I can’t believe we’re halfway through 2020 already.

The last 3.5 months have flown by and our Euro adventure will be over before we know.

It’s crazy to think back to last year and how much more we did between March and June in 2019.

We:

- Flew from Dubai into our new home for the next two years, London city

- Downloaded City Mapper, opened a bank account with Monzo and set up our Oyster card. All essentials for London newbies

- Found our new flat and met our new flatmates

- I got my first tastes of contract work and was blown away by job opportunities and just how much the city of London has to offer

- Visited Belgium, Scottland and Germany

Whereas so far in lockdown I’ve…

- Not ventured past a 5km radius of Clapham North

- Re-watched season 4-10 of The Simpsons

- Grown a beard and now look homeless

- Came to the realisation that Carole Baskin killed her husband

To say this year is not panning out as I’d hoped is putting it lightly.

On the flip side, whilst we never, ever intended to go on this trip to save money, lockdown has actually forced nearly everyone on the planet to spend less purely by taking away options. We aren’t spending money on restaurants, entertainment, concerts, live sports… you know, all the good stuff we moved here to do and see 😅.

Not being able to travel absolutely sucks. We will be back home early next year and then it’s on to the next chapter of our lives. Who knows when we’ll be back in Europe, and even when we do come back, I doubt we’ll ever be as carefree as we’re now.

Ah well, ya win some you lose some. At least we got to do so much last year and looking at the bigger picture outside of our bubble, we’re very fortunate to be in a job and healthy.

But speaking of travelling, we are planning on doing a small trip around the UK in August. We want to visit Wales, the midlands and venture into the Scottish highlands.

Given the current circumstances, especially after hearing about Victoria and parts of Spain going back into stricter lockdown, it was too risky to book anything international in the event that we might need to quarantine once we get there.

I’ve been wondering if we’ll be allowed back into Australia at the end of the year now.

It’s been unbelievable watching Daniel Andrews speak about reinstating stage 3 restrictions after the recent outbreak. It’s such a hard decision with no right answer. They need to lock shit down in case it gets out of control, but that surely can’t be a long term strategy… right? Is the world relying on a cure/vaccine? I mean, if Victoria (or any other state) has to shut down every time there’s a flare-up… when will this end? I haven’t been following it closely enough to really have an educated opinion but part of me feels like Australia has shifted from flattening the curve to stop the hospitals being overrun to completely eradicating the virus from the country. And with NZ/Greenland being shining examples that it’s definitely possible I understand the want to be part of that group. My only question with all of this is what happens after that’s achieved? Quarantine for everyone coming into the country until there’s a cure/vaccine?

I’d love to hear from anyone who’s been following it more closely than I have in the comment section.

Net Worth Update

Strong gains from the sharemarket/Super plus another stellar month saving most of our 💰.

Only $6K off our all-time high too. Talk about that V shape recovery!

