Wooooooweeeee what a month!

Hard to know where to even begin. A lot to get through.

Let’s start with what most of you guys out there will probably be interested in, and that’s the insane crash that happened in March.

Or more appropriately summed up in this pic.

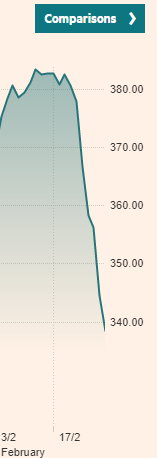

Here’s where we were at in the last net worth update.

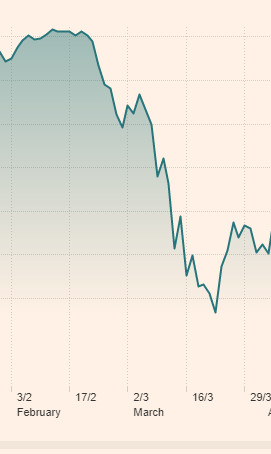

And this is what it looks like now

Mumma mia!

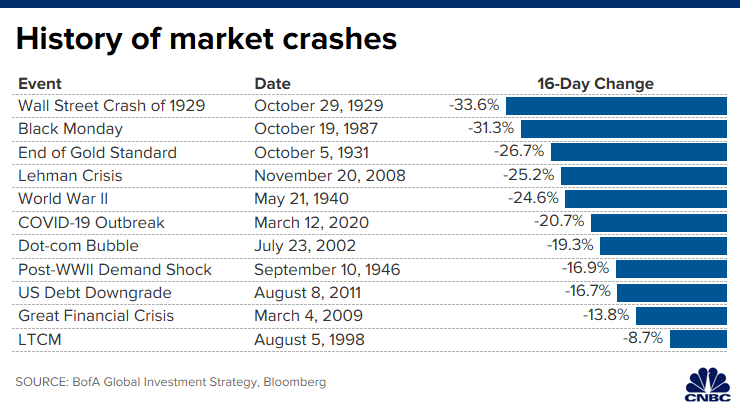

The COVID-19 crash has officially become one of the worst in history.

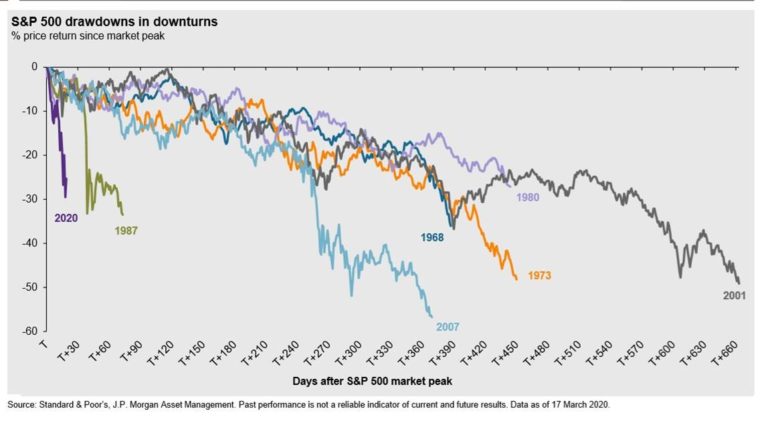

This line chart gives a better historic point of view

So make no mistake, we’re well and truly in bear country now.

But the thing is, from our investment strategy point of view, nothing has changed from the last update. We bought more stocks in March just like we do every single month and will continue to do throughout our lifetime. The reason I even bring up the above graphs and data is because it’s sort of hard to talk about our biggest net worth drop ever since I’ve been tracking it in 2015 without providing the context of what’s going on in the markets.

I’ve only been investing in the stock market since 2016 and in the grand scheme of things, I’m relatively new to all this stuff, which is why during the panic that swept the FIRE community in March, I reached out to someone who’s been investing throughout many crashes in history (some listed in the above graphs) to draw some wisdom and perspective. That was none other than the Aussie FIRE cult hero himself, Peter Thornhill.

You can have a listen to that podcast here but basically, Peter and I (and most others in FIRE community for that matter) share the same point of view that it’s not wise to try and predict market movements, we should stand to the side of the stampede of panic sellers trying to exit and stick to the plan.

I still think Peter’s unwavering hatred of property is a little bit extreme 😂 plus I like both ETFs and LICs but other than that, the man speaks with conviction that’s backed up by decades of experience and proven results. Hard to argue against that!

If you’re worried about this crash from an investing point of view, go listen to that pod.

It was fun to hear that Peter was also a resident of Clapham during his time in London. And yes, in typical Australian fashion, Mrs FB and I both live in Melbourne 2.0 aka Clapham in the South of London.

