The dream is over!

Not really, quite the opposite in fact but I’ve landed a 6-month contract which means I’m back in the office.

That might sound a bit depressing, and there was definitely a stage in my life where rocking up to a cubicle each day felt grim.

But mindset makes a hell of a difference!

For as blissful as our October update was, my mind was melting a little after not being fully stimulated for over 4 months! We travelled during our time off which was fine, and our mental recharge/mini-retirement was one of the best things I’ve ever done. But both of these don’t scratch the all-important itch that all humans have and that’s challenging/meaningful work.

It’s an absolute staple for mental health IMO.

And for any other developers/programmers/admins/IT experts out there, you’ll know what I’m talking about when I say there’s something really special about creating a solution that solves a real-world problem.

Whether it be crafting a beautifully written script that automates a business process and eliminates human error, or designing a custom front end form that enables field workers to enter in data and not have to double handle it when they get back in the office, or optimising a SQL query and marvelling at the efficiency and speed that it returns your dataset.

This was the part of my life that I needed back.

I’m also an extrovert and love team environments. I felt all cooped up inside for the last few weeks applying for one job after another.

There’s also the negative feelings associated with the perceived notion of rejection when you don’t get a job.

It’s funny because there was absolutely no pressure financially for me to get another job and relatively little social pressures other than my flatmates asking how I was going every few days but I still felt some kind of internal pressure.

There was a lot of valid reasons why I wasn’t landing contracts in the first few weeks, and I’m an optimist at heart but I just couldn’t shake it. And I was only searching for a little over a month. I could imagine that it would have gotten worse the longer the search went on.

I’m working at a startup now and I am loving all the tools, fresh environment and office space.

Check out my view!

The tech stack the IT has implemented is really cool too.

Literally, everything is cloud-based. Which means I get to work from home two days a week 😁

But for real, working at established companies usually means dealing with a heap of legacy systems that are hard to change, interface with, update etc.

With a start-up, you get to start completely fresh and they have chosen the best in business tools which just makes working a delight.

It’s my first time using Slack too. So much fun!

We visited Richmond park this month too and I was honestly blown away by the sheer size and beauty of the place.

It was absolutely gorgeous to visit in autumn, the colour of the leaves falling and the sunshine poking through really made for an enchanting Sunday walk. These photos just don’t do this place justice!

We also saw John Mayer at the O2 🎸

I only managed to get through two more books last month.

*The above books have affiliate links

This is mainly because of the sheer size of Stephen King’s ‘The Stand’. My god is that book long and I didn’t particularly enjoy the ending either 😒

‘A Guide to the Good Life: The Ancient Art of Stoic Joy’ was a book I’ve been meaning to read for a while and one recommended by MMM himself.

There seems to be a lot of crossover for us FIRE folk. 8/10 times someone on the road to FIRE will usually be interested in minimalism, delayed gratification, frugalism (is that a word?), environmental impact and/or more often than not… stoicism.

Stoicism gets confused in mainstream media but it can be a fantastic philosophy of life. I’ve been trying to practice negative visualisation every day since reading that book and I can truly say I feel more grateful for it.

I was on the tube the other day when my connecting train was delayed 😡. Everyone was pissed (myself included) but then I tried to imagine what it would have been like living in London 500 years ago when trains hadn’t even been invented. I thought about how hard it would have been, walking to places in the mud, trying to cover yourself when the wind and rain belted down, the limited options you would have had etc…

And before you knew it, my train had arrived to whisk me away in incredible comfort, speed and convenience. If you think about all the 21st centuries luxuries we have, it’s actually incredible to be alive in 2019!

And lastly, I was told about the Christmas festivities in London but my god do the Brits get around it!

Seriously, the lead up to Christmas is nothing I’ve ever experienced before. The city is buzzing with Christmas cheer lol. Ugly Christmas jumpers everywhere, pubs are packed, Christmas parties are popping, festive markets, hot mulled wine, outdoor ice skating rink at Hyde Park, Christmas trees in almost every major lobby and to top it all off… it’s cold AF.

