This section of our monthly updates usually features a travel pic or two plus some sort of mini diary entry on what’s been going on in our lives during the last month.

But how can I not start today’s update without addressing the elephant in the room?

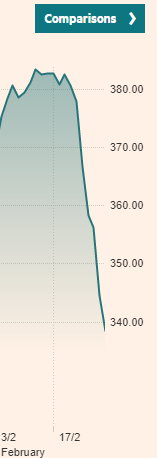

I logged into my Sharesight account last Friday night only to discover that the share portfolio had lost over $40K during the last 2 weeks.

At this point, some of you might be thinking that my reaction may have been like…

But that’s how a n00b reacts.

I was more like…

Everything just got a hell of a lot cheaper to buy.

If you’re in the accumulation phase of your journey (that’s anyone who hasn’t yet retired), having a big crash like this is what you should be hoping for, praying for, becoming unnecessarily excited for!

Why?

Because next time you put your buy order in, you’re going to receive more units than you would have otherwise and thus inching you even closer to financial independence. In a perfect world, the price of shares would remain low during your entire accumulation period and skyrocket when you retire. But that’s not how real life works. And unless you think that this epidemic is going to wipe out civilisation as we know it, the market will recover and continue to reach new peaks.

IT ALWAYS DOES.

I even hesitate to mention the coronavirus because IMO it really doesn’t explain the crash. Like, sure, the timing would suggest that the market crash was initiated because of this virus but how can anyone actually know for sure that there weren’t a whole bunch of factors at play? Maybe it was the straw that broke the camel’s back? The markets have been on a pretty big bull run as of late.

That’s the thing about the market, it’s heavily influenced by irrational humans.

Or as the great Isaac Newton once said after he lost $3M on the stock market.

‘I can calculate the motions of the heavenly bodies, but not the madness of the people.’ -Isaac Newton

And speaking of the madness of humans, I keep seeing these toilet papers memes all over my social media. This one’s my favourite.

😂😂😂

Maaaaaaaaaan I can’t 🤣. Has everyone lost the plot back home or what?

HAVE YOU NEVER HEARD OF A BIDET PEOPLE!

Anyway, I keep reading all these comments and articles from armchair experts qualified in an intense 4 hours Google session about how bad this virus is and how it’s got the potential to be catastrophic (if it isn’t already). And hey, they could be right! But I’m punting that humanity will pull through (like we’ve done many times before) and companies will continue to innovate and make money for their shareholders.

And when the market does recovery (remember, it always does!), I want to be holding more units than ever before. And the best time to buy a lot of units is when they’re on sale… like right now 😁🤑

“But…. but… it’s forecast to get worse. I’m ganna hold out a little longer until I know for certain that we’ve hit the bottom”

Say it with me everyone

👏YOU👏CAN’T👏TIME👏THE👏MARKET👏

Why?

Because it’s irrational. It doesn’t bloody make sense half the time. Yes, over the long term, the trajectory will be up. But dipping in and out trying to beat the peaks and troughs is a game that the majority of professionals don’t win. What makes you think you can beat them?

Another thing about this whole ‘Get out why you still can‘ attitude that seems to be sweeping the community right now is the mental drain.

Last year when I had Ted Richards on the podcast, something that has always stuck in my mind is when he spoke about the psychology of investing. He studied behavioural finance at Havard University and believed that investing is more psychological than anything else.

When emotions are high, logic is low!

Asset allocation, low management fees, international diversification etc. all mean diddly squat if your noggin is having a meltdown when the bears come out to play.

That’s why defining and sticking to a set of rules through thick and thin is so important. It will not only serve you well in your investing journey but most other facets of life in general.

I can’t even tell you how comforting it feels to have a plan of attack that is executed each month that inches us closer and closer to financial independence without the need to research or study companies.

Which is why we will continue to buy in March just like we did in the previous month and the month before that.

Stay the course!

We only travelled to Cambridge in February but the weather was pretty grim and I didn’t take any photos worthy of the blog. Highly recommend Cambridge though. It’s cool to set foot in the same places as some of the greatest minds in history like Issac Newton, Charles Darwin and Stephen Hawking.

One of my all-time favourites, David Attenborough also attended the University 😍.

