by Aussie Firebug | Sep 27, 2020 | Classics, Mindset, Popular Article

The below article is actually a chapter I wrote for a great collaboration ebook put together by Pearler. I would highly recommend checking out the entire eBook (for free of course) which you can grab here.

“A dollar saved is better than a dollar earned”

We’ve all heard that one before. The ability to save more than you earn is a fundamental principle upon which FIRE is built.

Hands-down the most important step for reaching FIRE is how much of your paycheck you can keep and invest.

You cannot earn/invest your way out of bad money habits. It will eventually catch up with you no matter how much money you make. If you’re spending more than you earn, you’re going to be broke. It’s just simple mathematics!

It’s sorta the equivalent of trying to outwork a bad diet and expect results in the gym. In fact, there are so many parallels between good financial habits and being fit and healthy it’s uncanny. Most health/fitness experts would agree that your diet probably plays the biggest role in keeping your body happy. The other two major players would most likely be exercise and sleep. If you’re nailing all three of those, there’s a pretty good chance your body is feeling awesome.

Savings is to FIRE, what eating the right foods is to living a healthy lifestyle.

And if we follow this little analogy a bit further we might conclude that…earning money in FIRE is equivalent to or around the same level of importance as exercise when it comes to health and fitness. And maybe we can put getting a good nights rest at the level of investing.

It’s not a perfect one for one comparison but it makes for a good metaphor so let’s keep rolling with it.

I’d wager that 90% of FIRE content is either about saving money or investing. But we seldom read how to earn more money even though it has astronomical benefits when implemented correctly. It’s true that FIRE is income agnostic, two people with a savings rate of 65% will both reach FIRE in around 10 years even if one earns $60K and the other $400K.

But there comes a point of diminishing returns for both saving money and investing.

The purpose of this article is to explain how beneficial it is to spend more time and energy increasing the amount of $$$ that flow into your accounts. Anyone who is on this path is already doing some form of exercise (earning money) but if you can look past your standard crunches and pushups you’ll discover there are gymnasiums out there filled with weird and wonderful machines that provide all types of workouts. And when you combine a great diet with a dialled in training routine that works best for you, the gainz can be off the charts.

BFYB Factor

The aim here is to illustrate just how much of an impact increasing your income (even a tiny bit!) can have on your journey towards FIRE.

Let’s try and apply the same metric to the three most important focus areas IMHO when it comes to reaching FIRE.

- Save more than you earn

- Increase how much you earn

- Invest your savings

We’ll call the metric BFYB (bang for your buck).

BFYB = The amount of effort required to improve a focus area

Let’s look at our first focus area (save more than you earn) and re-establish why it has the best BFYB value.

Increasing Your Savings Rate

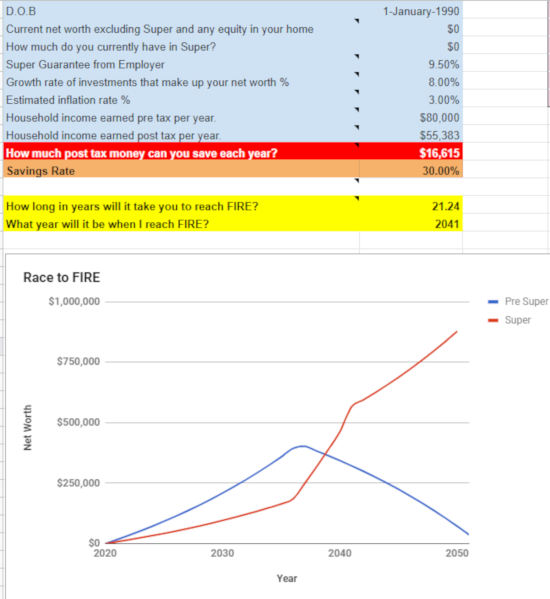

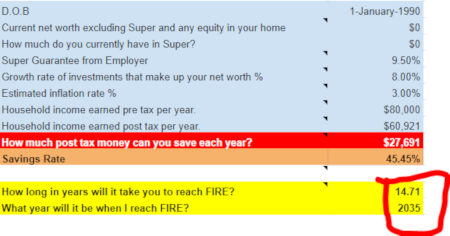

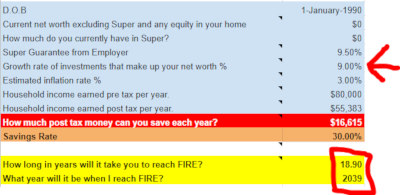

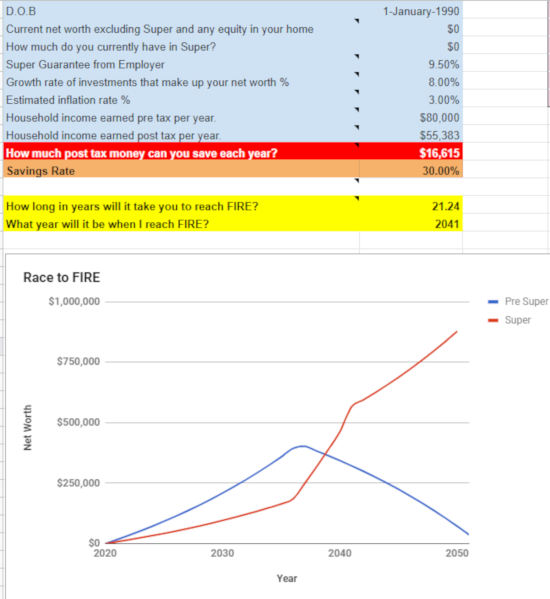

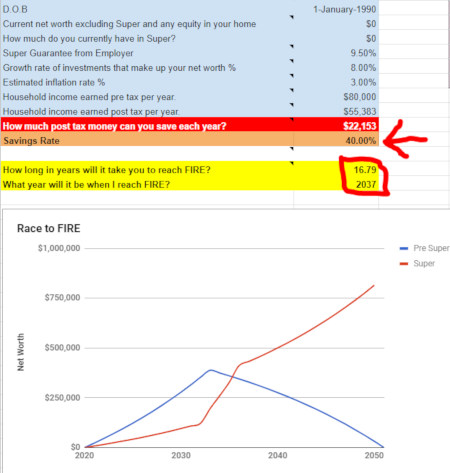

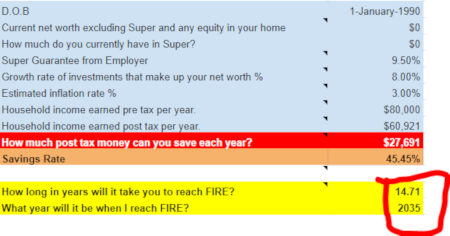

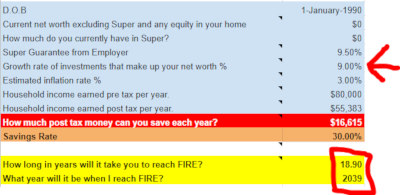

Using The Australian Financial Independence Calculator we can plug in Joe Smith’s journey towards FIRE starting from $0.

We’re assuming he is a single 30-year-old Sparky from Brisbane who owns his 3 bedroom home (no mortgage), works 38-40 hours a week, doesn’t have kids and all the below numbers stay constant over the next 30 years to make the modelling super simple.

Ok, so an Australian who earns $80K with a savings rate of 30% can retire in 21.2 years. Not too shabby.

A 30% savings rate is already way above the average but let’s just assume Joe, whilst obviously a diligent saver already, is living a pretty normal consumerist 21st-century lifestyle with a heap more fat to cut. I don’t think it’s unrealistic or even that hard for him to go from a 30% savings rate to 40% given his circumstances above. The difference between 30%-40% is $5,538 a year or $106 week. I would almost guarantee that 90% of Australians spend more than $106 dollars a week on things they don’t need or even want half the time (myself included). Optimising big-ticket items like housing, transport and food would almost certainly save a whole lot more than the $106 a week we require for this example.

Anyway, if we bump the savings rate up to 40% we wipe off 4.5 years!

BFYB: Great

Everyone’s circumstances will vary but the effort required in my guesstimation for Joe to increase his savings rate 30% to 40% is rather small and the BFYB is high.

This is what we want. Low effort, high reward.

And it’s why focusing on your savings rate is absolutely the best way to decrease the amount of time towards FIRE… up to a certain point.

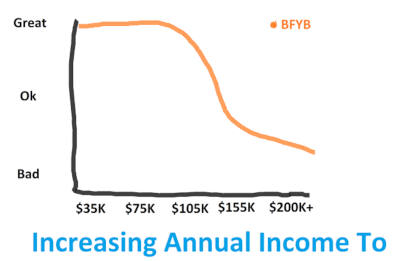

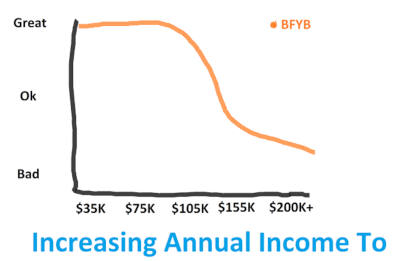

There comes a point of diminishing returns where focusing on your savings rate will not yield a good BFYB and the hard part is that it’s different for everyone because of circumstances. I can only speak for ourselves but this is what our savings rate BFYB chart looks like:

Currently, we can pretty much save close to 40% of our after-tax income without breaking a sweat. That means no sacrifice or comprising on anything. The effort for us to save 40% is almost the exact same as saving 10%. But the effort required to maintain a savings rate of >60% is when things start to change. For us to optimise our lifestyle further and squeeze out a few more percentages is astronomically harder to do when we start to get around the 65%-75%+ range. Don’t get me wrong, we could do it. And that would speed up our journey to FIRE… but at what cost?

If I can draw from our earlier metaphor of our savings rate being similar to a diet, we could say that cutting out junk food during Monday-Friday and making sure you eat some sort of leafy greens every day is a realistic goal with huge health benefits. But if we tried to never drink alcohol or eat Macca’s ever again, firstly we might be setting ourselves up for failure and secondly, whilst being the healthy option, it’s not going to have as big of a health benefit as the first goal. There are diminishing returns for eating healthy just like there are diminishing returns for improving your savings rate.

Increasing Your Income

This is the focus area that doesn’t get enough attention.

Increasing your income has a direct correlation with your savings rate but for whatever reason, a lot of people never put in the time and effort to improve it. There’s so much low hanging fruit which doesn’t really require a whole lot of effort but has a high BFYB value.

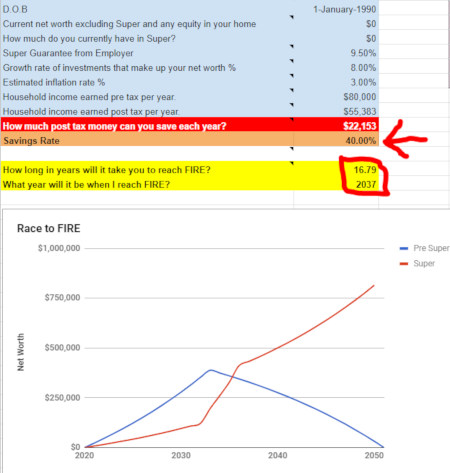

Let’s look back at Joe Smith from above but change one thing. Instead of him saving $5,538 a year, let’s have him earn an extra $5,538 (after tax) a year and see what happens.

Joe increased his after-tax income by $5,538 which in turn wiped off 2.7 years!

BFYB: Really good

We’re going to be talking about the low hanging fruit later on but if I’m being honest, Joe could easily make an extra $5,538 (after tax) purely from giving up more of his time. If we assume he’s making an after-tax hourly rate of $28, he would only need to put in an extra 197 hours worth of work over the year. And that’s not even factoring in overtime or weekend rates. An extra hour for 197 working days a year is really not that much.

Some of the stories I’ve heard first hand from young London bankers is absolutely mind-boggling. Think 70-80 hours per week… and work on weekends is to be expected!

2.7 years is not as good as our savings example above which wiped out 4.5. But if we combined them, we get epic results!

Improving our savings rate and increasing our income by the very same amount has annihilated 6.53 years of working.

Now we’re cooking with gas!

But just like our savings rate, there are diminishing returns in the pursuit of increasing your income. And I keep coming back to circumstances but unfortunately, it’s very much a circumstantial question when we start talking about this focus area because we all aren’t on an even playing field.

Below is my personal increasing income BFYB chart:

Let me explain what this means because it’s important.

Let’s say I’m unemployed next year (which is what’s most likely going to happen when we move back to Australia) and my salary is $0 (ignoring any investment income of course). I’m scanning through the classifieds looking for my next job, which, for this example will be the sole source of my income.

For my circumstances personally, it doesn’t require any extra effort for me to land a job paying $100K as opposed to around $35K annually. I don’t want to sound overconfident but I have a certain set of skills and experience that the market is willing to pay me and I’m 99% sure I could land a job paying close to $100K no worries. In fact, I’d probably have a harder time getting my old job back at Coles if anything. Beyond $100K is when the effort required starts to increase and the BFYB value starts to go down.

Remember, BFYB = The amount of effort required to improve a focus area.

The effort required to earn a salary past $100K starts to increase a lot and for me personally, the extra effort doesn’t justify the extra income at around the $130K-$150K mark. Beyond that, there’s too much sacrifice with not enough gain. Too many responsibilities and work-related stress that I don’t feel is justified for the extra $$$. You may have certain skills and experience where earning $150K is actually quite easy and no different (in terms of effort) than earning $100K.

If we look at the ABS data from 2018 the median income for a full-time employee in Australia is $76K a year. If we adjust for two years of inflation we can round it off to 80K and we now have a benchmark.

$80K a year is the standard form of exercise for full-time Aussies. One light jog and occasional push-ups weekly would probably put you in the average to above-average category of exercise in Australia as sad as that is.

If you’re earning under $80K a year and have already optimised your expenses, you may be in the position to grab some really low hanging fruit and increase your income for an excellent BFYB return.

Adding in some resistance training 2 hours a week is such a small amount of effort that has an incredible return. Not only will you become healthier and stronger, you’ll potentially save yourself a lifetime of injury and illness that’s so common in our sit down all day 21st-century culture. Cardiovascular and resistance training has shown to help with sciatica, pelvic tilt, back pain, heart disease, diabetes etc. I have always considered myself a pretty active person but even I had hip issues 3 years after starting full-time work which I 100% attribute to sitting down all day and not stretching my hip flexors or strengthening my glutes. This hip issues crept into a lower back pain issue and before I knew it, I was going to the physio a few times a month. It didn’t take longer than a few weeks of specific stretching and strengthening exercise to completely resolve all of my issues and I continue parts of that program to this day nearly 10 years later.

You don’t need to jump into a 5X5 strength split or start yelling “Yeah buddy…Ain’t nuttin’ but a peanut!” after every rep in the gym. Three focused 45-minute sessions a week offers great health benefits just like spending a bit more time increasing your income can wipe years off your FIRE journey!

Improving Your Investment Returns

And now we’ve come to the most talked about, most analysed… most overrated focus area.

Investing!

I want to bring up two quotes to set the tone for this focus area.

“If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.” – George Soros

“There seems to be some perverse human characteristic that likes to make easy things difficult.” – Warren Buffett

I am so guilty of the second quote. When I first discovered financial independence I was convinced that there’s some sort of magic formula that these rich guys must be using to get ahead. It’s part of the reason I started investing in a trust. It was like this complicated black box with all these advantages that only the rich guys understood and used. I wanted in on the secret and did my research hoping to stumble upon the golden goose. While there are some benefits of investing within a trust, I must admit that I was lured to its complexities and perceived mysteries (for whatever reason). It took me years to fully appreciate the power of simplicity and if I could start again, I would have never bothered with the trust.