Properties

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

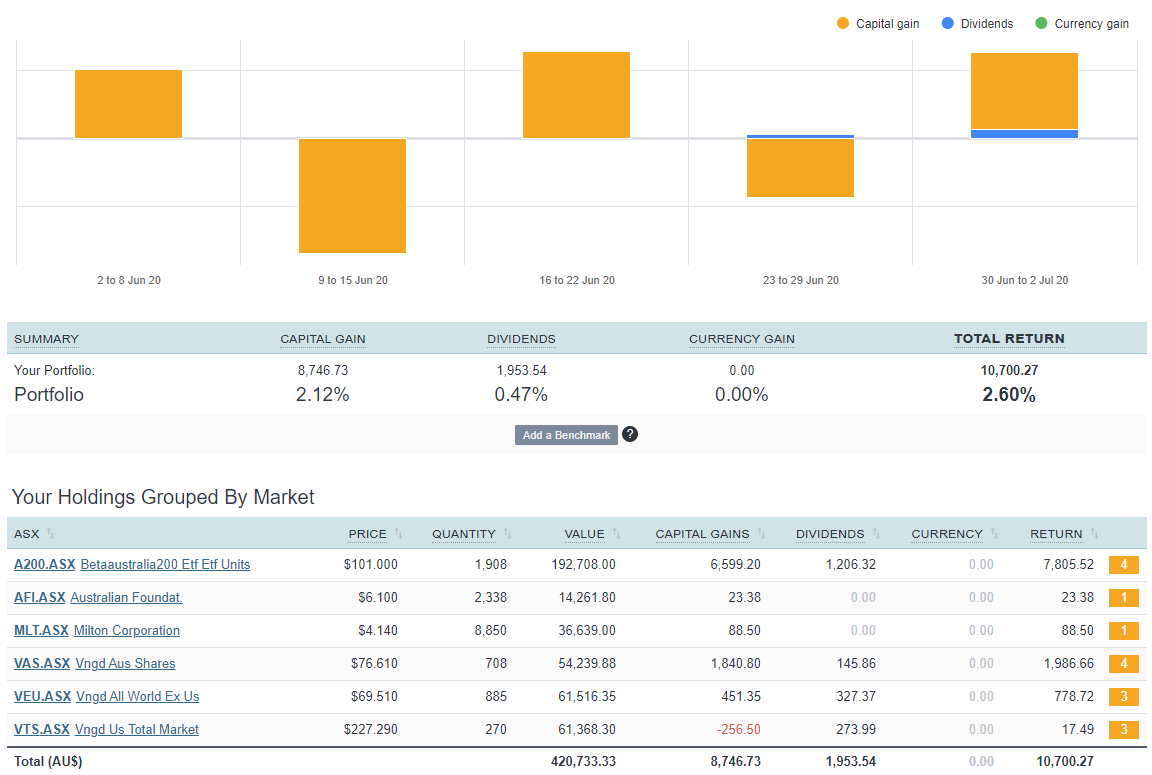

The above graph is created by Sharesight

Good returns, not bhed.

Before the Rona, I was expecting our dividends to be a fair bit higher than what they were this month. But given what has unfolded globally, it’s still a bit surreal to receive dividends at all. Not what I was hoping/expecting but we’ll take it anyway.

We purchased around $15K worth of A200 in June after we transferred back some £££ home.

Hey…great site…just a question re the cash….i.e. $14k for June…is that your savings after dividends, less living expenses and tax?

It’s how much of the gain ($27K) came from cash during the month. We have multiple sources of income so it’s a bit all over the place.

I earn money contracting so I don’t pay tax until each quarter, Mrs. FB is currently being furloughed so the money that comes in from her is after-tax, aussiefirebug.com earns money which has only recently been subjected to quarterly taxes due to earning over a certain threshold, rental income isn’t taxed and the dividends actually come with a tax credit!

The $14K is close to what we saved when we combine all the sources of income together but I still have tax burdens that need to be taken care of later on. We actually earned more than the $14K but of course we need to pay for living expenses which hover around £2K a month atm.

Great savings! Any chance you can break the $14K down further? I’m saving $2K/month so I’d like to know how much is from the job how how much from other sources. Anyways on the the non FIRE topics.

Flattening the curve might not be a one and done deal. I makes sense to lock down Melbourne right now even if the goal is just to flatten the curve. Then once it stops peaking they’ll probably start opening again.

IMO Carole didn’t kill Don, many reasons why:

He had more money than anyone knew and it was from mysterious sources.

His pilot’s license was revoked.

He flew under the radar.

Monthly trips to Costa Rica.

He sounds like a drug dealer/runner to me! Plenty of opportunity to get killed in that line of work.

Also not related but he was 42 when he met a 19 year old Carole on a street known for prostitutes.

I should have out financial year savings/income post out by the end of the month which breaks everything down further.

Nice break down from Tiger King haha. Can you imagine if that dude is still alive and got to watch the Netflix series?

Keep on truckin’ AFB. Stay true to the course.

Yes from my POV Australia is gunning for eradication, which would be an awesome status to achieve, but damn hard for some Victorians ATM.

Market-wise, I’m cautious of a bull trap; GFC-esque. Maintaining a decent cash position is important for me at this stage.

My IVV holdings have performed well over the past 6 weeks, but as IVV is not hedged to AUD, net gain was almost zero, due to changing for-ex. Good lesson on hedged vs. unhedged ETF’s.

I’ve diverted some cash to P2P lending. The risk/return profile works for me during these months.

In Qld, the first home buyer market demand is remaining reasonably strong, while supply has slowly declined.

If you’re still bringing in decent earned wages you’re in a relatively strong position.

Great read as always mate! I look forward to it every month. I’ve started my net worth spreadsheet 3 months ago and has been great to really see where everything is going.

One question, will you stick to investing mainly in ETF’s and if so what’s your main reason why?

West Oz is tracking pretty good on Covid as long as we can keep out those disease ridden east coasters…haha.

