P2P Lending

P2P lending is a topic I have been wanting to do for a long time but I never had the experience or expertise to write about it. I’m the kinda guy that actually likes to do something before I claim any knowledge on the subject. There are people out there believe it or not, that actually give seminars and speeches about how to become master in topic X without ever actually have been a expert in the first place.

Anyway, peer to peer (P2P) lending has been an interest topic of mine for about 2 years now. And when a reader emailed me with their experience with P2P lending I thought it would be a good opportunity for a guest post.

Chris has been investing in P2P lending platforms for over 2 years and he was kind enough to share his experience with us.

So without further adieu, here is the post. Enjoy 🙂

P2P Lending Guest Post

Several years into my FIRE journey I was seeking more diversification, more yield, and more interesting ways I could take control of my investments. Already I had delved into the share market, given managed funds a second chance (a story for another day). Then, one dark & stormy night, while searching across the digital internet on my electric computing device, I came across something called Peer-to-peer (P2P) lending.

Reddit and Whirlpool, where all the cool kids hang out, wasn’t much help in terms of details – just a few mentions here and there about UK company, RateSetter, entering the Australian market.

Magnets, How Do They Work?

I was able to discern that P2P lending, broadly, involves lenders/investors, being able to choose where their money is invested using online platforms. This is in contrast to a Real Estate Investment Trust, or index fund, where the investor’s money is managed by someone else. ASIC has a nice little write-up here (https://www.moneysmart.gov.au/investing/managed-funds/peer-to-peer-lending).

Each P2P provider does things in their own way, but it seems common across all platforms that these investments are very risky, often uninsured, unsecured, and can have a very delicious return.

At the time (December of 2015) the major players were RateSetter and SocietyOne.

SocietyOne is only open for the “sophisticated” investor – with a hefty minimum investment of $500,000, while RateSetter had a minimum

investment of $10… So, ugh, RateSetter it is!

My Experience With RateSetter

RateSetter operates both personal loans and business loans. Lenders elect what rate of return they want, what amount of money to lend at that rate, and for how long (1 month, 1 year, 3 years, 5 years). Then, they are matched to a borrower, who is seeking the lowest rate they can get. This makes the market a bit competitive as lenders undercut each other in order to get their money matched to a borrower.

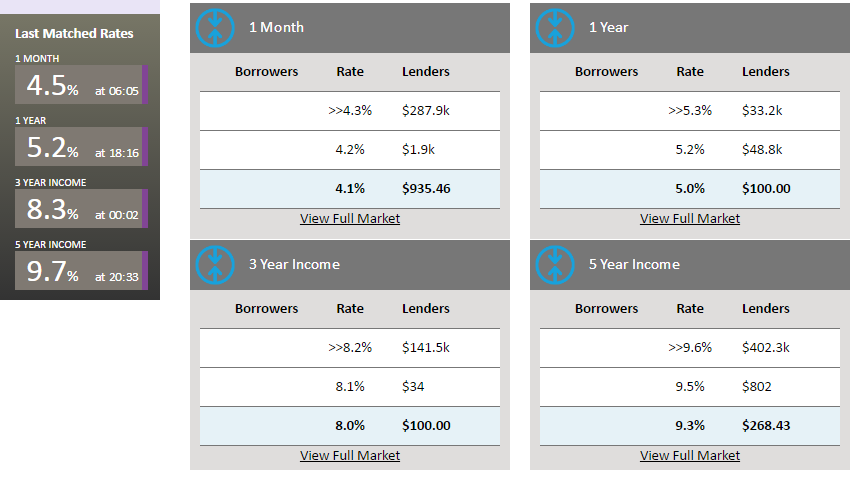

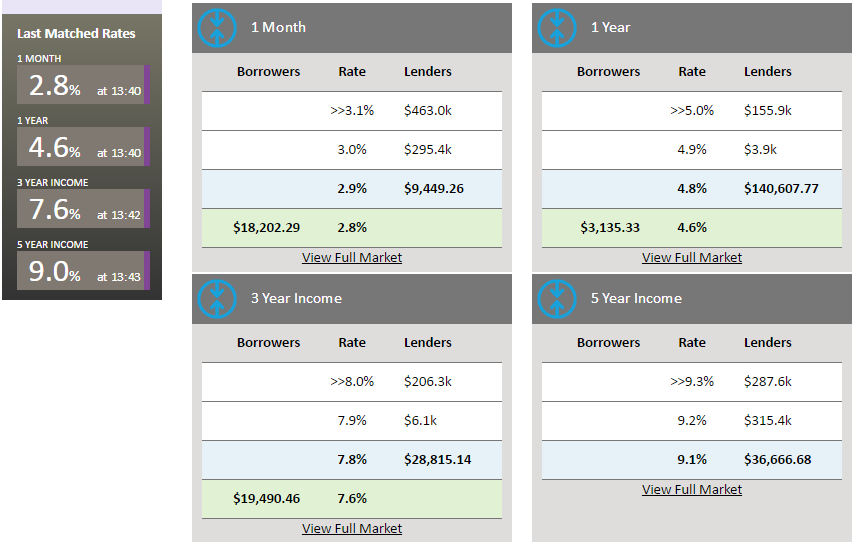

In this competitive market borrowers can snag rates better than what a bank would offer them, if the bank would lend to them at all. I’m going to paste in two screenshots now. The first is from December 16th 2016, and the second is from January 12th 2017. You can see how competition and demand can affect the rates over the course of just one month.