And it was an honour to be featured on the ‘9 Investment Podcasts For Australian Investors’ list by canstar.com.au the other day 😊

Net Worth Update

OOOOOF!

Down over $32K.

The biggest NW drop in the history of Aussie Firebug.

Realistically, I have been expecting a significant drop for some time now. The long term average of the stock market ranges roughly between 8-9%. We were sitting at an annualised return of close to 19% before this drop so a downturn like this is to be expected at some point. It’s something that anyone in the accumulation phase should look forward to really.

In fact, if we look at the market return for the last decade and I was forced to guess, I’d say it’s still got some dropping to do until it returns back to the norm. The hard (impossible) part is trying to time it which is why I don’t worry about that and just continue to buy each month like normal.

So maybe we won’t be hitting $800K anytime soon if this keeps up. All good though, it just means when the market does bounce back, we’ll be riding that bad boy upwards holding a few extra units 😁

Properties

Thanks to everyone who recommended a real estate agent.

I’ve engaged with a few and am in the process of selecting who I want to go to market with. I’m still deciding which property I want to list but I’d be sure to keep everyone updated here it all unfolds.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

The above graph is created by Sharesight

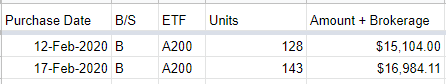

Now that I have some stability in my job for a few months, we decided it was finally time to start transferring a decent amount of £ into $ and continuing investing back home. We’ve been sitting on a pile of cash for way too long because of the uncertainty of my job but the time felt right to convert a decent amount.

Now if you can remember back to when we sold IP1, we had $200K cash sitting around and I was too scared to dump it into the market all at once even though I knew statistically it would have been the better move… so we DCA’d it in $15K monthly instalments that make up a large percent of today’s portfolio you see in these updates.

And you know what the markets did in the next 12 months when we sold the first property?

Yep. Straight up!… and that chart doesn’t even include dividends.

So as you could imagine, I decided from that point onwards that it’s always better to just stick with the FIRE literature and dump it all in next time. So I placed these two orders in February

Aaaaaaand, of course, the market went like this

…

…

…

I’m actually carrying on like a pork chop because, in the long run, these unfortunate timings don’t really mean that much. As long as you’re consistently buying, it all averages itself out to be rather insignificant.

Completely agree with the correction not being a bad thing (at least not for those in accumulation phase, as you say). For me, it’s been an opportunity of sorts. I sold out my entire managed funds portfolio in July 2019 and switched to an ETF/LIC/Satellite model and the capital gain will push me into the highest tax bracket for FY2020. I’ve used the downturn as an opportunity to harvest some paper losses (by selling and buying back in at a similar price) so I offset some gains that would otherwise have been taxed at the highest marginal rate for the cost of brokerage both ways.

Probably no net worth records will be achieved in the near future but you’re absolutely right about it being a long game and the long term trend is up – it always has been through far more disruptive events than what we are seeing now. I really liked something your mate Dave said on the podcast about his thinking being about maximising the number of units he holds because each one contributes to FIRE and the cheaper you can acquire them the better!

Steve,

“by selling and buying back in at a similar price”

I’m pretty sure that’s called a wash sale and is illegal.

https://www.ato.gov.au/law/view/document?docid=TXR/TR20081/NAT/ATO/00001

Yeah… I didn’t think tax-loss harvesting was a thing in Australia.

Agree with what you say about shocks being insignificant in the long term, but theyc ni still hurt! I got into cash a week before the crash – just couldn’t see how the market could shrug off the effects of the virus. I also bought a $20 bidet on eBay!

Haha nice one 💦

Also nice timing 👏

There you go – didn’t know that. It’s a funny beast the Aussie tax system – progressive in some ways (franking credits) and backwards in others (this situation). Thanks for pointing it out.

Only illegal if you purchase exactly the same share you sold at the same time. Nothing stopping you from taking losses on shares/ETFs etc and then buying into a different share, but maybe same asset class etc

I also capitalised on this correction to employ a long term strategy of moving from individual shares to ETFs. Sold out of several shares for a paper loss and dived back in to top up local and international ETFs. So, no market timing, but opportunity to engage a planned move at a time when I can minimise and actually eliminate CGT

Yes, I loved that quote. I believe it was my mate Jimmy that said it.