It’s not snowing (which would be epic) but it’s the first time in my life where the lead up to Christmas has been feezing (by Aussie standards). And there’s something magical about rugging up and sipping on a hot chocolate while walking around the city enjoying all it has to offer.

It’s a novelty for us this year but not something I’d like to do every Christmas. Beach cricket and barbies will always reign supreme!

And if you haven’t joined the Facebook group yet you’re missing out! We just cracked 2K members!!!

Net Worth Update

It’s been absolutely fascinating to watch the markets continue to roar on upwards this year.

Everyone (including myself) was expecting some sort of crash leading up to 2018 and then 2019 but it still hasn’t happened. I’m not saying it won’t, quite the opposite actually because it’s a matter of when, not if, but the point I’m trying to make is that there are still people sitting on the sidelines waiting for the house of cards to come falling down.

But even when the next crash does happen, who’s to say you weren’t better off investing through it rather than trying to pick the bottom and going all-in?

Once you’re in the market it’s a lot easier to keep adding to the snowball as opposed to sitting on the sidelines with a wad of cash.

We didn’t save too much cold hard cash in November because I only just got another job and haven’t received my first paycheck yet. The share market contributed a whopping $17K to our net worth last month.

We also booked a 3 week holiday for Christmas and New Years which meant our cash reserve took a hit. But now I’m back in a job for a decent amount of time (6 months) we’re going to tap into our big cash reserve a bit more aggressively and start to transfer our £££ to $$$.

I’m hoping we have a good month in December and can crack $750K to end the year!

Properties

No changes in the properties this month.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