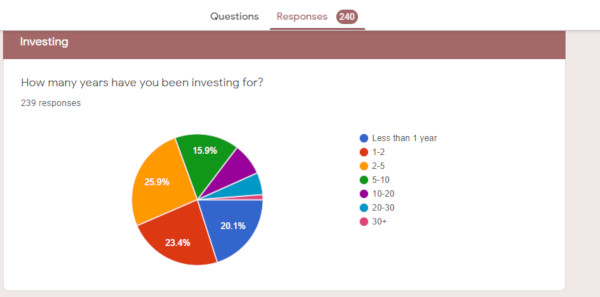

A big reason that I reached out to Peter to put together that podcast (in record time too I might add) was because I felt like so many people in the Australian FIRE community have never invested through a crash (myself included). So after that podcast was published I decided to start a mini-project that has been on the shelf for ~2 years now. And that’s to conduct an annual Australia FIRE survey each year just like how Stack Overflow does for developers because I suspect that the bulk of people who read this blog haven’t invested through a crash. I really enjoy reading the developer survey each year because it helps me find new technologies, what developers earn in which countries, the most popular IDE tools used by most professionals and so on. I’d love to know the most popular ETFs, LICs, side hustle strategies etc. and create a nice visual for analysis.

It’s completely anonymous and I reached out to the Facebook group for what they wanted to know beforehand. I think it will be super interesting to know where people are at and from which demographic. Like, if I’m between 29-35 from Victoria in a relationship. What are people around that same age investing in and what’s their savings rate etc. etc.

The survey has already been up (just within the FB group) for a week and there’s already been over 200 submissions 🤯

From the limited sample size, it would appear that my original suspicions were correct.

I really think the analytics that will come from this dataset will be extremely interesting!

The analysis will only be as good as the underlying data so if you’re keen to help out, please complete the anonymous survey here.

The results will have its own dedicated post and I’m really excited to share it with you all. Already I’m seeing super interesting submissions and trends between the dimensions.

We started off the month in Bansko, Bulgaria for a weekend of snowboarding.

This was before everything went crazy.

This was before everything went crazy.

Our trip went something like this:

- We kept hearing about this Coronavirus thing. Heard it was getting pretty bad and people had cancelled their holidays to Italy

- There was talk of a shutdown but a lot of people thought it would never come to that. Italy hadn’t handled the situation properly but the UK would surely be ok…

- We were 50-50 on actually going to Bulgaria but thought surely things can’t get too bad in a space of 3 days…

- Left on Friday (13th of March) afternoon and whilst we were in the air, Bulgaria declared a national shutdown 🤯

- We land and discover that everything had been ordered to shutdown immediately and the only place we can get food is in the Super markets 😱

- At this point, we weren’t sure if the mountain would stay open but the UK hadn’t declared a lock down yet so we were confident that we could get back home on Monday. Worst case we thought we’d just be stuck in Bansko for a few days and then fly back home

- Thankfully the chairlifts stayed open and we basically had the mountain to ourselves for the weekend

- We flew home on Monday and read on the Bansko Facebook group later that night that they shutdown the mountain the day we left

- Borris gets on the telly the following Monday night and declares the UK is in shutdown

We felt like Indiana Jones running away from impending doom and just getting out in the nick of time.

Bulgaria will be our last travelling pics for a while I think. We had plans to hit up Norway and Sweden in June but the way things are looking, that seems unlikely.

Even if things do go back to be semi-normal, the international travel restrictions will probably get us.

We can’t complain though. Both myself and Mrs. FB are healthy and doing fine which is the main thing. Mrs. FB has lost her job as a teacher but might be getting government assistance at the end of April (we shall wait and see). I’m still in a job… for now. But as a contractor, I’ll be the first to get the ass.

We had a really interesting Zoom call with the CEO the other week where basically it was an open forum where staff could submit questions and the CEO would answer them live. In a nutshell, because the insurance company where I’m working is really new, all their systems are in the cloud and they’re strategically positioned to be able to leapfrog the competition in the coming months as a lot of the archaic insurance companies in London are still running legacy systems where it’s hard to get people working from home.

It’s a really morbid thing to even talk about when there’re people dying but in a similar fashion, if you’ve got a solid job and have been sensible with money. You might be in a position to take advantage of this crash and pick up assets at a discounted price.

I’ve been looking at houses back home since the start of the year and I have no idea how much all this will have on country Victoria real estate prices but the point is that we’re in a position to capitalise on an opportunity if one presents itself. I’ve always believed that you can create your own luck to a certain degree. Luck is when preparation meets opportunity!

And other than that, it’s been a pretty boring month just working at home.