I feel so many FIRE n00bs fall into the same trap. They go looking for a magical formula that simply does not exist. And even if it does, it’s almost certainly locked away in a secure blockchain quant investment hedge fund somewhere.

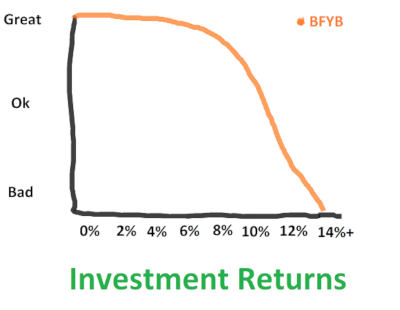

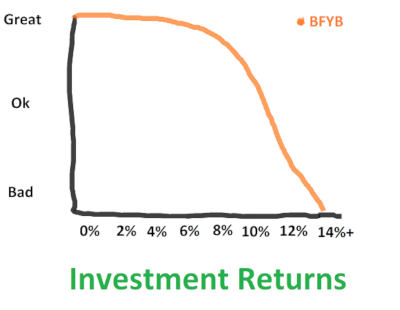

Here’s the deal, you can absolutely optimise your investment results up until a certain degree with barely any more effort involved. I’m going to ignore inflation, risk appetite and investment horizons for a second to make the point.

Investment returns have historically fallen around these marks:

0% – Storing your money in a shoebox under your bed

2% – HISA

3.5% – Bonds

7% – Real estate

8% – Shares

You can argue back and forth about how those numbers were gathered and what methodologies were used but it doesn’t really matter.

Realistically, any Aussie out there can achieve those returns rates in those asset classes without an economics degree. Index investing opened Pandora’s box and enabled the average Joe to grab a piece of the market without needing to spend the time researching and analysing financial statements.

Diversification and low management fees provide the best BFYB when it comes to this focus area. Everything else has such minute benefits that it’s laughable so many people spend so much time and effort trying to see which ones better.

To demonstrate this here is our BFYB chart for investment returns

So basically we can get up to around 8% without much effort required. It’s always good to put the time and effort into understanding the asset class but theoretically, any Joe Blow could dump their money into a diversified index fund like VDHG and get ~8% over the long term.

I don’t know any assets class where you can get a better return without extra effort. There’s plenty of ways to improve your return on investment. I sold my first investment property and calculated an after-tax annualised return of 36% but the number of extra hours I put into that investment was the equivalent to another part-time job.

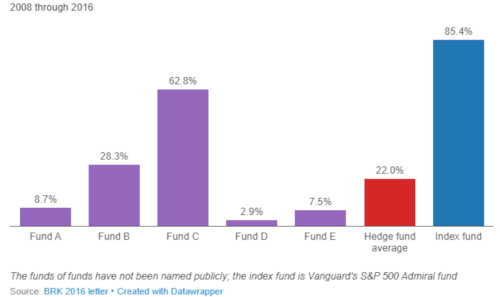

Newbies to FIRE and investing don’t really understand just how hard it truly is to beat the market consistently over a long period of time (20+ years). There are people who can do it, I’m not saying it isn’t possible. But the amount of effort and skill that is required to actually discover alpha year after year is something only a very few incredibly skilled people have managed to achieve.

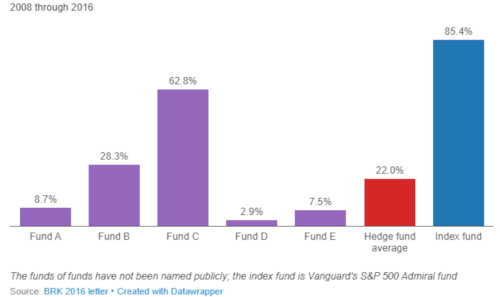

We’ve all heard the famous story of Warren Buffett betting a $1M bucks against 5 hedge funds that a simple index-tracking ETF would outperform them over an eight-year period. Not only did he win that bet, but it wasn’t even close.

But let’s just entertain the idea that you’re an outlier. You possess incredible skills and techniques far beyond most active traders and hedge fund managers all around the world and you’re able to consistently beat the market.

How much better off would you be if you were able to outpace the market by a whopping 100 basis point (1%). 1% doesn’t sound impressive but if someone can beat the market by 1% over a long period of time then you’re most likely going to make more money in a hedge fund picking stock than you are at your day job. Your skills are extremely valuable.

We’re going to pretend that you keep this incredible skill to yourself and only use your god-given talents for your personal share portfolio. How much of a difference would 1% actually make?

Let’s find out.

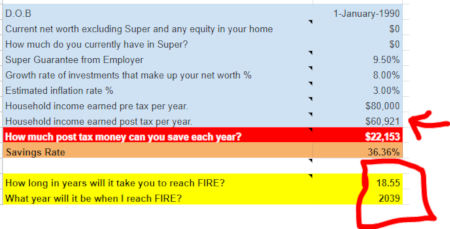

Even using our top tier investing prowess we only managed to wipe off 2.3 years which was actually the worst result compared to saving $5,538 (4.5 years) or earning an additional $5,538 (2.7 years).

BFYB: Bad

Think about how much time and effort some funds put into research for investing. It’s a full-time job with an army of analysts and advisors all crunching numbers, creating models and using the latest predictive methods in the odd chance that they can justify their hefty management fees. And most of these funds don’t even beat the index when fees are accounted for.

What hope in hell do the rest of us have?

The example above used a huge 1% difference over nearly 20 years.

How many times have you seen someone ask about A200 vs VAS on the internet? It’s gotta be one of the most discussed and analysed topics within FIRE communities. The difference in management fees between these two funds is 0.03%…

Let me say that again. 0.03%

They do track different indexes (ASX200 vs ASX300) and do you know what the difference has been between those two indexes over the last 10 years… 0.04%

So maybe… just maybe those two funds might return a difference of +-0.1% over the long term.

10 basis points of difference is your reward for correctly picking the better performing ETF over that time period.. and that’s assuming you’re even able to use skill to pick the one that’s going to perform better (which you almost certainly won’t be able to do).

BFYB: Horrendous

A200 or VAS?

A200+VGS or VAS+VTS+VEU?

IVV or VTS?

AFI or VAS?

LICs or ETFs?

VDHG or create my own?

Most of these arguments don’t make a huge difference. It’s really important to understand the key concepts around management fees, diversification and why index investing works. But just understand that if you’ve got one of the above combo’s, you’re already more diversified and paying lower fees than most Australian investors to begin with.

The basic investing principles for Australian FIRE is to build a low cost, diversified share portfolio mainly made up by ETFs/LICS. You want to buy consistently no matter what the market is doing and grow your snowball to a point where it’s passive income can fund your lifestyle.

There’s going to be a 100 different flavours of that ice cream but once you have those basics down pat, the bulk of the work is done. You can always tweak and improve your portfolio to suit your circumstances but honestly, if you’re trying to reach FIRE faster and think that crunching numbers in Excel for 10 hours a week is going save you years of working, you might be in for a rude shock!

Keep your investing simple and boring. Use your precious time optimising your expenses and working on ways to increase the amount of money that flows into your account because IMHO, focusing time and energy on savings and increasing your income has the best BFYB returns.

Different Ways to Increase your Income

I hope after reading the above you can now appreciate just how underrated increasing your income is. The saving rate is held in high regard within the FIRE community thankfully, so there’s not much to add there.

But my goodness does investing get way too much of the limelight. It’s largely out of your control too. Other than choosing your diversification levels and sticking to a low-cost fund, you’re very limited to how much you can improve the results.

When it comes to increasing your income though, the complete opposite is true. The harder you grind the more money you will make! And the more money you make, the higher your savings rate will be (if lifestyle inflation doesn’t get ya)

So let’s jump in to see how we can improve our crunches and pushups and maybe head over to the dark corner of the gym, away from the treadmills and cross-fitters… the weight room!

Ask For A Raise

We’re going to start by improving our current workout (salary job).

One of the easiest and most low hanging fruits on anyone’s list should be to simply have a conversation with their boss about their salary and ask for a raise if they think they deserve more money.

How many times have you heard about someone complaining for years that they’re underpaid but never actually taking the action of setting up the meeting to discuss their pay? I’m not saying this will have a 100% success rate but more often than not, it will start the process of you either getting more benefits or creating the plan for your next raise or bonus.

You probably want to approach the meeting with some sort of reasoning like citing average incomes within your industry or comparing the work you do with someone else that’s being paid more.

BFYB: Great

Hardly any effort with the potential to add thousands extra to your accounts for years to come! No real risk either and it’s not like you have to learn something new.

Change Jobs Regularly

Asking for a raise or putting your head down and bum up climbing the corporate ladder is a noble way to jump the food chain and reap the rewards. But the sad truth in my experience is that loyalty to a company (or business for that matter) is rarely rewarded.

Your utility provider doesn’t offer a better deal when you’ve been a loyal customer for 10 years. It’s only when you leave do they all of a sudden roll the red carpet out.

If your goal is to make the most money in your field, changing jobs every 2-3 years is the best way to do it.

Be bold, be confident. Apply for positions beyond your capabilities. Back yourself to get the job done after you land it.

Fortune favours the bold!

I’m not saying to lie your way to a position only to fall flat on your face. Just understand that an ungodly amount of people are in jobs they were never qualified for or completely lacked the experience necessary to perform it at the start.

When I worked for the government back in Australia, we would engage with consultants all the time from various companies who always charged an obscene day rate to perform projects. Think $1,000+ a day. I worked directly with a lot of these consultants on the technical side and it always struck me as odd when they clearly didn’t know a whole lot. Here we were, getting charged $1,000 a day and I would end up doing 30% of the work.

Fast forward 5 years and I became a consultant myself after picking up contract work in London. My second contract was at one of the big four global consulting firms who are widely regarded as having some of the best professional services networks in the world. And boy do they charge accordingly for that reputation.

I worked on client-side with a team of consultants but was the only contractor. Two of the team members were really junior. One was 18 months out of uni and whilst really smart and willing to learn, didn’t know a whole lot about the technologies we were implementing.

My day rate for that contract was a whopping £500. It was more than double my daily earnings from back home and I couldn’t believe that a company would be willing to pay me so much.

Well, you might have guessed that I was completely blown away when I found out that the consulting company who I was subcontracting for, was actually charging me out at their SC (senior consultant) rate which is a staggering £1,250 a day 🤯. Even at £500 a day, I was only getting 40% of the pie!

And now it made sense why all the firm’s partners were driving McLaren’s…

But here’s the point of the story… everyone on the team was also being charged out at £1,250 a day!

I mean… honestly. One of them barely knew anything. And it was at this point that I realised that companies will lie and exaggerate the skills and experience of their products/services in order to get the most amount of money they think they can get away with.

You should be doing the same!

Last point on this one, be prepared to move somewhere where your skills are in demand. This might mean international.

BFYB: Great

Side Hustles

Time to get out of your comfort zone!

The two tips above were focussed on improving your current situation. Everyone’s working out to some degree so it would make sense that we start by improving your running technique or buying training gear. But now I want to take you into that dark corner of the gym where you might not have been before. It’s not going to be easy and learning new things can be difficult. But I promise you that the benefits here are worth the effort.

I’d rather not bore you by listing every single side hustle I can think of either. I have personal experience in a few side hustles which I’d like to talk about but there’s really an unlimited amount of ways to bring in a little extra cashola.

Work a second job:

This one depends on how exhausted you are working your main job, but there’s plenty of people who work two jobs and cope just fine. Mrs FB used to do a bit of bar work on Thursday and Friday nights even though she didn’t need to. She worked with her sister and a few friends and half the time most of her friends were drinking at the bar (a small country town so not many other options lol) so she was sort of where she’d be anyway just earning money instead of spending it. A little bit of extra work equated to thousands of extra dollars in her account without too much effort involved.

The second gig can be anything too. Teaching piano, tutoring, Uber driver etc.

BFYB: Ok

Sell stuff:

One of my biggest pet peeves is throwaway culture. The amount of effort that went into digging something out of the ground, refining it, transporting it, manufacturing it, shipping it, storing it and to have someone finally buy/consume it… only for it to be thrown away in the trash not long after.

Utter insanity!

Never throw away something just because you don’t want it anymore. If it was once a good product, odds are you can sell it online to someone and recoup some of your losses. Hell, I even managed to sell my old pair of Nike’s for $30 once. Legit took me less than 10 minutes to list it. How many of you out there would be willing to work for $180 an hour?

At worst go down to your local Salvos and donate it. Chucking something that is perfectly fine in the trash is sooooo lazy, a bad financial habit and adds to humanities ballooning trash pile that mostly ends up in our oceans.

BFYB: Ok

Credit Card Hacking:

I’ve been credit card hacking for nearly a decade. In a nutshell, you sign up to new cards to take advantage of the signup bonus these CC companies offer and then spend the points on products, flights or convert them to cash. You can also pay for everything on the CC and accumulate points over the course of the year. A little bit of effort for a pretty decent bump IMO. The only risk is that you need to ensure you pay off the CC amount in full at the end of each month.

Oh, and some cards come with free travel insurance which can cost hundreds of dollars.

BFYB: Ok

Matched Betting:

Something I only discovered in 2019 after ignoring it for nearly 6 months because I thought it was a scam. The principles are very similar to CC hacking. The bookies offer you signup bonuses where you join with the caveat that you need to gamble the bet in order to access it. Matched betting is the mathematical approach for discovering arbitrage opportunities between back and lay bets. Or simply put, playing the bookies against each other to make money. When you do it correctly it’s mathematically impossible to lose but it’s a lot more complicated than CC hacking.

There’s a lot of low hanging fruit here for those who who want to put the time and effort into learning it. The two advantages that matched betting has over CC hacking is that firstly the amount of money you can make is a lot more. The low hanging fruit can be anywhere between $1K-$2K. And secondly, matched betting can be done for an extended period of time and not be just a one-off. I’ve had many people email me about the money they have made from matched betting exceeding $15K.

The signup bonuses are the low hanging fruit because after that it basically turns into another job. The fact that you can do it over the internet is a huge plus in my book.

Full warning with this side hustle though, you must do your research because if you make mistakes you can lose a lot of money. I’d suggest listening to the matched betting podcast I recording in 2019 and reading about the feedback I received from readers later that year. Some people had good experiences, some had bad.

BFYB: Ok

Start An Online Business

I’ve become an enormous advocate for having a crack at online business.

There are just so many advantages that being 100% online offers to the traditional way of doing things.

Some of my favourites are:

- Can run the business/company from anywhere in the world as long as you have an internet connection

- Startup speed. You can literally create a website/blog/YouTube Channel and begin creating content/a product and have the world at your fingertips within hours. This is simply mindboggling and it gives any entrepreneur a realistic chance to create something that will be successful.

- Incredibly small start-up costs. Gone are the days where you’d have to risk financial ruin in order to start a business. How many people over the last 100 years have had a killer idea but lacked the capital to get it off the ground? I think Aussie Firebug cost me <$100 the first year.

- Can scale as your business grows. This is what I love about cloud services in general. You only pay for how big you are and you can scale in a matter of seconds to accommodate a larger audience if/when you get there.

Aussie Firebug will always be a passion project but around late 2018 I officially started to monetise my content and miraculously it managed to make over $30K last year and I’m on track to make it again this FY.

I could do an entire article about how to monetise a blog/podcast because making money digitally is such a new concept (relatively) and there’s a lot to get your head around. Even though I’ve already listed a whole bunch of benefits above, probably the biggest advantage that an online business can offer someone on the road to FIRE is its ability to make semi-passive income.

A website/podcast/YouTube Channel is constantly available to everyone in the world. It’s not like a shop where you need to physically be there to make things run. And if your product is digital (you’re not selling something physical) you don’t need to store it and it can be replicated without any cost. If you sell a physical book you will need to pay to get that book printed and shipped. If you sell an ebook, you can literally just copy and paste a new version and send it to people straight away. The power of the internet!

