First up, big shoutout to CaptianFI who invited me on his podcast. I had a blast chatting and would highly recommend his content. You can check him out 👇

In case you haven’t noticed lately (which would be hard to do since these net worth posts have turned into a travel blog 😅), we’ve kinda been travelling around a fair bit as part of our YOLO adventure which started in January 2019 and will finish in January 2021 (our two-year working visa will expire).

It’s been exactly 1 year since we departed and I thought it’s time to do a little summary of what the last 12 months have looked like. This is more for my own personal reflection than it is relevant for this update but it might be interesting for some you following us along in our FIRE journey 😊. I also had a revelation whilst thinking back on it all that I want to talk about below.

The rough timeline of events have been something like this:

- JAN-MAR

- Left Australia to live out a dream of working in the UK and exploring Europe

- Took our time travelling through SE Asia and eventually made it to Dubai in March where we spent some time and made the final flight to our new home, London

- MAR-JUL

- It took us three weeks to land in London, find a place and set up shop. Mrs. FB already had a job lined up before she left but my work was a lot more unknown. I’d never done contracting before but had heard it paid well and had just enough experience (with a little bit of exaggeration of course 😉) to start applying for roles

- I eventually landed one towards the end of March and was in my first gig at the start of April

- I ended up working one more contract which lasted until the end of July

- Mrs. FB was working the entire time but had 3 weeks off for school holidays before the big summer break which of course is in July-September for the UK

- Presented to me like an apple from the garden of Eden, 2 weeks before the end of my contract I was asked to extend. But this trip was not about making money. We were here to see as much shit as possible!

- We sublet our room, packed up a whole bunch of stuff and went exploring!

- JUL-SEP

- Travelled around parts of England, Spain, Egypt, Jordan, Croatia, Italy, Austria, Germany and The Netherlands

- Got engaged with both sets of parents there. An incredible moment in our lives and one we’ll never forget

- Meet up with friends throughout our travels and made some life long memories

- Got back to London at the very end of September absolutely wrecked! I had lost weight, was out of shape, needed to sleep for days and was so looking forward to some home-cooked meals and rest.

- SEP-DEC

- Mrs. FB went back to work after two weeks. Teaching is seriously underrated I feel and is one of the best professionals for the travel lifestyle here in the UK. You can literally pick and choose your days and the demand for them is through the roof. My contracts, on the other hand, are a lot harder to apply for, land the interview, start working and get time off when you need (you basically can’t)

- I accidentally feel into a mini-retirement as I was just so buggered from all the travelling we had done and just wanted to take some time off from the go-go lifestyle we were living. We’d been working so hard for months before we even left Australia (to get everything sorted) and I felt like I hadn’t had a moment to breathe in a long time

- Feeling like a new man after my mini-retirement, I got stuck into the job boards at one of the worst times of the year (just before Christmas) but managed to land another contract for 6 months

- Having the financial strength behind us, I, almost arrogantly, asked for 3 weeks time off over the Christmas break and thought that even if they don’t hire me for this job, we would be absolutely fine money-wise which was extremely comforting. They ended up saying yes (somehow) to my break and I ended up working a few weeks before Christmas

- We headed over to Canada for Christmas to see my extended family in Toronto and also made it to Quebec for a bit of snowboarding 🏂

- We ended our lease because our landlord was being a dickhead (long story don’t even ask) so we didn’t have to sublet for this trip

- DEC-JAN

- We left Canada and headed over to America (pictures below) to see my favourite basketball player Ben Simmons and to visit NYC

- Rocked up back in London mid-January and had to move into our new place asap (we found a new place before we left)

- Had a crazy 3 weeks of getting our new place all set up, going to France the following weekend we got back (it was pre-booked) plus busting my ass at this new contract to get myself up to speed with everything. It was crazy and a major reason why I haven’t been as active on AFB

- Finally settled into a nice groove and feel like the routine is back on track

Wowee! It’s crazy how much we’ve done over the last 12 months and I’m buggered just typing all that stuff out lol 😴

So if I roughly tally up all the months I worked, it equals out to only be around 5 months 🤯, Mrs. FB worked closer to 7 🤭.

So what’s the revelation I talked about earlier?