Oh, one last thing I want to mention. Since all the bike shops are shut, I’ve sorta been the local bike repairman on the block changing multiple tyres over the last week or so. And I’m using this as my excuse for the lateness of this update 😜

Net Worth Update

Big(er) OOOOOOOOOF!

Holy moly, another month in the red, this time we’re down a whopping $74K 🤯.

Back to back biggest NW drop in the history of Aussie Firebug.

What can I say really?

The ups and downs are just part of the game. Although this is one mighty down at the moment. There are two silver linings in all this chaos. I’ve already spoken about the first one plenty of times before, and that’s the opportunity to buy discounted shares. But the other one is how we’re handling this historic drop mentally. And I can report that everything’s holding up strong at the minute. Me keeping my job has probably played a huge role in feeling as relaxed as we currently do even though we’ve just lost over $100K on paper during the last two months.

2020 has started the decade off with a bang that’s for sure. Interesting times ahead.

Properties

Maaaaaaaan!

So the original plan before COVID-19 was to sell one of the IPs we still have in Queensland and use that money as a downpayment for our family home we want to purchase next year. And I just seriously started the process of getting one IP onto the market to sell. But now it looks like that plans out the window. I mean, so many people have lost their jobs and I just can’t see many people even being able to get out and see homes at the moment let alone be approved for loans to purchase in these conditions.

So it looks like the selling of our IPs has once again been put on the back burner 😞 and we’ll just have to save up the deposit between now and the end of the year.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

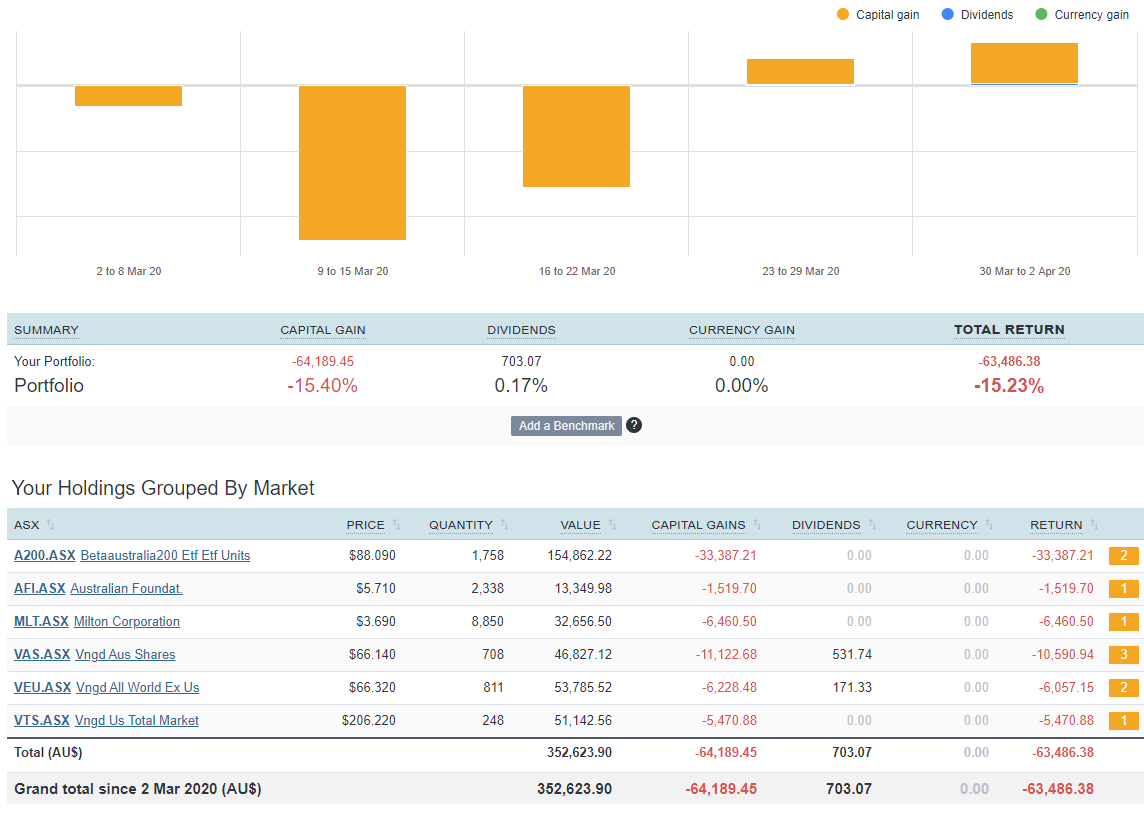

ETFs/LICs

The above graph is created by Sharesight

We continue Strategy 2.5 and purchased $5K worth of A200 during March at a ridiculously discounted price of just $84 per unit. This is the cheapest that A200 has ever traded for since it’s inception in May 2018! The dividends from A200 (or VAS for that matter) will 100% be lower than usual over the next 6-12 months (maybe longer). But I’m not buying these shares for the next year or two. I’m buying these shares with the intention of purchasing the income stream they will generate over the next 40-50 years!