Plus there’s a whole bunch of automation you can set up in the background where a lot of the day to day business operations can run on autopilot.

I think back to how many hours I put into Aussie Firebug during the first three years. The amount of time was crazy, probably averaged 1.5 hours each weeknight for 3 straight years. But the beauty of something like a blog/podcast is that most people are making the content because they really enjoy it. I didn’t earn anything for the first three years but I built the content that would later be the main drivers to allow the site to be monetised.

I’ve made over $60K during the last 2 years and I’d say on average I’m lucky to spend ~5 hours a month these days. My life has become completely different since moving overseas and travelling around and I just can’t dedicate as much to Aussie Firebug as I would like to.

But the point is that I’ve set up certain automations that enable the site to make me money while I sleep. I can’t tell you how satisfying it feels to wake up most mornings and see people taking advantage of companies that I use and recommend.

This concept is immensely powerful no matter what the online business is. Work can be recycled and can continue to make you money even while you sleep. I know a YouTuber that basically earns most of his money from a few videos he recorded years ago. Yes, he still continues to make new videos to keep the channel up to date, but the bulk of his income is still being generated from 2 or 3 pieces of digital content he created a long time ago.

That’s something you simply cannot do when you trade your time for money.

If you’re thinking about creating content I’d probably say that YouTube is the easiest way to start earning serious cash, followed by starting a podcast and unfortunately, dead last would be blogging.

The Double Whammy Effect

Side hustles and online businesses are a great way to bump up your income but there’s also a massive opportunity to simultaneously work on something that’s often forgotten about.

What are you going to do once you reach financial independence?

You don’t need to be FI to start plugging away at your passion project or whatever it is you’ve always wanted to have a crack at.

Start that project this weekend!

Momentum is a powerful force. If you have a little side hustle or project you get to work on for fun in your spare time, more often than not, when you do decide you’ve had enough of sitting in a cubicle for 40 hours a week, the transition is so much easier because you’ve already built up something to further sink your teeth into.

My preference will always be an online business but it doesn’t have to be that. Make candles, sell scented oils from Etsy, create a monthly COD tournament in your area. Anything you’re interested in will do. And don’t worry about making money because 9/10 times if you start doing something you love it somehow finds a way to pay for itself eventually.

Wrapping It All Up

I wrote this article with the intention of highlighting one of the most underrated focus areas in our community. Everyone should know by now that your savings rate is king but rarely do I see such admiration for putting time and effort into earning more money in your day job or by hustling on the side.

Far too often people come to the FIRE community hoping to discover the secret sauce that enables us to retire 30 years earlier than most. The methods we use to invest are actually incredibly boring and simple.

If you’re anything like me, discovering the concept of FIRE can change your life. I was bursting with excitement and enthusiasm when I realised that financial independence was an achievable goal that nearly any Australian can achieve if they prioritise it highly enough.

Focus more of this energy into something that’s within your control. That’s saving money and earning more. The majority of investment returns are largely out of our control which is why the never-ending debate between which investment is the best is largely a waste of your time. I’m not saying you shouldn’t educate yourself about investing. Just know that the difference between choosing A200 or VAS will not be a difference-maker that could potentially wipe years off your journey.

On the contrary, starting a hobby of making and selling custom jewellery in your spare time does have the potential to eliminate multiple years and maybe even decades. But more importantly, side hustles/businesses can offer the more important benefit of shaping your future in retirement. No one wants to reach financial independence just to say they did it. We want the freedom that it grants. But using that freedom to create your ideal lifestyle doesn’t have to start once you reach that magical number, you can start meaningful work right now and it can help you along the journey!

If I can refer back to our metaphor from the intro one last time I’ll leave you with this…

Most of you guys already have a great diet. Some are dialled in so well that you are hitting your macro and micro-nutrients to the gram. But it’s time now to look at your workout routine and see if you can fit in a few more sessions every week to really take it to the next level!

Spark that 🔥

by Aussie Firebug | Aug 30, 2020 | Investing, Mindset, Saving

This years review is a bit tricky once again because we (Mrs. FB and I) earnt money in two different countries so some of the tax stuff has not been accounted for (yet).

You can check out last years review here where we achieved a savings rate of 56%.

So how did we do this year?

Let’s get into the numbers.

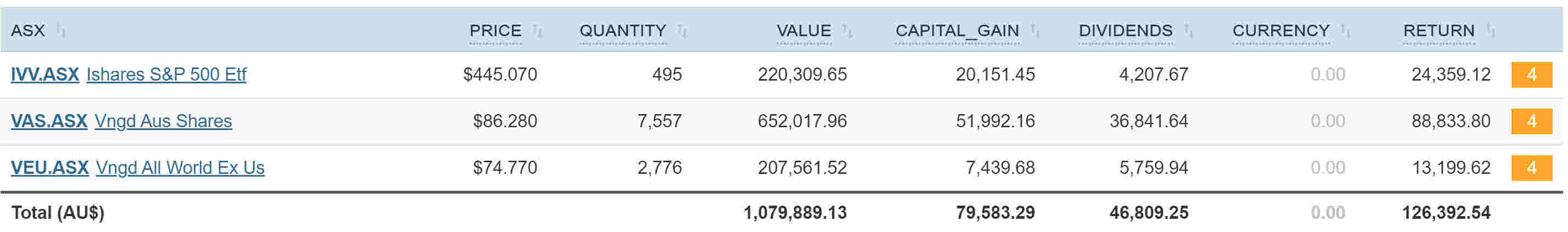

Savings Rate For 19/20 Financial Year

Our savings rate for last financial year was… 61% (▲+5% from last year)

We earned $200,919 (▲+$15,478…mostly after-tax*)

And spent $79,182 (▼+$1,635)

I’m honestly shocked that we ended up with 61% as our savings rate. I think a lot of that had to do with COVID hitting which essentially stopped us (and most of the world) from spending money on anything other than the essentials. The only way I can explain how we managed to spend less than the previous FY (other than COVID) is that we pre-paid for a shit load of travelling in May 2019 that obviously is not included in this year’s report. That travelling lasted all the way up until the end up September so even though we have been technically paying for London’s notoriously high living costs, 3 months of this years review was pre-paid for from the previous year which makes it appear that the last 12 months were cheaper than they really were.

*This year’s update does account for AFB tax obligations since I was required to pay them during the year but the dividend components are not finished yet. I’ll update this article once it’s done

Breakdown Of Spending

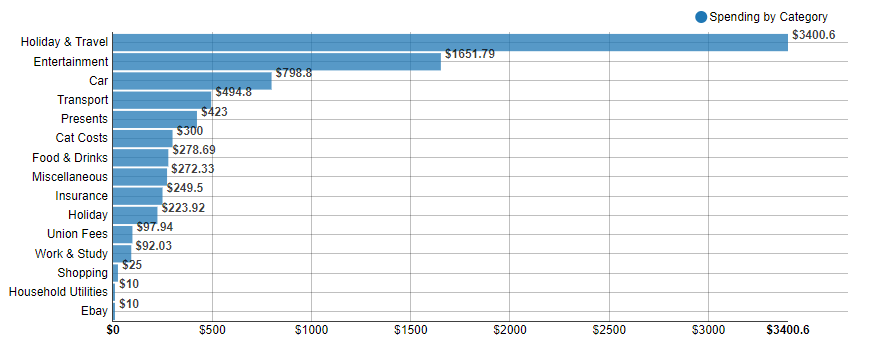

Because we use two different pieces of software (pocketbook for Oz and money dashboard for UK) to track expenses, they are broken down into two categories.

Australian expenses = AUD $8,328

UK expenses = AUD $70,854

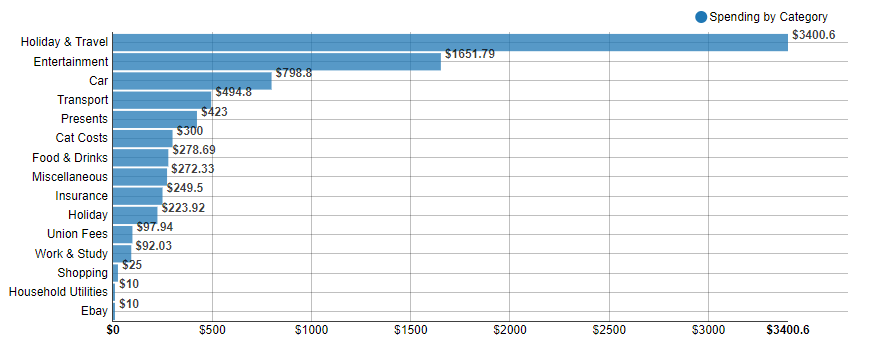

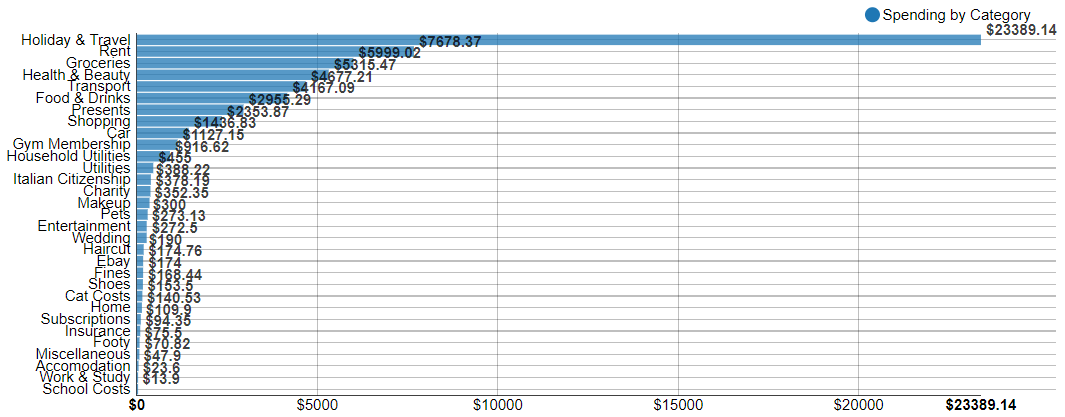

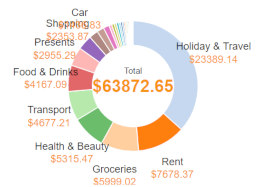

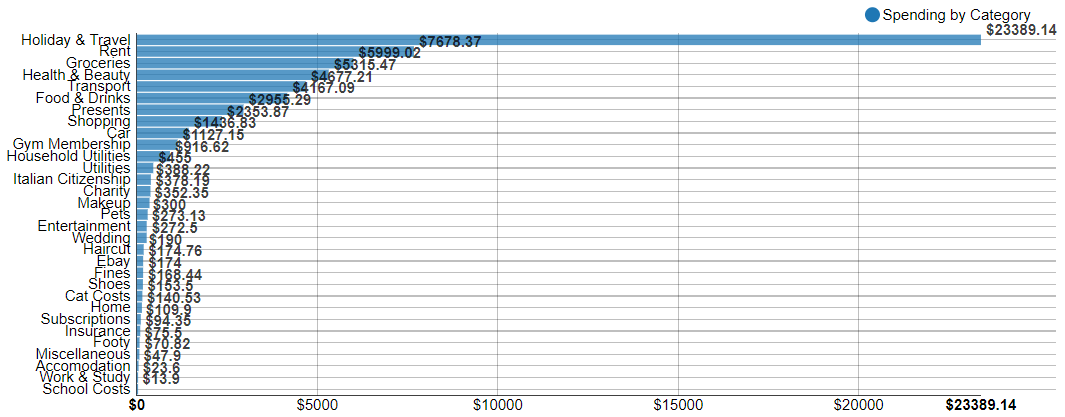

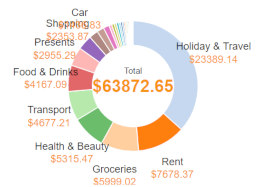

Below is our Australian expenses for the last FY.

There were a few expenses we still needed to take care of back home like car rego (Mrs. FB’s mum is currently driving her car), insurances and some odd bits and bobs. The biggest expense above is Holiday & Travel because there were occasions where we used our Australian Citibank card instead of our UK card and hence those expenses showed up in our Aussie accounts.