Looking at your units increase every time you buy is a nice little mental win you can use if you’re the sort of person who gets spooked by the markets.

Yep, you’re right – it was Jimmy. That was a really good ep!

Just had our first kid (amazing), however it means we’re down an income and not saving anything significant for the next year or so.

Timing for investing really sucks. I feel like I’m gonna miss out on the lows. Hope you can make the most of it!

Hey, you never know dude. We could look back in 20 years and be like:

“Wow, the innovation of the AI boom of the 2020s was an incredible run. If only I could be apart of another run like that nowadays”

Who the hell knows 🔮🔮🔮

Nice post and agree with the investing philosophy completely.. only two questions,

1) If you are (i’m) 35, at what are would you consider to be out of the accumulation phase? Is there a hard rule for this like 5yrs before your planned retirement age?

2) Lets say someone who’s just hit the “out of the accumulation” phase or he’s about to, eg one year left till retirement. He’s no longer making active income..And his accumulated over 1mil+ plus of assets (say it’s 40% A200 and 60% VGS), and seeing the big drop happening now with the potential of market crash of 50% (just as an example),what would you recommend him doing? Should he sell any of the shares?

Keen to hear your thoughts

Thanks

Victor

Hi Victor,

1. The accumulation phase is literally anyone who hasn’t retired. You’re in your accumulation phase all the way up until retirement.

2. A big drop as soon as you retire is literally worst-case scenario. Funny enough, this topic was brought in the London FIRE meet up just last night that I attended. Basically, you’ve got a shit load of options and the issue is often way overblown. You could…

– Have a huge cash buffer (3+ years living expenses) if you’re really worried

– Stay working a few more years through the bear market

– Tighten your belt and spend less

– Pick up part-time work

Bear markets historically don’t really last longer than 18 months or so. Yes, there are a few outliers but the bulk recover well and truly within 18 months when you factor in dividends.

In your hypothetical, I wouldn’t sell anything but find ways to make it work but doing one of the above (or a combination)

Cheers

Thank AF, much appreciated.

Hi Victor,

This is known as sequence of return risk. Alot of FI people have a cash cushion to absorb these periods.

Check out how the couple at millennial revolution handles that.

https://www.millennial-revolution.com/invest/sequence-of-returns-how-not-to-fail-at-retiring-early/

Thank Shane, much appreciated.

It’s certainly been an interesting couple of weeks in the markets! I’m down a fair chunk of change and so far have been pretty relaxed about it which is nice from a behavioral viewpoint. I think it helps that if you’ve studied the markets a fair bit then you come to realise that this scale of drop happens pretty regularly, albeit not normally quite this quickly.

Great to hear that you’re staying calm and not panicking!!

I’m panicking at how long it takes for the cash to arrive in my brokerage account 😂

Nice update. I must say that despite having a plan and buying my monthly parcel on schedule yesterday, the virus does have me a little nervous about what might happen next few months.

Had to laugh re your market timing. I started buying regularly in August 2018 and about my first 5 purchases were followed by some of those really bad days on the market late 2018. It was almost like clockwork and felt like an inevitability. Of course in the fullness of time, I only wish I could buy back in at those prices today (which we may have the chance to do soon).

PS. Toilet paper situation is ridiculous. Did you hear that someone got tasered after getting into a fight over dunny paper at the supermarket?

Hey AFB, great post and really reassuring to hear your thoughts on the current state of the market. Really testing my fortitude at the moment as a relatively new investor.

Regarding your portfolio, I notice you don’t hold any bonds. Do you rely on the property/offset account aspects of your portfolio for stability?

Also, thoughts on investing in Kimberley-Clarke while they’re running hot? Just kidding.

Thanks

Fraser

😂😂😂

Yeah… so we basically just want to run a cash+shares portfolio moving forward. We still have the properties but they will be sold over the next few years.

Stability is a tricky one. Do I sacrifice gainz for stability and introduce bonds or gold? Or do I just build a big cash buffer??

Not sure on this one just yet. I’m thinking of a big cash buffer but we’ll see.

“So as you could imagine, I decided from that point onwards that it’s always better to just stick with the FIRE literature and dump it all in next time.”