Great to hear you’re handling things well mentally mate, it’s not fun when you see big drops like this but if shares did nothing but go up everyone would do it! It’ll be interesting to see what happens with property prices because so far the market seems to be pretending they haven’t moved at all but surely this will change at some stage.

Hopefully your job stays secure and the Mrs gets a bit of help from the government, if not at least you’re well positioned to be able to ride out the storm.

And man, it sure sounds like you got lucky with the holiday and getting back to London before it all shut down!

Cheers mate.

All I can think of is how different everything would have been if this happened 12 months ago. I just left my job, I had no contracting experience. There’s a very good chance we would have come straight back home with our tail between our legs having seen and done nothing!

So when I think about that, we are just thankful for the great stuff we’ve been able to do so far.

Excellent update, and glad you didn’t get marooned in Bulgaria!

It’s how you react to the ‘big hits’ that count for a lot in terms of working through to better outcomes, so it’s great that you’re in a balanced place. I had a similar experience to you, buying VAS, and needing to recheck the purchase price.

It will be interesting to see how much dividends drop off in June, September quarters and what happens from there. I guess its the price of living through history and having interesting stories to tell!

Glad to hear from you mate. I really appreciate your calm perspective at a time when lots of other people seem to be singing the “poor me” blues.

My own thoughts: my grandparents lived in London at a time when Hitler was dropping bombs on them most nights and they had to send their kids to live with strangers in the country, and there was actual rationing for years after. Across the channel my best friend’s grandparents were ealing with the threat of being rounded up and sent to concentration camps. I need to stay home and take naps during the day – this is nothing.

It’s not that this isn’t scary or stressful, or that our business hasn’t flatlined, but in the great scheme of things I have a roof over my head a reasonable expectation a full stomach and no one dropping bombs on me or shunting me off in a train to work me to death, so I can settle in and wait this out just fine. We have an ample cash reserve and although I’m sorry for our friends in the hospitality industry, I can eat and drink at home. As an added bonus I didn’t have to visit family in S#tsville Oklahoma on a planned business trip to Texas (love the family there; don’t ever need to see Oklahoma again).

So all my best to you and Mrs. FB and thanks for letting us know what’s going on 🙂

Thanks Sianzilla!

So true about the perspective. Staying at home for months on end with all the modern-day luxuries isn’t that bad.

Not a fan of Oklahoma? Can’t say I’ve ever been but I wouldn’t mind going one day.

Hi AFB

Long time reader but first time comment. I was interested in your outlook on the world markets in light of recent events. It great to see it isn’t fazing you too much and your wording is less aggressive then my man crush (Thornhills) approach to it all.

I think the survey is a great idea and am looking forward to seeing the data, thanks for putting a link on here too. Even though I am still in my early thirties I grew out of Facebook many years ago!

Hi AF!

I’m really curious to see through the survey who else makes up our Aussie FIRE community.

My partner FIRE’d back in June last year and I’m still working part time in a job I like.

My job is secure for now and the transition to WFH over the last few weeks has been good for me.

Actually I’m wondering whether I keep this WFH arrangement permanently and finally move out of Melb when things are a little less shut down.

We’re continuing to buy LICs/ETFs, moving more of our cash that’s been sitting in an offset account waiting to purchase our family home. The thinking here is we can save up for this deposit again later in the year.

Wishing you continued good health and many, many thanks for all the hard work you put into this fantastic blog.

No worries Rach 🙂

I’m glad you’re enjoying the content

The Facebook group and page are literally the only things keeping me on the platform. I’ll log off for good one day

Awesome read!! Glad to see you’re keeping it together and perfectly poised for these opportunities.

I see you use Sharesight to track your shares. Do you know of any similar sights or best way to track which are free? Trying to limit expenses 😉

Sounds like you could get a side hustle happening as a bike mechanic and Mrs Firebug should definitely look into online tutoring. That has been going crazy at the moment with overwhelmed homeschooling parents.

Enjoy the ride!

Cheers

Lance

Share sight is free if you have less than a certain number of holdings. I use it to track my shares.

Sharesight is free for under 10 holdings mate 🙂

Haha yeah that’d be a fun side hustle

AFB, you should probably add bonds question(s) to your survey. Enjoy the blog and the podcast. Appreciate the transparency. Cheers

Don’t assume that the losses are over yet. I think we have at least 50% chances of another significant tumble. A one month bear market would be incredibly uncharacteristic.

