Pretty boring month tbh.

Was nice to slow down and smell the roses as they say. And I did enjoy most of April but I felt the last week or so has been a bit of a drag.

Mrs. FB and I have been doing some pretty epic rides on weekends as our daily activity. We’ve been riding through London CBD on the old pushys and I think it’s a once in a lifetime experience.

Riding over London Bridge and throughout the CBD when there’s not one car to be seen or heard is surreal. The more I think about it, it’s like the perfect time for cyclist actually. If you wake up semi-early on the weekends and ride through London you can literally have the whole street to yourself and maybe a few other cyclists, but that’s it!

I’ve got heaps of videos and pics to show the kids one day.

In other news, the cogs are still turning in the insurance industry thankfully and the startup I’m working for has actually been hiring people during all of this which is really reassuring. We’ve had a few people join the team during lockdown which is just bizarre. I wonder how they’re feeling not having met anyone in person.

Mrs. FB hasn’t gone back to work but is receiving furlough from her agency which roughly translates to 80% of her income. This has been a nice surprise but part of me does wonder how the hell all of these countries are going to pay for these stimulus packages in the future. Maybe there will be some sort of COVID tax for the next 30 years 🤔.

And lastly, I think we’ve exhausted just about every Netflix series out there so if anyone has any killer documentaries/series to watch I’d love to hear about it.

Net Worth Update

We’re back in the 700’s baby!… for now anyway.

Most of the gains we saw came from the stock market and cold hard savings. We basically aren’t spending money on anything other than food and rent so the savings rate is off the charts.

Man, 2020 has been a rollercoaster!

