by Aussie Firebug | Oct 30, 2016 | Classics, Investing, Mindset

What a horrible mash-up of words. Rentvesting? Rent-Investing? Rentvestor?

Yuck!

While the term itself doesn’t sit well with me, the underlying principles definitely do and I think a ton of millennials could benefit from it, so listen up muchacho’s!

What The Hell Is Rentvesting?

Put simply ‘rent where you want to live, while you invest where it makes sense’

If you’re a citizen of Sydney or Melbourne, you may know about the incredible median house prices.

The stock standard formula for buying a house used to be:

- Get a good job

- Save enough money for the deposit

- Buy house

- Pay off the loan

- Live happily ever after

But as the great Bob Dylan once said

The new formula is now this:

- Get Arts degree

- Skip smashed avocado for 6,363 days

- Pay your deposit

- Spend the rest of your life paying off your loan

- Enter death blissfully knowing your financial situation will not follow you to the afterlife

I kid I kid.

But the point I’m trying to make is that the old school conventional way of buying a house in our two biggest cities doesn’t work anymore for the majority of people without financial help from their parents or inheritance.

This is because the game has changed! It ain’t what it used to be when ma and pop were hunting for a house.

Can Rentvesting Help?

Absolutely!

As I have already explained with my Rent vs Buy article, renting is cheaper 90% of the time.

And if you live in either inner Melbourne or Sydney, this becomes 110% of the time.

So instead of taking on a mortgage in either of these two cities, why don’t you rent for a few years and invest where it makes sense to do so.

Rentvesting can get you into the housing market without the financial stress when buying in inner Melbourne and Sydney.

How Does It Work?

One rentvesting example might be ‘Harry Hipster’ from inner city Melbourne complaining that the housing market is rising faster than he can save for a deposit.

Harry desperately wants to enter the property market but cannot save enough for the deposit and is unsure if he will be able to make mortgage repayments without at least a 20% deposit. Caution Harry is also extremely hesitant about the Melbourne market being in a bubble and is worried that prices could come crashing down just after he has bought.

He has been very cautious of a potential crash for more than a decade now and year after year he has seen friends and family around him buy real estate and increase their wealth. He’s sick of being on the sidelines but can’t afford to buy in inner Melbourne.

Harry discovers rentvesting and decides to take his savings and invest interstate where the property market is more affordable. The collected rent would cover the majority of costs associated with the investment with plenty of upside for capital growth.

Rentvesting has allowed Harry to get into the property market without the mortgage stress he would have had if he had bought in inner Melbourne. Furthermore, if Harry’s financial situation changes he can adapt quickly.

If Harry gets a raise, he can move into someplace more luxurious. Maybe he loses his job? No worries, he can move somewhere more affordable until he finds his feet again. None of these luxuries can be had once you lock yourself into a mortgage that you’re paying for. The investment property is an asset, not a liability. The mortgage on the IP is not paid for by Harry, he has tenants that are paying that loan off for him.

After a few years, Harry may decide to sell the IP getting back his savings plus whatever capital growth occurred during the years and use this money as a down payment for an inner Melbourne house. The entire time, Harry was in the property market and benefiting from whatever gains occurred instead of missing out on the sidelines. Harry was also not under financial stress and had the flexibility to live wherever he wanted to based on the circumstances he was in that year.

| PROS |

CONS |

|

No mortgage stress |

|

You won’t be paying off your home to live in. There is a psychological connection to be paying off something that’s yours. Renting can feel like dead money |

|

Ability to save and invest more |

|

No security in renting. Can get kicked out anytime |

|

Exposure to the property market sooner |

|

Rentvesting is for the disciplined! A mortgage can act as a forced savings mechanism. Rentvesting relies on you having the discipline to stick to a budget and not blow the extra cash. |

|

Flexibility to change your biggest expense (living costs) when it suits you. |

|

|

|

Start building your wealth now not later |

|

|

|

Invest on your terms. 9/10 the place you want to live in is not the best investment. Rentvesting allows you to live where you want and invest where it makes sense. |

|

|

|

Frees up cash flow for more smashed avocado on toast ?? |

|

|

Conclusion

With the two biggest cities in Australia being more expensive than ever, more and more Australians are struggling to get their foot into the property market. Rentvesting can be used to get into the market without having the stress of paying a mortgage yourself.

Rent where you want to live, invest where it makes sense.

My partner and I are rentvestors and have no plans to buy a house to live in anytime soon. This gives us the flexibility and freedom that we want this time in our lives. When circumstances change, we have the flexibility to adapt.

Are you currently rentvesting? Why? Why not?

Thoughts and feelings in the comment section below.

by Aussie Firebug | Oct 6, 2016 | Net Worth

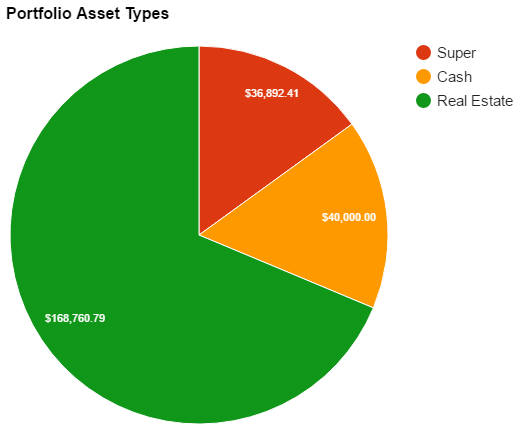

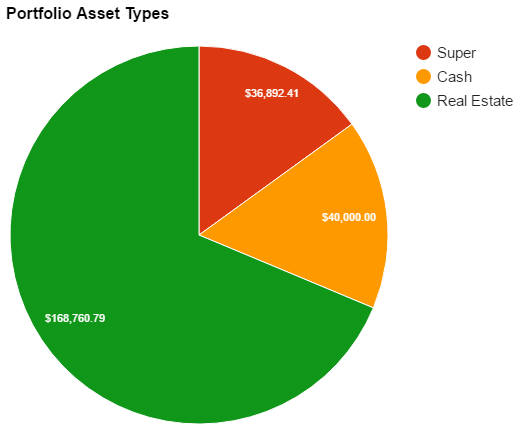

September has been an interesting month. Super had a little bump, updated my HECCS debt and some extra savings in cash.

