Forget the savings rates, forget which ETFs/LICs performed the best, forget the whole bloody net worth for a minute…

Whilst all very important in their own right, they PALE in comparison to what else happened in July…

🥁🥁🥁

THE PUBS ARE OPEN!

I cannot even begin to try and describe the difference in my mental health now that things have started to open up. Human beings are social creatures! Even if you’re an introvert, we all have our little tribes and as much as Zoom calls try their best, they just ain’t the same as knocking back a few with your mates at a nice rooftop in Peckham.

The other massive plus this month has been the fact that my work has opened up the office again. I’m only a 20-minute bike ride in and with luxuries like dual 27-inch monitors, coffee machines and even free snack foods, it was an easy decision to start doing a few days in the city and a few from home.

A lot of my colleagues are coming in only once a week because it takes them an hour to commute in. I’d probably be doing the same thing too if I were them but since I’m so close, the change of scenery has been spectacular not to mention the water cooler convo’s in the office. There are only around 10-15 people in at once in the office which must be a tough pill to swallow for the company as they fork out over £200K a month to rent the office space (holds around 200 people).

It’s a bit surreal atm in London. We have been heading out to pubs and restaurants and the crowds and lines are nearly all but vanished! I’d love to see some data on how many tourists and ex-pats there usually are in London and what that number is currently. It’s actually the perfect time to knock out some of the touristy stuff because there’s hardly anyone doing it!

Net Worth Update

We had an expensive month and the share market/Super went down so we still haven’t hit our all-time high of $770,141 just yet.

We have officially booked our wedding for next year and a 2-week road trip around England/Scotland for August. I’d like to do an entire post about the wedding costs so that one will have to wait (not everything has been paid for just yet) and we thought it was too risky to try and travel internationally so decided we should explore the UK instead.

I’m actually writing this update on our August road trip which has been great so far (it will feature heavily in the August NW update).

Our discretionary spending shot up heaps in July because a lot of businesses started to open back up again. We spent sweet FA during lockdown but it wasn’t a strategic choice. As I’ve mentioned many times, the trip we’re on atm was never intended to make us money. We wanted to see and do as many things as possible.

And I know there’s some of you out there that go through these updates with laser-like precision who may have picked up on our cash reserves getting a big bump while out Super has gone down. You might have guessed what happened but Mrs. FB was eligible to withdraw $10K from her Super after losing her job during the last financial year. I spoke a bit about it in the early access to Super podcast but essentially, we’re building our financial independence snowball outside of Super for a bunch of reasons and withdrawing made sense for our situation. She is also going to take out another $10K for this financial year too so expect to see a further drop in that part of the pie in the next update.

Properties

Ok so this is an interesting topic that I’ve personally been seeing and I’d love to hear from you guys to see if it’s the same or if it’s different.

We would like to buy a house when kids come on the scene and I’ve been watching the local property market of our home town like a hawk since the start of the year. When COVID hit, I set up a bunch of alerts to take advantage of a situation that might have presented itself. I mean, one of the worst economic crisis to hit our economy ever, businesses going bankrupt, people losing jobs. You’d think that house prices would take a hit right…?

Wrong!

I can only speak for my home town because that’s what I’ve been paying attention to but house prices seem to actually be going up along with the demand for them.

I have never pretended to know wtf is going on with any market because as you all should know by now, it’s almost impossible to predict the future, but taking a stab at it, surely this is a result of government stimulus right?

Job-keeper, Job-seeker, $20K FHOG, $25K Home Builder grant, $20K early access to your Super…

These things can’t go on forever… can they?

I’m sure someone is going to point out the hypocrisy of me continuing to invest in the stock market when the same could be said about its recent recovery and trying to time the housing market is the same as trying to time the share market… and to that I say… yeah I agree lol.

But it’s still fun to talk about why we think these things are happening and just what would it take for housing in Australia to take a tumble. Because if COVID can’t shake it… will anything?

I’d love to know your thoughts in the comment section.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