1 – December 16th 2016.

2 – January 12th 2017.

After assessing the PDS and reading about the risks involved, I decided that $5k was appropriate for me to start lending. I watched the 1-year market, selected a 5.9% rate (which was slightly above the last match) and I got matched in a few days.

This turned out to be a good rate, as competition pushed the rates down a full 1% a few months later.

Given the Peer-to-peer nature of the platform, I was expecting a little more involvement on my behalf in the matching process, and later I’ll discuss MarketLend which has exactly the level of control I was expecting. Then again, I can see how some people might prefer the ease of RateSetter’s automatic matching.

The 1-month and 1-year markets in RateSetter are structured very straight forward. Your returns are paid once per month at the rate you were matched and at the end you get your principal back.

In the 3-year and 5-year markets, however, both the interest and part of your principal are returned each month.

None of RateSetter’s loans are secured but there is a “provisional fund” from which they can compensate lenders for losses at their own discretion. Information on how often this happens is hard to come by (my Google-fu failed me).

Over the course of the investment, here are my interest payments:

| Jan/2016 | 26.73 |

| Feb/2016 | 23.49 |

| Mar/2016 | 23.49 |

| Apr/2016 | 26.73 |

| May/2016 | 22.68 |

| Jun/2016 | 25.11 |

| Jul/2016 | 25.92 |

| Aug/2016 | 23.49 |

| Sep/2016 | 25.11 |

| Oct/2016 | 25.11 |

| Nov/2016 | 24.30 |

| Dec/2016 | 23.49 |

So… what to do now that’s finished?

Well, I delved straight back in again and got matched in the 5-year market at 9.5% 🙂

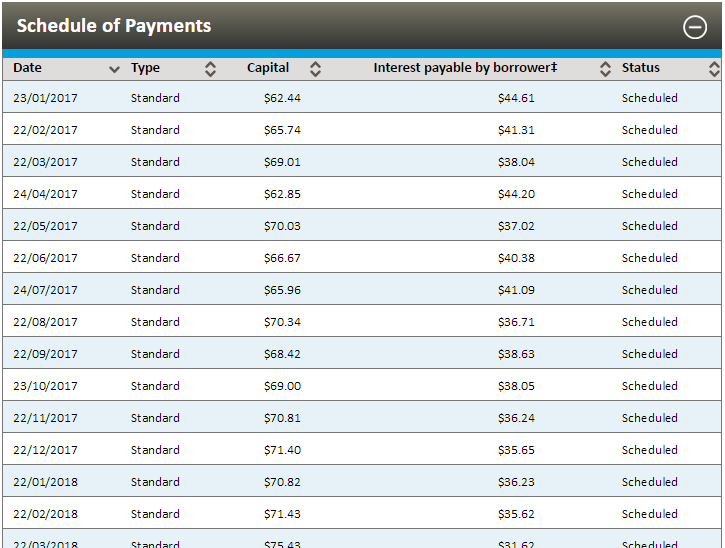

And RateSetter provide a nice little schedule of payments for the life of the investment.

As you can see, this time, in the 5-year market, a portion of my principal (“Capital” column) will be returned each month, and my interest earned is reduced accordingly.

When these payments start rolling in, I will give the “auto-bid” feature a crack. With the auto-bid, payments made to your holding account can automatically be reinvested in the market and rate you specify – either a set rate, or the current market rate. Very handy!

My Experience With MarketLend

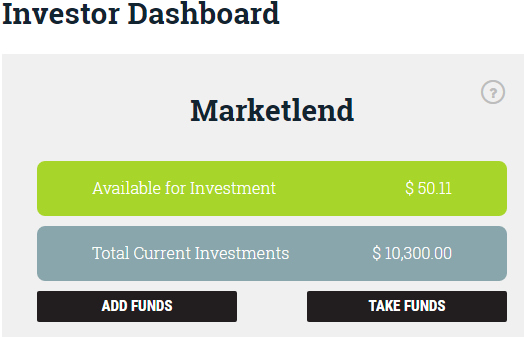

My good experience with Ratesetter made me a little braver when I decided to try out MarketLend. I threw $10k at it in August 2016 and payments started in September.

This is a platform which focuses on business loans.

Some loans are insured, some are uninsured. Some loans are for supply chain financing – where MarketLend will own the supplies – and some are simply a line of credit. One of the more interesting loans I’ve seen was for a short-term money lender. I was an investor, lending money to a business to lend money to a business to lend money to people… Hold on while I go watch “Inception” again….