Sometimes the grass isn’t always greener on the other side.

Have you ever just sat there and daydreamt of how good your life will be once you hit financial independence?

Back in the day, this was something I did regularly! I would often drift off in thought (usually whilst I was at work actually) and think about how epic it would be to just travel around all the time and see and do as many things as possible.

But now that we’re in that position and living out this dream I can tell you right now, imagination can sometimes be a lot different to reality!

We discovered over the last 12 months that our sweet spot for travelling is around 5-6 weeks. Anything past that time period, our enjoyment of experiences starts to decline. Meals don’t taste as good, the wine is less sweet, paying €17 for a shitty pizza that wouldn’t fill up a toddler suddenly starts to piss me off.

Don’t get me wrong. The year has been incredible and I wouldn’t change it for the world. But I do wonder how many people out there have dreams and aspirations for something that might not actually turn out to be as enjoyable as they once had imagined.

We’ve only got this year left to see as much stuff as possible before we head back to Australia and enter the next chapter of our lives… marriage and kids!

We’re back into the swing of things now and I’ve been doing pretty well at work which is such a great feeling. There’s honestly nothing better for me to be apart of a team working on a fun problem and actually contributing to the solution. In fact, much like working out, sometimes you need to go through a painful and uncomfortable experience to receive the best and happiest of outcomes.

No one enjoys the act of lifting heavy weights. You get the joy from the results of lifting heavy weights or running a marathon or spending weeks developing a solution from scratch. It feels really good to finish a set at the gym and know you’re improving your health and fitness. It feels even better when you start to see results.

I get similar satisfaction from working on projects I’m interested in. Keywords being ‘projects I’m interested in‘. That’s the power of FIRE in retired life. You can still work and make money, but odds are you’re only ever going to be working on stuff you like doing.

Speaking of things I like doing. I ended up buying a bike!

I was really pushed over the edge by the great advice from a reader (thanks Prash!).

It’s probably well overdue actually. I have a bike back home and used to ride everywhere, but I only worked in the city 1 day a week last year and never had to get the dreaded tube. But now that I’m in a contract until June and I’m having to catch the tube three days a week (I get to work from home for the other two), a bike makes sense.

The bike will pay for itself in just over 9 weeks but there are so many more benefits other than just saving money. Cardio exercise is a big one! I do run at the gym but I must admit, without footy training to keep me in check, it’s a lot harder to get off the couch and actually make it down to the gym. Avoiding the tube has to be the greatest benefit. Yes, the weather sucks right now, but I’d rather ride in the rain then have to be on the tube.

Would you believe that it’s actually quicker to ride your bike than it is to catch the tube! It is amplified in my situation because I have to walk 7 minutes to the station and then 7 minutes to my work but still.

And lastly, the TravelBug part of this FIRE journey can be followed along with the pictures below which are all the places we hit up in January.

Getting destroyed by a chess hustler in NYC. He said he was rated around 1800-1900 which is really, really good.

Net Worth Update

Boom!

We passed the $750K mark and are rapidly closing in on $800K.

It still boggles my mind when I look at our net worth graph below. How TF did we managed to accumulate that much? Well, thanks to these net worth posts which are sort of like financial diary entries, we know exactly how we did it but still! They say the first $100K is the hardest and it only gets easier from there, oh how true this is. Almost laughably easy once you past ~$300K in shares I feel. You really start to see it compound around then and it’s just crazy how it all adds up.

The philosophy of building a snowball and letting it compound over the years is such an incredibly powerful concept.

The sharemarket continues to bullishly rage on with all indexes trending north. Our share portfolio along with our Super had an incredible month.

We only worked the last 2 weeks of January because we were in America up until the 16th but I received another contracting paycheck for days built up in December and a bit between the holidays.

We spent last night going over this years travel itinerary and we basically have 2 short (1-2 weeks) trips and 2 big (4-5 weeks) trips left for the next 12 months. I have full time work up until June but after that, I’m not sure what my plans are work-wise. I’m pretty sure they are going to extend my contract but this would mean I miss out on travelling over the summer which isn’t an option. In a perfect world, they would allow me to have 5 weeks off during summer and keep me on until the end of the year but that doesn’t really happen with contracts.