Keep up the good work Matt

As a Melbournian about to re-enter lock down again, it is a bit frustrating that the people living in other states are a bit smug. As the gateway for returning Australians from the other states, Melbourne and Sydney are shouldering the burden of screening these other states returnees. Unfortunately in the same way NSW Government failed to properly manage infected cruise ship returnees, the Vic Governmrnt has failed to manage the hotel quarantine. Outsourcing security to the cheapest bidder who in turn hires untrained casuals who lack protective equipment meant the virus inevitably spread into the community. An infected security Guard then keeps driving an Uber while waiting for a test result beggars belief!

Cheers Jed.

Yeah it will be ETFs for the foreseeable future. Check out my post on strategy 2.5 if you’re interested to know the reasoning behind that decision.

I’ve been expecting a big drop for a while now. Going to be interesting to see what the government do when job keeper/seeker ends.

They have really put themselves into a corner with further lockdowns. Because now they have no choice but to lock shit down at every spike. And if they don’t, people will wonder what the purpose of these lockdowns were in the first place.

Can you imagine if by the end of the year all the politicians just decided that continuing to go into lockdown was unsustainable and just told people we have to adjust to life with Covid. All the businesses that have gone under would feel robbed. All the people who lost their jobs…

🙏ing for a cure.

Hey Aussie FB

Good to hear your updates. I take a lot of inspiration from your blogs.

One question on your portfolio mix: any concerns regarding concentration risk in the Aussie market with VAS/A200/AFI etc?

As a VAS/VGS investor myself, VGS has held up much better though the pandemic so far and it’s made me consider adjusting my 50/50 strategy to something more like 30/70 going forward.

Appreciate your insights

Thanks

Mate why would u buy nothin but australian? Support ya aussie businesses ya scumbag or crawl over to the euro firebug page mate which is probably run by a girl. Ive got plenty of mates out the mines and there raking it in like bloody loose cannons. If I had the smarts and cash outside the pokies to invest Id be all in aussie and whipping up fucking charts left right and centre like this bloke

Lol.

Relax on the insults Daz or you’ll get banned.

Hahaha, this Dazza lad has got to be one of your British mates taking the piss!

WTF

Cheers mate.

This split is where we feel comfortable. Everyone’s different but 70% Oz will provide as with great dividends and 30% international is enough diversification IMO. There’s no formula I’m working off here. I just literally pick the weightings that I’m comfortable with.

Simple as that

Hey, i was wondering whats your reason for only having these 6 ETFs from the other equities? do you have exposure to bonds in your portfolio?

Too young for bonds I’d say. By investing in bonds you are missing out on returns in the accumulation phase.

Don’t feel like I need bonds at this stage in our life. Could change later on

Nice to see that portfolio coming back for you AFB, albeit with at least some of the recovery being due to increased savings. I feel like I’m the only sucker who’s still down a fair bit from the peak, but that’s mostly due to my additional investments not being as big a factor as it is for a lot of others.

It sure would be nice to have some clarity from the government as to what exactly we’re aiming for in regards to the virus. As you say it sure seems like the goalposts have shifted from flattening the curve and not overwhelming hospitals/ICUs to eradication, but there hasn’t been anything official on this as far as I’m aware. It’s pretty frustrating, and a lot of my friends overseas are absolutely staggered that a city of 4 million people is locking down over a couple hundred cases a day when they’re seeing that in their much smaller towns and opening back up, especially if we’re not explicitly going for eradication.

I don’t even think they know what the long term goal is. No one knows what’s going to happen!

The worlds in a tough position. They need to be seen doing something but what they’re currently doing surely can’t be sustainable for much longer. Coming from an uneducated position on the subject matter I’m almost definitely wrong, but managing this pandemic makes more sense to me vs trying to eradicate it which might be impossible.

Pretty clear if you Google or listen to any scomo preset Australia are not trying to eradicate the virus. Containment is the clear goal. When you have stupid sicktorians spreading it by community transmission more than has ever occurred before in the history of covid then you get locked down by chairman Dan. Contact tracing cannot occur with such high cases. It is NOT from overseas arrivals as Sydney has more. Sicktoria…… why would you want to go there.

I’m German living in Sydney, so seeing how Australia is reacting so conservative towards the Covid numbers is quite strange for me. I think the total number of active cases is below 1k for Australia in total meanwhile even the internal borders remain shut. At the same time my German friends are starting holidays in Italy, Greece etc..

But you as an Australian citizen should always be allowed back in, right? You’ll only have to quarantine upon arrival.

That’s the thing, we had around 300 new cases here in London the other day but things are still opening back up (had my first 🍺 at the pub on the weekend 🙂).

The UK is probably one of the worst countries in terms of infection rate but they seem to be trying to take the balancing act approach of not overrunning hospitals but opening up the economy just enough so people can work/businesses can survive/people stay sane.