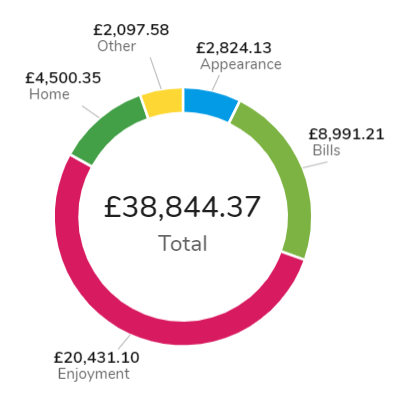

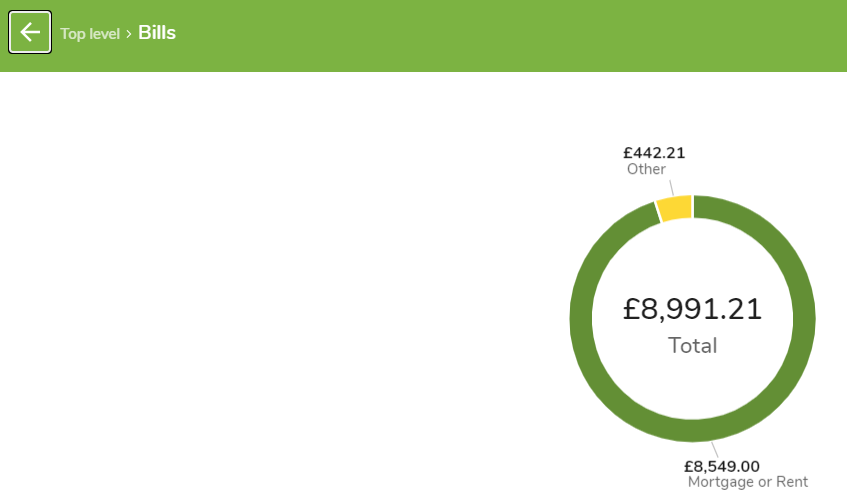

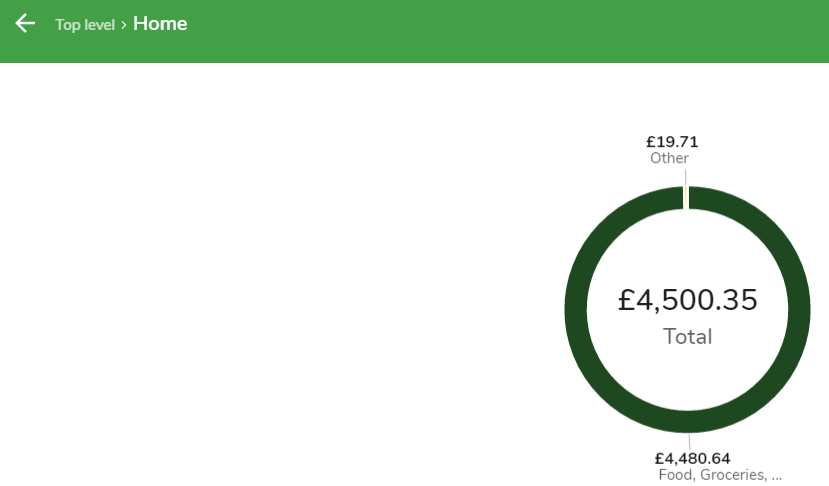

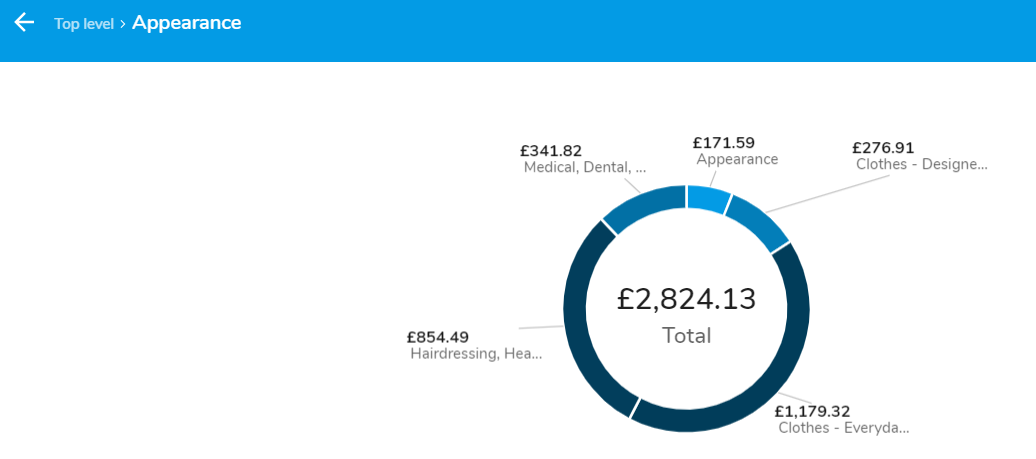

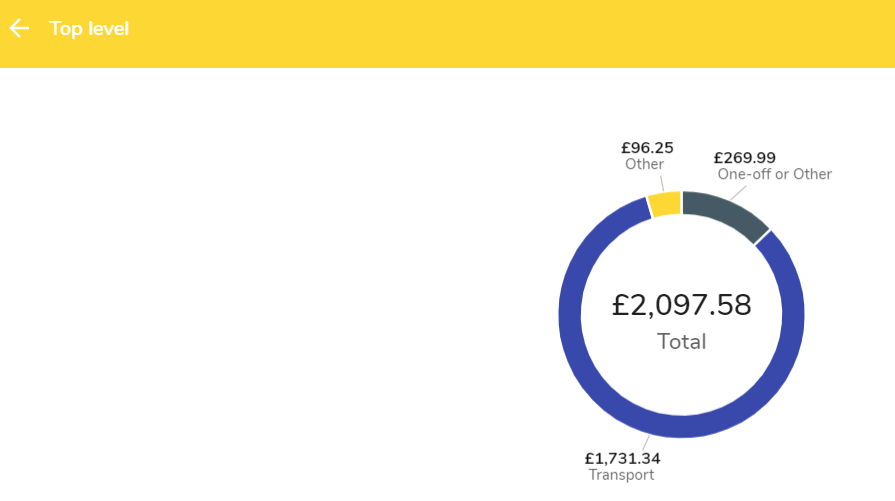

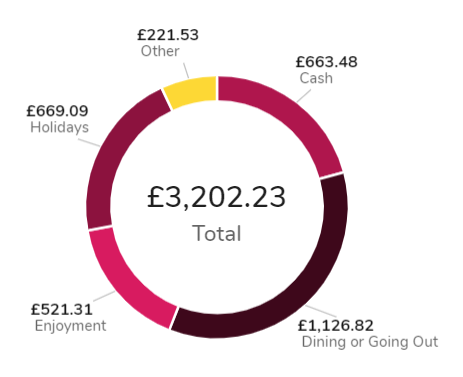

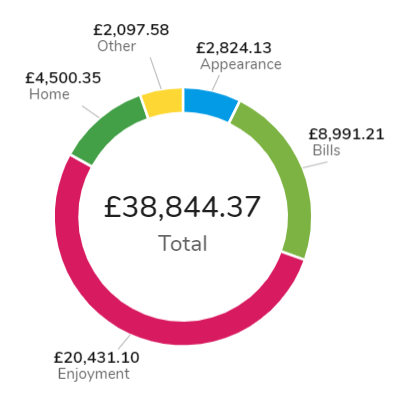

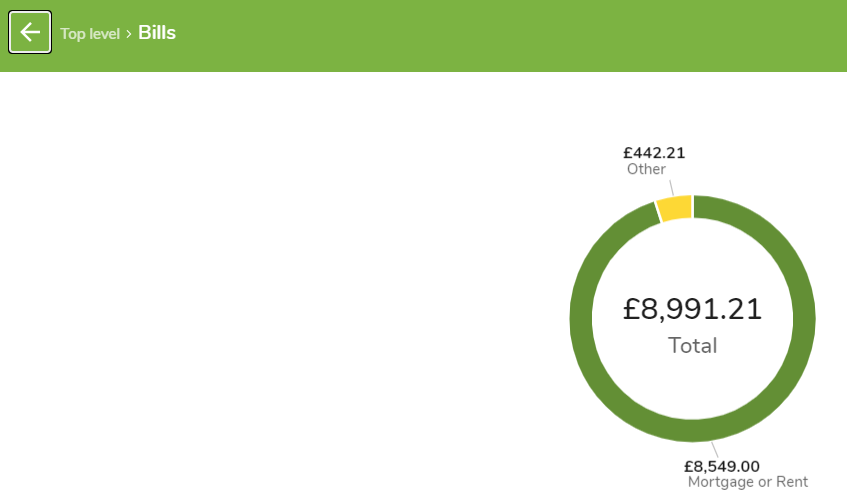

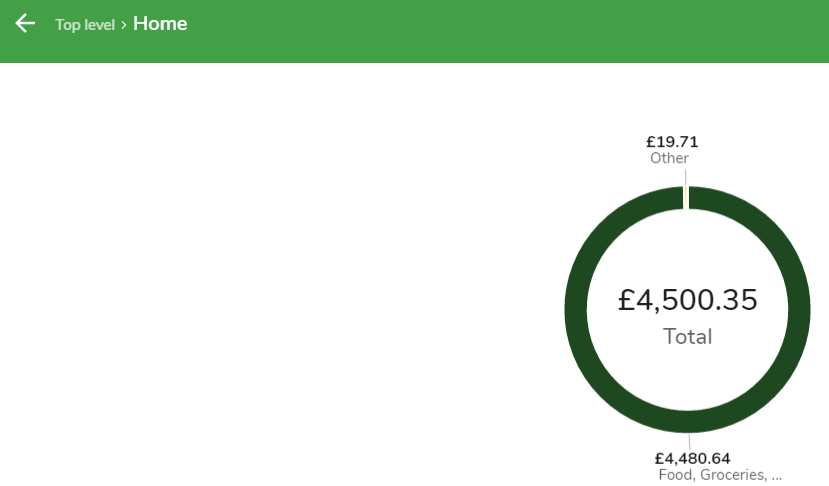

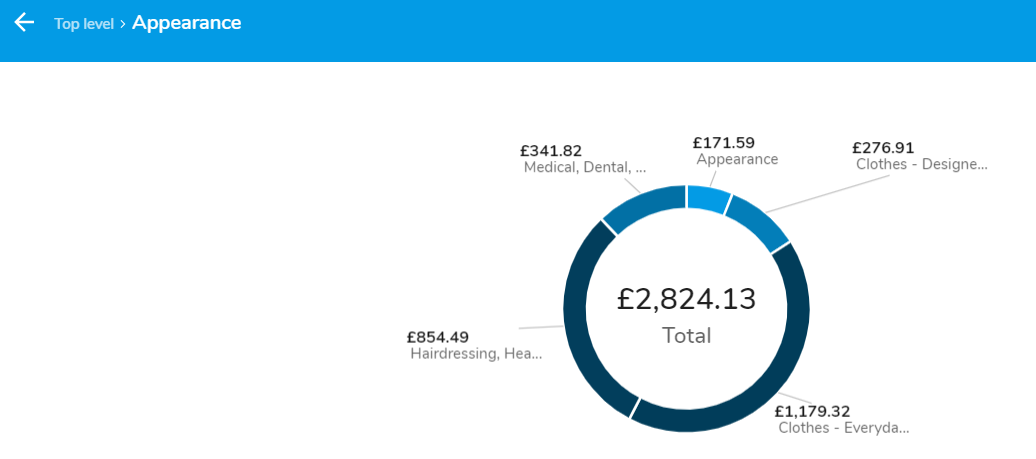

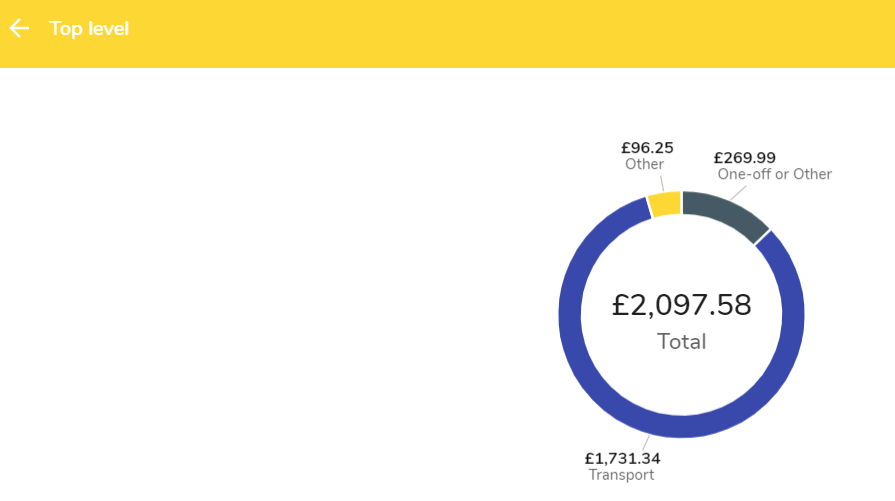

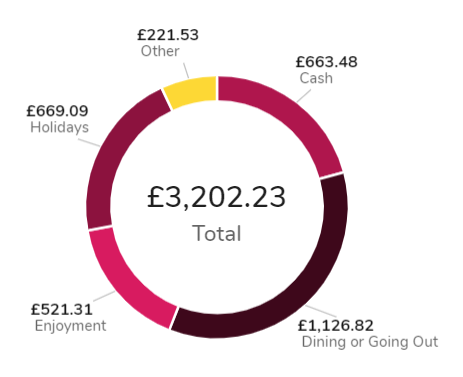

And here is a high-level breakdown of our UK expenses

And here are all of those categories broken down again so you can get a better idea of where we spend our money.

It’s no surprise that for the second year running our Holidays category is right at the top. The Cash category is hard to group because we went to a lot of countries where we would have to withdraw a heap of cash to spend whilst we were there. Egypt was a good example of a country that still predominately uses cash as opposed to EFTPOS. So you could almost certainly group up to 90% of the Cash category into the Holidays too which would make it number one. We try a new restaurant in London every single week and dined out a hell of a lot during our travels so I’m not surprised to see Dining and Going Out up so high. It’s one category that will plummet once we get home back to our country town purely because there are not that many options where we’re from 😅.

Anyone who has lived in London can back me up when I say that the cost of living here is insanity! I mean honestly, unless you have a decent-paying job (>£50K) you’re much better off moving to Liverpool or Manchester. Rent will be halved and the general cost of most things will be down too but you’ll still get the benefit of being on Europe’s doorstep for travelling. One thing to take into consideration with the above number is that we only paid 8 months worth of rent for the last financial year because 4 of those months we were travelling and had sub-letted our room.

Food and Groceries is one area that we have been really lazy with. Unfortunately, overpaying for the sake of convenience is a common occurrence when we shop at the moment. We’re not set up to succeed with this category in London. I’m missing a few key kitchen utensils that I can’t justify buying because we’re leaving this year plus the freezer is not that big which makes it hard when you have to share it with 4 other people and It’s just generally harder to meal prep without spare time. We still do meal prep a bit but I’ve often found myself asking Mrs. FB if she wants to go out for dinner because it’s an amazing night in the city and I’m exhausted from work and don’t want to deal with the messy kitchen back home.

These are all excuses but the difference really can be night and day when you create an environment to be successful with anything in life vs trying to push a rock uphill. If you study in a quiet library you’re probably going to have a better chance of retaining the information vs trying to study whilst watching Netflix. If it takes you 30 minutes to get to your gym, you’re probably less likely to keep a consistent training schedule because it will be easy to justify not going etc. etc.

This is one area I can’t wait to improve on when we’re back home. A veggie garden will be built asap when we finally have a backyard again 🍅🥕🥒😁

I’m gonna go out on a limb here and say that 80% of this category can be attributed to Mrs. FB 😜

Buying a bike and COVID hitting has reduced our transportation costs enormously.

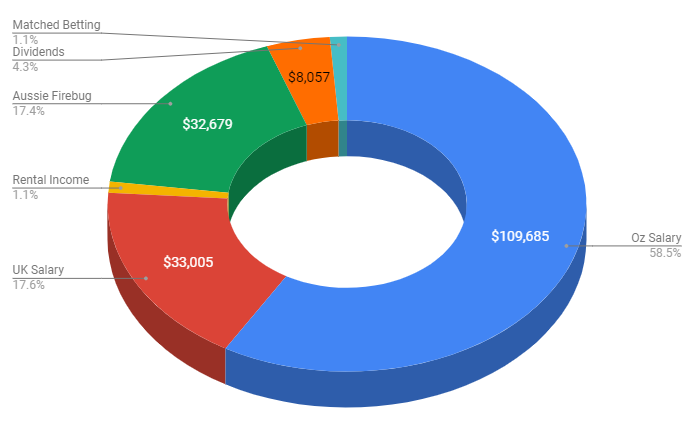

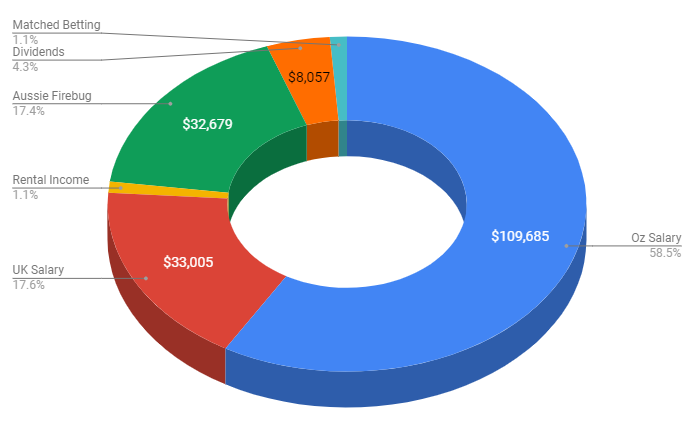

Breakdown Of Income

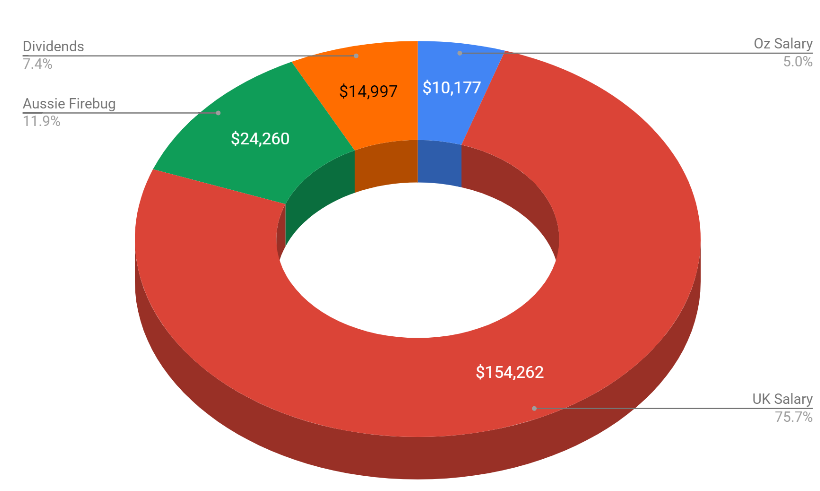

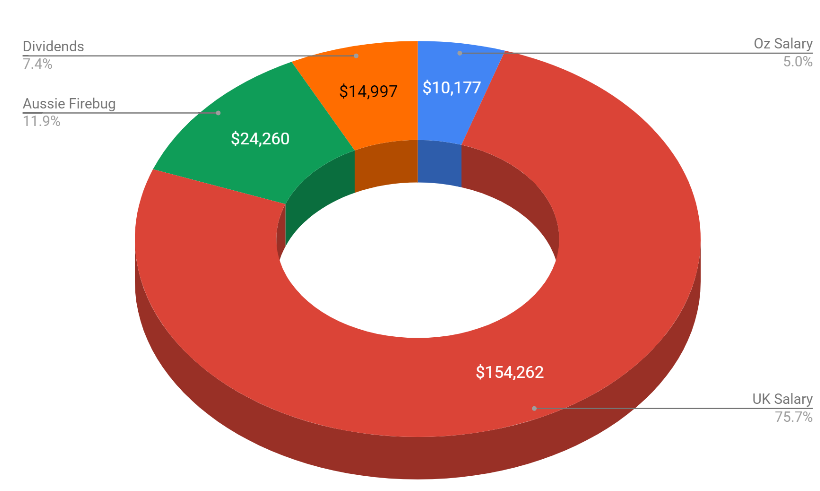

All numbers are in AUD

* There were a few big expenses for the properties during the last FY and it resulted in them actually costing us $2,776 🤦♂️ which is why you don’t see rental income in the above pie

It’s absolutely insane that we managed to earn $200K mostly after-tax considering how much travelling we have done during the last financial year.