The entire point of contract work is that they get you in for a short amount of time where you work really hard in a specialised area that they don’t have in house and you’re paid accordingly. I feel like I pushed my luck already by asking for 3 weeks off over Christmas 😅 but we’ll see. The power of having a net worth near $800K is that you’re not forced to take more work. My only concern would be going through the whole process of finding another contract to last me until the end of the year. I’m all set up in this one and have built my routine already. It would suck to have to start over again.

Properties

I’ve started to get off my ass and actually look into selling at least one of these bad boys for the end of the year. I’ve engaged with a few real estate agents so I’m keen to update you all on the progress of this in the coming months. I would usually try to sell the properties myself as I did with IP1, but I’m not in the country and I’m really choosing the easy/lazy option here but I just can’t be F’d doing it again myself.

Can anyone recommend an agent in the gold coast area?

Updates on this soon…

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

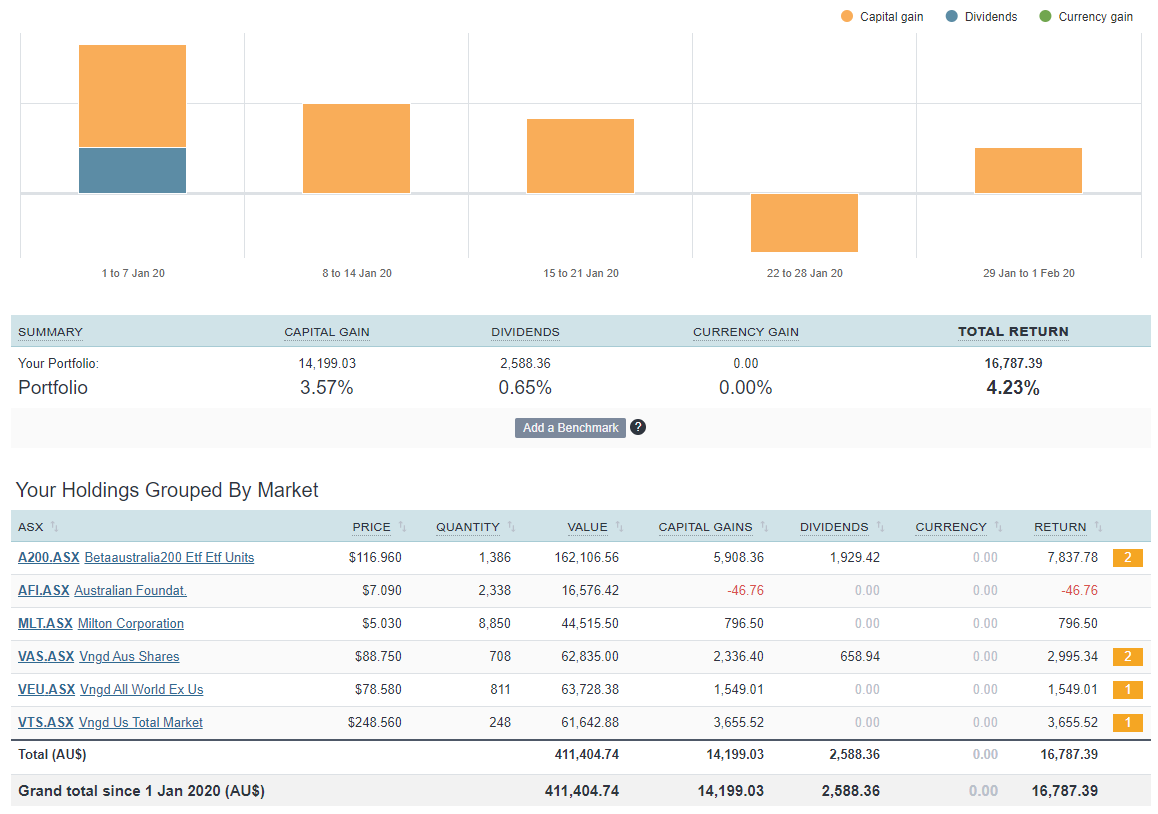

ETFs/LICs

The above graph is created by Sharesight

$2.5K in dividends, don’t mind if I do 😁

Strong performances across the board (except for AFI) last month. VTS has actually been going off its head and it just keeps defying belief. Would you believe that currently, our annualised return for VTS is sitting at 24.78% 🤯

And I’m pretty sure (someone please correct me if I’m wrong) that Telsa has officially entered into the S&P500 which means we will now own it upon the next purchase of VTS ⚡🚗⚡. This is a big deal for me because I’ve been a Tesla fanboy since like 2012 and was always showing people how epic their electric car was. My mates would ask me if I invested in it and I always said no because that’s not how I invest in shares even though I love the company and 🙏 they succeed.