Ahhhhh FFS I’m dumb 😡. I also missed Super (D’ho)!

This is the first one so it’s not gonna be perfect. I’ll rerun the survey in JAN next year and will fix all the questions I missed… So this one won’t be perfect but will still be better than nothing 😅

Our net worth is down $150k this month and that’s excluding our house which was worth over $2m. I’m sure that’s dropped as well. Ouch

Yeah I did wonder about the houses. I might do some research on them for next month to see if they’ve dropped

Wow, I love your optimism. Glad you scraped in that visit to Bulgaria. The picture looks great. Imagine having a mountain to yourself for a weekend. This virus is impacting most of the world and 2020 has been challenging for many. But the end of 2019 was also bad for many Australians with the drought and horrific bushfires and the air full of dust/smoke. Luckily you missed that.

A few of the old people I talk to, think that the virus reaction is all overdone. They report they have lived through WW2, survived bombings and great hardship. We might have to queue up outside a supermarket (only sometimes) where there is plenty of items (some exceptions may be toilet paper, rice & pasta), but they report waiting in line for limited and small quantities of food. My mother in law was from Germany and some of the stories she is telling me now is incredible. However, this pandemic is probably the most devastating event that the younger folk have had to endure. And the social isolation is likely the lesser of problems, compared to say loss of life and financial hardship.

You will look back over this event in many years to come and report on your interesting time in London from many perspectives (including being the bike repairer). I also look forward to your survey results.

Hi AussieFirebug,

I am new to FIRE and your blog has been a treasure trove of information and inspiration. So a big thank you to you!

I’ve got a query which I hope you’d be kind enough to clarify:

Why do folks who are beginning their FIRE journey purchase LICs compared to ETFs? I understand irrespective whether you buy a LIC/ETF, the aim is to build a sizeable dividend returns to build a steady stream of passive income. And LICs are known for their stable dividend returns, BUT, LICs don’t appear to have much share price growth compared to ETFs.

I am looking to adopt Thornhill’s Debt Recycling method as I have some equity in my PPOR. If in 20-30 year’s time, I want to reduce or pay off the “Debt Recycling portion” of my home loan, and if there hadn’t been much capital growth in the LICs I’ve bought (compared to ETF), I’d have to sell lot more units to pay off the loan.

I dont understand why folks who are building their FIRE foundation are buying LICs, when an ETF would give a similar dividend return *PLUS* capital growth?

Please set my thinking straight. Appreciate the time!

Cheers,

Inba

Hi Inba

As I’m sure you are aware there are many ETF’s and LIC’s. Your statement that LIC’s don’t appear to have as much growth could be deemed reasonable or ridiculous depending on which specific examples/metrics you choose .

However it is a fact that over history (the last decade especially) that index tracking ETF’s have outperformed a large majority of LIC’s.

Some people’s perceptions may be skewed by how much most index tracking ETF’s cost per unit. A small example is from 12APR19 to 21FEB20 (before the crash) A200 rose from $104.56 to $119.7, a healthy capital gain of $15.14 or 14.5% per unit. Meanwhile Whitefield (WHF) only rose $.98, from $4.46 to $5.44. While the dollar amount seems small this is actually a percentage rise of 21.9%, add the fully franked dividends it comfortably blows A200 out of the water (for that period).

I have done what I have previously stated, used a specific example to prove that LIC’s growing slower then ETF’s is ridiculous. It is of note over that same period MLT rose only 11% and ARG bang on with A200 at 14.5%.

I feel LIC’s get a bad name because their yardstick is the market, while Index ETF’s are (essentially) the market. As there are a hundreds of LIC’s it is easy to put them up in the headlines when the fail to beat the one market. However index ETFs can’t under perform themselves and it is extremely unlikely that the index will under perform against the hundreds of fund managers running LIC’s.

In short, quality LIC’s have just as much capital growth as ETF’s, their smooth dividends and fully franked dividends makes them just as attractive to FIRE aspirants weather they are near the beginning or end of their FIRE journey.

Thanks for your reply, David C. I understand what you mean. So selecting a quality LIC is the key. When done correctly, a LIC’s returns (cap growth + fully franked dividends) will outperform an index ETF.

Incidentally, I was just looking Whitefield prior to reading your comment. Peter Thornhill is a fan of WHF too as it’s 100pc industrials.

Cheers,

Inba

That is the general gist of what I was saying yes. Bear in mind just like the market itself, LIC’s have good years and bad years. Even with fully franked dividends taken into account you will not find a LIC that beats the index every year (but if you do let us know which one it is). But this is why most people (myself included) hold at least two LIC’s, just incase one makes some bad investments and it share price and dividends take a dive.