I’ve got $180k cash to inject to my portfolio, and I’m thinking about splitting it into 30k a month for the next 6 months. Where did you read that FIRE literature?

Not really FIRE related but this makes for an interesting read on the topic:

https://www.morningstar.com.au/learn/article/the-dollar-cost-averaging-myth-why-lump-sum-i/197410

Even after reading this however I still DCA and have been for over a year now. More to make it somewhat easier from a peace of mind POV than anything else. In the current environment I think this would apply even more so.

Yep. It’s the psychology of being able to sleep at night that makes DCA more appealing to me. I’m not gutsy enough to lump sum.

James, this could be what you’re after.

https://www.vanguardinvestments.com.au/retail/ret/articles/insights/research-commentary/investment-principles/dollar-cost-averaging.jsp

Thanks guys, interesting reading.

This is what I was thinking of 🙂

I know this is a form of market timing but as the market is “on sale” are you tempted to buy more shares given you have the cash or do you prefer to stick with your strategy of DCA and only invest $15k a month (no more, no less despite what the market is doing).

I’ll be continuing with my regular purchases, but have also set aside an extra amount to pick up shares which I consider bargains along the way.

Market down 5% or so in a few hours today…

https://media2.giphy.com/media/6pJNYBYSMFod2/giphy.gif

Urge to place big buy order… rising.

VAS dips into the $60s I’m doing it… then every $10 decrease from there till I run out of money. Gotta have a plan!

We only did $15K because of the big lump sum we had from the sale of IP1. We aim for $5k each month.

It is tempting to put in a bigger chunk this month but I think we’ll just stick to the normal $5K for March.

Hi AussieFirebug,

I was looking through your NetWorth in relation to your Investment Properties. Why did you decide to start reducing the loan on both properties in 2019? Did it become positively geared or you used some of your own money? Interested in paying off investment loans vs placing money in shares. Thanks Matt

Because of APRA, the interest rate for P&I vs IO was such a variance that it didn’t make sense to only be IO anymore. If they changed the rules again, I’d revert back to IO

Interestingly enough, I prefer to DCA on my investments and focus primarily on stocks that pay nice dividends and their attached franking credits. Granted some would prefer LICs/ETFs to minimize their trading costs and mimic the market, but I’d prefer to control which of the stocks have a nice business model, strong balance sheet, growing dividend payouts, and so on. Instead of looking at the stock price daily or weekly, focus on the quantity and accumulate more every quarter. My passive income now averages about 12% on dividends and franking credits, excluding any capital gains on sells. I consider the positive cash flow as a defense to the market downturn and eventually buying up more units cause of DCA, in addition to the my monthly savings. On an uptrend market, churning becomes possible. Over the past 3 years, I managed to increase my Passive Income by 15% annually. Each stock is set a target %, to determine how much quantity to buy for each of my stocks based on the amount I’m investing. Once the DY% reaches a number less than my comfort level, I sell. It’s mainly cause of the stock price increasing so decide to capitalize a portion.

If you revert back in 2016, the P/E for the ASX was about 22. That’s acceptable. My comfort range is +3/-3 annually, but not consecutively. For every % upward trend, I sell a certain % and keep some in cash, and accumulate some in my other stocks that may have dropped, but only for the ones that retained their DPS with a DY% of 3%+ for the interim payouts. In 2017, P/E was about 25. By mid-2018, P/E was in the 29 range. Over about 2 years, I’ve liquidated about 20% of my portfolio by June 2018. Everyone has their own method of DCA, but my method is based on the % up/down per quarter after the dividend payouts. There are plenty of articles that says P/E isn’t a solid indicator, but beginning of 2008 the S&P P/E was at 70. That’s astounding. Sold more than half of my total portfolio. The year before that was under 22. You can’t time the high or lows, but I prefer a mix of growth and income stocks.

Interesting strategy Eric. Nice returns too 👍

Yes I really like the FIRE community . No I’m not predicting doom for them . But surely a better name would be Market .Dependant . Retire Early for a while ? Only way to be really financially independent is not to be connected to the whims of the market …surely ?

But anyway , if nothing else . Spare a thought for the retired community . They have been earning 0.5% on their savings account … money to supplement their lives . So in droves they have invested in the market to get a better return .. and yeah I get it , if you invest in property , stocks etc and you make money , your called a savvy investor . If you lose money you cry fowl and call yourself a ” mum and dad investor ” . Everyone pays their money and they takes their chances . But these people , can’t re earn the losses . . Do we care ? , I don’t think so . It’s every gender neutral person for themselves these days . But for myself , just like the weather , I think the financial market is much more prone to radical movements in recent history … my prognosis? Western society is on borrowed time . It doesn’t work anymore . Unless you have reasonable interest rates the capatilist system no longer makes sense . That’s a problem . For myself I invest in nothing . No losses , no gains . You can’t retire early , but you do know where the #%*%# your going … and yes , I’m sure the Bear market will be over soon enough . 1 year , 5 years , 10 years ? Before investors break even ? What doesWarren Buffort say ” if market history was important , the richest people in the world would be librarians ” . Anyway Bon Chance : )

A lot to think about in that comment mate.

I do feel bad for the retired who can’t earnt their losses back. Half the reason I was so angry about the franking credit refunds potentially being axed last year but that’s a whole other story.

Hi AFB.

Are you still purchasing units through SelfWealth? Just noticed you are no longer affiliated with them after clicking on your YouTube video link

I am!

Hi AFB. What articles on your site / where would you recommend to start reading for someone who hasn’t invested before and just getting started, but has quite a sizable amount saved up already (e.g. mid six figs)

Read my Start Here page and then head over to Passive Investing Australia.com

Hey Aussie Firebug,

Keep up all the awesome content, my partner and I are loving it!

Quick one on the ETFs you currently invest in. I’ve been listening to your podcasts and vaguely remember you saying something about a couple of different ETFs you were considering because they offered DRP where some of your current ones don’t (or something along the lines of that)?

Basically what I’m wondering is…. If you were just getting started now, would you choose the exact same ETFs or would you choose different ones and if yes, why?

Thanks heaps,

Jess 🙂

Hi Jess,

I’m glad you’re enjoying the content 🙂

If I were to start again today… I would probably just go for three funds. A200, VTS and VEU. Keeping it really simple and easy.

I’m running a 70/15/15 Oz/US/World split atm and I’m comfortable with that.

So much can change over your life. One of the biggest steps in teaching FIRE is just making a start. You can tweak and adjust along the way.

Hope that helps!

Hi,

Any reason you have multi ETF’s and not VDHG?

Cheaper, no bonds and I like to be able to allocate my splits myself (70% Aussie, 15%US, 15% World Ex US).

Hi, I thought I read one of your posts in which said that you had a 40-30-30(VAS-VTS-VEU) breakdown.

I’m curious to know what made you change your proportions. Cheers!

A big influence was reading the “Idiot Grandson Portfolio” by the Scott Pape (Barefoot Investor).

In that extremely well-written document, he comes out with a 70%OZ, 30% international split. There’s a lot in there but if you’re curious I’d suggest reading it.

To be honest, the splits are really set in stone and can change. I really don’t put a whole lot of thought into them.

Cheers

Hi AF,

Love the update and info. It inspires me and I hope it does the same for others.

I noticed a couple of HECS payments coming in July each year. Is that the total from the year before? Is the plan to include your debts outside of the mortgages in your networth calculations?

I apologize if I missed something and you are already debt free except the mortgages!

Have a beautiful day.

Mike Staunton

Hi Mike,

I really should include the HECS debt. It’s literally the only thing missing from these updates. It should be gone in the next few years but it completes the picture so I’ll see what I can do 🙂

Just reading a fairly convincing arguement by someone in the US that we are reaching the bottom of the sell off now . They are using the market drop in 1917 during the Spanish Flu pandemic as their reasoning . They table that the bottom of the crash was late 1917 and the market was on the way back up from then , even though the worse month for the Spanish Flu was not until Oct 1918 . On the one hand it sounds a bit simplistic to me . There were other factors going on . The U.S. had entered the Great War in mid 1917 after the Germans re started their unrestricted submarine war fare strategy . The U.S wasn’t the industrial giant it became in later years , so relied heavily on French and British equipment to outfit their forces . One assumes there were some mega contracts being placed at home though . That surely would have been supercharging industry and of course the market . So am a little sceptical. On the other hand though … I get the feeling they may be right , but possibly for the wrong reasons . In a way this is the crash we had to have . It just needed someone to yell ” the sky is falling ” about something and we were going to have a major correction at the very least . It smells like close to the bottom now to me .

On the home front … well that’s all our interest rates gone , onto printing money next with quantitative easing I suppose . But hey , the yanks are 23 trillion dollars in debt from doing that in the early 2000’s and no one bats an eyelid about it as far as the markets go . Basically I think the fear of fear will end in the next 3 months . People and the markets will accept the challenge and stop panicking . Then the one human characteristic we can always rely on will kick in , which of course is greed … and people will start to see opportunity .

I won’t be buying , as I’ve never bought a share … a lotto ticket , or bet on a horse race in my life .. that’s just not me . But I think the bottom is just about here from my voyeristic fetish of studying the markets from afar over the years .

We’ll see hey .

Forgetting about our wallets for a moment . This is of course a terrible thing which is happening . Perhaps there may be a small positive to come out of it though ?…in the end . The GFC taught us that money isn’t guaranteed to just keep growing on trees forever . Maybe when this is done and dusted we will have remembered what the really important things are in our lives and focus on them more in the future ? .. again we’ll see ? .. first we have to get to that point . Stay safe everybody , and stay positive . We’ll beat this like we have beaten everything else we have confronted since summoning up the courage to climb down from the trees and make a run for it through the long grass of the Savannah .

Bon Chance .

Thought-provoking comment mate 👍

Yes, Savannah – you could say all this is teaching us that money does grow on trees!

Hey mate,

Love the detailed info.

Mind if I ask where you found the properties at such a great price?

Thanks

SE Queensland mate.

Hey mate, love your content, keep it going!

Would you consider buying some international ETFs (IHVV, VGAD) with AUD hedged on these times of lowest AUD ever, unhedging in case it goes back to 0.65-0.7 USD? What are your thoughts on that?

Especially if your portfolio was focused only on international shares (my scenario, running 50/50 VTS/VEU atm).

Cheers,

Hey Lucas,

Eh, maybe. I honestly don’t really focus too much on hedging and subheading sorry.

Those are solid products though so I don’t see in issue in using them.

Sorry if that’s not helpful

Hi AFB, I have been enjoying this for a while. I really appreciate your help and commitment. I am also planning to invest via Q super (for tax benefit).

Few questions, please

1. I remember you had mentioned about VAS (vs SP 200). What would be the main difference and why do you prefer SP 200?

2. You had also discussed in one of your podcasts about buying IVV instead of VTS. Can you please explain that? You have VTS (not IVV)

If I invest through Q super- would you recommend the same split? (60/20/20)

No worries Mahendra 🙂

1. Legit just the MER difference for me. A200 is cheaper that’s about it.

2. There are rumours of VTS being domiciled in Australia so I’m waiting to see if that happens. Otherwise, IVV is a great product.

Your Super split is completely dependant on your circumstances. What’s best for me might not be best for you. Research, learn and develop your own strategy with confidence 🙂

Let’s just hope the rest of the year produces something better than what we have seen recently. Ouch!

I’m relatively new to your site but was wondering: a) why do you have no exposure to USA?; b) why such low exposure to the rest of the world?

Have you ever considered VGS and why do more people not opt for that? Seems to me a 50/50 split between A200/VAS and VGS is great.

Love your updates. They keep me motivated.

a. We do! VTS 🙂

b. The income stream from Aussie divs too good to pass up IMO. Your analysis may differ.

VGS is a fantastic product too. We just went with the lower MER option (VTS/VEU). Both can work

Cheers

Ouch! I’d been catching up on your blog over the past month, and when you mentioned your plan of drip feeding your real estate profits while simultaneously talking up the lump sump argument… there was that part of me that was so worried you would drip feed it through the rise and give up and lump sum it before the fall! Ouch indeed. Still, it’s recovered loads since February and in the long term it will just be a blip.

I know right 😭😭😭. In the grand scheme of things, it doesn’t matter that much but it still hurts a bit lol.