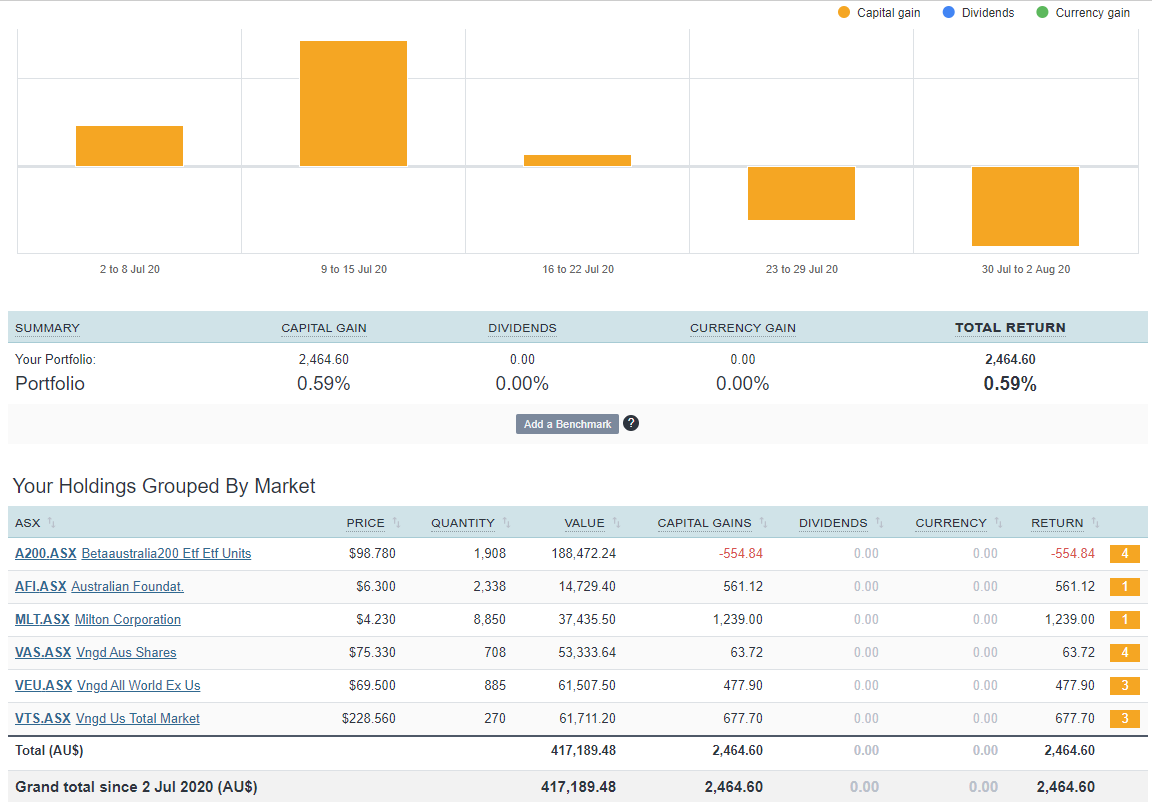

The above graph is created by Sharesight

So I actually took this screenshot but didn’t record our net worth until later which has thrown off the numbers here a bit. The long story short is that we did make some money in the share market in July but because I didn’t get around to making this post straight after, the market went down and we ended up lower in this July update then we were in June.

Also, we didn’t make any trades this month because in one of the worst kept secret ever, I have switched to a new broker… more details on this to come.

Quality content as always! Especially while i’m on night watch. Making the most of it until I reach FIRE 🙂 Congrats and hope all your wedding plans go to plan 🙂

Cheers Dave 👍

https://www.barefootinvestor.com/articles/flattening-the-financial-crisis-curve

No surprise regarding the strength of the Australian property market. Overcompensating helicopter money to the unemployed and moratoriums on debts and bans on evictions and foreclosures means there is zero financial pressure on the unemployed.

We will see how long government interference in the operation of markets will last when this becomes the new normal.

@keith_invests I had to pipe up, I’m watching friends with mortgages and children who are very much feeling the financial pressure of being unemployed and underemployed. Australians seeking financial counseling and mental health assistance is up across the board because of the financial strain people are under. Our economy is in the relatively stable position it’s in because of the governments quick action and financial incentives. I’m very grateful my house price hasn’t tanked and I’m still employed.

Kat, I am not disputing the short term blessing to many of the Government response with payments & deferrals to cushion the blow for many.

However, this is an artificial and financially unsustainable policy attempt to stop market forces from acting on payment defaults.

The financial impact of the deficit spending on non productive spending will be paid for by future generations in the form of higher taxes or debased purchasing power of their savings.

There is a financial cost to borrowing money to fund consumption.

There is no such thing as a “free lunch”. Someone will be left to pay the bill.

https://www.zerohedge.com/economics/greatest-pull-forward-history-why-recession-different-similar-worse

House prices are rising outside of the inner suburbs because those who still have jobs are working from home and don’t need to commute as much as they did, that makes the sea change /tree change very appealing especially for those city slickers. Also seeing plenty of property interest on the Mornington peninsula from cashed up holiday home buyers who can see that international travel will not open up for some time yet.

My money’s on the debased purchasing power.