Can’t wait until VTS drops in our weightings so I can pick this bad boy up and officially say I own part of Telsa!

Oh and we made a big transfer from £££ to $$$ for the first time using TransferWise(affiliate link). Because we have a solid 4 months worth of work coming up. I didn’t feel the need to float so much £££ in case something happened. We sent home around £7K which cost us £26.07 in fees (the lowest out there) and converted to be $13,768 AUD which hit our Aussie account. It helps that the GBP is doing well against the AUD lately.

We then transferred that along with some other money we had into our broker account and purchased $5K worth of A200 since the Australian part of our portfolio was the lowest split. We’re running a 70/15/15 split atm. 70 Aussie, 15 US, 15 world ex US.

Networth

VTS is Total US Market of over 3,500 stocks, not just the S&P500 so you’ve always held TSLA.

Oh crap! I always mix it up and think VTS = S&P 500 🙈

I guess I’m already an owner WHOOP WHOOP!

I NEVER actually knew your “Net worth” included the houses etc, I thought it was just the Shares combination & Super!

In saying this, how do you define when you’ve actually reached FIRE?

We own our home (approx 600K) , all our cars, no debt at all, and have just recently started passive investing with 65K in so far.

Technically we owe nothing, but Im still required to work full-time to keep food in the fridge/bills paid etc, I plan on choosing DRP option on all my shares so not banking any dividends.

At what time/stage would stepping back work hours be an option?

You might find this link worth a read https://www.strongmoneyaustralia.com/semi-retirement-shortcut-to-freedom/

just checked, VGS too..

Thanks for the post, it sounds amazing how much you travel, one of those things I love doing the most, I’ve done a couple of mini retirements in Argentina.

I’ve got 2 questions for you:

1. How did you decide the 70 Aussie, 15 US, 15 world ex US split? I’m curious about the criteria

2. I remember from a past post that you remained an australian resident for tax purposes, do you now pay more taxes because you’ve been out of the country certain number of days? I’m asking because in the future I’d love to live off my dividends and move to Spain, way before preservation age

Thanks a lot and keep sharing your travel adventures

Thanks Alex 🙂

1. That’s just what we feel comfortable with. Heaps of Aussie dividends and franking credits but still a decent amount (30%) of international exposure. To be honest, I wouldn’t really care if it was 50-50, 80-20, 60-40. The main thing I focus on these days as far as our investment strategy is concerned is simplifying it. Hence the selling of our investment properties. Once we are 100% in shares and Super, things will be laughably easy.

2. I actually paid for professional advice when it came to this question, plus I still have my Australia>London post in the editing room (I just don’t have the time for any AFB stuff lately) which covers this in detail. But essentially it was better for me to become a resident of the UK for tax purposes. This meant that I had to have my parents take over as directors for our corporate trustee (which controls the trust where the assets are held). If the trust has income to declare (it previously hasn’t because we have 2 investment properties in the trust who’s depreciation brings down the earnings of the trust to actually make it have losses. In hindsight this was a mistake to have those properties in the trust but we live and learn) it will be distributed to my parents/family members whilst we are away overseas.

Once we get back in the country next year, I will take over as director again and will control all the assets.

The only source of income where I’m going to be taxed into oblivion is the money I’m making through this website.

I’m not sure how you’d become a Spanish resident and live off the Aussie dividends without paying lots of taxes… Do any accountants out there want to chime in?

Thanks AFB for that detailed response, congrats on your progress its so inspiring!

Like Alex I would also like to move to Spain before my preservation age, and I am wondering what ETF strategy would suit this idea best. Any input for anyone savy on this would be greatly appreciated :)!

