Currently exploring South America. Love it. Became a dive Instructor, Love it. There is so much i can think of doing – in the process of building my first web company. But I found that I want to return to work to work towards FatFire next. I will feel more secure knowing I’m in a financially abundant position rather than just being ok.

Keep writing those great pieces. Cheers,

Financial Gladiator

Financial Gladiator, for financial calcs relating to FIRE, do you include your Super balance, but exclude your PPOR?

Glad you enjoyed it mate 😊. Plenty more pieces coming up

That’s exactly right. I’m well off reaching FI let alone RE/ER as we are a single income couple.

But we also live a very low cost lifestyle. If I ever reach ER I will most certainly still work. I can’t sit still for too long. I’d still work, maybe 2 or 3 days a week and take the rest to do other hobbies.

Good summary here Firebug.

Crazy we wrote similar posts on the same weekend – must be that ‘great minds’ factor lol 😉

The FI part makes sense to many but the ones struggle to see the point of the RE part probably just aren’t thinking hard enough!

It’s very unlikely their current life is filled with their desired level of family time, pursuing hobbies, living healthy and meaningful work etc.

Also, to answer your question, zero regrets quitting my job. I’m so glad I didn’t wait a few years longer as I was tempted to do. So powerful to get your life back and build a lifestyle from scratch doing things that you really enjoy!

Inspiring mate. We’ll get there one day but I’m loving the journey right now 😁

I kind of did ER without the FI, or you could say I did mini FIREs (without really being aware of anything financial outside of the idea of “pay yourself first”). I never had a particularly skilled job and was impatient but was able to happily manage a 70-80% savings rate.

I spent the majority of the past 6 years travelling 30 countries, mostly Asia and Europe. To begin, I sold my excess stuff and worked for 6 months. During the 6 years I returned to work twice for periods of 6 and 8 months. The rest of the time was travelling slowly and simply (1-3 months per country) at an average* of 1.5k AUD a month (sometimes 500 a month, sometimes 2k). Made numerous friends couchsurfing, visited some family/family friends along the way, revisited friends from earlier trips a few years later!

Not just “cheap” countries, for example I’ve lived in Switzerland, Hawaii, and even Japan 5 times (~9 months total). Though I’ll admit that on the whole, more time has been spent in cheaper places.

The costs really come down the slower you travel, when you have complete flexibility and there are few time pressures you are forced to work with (would be zero if not for visa expirations). Definitely depends on whether you see the world as interesting or scary though. For example, I could have taken a $250 train by myself from Munich to Montreux or I could join someone’s regular trip on a carshare site of $20 fuel, chatting about the country we’re driving through and listening to music the whole way. If I only had a 2 week holiday I wouldn’t be able to line up the dates / have the flexibility to do so.

Was I bored outside of the travel? Nope, I would usually “work” for ~4 hours a day on side projects which ended up involving teaching myself what I needed to obtain a skilled job. I stopped travelling when I felt I had enough experience (and was low on savings heh). I now work remotely for a software company and I’m 1 year into my 8 year FIRE plan.

I’m looking forward to FIRE to spend more time on hobbies, volunteering, and being able to choose paid work that matters to me.

Inspiring stuff dude. I’m feeling ya with the slow travel! We did SE Asia over roughly two months and it still felt rushed! I met heaps of people who slow travelled for bugger all and was amazed how little they could live off.

Well said.

“This career is not fueled by monetary gains, status symbols or power but rather what brings the most happiness to your life.” Great comment!

Thanks Stephen 🙂

What I would like implied is something like “Financial Independence Do What You Love” or “Financial Independence Follow Your Passion”, but they do not make a nice acronyms!

FIDWYL…yeah no dice haha

Hey AF. What about Fire Independence, Rethink Everything. Meaning once you achieve FI you get to set things on your terms. By doing that everything then changes as you get to decide how to spend your time, how you work (or not), etc.

Cheers Murray

Hey Murray,

That’s honestly one of the best ones I’ve heard! Financial Independence, Rethink Everything.

Brilliant!

I’m ganna steal that when trying to explain it to someone in the future 😛

For me, FIRE is about Freedom from control by others.

Instead of “Retire Early” I say “Retirement Elective”, as I decide how I spend my time.

When a family member needs my help, I have often dropped everything and just stepped up without the need to clear my schedule and get sign off by someone else over how I spend my day.

I no longer set my alarm clock and wake up naturally every morning.

If I feel hung over in the morning, and my body wants me to get more rest, I will happily drift off back to sleep. Knowing, I have a roof over my head, food in my cupboard and all the time in the world to pursue my life goals.

Good lord that sounds bliss!

Living the dream Keith 🤘

Aussie. I thought you would like this. A lady that sings from the same song sheet as you and is not advocating retiring early!

https://www.youtube.com/watch?v=XSHNDyinZSQ

Lacey FIlipich

Brillant video Belinda! I really enjoyed it. I found it interesting about the health scare. Another author a really enjoy is Steve McKnight who has something similar happen to him at around 30. Completely changed his life and forced him to look into property investing to escape his stressful job. Seems to be a common theme among highly motivated people.

I’ve come to the conclusion that there’s no perfect plan when it comes to FI – you can never plan it perfectly, and only really see the pieces coming together when you look back. I was obsessed with FI for a long time, but since life actually became enjoyable and fun (including work!) I’ve changed my tact, and am happy with the slow and steady approach to FI. There’s uncertainty whichever way you approach it, and FI definitely gives you more flexibility, but I believe you’ve got to just lean towards whatever is most important to you in life while you can. The bigger shame is that most people don’t like what they do for most of their days….