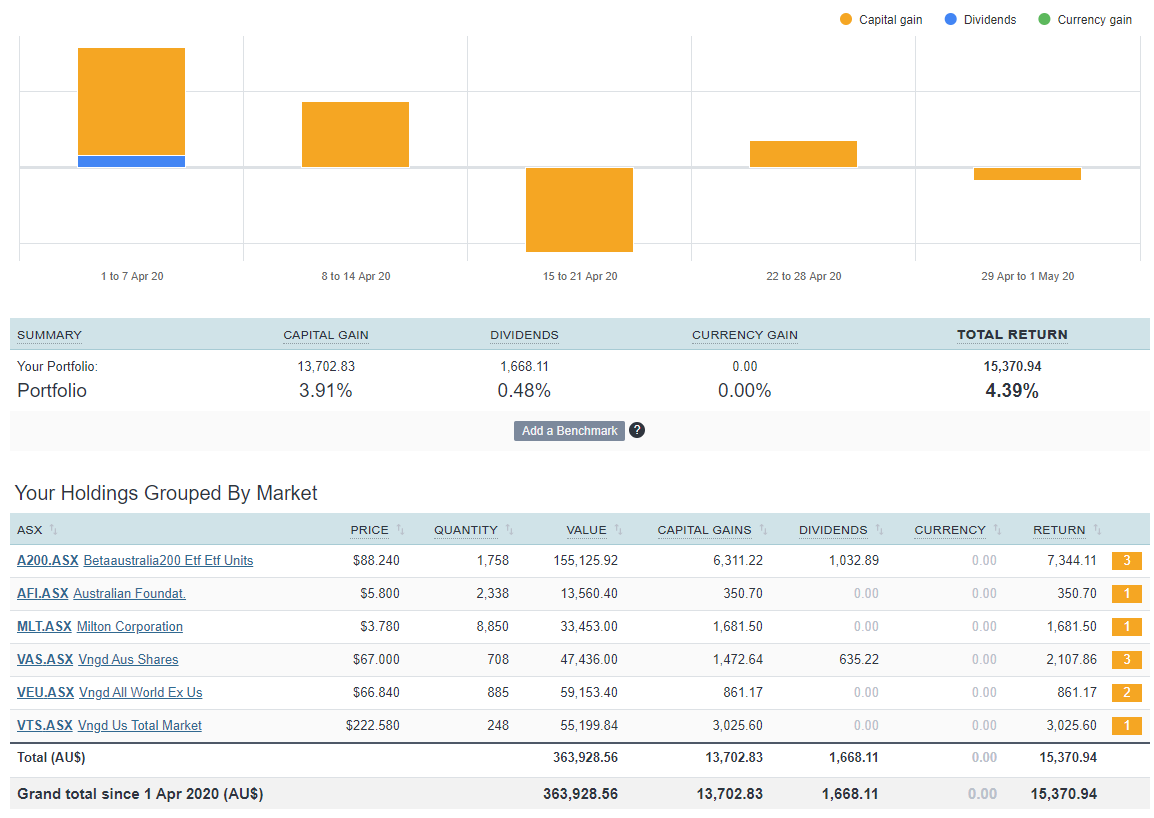

Defying most logic, the markets roared upwards in April returning an incredible 4.4% (for our portfolio) after the monstrous drop in March. We still have a long way to go before we’re back to where we were. And there’s the possibility that we haven’t even seen the bottom yet.

I’m a true believer in index investing so I don’t let my very limited world economic understanding creep into my investment decisions but it’s hard to not look at what’s going on out there and be a bit puzzled by the gains we saw last month. Although the same could be said about the drop I guess.

Did anyone catch Warren Buffett and the Berkshire Hathaway Annual Shareholders Meeting the other day?

To paraphrase Buffett, he basically asked if anyone truly believed that the value of all companies fell by 30-50% because of this crash? You could conclude that some companies definitely would be worth less, airlines come to mind, but some might actually be benefitting from the current crisis… Amazon anyone?

What has become abundantly clear during April is the stock market is not the economy!

They are linked but are distinctly different as we’re currently seeing right now.

So what does this all mean for us…?

Not much really, continuing to buy and hold 😁

Properties

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

The above graph is created by Sharesight

Huge gains for April, most of which came from our US holdings VTS (in percentage terms) but the Aussie companies held their own.

We also received some dividends from A200 and VAS which is what most of the FIRE crowd are more interested in as opposed to the stock price.

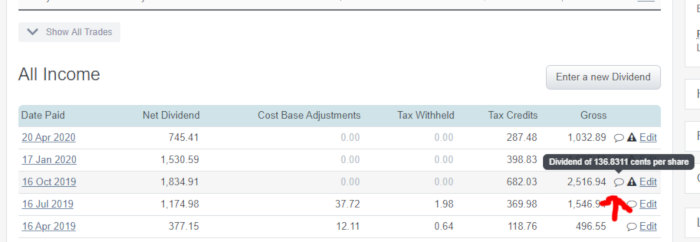

A cool feature of Sharesight is the ability to quickly determine what the dividend amount per share was historically. You can do this by hovering over the little chat box icon under the “Recent Income” section in the “Holdings” tab.

Now the interesting part.

VAS paid 91.6 cents per share for the 2019 April dividend and 67.3 cents for the 2020 April dividend

That’s a 27% drop in dividends.

And it’s even worse for A200.

A200 paid 91.5 cents for the 2019 April dividend and 42.4 cents in 2020.

That’s a 54% drop 😲.

Lower dividends were to be expected and tbh are going to continue for a while with the worse yet to come. We can’t shut down the world’s engine without any repercussion and dividends have always been tied more to business performance than share prices.

A200 is still maturing and I’m not sure when we will see comparable dividend yields to VAS but it’s important to note that the total return between the two funds will be similar regardless of A200 size and consequently, it’s lower dividend yield.

We topped up VEU to the tune of ~$5K to bump it back up to 15% of our portfolio.

Hi, Thanks for your post. Always great to read!

I read about tax-loss harvesting on the millennial revolution blog. What are your views on that?

Thanks Nat.

We can’t do TLH in Australia as it’s against the laws. A shame really as this would be a great strategy to do and make the robot companies a lot more attractive.

A couple of articles of interest here

https://www.sharesight.com/blog/tax-loss-selling-for-australian-investors/

https://www.reformedadviser.com.au/news/2015/10/28/tax-loss-harvesting-in-australia

Well, there ya go.

I was always under the impression that this was considered a ‘wash sale’ and illegal.

It is only considered a wash sale if you repurchase the stock and yes then it is illegal

Thanks!

Hey there! When you say 16K cash savings this month, is that what’s left from both yours and your partner’s income after paying the bills? How do you get to this number? Thanks!

That’s correct George. It’s artificially high because I haven’t paid company tax yet so that’s going to be big chunk taken out for the May update.

Interested in this also as the month prior was $15k savings

Great read AFB, and I enjoyed the Day of the Triffids (with bikes!) photos.