Kicking goals mate!

Not too sure if many people know this yet but government passed legislation in Dec 19 that if you’re a foreign resident you can no longer claim the main residence tax exemption on a property (no 6 year rule) for CGT. From what I read when you come back it will retain the exemption…just something to consider especially for that uptick in Property 3 🙂

Keep sparking that 🔥

This is definitely something you would be wanting to get advice on in the lead up to selling as many real estate agents have no idea about it. There is a grandfather arrangement that applies for sales prior to 1/7/2020. I found this webinar pretty useful (no relationship with them, just found it useful especially the examples they gave using actual numbers). https://atlaswealth.com/sg/news/main-residence-exemption-webinar/. All up, its complicated so get advice.

Yep. This is definately a thing. From what I have read, get rid before June/July, or wait until you are an Aus tax resident again- pref the former from what I have read.

Great work, look fwd to these monthly progress updates, here’s hoping your right with the $300k comment and exponential growth with my super finally hitting that mark

Cheers Baz. It has helped that it’s been a massive bull market since we passed the $300K mark but still.

Another excellent update!

I was interested in your hitting your discomfort zone in terms of sheer travel. That’s something I have seen other FI achievers comment on as well – that the lure of extended travel doesn’t quite get delivered in real life.

Still, have to say – the photos are great!

The ‘keeping track’ value of blogs is really under-rated I think. Sometimes it’s really good to have just an independent record of what you thought and did during a busy period.

Definitely dude.

This site has turned into my online diary which is pretty cool.

There’s something therapeutic about writing each month. I think I’ll try to continue once this blog finishes (maybe offline).

Honestly, I read FIRE blogs etc, but I know myself, which is to say: I don’t want to retire. I like that work keeps me busy, and gives me money. And I like my 4-5 week holidays each year, and then back to a grind – you need that contract. Well ‘you’ is ‘i’. I had 6 months not working in 2019, and it was fine (surprisingly, myself and others thought I’d go mad, I didn’t – but I was also pretty financially conservative). I did however take a low paying job when I returned to work, and it bums me out to not see my savings grow (which is really ‘offset to mortgage’ grow). I have shares, but $25k. I invest $2k a year, and aim to pay off my mortgage first. It’s just my point of view.

Always great to hear another point of views Sarah 🙂

Nice to see the net worth keep ticking up!

There’s definitely diminishing returns on travel if you’re doing it for an extended period of time. You get pretty sick of living out of a suitcase or backpack, plus there’s the constant stress of the basic logistics like accommodation, transport, where to get food, washing clothes etc. Decision fatigue is a real thing. I really think that travelling with someone is a great indicator of how well the relationship will go.

Similarly if you’re doing a bunch of weekend trips, if you’re working full on during the week then straight to the airport after work, spend two days seeing as much as possible and then back home late sunday and back to work the next day. When I was in London one year I visited 22 countries and spent 26 weekends overseas, plus a bunch of festivals in the UK. Great fun but man was I tired! The good news is that after a while you don’t remember the tiredness and stress but you still have the great memories of the things you’ve seen!

Hope you keep having a blast over there!

Spot on mate!

We were talking the other day like “Geewizz, I’m not actually sure if I can be bothered trekking around for 5 weeks this summer lol”

But like you said, once we get back home to Australia we will forget how exhausting the trips were but the memories will live forever!

This is definitely a first-world problem to have haha

“My mates would ask me if I invested in it and I always said no because that’s not how I invest in shares even though I love the company and 🙏 they succeed.” hit the nail on the head here mate, no need to invest in individual stocks when you track an index.

re: bicyle, when i was in london i believe they had a scheme (ride to work). check it out, you might be able to get something back.

also, i had a question around super. what happens when you are away in UK? are you contributing at all or just leaving it be?

that is something i have been thinking about if i move back to europe before preservation age.

I’ll check that out Shane, cheers.

I’m not contributing anything to Super atm. We plan to build up our snowball outside of Super anyway so this isn’t really a concern for us.

There is an option to build up your pension fund here in the UK but obviously we’re heading back home next year so that wouldn’t make sense. Although I’m not sure if you can transfer it to you Super in Australia… That’s a very specific question.