I 100% agree Frankie. I’m starting to care less and less about FIRE as we move closer and closer to it. It just kinda falls away once you see the finish line.

I think there’s a major difference between people tolerating their day jobs for money vs people who legitimately would do their job for free.

If I ever have kids I know the common advice is ‘do what you love and you’ll never work a day in your life’ but honestly… How practical is that really? I think I’d take more of a ‘Pick something you’re interested in and find the field of study that’s in demand so you can start earning good money and have a choice later in life’. Workplace politics and horrible bosses are everywhere even if you’re working your passion unfortunately.

Hi Aussie Firebug

Thanks for your podcasts and posts which I love listening to and reading.

In your most recent podcast you mentioned the 25x rule.

You mentioned that if you want to have a passive income of say, $80,000 (net) per year, then you must have 25 x $80,000 in assets ($2,000,000). You can then safely withdraw 4% per year adjusted for inflation.

But isn’t the $80,000 withdrawn each year taxable? So if you want to have a lifestyle of $80,000 (net) per year you must save much more than 25 x $80,000?

Hi Matt,

It’s a rough guide mate. It’s easier to say X25 so most people can quickly understand. I know it’s not perfect.

Yes the income is taxable but if you have a partner to split the $80K between the tax paid is a lot less. It’s different for everyone’s tax situation of course.

Hope you are enjoying England and Europe! Croatia and eastern Europe are amazing and would definitely recommend venturing that way if you can.

My partner and I did a very similar trip in 2016/17, at the age of 28, where we quit our jobs and travelled around Europe and then SEA for a year. It was amazing! We were going to get jobs and stay for longer but wages in UK and rest of Europe were less than 50% compared to Australia and after 12 months of travelling we felt home sick and I personally needed some routine back in my life.

My FIRE journey has only started recently. Towards the end of 2018 after having an epiphany that many of us have. I realised that there has to be more to life than 9-5 and I genuinely love my job but I still wouldn’t do it for free. There just had to be more!

At that time, I happen to come across Barefoot Investor book and since then have been obsessed with personal finances reading number of books some you’ve mentioned in your podcasts/blogs like Rich Dad Poor Dad, Your Money or Your Life, The Millionaire Next Door and many others. I was and still am so inspired to create a better today and tomorrow.

We’ve reintroduced frugality that kind of escaped after returning from our travels. It’s still work in progress but I enjoy the challenge. Hopefully I can make my partner become motivated to focus on our goals. I feel like she thinks I’m crazy with the obsession at times. Though I still don’t feel like we miss out on much at all and she agrees.

I came across you only last week whilst searching for more Aussie content and podcasts to listen to. You were number one recommended personal finance podcast on one of the lists! Since then I’ve read your entire blog and listened to number of podcasts and you have done and are doing an amazing job. Majority of the comments you make strongly resonate with me. Namely of how you came into FIRE realisation and your ever changing strategy to improve. I’ve loved and appreciate the endless work you’ve put into this not just for your own benefit but for others.

My partner and I were looking to buy a family home next however, the more I read into personal finance the more I want to get stuck into the stock market. I have a feeling I’m going to start pouring into ETFs and review the home idea in a years time.

I note that you’re ultimate goal is to live on cash flow from dividends once you “retire”. I’m wondering what you plan to with the capital? Will you ever sell it to spend or make certain bigger purchases or other investments (e.g. business)? Or is your plan to keep the capital invested until after your preservation age? By then I feel that your capital will be worth many millions in addition to any super. I appreciate the reasoning to live off dividends in particular if there is a bear market soon after “retiring” but I note you are not huge on leaving a big inheritance.

Anyway, keep up the great work and enjoy the food. Probably the best part of travelling!

Cheers,

Vlado

Hi Vlado,

We’re loving our travels so far. You’re right about the food! OMG, we want to go back to Thailand purely for the Pad Thai!

The house vs investing is such a conundrum many people face. There’s no right or wrong answer and a lot of the time there are the intangibles that are most important, not what works out best for you financially.

Do you know what… I’ve never really thought long and hard about the big snowball we’ll end up with at the end. I have more thinking to do about that part in the years to come. Part of me would love to set something up like Peter Thornhill and donate it to an organisation but under certain conditions that they can’t touch the capital, but only ever receive the dividends from it… maybe a little for the kids/grandkids too. But not a lot!

Good question!

I also wonder what people intend to do with their capital? Leave a huge inheritance to their children, grandchildren or to charity?

I am leaving some of my inheritance to charity I am passionate about.

I definitely won’t be leaving a huge inheritance. How selfish of me to rob my children/grandchildren of the privilege of reaching FIRE for themselves. I’m not there yet, but this journey has been one of the most fulfilling things I’ve ever done in my life. I want them to have that opportunity even if they aren’t interested to do so!

Awesome Post Aussie Firebug! I love that you have used so many simpsons memes to get your point across haha! Your point about meaningful work in early retirement particularly resonated with me… I am fairly new to the ‘FIRE’ game but one of my massive motivations for seeking financial independence is to be able to raise a family – I guess similar to how Mr Money Mustache did it. Cheers, iFD.

Thanks mate,

Spending more time with your family is such a luxury that being financially independent can grant.

Great article Firebug! Been enjoying your Pods lately too! It’s funny, I’ve been getting that response from a lot of people too, the whole, Why would you want to RE? , when hearing about FIRE.

Some great points there, and as a single mum who works FT and only discovered the FIRE movement last year, I can say I’m fully motivated to get there and so enjoying many blog posts and pods for education and motivation.

Welcome to the club and thanks a lot for the kind words.

I’m glad you’re enjoying the pods and articles 🙂