When we decided to YOLO at the start of 2019 to live out a life long dream travelling Europe, I was convinced that my dream of FIRE would have to be put on hold and this once in a lifetime trip would delay our financial independence for a few years. What I honestly didn’t expect to have happened was the dramatic increase in income. I work in data (currently a BI Dev) and always knew that Melbourne and Sydney offered a higher paycheck for the work I do but those cities have a much higher cost of living than the country so I never really bothered pursuing it figuring the net gain might be a little bit more but not that much.

Well, let me tell you right now that London contract rates for tech workers are insane!

Before I get into exactly what I was paid I want to remind everyone (especially any newcomers to this blog) that my average wage, previous to moving to London, hovered around $90K for 8 years. My first job out of uni was around $72K in 2011 and it peaked at $110K before I left Australia which I understand is still high (especially for the country). I really want to emphasise that FIRE is possible without a high salary. It might take you longer, but almost every Australian can realistically reach financial independence with the right lifestyle.

With that being said, my first two contracts were at £500 a day and the one I’m on now is a fixed-term contract for 10 months with a base of £80K plus a £20K bonus.

That’s a lot of money, to begin with. But what makes the contracts outrageously lucrative is the way that limited companies are taxed in the UK (you need to be a resident of the UK for tax purposes to take advantage of it). I’m not a tax expert and I don’t know why they even do it the way they do, but for whatever reason, you essentially get taxed bugger all if you operate outside of a ruling called IR35.

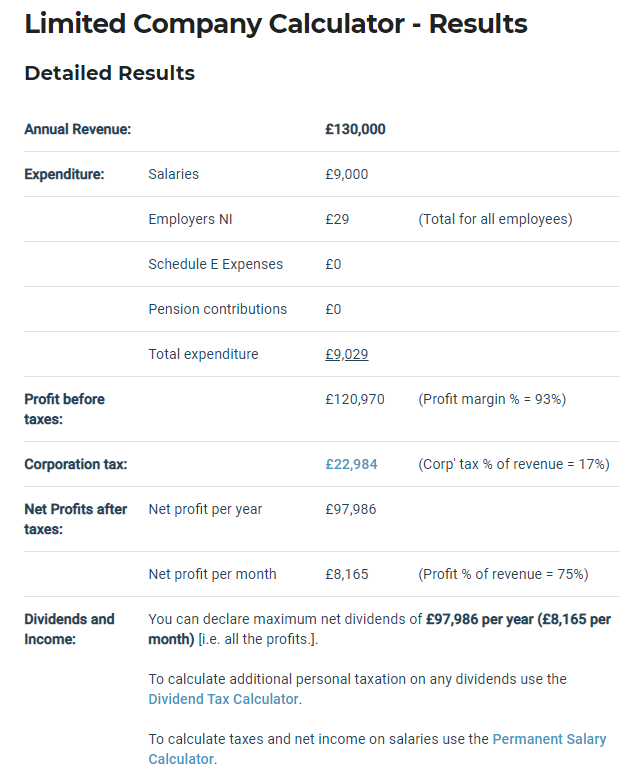

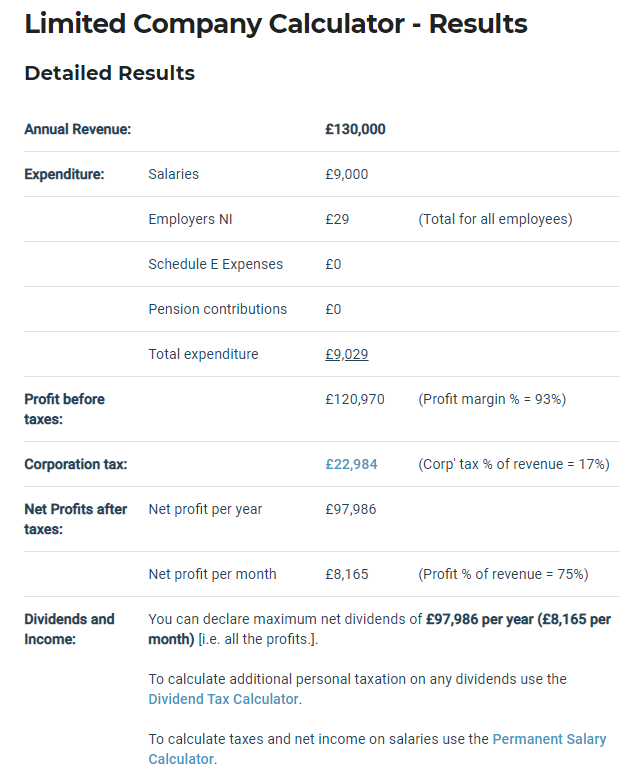

Let’s assume that I worked for 12 months with a £ 500-day rate (I was actually asked to extend one of my contracts but had to turn it down because we were travelling during the European summer and the amount of money I was passing up did kill me inside a little bit 😂) which works out to be £130,000 a year. Here is roughly how it breaks down according to the laws currently using a UK Contractors calculator.

So you can take a £9K salary from the company which is like the minimum wage which means you won’t have to pay any tax on that part. The rest can be taken from the company as a dividend which is where the tax rates are insanely low.

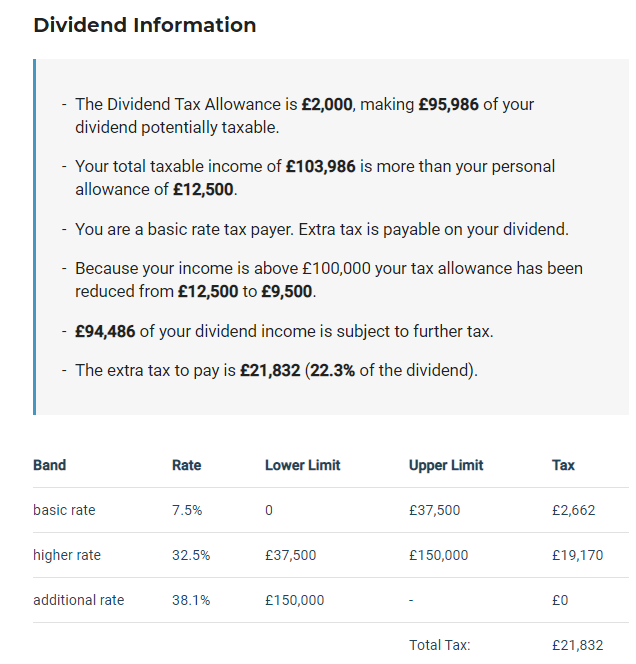

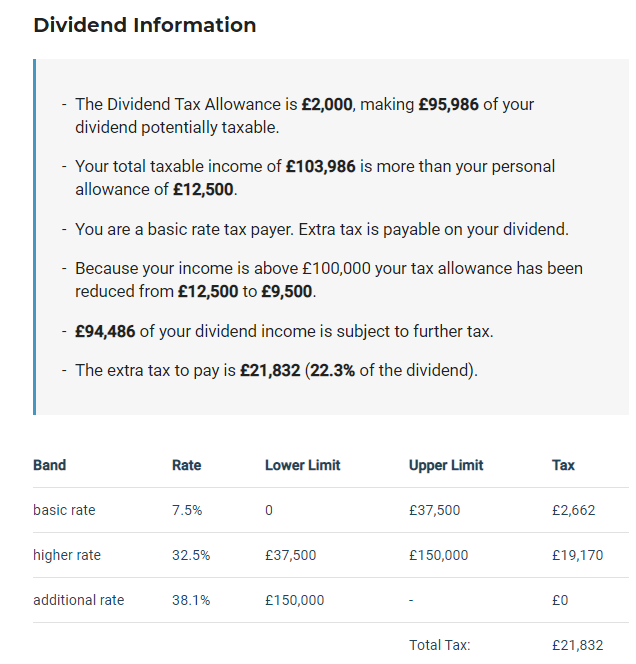

So taking £97,986 as a dividend with the current tax rates looks like this.

Those rates are crazy low! If we double the £ to make the conversion easy that essentially means that someone who received AUD $188,972 (£94,486 * 2) as a dividend only paid $43,664 in taxes. The equivalent for a salaried worker in Australia earning $188,972 is ~$62K in taxes and that’s including with the $18K tax-free allowance!!!

So if we wrap up everything here and assume I did accept my contract extension that lasted 12 months. I would have ended up with:

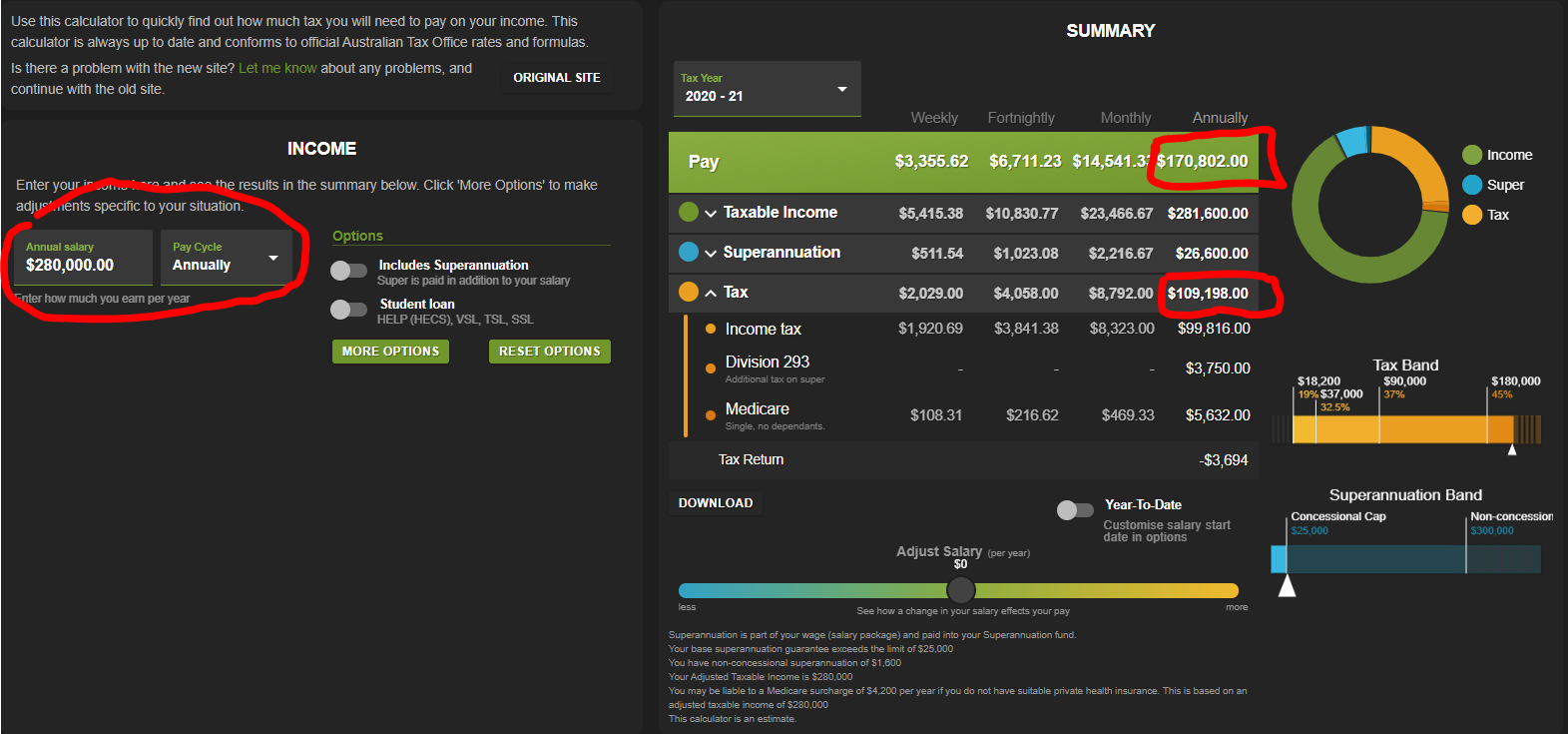

£130,000 (annual revenue) – £22,984 (corporation tax) – £21,832 (taxed owed for dividends) = £85,181 after-tax income

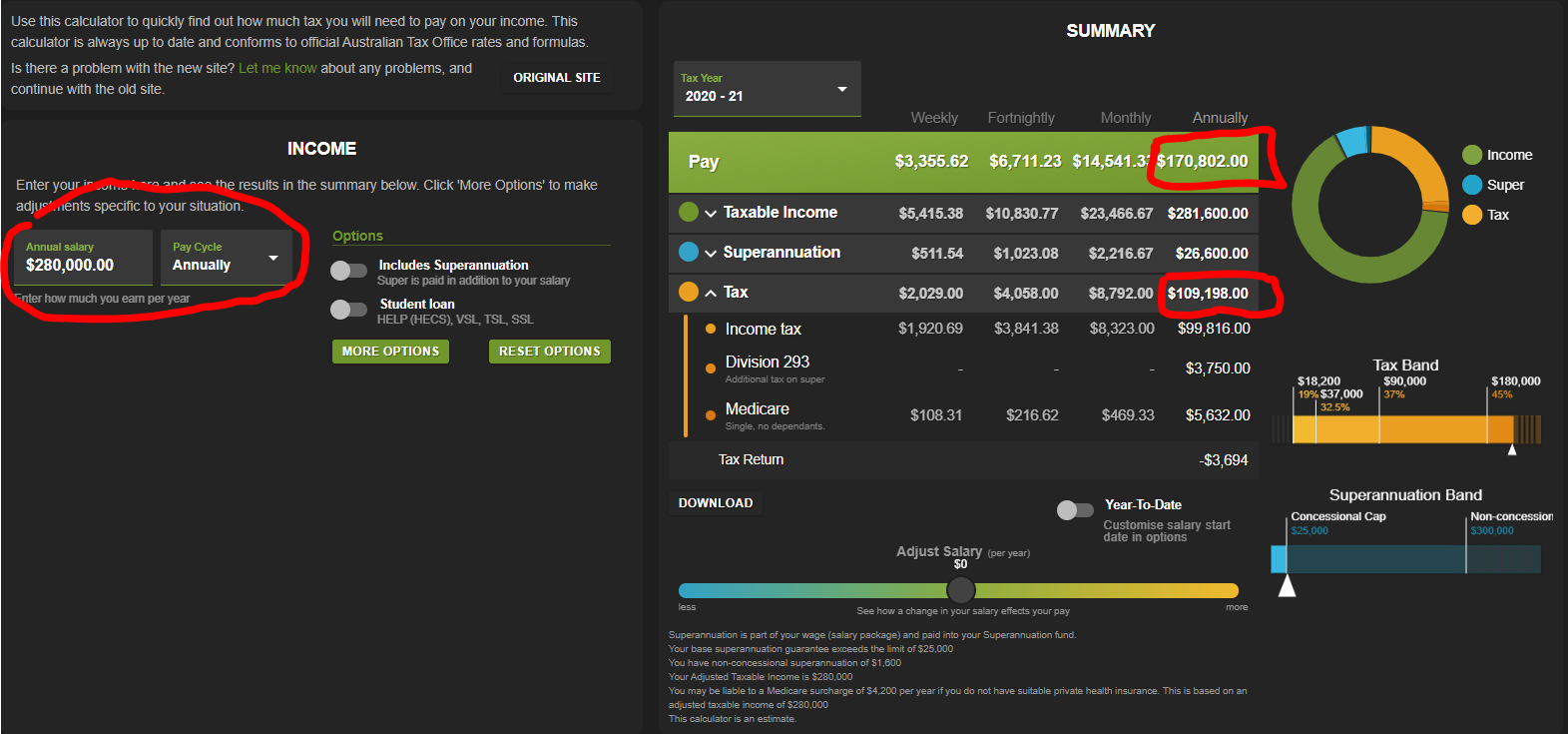

If we double that number we get AUD $170,362.