We won’t know for many years who had the correct approach though. I very much look forwards to watching the Corona Virus mini-series doco on Netflix in 2030 and seeing the hard data as to what worked and what didn’t in the long run.

Mate, checkout the slope on that V!! Jacked up savings rate is great for FI, but hardly what the plan was when you jumped on the plane… A silver lining I guess 🙂

For sure!

Wasn’t the plan but we’ll take it 😁

Hey AF, has the reduction in dividend yield affected your thoughts on the ideal asset split come fire time? A significant dividend yield reduction will probably happen a few times over your fire period, so I’m wondering if you’d consider holding an unmortgaged property (despite the active management, less yield and potentially less capital growth) to diversify your income stream away from dividends. Whatever your answer, would that change if you didn’t have other income streams (such as this site)? Thanks for the great blog!

Hi Kshizzle,

The thought hasn’t crossed my mind honestly. Having multiple income streams is so important but receiving dividends from over 6,000+ companies is sorta the ultimate diversification of income IMO.

I don’t plan on receiving money from this site forever either. Once we have reached FIRE I won’t be making these monthly updates anymore.

The truth is that the portfolio will provide us financial independence but it’s almost a certainty that the meaning work we pursue in “retirement” will generate some sort of income too.

Hey mate

Discovered your site last week and have thoroughly enjoyed it. I’ve been tracking my NW for many years in a similar way and can relate to lots of the content. I love how it creates a story and a journey, looking back to the first time I started recording, and seeing the magic of compounding as well as the effects of simple saving and general smart living.

One query I have is what is your cumulative $ gain across your stock portfolio?

Keep up the awesome work and I’ll keeping reading and hopefully contributing!

Rob

I’ve done some sums on this as I was also curious. It is hard for an observer to calculate exactly as AussieFireBug doesn’t detail his cost base (share price of each purchase) and his exact dividend income. If you ignore dividend income and use the closing share price of each respective month to determine the cost base his returns for each security to end June 20 are: A200 minus $15,792; AFI minus $561; MLT minus $2,476; VAS $2346; VEU $2,083; VTS $16,000.32 —> cumulative to end June 20 $1,599.

If you wind the clock back to January though: A200 $14,089.41; AFI minus $1,098; MLT $5,753; VAS $12,003; VEU $9,550; VTS $22,127 —> cumulative to end January 20 $62,425.

Again, this ignores any dividend returns, but certainly shows the massive dent that COVID19 has had and the risks of the market.

Other AussieFireBug’s earnings, his most lucrative returns have been his property transactions (circa $226k gain)

I might do a post about how much money I’ve made through investing as a whole because it’s a pretty interesting topic actually.

I’m glad you’re enjoying the site mate 🙂

As of right now, the shares portfolio has returned us $48K (6.59%). Not great but not too bad considering what’s happened this year.

One other question – do you ever use inverse ETF’s such as ASX:BEAR for uncertain times?

Nope

Just curious which superfund you use. Sorry if you have answered previously.

I’m with Vision Mrs. FB is with VIC Super. I’m looking forward to see what Vanguard bring to the table in the coming years though… will probably switch to them if it’s good

Has been interesting watching the markets this year, have you had any temptation to deviate from the plan temporarily? For the most part I’ve tried to keep a lid on things and keep purchasing as normal but it’s funny how the emotions can start to set in even with a plan, more so in regard to buying more than withholding, have had to pump the brakes in the last month as there’s uncertainty in the air for the next 6-12 months (stood down).

You asked for a Covid rant so here ya go…

The Covid situation and the way it’s being portrayed is a bit bananas, the positive case rate relative to the population is essentially the same state to state (0.3% across the board with exceptions to NT at 0.2% and TAS at 0.4%) yet Victoria is put into forced locked down again, yes there’s a flare up but like you said where will a line be drawn? I’d say it’s when we can’t afford it anymore and we’ll be forced to continue regardless and like you pointed out, the people that were forced to run dry will be very salty. I’m originally from WA and have been living in Melbourne, currently back in WA as I got a travel exemption and WA will have no restrictions at all as of next Saturday and will be back to 100% pre Covid, meanwhile WA actually has a worse death rate than Victoria as per population. I’m also sure that if each state were going through the suburbs with mouth swabs like Victoria they would 100% find active cases. Gunning for eradication is nuts, a respiratory disease will not simply disappear because you want it to and you’ve stayed at home for a while – for reference I’m not an internet potato warrior, my partner is in medical.