Did I read that Mrs FB has teaching experience? Has she given any thought to creating a course for parents to teach their children about Financial Independence and Personal Finance.

You read correctly!

Ahhh just mentioned it to her and she responded with a Mrs. Krabappel “Ha!” laugh.

So I’d say that she may not be that interested haha. I hear good things about the Barefoot investor children book.

Just wanted to say I love the blog and podcast!

Congrats on getting engaged. I proposed to my gf recently in Japan. I came across you a few weeks ago and have smashed out most of your podcasts and a lot of other content and got her to listen to a little bit as well. I have been passively investing (a small amount) in Vanguard for a few years but after coming across you and a few others I’m 100% committed to aiming for FIRE 🔥.

Would be interested to know roughly how big of a wedding you are going to have? and if you’re going to cut into how much you you invest or if you’re going to just try and reduce how much you spend. We’re in the early stages of planning and both of our parents are going to put in roughly a 1/3 each as long as it’s not a crazy expensive wedding.

Keep up the good work!

Thanks Myles 🙂

Soooo basically Mrs FB is running the entire show for the wedding.

If it were up to me, we would have found the local chapel the night I proposed and got it done and dusted.

However! Mrs FB wants her mum/sister there and it means a bit more to her than it does to me.

So in a situation like this, money isn’t really that much of a consideration. We discussed it and I said that we should do whatever she wants. I don’t particularly want a big wedding but if that’s what she wanted then I’d be happy with it.

She has been researching it for a while now and it’s looking like a small wedding in Fiji might be the go. Family only…

I’ll will be on one of these net worth posts once we book so keep an 👁 out for that update.

Hi AFB! Do you plan to add BONDS or TIPS in your portfolio? Or do you plan to invest 100% shares into retirement? Is there some sort of framework in the F.I.R.E. community on when to add BONDS e.g. add it when you’re 50% of your F.I. number, 75% or from day 1?

Hey dude!

No bonds at this stage… things might change in the future but as of right now we plan to retire in 100% shares. And I didn’t even know what TIPS were haha.

There isn’t a framework unfortunately because there’s just way too many factors that differ from person to person.

I don’t think bonds a bad thing either it’s just that we like shares better.

Hey AFB, thanks for the update, which is always eagerly anticipated. Looking forward to more travel pics in upcoming monthly updates.

I finished listening to your monster superannuation pod over the weekend, and thought to ask – do you have a pension account over there (i.e. superannuation) for your UK work? I’m not sure how it works with contracting. I have two defined benefit pensions associated with two different permanent jobs in the UK. Transferring the money to Australian superannuation is tricky, so they’re still sitting in the UK for me to access once I hit (UK) retirement age. It’s a bit of a pain to have them stuck over there, but I guess it adds diversification to my retirement funding, which is probably not a bad thing.

Hey Andy,

Great question!

I don’t have a pension account and neither does Mrs FB because of the exact issue you’re dealing with now. Thankfully we were notified early that it’s better to opt-out of the pension scheme unless you’re planning on retiring in the UK (which we aren’t).

That’s an interesting situation though. Does HMRC not let you just take it out since you’re not a resident for tax purposes anymore? Why would you have to wait until the preservation age? Are you a dual citizen?

Tesla might even one day make a profit.

😂😁⚡⚡

Hey AFB,

Great post as always. Something worth considering if you aren’t ready to return to non-expat life in 2021 😉 is a stint in Singapore. We’ve been here 5 years now and it is a great lifestyle – close to home, great travel hub, safe, everything works, English as first language, and the tax rate is 15% which is obvs great for FIRE. If you have a whole year to try for roles, there are teaching jobs here for expats at the international schools, esp. if Mrs AFB can work for the same org in the UK now. And Tech is big here obv :). Cheers, Chloe

Hey Chloe,

You know what, that sounds amazing and it really does appeal to us to continue living the ex-pat life but we’re ready to move onto our next phase… marriage and kids!

I try not to dwell on the past too much but if we did this trip back in our mid-20s, I think living and working in Singapore would have been high on our list. But then again, I’m not sure I would have been able to land these high paying contracts with 2-3 years experience back when I was 25 ya know.