Another aspect that I haven’t touched on is LIC’s priced at a premium or discount to their Net Tangible Assets. I take Thornshills approach and just buy when i’m due, however it is something a lot of FIRE seekers pay strict attention too, (including AFB when he was buying LIC’s). Unlike Thornhill however I can see the point in ETF’s and I personally have mix of the two. AFB’s future survey data may prove me wrong here, but I would say most FIRE seekers also have a mix, what percentage of which is entirely up to the individual.

Please advise how to correctly choose an LIC that can be guaranteed to outperform the index. 😆

Hi Inba,

I’m glad you’re enjoying the blog 🙂

I agree with the above comment. Old school LICs and ETFs are extremely similar and should have very close returns over the long term. Both are suitable products for reaching financial independence in Australia IMO.

Thanks for the update AFB.

Quick question – I remember reading once you have quite a big cash reserve from selling one of your properties. How comes you are not using this to buy more shares during this period rather than the usual monthly purchase?

You’re correct. I did use the extra cash over the last 18 months or so. We’re looking at buying a home next year so our cash reserves are a bit higher than I’d like. Also, with everything that’s going on atm, it feels nice having a big cash buffer

Good to hear Mrs Firebug can get a chop out from the Government, especially since you guys are doing it so tough.

This entitled millennial bullshit has got to stop soon, hopefully COVID does it’s job and changes capitalism for the better.

I’d hardly say we’re doing it tough mate but I appreciate the good wishes. Not sure I follow with the changes to capitalism…?

Love the update! I filled out your questionnaire! We are just starting our investment journey this year and am so excited to start seeing my net worth increasing! We are in the very fortunate position of not having any change to our family income so can continue investing as per our plan!

Nice one. Keep prepared because you might be able to create your own luck in the coming months 🙂

Great to read your latest monthly update and that you are stepping to the side while the herd rushes past. I’ve dusted off my bike and getting my exercise now as the gyms and yoga studios have closed. A couple of questions; the online insurance company you work for isn’t owned by a Perth bloke by any chance? Secondly, the Net Worth chart you provide; is there a link to it somewhere that we blog followers can use and adjust to track our own net worth progress? Keep up the good work!

No worries Smitty,

Nah the dude is from London and has been in the insurance game for 4 decades.

If you enter your email address into the form at the bottom of this page the system will automatically email it to ya mate. Let me know if it doesn’t work though

Australia is doing well combating the virus and if the government makes no more fuck ups (such as the Ruby Princess or letting in 30,000+ Chinese students) we should be on top of it by May, maybe even have restrictions lifted.

If we keep the borders shut our economy can return to normal pretty easy with the exception of a few sectors such as airlines, universities and maybe tourism. No more overseas holidays, no more foreign students, no more foreign tourists, no more foreign workers and no more immigration will be all that is needed to keep the virus out. Goods can be imported and exported. Tourism should rebound with Aussies travelling domestically and not internationally.

If foreign students are really in it for just the degree then they can study online. If foreign students are in it to work than those jobs can be done by unemployed Aussies. In the long term I expect our unemployment rate to be lower than pre-Covid without foreign workers, students and immigrants adding to the supply of workers.

I am also less optimistic that without immigration and foreign buyers the housing market will drop to realistic levels and young Aussie families will be able to afford homes.

I see this as a correction we had to have and a good thing, long term, for the country. Sadly 50 people have died though from talking to a friend in the medical community those people had underlying issues and likely would have died from the seasonal flu or some other illness during 2020.

The only real issue I have with this is I cannot decide whether to buy more shares because I expect them to rebound or keep it in cash to purchase a house when the market bottoms out due to the lack of foreign cash.

Jeez lad, you’re running pretty close to being xenophobic.

What about that was xenophobic?

No more highly educated migrants putting in 35 to 40 percent taxes supporting the aussie economy and an aging population. No more universities charging an international student 4 times it would a local in order to continue to develop and offer better education, no more qualified labour as people who are not bothered with finishing a trade or a uni degree sit and curse migrants when they don’t believe in putting in the hard yards.. and dont understand that the only reason a migrant had to be brought in to do a job was cz a local wasnt bothered to get qualified to do so. It’s a land of equal opportunities mate, dont complain, just work hard, and you will find nothing but your own self was in the way.

Glad to hear that you guys are healthy! I enjoy the Peter Thornhill commentary, I saw him live last year and have adopted some of his techniques, I look forward to the smoothed LIC dividends in the next half, hopefully the DRP will yield plenty.

Thanks for your blog and podcasts, being an ex country boy from Victoria, I can relate to you well. Keep up the good work and stay healthy!

