Things are finally starting to feel semi-normal again here in London 🙌.

We’re still wearing masks in indoor places but most of the things we care about (restaurants, gyms, markets etc.) have opened back up and really the only major hassle for us at the moment is the risk of having to quartine when travelling outside of the UK.

I finally was able to take a holiday in August after working at an unsustainable pace for the last 8 months 🤪 (which is the reason for the lack of podcasts this year). I managed to snag two weeks off and Mrs. FB and I ummed and ahhed about whether we wanted to risk quarantine and head overseas. We decided it was better to explore a bit of the UK instead and to aim for a Euro trip in September depending on what happens, which I felt was the right move.

So we decided to load up the playlist with bulk Taylor Swift bangers and head north.

After doing a nearly two-hour roundtrip commute for 5 years at my first job, I’d never thought I’d say that I was really looking forward to jumping back into a car to set off on a 1,500 miles road trip. There’s something different about blasting your favourite tracks on a road trip that I’d sorely missed.

We headed up north to explore some of the other cities in England and pop over to the top of Scottland visiting the following:

- Stratford-upon-Avon (birthplace of William Shakespeare)

- Liverpool

- Lake District

- Edinburgh

- Inverness (home of the Loch Ness monster 🐍)

- Isle of Skye

- Newcastle (we got mortal)

- York

First off, I feel like the department of tourism for the UK has done a terrible job promoting the Lake District or I just haven’t been paying attention. I had no idea that places like this existed here.

Like… what the hell England? Since when do you have stunning lakes with rolling countryside 😍

We went back to Edinburgh for a day even though we’d already been there because Mrs. FB wanted to catch up with a friend and I wanted to catch up properly with Brandon aka The Mad Fientist. I’d met Brandon briefly at the London Premier of Playing with Fire and even had him on the podcast back in 2016 but I always wanted to sit down and have a chat with the man that really inspired me to create Aussie Firebug. They say that imitation is the sincerest form of flattery and if you look closely, you can clearly see that this website and podcast is heavily inspired by Brandon’s work at the Mad Fientist.

Aussie HIFIRE wrote a great article last year called Folks Need Heroes (and the equally fantastic follow-up article Folks need heroes – but you shouldn’t follow them) which really summed up the Australian FIRE scene and listed a whole bunch of Aussie content creators from different stages of life with different creative styles.

Everybody who’s into FIRE knows who Mr Money Moustache is and a lot of people would probably say he’s their favourite FIRE blogger. But that wasn’t the case for me!

I clicked with what Brandon was writing/podcasting about a lot more because he was more related to me than Pete and the others. MMM had already retired and had kids. Brandon was still on the road towards FI and I have (and still do) an unhealthy obsession with podcasts so naturally, I gravitated towards his content the most.

This guy really played a pivotal role in the direction my life has taken and I’ve always felt like I’d like to tell him that in person. As a blogger, you might get a few extremely heartfelt emails from people explaining just how much you’ve helped them, but it’s different when you meet these people in real life.

We braved Scotland’s scorching summer heat of 19 degrees to have some street food at The NeighbourGood Market and the funny thing is we didn’t really chat about FIRE at all. It was a great experience getting to know someone you look up to and I hope he makes it down under one day.

I was so glad we made it back to Scotland to explore the highlands. The 500-mile road trip called the North Coast 500 was truly epic. I couldn’t get a good shot of the road (the below is from Google images) during the drive but it has to be one of the most beautiful and scenic trips I’ve ever done in my life.

All throughout Scotland, we kept seeing this bright purple like growth throughout the giant hills and valleys. I originally thought it was a little patch of flowers or something but the stuff was everywhere! Turns out that it’s actually a gorgeous flower that’s commonly referred to as heather which enhances the already stunning views throughout the countryside.

We saw and did a lot within the two weeks but my favourite place we visited had to be the Isle of Skye!

I mean… check out some of these photos!

I felt like I was in The Land Before Time or maybe Lord of The Rings.

We were absolutely blessed to have good weather for the majority of the trip too. A lot of people I’ve spoken to that have done the same trip had to fight the elements the whole time. So it’s very weather dependant unfortunately but worth seeing it either way.