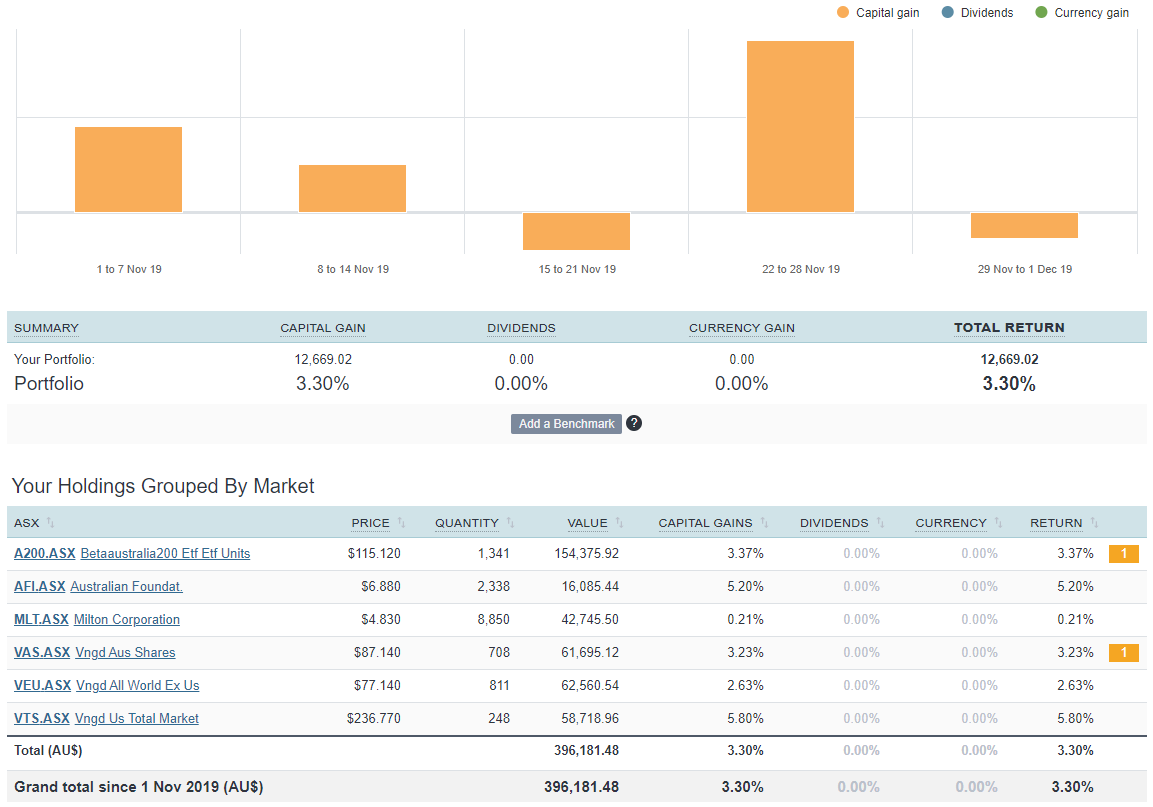

The above graph is created by Sharesight

Absolutely unbelievable!

The bull that just won’t quit. We saw gains across the board with the states leading the way followed closely by Milton and the other Aussie investments too.

I’m expecting an enormous crash any day now because this year has just been off the charts. Sharesight is telling me that the portfolio has grown by over 17% within the last 12 months. We know that historically we should be aiming for 8-9% so that is well above the norm.

I’ve said it once but I’ll say it again. These numbers look great on paper and they do make me feel good but in reality, all investors shouldn’t hope for increasing equities when in the accumulation phase. Once you retire, you hope everything goes to the moon! But each month everything becomes more and more expensive, meaning we’re able to buy less and less units that will ultimately enable us to retire early.

It’s bittersweet when I see the markets have had such big gains.

Following Strategy 2.5 we bought another $5K worth of VEU in November.

Networth

Great update, I always enjoy reading about your European adventure. Makes me miss home though! I know you are busy working now, but if you get the chance to get away for a day or so, I can highly recommend the German Christmas markets! (You can even take the train to Cologne from London (via Brussels) and work on the way)

What you said about how good it feels to be back at work working on solving real-world problems really resonates with me. I’m back at work now after mat leave and to my surprise, I’m really enjoying it. I also work from home a couple of days a week which is great. I really can’t picture a life without at least a modest amount of work – it’s about more than money: social interaction, structure, a sense of achievement.

Thanks Mrs. Flamingo 🙂

I’ve heard such good things about the German Christmas markets. Maybe we’ll pop over next year.

I’ve been so busy with the new job lately but you’re 100% about the social aspect and sense of achievement. Such a good feeling when you’re able to contribute to a team and achieve something!

Congratulations on what sounds like a rewarding 12 months for you and your partner, it’s great to hear about the benefits which can come from starting anew on the other side of the world and taking time to travel.

Can we expect a discussion about super in 2020? I’m personally wondering if I should be moving to a balanced index option as opposed to the standard pre-mixed balanced option which is offered by my provider.

I second this – I’m with Equip which only has pre mixed options, but mulling over switching to Sunsuper which also has ability to invest purely in index funds (much lower MER)

I’m interested to see what Vanguard plans to offer in terms of Superannuation in 2020.

Hi Lachlan,

The Super pod has been recorded!

Just need to set aside a few hours to edit and publish it. Expect it to drop before the end of January mate 😁

Love reading up on your Euro adventures. It’s making me want to do the same! Thanks for your honesty about your feelings towards work. Being in an unsatisfying job (for now) it feels validating that I’m not alone in feeling that.

FB, any thoughts about Vanguard entering the Super space next year? Will you be swapping over if the fees are lower than industry funds? Enjoy a magical Christmas 🙂

Hi J,

Do it!!! One of the best things we’ve ever done. Wish we did it earlier actually.

Soooo I have the Super podcast in the edit room as we speak and I reached out to Vanguard about their entry to the market but they told me that it’s super (no pun intended) early and they don’t have any details to give. Either that or they want to keep it secret but when it’s gotta be one of the most anticipated entries to the Super market that I can remember. Let’s see what fees they end up charging and the options.

Exciting times

I couldn’t agree more that having paid work can provide so many more benefits than just financial. Having just finished our first year of semi-retirement, I was surprised at how important working sporadically was to positive mental health.