The A200 drop is intriguing isn’t it? It seems quite severe for a period in which the lockdown was only really commencing, doesn’t it? So perhaps a continuing growth of fund issue. It made me glad to have both VAS and A200, like you.

Yep. Interesting indeed. Going to be fun watching what happens over the next 24 months me thinks

Hey mate have you looked into equal-weighted index fund investing in RAFI style vehicles? ie QOZ and QUS offered from betashares? This offers more of a value approach to investing and systematically underweights the seemingly undervalued metrics measured from certain metrics like sales volumes… Market cap index investing seems to overweight the very optimistic prices forecast for the growth companies with best case scenarios built into the share prices.

I’ve never heard of it mate. But after a quick Google… it looks very interesting. Might have to have a read. Got any books you’d recommend?

Not books as such I listened to an Equity Mates podcast that interviewed a US investor- Jesse Felder. And he mentioned it and referred to an interview he did with Rob Arnott about it. Both podcast worth listening to mate as an alternative perspective to the market-cap weighted index funds. The website that Ron created and the strategy these ETF’s follow are RAFI (Research Affiliates).

Let us know if you get time and have an opinion on the strategy mate cheers.

Cheers dude. I’ll add them to my list

Hi Ryan,

I am also keen on these ETF’s. This approach is based on Rob Arnott style of invetsing who manages $200 billion for clients in US. You may find any other website or more information from his company Research Affiliates.

Another good investor with a similar style to Rob’s thinking is Meb Faber. Another American but you can download a free PDF copy of his Global Asset Allocation book from his website- just google him. Pretty much studies some of the most successfully investors in the past and their asset allocation. Very important to diversify over the various assets… AFB in my very humble opinion its good you didn’t choose all Aussie shares for portfolio especially with currency and other risks.

Hi Mat. Have you ever thought about refinancing your realestate to pull some of the equity out to buy more shares?

Hi Andy,

I’ve actually done that a few times already in the past. But with the current lending conditions… it’s a lot harder to do. The plan is to eventually sell the IP’s (when we get past this virus) and move to 100% equities.

Hi, I see you debt is reducing on your investment properties. Are you paying p&i repayment? Who are you with?

Hey there, interested to know where your IPs are how did you pick them and subsequently manage them? Keen to know since you obviously do it remotely and what the process is like for a cash flow focused IP. Cheers.

SE Queenland. They are managed through an agency. SE Queensland was an attractive place to buy IP’s back in the day because the yield was way better than Melbourne and Sydney and I thought the chance of growth was also good. There were a lot of infrastructure projects being developed and the population growth projections were attractive.

Yes I am. Macquarie.

Great to see you taking advantage of the opportunity to see some of London when it’s really quiet! It’s amazing how much of the Square Mile in particular shuts down on the weekend normally, I can only imagine how empty it must be at the moment.

Nice to see the markets ticking back up again as well. The difference in performance between the Aussie sharemarket and the US has been interesting, it really shows how much of the former is in banks which have been smashed, and the latter which has a much higher tech focus. Another great reason to diversify your investments!

It’s a bloody ghost town!

The tech giants make up so much of the US market it’s unbelievable. But like you said, it’s good to have a mix of asset classes right.

Good on ya Firebug – those pics of London town are pretty incredible, definitely one to pull out to show the grandkids by the fire one day! Haha, also nice to see the portfolio bounce back a bit, I’ve been wondering what the price for all of these stimulus is, probably give the future generation even more reason to resent us oldies more!

Was ‘Money Heist’ one of the series you’ve exhausted? If not try that one out.

Ohhhh nice one. We haven’t watched that yet. Added to the list!

Not on Netflix, but both big little lies and especially Chernobyl are both very very good.

Yeah, I enjoyed that too… does drag on a bit, but entertaining enough.

100 Humans was interesting too, if you’re interested in psychology.

Great update. We have been watching After Life which is great, also enjoyed Michelle Obamas ‘Becoming’ documentary and just started watching the Overlander TV series which surprisingly for him my husband is also enjoying.

We just watched the Michelle Obama doco on the weekend actually. What an absolute boss that lady is!

Michelle and Barack might possibly be the coolest presidential partners ever!