I would have to be earning ~$280K AUD as a salaried worker to get the equivalent after-tax income 🤯🤯🤯

https://www.paycalculator.com.au/

I mean… that’s more than some CEOs right. I would never, ever, ever have thought that this earning potential was out there.

I can only really speak for tech jobs (mainly in data) because I’m not too sure what the difference is like for other fields. Mrs. FB, for example, makes almost the same here and when you factor in the difference in living costs it was definitely a net negative for her to move across.

If you’re in one of the following (there’s a lot more but these spring to mind):

- Data Analyst

- Data Scientist

- BI Developer (Power BI, Tableau, Qlik)

- Data Analytics

- Data Engineer

- Data Warehouse Architect

- Data Pipeline Developer (SSIS, Data Factory, Alteryx)

- Software developer

- ML/AI specialist

- Dev Ops

- Cloud Architect (AWS, Aszure, GCP)

There’s a lot of money to be made out there (assuming you’re willing to move).

Unfortunately, the crazy low tax rates for contractors are coming to an abrupt end next year. It was actually meant to end this year but COVID hit and they postponed it another year. I don’t know what things will look like after they make the changes but I’m glad I was around before they did.

I have to admit that my eyes have been opened after working these contracts in London. Sometimes I feel like we, in the FIRE community focus too much on reducing expenses and investing but nowhere near enough on trying to earn more money. I recently wrote a bit more about this subject in Pearler’s ebook project actually. And low tax rates are not something that’s unique to the UK. I’m pretty sure Singapore has a really low-income tax rate and Dubai has no income tax at all!

Reducing expenses is still 👑 but I’m convinced that so many people reach a point where they would be served much better investing in themselves and trying to find a higher-paying job. It can really help the process!

This blog had another amazing year generating an after-tax income of ~$24K. The taxes were brutal for me this year because I’m a UK resident for tax purposes (to take advantage of the crazy tax rates) which means I pay a high rate straight out the gate for all income made from AFB.

The craziest thing about this site still being able to generate some serious cashola is how little time I have spent on it during the last financial year. I’ve spoken about this before but I put a crazy amount of hours into this passion project for the first three years. And it didn’t flip a cent because I never cared if it made money or not. There’s no way you’re going to work on a project for 3 years without making any money if you don’t love it! But all that hard work is still paying dividends today because a lot of my traffic is still generated from some high ranking articles/podcast there were made all those years ago.

We’ve just been so busy during the last year that I haven’t been able to make as much content as I would have liked. Shit, I haven’t released a podcast in three months but I’m still ranked at 38 (humble brag 😜) for Aussie Business Podcasts according to Chartable. I guess my point is that even though I’ve really been slipping with AFB stuff, the site/podcast continues to churn away even when I’m sleeping. The internet is an insane bit of technology!

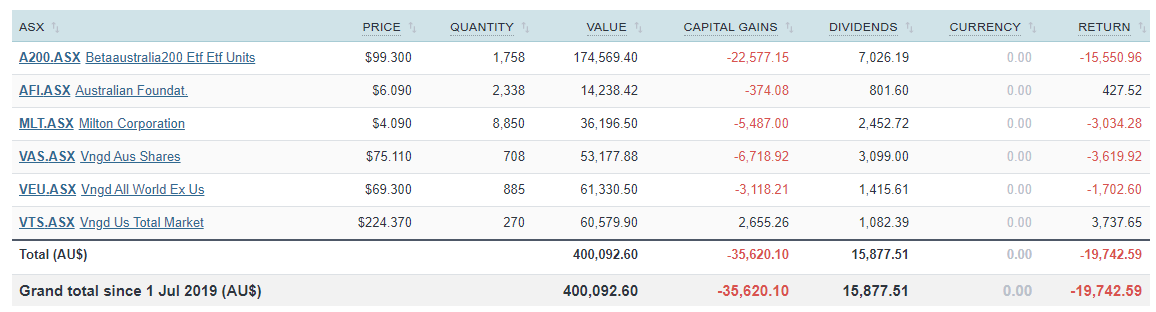

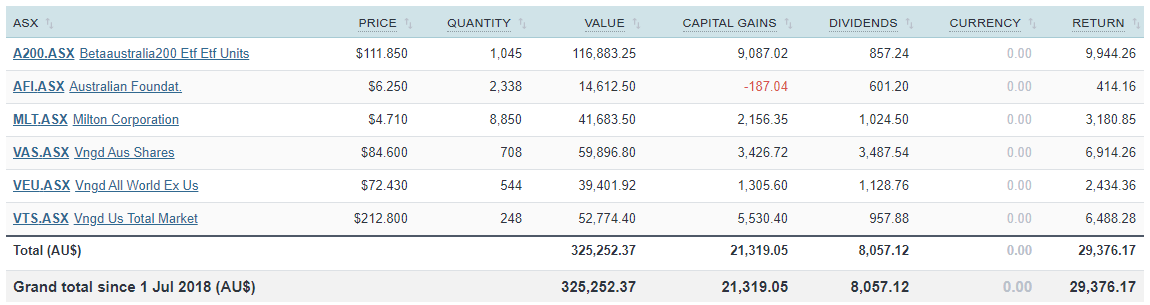

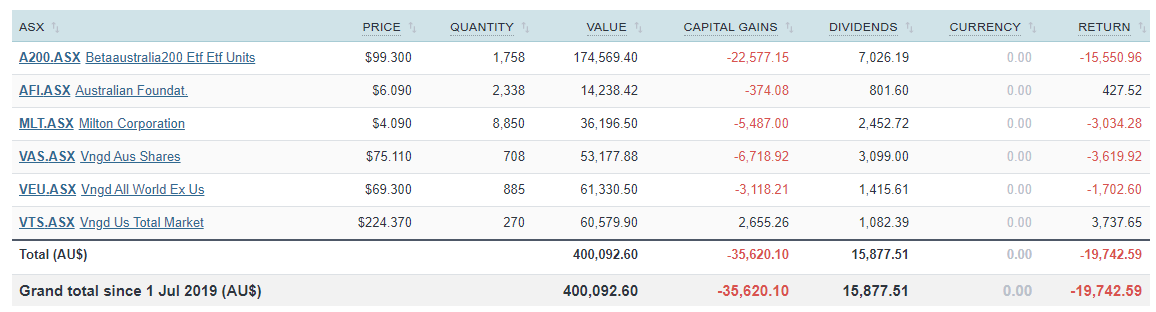

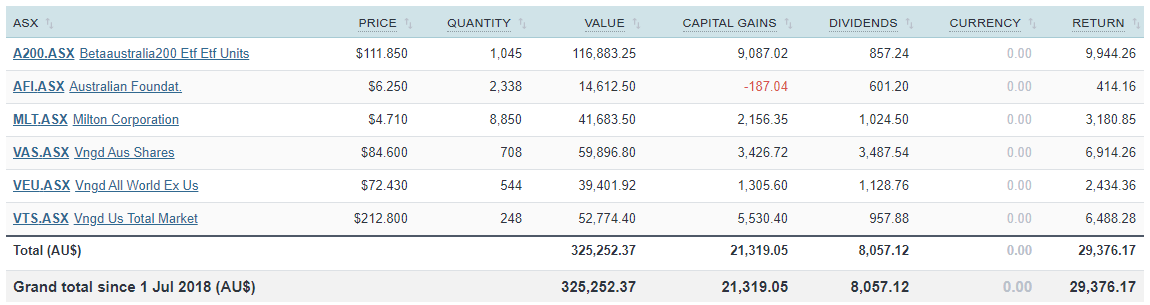

Dividends were broken down like so:

Nearly $16K even with the effects of COVID! Pretty pumped with that tbh. It’s just shy of double what we received last year ($8,057) so I’m really happy with how things are progressing. It’s going to be interesting to see the results for these next coming 12 months but after a few years (hopefully), if the payouts are similar to what they have previously been, we should see a strong uptick in dividend income which is really exciting!

What About You?

That’s it for another year!

Tracking your expenses is a must if you’re serious about financial independence because unless you know how much you spend, you’ll never know how much passive income you’ll need to FIRE. I’ve been blown away with the job market in London for my field and it’s opened my eyes to what’s possible earnings wise. This has been an unexpected benefit of moving to another country but a welcomed one at that.

So how did you go the last time you checked your expenses? Is there an area you’d like to rope in? Or maybe investing a bit of time and energy into your earning capacity would pay even higher dividends.

Let me know what you think in the comment section below 🙂

Spark that 🔥

-AFB

by Aussie Firebug | Oct 22, 2019 | Investing, Mindset, Saving

This years review was a lot more complicated to calculate because we earned and spent money in two different countries which meant keeping track in two different systems. The tax was a bit tricky too and it has taken a lot longer than I would have hoped but better late than never!

You can check out last years review here where we achieved a savings rate of 66%.

So how did we do this year?

Let’s get into the numbers.

Savings Rate For 18/19 Financial Year

Our savings rate for last financial year was… 56% (▼-10% from last year)

We earned $185,441 (▲+$43,944…mostly after-tax*)

And spent $80,817 (▲+$32,818)

Compared to last year we increased our income by $44K, which is great but unfortunately, that was accompanied by a record-breaking amount of expenses which was mostly due to our travels. We spent more than $32K compared to the previous year which decreased our savings rate by a whopping 10%. This further illustrates that it’s the expenses that are a lot more important vs how much you earn when it comes to your savings rate!

I’m pretty stoked about 56% tbh. It’s a fair dip down from 66% but considering our travels this year, we can’t complain at all.

I’ve included a breakdown of our income for this years update too so you can get an idea of where our $$$ come from. But the really important part is still the expenses.

*I’m still in the process of completing the tax obligations for the trust and AFB. I’ll update this article when it’s done

Breakdown Of Spending

Below is our Australian expenses for the last FY.

And in pie form

Holy Mackerel our ‘Holiday and Travel’ category exploded into our number 1 expense which isn’t all too surprising really. Majority of that $23K was the costs of flights, accommodation, food/drink and cash out for activities. It also covers some of our London setup costs when we were still using our Australian Money to pay for things before we set up our UK account. It’s a lot of money and it’s crazy how it all adds up but this trip (that we’re still on) was never about saving money. It’s not something we plan to have in our yearly budget once we FIRE though.

Not surprisingly, rent and groceries come in next which was our number 1 and 2 expense for last year.

‘Health & Beauty’ came in 4th because Mrs. FB had a toothache about 4 months before our trip which resulted in an operation to remove her wisdom teeth. We went private because we needed it done ASAP but it cost around $3,500 💸. If we had more time to plan properly, I would have liked to research how much it would have cost in Maylasia or somewhere similar. I’ve heard stories about how dental care there is just as good as in Australia but 1/5 the price.

‘Transport’ was the new category instead of our ‘Car’ one for last year. It went down a little because we left Australia in January and only had ~7 months of Car expenses instead of 12.

‘Food & Drink replaced ‘Entertainment’ and went slightly up.

Our ‘Gym membership’ went way up because I started to train Brazilian jiu-jitsu twice a week but I absolutely love it! I’m still a white belt and haven’t found a gym to train in London unfortunately.

Those were the main ones with the rest of the expenses being pretty similar to last year. Nothing else really jumps out at me.

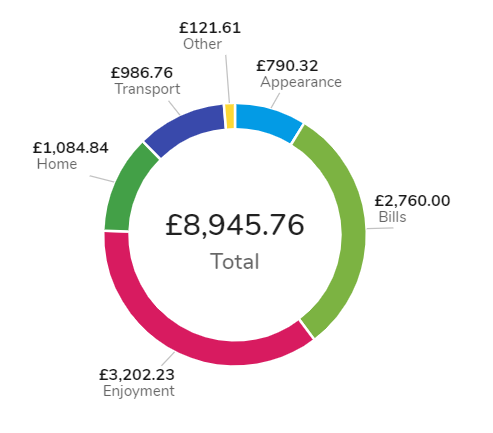

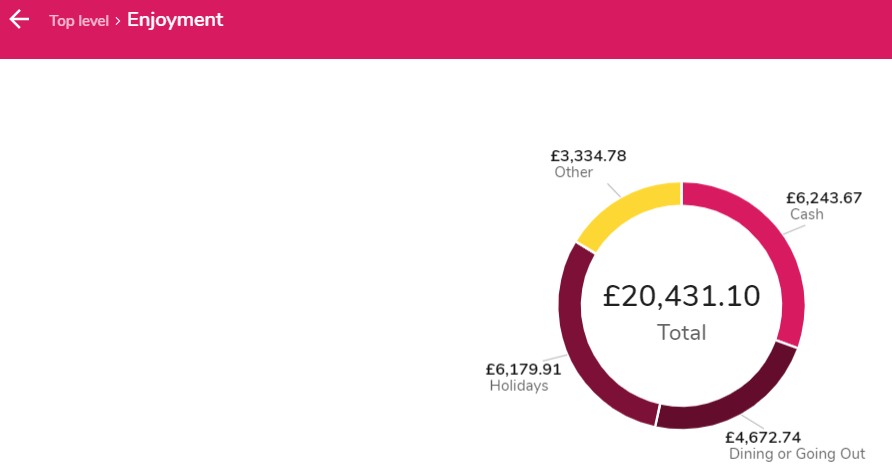

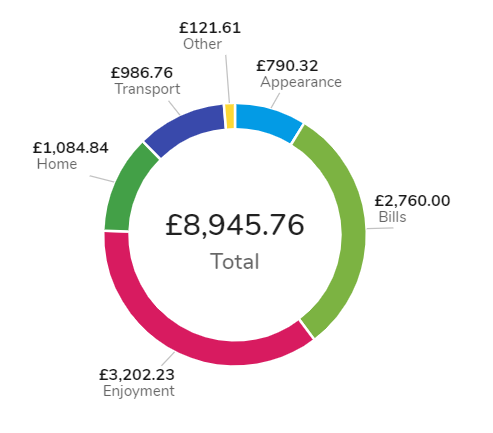

And here is our break down for the UK

We use an awesome money management tool here in the UK called Money Dashboard which works very similar to Pocketbook but it’s actually a lot better. For one, you can split transactions! This has been a feature request I’ve wanted pocketbook to do for like 3 years but they just won’t bloody do it!