Thanks Greg. I’m glad you like the content mate 🙂

Great to hear you guys are doing well – that Bulgarian story is pretty epic, one for the memories for sure. Assuming your strategy hasn’t changed – just continue to slowly invest and chip away at it?

Yep, still investing each month like usual

Great Post!

I loved looking at your net worth growth over 7 years – hugely impressive.

Self motivating if nothing else.

Also noted with interest you thinking of selling your IP in Queensland – I was lucky years ago to have an IP in Cairns – bought during the Japanese recession (coincided with 911) and sold 5 years later and doubled our money. Queenslnd is extremely volatile. We are now priced out of the Cairns Market – but this might be a time to get back in (i sound like a vulture)

Im also keen to listen to the podcast episode with Perthe Thornhill – lots of good stuff for newbies lik me (ive lved through a ton of recessions, im 53, but never actively invested).

Im hoping that this also gives me some good insights in to ETF v Index Funds. If not, where can I be looking for good material on this?

Shaun

PS – glad you got off the snow and back home in time. Sorry to hear about your wifes teaching job,. My nephew is also working in London, In insurance, in a new startup. Busy times.

Thanks for the kind words Shaun.

What company is he in lol? I work for a start-up insurance company in London 🤔

G’day mate, I just spent the last two hours reading through your articles and wow I am blown away. I only started investing last October and own a few individual shares such as Zip, BHP, Wesfarmers & NAB. I’m thinking about purchasing VDHG, A200, VTS & VEU, and balancing those out, would that be something you recommend? Or should i just purely focus on VDHG?

Hi Mick,

I don’t recommend anything but it’s my personal opinion that both of those options would be suitable for most Australians trying to reach FIRE. VDHG is the easiest and most idiot-proof.

They say the markets are forward looking . Looking across the valley a year in advance …. maybe that’s true . But I think I will bank on debt free and all money in cash ….. just in case .

Read once that your plan should have an 80 to 90 % chance of success . Because no one can predict 100% success …j I am going to do my best to protect myself from that final 10% for the rest of the year ..

Quite the drop! But at least it will help boost next months numbers making it look like some nice gains. Keep up the great work.

Cheers BHL

New to FIRE and trying to set my household up. Thank you for sharing your story here it’s really helpful.

One question: Are you renting or have a home mortgage? I’m wondering when I calculate net worth do I include my house? My mortgage repayment is the biggest expense that I will have to cover each month, and majority of my net asset is in the house….

Hi Shroom,

We rent and wouldn’t include our PPOR’s equity if we had one.

But it doesn’t REALLY matter, because at the end of the day it’s just a number. The important part is to track how much you spend and try to replicate that number with passive income… Having a paid-off house will drastically reduce you’re spending because you won’t be paying rent or a mortgage.

Hey AFB, I’m glad to hear you guys aren’t stranded. that sounds incredibly stressful. My work has taken a step back too as globally aviation has slowed down, but I am still trying to live below my means and invest as much as possible. I’ve seen a decent hit on the portfolio too, but like you I am not too worried about capital values – its really the income producing ability of the portfolio that I care about. Whilst that did take a hit with the March/April reduced dividends, it wasn’t as bad as the capital value decline, and both will improve after we move on with this rough patch. There is not really any alternatives anyway. Doubling down! Enjoying some more free time to catch up on re reading this blog, as well as mr money mustache. Cheers

Good point Cap!

The free time that’s come out of Covid-19 has been a breath of fresh air really

Hi AFB,

Big fan of the blog. Just couple of questions, hopefully I’m not repeating others above.

In your 2.5 investment strategy you increased your international weighting but still heavily favoured Australian shares (circa 60%), looking forward do you think you are going to increase your international weighting further or double down while the market is depressed?

Are you planning on keeping property as part of a diversified portfolio long term (albeit part of the Australian market) or have you found it more hassle than it’s worth?

With the slowing down of the economy there are going to be lots of opportunity’s in both property and the share market, sadly most people are unlikely to have the capital to do both.

Thanks again!

Hi Randomer,

I’m glad you’re enjoying the blog mate 🙂

1. We’re happy with 70% Oz, 15% US, 15% World Ex US for the time being. This might change in the future. I don’t think about it too much if I’m being honest.

2. No, we’re not. Eventually, we will sell both properties and be 100% in shares though ETFs and LICs.

Cheers

Which platform do you use for buying EFTs, LICs

Curious as to the cash holdings/ defensive assets you hold or have held and how you plan to utilize them at the moment

Yes, I was going to ask the same question.

Hi Welease,

We have way more cash than we usually would atm. We are keeping cash reserve on the higher side for two reasons.