Unfortunately it’s starting to drive a wedge between people and I keep hearing more and more “us and them” conversations, probably because I’ve gone from one side of the country to the other and this will sound crazy but my uncle didn’t want to see me because I’m visiting from Victoria and I haven’t even told all my mates back here that I’m even visiting because I can’t be bothered having these conversations constantly or finding out who’s hiding under a rock. Just like the internet everyone has a hard line opinion from their sofa without much of a change in circumstance themselves and similar to divide in the world when it comes to race/culture etc there’s a low level of separation developing for some people between states – sad to see.

To draw from Peter Thornhills book….I feel the publics perception of Covid is similar to the reporting of the stock market vs property…. the stock market gets a daily update reminding everyone of every little bump in the road and the risk involved, much like the daily updates of Covid cases. If every time you put the news on there was an info banner rolling along the bottom of the screen showing the updated count of every disease for the day you wouldn’t want to leave the house. On that note just short of 400 people a day are diagnosed with cancer in Aus yet it doesn’t change most peoples behavior (hello smokers) or strip people of their own choices in taking risk with exposure if they want to (becoming a smoker, or simply going back to work). In saying all that like yourself I must be grateful for what I do have, aside from life in Aus I wonder how much this is going to hit hard on people in vulnerable nations, the ripple effect from the developed world going insular. I’ve traveled to some very poor places and can only imagine things are in complete shambles.

If you want to have a quick skim from the UK every so often this is updated daily I believe – https://www.health.gov.au/news/health-alerts/novel-coronavirus-2019-ncov-health-alert/coronavirus-covid-19-current-situation-and-case-numbers

Very interesting comment.

I completely agree with the smoking analogy. There’s a difference between public and private health but one kills more than the other and I don’t see any lockdowns or curfews for ciggies.

And what I find interesting is that second-hand smoke kills 1.2M non-smokers a year, yet for some reasons governments are ok with letting people take that risk and to also potentially kill others through second-hand smoke. I’m not saying we should ban smoking, just pointing out the hypocrisy.

Hi AFB,

I decided to give your FIRE Calculator another look after couple of years and then for some reason decided to play around with your numbers with some estimation. It appears that you are pretty close to FIRE ~3 years. I guess my question is, have you considered this of late and what may be your plan?

Thanks,

Vlado

My plans for when we do reach FIRE?

I have not stopped thinking about that for a few years now… I think I’ll make a post about it but basically my main focus in my 20’s has been to reach financial independence. Now that I’ve entered my 30’s and FI is not a matter of if but when… I have thought deeply about what I want the next chapter of our lives to look like and what goals do I want to achieve.

There’s a bit to cover and as I mentioned, I’ll probably do a big post about it 🙂

Cheers

Hey AFB! Can totally relate to growing a beard and looking homeless, I also got sucked into Tiger King haha. Its been a good chance to have a breather and spend time with family. I hope everything is going well for you in London and the lockdowns are easing soon. But hey, great opportunity to reign in that spending rate since no one is really going out much these days. Everyone is a bit nervous in Sydney about a second wave, and Melbourne seems to be copping it. Another great reason to live rural, away from the city.

I shaved the beard when I got a proper haircut and a few people on the Zoom calls didn’t recognize me lol.

Things are starting to come good in London dude, but I do fear for a second wave too. Parts of the UK are starting to go back into lockdown 🙁

I can’t believe what’s happening in VIC atm 🤯

Hi AFB,

I have started less than a year, so not much experience.

Just wondering:

If you were to invest for a kid (build a nest) until their 18, which EFT would you go for?

• VAS

• VGS, or

• VDHG

Probably just VDHG so I didn’t have to think about it ever again.

Hey AFB. Just a quick question on the early super. I’m currently at uni and want to continue building my investments. I was looking into taking advantage of the early super by placing some of my super into A200. It looks like I will have a similar return, however, I will save money in management fees, as SunSuper is ridiculous. What are your thoughts on this? Is it worth it? Thanks!

It all depends on your goals. If you’re looking to maximise your investment returns then you’re best off keeping the investment in a low tax environment that is Super. Maybe you can look around at different Super funds and find a cheaper one. Our goals are pretty unique tbh because we’re going to reach financial independence in our early 30s so I’m less concerned about maximising tax advantages and more concerned about reaching freedom as soon as possible. I don’t want money locked up in Super even if there’s going to be more of it when we eventually reach our preservation age.

But everyone’s different so it’s impossible to say what I would or wouldn’t do without knowing the whole picture.

Hope that helps mate