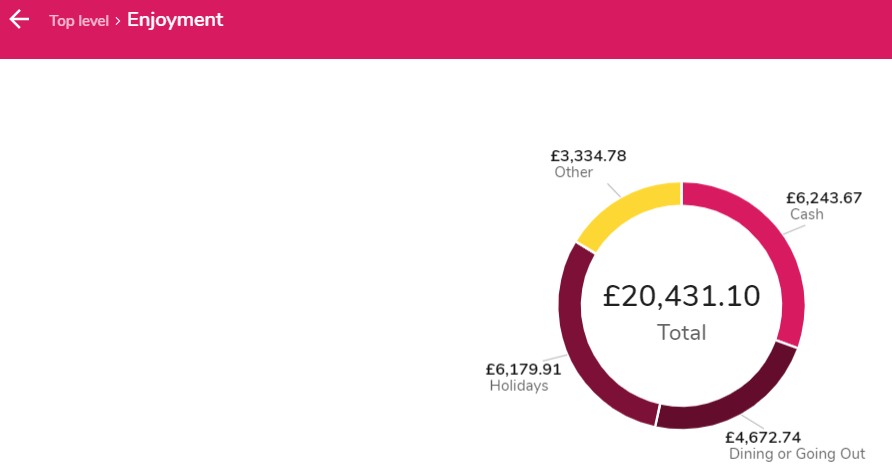

Anyway, our ‘Enjoyment’ category has been our biggest expense while being in London and it drills down to look like this.

To say we have been ‘treatin’ in London when it comes to our ‘enjoyment’ category would be an understatement. Part of experiencing our new city has been taking advantage of what it offers in terms of sporting events, restaurants, concerts, activities and nightlife. The funny thing is, we don’t actually spend that much compared to our friends over here. We still take a packed lunch, get the bus/train, look for things second hand on GumTree etc. It’s just that if I compare how much we spend on doing ‘stuff’ in London vs back home in country Victoria, it’s been a blowout!

‘Bills’ has been mostly made up of our £900/m rent costs and ‘Home’ covers all our groceries home set-up costs.

Breakdown Of Income

A new addition to the yearly update. I thought it might be helpful for people to see where we earn our money and how we have built multiple streams of income that contribute to growing our snowball.

No surprise that exchanging our time for money (a job) generates the bulk of our income. A combination of our Australian and UK salaries equate to over 70% of our income. But the remaining 30% is a little bit more interesting and is part of the pie that we are aiming to grow over time.

This blog generated an astonishing ~$33K during the last F/Y (excluding taxes). That was through a combination of sponsorships on the Podcast and affiliates. I only started to seriously monetise this site last year with companies I was already using. I actually pioneered a few affiliate programs that you now see being used by a lot of other bloggers/authority figures. It’s amazing what a simple conversation can do.

I approached some of my affiliates with something along the lines of

‘Hey, I use your service and love it. I often recommend your product on my website if people ask. Would you be interested in buying some adverting space on my podcast or maybe an affiliate where my audience gets something that’s not available to them now? What do you think?‘

Sometimes I don’t hear back from them, but other times it works out better for everyone. I end up getting paid for my work, my audience gets a better way to sign up with a company I use and recommend, and that great company gets a new customer!

A lot of people have mixed feelings about monetising a blog. I’m a huge sceptic myself whenever anyone receives a financial incentive for recommending a product and there’s really nothing I can say or write that will convince some people otherwise. I’m pretty transparent on this website and I would like to think that I’ve built up a certain level of trust amongst you all, but I understand that there’s always going to be people who don’t dig it.

Having a side hustle can be a huge accelerator towards FIRE. But let me tell you straight up, if you’re thinking of starting a blog with an intent to monetise it later, you’re probably not going to get far. And even if you do, I’d doubt you’d make anything worth your while if money was the sole intent. If I was to divide the money made from this blog by all the hours I’ve put in, I’d be much better off working at Hungry Jack’s on minimum wage. This site is about money but was never intended to make any, I simply love creating FIRE content for Aussies and will continue to do so with or without the sponsors/affiliates.

You can see every company I’m affiliated with on the resources page.

Dividends were broken down like so

I’m stoked with $8K but am really looking forward to seeing the results of this report next year. A200 only returned $857 mostly because it was a new fund. Considering we currently have over $150K in that ETF as I write this now, the dividends should be closer to $5K-$6K assuming there’s not a crash or bear market. This is the slice of the pie that we want to grow as much as possible and will become the foundation for our financial freedom. It’s so exciting seeing the income grow each year especially now it’s starting to add up to a considerable amount.

I mean shit, even at $8K a year, that’s a kick-ass yearly holiday for the rest of our lives! Not to mention that even if we never added another dollar to the snowball, it would continue to grow faster than inflation and consequently raise the income without us having to do anything!

We ended up making just over $2K from matched betting which came mainly from the signup bonuses of the bookies. While it is possible to continue making money through matched betting, it takes time which I didn’t think was worth it for me personally after we had exhausted the sign-up bonuses. A Family On FIRE documented her experience using matched betting as a side hustle which is a fantastic case study and well worth reading if you’re considering trying it.

And last but not least we have the good old rental properties generating us a measly $2K. I’ve said it before but I’ll say it again, Australian residential property absolutely sucks at cashflow. The amount of time and effort I put into our two remaining properties with all the banks, conveyancing, tenant issues, chasing rent etc. makes it laughable that they only returned ~$2K cash last year. Now we all know that the real reason most people invest in Aussie property is for that sweet, sweet capital gainz gravy but eh… I won’t know how much that turns out to be until I sell and it doesn’t help me until then.

What About You?

That’s it for another year!

My number one tip has always been to track your expenses. You won’t ever know how much passive income you’ll need to FIRE unless you do and it creates good financial habits. I hope this post was helpful to you as it’s always interesting to see what people spend their hard-earned dollars on.

What about you? Do you have a category you really need to rope in? Or maybe it’s time to look into a side hustle to boost your income?

Let me know in the comment section below.

by Aussie Firebug | Sep 24, 2019 | Investing, Mindset, Popular Article, Tax

In case ya missed it, earlier this year I published what turned out to be my most controversial article of all time (and it’s not even close). The Curious Case of Franking Credits and the FIRE Community of course.

The thing is, I actually really don’t like talking about politicians and what they say and plan to do at all. That piece was never meant to be political but after reflecting for some time now, it was always going to be that way due to the nature of the subject matter.

So why the hell would I ever go near it again?

Because even though I don’t like those 🤡, politicians do affect us in the journey to FIRE and I need to set the scene first in order to talk about how we come to the conclusion at the end and where we’re heading moving forward.

And the beauty of having your own blog is you get to write and publish whatever you want. I create content from my point of view and never claimed my writing was balanced. This site isn’t the ABC or some neutral FIRE outlet. I presented facts in that article with my opinion which I understand everyone isn’t going to agree with.

However, that topic was interesting to me (and a bunch of others) so if I’m offending you or you don’t like what I’m writing, maybe you should follow another FIRE blogger ✌

Franking Refunds Survived…For Now

Like Steven Bradbury before him, ScoMo and the Coalition skated past the ALP for a come from behind victory and with it, the franking credit refunds will remain for the foreseeable future.

This was a hot topic amongst the FIRE community and now that the election has passed, it seems like things should proceed as per normal right?

I mean, franking credit refunds didn’t get the chop so fully franked dividends are safe to retire on yeah…?

Well… about that

Whilst I think that the result of the election speaks volumes to where the majority of Australians priorities lie, I strongly believe that a lot of the policies the ALP were trying to win votes on will not be touched for a very, very long time. They were aggressive with their tax reforms, franking credit refunds being one of the smaller changes (CGT and trust distributions being a lot bigger).

This was supposedly the unlosable election for the ALP. Every poll in the country had them winning by a landslide. Sportbet even paid out on them winning two days early to the tune of 1.3M 😮

For them to lose in the fashion they did, especially after all the shit the Coalition has done during its previous term tells me that the majority of Australians did not agree with the policies they were proposing.

And it’s my opinion that aggressive tax reforms played a huge part!

Now I’m definitely not an expert on this subject and don’t know for sure (no one really does) but I doubt we will see such aggressive policies proposed by any party for some time. I’d almost bank on it that scraping franking credit refunds will not even be thought about in the next election. They’ll go after something else, that’s a given. But it won’t be the same policies that contributed to them losing the election this year.

Sidebar: I’m not here to talk about the policies or politics so for the love of God don’t @ me in the comments about it.

But that’s enough about the election.

Again, I really don’t like politicians in general and try to avoid talking about them as much as possible. I only bring them up because it’s important to set the scene for the decisions we’re making in regards to investing for financial independence which is what this blog is all about.

Which brings me back to the point about the franking credit refunds.

Whilst I truly don’t think any political party will go near them for a very long time. I also learnt something very valuable from that campaign policy.

The legislation risk associated with franking credits in general.

I was completely naive in thinking the government would not pull the rug out from underneath us and the refunds would be here to stay.

What a fool I am!

I’m just thankful we’re still in the accumulation phase and have a chance to mitigate this risk a bit moving forward (more on this below).

But wouldn’t it have absolutely sucked if you’d worked your whole life and built up a retirement fund utilizing franking credit refunds only for the government to turn around and change the rules on you!

The refunds are safe for now. But I plan to be retired for 50+ years. That’s a long time for people to forget what happened in 2019 and if I were a betting man, I’d wager that sooner or later, franking credit refunds will be back on the chopping block!

Are Aussie Shares Worth It Without Franking Credits?

The thing about franking credits for those who are chasing FIRE in Australia is that without the refund, they are worth a hell of a lot less and in some cases, will mean that you don’t receive any benefit from the franking credits at all.

Let me give you an example.

Mrs FB and I know that to fund our current lifestyle in Australia, we spend around $48K over the course of 12 months.

We plan to own a house one day, so if we remove our rent and add on a bit to cover rates, maintenance on the property, insurance etc, we get to around ~$42K at a guess.

The plan before the election was for us to split our dividend income 50-50 and pay ourselves the $18,200 (tax-free income threshold) each from Aussie franked dividends. Let’s assume that the dividends are fully franked.

We each would receive $18,200 in cash throughout the year plus $7,800 in franking credits each. This means that the ATO would look at us having a taxable income of $26,000 for that year (dividend plus the FC).

Here’s the math behind the grossed-up dividend.

| Dividend |

% Franking |

Franking Credit |

Tax Before FC |

Tax After FC |

Grossed up dividend |

| $18,200 |

100% |

$7,800.00 |

$1,482 |

-$6,318 |

$24,518.00 |

The franking credits soaked up the owed tax of $1,482. This will still happen if the refunds were ever removed.

But more importantly, the franking credits refunded us $6,318!

Because we, as the shareholder, have already pre-paid tax @ 30% that was removed from the dividend before it hit our accounts. It’s only fair that this is recorded (the franking credit) and the ATO is aware of us pre-paying the tax so we can be refunded later if we paid too much tax for that year which in this example, we did.

This was always the intention of imputation credits. Not to only stop double taxation (which consequently it also does), but to ensure that income is taxed once by those obliged to pay it.

So the end result is around $24.5K each to fund our life after retirement.

That’s almost $50K! More than enough for us to live comfortably forever whilst factoring in inflation.

But if we remove the refund. We only end up with $36K between us.

That’s a whopping $13,036 dollars difference and means we need to head back to work.

Or let me put it to you another way. You’re losing 28% of your return 💸

Tipping Point

I was on the fence for a long time before moving towards an Aussie dividend approach with Strategy 3.

A lot of people out there don’t realise that a major part of the dividend approach for me was not about total return. In fact, I even mentioned it in Strategy 3 that if I were to guess, I’d wager that Strategy 3 would slightly delay my FIRE date because of the less efficient tax method of income (dividends are less efficient vs capital gains) and less diversification.

We moved to Strategy 3 predominately because of the psychological aspect of receiving income that was not affected as greatly by human emotion (share prices) and is more anchored to business fundamentals (income of a profitable business that is passed to the shareholder via a dividend).

There have been great Australian based articles written that objectively looks at retiring on dividends vs capital growth and I constantly receive messages that link to studies showing superior returns for an internationally diversified low-cost ETF portfolio.

Guys, I’m a die-hard FIRE fanatic,

I’ve come across most of these theories and articles before! What’s missing here is the human element. We’re not investing robots. I’m not too fussed between minor differences in returns and place great value in simplicity and sleep at night factor.

I thought the trade-off of less international diversification and a slightly delayed FIRE date was worth retiring on dividends vs dividends + capital gains.

But everyone has their tipping point.

Without the franking credit refund, Aussie shares just don’t cut the mustard IMO.

The difference is just not worth it for us. But everyone’s circumstances are different.

For instance, those looking to retire on FATFIRE will not be as greatly affected by this change since they will have more of an income to soak up those credits.

And many people have rightly suggested to me that there are a lot of alternative strategies to generate unfranked income such as REITs, Bonds, P2P lending etc.

These are viable alternatives for some, but we want to continue investing in companies for now.

Mitigating Risks

Let me be quite clear.

I’m still a massive fan of the dividend approach.

But placing such an enormous amount of faith that politicians won’t change the rules around franking credits over the next 50 years just doesn’t seem logical to me.

I want to mitigate the legislation risk of a potential franking credit refund axing as much as possible but at the same time, continue our overarching investment philosophy of investing in great companies.

We want to reduce our portfolios franked dividends and take advantage of a more diversified portfolio again. Which means…

I kept the international part of our portfolio when we decided to focus on Aussie shares. And when the very real news of potential changes in franking refunds was mentioned, I felt such a huge sigh of relief knowing we still had some international exposure. I guess this just goes to show the power of international diversification. If one country stuffs something up, there’s plenty more out there so you’re covered… doesn’t really work if you’re all in on the one country though 😅

Given that I don’t think franking credits refunds will be there over the next 50 years (no refund for us basically means no credits at all). I would like to receive some income from international companies along the way. It’s not going to be as good as the Aussie yield, but it helps the situation and my sleep at night factor.

Also, with the help of capital gains, an internationally diversified portfolio according to almost every major study done of the subject, will reduce risk, volatility and increase safer withdrawal rates!

To LIC or Not To LIC?

This one’s quite straightforward. A LIC has to pay a fully franked dividend. An ETF does not. VAS, for example, has a franking % of around 70-80 % which means that part of the income is not franked.

As I detailed in my ETFs vs LICS article, they are so similar that we are basically splitting hairs when comparing the two. As such, the greater legislation risk associated with LICs to me has shifted my favour towards ETFs.

I want to make myself clear again. I’m still a fan of LICs. I love the dividends they produce and the two companies I’m invested in (Milton and AFIC) have goals that align with my own (to grow their income over time).

It’s just that A200/VAS are so incredibly similar but have the key difference in utilizing a trust structure and not a company. The legislation risk has tipped the scales in favour of ETFs for me moving forward.

This is purely a tax minimisation decision. It has nothing to do with changing the overarching investment principles (investing in great companies) or a shift away from Aussie dividends.

The FI Explorer wrote a great piece on a sceptical view of LICs which some of you out there have emailed me about. I agree with what is written in that article, always have. I never invested in LICs expecting a superior return. What I go back to is the mental aspect of investing. A lot of people who retiree will feel more comfortable living on a relatively stable smooth flow of dividends vs more volatility but a slightly higher return.

Strategy 2.5

Okie Dokie.

So here she is. The new…ish strategy moving forward.

It’s called 2.5 because it’s extremely similar to strategy 2 just with a few tweaks. It’s almost like we’re going back to strategy 2 and I didn’t think enough has changed to honour it with strategy 4.