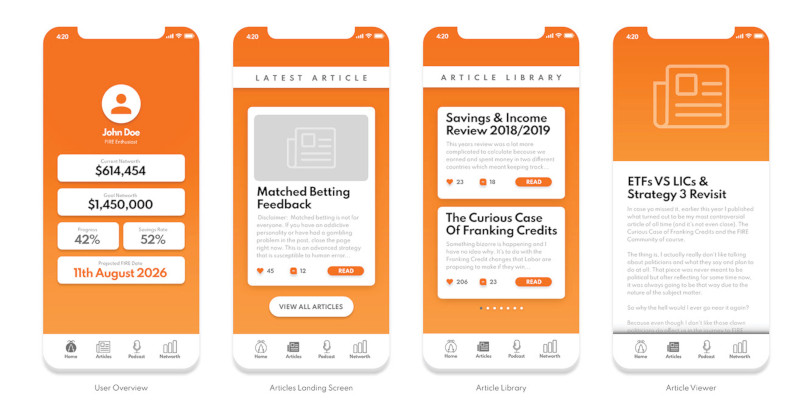

I also received a super cool email in August from an extremely talented fella called Beau. Beau actually reached out to me years ago and he shot me through an update which mentioned something along the lines of an Aussie Firebug brand re-design/App he made for a project. Well, I don’t know what I was expecting but the work he did for the fan piece blew me away.

Check this out!

It is so impressive and professional-looking, I just had to give it a shout out in the monthly update!

Beau is probably going to kill me because I had to reduce the quality of the pics but if you want to check out the whole re-brand piece, head over to his Behance Page. There’s even a little video demo showing how the app would function 🤯👏.

And if anyone is reading this thinking “HOLY CRAP THAT’S GOOD DESIGN! I need a digital designer for my business” I would more than recommend you hit up Beau on LinkedIn.

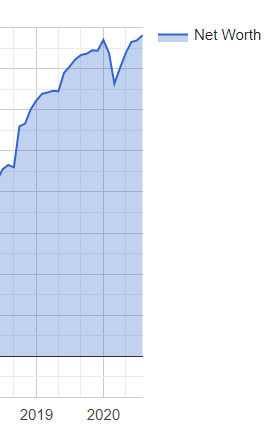

Net Worth Update

$781K 🤯 that’s a record baby!

Talk about that V-shaped recovery

We have officially climbed our way back from the COVID bear market to reach our all-time high 🙌. I’ve probably jinxed it now (but secretly all non-retired people should hope for another crash😉) but it’s pretty crazy how quick that crash was. I’m sure all this government stimulus has lead us into a false sense of security but you have to celebrate the wins when you get em right.

It’s funny because at the start of the year I was hoping that we’d be closing in on $900K, not $800 lol. But that’s the markets for ya.

If you read our last update you would know that Mrs. FB withdrew $10K from her Super last FY. She withdrew another $10K for this FY which we need to get into the markets as our cash reserves are way too high for our liking. We still might buy a house next year so part of me likes having a big fat deposit ready to go but the other half feels like all that money is just losing value in our offset (I know it isn’t but still).

Properties

So, after seeing the unexplainable real estate boom that my local town back home has witnessed throughout lockdowns I thought, “What the hell, let’s take another look at the market on the Goldie and see if the prices have picked up at all”.

I’ve had pamphlet after pamphlet delivered to my parent’s house back in Oz to ask if I’d be interested in selling. I emailed one of them saying I was looking for offers and to get a free appraisal done.

The appraisals didn’t exactly blow me away so I’m back in the camp of waiting until things improve. That could be many years away but we’re in no rush to sell. I’ll definitely be updating you all in these articles if things change here.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

The above graph is created by Sharesight

The markets continue to march ⬆ and we continue to DCA into it each month as per the plan. Pretty boring 🙂

One big change that was made in our portfolio during August was the sell-off of our holdings in AFI. We only had around $15K in there and the plan was to always sell it eventually to simplify our portfolio because it doesn’t really make that much of a difference to our weightings. A200 and VAS make up the bulk of our Aussie holdings and we will at some point probably sell MLT too. I was happy with the 8.1% return AFI gave us over the last ~18 months but I can’t say the same for Milton, which unfortunately is currently sitting at 1.61% 🙃. I know it’s a long term game so I think we’ll wait until MLT bounces back before we eventually sell it and get down to only 4 holdings. I think we’ll keep VAS + A200 for the foreseeable future in case VAS does lower their management fees in the future which is almost a certainty.

Thanks very much for the access to the net worth spreadsheet.

I have been looking for something for ages.

Legend.

My pleasure Jas 🙂

Sounds like an awesome roadtrip mate, stunning photos as well! There’s an amazing amount of natural beauty to see in the UK, but you’re right that they don’t seem to do a great job of promoting it. Spot on about the weather as well, if you have sunshine over there it can be absolutely glorious, but it’s so easy to get rained out the entire time.