So maybe everything happens for a reason 🔮

If you are looking for a GC real estate agent and are anywhere near Robina, I recommend Tina Nenadic (https://www.gcsr.com.au/staff/tina-nenadic/). Tina sold a property for friends of mine who had moved to the US; they were very happy with both the result and the communication from Tina and her team throughout the process. I use Tina’s company GCSR to manage 2 IPs and they have always been professional.

Excellent to know James. I’ll be sending her an email very soon!

Well done on that snowball gathering real momentum while you’re trekking around this awesome planet.

For GC real estate agent I had John from http://www.platinumrealtygc.com sell a place for me last year. He was great to deal with and did a fantastic job with everything. A couple of my friends referred him to me after he sold their places in the past few years too.

Cheers mdk. I’m going to be hitting up multiple agents and see how I go 🙂

Great post man. I’m with you on the daydreams, I used to have them too… except mine was imagining FI is just this perfect bubble where you’re on a permanent happy-high and you feel fulfilled even doing nothing. Safe to say that’s not the case lol.

We did some travel in the early days and will prob do more later, but I do find it tiring and even after a week I end up wanting go back to a ‘normal’ routine.

Really enjoyed your pod with Captain FI too and the stories about your old man giving you a hard time for spending! 😉

Thanks dude!

Maaaaan it must be a thing FIRE obsessed people do haha. I remember sitting there looking at my net worth sheets, tweaking the returns I was expecting and looking at the years it was going to take for legit hours some times. So silly now that I think about lol.

Where there’s a will, there’s a way though 👊

We’re almost ‘over’ travelling haha but we know we won’t regret seeing and doing a whole bunch of shit this year and before you know it we’ll be back home wishing we were in Europe no doubt!

It was awesome to be on Caps podcast. Loved it! Yeah, the old man defiantly played a big part in my frugalness.

So much travel! Love it – surely living a mini-FIRE lifestyle already? Seems like a very Aussie thing to do, is to just head over to the UK in your mid-late 20s and see the world!

Cheers mate.

That’s the funny thing. I kinda feel like we’re already living our RE life 😁 even though we haven’t hit our FIRE number yet.

This bull market has probably lead us into a false sense of security though. Let’s wait until we hit a bear market lol

Thanks for the post. I read from your other post that you plan on reaching the $1m investment which will produce roughly $42k annual dividend income which you intend to live on. So, I have two questions and hope you can shed some light:

1. Surely your annual expense will increase when you start the next chapter with kids? So how are you going to maintain the living style if you don’t work anymore after hitting the $1m goal?

2. Why stop at $1m and not keep going so the annual passive income is much higher and allow you to have an even better lifesytle?

Hi Victor,

1. I feel like the cost of kids is blown out of proportion but I guess we’ll find out hey! Since we will be able to be with our children and not have to spend money on daycare, I’d imagine that it will be a hell of a lot cheaper for us to raise kids vs parents who aren’t are free with other commitments. Our $42K lifestyle is exploding with luxuries. There’s so much fat we could shave off our budget if needed that I’m more than confident we will be able to managed push comes to shove. And finally, we’re not quitting work, we’re quitting trading our time for money. Almost everyone I know who has reached FIRE continues to make some sort of income from their hobbies and passions without even trying. This blog pulls in healthy income itself so I’d imagine that we will still have some sort of income coming in however, we won’t be relying on it to fund our lifestyle. It will be a bonus.

2. Because I don’t associate higher passive income with a better lifestyle. Happiness and income are definitely linked to a point, but I think it’s a bell curve and not a straight line up. As long as we have a nice place to stay, can buy great quality food, afford the basic 21st centuries luxuries like an ensuite, flat-screen TV, smartphones etc. I’m incredibly happy and don’t think trading my time for more money is worth it.

I have good news and bad news for you. Bad news – Tesla still isn’t in S&P500. Good news is VTS tracks total US market and not S&P500, so you already own Tesla! 😂 For greater but still indirect exposure you could consider NDQ NASDAQ index but probably all over valued at moment so maybe no point changing your strategy (Tesla trading on a PE ratio of 2000 is just insane!)

I love Tesla but that is INSANE!