I had some pretty biggish expenses last month mainly caused by weddings.

Wowee are weddings expensive for nearly everyone involved. It is just me or have Weddings become so incredibly commercialised that it has lost it’s original core purpose? Don’t get me wrong, I love going to weddings and the idea is Ok but seriously. It’s almost expected now that weddings MUST have:

- Entertainment

- Flowers and decorations

- Fancy cars

- Professional hair and makeup

- Professional photography and videography

- Fancy accommodation

- Doves flying when the bride walks down the isle

- Custom made bobble heads of the bride and groom

- Congratulation message from Kim Kardashian,

- Entry to the reception via a chooper…

Ok maybe I’m going over the top here but you get my point. The amount of industries pumping up the idea that a wedding MUST be this or MUST be that is nothing more than marketing.

And you can’t escape the costs associated with a wedding even if it’s not your bloody wedding!

Oh no no, can’t an untapped market (wedding guests) getting away scot free. It’s now expected that for the engagement party the guest bring a gift of a value of no less than $100 (in my circles anyway) or else you will be branded stingy and a tight ass… SINCE WHEN DO YOU GIVE >$100 PRESENTS TO PEOPLE JUST BECAUSE THEY GOT ENGAGED???!?!?

I can’t help but think that the idea of a wedding has been hijacked by very clever marketing companies to brainwash loved up n00bs to spend maximum dollars at their stores. They even have the guests forking out hundreds and have so so cleverly shaped society to attack people who refuse not to participate in this circus of unnecessary spending.

Wow that was an unexpected rant. But yeah…weddings are hella expensive…for everyone involved.

So back to the main point of this article… Networth ticking along nicely. Should be able to get to quarter of a Mil if nothing goes drastically wrong by years end.

Networth

[wp_charts title=”linechart” type=”line” align=”alignleft” width = “100%” datasets=”-36000,-36000, -32000,-7000,20000,32000,45000,65000,83254,130000, 187910, 229010″ labels=”1-Jan-2011,1-Jul-2011,1-Jan-2012,1-Jul-2012,1-Jan-2013,1-Jul-2013,1-Jan-2014,1-Jul-2014,1-Jan-2015,1-Jul-2015,1-Jan-2016,1-Jul-2016″]

| Date |

Rolling NetWorth |

$ Change |

Notes |

| 1-Jan-2011 |

-$36,000 |

$0 |

HECCS debt |

| 1-Jan-2012 |

-$32,000 |

$4,000 |

Started Full-time work late Nov |

| 1-Jan-2013 |

$20,000 |

$52,000 |

Built property and recieved FHOG ($21,000) |

| 1-Jan-2014 |

$45,000 |

$25,000 |

|

| 1-Jan-2015 |

$83,254 |

$38,254 |

Bought second IP |

| 17-Feb-2015 |

$110,215 |

$26,961 |

|

| 18-Feb-2015 |

$121,541 |

$11,326 |

IP’s re-valued |

| 4-Mar-2015 |

$123,715 |

$2,174 |

|

| 18-Mar-2015 |

$122,128 |

-$1,587 |

Paid for holiday |

| 15-Apr-2015 |

$125,906 |

$3,778 |

Withdrew equity from property |

| 14-May-2015 |

$127,906 |

$2,001 |

|

| 18-Jun-2015 |

$131,904 |

$3,998 |

|

| 21-Jun-2015 |

$152,904 |

$21,000 |

IP’s re-valued |

| 12-Jul-2015 |

$159,904 |

$7,000 |

Paid 4K off HECS Debt |

| 23-Jul-2015 |

$161,904 |

$2,000 |

|

| 31-Aug-2015 |

$167,904 |

$6,000 |

|

| 31-Sep-2015 |

$170,110 |

$2,205 |

Car went out of Portfolio, Bought IP 3, Super went up and one IP went up |

| 31-Oct-2015 |

$171,376 |

$1,265 |

Big bills. Not much saved. |

| 30-Nov-2015 |

$173,263 |

$1,887 |

Super went down slightly |

| 31-Dec-2015 |

$186,910 |

$13,648 |

IP went up in value |

| 12-Jan-2016 |

$187,910 |

$1,000 |

Some big bills |

| 2-Feb-2016 |

$189,910 |

$2,000 |

Bills (again) |

| 1-Mar-2016 |

$191,410 |

$1,500 |

Didn’t save very well |

| 1-Apr-2016 |

$193,410 |

$2,000 |

Steady month |

| 1-May-2016 |

$182,410 |

-$11,000 |

Two IP’s went down. |

| 1-Jun-2016 |

$211,010 |

$28,600 |

All 3 IP’s went up and super was updated |

| 1-Jul-2016 |

$229,010 |

$18,000 |

IP’s revalued with 2 out of three going up |

| 1-Aug-2016 |

$233,653 |

$4,643 |

Super went up along with cash |

| 1-Sep-2016 |

$237,390 |

$3,737 |

Super went up, HECC debt went down plus savings |