Congratulations on the new highs for the net worth, but yep, it seems like you’ve jinxed it going by the last few days! Oh well, another chance to get more money into the market I suppose.

Thanks very much for the mention as well, much appreciated! I’m pretty sure there are a lot of Aussie FIRE devotees and bloggers who were inspired by you! 😉

Cheers mate.

I can only hope my ramblings encouraged others to start creating their own content.

I’ve noticed you seem to only be including your home equity in your net worth. Why aren’t you including your mortgage (i.e. a liability, which is a debt that has to be paid) in your net worth?

Insane pictures mate…looks like you were blessed with some fine weather! Looking forward to your “pearler” podcast 😉 stay safe champ

He’s including the equity – current valuations less mortgages (debt)

I see. I guess I was looking at it from an asset and liability standpoint. Equity = Property value – loan amount, so if for example a property is worth $1 million and there was $800,000 owing the equity would be $200,000 yes but the mortgage would still be $800,000 so therefore net worth would be -$600,000.

Lee – Assets: $1 million (house), Liabilities: $800k (mortgage), A-L = Equity, $200k.

Net worth would be $200k, not -$600k.

Do you realize that equity = current value – debt?

Great… thanks for jinxing the market. I think I can now attribute all of my future capital losses to this blog post. 🙃

If you’re in the accumulation phase you should be thanking me right 😜

Nice Firebug! Really is a very beautiful part of the world, they don’t promote it to keep it that way haha. I’ve been made redundant due to a restructure at work. Wondering if you could do a redundancy special podcast as I feel there is an opportunity for me to kickstart my FIRE journey here. Thanks. D

Sorry to hear D,

If I was made redundant, I’d forget about FIRE for a bit and focus solely on getting another job. Can’t get to FIRE without a job! I’ll have a think about that podcast though 👍

Cheers

Roadtrips are so underrated! Looks unreal. We skipped the UK doing a big Euro loop specifically for this reason, I didn’t want to just do a couple of days in London or something, really wanted to lap the whole place. Awesome checking in with the MadFientist, they’re both good but I also sway MF>MMM.

I hold a small amount of MLT have considered dumping it longer term as well. Hsa been interesting to see how the last 6 months have gone and particularly what will happen in the next few years. The US (I hold IVV) has been chugging along buton more of a social/politcal level things are getting spicy, will be interesting to see how it pans out moving forward.

Haha, all good on the resizes, it’s to be expected. My uni pushed some of my work on their social channels after winning a competition recently and it looks like it was screen capped from a Nokia 3310 so this is totally fine. Appreciate the plug.

No worries legend. Appreciate your work 🙏

Your portion of super, am I correct in assuming all equities? Just wondering what your super allocation is 🙂 sorry if this has already been covered .

Photos look amazing!!

Correct!

We’re in the most aggressive allocation in Super which is around 50-50 Oz to international I believe.

Hello, great update. Just curious – adding your network ‘pie’ up, I get a total of ~801k about 20k more than what you post. Any reason for this? You may have covered this before so sorry if this has been answered already.

Networth*

HECS Debt

Mrs. FB HECS debt… I should really add that in somewhere 😑

Incredible photos.

I actually thought the Isle of Sky photo’s were Iceland at a glance.. look’s quite similar.

I didn’t get to see much of northern UK when I was last over there, mostly England, Wales and Scotland. I spent a lot of time across Europe though but those photo’s made me realize what I missed out on.. must be some amazing trekking up that way.

Cheers Scott.

The treks were epic and we only did a few. I’d love to come back one day and do the downhill mountain biking that they offer. It’s meant to be some of the best tracks in the world 🚵♀️🚵♀️🚵♀️

Great to hear things are starting to feel more normal!

The Lakes District looks pretty amazing; definitely not the impression of England that I had. Hope you survived the scorching 19 degree heat – sounds like a recipe for disastrous heat stroke indeed 😂😂.

Appreciate the humour in your posts! Keep it up.

😂 thanks mates, will do.

Did you sell AFI after it went ex-dividend?

After… I think.

if you want a nice mid-week getaway then hire a narrowboat on one of the canals. ABC Boat Hire do last minute rentals.

Good to see the bounce back but I think it will be short lived. There’s a lot of new money coming into the market from people that have no understanding of what they have bought. Always a bad sign. The moment things go backwards they panic and sell.

Thanks for the tip Bradley 👍

I hope it starts to slide soon, need to go bargain hunting again like in March/April 🙏

Hey Mr Firebug!