Great update. Do you adopt a corporate trustee as trustee for a discretionary trust to purchase your shares in? Or do you do it in your own name? I’m relatively new to investing and thinking of getting some proper tax advice but curious as to your structure!

We use a discretionary trust with a corporate trustee.

We don’t own anything but control everything… Well… actually my mum is currently controlling everything because I’m not an Australian resident for tax purpose at the moment. But when we get back to Oz I’ll become the director again.

Could you elaborate on your reasoning for setting up the Discretionary Trust?

I assume that the main benefit is tax minimisation?

We did it years ago because we wanted to be able to direct the income from the trust at the most efficient rate.

Having said that… it complicates things unnecessarily and if I could go back in time I would have never bothered setting it up and learning how it works. You can reach FIRE without it!

AFB, have you considered crypto DeFi (decentralised finance) as a side hustle? There’s plenty of platforms out there that are willing to pay over 10% p.a. interest on USD backed stable coins – no exposure to volatile markets. Kinda like a term deposit. To name a few:

https://celsius.network/earn-interest-on-your-crypto/

https://invictuscapital.com/imlFund#aboutIML

https://crypto.com/en/earn.html

Never heard of it Bob. Sounds… a bit suss. Can’t be bothered to look into either so I’ll just have to take your word for it

Fair, it does sound suss.

“The whole point of our existence is we say banks should pay the interest to the depositors and not the shareholders.” – Celsius CEO

Crypto.com are insured for $360 million from Arch Underwriting at Lloyd’s Syndicate 2012 and BitGo. If you are a US resident, your USD fiat balances (non-crypto) are covered by FDIC insurance, up to $250k.

The Celsius whitepaper had BitGo as the custodian (who are insured up to 100m by Lloyds). Although the Celsius website now says deposits are not insured. Not sure what happened there. Nexo is an alternative. Nexo is listed on the BitGo website, and the nexo website states what is covered by insurance.

Why USD? US fed prints 6 trillion in USD, but the global demand is 80 trillion which is pushing up USD price. There’s 14 trillion USD that the world owes the USA in a currency they can’t print. As the USD pushes higher, the lesser countries will start defaulting on their debt. Defaults means to destroy USD, removing supply, pushing the dollar even higher, until more counties default. USD will eat all it’s competitors before eating itself. Check Raol Paul and Santiago Captial with the dollar milkshake theory.

https://www.coindesk.com/crypto-com-lands-record-360m-insurance-cover-for-offline-bitcoin-vaults

https://medium.com/nexo/nexo-is-the-only-crypto-lender-to-offer-crypto-custodian-insurance-83e3cc5bd378

Worth reading up on DeFi though (IMHO) – could be the future of finance (or, a least, there’s a slim chance that some parts of DeFi will become incorporated into every day finance). Kind of like learning about computer networking in the 80s. I haven’t read all your posts but think I saw something about insurance startup, insurance is definitely something that DeFi can make a big dent in.

For example, I hold Ether (the Ethereum token) – held it for years and I don’t want to sell, but I can use it as collateral to get a loan which is backed by a smart contract, no banks and no having to trust peers. Big learning curve but worth looking in to if you have time.

https://hackernoon.com/whats-makerdao-and-what-s-going-on-with-it-explained-with-pictures-f7ebf774e9c2

Hmmmm I get hearing more about this DeFi. Might have to do some research. Got any good sources to read from?

https://nuggetsnews.com.au/resources/basic-knowledge/what-is-defi/

After that, check his youtube, I think there are dedicated defi updates.

You both have podcasts. I’m sure one of you can appear on the other’s show.

Thanks for the update, I am very new to this type of investing, but looking at these figures, I can see that you have approx $200,000 invested in A200 and VAS with a monthly dividend return of $1600. Am I reading that correctly. My reason for asking is Im currently deciding between investing in a property or pursuing this dividend strategy. Thanks

Hi Tommy,

Looking at individual years is doesn’t help you get a clear picture. Have a look at Sharesight and see the stock performance of those funds over the last 2-5 years to get a better idea.

The Corona crash was one of the worst in history mind you…

The market is not the economy …never a truer word spoken . It’s pretty much a legitimate ponzi scheme run on confidence … or in this case liquidity . You can’t fight the Fed they say and there was no coincidence that the market stopped spiralling and went up 9% the day the US Central banks released the first few trillion .

Detractors say this is no longer capitalist. When a safety net gets put under risk investments it’s now more akin to the China mould . But what are governments supposed to do , they have removed every other avenue of making money apart from the stock market and real estate .. so they are duty bound to make sure those things don’t fail .

Supporters say ” you beauty my super went back up a bit ” and rightly so , as without Fed intervention in the US it looked like an 80% drop was on the cards over there and you can be pretty confident we would have followed .

Someone’s going to have to answer in the end for those trillions and trillions of dollars of funny money though …that’s when the “economy” gets real . So all praise to zero interest rates and no inflation for a few decades , so the RBA and the Fed can make the repayments . You never know , interest rates might go negative … now won’t that be a crowning cherry on our solid economy .

Oh well , we are all just little people . And I for one sure as s#it don’t understand economics , so just be happy I guess .

It’s true also that the ASX has not quite done its lap dog following of the US markets for a change . Think there is some confidence there that we are in a better position because we didn’t so much flatten the curve of the virus …we pretty much just didn’t have a curve . No one has watched more Netflix that the covid-19 nurses in Oz patiently waiting for the hordes of dead and dying to arrive . Could be a poison cup though maybe ? , now we really are disconnected from the world . How do we open back up to it ? Wait for a vaccine? That could take a while , although announcing yet another one is imminently about to go to trial always gives the Ponzi scheme … sorry I mean stock market a 2% bump on any given day .

So what next ? . China -US relations looks interesting . Even as interesting in China -Oz relations . You can sort of imagine Trumpster will do a fair bit of sabre rattling deflecting the blame on China ( and probably rightfully so ) but if he would take it to trade sanctions and knock another cannon ball through there own economy is doubtful . It’s an election year over there after all . He won’t get re elected if there’s no recovery . Will be interesting to see if China will want to make us pay for calling for an independent investigation though . A bit of barley and some meat products are chicken feed to how it could really be if they get proper pissed with us . Now people are saying we shouldn’t have a third of our exports with one country … i mean , seriously ? We are going to act like we didn’t know China was a communist /dictator state who rode rough shod over human rights ? … please , a bit late to take the moral high ground now . We made our own bed , time to lie in it and cow down to China and stop talking when we should be listening . Go back to our money is the ultimate diplomacy angle . If we don’t there could be trouble in the short to medium term for our economy .

So now it’s not down to virus deaths or second waves … it’ll be down to consumer confidence . We all ready to get out there and buy,buy,buy with our disposable income to generate the economy so it can prop up the stock market ? Not sure I am just yet .. keep it for a rainy day me thinks . But hopefully the rest of the country’s consumers do just that and spend .

This possibly seems like a negative post ? , not my intention . I reckon the worst of the imminent danger is passed . Now our polly’s need to shut up about world politics and let the big dogs fight it out and concentrate only on getting us up and running .

Get Sydney and Melbourne house prices to go up yet another 20% ( as of course that’s the only housing market of importance in australia) make a few rich property developers a bit richer ( in the process ensuring our children’s children will only read about home ownership in the history books ) and get back to the “greed is good ” model . But the new intergenerational inequality movement is getting stronger so give it a few more years and they’ll work out a tax to take your hard earned winnings off you and redistribution it to the younger generations another way .

Bottom line – stock market go up – you beauty , my super has come back a bit ! So I’m happy .. for now .

Hey mate,

Big fan of the podcast and the blog. Apologies if this is covered elsewhere but I haven’t been successful in word searching it.

Why do you guys keep so much in cash? Is the house deposit money for the end of your overseas holiday?

Hi Nath,

I’m glad you’re digging the blog dude!

You’re correct. We plan to buy a house next year and will need around $80-$100K for a 20% deposit.

Why so much aussie exposure? dividends? Isn’t there more growth in S&P500?

It’s what we feel comfortable with Bob. Probably not optimal but eh… we sleep fine at night with this allocation 👍

https://medium.com/@philippsandner/decentralized-finance-defi-what-do-you-need-to-know-9cd5e8c2a48

I recommend buy a small amount of ether, make some transfers between your own accounts, use some dapps, then open a CDP with https://oasis.app/

If you’ve never bought any cryptocurrency and don’t have any accounts but you’re still interested let me know I can transfer you some, otherwise check out coinjar.