Change 1

Firstly, with the addition of buying more international shares back in the plan, we will move back to a ‘split’ approach.

Our splits have changed slightly from strategy 2 with more of an emphasis on Aussie shares as the dividends are still attractive regardless of franking credits refunds.

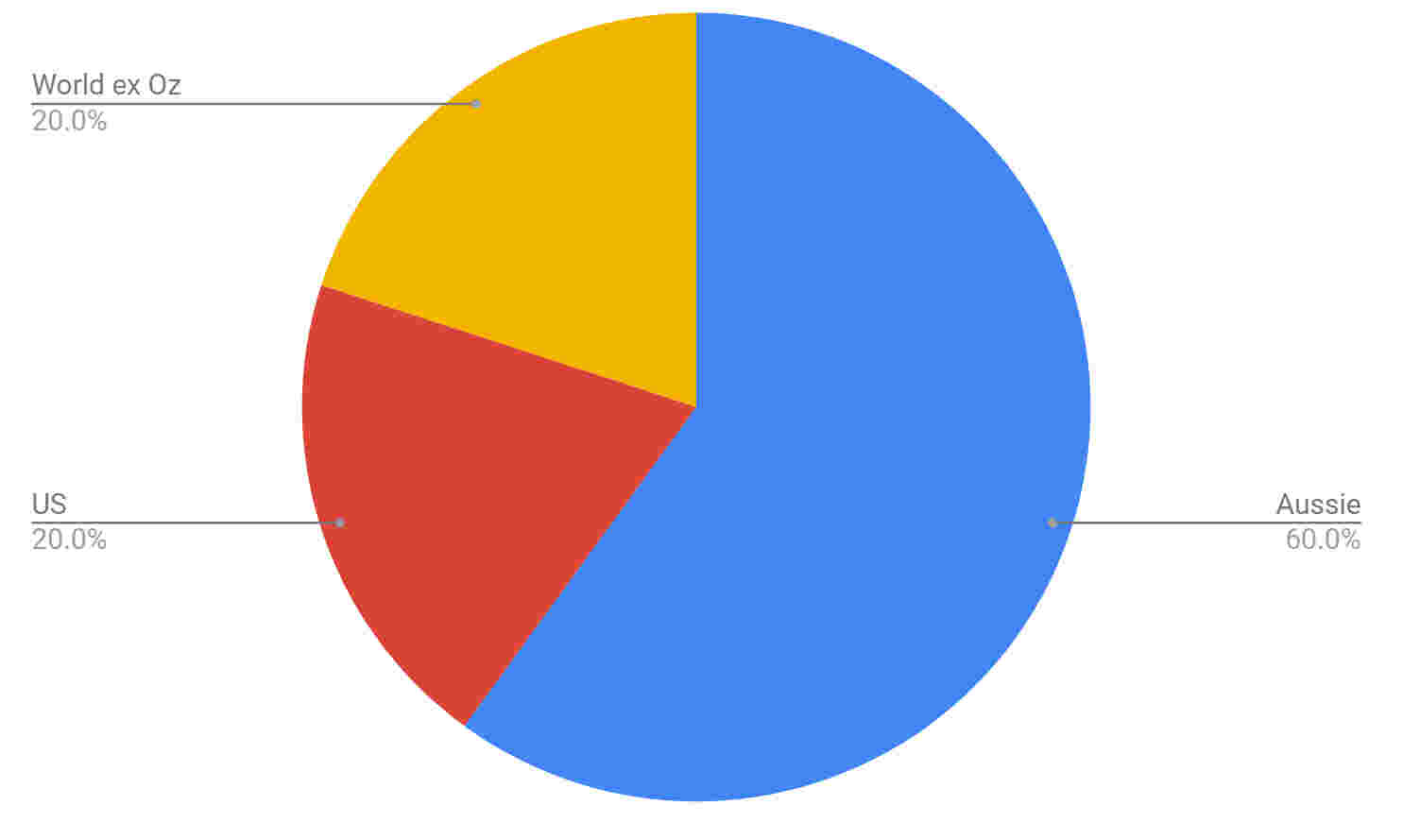

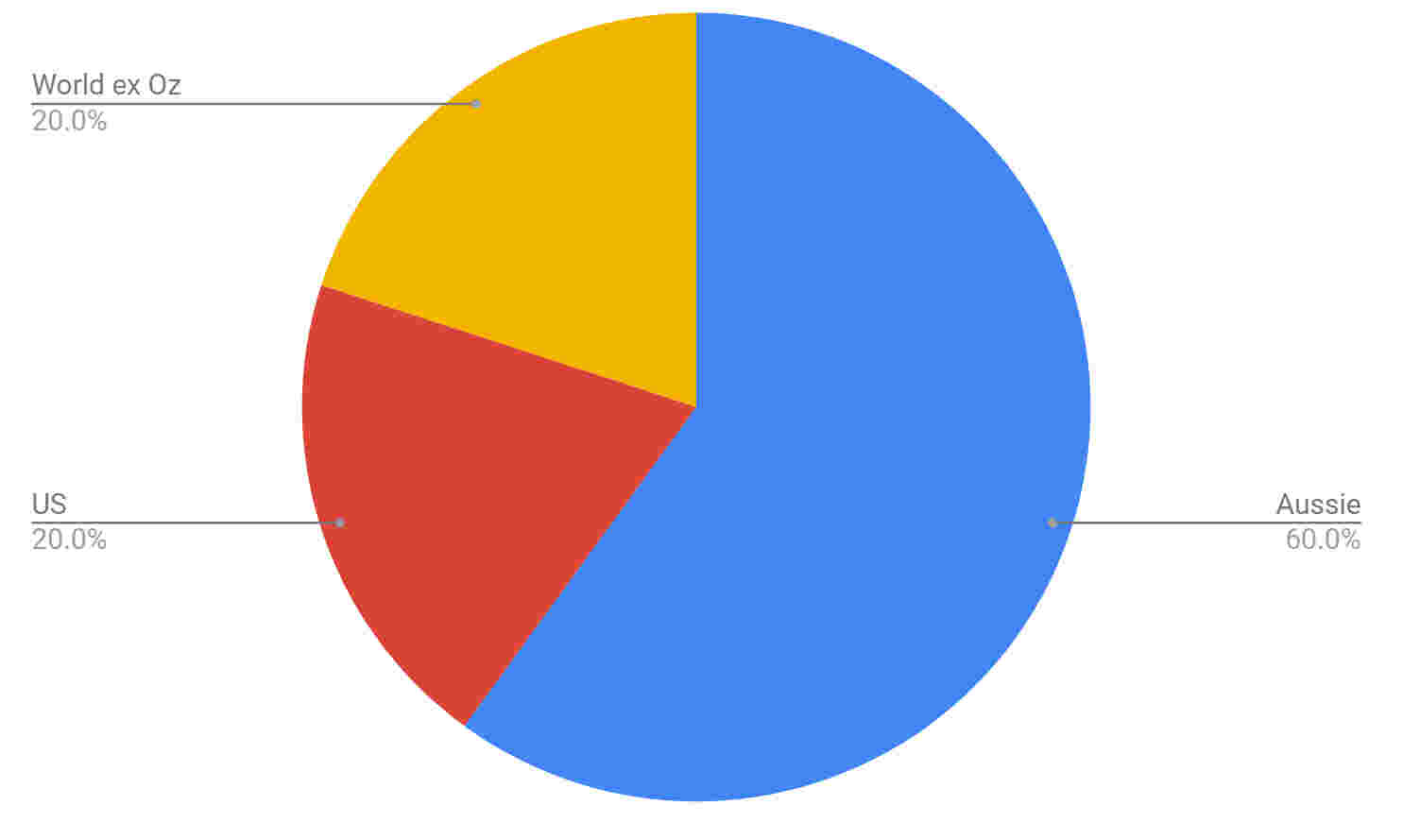

We will be looking to maintain a split of

60% A200/VAS/LICs (Aussie)

20% IVV/VTS (US)

20% VEU (world ex US)

We’ll keep our two LICs in the portfolio but won’t buy any more units moving forward.

The plan when buying new shares is a lot easier than looking at when LICs are trading at a premium or not.

Before we buy each month, we will look at the current splits in the portfolio and purchase the shares which have the lowest targeted weighting.

For example, this is what our portfolio currently looks like.

So next time we buy, it will be to ‘top-up’ the lowest split, which in this case will be World ex US or VEU. The splits are all out of wack because we focussed on Aussie equities during the last 12 months. Ideally, you want to be as close to your splits as much as possible. When your portfolio reaches a certain point however, the market movements will be so great that you might find it hard to maintain your splits even by buying the lowest weighting split. But this will be a good problem to have since your portfolio at that stage will be in the 7 figures.

Something really cool about this strategy is that you’re always buying the split that is down. If one split booms but the others don’t, you won’t be purchasing more of that booming split.

Change 2

The second change we will be making is switching from VTS to IVV.

iShares Core S&P 500 ETF is extremely similar to VTS with a few differences but no major ones we’re concerned about. VTS is more diversified and 0.01% cheaper but is not domiciled in Australia and does not offer DRP. This means that we need to fill in the W-8BEN-E form every three years or so.

The W-8BEN-E form is literally 10 minutes of your time every 3 years and is often overblown in terms of effort, but nonetheless, the two funds are so similar that it’s worth saving the extra admin plus having the DRP option available which I’ve been looking to use as of late.

Here are their 10-year returns to just show how similar they are.

Change 3

The third part of the plan is a hybrid approach between relying only on dividends vs dividends and selling parts of the portfolio. IVV and VEU don’t pay a lot of dividends, but they still pay them.

IVV has returned 3.27% over the last decade and VEU has done 2.85%. Not great, but still cash flowing into the account. And more importantly, those dividends are unfranked income!

We will aim to not touch the portfolio and use the dividends from both Aussie and international shares to live on. If it’s a bad year, however, we will look to sell-off some units to cover the shortfall.

I’ve already gone into why selling parts of the portfolio is perfectly ok if you allow for it to recover in strategy 2. In fact, from a rational market point of view, there’s really little difference between selling units for income and having the company pay you via a dividend. In theory, both should have the exact same consequences. But markets are not rational so they vary to some degree and is a prime reason why we like the dividend approach more.

How It Works

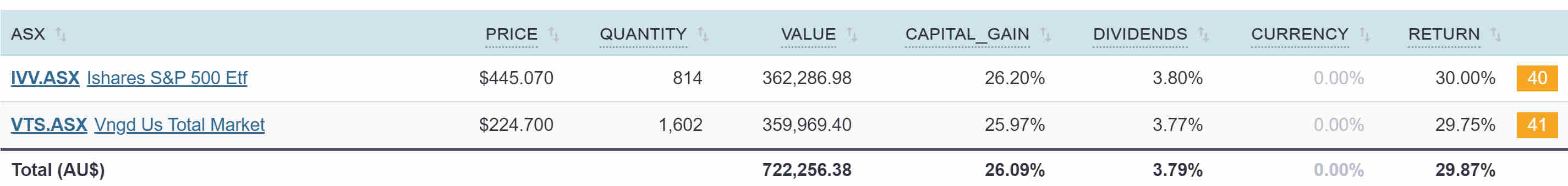

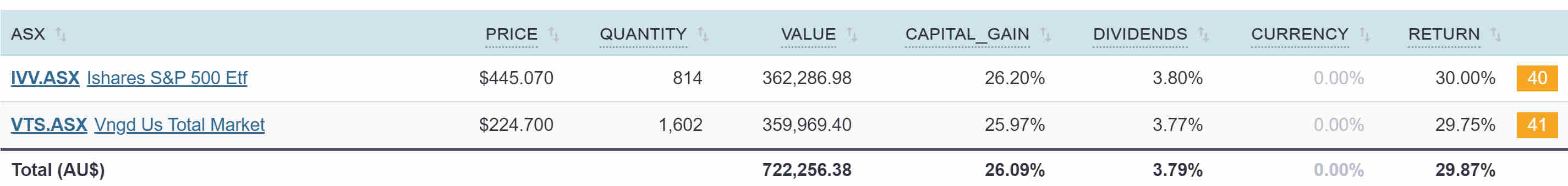

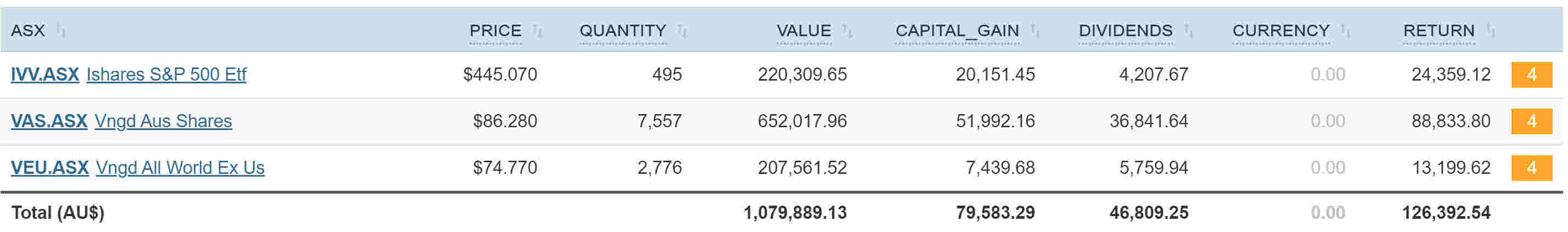

Let’s look at how the newly allocated portfolio would have done during the last 12 months. Here, I have created a dummy portfolio with all trades done exactly one year ago with the total of the portfolio’s value being a cool $1M which is what we’re aiming for.

Aussie equities (I had to use VAS to go back far enough) @ 60%

US (IVV) @ 20%

World ex US (VEU) @ 20%

$46,809 worth of dividends ain’t bad and is more than of FI number of ~$42K!

Bumping up the weighting of Aussie shares to 60% (it was 40% for strategy 2), plus the lower dividend payments of our international shares have actually generated enough income for us to live off during the last 12 months.

But this was a particularly good year for Aussie shares and it won’t be this good all the time. We will save any extra income during those good years to create a cash buffer in preparation for the bad ones that will no doubt come.

If it’s a particularly bad year for dividends, we will look at selling off some units to cover our expenses.

The other thing is that the likelihood of us not earning any money in retirement is extremely low. I’ve covered this in what retire early means to us in the context of FIRE.

I’m extremely confident that the dividends from a $1M portfolio that is weighted to 60% Aussie shares plus any additional income will be more than enough for us.

Selling off units is there as an option but I don’t think we’ll need it tbh!

Time will tell.

To summarise strategy 2.5

- An internationally diversified portfolio consisting of 60% Aussie shares and 40% international

- Buying IVV instead of VTS moving forward for DRP and Australian domiciled.

- Buying Aussie ETFs and not LICs due to risks associated with franking credits. ETFs don’t pay fully franked dividends and are impacted slightly less in the event of legislation passing.

Stop Changing Strategies Dude!

This is you

“Man, you flip flop more than my thongs! Stick to one strategy mate and stay the course. If the axing of the franking credit refund caused you to change strategies, you were never in it for the right reasons.”

And this is me

“Yo! The overarching strategy of investing in great companies has never changed. There was definitely a major difference between strategy 1 and strategy 2. But the fundamentals from strategy 2 to 3 and now to 2.5 are exactly the same”

The thing is, investing in great companies should always be the number 1 goal. All this other shit comes later.

The issue with picking the good companies from the duds is that it’s really hard to do. Which is why index investing is so cool.

The tweaks between our strategies are really fine-tuning our portfolio to meet our specific needs in the following areas:

- Mindset/sleep at night factor

- Simplicity

- Tax minimisation

- Mitigating legislation risk (something I hadn’t considered before)