Amazing photos and thank you for sharing your entire journey!

Just wondering why did you decide to move away from LIC’s and go back to your original strategy of investing only on ETF’s?

Hey Aussie Firebug,

I too would love to know the answer to this question; LIC’s have out performed ETF’s in this bear market in terms of dividends and will likely continue to do so – I know this will even out during the next bull market but surely a good idea to have both?

Will they outperform though? Maybe they will, maybe they won’t.

I honestly don’t put that much thought into it. The ETFs are cheaper and the after the previous election, I realised just how fragile the franking refunds are. It’s more of a psychological play tbh. We just feel more comfortable investing in ETFs atm than LICs.

Both are still good.

Cheers Carlos,

I still like LICs but I think that the axing of franking credit refunds (and potentially franking credits in general over time) is inevitable. ETFs would fair better if that ever happened and they are so similar to LICs that I just feel more comfortable going with ETFs for now.

Plus we only had around $15K in AFI so consolidating the portfolio is something I’ve been meaning to do for a while anyway. We’ll probably sell MLT eventually when the times right too.

Loving the rebrand – looks amazing. Also – glad to hear you guys got to do the roadtrip. How epic are those areas? We did a trip through there a few years back and the scenery is just mind-blowing. We also had some ‘hot summer weather’ while we were there – tops of 14C and rain LOL.

Thanks Sarah 🙂

The hiking in Skye was amazing. I’d love to go back for a week and check out all the spots

You are my hero, mate. Well slightly ahead of Scott Pepe whom I credit primarily for the book that intrigued my interest in finance and started a journey that has been eye opening and exciting. This book led me to your page through the marvellous jungle that is the internet. I remember first reading your post ETFs v LICs and going WTF is all is this but your writing style appealed to me and, in my opinion, your content is hands down the best one I’ve come across and I think I’ve read/listened to most of it.

♥

Loved reading that Vlado!

Thank you for the kind words 🙂

How good is the Lake district! I loved sipping beers there in winter at Ambleside. The best!

It’s amazing! Loved it

How have you avoided paying back your HECs for so long? Given your income – particularly the last few years – surely the tax man would be sticking his hand out for you to pay him back? It’d be great if you could do a piece on how you’re managing all your taxes!!

No HECS if you live and pay tax overseas.

That’s why so many students bugger off overseas after graduating. Doesn’t help the “clever country” strategy.

The government is trying to work out how to fix that.

I hope he’s not getting his tax advice from you Bradley!

Some reading for you:

https://www.studyassist.gov.au/paying-back-your-loan/what-if-i-move-overseas#:~:text=If%20you%20move%20overseas%20and,by%2031%20October%20each%20year.

Fair enough. That was introduced in January 2016 and I haven’t looked at the rules for quite a while. I do have some ex-colleagues that used this as a method of avoiding repayment so hopefully they are now being responsible Australians.

I’m an engineer, not an accountant so I don’t give tax advice, I will relate personal experiences though, even when they are out of date.

I don’t have a HECs debt. Mrs. FB does but she is a few years younger than me and hasn’t worked that many years full time (she’s taken years off to travel before this big trip).

I’m working on a big article about how we’re investing during our travels and focussing on me being a resident of another country. It will be out before the end of the year 🙂

I have just discovered your blog/podcast and have been binge reading/listening! Great content! Not sure why it took me so long to find you given I’ve been a fan of MMM, Mad Fientist and Afford Anything for many years. So great to find Aussie content discussing our investment options and tax system. I’ve been fumbling my way towards FIRE since I got my first job at 12yo (a paper run) and discovered compound interest. Im 37yo now with a husband and 3 kids. Our net worth is approx $1M (paid off house, IP and super). I’ve dropped to contracting work while the kids are young. So great to have the freedom to be flexible. We still have a fair bit to learn are now keen to build our shares portfolio outside super to move away from property and access the benefits of shares prior to preservation age! Thanks for all your great info in this space. Awesome to follow your journey and connect with the Aussie FIRE community!

No worries PsyFI. I’m glad you’re enjoying the content mate 🙂

Hey FB, to clarify – are yourself and Ms FB buying shares together just under your name? My partner and I are considering how to build a share portfolio, we are not sure of the most tax effective approach? Thanks

We use a trust. But if I had my time over again, we most likely would have either went 100% in Mrs. FB name or 50-50.

Nice app design, wanna make it real? I mean turning blog into FIRE social network?

You had me at Taylor Swift bangers. 🤩