1. We plan to buy a home next year and will need a down payment of around $80K-$100K

2. The uncertainty in today’s climate for us means we feel a bit more comfortable increasing our emergency fund for the time being. We usually only would have around $30K sitting in an offset

G’day AFB.

Have you considered learning how to trade to see how the other side does it, even if you don’t think it’s a valid side hustle? Some techniques like risk management, or being able to hedge portfolios to minimise drawdowns can be complimentary.

If do you find it to be a valid side hustle, I think the engineer in you will find that it’s not different to being a casino and letting the probabilities play out in your favour over a large number of trades.

Interesting point of view. I’m looking into trading and wanting to explore day trade too. Any recommendations as to how to start?

I put the response in the wrong thread, below (woops).

Interesting Bob. TBH I just don’t have that much of an interest in trading really. There are other side hustles that I find a lot more fun to do. That may change one day though…

Shroom, you should understand some basic technical analysis: market structure, support & resistance, Fibonacci, convergence/divergence. Avoid techniques that have subjectivity: eg sloping trend lines. Remember that all indicators are lagging and that price action is most important.

Then you need to develop a trading strategy from these basic techniques, the edge you have over the market. You may use another person’s edge, but you have to understand how these techniques comes together to create a confluence. You should test your edge over a number of trades (maybe paper) to prove it’s winning probability. Then create rules for the edge: entry and exit conditions. Use stop loss and take profit orders to achieve this.

Use risk to reward to your advantage. Eg, For an even coin, if I bet and win $10 for Head and lose $10 for Tails, over 100 coin tosses, what would be my expected value? Break even right? What if for each Head you won $20 and for each tail you lose $10, would this be a game you’d play? A good place to start is to only risk 1% of your account value for each trade.

Then there is the mindset. It’s important to plan everything before entering a trade, so that you don’t make emotional decisions during the execution. Remember, you don’t lose money taking profit. It’s important act on your edges while being outcome agnostic. Your job is be disciplined and place good trades as defined by your edge.

Personally, I trade crypto. Exchanges are open 24/7 meaning price doesn’t gap past your stop loss (ie your risk management) . Secondly, traders love volatility and crypto is most volalite. When markets move, it creates opportunities for traders to make money. Except traders don’t have to stomach all of the ups and down with a buy and hope type investment strategy. They risk their capital when conditions are good and probability of win is higher, as defined by your edge.

Solid post! I hope you had a great time in Bulgaria. I used to go to their beautiful beaches 30 years ago as a kid. Now it looks that there will not be much travel in next few months or so. Probably we will not be allowed out of Queensland at least till September. But here in Sunshine Coast we have great spot to wait it out. If it takes long I will just be catching the waves in Noosa for longer.

I definitely agree with your comment on savings (and I have even written short blog about it). As long as you have some cash stashed away you will always do better than majority. Especially if you loose your job. It is sad to read stories of people who lost their jobs and worrying that in a month they will have no money for rent. Luckily this is what the FIRE movement teaches. Prepare for the time without your job. Unfortunately majority thinks that their job will always be there. But if unemployment hits 10-15 percent, most jobs might be scarce.

So it is good to know that you always can go back to the STASH. And because we have lowered our living standards to be way below our means, it should last long.

Stay safe during the crisis

Mr Whyninetofive

I ♥ the Sunshine coast… Learning to surf is on my hit list too!

Thanks for the comment WHY925 🙂

Hi AFB,

I’m definitely appreciating this website and these posts. I hope this doesn’t come across as negative, however for my own understanding of your circumstance versus mine, I noticed from Jan 2015 to Dec 2015 your net worth rose 79k. Would you be able break that number down as to what was money saved from salary versus capital growth on the investment properties etc versus what was Super etc?

Kind Regards,

Jake

Hi Jake,

I wasn’t tracking my net worth religiously back then so the numbers are going to be a bit fuzzy but the majority of that rise from the notes I do have come from the increase in the value of my 3 properties I had.

Melbourne was booming which is where the most gains came from.

Adding to that, I can’t say for sure but I’m pretty confident that my savings rate was insanely high (> 80%) back then too because I was living at home and was obsessed with reaching FIRE ASAP which meant I didn’t spend money on anything other than completely necessary (I wouldn’t recommend this approach lol).

We didn’t have shares back then and my Super would have been bugger all so it was basically properties and savings that year.

Hope that answers your question 👍

Hi AFB,

I have not read all your posts about buying EFTs, LICs etc so perhaps you’ve already answered my question but can you tell me what platform you use buy your ‘share’ investments?

At the moment I use CMC which I find very easy but Vanguard is developing a platform which is focussed on buying their products and I’m thinking (due to the no brokerage fee) that I might set up an account with them AS WELL!

Thanks

Pet

I’m with a company called Pearler Pet.

Cheers