Summary

Recorded and released on the 19/03/2020 (London time).

There’s a whole bunch of fear and uncertainty going around within the FIRE community right now. A lot of younger investors, myself included, have never invested through a bear market before.

I thought it would be helpful to hear from someone who has seen a thing or two in the investing world and be the voice of reason during these turbulent times.

I chat with Peter Thornhill about the current market crash and if this is any different to previous bear markets.

Some of the topics we cover today include:

- Peter’s experiences with previous bear markets

- Similarities to the GFC

- What Peter’s buying in this downturn

- DCA or lump sum?

- Is this just fear and confusion or maybe a financial reset?

- Plus a whole bunch of community questions from the Facebook Group

Show Notes

- Peter looks forward to another GFC

- Bill Gates TED talk about the next outbreak

- Manias, Panics and Crashes by Charles P Kindleberger (Pic1) (Pic2)

Transcript:

Aussie Firebug: Hello, Peter. Welcome back to the podcast. Thank you so much for coming on.

Peter Thornhill: My pleasure, Matt. Good to be back.

Aussie Firebug: There’s a whole bunch of fear and uncertainty going around the FIRE community right now. A lot of younger investors, myself included, have never invested through a bear market before. I only started investing in shares back in 2016 and have only ever really known the market to turn up until the last month. I’m currently down a whopping one hundred and twenty eight thousand dollars. Can we start with your experiences with previous bear markets when you’ve had skin in the game?

Peter Thornhill: Well, welcome to the real world. History is, of course, my guide. And as long as you appreciate and understand history, you can foretell the future. I can therefore say with great confidence to most people that at some stage there will be a disaster and everything will go pear shaped. I have no idea when. I have no idea what, but once the herd stampedes, then off we go.

Aussie Firebug: Does this bear market feel any different to the others that you’ve personally invested through and that you’ve lived through?

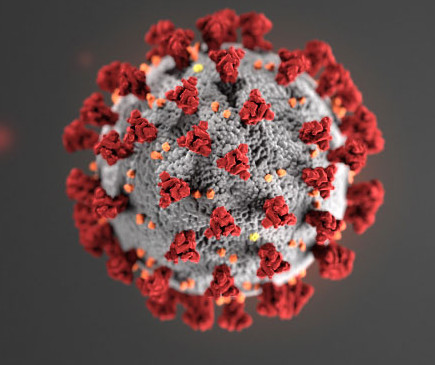

Peter Thornhill: Well, I guess in one respect, yes, it is, because I’ve actually had a look at all the pandemics that have occurred over the last two thousand years. There’s been a lot of them, but not not many have had the same impact on the share market as they have SARS ebola They’ve all had an impact, but not to the extent that this one has because this is knocking on everybody’s door, whereas a lot of the other epidemics were isolated to largely individual countries, whereas this one this is a global job. And as we’re now all globally connected, news travels like wildfire. So you can have everybody panicking all at once.

Aussie Firebug: Feel like the media plays a big part as well with the fear and the scary headlines sell a lot more than just mild headlines. And that’s not to downplay the seriousness of this virus, because it is is very serious. And there are thousands and tens of thousands of people that are dying. But just this day and age, I think you’re right that it does, especially with international travel and everything. Things are spreading quicker and there’s more there’s more communication and maybe a bit more preparation this time around than previous before.

Peter Thornhill: I wouldn’t say that there’s been more preparation. If you want to see the real story there was a TED talk by Bill Gates in 2015 and I encourage everyone to go and look at it. I’ll put that in the show notes. He suggested in that TED talk that the next pandemic was the world was as ill prepared as it always has been. And whether it’s a war that kills 40 million people or whatever he forecast in 2015 that the next world crisis would not be a war, it would be a pandemic. And listening to his TED talk is just an absolute revelation. This is a guy telling it as it is and governments around the world are totally ill prepared. I mean, if there’s a war, they’ve got armies, they’ve got tanks, they’ve got planes, they got ships, they’ve got missiles, they got everything and they got reserves that they call up. But if there’s a pandemic, there’s absolutely no fallback position whatsoever. And that was the thing that struck me most about Bill Gates talk.

Aussie Firebug: Interesting. I’ll definitely link that talk into the show notes so everyone can have a listen. So so you’ve lived through a few bear markets in the past. Can you speak about some of the ones that stick out in your mind?

Peter Thornhill: Well, rightly or wrongly, they all stick out. 1973/74 was the first that I was really aware of. We were only in England for sort of three when the first oil crisis, share markets tanked. The UK market fell about 30 percent in 1973. Everyone said, Oh, thank God, that’s over. In1974 It halved again and the impact of that, because I was working in the financial services industry in London at the time and it was absolutely devastating the way it affected people. The next one, I guess, was probably 1987 the year before we got back to Australia. 1973/74 I was young, foolish. I didn’t have much money anyway, so it really had little, little or no impact on me, but I was aware of what it did to other people and 87 fledgling investor at that stage. And again, not much money to be able to take any advantage of it. So the big one for for us was the global financial crisis, which just was an absolute crackup.

Aussie Firebug: That’s a good segue way into our next question. So obviously, a lot of my audience and people that listen to this podcast fall into the younger demographic. So they’re just starting their investing journey of Perth. Are they? Or have only been investing for a few years like myself. So the GFC is obviously the big one that we all sort of remember. So I remember I was just out of high school when it happened. And like you said, I didn’t have any money to really take advantage of the situation. It was big news and a lot of headlines, a lot of newspaper selling about the financial markets crashing around the world.Do you do you see any similarities with the the fear and everything that’s going around with this pandemic to the GFC back in 2008?

Peter Thornhill: Well, the key with all of them is fundamentally that fear is based on ignorance. We’re frightened of things we do not understand. Knowledge is power. And the sad part is that too many people have really very little knowledge and easily frightened by what what the hell is going on around them. And my advice to young people today is self-quarantine and put your bloody phone down. Turn off the computer. Stop reading the newspapers. Turn off the television and you can follow me floating through this current disaster.

Aussie Firebug: So obviously, it sounds to me like you believe this is just another crash. Another thing that’s gone wrong in the world, which will continue to go wrong every every couple of years, something like this happens. So you obviously believe this will pass and there will be another time of prosperous business increasing their profits going into the future and it’s only a matter of time before this pandemic passes and the stock market recovers. Would that be fair to say?

Peter Thornhill: I think so because the stock market ultimately is a barometer on a daily basis of the fear, the greed, the stupidity, the day trading, the short selling. Every man and his dog has access to this thing called the share market is reflected in the performance of the stock market. But people for some reason read this as a reflection of all the businesses. When in actual fact, all it is, is the infection. It’s it’s a little bit like when you do get older, you get a favor. Okay. The sharemarket’s got a fever. It’s flashing red and everybody goes bananas.

Aussie Firebug: Indeed. Do you think, though, that there’s going to be some fundamental losses in a lot a lot of businesses around the world that potentially you’re going to have no business for three to six months, like that’s going to affect their bottom line?

Peter Thornhill: Absolutely. And this is where it’s different to the GFC. For example, the global financial crisis was a disease incubated in the United States with corrupt investment banks, creating some absolutely toxic derivatives and then creating their own derivatives to better get it against them and then they export that disease to the rest of the world. So that was confined to basically incredibly toxic derivatives based on residential property and mortgages. This one is different. And you’re quite right. The impact on business generally is going to be devastating. But fundamentally, I cannot accept that as a result of this pandemic that all of a sudden things have changed and that all human endeavor is going to grind to a halt. I would suggest that out of this, like every awful event, the creative nature of humanity will come through. But in the meantime, it’s gonna be a very painful journey, just like every one of these incidents. Always are.

Aussie Firebug: Now, there’s a famous clip of you on YouTube. I’m gonna put that in the show notes because everyone should watch it. You said you look forward to events such as the GSC. In fact, I think you even said that you love them. Can you explain the reasoning behind this and how you are containing your excitement of the thought of another GFC this time around?

Peter Thornhill: The excitement is tempered by my concern about the health of everybody. My family included that the GFC was an absolute godsend. And just to show you how silly I am, CBA went from sixty four dollars to fifty and I bought so they went to forty. I bought some more. They then went to twenty six with all my sphincters tightened. I bought some more. And funnily enough, I’ve had people say to me, Well, why didn’t you wait and buy them all at twenty six? I said, Well, I didn’t have you there to tell me that that was the bottom. The subsequent events were CBA went back up. So the fifty, forty and twenty six didn’t look so silly after all. But the best part is that was the GFC in 2008. We have had one hundred and thirty five percent of what we invested during that period return in dividends alone. Unbelievable. There was no perfectly believable because I can I could give you the same story for Wesfarmers. We’ve had one hundred and forty six per cent and yes, there was that famous quote. You know, I look forward to the global financial crisis. And the thing is that when the herd is spooked, it goes berserk. And it enables us. I was asked why I lied, why I wanted another GFC, and my comment was quite simply where I’d like to buy some more Commonwealth Bank of twenty six. Some more Wesfarmers at $13. Because I didn’t go hard enough the first time round. I mean, it sounds ludicrous, but to me, when the herd panics, you never, ever stand in front of the herd. When it stampedes, you step to one side. You let the herd go hurtling past in a cloud of dust. And then you turn around and you pick them all off one at a time from the rear.

Aussie Firebug: So that that’s a really great analogy. So what you’re saying there basically is as everyone is liquidating and selling, this is the smart thing to do in a situation like this is to stand to the side.

Peter Thornhill: Hold your shares. And as as the price comes plummeting down, you go shopping.Because we get to buy the future income stream from those businesses at a huge discount.

Aussie Firebug: I probably should clarify it, and I’m sure people understand, but I’m sure yourself as well as my partner. We don’t look forward to to a pandemic, of course, because of pandemic powerful, but this is purely on these podcasts obviously is about finance. So we just trying to navigate the waters in regards to investing. So I just want to make that clear to everyone listening now. There was another golden quote in the same video which I’ve actually referred to on the blog before. And it goes something like you said, watching the share prices drop is a totally different thing to the cash flow that’s coming out of the portfolio. That is what we are living on. We are not leaving on the capital as a source of income. It’s generating the income for us. Now, that quote really resonates with me personally, but I’d love for you to talk about that and how dividends can help during a bear market.

Peter Thornhill: Well, the dividends tend to be far more stable because they are a function of the management of the company defining what is a suitable higher ratio and paying out the dividends accordingly. So companies with higher capital requirements will probably retain slightly more profit. Others with less capital requirements have no point in the company retaining those sitting on their balance sheets so they can lift their dividends. So you sit there and the cash flow pours out of these businesses and that is what sustains our future life. The share price is to a large extent, irrelevant dividends.

Aussie Firebug: Now, we spoke in a little bit about that. These pandemic, unlike 2008, is going to affect a lot of businesses. Bottom line is actually the fundamentals of the business is gonna take a hit. Dividends will most likely or almost certainly will drop in the future, but not as much as the share price. Can you explain why that is?

Peter Thornhill: Well, it’s going to be a mixed bag depending on the industry you’re in. The manufacturers of toilet rolls are going to honor an absolute pardon me, pardon the pun, an absolute roll. So the profit performance will vary according to the pharmaceutical company that creates an virus or a medicine to deal with it Are going to go up. So you’re going to have all different organizations producing different results, which is why I love a broad spread across a whole lot of companies. So there’s going to be good and bad as there are in every stock market. So it’s that diversification that protects us. But yes, dividends are probably going to take a hit, which is one of the reasons that I’m delighted that some share prices are down 30, 40, 50, 60, 70 percent, because I don’t think the companies are going to go broke. But I can buy their future dividend stream at a discount of 30, 40, 50, 60, 70 percent. And I think that is outstanding. So although across the board, there may be a reduction in dividends because I own more of these shares. We are largely insulated from the worst of the disaster.

Aussie Firebug: Now, this is almost gone into my next question here. Speaking of buying shares at a discounted price, what are you buying during this downturn?

Peter Thornhill: Well, it’s interesting, Matt, because at the stage we’re at now. You know, I used to keep myself when I worked in the financial services industry and for a number of fund managers here and abroad that I, you know, knew what I was doing. The realization came that I didn’t know what I was doing. However, I am unwinding how direct individual shareholdings and I am feeding more and more and more of that into the listed investment companies. The old fashioned ones and increasing the holdings there. Because to be honest, Matt, I have far better things to do than mess about my wife than money.

Aussie Firebug: Fantastic. So specifically, which LICs? Because I know there’s gonna be a lot of listeners out there that want exactly which ones that you have on the limit.

Peter Thornhill: Okay. Well there’s there’s a few of them for a variety of reasons, but the original ones and some of them by accident because I ended up with some of them simply because a smaller listed investment company was taken over via larger one. Cambria was taken over by Milton, which is why I ended up with Milton. Anyway, cut a long story short of the good old fashioned ones. AFIC, Argo, Milton Whitefield. I like whitefield because it’s one hundred percent industrials. It looks like a load of rubbish when there’s a resources boom and it looks absolutely heroic when the resources boom dissolves. Soul patts, brickworks. There’s loads of them. I mean, I’m not going mad, but the diversification is there because the last thing I want is to leave my wife with a portfolio of 40 or 50 shares, individual shares. I mean, she knows why they are there. But she doesn’t want to get involved. She loves the income stream, I’ve got to say. And that’s important. So I’m actually, with a little bit of work over time, I think we’ll probably end up with maybe six or seven listed investment companies speaking untold hundreds of thousands of dollars of income a year. And on average, we are probably gonna chug along at about 10 percent per annum compound. Now, I know there’s a lot of people out there that want the alchemist stone to turn lead into gold, but I’m quite happy with a boring 10 percent.

Aussie Firebug: That sounds good to me. I’d definitely be happy with 10 percent at the moment after my portfolio, the hit that it’s taken.

Peter Thornhill: Think about it on an accumulation basis. You’re going to double it every seven years. Thousand is two hundred. Two hundred is four hundred four hundred to eight hundred eight hundred one point six million 1.6 million 3.2 million. For God sake, in 40 years. What are you going to do? Absolutely heroic.

Aussie Firebug: Yeah,That’s the plan. So I question so I just had a thought popped into my head the last time we spoke. You weren’t the biggest fan of ETFs And I think that type of you just had some questions about them. Has anything changed in that regards with ETFS. or are you more on the at least the investment company

Peter Thornhill: I’m still not uncomfortable.I prefer the company structure rather than the ETF structure. Right. Because if a there is a company takeover and it’s cash, not scrip, the listed investment company can reinvest all that money on behalf of their shareholders. The ETF has got to do something with it. It can’t retain it.

Aussie Firebug: Interesting. When you’re buying these Elyse’s at such a discounted price at the moment, how are you deciding what to buy? Is there a price that you’re looking for? Or do you just invest regularly? You just have a plan that you stick to and it just is like clockwork.

Peter Thornhill: I have no plan. There is nothing clockwork. It is totally emotional. And it is on the day. How do I feel? And let’s go.

Aussie Firebug: It is interesting to hear. So you don’t. Dollar cost averaging into the market. It is not like a time that you buy every month or know those.

Peter Thornhill: Those days are gone mad. But effectively there is dollar cost averaging. Because with a lot of the old fashioned dollar cost averaging they have capital raisings. It takes one of two forms. One is a share purchase plan or the other is a rights issue on a pro rata basis, a one for ten or something like that. The rights issues require a full prospectus, so it’s like any company raising fresh capital. The share purchase plans do not require a prospectus. It simply requires a BPay on those on the form and it’s done. Now, these have proven to be a real boon for my three sons because investing in these LICS they don’t ring me up and say, Dad, you know what? What about argo? What about Afic? What about movement? Blah, blah. They just take them up because that’s how I’ve trained them. Now people are going to say, oh, yeah, but what happens if they’re in a think? Asset value is lower than the price. So there’s a premium. Yep. Okay. So if you look at the chart of the stock market, it goes up, down, up, down, up, down. But it’s all headed in one direction. So OK. I bought a premium. I bought a discount. I bought a premium discount premium discount premium. Discount premium. The end result is you draw the line through the middle. And what directions is it heading in…UP! But every one everyone has to finesse everything to the ends degree. I have better things to do.

Aussie Firebug: It seems to me every single time I wake up, with the exception of a few days last week, the prices are plummeting and they’re plummeting down. So what is your approach in a situation like this? I know that there’s a common saying, you know, don’t try to catch a falling knife. Are you waiting for a specific price to hit? Or are you just you wake up one day, like you said, emotionally and you like the look of the price, you’re gonna to invest in it. And then if it’s cheaper in a month’s time, you’re gonna go again.

Peter Thornhill: Matt, as I indicated earlier, I was trying to catch a falling knife. I bought CBA 50. I bought them at 40. I bought my twenty six. I have no idea where the bottom is. No one does. And sometimes I’m going to look like an absolute donkey. But in the overall scheme of things, it doesn’t make a blind bit of difference. But just to give you some sort of sense of where the hell we’re at. Frieda and I have watched four million dollars evaporate from our portfolio.

Aussie Firebug: Well, I was actually I was gonna not so much that I didn’t, you know, it was appropriate that, yes, they formally. That’s a lot of money.

Peter Thornhill: Now, am I having sleepless nights? I have the perfect antidote to the current Corona virus, which is half a bottle of champagne each before we go to bed.

Aussie Firebug: It’s a gritty and strong cash flow, no doubt. Still Strong cash flow. Yep. Yep. Fantastic. Okay, so another question. Do you have much international exposure in your portfolio? Why? Why not?

Peter Thornhill: The answer is yes, I do. I have CSL. And a a number of other high quality, outstanding Australian companies that are global. So you don’t want to buy American share? No. Too much bloody trouble. We have some absolutely fabulous world class companies. I mean, Cochlear and CSL are two perfect examples of this. Both of them being absolutely slaughtered at the moment. And I’m rubbing my hands with glee.

Aussie Firebug: Interesting. Okay, so it’s predominantly everything that you own is on the ASX. It’s just that some of those companies are really a global company.

Peter Thornhill: Well, yes, but in fairness, Matt, I sort of own up to the fact that this may or may not be an issue for you when you come back to Australia. But I wasn’t sure that I wanted to leave what we considered at that stage to be our home. So I left my pension fund in England so that accumulated from nineteen eighty eight onwards. And I converted to a self-invested personal pension when I retired. So I have holdings in the United Kingdom and basically my super fund in England has four holdings. It is four old fashioned listed investment companies.Each of them pays quarterly dividends. That is sixteen dividends a year.So I draw a monthly income.Twelve income payments come out and it’s that is that in pounds. And then you transfer sterling. And because of the double taxation agreement, I pay no tax in the UK, it’s all treated as taxable income in Australia.

Aussie Firebug: Interesting. Oh, you must be liking the exchange rate at the moment.

Peter Thornhill: I’m definitely I’m I’m loving it.

Aussie Firebug: I’m definitely keeping my eye on that because I can sterlings myself the pound and we send money back home to Australia each month to continue our investing. Sorry. Yeah, it’s it’s I’m looking at that with a cane or I think it’s over one pound. Over two. Yes, over $2 now.Okay. So we have some questions now. So I basically know these podcasts to everyone listening. It was really spur of the moment. I actually listened to the mad scientist had a podcast and he brought in someone that was a seasoned investor jail, J.L. Collins. And it was really just a to come over on. Diana was such a turbulent, turbulent time in the market. And I really took inspiration from that podcast and thought, who can I get on really, really quick just to have a chat? And of course, Peter Thornhill being the man, the myth, the legend. I thought, let’s get him on the podcast. So I literally just sent you an email, Peter, last night, I think, and you responded very quickly. And I thought, let’s do it. Let’s jump on and do this podcast and get it out there as soon as possible. So I literally posted something in the Aussie fire discussion Facebook group that I have, and I posted it probably about an hour before this show happened because it was just spur of the moment. And I think there was about a hundred questions within the first 40 minutes, which just goes to show how popular popular you are, Peter. I’ve got a whole bunch of questions from the community that were the most liked and I’d love to hear your response to some of them. So the first one is would you purchase LICs now while they’re trading above the NTA (net tangible assets)?

Peter Thornhill: Yes, the answer is yes. I would.

Aussie Firebug: Yeah. It doesn’t really matter does it. You just purchase. It’s not something that you concern yourself with. You’ve got other things to worry about.

Peter Thornhill: Yeah, well, I have nothing to worry about. I have lots of other things to think about. its A good way to be.

Aussie Firebug: Second question, does the heavy drop in VAS, which is the Vanguard Australian Index, top 300 fund and low Aussie dollar change your mind on buying HFS.

Peter Thornhill: Not one jot

Aussie Firebug: what financial steps did you take during similar events in the past? And did they work?

Peter Thornhill: Well, the answer is that the probably the most significant was the global financial crisis. And the answer is I stepped up to the plate and I took advantage of it. And it had a profound impact.

Aussie Firebug: Expand on what stepping up to the plate means.

Peter Thornhill: Yeah. You may remember my two golden rules spend than you earn, earn borrow less than you can afford. So during the global financial crisis, I was able to go across a whole raft of shares and the impact of that post the global financial crisis because share prices tanked. We bought in at the well, let’s take CBA. We bought CBA at twenty six. For example, the dividends we’ve had since have paid us more than 100 percent of what we put in. In the meantime, the share price came back from twenty six to over 80. It’s currently back around the 60s or something. But where the market recovered from the low point because of buying that cash flow our result and particularly at that point, as far as the index is concerned, our portfolio recovered far greater than the index did and our cash flow exploded also as a result of that. So it was you know, there was no rocket science associated with this. It was just taking advantage of everything being on sale and stepping up. And I’m doing exactly the same thing now. We still don’t spend all we earn. I still haven’t drawn down all the liquidity that I have available. So I’m sitting there with all the armaments you need to be able to sit this war out and take full advantage of it.

Aussie Firebug: That’s a very interesting point. I just want to touch on that. You have obviously some dry powder. How how how much cash reserves do you have or have? Have you had the same amount of emergency filed your whole life? Like you keep a set amount, six months worth of living expenses, a year’s worth of living expenses that gets it.

Peter Thornhill: No, It relates to, you know, inflation, basically. So what we had originally was nothing like we have now. Because to me, unfortunately, I own an apartment and, you know, it grieves me but unfortunately, whether you’re aware of this in the UK, but security of tenure is not an issue for people who are renting because long term lease holds a part of the furniture in the U.K. They are not here. So there is no security of tenure. And you are left in the hands of bastard property speculators on 12 months and 60 days notice to quit anyway. So we own an apartment. That’s fine. So I’ve got all this money sitting rotting in this damn place. Now I can utilize that because the bank’s been managed by Australians they love property. So they are currently lending me money at 3.3 percent and I am able to invest that in shares producing around for four and a half percent. I get franking credits on top of that. I get a tax deduction for the three point three percent. You’d have to be nuts not to take it. The banks are paying me to borrow money from them to invest. So I have loads of dry powder. There’s probably about 2 million undrawn.

Aussie Firebug: That is that’s incredible, so obviously the dry powder. The point I was trying to make is that is crucial to be able to take advantage in a situation like this. Like if you don’t have the fundamentals, you’re not going to be able to sleep at night, you’re not going to be able to take advantage. So obviously, like you said, the two golden rules spend less than you earn and borrow less can afford.It works really well in a situation where you’re comfortable and you have that dry powder. A lot of people out there maybe don’t have a whole bunch of cash and, you know, a little bit worried about the future in what way it where it’s going to head maybe about their job security. So we’ll be your advice to someone that potentially doesn’t have that emergency fund built up, like would investing be the last thing you would be thinking about if you didn’t have that dry powder?

Peter Thornhill: This is the tough one that it’s really easy for me to sit here at Seventy three telling you these stories and we’re talking to an audience that’s probably not even half my age. And all I can do is cast my mind back to when we began. And I was very fortunate because I married a saver. And I’ve got to say, over the years presenting, I’ve become acutely aware of the issues associated with that. To savers, nirvana, to spenders, not the best, but they’re aligned. The worst is one spender, one saver, because one of them can spend their life white anting all the efforts of the other total bloody disaster.So, you know, two savers, you know, nothing heroic on our part. Free to stop work when the foot when our first child was born back in 1975. And she has her career has been raising three absolutely magnificent young men and supporting me in my donkey job of going out and earning money. And basically, that’s it. So when when there were no reserves anyway, all we could do was with what little we had. And I’m afraid today and I say this knowing I’m probably gonna offend people. So many young people today expect to have today what it took forever and I lifetime to achieve. They want it now. Well, that’s okay. But there’s a thing called opportunity cost and the price you’re gonna pay for having everything now. How can I best express it? Today’s pleasures beckon more strongly than tomorrow’s pay.

Aussie Firebug: Another famous quote, I’m sure that also an Peter. Yeah. I couldn’t agree with you anymore. I think that what I was thinking of when you were speaking was if you haven’t done the fundamentals before, this situation happens like we’re in now, probably not the best situation to take advantage of it. But if you are, I guess the message is things like this happen. These events happen. And that will continue to happen. But it always recovers. And that’s something that I believe in. And I’m sure that you believe in as well. Eventually, in the long run, it will recover and the stock market will reach new heights.

Peter Thornhill: Matt, if I could just interrupt there for a second. The full day presentations that I do and the next ones coming up on Saturday, I have the history of all the sharemarket crashes going back, back, back, back, back. I’ve added an extra slide for this coming Saturday’s presentation and it covers all the pandemics of the last two thousand years.

Aussie Firebug: Always if you’ve got that slide or I can include it in the show notes if you’re willing to share

Peter Thornhill: All of this has been going on. Whether it’s you know, I think about my my parents, my grandparents. You can imagine living through two world wars and a depression. And we’re sitting here, you know, weeping and gnashing of teeth as a result of what’s going on at the moment. I mean, you never know you whether a bomb was going to drop and destroy your entire bloody family. Actually, technology’s an interesting thing. I was just having a look at the First World War. Total casualties, both armed forces and civilians were forty million, but the burst of technological advancements that occurred as a result of the First World War tanks, aircraft, blah, blah, blah.They managed to kill 80 million in the Second World War.Technology is a wonderful thing. Or worse, it’s.

Aussie Firebug: Yes, exactly right. Onto the next question, Peter. Now, you touched on it a little bit before, but I’m going to ask it anyway. Do you recommend continued continuing to dollar cost average and buy and hold index funds or LICs?

Peter Thornhill: Yeah, I’m not particularly interested in index funds because taking the Australian market as an example. I think we may have had this conversation before. I ignore resources, no interest. I don’t want them dragging my performance back because if you look at the comparison between the industrials indices and the resources, the gap is huge. My second cut is I don’t want any property. So the listed property trust sector is very it’s part of the industrials index. If I take that out, the industrials index rises even further. So for my simple mind, the easiest way to beat the All Ords and the industrials index is to get resources and properties totally out of it. And that’s the real simple cup. And it has paid magnificent dividends for us over the years.

Aussie Firebug: Fair enough. Banks are a bit on the nose at the moment. Are you buying more CBA, like you said in the past? Or is the value and growth elsewhere in the markets? Obviously this isn’t financial advice

Peter Thornhill: Absolutely not, because I am moving away from individual shareholdings. I’m moving more towards the LICS. So it’s a fairly dumb option. But to me, if I can have six or seven LICs in a portfolio producing five or six hundred thousand dollars a year in income, what the hell do I need to spend my time trying to finesse it? I don’t want to be a slave to the money doing what you’ve just said, which is try, you know, trying to choose where to tip in. I want money to be my slave. So I’m using the dumb option.

Aussie Firebug: Yep. Now, someone has recently read your book and they say it stands up well. Would they be any new chapters you would add if you were writing it today?

Peter Thornhill: The answer is no. I mean, the principles are fundamentally the same. You know, we’ve had five editions or five iterations of the book. Nothing fundamentally has changed over that period apart from when the GFC hit. But to add another chapter on chapter on pandemics, I don’t think it’s going to add any value to the book itself.

Aussie Firebug: For a younger investor, would you recommend leveraging more into the markets to make the most of a time like this? Because we know that in the past you’ve been a fan of using your home’s equity to reinvest into shares. So what would you what would you say to a question like that?

Peter Thornhill: Let’s not try and be heroic. This is where people try to get ahead of themselves. This is the snap opportunity. Forget it. The most valuable asset that everybody has is their time. As I mentioned to you earlier, you know, 10 percent, you double every 7 years. So 7, 7, 7, 7, double, double, double.The time is going to do all hard work for you. You don’t have to spend time agonizing over. Is it right to go now? Should I go harder? Do what you can afford. Because source law says if you’re really trying to be heroic, what do you do at a particular point in time? Comes back to bite you.Just relax. OK. Self isolate and carry on

Aussie Firebug: Is there any signals that you are looking for in the market or water economy to mark the bottom?

Peter Thornhill: What’s the bottom? What the hell am I looking for? I mean, for God’s sake, does anybody know where a bottom is? Does anybody know where a top is? This is the problem. For some strange reason, we are led to believe that there is something magical about selling at the top. Buying at the bottom. Blah, blah, blah. I’m sorry. I don’t think anyone has a crystal ball to enable you to pick either tops or bottoms. And all you have to do is watch. And this is this is the other issue. It’s boring being a dividend investor. Because you only get excited twice a year. Whereas with share prices, you can get excited or disappointment disappointed every single day.

Aussie Firebug: Yeah, I couldn’t agree with you any more, Peter. I know it’s I sort of had an idea of what your answer would be to that question, but I had to ask it anyway because I had a lot of likes in the Facebook group at the moment and I’m getting a whole bunch of emails myself. You know what? When do you think the bottom is? How do I know this is the right time to invest? And I couldn’t agree with you anymore. No one knows. And if they say they know they’re lying or they’re delusional. No one knows when the Next week, we could start rebuilding. It’s probably unlikely, but it could rebound and it could go into new highs like you just don’t know. And my view on the matter is just to invest like we usually do every single month we we put in and out into the market, dollar cost average and we just go about our business. But it’s it’s good to hear from you paid. It’s so similar. Thinking, too. It’s basically impossible to know.

Peter Thornhill: In the GFC,Why the hell did I buy CBA? Fifty one to buy them at 40. If I’m an investment guru, shouldn’t I know when the bottom is? I’ve got no damned idea where the bottom is, and I can say to you categorically. Taken to its logical conclusion. I bought shares in a company. This is going back some decades now and the price dropped. I bought some more. Price dropped again, just like CBA. I bought some more and then it went broke.Yeah, that was clever. Was.

Aussie Firebug: Well, like you said, you didn’t have the crystal ball.

Peter Thornhill: And the other difficulty is people are deathly afraid of a company going bust and losing their money. The biggest mistakes that I have been I have made have been sell decisions. If I can illustrate, I was a shareholder in Pacific Dunlop in 1995, Pacific Dunlop incubated and then floated a startup called Cochlear. As a shareholder in Pacific Dunlop, I got my shares at $2 50. They been floating around two hundred dollars, and just to show you how clever I am. My shares went from $2.50 to $20. How heroic was that? I sold some at 50. I sold some at 100. I sold some at 150. I sold some. That has cost me over a million dollars.

Aussie Firebug: It’s a good story, Peter.

Peter Thornhill: Well, I’ve got more. I did a site with CSL in it $7. I’ve been over 300 for a while and being a shrewd investor. You know, you don’t make a profit to yourself. I offloaded them. And I can tell you if I have parcels of, say, fifty thousand dollars in each acquisition, if a company goes broke, I lose fifty thousand dollars.I have lost millions of dollars by selling.

Aussie Firebug: It’s good. That’s a interesting way to look at it, Peter. Definitely.

Peter Thornhill: Yeah. Which is why now I take two aspirin, lay down and wait for feeling to pass.

Aussie Firebug: Very good.Yeah. This one this next question got a lot of likes and I guess it’s a hard one to answer, but to put it to you anyway. Do you believe that the market is declining based on fear and confusion, or is it due to a fundamental issue that won’t just evaporate?

Peter Thornhill: The market will generally react in a rational way to events. So the global financial crisis was a perfectly rational reaction to a period of extraordinary greed, stupidity and connivance by Investment banks in the US, etc.. This one’s slightly different in that it’s a pandemic, but ultimately the market overreacts because you have people who have no knowledge, Are fearful and at the first sign of trouble. Panic and index funds as share prices fall. So we’ve got shares down 40, 50, 60, 70 percent. Index funds have to reweight. So the whole selling process becomes so fulfilling. And this is the bit I love all those people out there mechanically doing what they have to do, simply feed the beast. And I just sit there. I mean, the analogy I have is when, you know, when the herd stampedes get out of the way, wait till the herd has stampeded past you and then turn around and just start picking them all off from the rear.

Aussie Firebug: Yeah, so really there’s no. We’ve touched on this subject so many times, it’s just but it isn’t it isn’t different. It’s different in the sense that it’s it’s a new pandemic. Like we’ve never seen this before, but it’s it’s similar to other events that have happened in the past. And it’s not like society as we know it is going to crumble. There’s going to be a financial reset of the world’s markets.

Peter Thornhill: The financial reset that everyone fears is that all these companies go bust. Okay. Now, that tells me they’re all human endeavor is gonna grind to a halt. There’s gonna be no food companies. There’s gonna be no banks. There’s gonna be no companies making bricks, glass, roof tiles, cement. So your lovely properties won’t exist any longer. I don’t believe that for one minute. I mean, even if there was a monumental disaster and we all went back to living caves. At some stage, I believe my wife and I’ll be sitting there on a rabbit skin rug trying to keep warm and follow the fire and there’ll be a thump, thump, thump on the front of our cave. And when I answer, there’ll be a likely lad at the front. And you say here, looking at. I’ve been grinding up some Alesia rocks and I’ve got some very pretty colors. I can paint your cave and it will only cost you three chickens. And human endeavor starts the whole silly process. One more time.

Aussie Firebug: I really like that story. That’s fantastic.

Peter Thornhill: Well, Matt, basically the stock market reflects the endeavors of the human race. So if you were telling me that it’s all gonna go pear shaped and human endeavor is gonna grind to a halt. I’m sorry, I disagree.

Aussie Firebug: I’m with you, mate. I think it’s gonna be outback as well, and I’m putting my money where my mouth is, obviously. Keep investing every month. It is scary, though. This it’s such a drop. Definitely. And I think you even said it about the GFC like you. You’d have to be someone without a without a heart to not notice or not to have some sort of emotional reaction to such a drop as the GFC. And it’s no different to this one. But I guess it’s just it goes to test everyone’s limits and what how they react in a situation like this, their risk to tolerance. So if you’re not doing too well now, maybe it’s a chance to look at your portfolio and maybe have a more defensive assets if you’re not coping with such a big drop. But it just goes to test everyone’s mettle at the moment.

Peter Thornhill: And Matt, I can say honestly, after 40 years of presenting that some people are just not wired the right way. I’m the lunatic fringe and everything between me and people who emotionally should never, ever own shares.

Aussie Firebug: Yeah, that’s a big one as well. The emotional factor of investing. I actually think it’s more important than, you know, the fundamentals of math behind investing means nothing if you’re not at an emotional state to cope with the ups and downs.

Peter Thornhill: Yeah, the emotional aspect of investing, you know, financial literacy is the key. And the barrier for most people to varying degrees is the amount of rubbish they carry in their head.

Aussie Firebug: Under what particular circumstances, if any, would you advise someone to sell some of their portfolio to take a loss And increase in increase their cash holdings?

Peter Thornhill: The answer is I will do it when my financial advisor tells me to go and I don’t.

Aussie Firebug: I would imagine that you will see him telling or her telling you anytime in the future.

Peter Thornhill: Oh, no. Fair. You know, with with due respect to him, he is extraordinarily valuable to me because he takes all of that away. And it was very important, particularly to Frieda and I, when we decided to retire, because I transferred a lot of shares in Frida’s name into the super fund, etc, etc. So there’s a lot of rearranging to be done. And I know I don’t know the rules. I don’t want to know the rules. The government changes the rules all the time. But again, I have better things to do with my time, so I rely on my financial adviser. And there have been some instances where it has been appropriate to offload a share. I am also guilty of it in the vernacular in England, doing some bed and breakfasting where I sell a share, crystalize a loss to bank it, and then by the share back again.

Aussie Firebug: I can’t do that. I don’t think you could do that in Australia, can you? Yes, you can.

Peter Thornhill: But you’ve got to make sure that there’s a gap between the transactions. So I have crystallise losses are still on the same shares, but I’ve crystallised losses, put them to one side so that if, for example, there had been a company takeover in my portfolio and there was a huge capital gain because it was 100 percent cash, no scrip. I’ve had these losses that I went without interfering with the overall long term holdings. I’ve got the losses that are back sitting there to help offset the capital gain. To me, it makes sense, doesn’t it?

Aussie Firebug: Yeah. Absolutely. Next question. This is obviously your favorite asset class. Do you have any thoughts on the housing market and how it will respond to this crisis. Is now a good time to buy? Or should we wait?

Peter Thornhill: Forget it.Rent don’t buy because the property bubble that has arisen as a result of the ridiculous policy of central banks and governments around the world of cutting interest rates has created massive bubbles in other assets.And I am ever so hopeful that this current corcona virus is going to be the catalyst that tips the whole thing over.And we have the banks up to their eyeballs, mortgagee in possession, owners of property and my sons tied on will be able to walk into the bank with a wad of cash and buy properties for half their current price much closer to their real value.

Aussie Firebug: How do you calculate a property’s real value?

Peter Thornhill: I have absolutely no idea.

Aussie Firebug: So just all that we know, all that you know at the moment is they’re grossly overpriced.

Peter Thornhill: Yeah. And it’s interesting because I often ask audiences if I gave them the balance sheet for Wesfarmers, how many of them would feel comfortable and coming back to me in a week’s time.Having analysed the balance sheet of the company in the annual report and telling me what the company was worth, I’d never had anyone put their hand up to say that they would be comfortable doing that. So my question then is what the most people use in their minds as the proxy for the value of the company?The share price.

Aussie Firebug: Yeah. Yeah, that’s that’s all. Yeah.

Peter Thornhill: On the basis that everybody knows the price of everything and the value of nothing. Where do you think property sits?

Aussie Firebug: Well, I would I would like otherwise look at it on the surrounding properties or similar types of properties. What they’re going for, because we may increase we’re looking to buy a house next year in Australia when we move back and settle down at family at rent. Well, the only thing about renting and like you’ve touched on is the stability. There’s no security and stability with rent either was because mostly I’m living in London now and travelling around Europe. Yes, you do see that stark difference in culture when renting and there’s families as generations that have rented the same place for, you know, 50, 60 years. That just doesn’t exist in Australia. So. I would be totally down for a long term rent. Back in the town that we’re from, but I don’t think we got going to get one. So in the event that we don’t, which is highly likely, we’re going to have to buy. Well, let me not have to buy it. I think we’re looking to buy at this point, which is just the reality of it.

Peter Thornhill: Can I just suggest comeback test the water initially rent? Because if the pandemic does its job then and really wrecks the system, then you’re gonna be able to buy a hell of a lot cheaper because there’s gonna be an awful lot of mortgagee in possession, sales going.

Aussie Firebug: I’m keeping an eye on the market. I’m watching it very closely.

Peter Thornhill: But never confuse property prices with the value of the value of these properties hasn’t changed much in the last 40, 50 years. The only thing that’s happened is the prices have changed. I can remember from some of the comments I think on our previous session together. You know, we left Australia, went to London when we realised we weren’t coming back. We bought a little terrrace house in clatan. I then got headhunted to move to the Midlands of England. We bought a house in Kitterman, soon Worcestershire. We then got headhunted to come back to London. I bought a house in Delage in London, then got headhunted to come back to Melbourne, bought a house in Melbourne, got hit. Harder to come in all that time. All I’ve seen house prices going up, but the values haven’t changed.We’ve just had this huge inflation which your generation is not going to enjoy. So the headwind and the tailwind we had was the tailwind in particular. Inflation devalued our debt and inflated the price of the property. So that terraced housing Clairton that we paid seventeen thousand pounds for, we sold for sixty two thousand pounds. Well that had that property in Strogoff and Road is now worth about 1.6 million pounds. Still the same frigging house.

Aussie Firebug: I was gonna ask you because I’m actually we’re in Clapham North. Funny enough. And I think we were platen common. There you go. It’s it must be. It’s typical Australian Australians to move to Klapper because I’m not sure if this was if Clapham was like that. Back when you hear it.

Peter Thornhill: It wasn’t met. It was Earls Court that was called Kangaroo Valley. We broke the mold and Clapton was close to Brixton, which was I won’t use the term that they described it. But it was largely West Indian and there were lots of Rusty Cortinas in the gutter. But, you know, we we paid 17,000. We sold it for sixty two because my salary had gone up. I could borrow more. So the house we bought in Kidderminster. We paid ninety thousand for. We sold it for a hell of a lot more than that. We came back to London. My salary had gone up. I could borrow even more. So this whole stupid chasing your tail has produced absolutely no value for us. At the end is where we are now.

Aussie Firebug: Wouldn’t you say, though, just on that, that even if the property is fetching more rent as it continues along through the decades in cash flow is rising and know. Property doesn’t have great cash flow. That’s not selling. I’m trying to argue. But if it’s getthis, it’s fetching more rent. Wouldn’t you say that the value of the property by large would rise? Maybe not as much as they are rising at the moment, but definitely in Australia. But if it is increasing rentals, wouldn’t that logically conclude that it is going to be worth more? No.

Peter Thornhill: If that’s the function in the UK and in Germany and Holland and Belgium and France and Switzerland, why are lots of people speculating and property like Australians?

Aussie Firebug: Well, that’s a very good question. I know that there’s a housing market in London icrazy. It’s it’s hard to stay with Sydney and Melbourne. I actually think it’s more expensive. So that’s definitely I know a lot of Europe and Germany. Like you said, it doesn’t have that ridiculous. Income to cost ratio that Sydney and Melbourne do at the moment. But yeah, I have no idea. The answer to that. Just to be frank and honest with you.

Peter Thornhill: Your rent is never gonna grow like the dividends from high quality companies. Number one. Number two, you don’t get franking credits with rent. Number three, you’re holding costs associated with the share – Zero. You’re holding costs associated with a property -Pretty awful. I cannot see we rent the lifestyle. And as I’ve hinted already, the only reason we own this damn property is because, like you, that we can’t get a long term leasehold in this country. I’m trying to get my wife into emigrating so we can enjoy it and we can come on holiday in this country and rent all the apartments that, you know, we were all properties we’d never bother buying.

Aussie Firebug: Yeah, we’ve rented a whole life as well. with Mrs. Firebug, so I’m definitely, definitely agreeing with you there. I just think some got to be some value summaries of the properties fundamentally rise in values. I don’t think it’s just cause I think a lot of it’s to do with the low interest rates, of course, but there’s got to be some sort of value placed on these properties. I would imagine and the price obviously doesn’t reflect that completely

Peter Thornhill: And there’s a whole lot of properties in Sydney and I’m sure in other capital cities in Australia that aren’t even occupied, they are bought by overseas. If I can use the word investors who are simply trying to hide their money somewhere else. You’re probably reading all the stories of the first time homebuyers who can’t compete with the investors in Australia. Investors like inverted commas there as well, who are betting against first time homebuyers. Have they still got the mortgage tax deduction?

Aussie Firebug: I dont know.

Peter Thornhill: Because when we were there and bought the house in Clapton, you got a tax deduction on the mortgage interest. Oh, yeah. It’s the other way round. First time homebuyers get crapped on, but everybody who wants to speculate in property gets a tax break. That is absolutely obscene. So, you know, a kid behind the eight ball as a potential property owner in Australia.

Aussie Firebug: Yeah, It’s interesting one. We could talk, we could have a whole podcast on it, I’m sure, about if we could. The struggles of the first time buyers and everything. But we’ve paid up. We’re just about time to wrap up this podcast. Before I let you go, what’s the one piece of advice you would give to someone young that’s just starting investing? And also to someone who is already retired or is close to retirement in this environment?

Peter Thornhill: Self isolate, number one. And number two, just get on with investing whatever you possibly can. In good quality, diversified, and I prefer the LICS, simply for the diversification. Because I don’t want young people wasting their time. I don’t want potential retirees wasting their time. The more important things in life are your family, your career, your future…..money is your slave. Don’t become the slave of your money and just get on with the process of investing. Unfortunately, it’s very boring and it takes time. But just be confident that if you can simply compound money at 10 percent a year, you will have a reasonably secure financial future.

Aussie Firebug: Right. And what about the people that are already retired or close to retirement? Is the same advice? Or do they need to look at this a little bit differently?

Peter Thornhill: Well, the tough part is they don’t have much choice because how much are you getting on your term deposit today? You should see the audience when I remind them of the interest rates that were available in the early 90s. 13, 14, 15 percent credit. Anyone who buys an annuity today needs their head examined. But, you know. So you have this these issues. There’s all this money swilling around. But ultimately, you don’t have any choice. That’s the hard part is getting over the one big problem with the stock market. It’s publicly available. It’s in your face every day. And they’re going to do every damn thing they can to get up your nose. The news this evening at about five o’clock, they were talking about this, this massive interest rate cut today of point to two five percent. We’ve watched interest rates go from 14, 15 percent all the way down, death by a thousand cuts.This is just complete and utter waste of time. Difficult times. But this tests the mettle of the individual. Are you ready for tough times? My parents. My grandparents. Damn it. I remember there was no money. You tighten your belt if dividends Okay. Let’s say our income drops from whatever it is now by 10 or 20 percent. Okay. What will we do? Okay. We’ll only travel abroad three times a year instead of four. Sorry, that’s being facetious, but you cut the cloth accordingly.

Aussie Firebug: Yeah, that’s that’s timeless advice. I feel as well in tough times you you tighten the belt, you find ways to spend less. You do the things necessary or you do the things that you need to do to get by. Because really, I look at you out lifestyle and our situation. Obviously, everyone’s different, but there is so many things that we can cut. It’s absolutely crazy to hear some of these people, especially from a first world country, that maybe is the first time they got to go through a tough time and they’re acting like it’s the end of the world. But unless and I want to downplay the pandemic and the seriousness of this virus. But to to say that you can’t cut costs we’re talking about in this day and age, I think is very few people that truly living week to week who probably couldn’t carry out a whole bunch of crap out of their spending.

Peter Thornhill: Matt, it’s all bollocks. Try cooking your own food. Try doing your own bloody laundry. And yet here a thousand and one things you could do. You don’t need a new car just because you got pissed off at the last bill for fifteen hundred dollars for a car service does not qualify you to go out and spend thirty thousand to buy another car. Just suck it up and.

Aussie Firebug: On that note, we will wrap it up, Peter. Thank you so much for coming on and being the voice of reason during this scary time in the markets and for a lot of us Like I said, a lot of millennial investors, this is the first bear market we’ve really gone through. So thanks a lot for sharing your wisdom, sharing your experience and coming on the podcast.

Peter Thornhill: Matt, my pleasure. And for heaven’s sake, have courage, everybody. It’s all going to come to an end and we will look back and it will be part of history. And you and a lot of other young people, when you are 60 and 70, you’ll be able to talk to younger people and say, I remember when just like me.

Aussie Firebug: That’s that’s excellent. Thanks a lot

The best podcast ever in existence! Love Peter Thornhill! Thank you Aussie Firebug 🙂

Thanks Phillip 🙂

BIG thanks to you both for giving us your valuable time.

Standing to the side and watching the herd stampede is exactly how it feels right now!

🦏🦏🦏🦏

Thanks for putting this together AFB. Peter seems like a really great guy, down to earth and he’s certainly done well with his strategy over the years. I was a bit concerned that there was really no discussion about the myriad factors that are going on in world economies right now – I don’t remember anyone discussing or any of the following topics come up

– Both demand and supply shock occurring simultaneously

– OIl War

– Looming credit crunch and corporate solvency issues

– Widespread downgrading of corporate bonds

– Unprecedented sustained high level of VIX

– Unprecedented govt stimulus spending

– Consensus that monetary policy is not working and will not work to solve the COVID-19 issue

– Underwhelming govt response to COVID-19 mitigation/containment

– Geopolitical power shifts

I think people that follow your blog might feel less ‘fear and confusion’ if these types of things were discussed. I for one am not convinced that we should just let all of the above just wash over us and repeat tired cliches..

Cheers

Luke

Hi Luke,

You should get onto the FB group mate so you could have asked your questions!

The overwhelming theme of this podcast… and most of the well-respected FIRE figures out there seems to be that everything you’ve mentioned is irrelevant in the long run in the context of investing.

Both Peter and I share the same opinion that unless you think the world is going to end… We should continue investing no matter what the markets are doing.

That’s not to dismiss the above events, it’s just that history has shown again and again that the market bounces back… ALWAYS!

So why would we stress ourselves trying to understand all that noise? The real things we should be concerned about is trying to stay healthy and washing our hands etc. etc. These have dire consequences if not handled properly. But that’s divulging away from what the pod and this site is about. And that’s reaching financial independence.

And in the context of FIRE, everyone needs to calm their farm and carrying on like normal.

Actually that was my question on FB that you asked – the follow up questions are also on FB underneath it.

I do not think that the world will end. However, to ignore all of the points above – is – well – I have no words..

Good luck.

Oh, that was you mate!

Nice questions and thanks for contributing.

I get where you’re coming from but let me ask you a question.

Do you think any of the points you’ve raised above will help you predict where the market moves?

If your answer is yes, then by all means, invest with confidence and I wish you all the best in trying to predict the movements.

But if you’re like me and many others in this community that think that it’s absolutely, 100%, categorically, unquestionably impossible to time the market, then I don’t see how any of your points matter.

It’s a fundamental difference.

If you think you can predict movements (in the short or long term), all the points you’ve raised will be of great discussion. Otherwise, carry on like business as usual.

Cheers dude

Thanks for the reply AFB! I dont think I can predict specific movements – but to my thinking its clear that the market is going to trend down over time for awhile yet. In my mind there are just too many shocks occurring simultaneously for me to ignore.

In any case – I appreciate your work – cheers

Yeah, I think Peter’s advice to isolate yourself is a bit dangerous – in this fast moving world you need to stay alert. I got iu of the market a few weeks ago when I read that shipping had ground to a halt due to what was happening in China. This seemed to me to be a very ominous sign.

In the contrary his advice of self isolating was spot on. He’s a wise individual.

So, you’re really going to avoid listening to the news and just keep buying, eh? Good luck with that strategy. Market down another 8% so far today… sorry, I guess you don’t want to know!

I knew it was down 8% this morning, still not buying though. Everybody has an opinion though and you and I are both welcome to ours.

When you know when the market is at its bottom and it’s time to buy back in, let me know. Thanks

Not yet!

Up 2% today. Is it time 🤷♂️

Yeah, might be! That $4t stimulus plan from Trump and the Fed could be what it’s been looking for:

https://www.google.com/amp/s/www.marketwatch.com/amp/story/guid/A168114A-6D23-11EA-8762-407E1360EFBA

Ray dalio is suggesting this could be a worse than the great depression. So, who should I listen too? I’m confused. Chris I need a definitive answer. Yes or No, not maybe. I thought you knew when to time the market?

Haha, wish I could Fergy! But I do think this is a bear trap and I am still out.

Seeing how low the aussie dollar is, what do you think of investing in VGS? would it be better to invest in Vgad as it is hedged or invest in VAS and wait for Aud to go up?

I’m not a huge fan of hedging. There’s usually a cost associated with it and in the long run it doesn’t really make a difference.

I have absolutely no idea about the AUD either. It’s a guessing game tbh. It could go up, it could go down.

No one really knows I’m sorry 🤷♂️

Thanks for the Podcast to you both. It’s not hard to get an understanding of how the market reacts to events. Just walk down to the supermarket and witness the irrational behaviour of the public.

I would be interested to hear peters views on investing in Super strategically. For a lot of people who may be in their late 30’s and 40’s and still don’t have much excess cash flow to invest in LIC’s as an individual and therefore it may be more beneficial to invest in Super to take advantage of the tax benefits. (15% tax for first $25k invested etc), which for most people is much more beneficial than paying 30% plus tax on earnings and then investing whatever is left over. And then a tax free pension during withdrawal phase compared to paying tax on any individual income outside of super until death.

So if 10% is already going into super and then you add an extra 10% per annum voluntarily this could put you in a better net income position in 15plus years. There would be a greater compounding effect due to larger capital and tax breaks. Obviously someone younger with less expenses etc and more time would most definitely be better off investing outside of super as an individual. But for a lot of middle aged people with young families there is only a small amount of money left over each year to invest and therefore in 15 years they probably won’t have a very large portfolio utilise.

So would it be better In this instance to simply set up a SMSF lite within super (no auditing responsibilities) and then invest in LIC’s within super and follow the income investment style this way. Then in 15-20 years an individual would have a larger portfolio and tax free income etc.

Would love to hear some thoughts about this as to wether you think this would be a better strategy or simply just keep super at your employer contribution rate and invest any surplus income into LICs outside of super as an individual.

Thanks for your time guys.

John

Peter is coming here to respond to comments so I’m sure this one will be answered mate 🙂

Would love to hear the answer to this too!

+1

I know with HostPlus and their SMSF Lite option – Choice Plus – the portfolio fee is $180 per year in addition to the standard admin fee of $78 per year

Then there is the brokerage fees of

$19.95 per trade of 0-$10000

$29.95 per trade of $10000.01-$27500 and

00.11 x trade value per trade of $27500.01 to a max $250,000

Then you also add on the management fees of the individual LIC/ETFs themselves

Not sure if the brokerage fees are charged for each Dividend reinvested in the Dividend Reinvestment Plans within choice plus for each LIC /ETF

Super is fine Fergy but inflexible.

One needs assets outside super for a variety of reasons. I have always had both. We used the recycling of our non super dividends to help us demolish our mortgages but, more importantly, to help cover unexpected problems. Having witnessed, infrequently thankfully, the devastating effect of a family disaster I have always been comfortable with the security of the non-super portfolio. Without trying to be too dramatic, if a member of our family had a life threatening illness and to save their life we had to have them in Switzerland within a week, I sell shares, T+2 mean the money is in the bank in 2 days and 48 hours later we are in Switzerland.

Longer term, as we age, the government mandated minimum pension withdrawal increases. At present it is roughly equivalent to the current yield (5%) on our shares so the capital remains untouched. When we reach the point where the withdrawals exceed that income we are forced to sell. As we are comfortably living on the existing growing dividend stream we clearly don’t need the extra so, in future, having withdrawn the excess from the sale we will then repurchase the shares in or own names. If we live long enough, all the assets in the super fund will eventually end up in our individual names.

My Mum died recently at 97 and my wife’s mother died at 95. I can tell, if you grow old and are unwell and spent the money you will wish you were dead.

As we are custodians of these assets for philanthropic reasons, it is our responsibility to maintain the integrity of the capital.

Thank you for this. I am retired, mostly in cash at present, been in cash for almost 2 years now, against the advice of almost everyone I know – I felt the market was overpriced but didn’t expect these opportunities (read COVID-19 crisis) to arise! Whilst I’m sad about the pandemic, I’m feeling far more confident in my choice to buy LIC’s after listening to Mr Thornhill. Maybe one or two big companies, but largely LIC’s. Thank you again. Mardi

Why LICs – I would not base your investment decisions off of one persons viewpoint – especially considering that LICs have huge flaws – Peter has done well – but times have changed

https://passiveinvestingaustralia.com/

It won’t be 100% LIC’s. Peter Thornhill is right, history tells us (usually) what the future will be. Why LIC’s? Because I, like Thornhill, don’t want to spend my life watching the market. There are far smarter people than myself out there. I have done well with individual stock picks, bought low, sold high etc but to my mind, it’s like sitting in a casino. I’m not a gambler and frankly, if interest rates hadn’t plummeted 9 years ago when I first started an smsf, I’d be in fixed interest mostly.

“”””

Why LIC’s? Because I, like Thornhill, don’t want to spend my life watching the market. There are far smarter people than myself out there.

“”””

There are indeed far smarter people out there than the average investor, but good luck finding them.

SPIVA reports have been around long enough to convincingly debunk the idea that active managers can out perform the index. Over a sufficiently long period of data tracking, over 80% of active managers fail to even match the index.

Take a look at all of the grandfather LICs and how they’ve done over the past decade relative to the index.

But yea, clearly LIC’s can outperform the market, and let’s believe that LICs are something special “cuz Peter Thornhill said so”.

Luke, please tell me what has changed. I invest in a LIC that was first listed in 1891. In 130 odd years do you know how many staff changes they have had? In the meantime, my last annual report informs me that the dividend for 2019 is the 53rd year of consecutive dividend increases. What have they dealt with over the last 130 years huh? World Wars, depressions umpteen pandemics but enough all ready. I am only interested in an investment company that has a very clear philosophy that has been followed religiously for decades; come hell or high water. However, if you can enlighten me I will pass it on to them.

There’s nothing inherently wrong with LICs, but they’re nothing special either.

Active management has been well and truly debunked. As much as the idea that actively selecting stocks to outperform the market sounds appealing, the reality is that only a tiny selection of professionals can do it, and over a sufficiently long period of data tracking it’s less than 20%. Take a look at all of the grandfather LIC’s over the past 3, 5, and 10 years relative to doing nothing besides holding the index for example.

This fallacy of being able to select companies who will do well also includes the fallacy of the ability to find companies that will continue to increase dividends into the future. You look backwards and use companies that have in the past intended to – and succeeded – to grow their dividends, but if you were to look forward this data is meaningless because looking forward you can not exclude those companies that intend to but then fail to do so.

Besides the active management fallacy, there are a range of other reasons that you put forward that are also easily debunked.

The idea that because LIC’s smooth dividends that they can be relied upon. LIC’s hold cash for their smoothing – there’s nothing magical about it. In fact this is a downside. A young person shouldn’t want any money in cash, it’s a drag on returns and any cash they need they can get from their future decades of employment income. In fact if they lose their job, they can’t even access the cash held in their LIC. A retiree should want more than what the LIC holds because if there is an extended bear market the LIC could easily run out of cash leaving those who listened to you and thought the income was reliable depleting more of their assets than if they had their own buffer of safe assets that suited their stage of life.

And this doesn’t even get to the fact that you simply make up stories that aren’t based on any fact whatsoever. You put forward the idea that REITs are no good because it has no “human endeavour”. I mean you just pulled this out of your ass. The data shows that REITs more than hold their own over the long term. You make it sound that since REITs are legally required to pay out 90% of their income as dividends to mean the value cannot grow, and leave out the fact that REITs still grow due to leverage just like many industrial companies use leverage. Whether there is any “human endeavour” is completely meaningless, not to mention completely made up.

Then there is the idea that mining provides poor returns. Your famous graph that you show repeatedly just happens to begin at the peak of a massive boom, so obviously going forward from that point it will appear to underperform as it reverts to it’s long running mean. You can see this is false with longer data from the RBA on page 12.

https://www.rba.gov.au/publications/rdp/2019/2019-04.html

I don’t consider the grandfather LIC’s to be particularly bad investments, but there’s nothing special about them either. The real problem is not with LIC’s at all, but rather with the misinformation you put forward about them, and this misinformation is spread throughout new investors who don’t have the knowledge to figure out if it is fact or not.

I am interested to hear a response on this.

Good points

Are in you favour of an index fund such as VAS? I mean, what else could we invest in for stable dividend income other than an LIC?

There’s no such thing as stable dividend income. An LIC smoothes dividends by saving a portion in cash at all times, earning nothing. Once their cash runs out it will be selling shares to make up the difference just as you would have, and the amount of cash they retain has nothing to do with your specific needs.

Investing is not that hard. It doesn’t need to ever be more complex than using 3 funds.

1. Australian index fund

2. Global index fund

3. Bond fund

Those who have spent over 3 long years trying to find some magical secret sauce and have never found one should stop trying to find one. Year by year you’re whittling away your money as you remain out of the market messing around trying to find some magical investment that has a high return and low risk. It does not exist. Decide on your risk tolerance by way of a stock to bond allocation, and invest in the Vanguard diversified fund that is the closest match to that allocation as soon as possible, and never look at your portfolio ever again.

I’m glad you said that because that is more or less in line with my plan except

>>1. Australian index fund

>>2. Global index fund

>>3. Bond fund

I was going to do

1. VDHG (which covers your points 1,2,3

2. Aussie LIC – AFI or ARG

3. A US strong pick IOO, QLTY or NDQ

Or, I would substitute #3 for a second LIC. I can’t decide.

There is no reply button on your post, so replying here

“”””

I was going to do

1. VDHG (which covers your points 1,2,3

2. Aussie LIC – AFI or ARG

3. A US strong pick IOO, QLTY or NDQ

Or, I would substitute #3 for a second LIC. I can’t decide.

“”””

Vanguard’s diversified funds already contains 7 funds.

It already has more than enough Australian equities, so the LIC’s is superfluous.

It already contains what is in the other funds too so again it offers nothing.

Stop screwing around, and an all-in-one diversified fund and leave it alone.

How many dozens of people have to tell you to stop screwing around before you get it?

How many years of earnings do you need to lose by sitting out of the market before you get it?

Why do I feel I know you 🙂

Company risk.

I know that VDHG is all I need but I’m not comfortable putting 100% of money into the one company.

In the meantime I am investing now that its a good time. Into VDHG, I’m about 35% in now.

—

Why do people buy AFI and also ARG? They are very similar. Why not just 100% in one?

130 years of miss information? Now who’s not looking at the research, as a matter of fact the ones in the uk are even older and the returns over the longterm would be larger then an etf over the same timeframe because of the retained cash for reinvestment. I own 4 LICs and 1 etf, As more people mindlessly flood into etfs I’m worried about the massive inefficient zombie companies bubble that comes with that, also as etfs become the new norm, it should become easier for actively run LICs to out perform. I was extremely surprised when I was a subscriber to the barefoot blueprint to find out that out of the 2000 or so business on the asx, only 200 or 300 were profitable, makes sense to choose from only these stocks. The trust structure is also I worry for me as the 70 page document Peter linked showed. I don’t disagree that evidence is there to prove passive is better then active, but there has never been so much passive management of wealth either which in its self creates a new type of bubble. Resources and property are good investments but because there so capital intensive it diminishes the overall return. Which is prob what peter is getting at. This being said I will prob buy a reit for the long haul, might be a good long term hedge against the removal of franking credits. Like most of your comments , but I don’t think peters real life returns vs your on paper academic ones means that peters advice is misinformation.

But if not an LIC what else is there. The only thing left is an Index fund right?

What are the flaws pray tell?

No worries Mardi.

I’m glad you enjoyed it 🙂