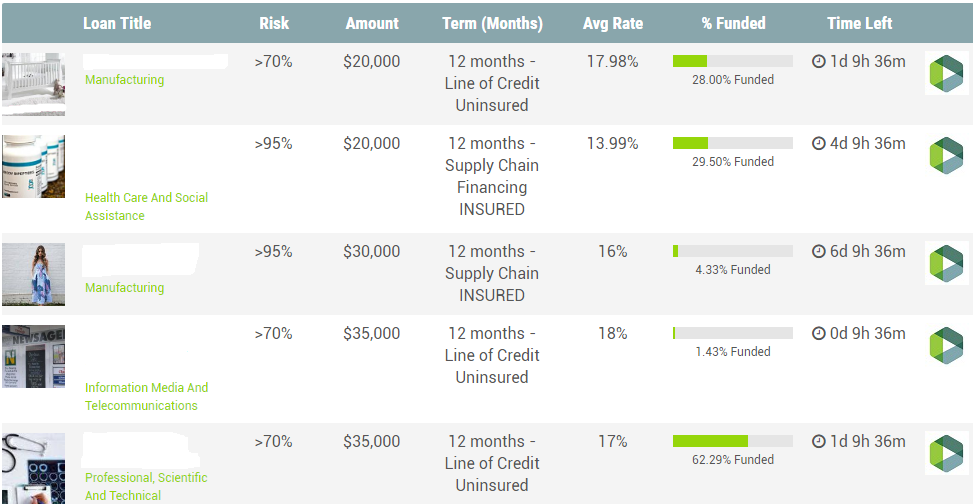

MarketLend advertises these loans to investors in the form of units, each valued at $100. I.e. if i want to lend $1000, I would bid on 10 units at the rate I want. At any time another investor can undercut my bids, introducing a competitive element here as well.

Those high percentages might look amazing but hold on… because I should tell you about utilised versus unutilised parts of the loans – which will affect your return.

In these loans, the borrower might not access all of the capital which is on loan. The money which HAS been accessed, is the “utilised” amount. The rest is “unutilised”. This is important because your return (of say 18%) only applies to the utilised amount. So, even though you might be lending out your money at an amazing 18%, your gross return will be much less. Then MarketLend takes out their fee and your pre-tax return might be %8 (this is my actual average return so far across all my units).

Borrowers could also back the loan early. In which case you get your principal back early, the loan ends, and you are free to carry on your merry way – maybe withdraw the money, maybe invest in more units.

What I really like about MarketLend, is that credit checks and financial statements from the borrowers are available, so you can get very acquainted with them before deciding to bid.

This is the level of control and information I was looking for in a Peer-to-peer lending platform.

In the interest of diversification, I spread my $10k around many different borrowers at many different rates and levels of risk. Here’s a sample:

And here’s my returns so far:

| Month | Amt | Real Return |

| Sep/2016 | 34.60 | 4.15% |

| Oct/2016 | 74.87 | 8.98% |

| Nov/2016 | 81.55 | 9.69% |

| Dec/2016 | 76.56 | 9.10% |

| Jan/2017 | 83.53 | 9.83% |

I have used my returns to buy additional units, so I currently have $10,300 invested.

Finally, MarketLend features a secondary market where lenders can sell off their units to other lenders. This is useful if you no longer wish to carry the investment, or just need some liquidity.

I’ve picked up a few discounted units here – it’s definitely worth a look if you decide to go down this path.

Conclusions

P2P lending is cool. It’s high yield. And comes with high risk (so read those PDSs).

I like how MarketLend lets me choose who to lend to and the ability to make an informed decision – but RateSetter is also nice so I will continue to use both.

| Ratesetter | MarketLend | |

| Pros’s |

Website looks and feels more professional. Predictable returns. Provisional fund may reduce risk of loss. |

More information and more control and over lending. Easier to diversify investments. Secondary market allows selling/buying units. Australian owned & operated. |

| Con’s |

Little control over matching process. Did not notify me when my investment ended. The queue-like structure delays matching. |

Utilised/unutilised was confusing at first. No Bpay facility. Did not notify me when one of my investments was repaid early. |

What’s Next?

Another P2P platform caught my eye recently; Brickx. These guys break down a house mortgage into 10,000 units, which investors can bid on, buy, and trade with each other.

Returns come from cash-positive rental income, or capital gains in a sale. I have a bit of saving to do, and a couple of impending financial commitments to get past, before I’m ready, though.

For now, my P2P returns will continue to be reinvested. Due to the nature of the investment, I should expect some losses over time, as borrowers default or make late payments, but that’s why we manage our risk.

-Chris

Wow, what a quality insight into the world of P2P lending. I would like to thank Chris again for putting that amazing post together. If you have any questions about it please feel free to comment on this article. Chris has agreed to answer your questions in the comment section below.

Show Notes: