This years review is a bit tricky once again because we (Mrs. FB and I) earnt money in two different countries so some of the tax stuff has not been accounted for (yet).

You can check out last years review here where we achieved a savings rate of 56%.

So how did we do this year?

Let’s get into the numbers.

Savings Rate For 19/20 Financial Year

Our savings rate for last financial year was… 61% (▲+5% from last year)

We earned $200,919 (▲+$15,478…mostly after-tax*)

And spent $79,182 (▼+$1,635)

I’m honestly shocked that we ended up with 61% as our savings rate. I think a lot of that had to do with COVID hitting which essentially stopped us (and most of the world) from spending money on anything other than the essentials. The only way I can explain how we managed to spend less than the previous FY (other than COVID) is that we pre-paid for a shit load of travelling in May 2019 that obviously is not included in this year’s report. That travelling lasted all the way up until the end up September so even though we have been technically paying for London’s notoriously high living costs, 3 months of this years review was pre-paid for from the previous year which makes it appear that the last 12 months were cheaper than they really were.

*This year’s update does account for AFB tax obligations since I was required to pay them during the year but the dividend components are not finished yet. I’ll update this article once it’s done

Breakdown Of Spending

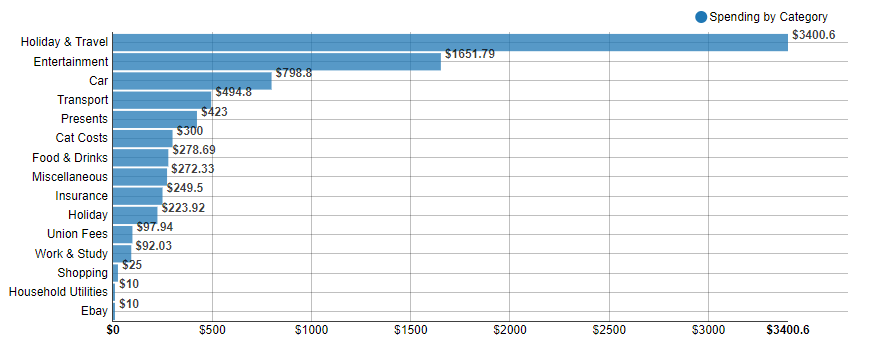

Because we use two different pieces of software (pocketbook for Oz and money dashboard for UK) to track expenses, they are broken down into two categories.

Australian expenses = AUD $8,328

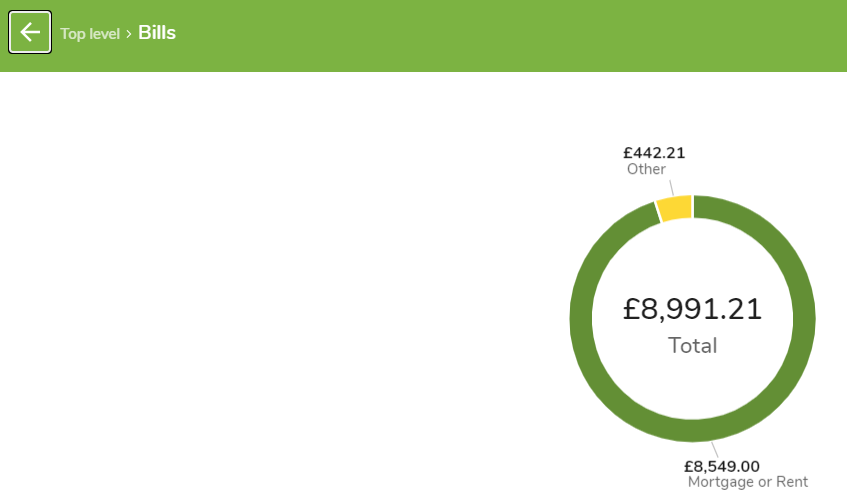

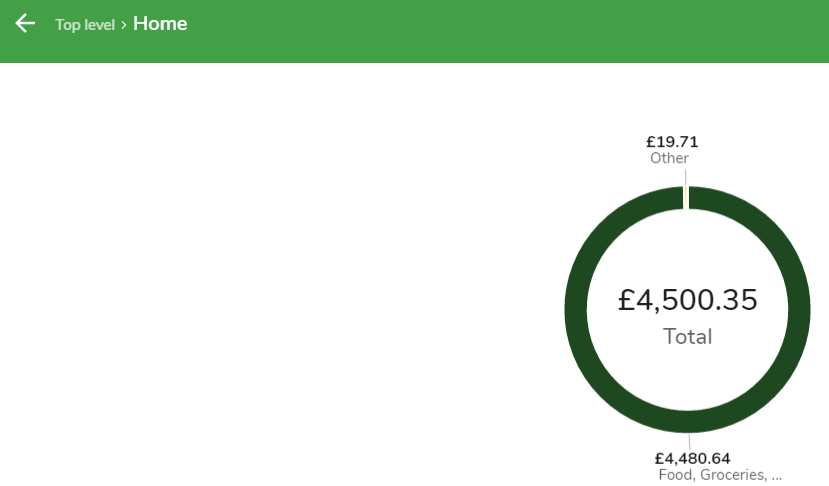

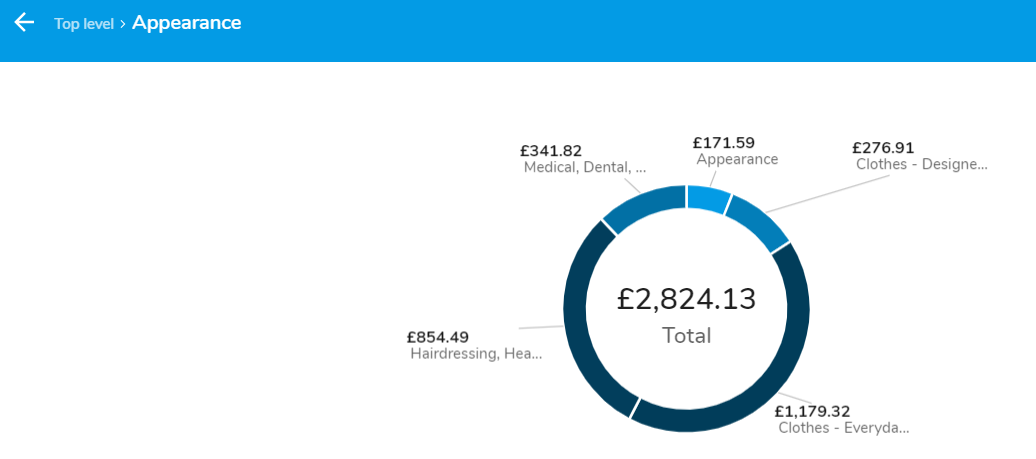

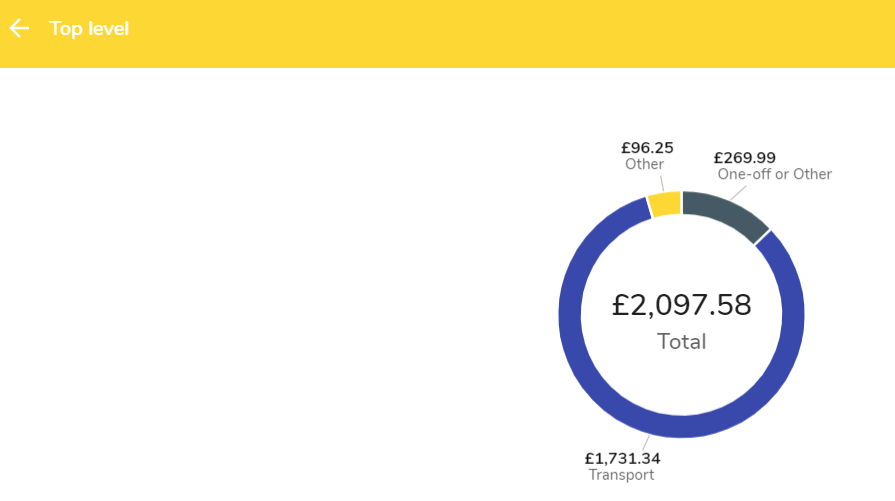

UK expenses = AUD $70,854

Below is our Australian expenses for the last FY.

There were a few expenses we still needed to take care of back home like car rego (Mrs. FB’s mum is currently driving her car), insurances and some odd bits and bobs. The biggest expense above is Holiday & Travel because there were occasions where we used our Australian Citibank card instead of our UK card and hence those expenses showed up in our Aussie accounts.

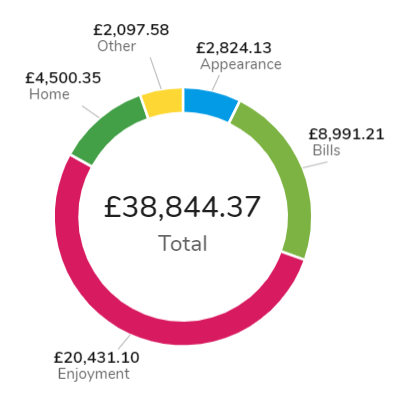

And here is a high-level breakdown of our UK expenses

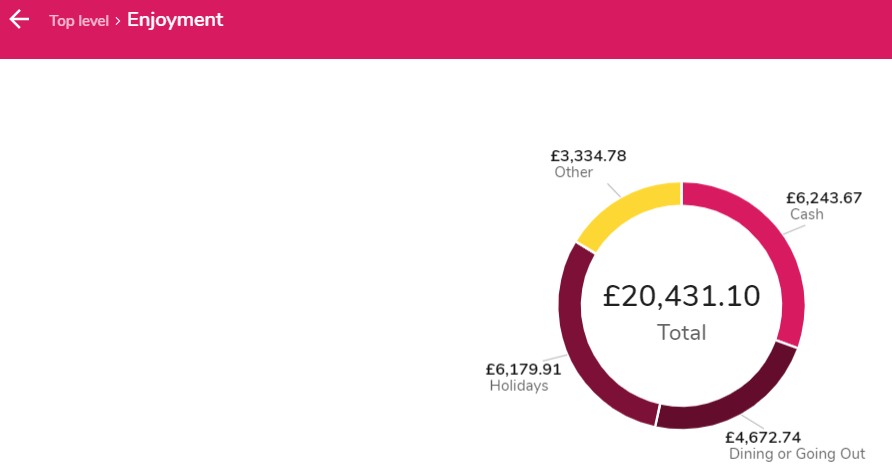

And here are all of those categories broken down again so you can get a better idea of where we spend our money.

It’s no surprise that for the second year running our Holidays category is right at the top. The Cash category is hard to group because we went to a lot of countries where we would have to withdraw a heap of cash to spend whilst we were there. Egypt was a good example of a country that still predominately uses cash as opposed to EFTPOS. So you could almost certainly group up to 90% of the Cash category into the Holidays too which would make it number one. We try a new restaurant in London every single week and dined out a hell of a lot during our travels so I’m not surprised to see Dining and Going Out up so high. It’s one category that will plummet once we get home back to our country town purely because there are not that many options where we’re from 😅.

Anyone who has lived in London can back me up when I say that the cost of living here is insanity! I mean honestly, unless you have a decent-paying job (>£50K) you’re much better off moving to Liverpool or Manchester. Rent will be halved and the general cost of most things will be down too but you’ll still get the benefit of being on Europe’s doorstep for travelling. One thing to take into consideration with the above number is that we only paid 8 months worth of rent for the last financial year because 4 of those months we were travelling and had sub-letted our room.

Food and Groceries is one area that we have been really lazy with. Unfortunately, overpaying for the sake of convenience is a common occurrence when we shop at the moment. We’re not set up to succeed with this category in London. I’m missing a few key kitchen utensils that I can’t justify buying because we’re leaving this year plus the freezer is not that big which makes it hard when you have to share it with 4 other people and It’s just generally harder to meal prep without spare time. We still do meal prep a bit but I’ve often found myself asking Mrs. FB if she wants to go out for dinner because it’s an amazing night in the city and I’m exhausted from work and don’t want to deal with the messy kitchen back home.

These are all excuses but the difference really can be night and day when you create an environment to be successful with anything in life vs trying to push a rock uphill. If you study in a quiet library you’re probably going to have a better chance of retaining the information vs trying to study whilst watching Netflix. If it takes you 30 minutes to get to your gym, you’re probably less likely to keep a consistent training schedule because it will be easy to justify not going etc. etc.

This is one area I can’t wait to improve on when we’re back home. A veggie garden will be built asap when we finally have a backyard again 🍅🥕🥒😁

I’m gonna go out on a limb here and say that 80% of this category can be attributed to Mrs. FB 😜

Buying a bike and COVID hitting has reduced our transportation costs enormously.

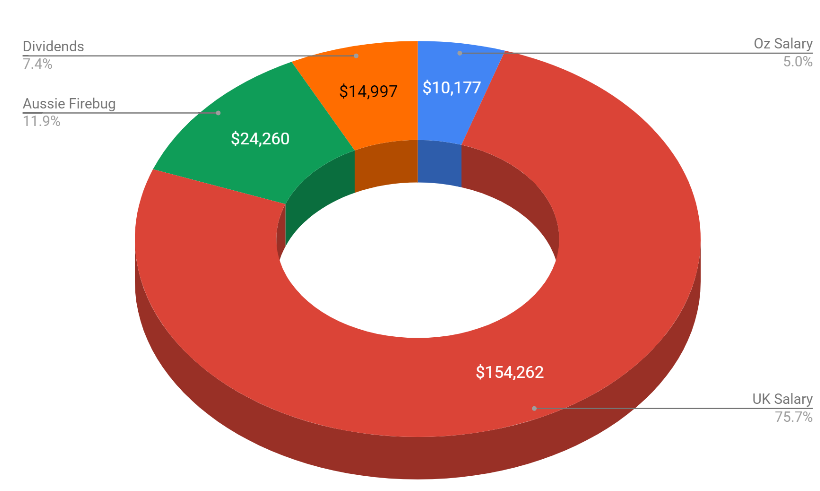

Breakdown Of Income

* There were a few big expenses for the properties during the last FY and it resulted in them actually costing us $2,776 🤦♂️ which is why you don’t see rental income in the above pie

It’s absolutely insane that we managed to earn $200K mostly after-tax considering how much travelling we have done during the last financial year.

When we decided to YOLO at the start of 2019 to live out a life long dream travelling Europe, I was convinced that my dream of FIRE would have to be put on hold and this once in a lifetime trip would delay our financial independence for a few years. What I honestly didn’t expect to have happened was the dramatic increase in income. I work in data (currently a BI Dev) and always knew that Melbourne and Sydney offered a higher paycheck for the work I do but those cities have a much higher cost of living than the country so I never really bothered pursuing it figuring the net gain might be a little bit more but not that much.

Well, let me tell you right now that London contract rates for tech workers are insane!

Before I get into exactly what I was paid I want to remind everyone (especially any newcomers to this blog) that my average wage, previous to moving to London, hovered around $90K for 8 years. My first job out of uni was around $72K in 2011 and it peaked at $110K before I left Australia which I understand is still high (especially for the country). I really want to emphasise that FIRE is possible without a high salary. It might take you longer, but almost every Australian can realistically reach financial independence with the right lifestyle.

With that being said, my first two contracts were at £500 a day and the one I’m on now is a fixed-term contract for 10 months with a base of £80K plus a £20K bonus.

That’s a lot of money, to begin with. But what makes the contracts outrageously lucrative is the way that limited companies are taxed in the UK (you need to be a resident of the UK for tax purposes to take advantage of it). I’m not a tax expert and I don’t know why they even do it the way they do, but for whatever reason, you essentially get taxed bugger all if you operate outside of a ruling called IR35.

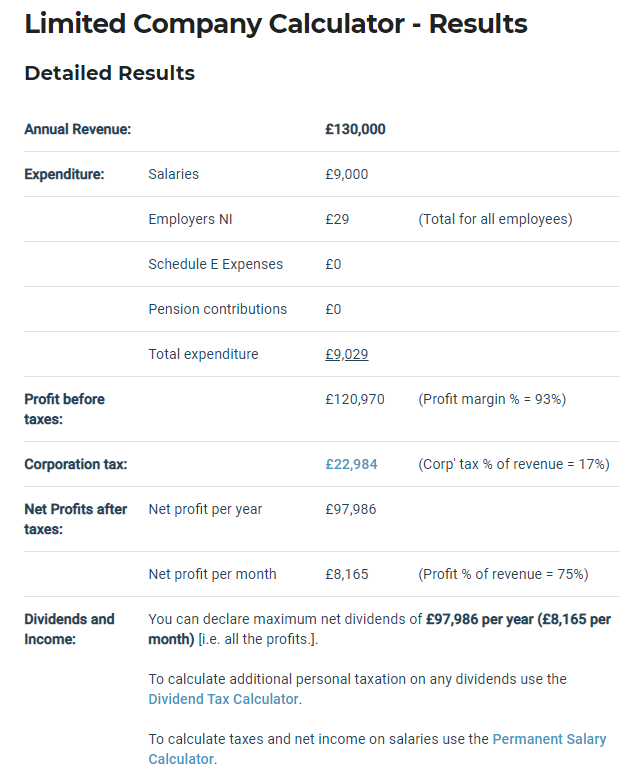

Let’s assume that I worked for 12 months with a £ 500-day rate (I was actually asked to extend one of my contracts but had to turn it down because we were travelling during the European summer and the amount of money I was passing up did kill me inside a little bit 😂) which works out to be £130,000 a year. Here is roughly how it breaks down according to the laws currently using a UK Contractors calculator.

So you can take a £9K salary from the company which is like the minimum wage which means you won’t have to pay any tax on that part. The rest can be taken from the company as a dividend which is where the tax rates are insanely low.

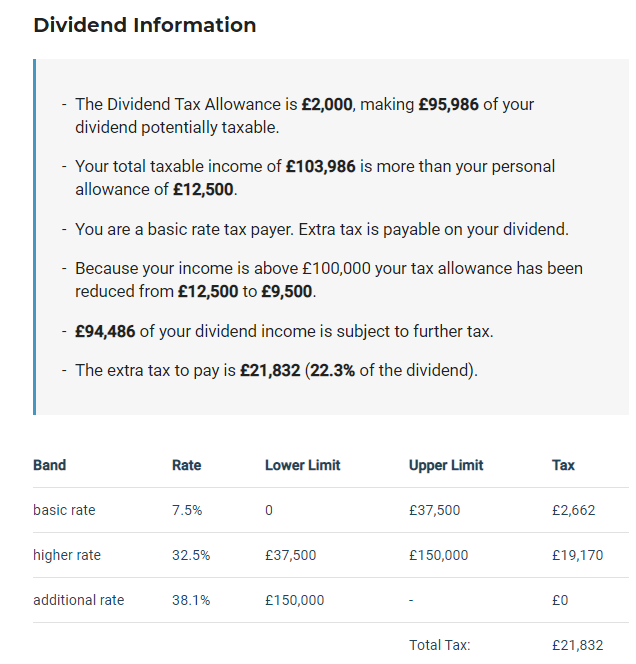

So taking £97,986 as a dividend with the current tax rates looks like this.

Those rates are crazy low! If we double the £ to make the conversion easy that essentially means that someone who received AUD $188,972 (£94,486 * 2) as a dividend only paid $43,664 in taxes. The equivalent for a salaried worker in Australia earning $188,972 is ~$62K in taxes and that’s including with the $18K tax-free allowance!!!

So if we wrap up everything here and assume I did accept my contract extension that lasted 12 months. I would have ended up with:

£130,000 (annual revenue) – £22,984 (corporation tax) – £21,832 (taxed owed for dividends) = £85,181 after-tax income

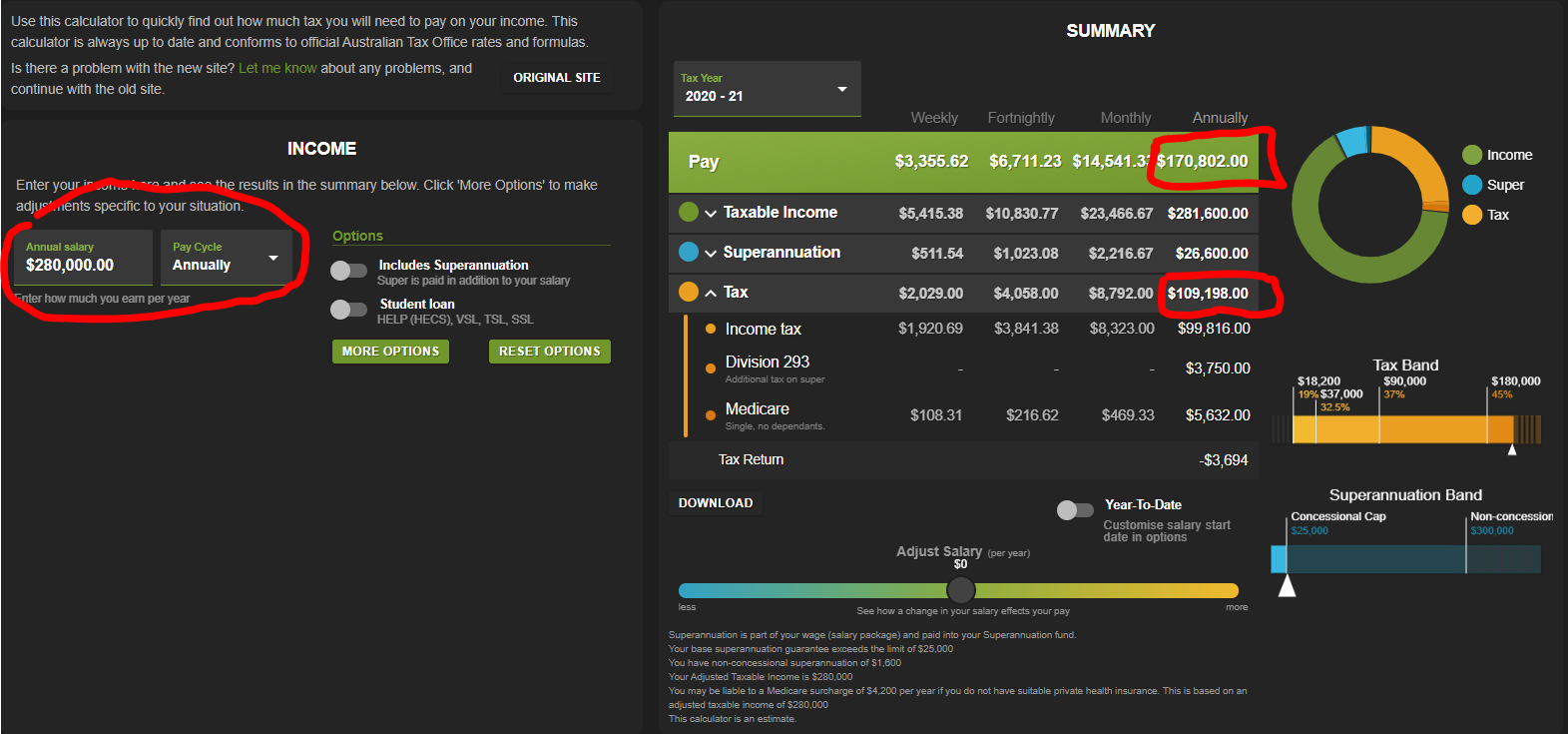

If we double that number we get AUD $170,362.

I would have to be earning ~$280K AUD as a salaried worker to get the equivalent after-tax income 🤯🤯🤯

I mean… that’s more than some CEOs right. I would never, ever, ever have thought that this earning potential was out there.

I can only really speak for tech jobs (mainly in data) because I’m not too sure what the difference is like for other fields. Mrs. FB, for example, makes almost the same here and when you factor in the difference in living costs it was definitely a net negative for her to move across.

If you’re in one of the following (there’s a lot more but these spring to mind):

- Data Analyst

- Data Scientist

- BI Developer (Power BI, Tableau, Qlik)

- Data Analytics

- Data Engineer

- Data Warehouse Architect

- Data Pipeline Developer (SSIS, Data Factory, Alteryx)

- Software developer

- ML/AI specialist

- Dev Ops

- Cloud Architect (AWS, Aszure, GCP)

There’s a lot of money to be made out there (assuming you’re willing to move).

Unfortunately, the crazy low tax rates for contractors are coming to an abrupt end next year. It was actually meant to end this year but COVID hit and they postponed it another year. I don’t know what things will look like after they make the changes but I’m glad I was around before they did.

I have to admit that my eyes have been opened after working these contracts in London. Sometimes I feel like we, in the FIRE community focus too much on reducing expenses and investing but nowhere near enough on trying to earn more money. I recently wrote a bit more about this subject in Pearler’s ebook project actually. And low tax rates are not something that’s unique to the UK. I’m pretty sure Singapore has a really low-income tax rate and Dubai has no income tax at all!

Reducing expenses is still 👑 but I’m convinced that so many people reach a point where they would be served much better investing in themselves and trying to find a higher-paying job. It can really help the process!

This blog had another amazing year generating an after-tax income of ~$24K. The taxes were brutal for me this year because I’m a UK resident for tax purposes (to take advantage of the crazy tax rates) which means I pay a high rate straight out the gate for all income made from AFB.

The craziest thing about this site still being able to generate some serious cashola is how little time I have spent on it during the last financial year. I’ve spoken about this before but I put a crazy amount of hours into this passion project for the first three years. And it didn’t flip a cent because I never cared if it made money or not. There’s no way you’re going to work on a project for 3 years without making any money if you don’t love it! But all that hard work is still paying dividends today because a lot of my traffic is still generated from some high ranking articles/podcast there were made all those years ago.

We’ve just been so busy during the last year that I haven’t been able to make as much content as I would have liked. Shit, I haven’t released a podcast in three months but I’m still ranked at 38 (humble brag 😜) for Aussie Business Podcasts according to Chartable. I guess my point is that even though I’ve really been slipping with AFB stuff, the site/podcast continues to churn away even when I’m sleeping. The internet is an insane bit of technology!

Dividends were broken down like so:

Nearly $16K even with the effects of COVID! Pretty pumped with that tbh. It’s just shy of double what we received last year ($8,057) so I’m really happy with how things are progressing. It’s going to be interesting to see the results for these next coming 12 months but after a few years (hopefully), if the payouts are similar to what they have previously been, we should see a strong uptick in dividend income which is really exciting!

What About You?

That’s it for another year!

Tracking your expenses is a must if you’re serious about financial independence because unless you know how much you spend, you’ll never know how much passive income you’ll need to FIRE. I’ve been blown away with the job market in London for my field and it’s opened my eyes to what’s possible earnings wise. This has been an unexpected benefit of moving to another country but a welcomed one at that.

So how did you go the last time you checked your expenses? Is there an area you’d like to rope in? Or maybe investing a bit of time and energy into your earning capacity would pay even higher dividends.

Let me know what you think in the comment section below 🙂

Spark that 🔥

-AFB

Love your work AFB.

I’m considering a career change, having spent 15 years as an engineer on aircraft. Would you say the data analyst area in IT is a growing industry in Australia?

And what quals are required to become proficient at the job?

I’m also an ex aviation engineer who is trying to transfer into the IT space. Currently completing an online degree in cloud computing through La Trobe University. I do some web development as freelance as well. Happy to connect if you want to chat.

Cheers mate.

Data and its importance to companies is exploding worldwide IMO.

Just look at some of the biggest companies in the world right now, Google, Apple, Microsoft, Amazon, Facebook. Those 5 companies probably own most of the worlds user data.

Other companies in every industry are trying to be data-driven and use the data they have to operate more efficiently and provide customers with a better product/experience.

Software is appearing absolutely everywhere. I recently read a quote that said something like…

“Every business no matter what the industry is in software. You might not be making it now but it will eventually make its way to either your business or your competitions”

And the underlying data is coming along for the ride with this software innovation that’s we’ve seen over the last 20 or so years.

Out of all the areas in data, I’d say that cloud storage and Big Data are the most in-demand.

If you know how to set up an environment in AWS, Aszure or GCP you are going to be paid a tonne of money. You don’t need quals but they certainly do help. I’m pretty sure Google, Amazon and Microsft each offer their own course where you can get certified in their technology. I’ve seen those a fair bit on LinkedIn.

If I really wanted to impress an employer, I’d start working on a little side project.

Download and install Python (a simple programming language) and see if you can return some data from a public API like Twitter. You might be interested in seeing how many times Donald Trump Tweets about China or something funny.

Then try to save this data to a database that’s hosted on one of the cloud platforms. Then try to create a dashboard that makes the data look sexy with some funky visuals and graphics.

If you could do all of that and present it at an interview and talk through that challenges you faced and why you made certain design choices etc. I’d almost guarantee you could land multiple jobs over here no worries at all.

With that being said, that little project requires knowledge across multiple disciplines but they’re all high in demand. Knowing the programming language python is a big one, having experience with cloud services is huge and being able to pull it all together and tell a story with the data is the end goal (BI Development) which is ultimately what the managers are looking at and basing very important decisions on.

Hope that helps 🙂

Hi Mate

Great to hear how well you are doing. Just wanted to ask how did you go about setting up you limited company setup? E.g how much did your accountant cost etc.

I am Australian and living in London (GCP Architect and would love to chat to you if possible).

Please let me know if I’m a dummy and have missed one of your articles on this topic.

I’ve just sent you an email dude 👍

Wow the things you have said about data analytics sounds really promising!

When deciding what I wanted to study in Uni as a 17 year old, I decided to study Data Analytics and Finance after my mum suggested that I do so, even though Data Analytics was a subject that I had never heard of nor practised before.

I then got a full time job in the public service as a data analyst in my second year of uni when I was 19, and I have been slowly growing my knowledge in the field whilst simultaneously studying it in school.

Whilst I find working in the public service OK, I LOVE the idea of being able to travel outside my hometown and possibly overseas to work for a larger tech company!

I am 21 now, and am about to settle on a townhouse I purchased. Maybe once I graduate from uni next year I can start thinking about fulfilling my career overseas!

How exciting Danella!

A career in data/analytics is very promising and one that you can travel the world with. Good luck!

The tax situation for you is so insanely good! Sounds complicated, but worth it.

We’ve started manually tracking our expenses – although it can be a pain it’s nice to always have spending front of mind. We feel really in control of your finances.

15k in dividends would be amazing to see. I’d imagine a lot of that would’ve been cut down due to Covid. Here’s to all of us doubling our dividend income for this fin year!

Thanks for the read mate!

Cheers FDU

Nice work AFB, and great to see that a lot of the spending was on the fun stuff like travel and eating out! There’s no point in scrimping and saving every penny if you’re not going to enjoy yourself, especially when you’ve got the opportunity to do it so much cheaper from the UK than it would be from over here.

The tax rates for companies in the UK really distorts things, because going from memory as a salaried worker the tax is pretty similar to Oz once you factor in National Insurance over there and Medicare Ley over here. So being able to be employed as a contractor really helps a lot! Running the numbers on my current salary over here I’d actually be paying more tax in the UK, and would have less going into my super/pension as well. If I was a contractor though I’d be way better off in the UK.

Great to see the blog paying off for you, I’m willing to bet there’s still a lot of time spent on that just replying to comments and the like even if you aren’t generating as much content!

We’ve managed to stay on track with our finances this year, mostly spending a bit more on groceries due to eating at home more, and conversely spending less on eating out. Our travel budget for the year is also entirely unspent given the lockdowns we have down her in Victoria, and we got given refunds on all the concerts and sports stuff we were going to go to. I’d much rather have been able to go than have saved the money, but not much we can do about that unfortunately.

Yeah I still spend time between these comments and the Facebook page. I haven’t been creating that much and the inbox has gotten out of control. I’ll clean it all back up when I finish up work at the end of the year I reckon.

Definitely put in the veggie garden.

We had an insane summer crop of tomatoes, which I bagged up and froze (almost 50kgs worth!!), pumpkins, zuccini and beans and over the 2 lockdowns, this has been a lifesaver. I have fresh greens in the garden, as well as herbs, and we’ve been living off all of this, saving is many trips to the shops. Tomatoes form the base of many a soup, pasta dish or casserole!

We haven’t had take-away since March. MARCH!!!!

Now Spring is coming and the freezers are starting to have large gaps in them, you bet I’ll be planting lots of tomatoes again.

And I bet that they’re the best-tasting tomatoes ever right! There’s just something about growing your own food that convinces your tastebuds it’s the greatest 😁

Fantastic data rich post AFB – I really enjoyed this, and good to see the equity portfolio at $400 000!

Expenses have definitely downshifted during the COVID-19 period. It will be interesting to see if they will ever quite bounce back to where they were – suspect it will take awhile.

Making the most of this opportunity you have is definitely the right way to go, especially with some markets still down – and added to that a 61 per cent savings rate is truly amazing!

What are your feelings about the eventual move back? Does your London experience change your views about moving within Australia for employment income maximisation on your return – or happy with your base?

We’re still planning to move back because we want to start a family within the next 2 years and while London’s job market has been incredible, setting up our home and being near family is more of a priority to us at this stage in our life.

We’re closing in on financial independence anyway so I feel less worried about chasing the big $$$. And it’s a lot harder work, to be honest. The hours are long and the work is quite stressful. I’m not sure if I could have handled many more years in this type of environment. Most of my contractor mates take long breaks between contracts to enjoy themselves and not burn out.

AFB, how stressful is the work and hours compared to in Australia? I’d love a full write-up comparing work experiences

It was an extra shock to my system because I’d come from working in the public sector.

There’s just a lot more expected from you as a consultant in terms of delivery. Things don’t stop once the clock hits 5 (or whenever you’re meant to finish work). If the job hasn’t been done, everyone is expected to work until it’s done. When I worked for the government it was much more of an “Oh well, we’ll pick this up on Monday” approach. But you get paid accordingly for this extra effort and sometimes it can be fine, other times it’s stressful as hell and you’re not sure if it’s going to get done in time lol.

I’m working on my Mega London article that will have a part dedicated to the work here in London and what to expect and how to find jobs… basically a how-to guide I wish I’d read before moving.

Amazing post AFB. This post makes me realise I’m in the wrong career haha! Oh well at least I enjoy my job.

I’d say that’s a lot more important tbh.

What about rental income? Dont you also have rental income from your IPs?

I talk about this very topic in this part Amber:

* There were a few big expenses for the properties during the last FY and it resulted in them actually costing us $2,776 🤦♂️ which is why you don’t see rental income in the above pie

Ah I see, must have missed that. Looks like you take the net effect, whereas I would have accounted for the Income & expenses of them separately 👍

Awesome news and also sounds like you’re having a blast in London at the same time! I’m a UK citizen from London but living in Melbourne for the last three years! Whilst I’ve been here I’ve invested in VDHG and VAS using CommSec. At some point I plan to move back, do I cash out and reinvest in UK. Or just leave them… (I believe there’s a double tax agreement between the UK and Aus). Little bit confused about it hoping you might have some advice given you are currently a resident for tax purposes in UK with investments in Australia, thank you (FYI I Livermore In Peckham for years and miss it)

I think in these niche situations it’s probably worth paying some money to an international tax expert.

Our circumstances are a tad unique because we invest through a trust which is currently operated by my mum (I’ll take back control when I become an Australian citizen again). So any income the trust distributes can go to my parents for maximum tax efficiency. But most people invest in their own name so it’s completely different.

I’d speak to a professional Alexa

If BI Dev is your scene, the money is in Canberra government not in Sydney or Melbourne. Massive shortage of developers in multiple government departments often with multi year contracts earning $300k+ a year

Wow no kidding?

I would have never thought about Canberra, to be honest. Maybe I’ll take a look on Seek when I get back 🙂

Incredibly happy to read about your story and progress on your fire journey AFB! I am myself a fellow Fire bug based in Sydney and chasing the dream to be financially independent in not so distant future 😉

The only question i had is how were you able to monetise from the AFB site; i mean i don’t see any ads or paid content so how come the revenue from the webbie?

Keep going and stay safe mate!

Cheers from Down under.

Thanks Chet 🙂

AFB makes all its income from affiliates/paid ads in the podcast.

So if you click through one of my affiliate links to a service I have recommended, I’ll get a commission. Read all about how it works here

Thanks mate, got ya!

Great post!

What’s the demand/Salary for roles like Business Analysts/IT PMs/ Scrum Masters /Product Owners?

It is around 800-1100 a day here depending on experience/location.

Anywhere from £300-£700 depending on experience. It’s all about contracting though. You’re only going to get around £40-65K on a salary. But if you’re a contractor you can expect to double that figure.

Been following you for a little while now. First saw you on Selfwealth when I got started on their platform and followed you there. 🙂 Thanks for all the amazing content that helps us to get started on our journey to FI. Just out of curiosity…who are you guy with now in terms of sharebrokers. I can see that you only have one holding on their platform now. Is there another broker that would be more cost-effective? Thanks!

Cheers Jermey,

I’m with a broker called Pearler. I’m still testing things with them but when I’m ready, I’ll be giving a detailed breakdown of what they’re offering and how it works.

Aha. Looking forward to that article. :p Actually just googled it. Their website looks pretty cool! Wish their brokerage would be lower tho as I prefer more regular investment into my mix of A200/VEU/VTS. Guess I will stick with my $5 broker for the time being.

Loved following your journey mate. Very inspiring.

I’m just wondering whether you plan to move some your money into bonds when you get to FIRE ?

Will you treat your LIC’s like a bond for the steady dividend and only sell some ETF’S for something more stable like bonds ?

Or do you plan to just keep your portfolio as is ?

Appreciate the effort of all your posts !

I’m glad to hear that Aiden.

I have no intention of adding bonds at this point in time but never say never. The current strategy is to just build up a big snowball and live off the dividends/sell parts if we need. It’s as simple as that. But little tweaks to the portfolio has occurred and will continue to do so in the future if I feel there’s a better way.

I’ll be writing about it if it does happen though of course 🙂

Cheers

Thanks for the reply.

If you have time.

Do you not worry about perhaps 50% of your portfolio shrinking from a crash whilst you have “retired” ?

You have a different plan then the usual “Bogle-head” portfolio allocation as you age ?

Look forward to future posts.

Nah not really.

We plan to live off the dividends and have a lot of fall back options if something really bad happened once we pull the pin.

Cheers

Thanks mate!

Hey Aussie Firebug! I’m sure you have said it, but I’m having no luck in finding where. Just curious as to when and why you starting investing in A200?. As form the most recently of your portfolio holdings, it looks to be the most %. Cheers!

Hey mate,

It just came down to the MER because they are so similar. That’s about it!