While working full time was a definite emotional negative, I was definitely caught off guard with the realisation that I will probably always try to do some type of work in my field due to the positive emotional benefits.

It also really reinforced how unbelievably devastating mentally (as well as financially) it is for people who WANT and need to be employed but can’t due to redundancy, illness, injury, etc. and what a toll it can take on their confidence and emotional/mental wellbeing.

It also really reinforces how unbelievably fortunate my partner and I are to be in the financial position we are in due to some good choices but also a lot of luck.

Agreed!

How beautiful is Richmond! Was up there as one of my favourite places when I visited.

Such a special park. The wild animals make it magical!

Thanks for your update.

You have been on this journey for a couple of years now, looking back how do you feel about your AU share allocation between A200/mlt/vas/afi?

Would you have changed your allocation if you could start again?

No worries.

Ummmm… If I could start again from scratch, I’d probably just stick with A200 or VAS for Aussie exposure. It’s just simpler to have one fund and they’re all so similar that I might end up consolidating them into one Aussie fund one day.

My mind changes slightly every year but I’m digging the split of 70/15/15 (AUS/US/World) that we’re running atm.

Honestly, I have been focussing on other things in my life. I use to obsess over the small stuff with investing but when you hit a certain net worth, it just kinda figures itself out and it’s only a matter of time before you hit your FIRE number.

Congrats on the new job and getting the brain juices flowing again! Totally agree that having something challenging/creative/productive to do is a must for happiness, something that’s easy to forget when we’re sick of work at times lol.

And man that park does look beautiful, love those deer!

Keep up the good work mate.

Thanks Dave 😊

Richmond park rocks!

Great update and great progress throughout the year. Been a silent follower this year and loving your updates. Between you and Dave (Strong Money Aus) – it has helped me start my own journey to improve my financial ‘iq’.

Also this update brings back a lot of memories (I lived in London for 6yrs and just recently moved back). One tip if you loved Richmond Park, have you checked out Hampsted Heath? And Alexandra Palace is a great lookout over London and normally has concerts or events on.

Anyway, keep the updates coming and roll on 2020!

Nice tips mate. We’ll be sure to check them out 🙂

Appreciate the kind words about the updates. These net worth posts have turned into a little online diary of our overseas adventure!

I sometimes load up previous months just to re-live where we were and what we did. I’ve never kept a diary, but now I know why people do 😀

Cheers

Hi. Love

Love your posts. It inspires me to do what you are doing. Out of curiosity, is the value for both you and your partner as your posts refer to the partner a fair bit and shared savings etc. So just wanted to know.

Hi Michelle,

I’m glad you’re enjoying the updates 🙂

The net worth is our combined finances. We combined finance in October 2016. You can read about it in that update 🙂.

Cheers

Hey there! Just wondering what online broker you use now that you’re internationally invested? I wanted to use SelfWealth but apparently you can only hold Australian Shares through them? Thanks 🙂

Hey! I thought in strategy 2.5 you said you were going to purchase IVV or VTS..?

I said international would be making a comeback… hence the purchase of VEU in this months update.

A few people messaged me about VTS becoming domiciled in Australia so I might just wait and see how that plays out. VTS (or IVV for that matter) has been doing far too well lately for me to top up on that split. If/when VTS falls outside of it’s current 15% weighting, it will be purchased in the following month.

Cheers

Can totally identify with the IT bit. I started my software development career in a very big corp (top 20 ASX), then moved into an even bigger corp (top 10 ASX). Now I run from anyone trying to hire me in to those sorts of places. Currently in a 20 person startup with the latest tools, fully Cloud based, no legacy systems. Slack. Work from home. I’m never going back!

Even when I hit FIRE I will always want to solve technical problems. It tickles my brain in the right way. All of your examples are my day to day. Although of course it’s 95% shouting and cursing at my computer. But the 5% of the time it works, is a thing of beauty.

There’s no better feeling than when you nail a really complex problem. You might have a mental breakdown before hand, but man is it nice when it works lol

😅