In a cruel twist of fate, I bet it’s the savers who cop the short end of the stick. And those with high amounts of debt will probably have their debt eroded away with inflation.

I guess time will tell though.

100% Agree.

https://www.youtube.com/watch?v=r7qsItaz-8o

I wish I had been as smart as Ray Dalio as I currently only have 13% of my net worth in $NCM as my Gold portfolio insurance. It should be at least 20% or more as Ray Dalio has shifted his funds.

Money printing is the world’s fastest growing industry with no end in sight, which is driving risky behaviours and creating a huge bubble which could pop on any trigger (ie. US Election, Brexit, Covid19 Deadlier Mutation, etc).

I currently have 27% of my Net Worth in cash (From selling into this rally) I am keen for an opportunity to buy into some quality businesses at a great price.

$NCM looks to have continued to slide, hopefully you picked up some quality businesses at a great price with the cash component Keith

Great to hear you’re back on the beers and congrats on locking in the wedding mate!! 🍻

Cheers Cob 👍

Perfect timing on this post, I’m up at 3am trying to put the baby back to sleep and had run out of things to listen to and read.

We’re also looking for a place to buy, I’m hoping towards the end of the year prices will go down. The COVID support (government and banks) can’t go on indefinitely and it will be interesting to see what happens as a result. It won’t be great news for those it happens to but surely there will be an increasing level of default in the coming months once the support starts being removed.

How’s the biking/exercise situation been for you while on lockdown? In Sydney I replaced my office commute with lunch time rides and got to explore my local area a lot more. (PS Thanks for the shout out on the bike post a few months back!)

No worries dude.

I forgot to mention in this update that the gyms have opened back up again 💪.

I was enjoying my park workouts but it has been nice getting back in a proper gym. I’m still doing my morning rides through Battersea park each morning that I don’t go into the office. I haven’t been healthier I reckon!

I’m going to try and incorporate a morning cycle into my routine for the rest of my life where possible I think. Great way to start the day

Hi, after reading this and listening to your last P.Thornhill podcast I have to agree with you more. I have thought about this for a couple of months now. I know he said to wait it out before purchasing a property but you never know whats going to happen in this day and age and if you wanted to buy a property for stability and raise a family I say do it!!

I know you would do your due diligence and research in finding the best property at the time as well as the strengths such as locality and facilities. Yep, properties may crash but who knows they could go up as well. As long as you’ve picked out the right strengths you would of minimised risks. and its for the long term right?:

Yeah I tend to agree. It’s a bit of a contradiction to say don’t try and time the share market but then turn around and say property is about to fall and you should wait… they are both different ways of trying to time the markets really. Always hard to take all emotion out of the equation though.

I think people get too hung up about contradicting past comments.

If the facts change so should you.

For example, selling your house allowed you to travel to the UK and work and live without having to worry about renting out your home while renting overseas. If you plan to settle down and have kids in your home town, it is extremely unlikely you will be uprooting your kids from their school mates and teachers for the decade of their primary and high school education.

Given the lengthy period in a single location, you can amortize the high cost of purchasing your home over a lengthy period of time. Even when the kids leave to go to University or work elsewhere, you are likely to remain in your capital gains tax exempt home to stay near friends and family.

Your high savings rate and investments before the kids arrive increasing your living expenses and decreasing your savings rate means you have completed the heavy lifting of securing a lifestyle asset without delaying your FIRE journey unduly.

Great update as always. There has been a fair bit of discussion on propertychat about your home town. Maybe you should find an interstate investor who wants to buy in your town and you might be able to rent from them long term.

Oooo that sounds interesting. Do you have a link? I’d love to read about it please

The smartest way to acquire a family home is to find a friend looking to buy a home of similar value who is of similar financial solvency to you.

They purchase your home while they purchase your home.

Then you rent to each other the home until the mortgage is paid off.

At the end of the mortgage period, you sell the property to each other at fair market prices which should be the same assuming you bought similar sized houses in the same location.

You convert a non deductible home mortgage payment into an income stream where you can claim the interest and maintenance costs during the life of the loan.

Another wrinkle is using Super savings precludes renting the home to a relative.

Though interestingly enough a cousin is not listed as a relative for the purposes of the related party transactions for property held in super.

I could never find a friend or cousin, I could trust to be as financially solvent and as thrifty as me who wanted to buy a home at the same time as I wanted to structure this arrangement.

https://onproperty.com.au/can-i-rent-my-investment-property-to-my-family/

Wow that’s a really interesting strategy!

I feel like this is one of those strategies that only exists in theory though and the odds and practicality of pulling this off successfully is close to 0% lol.

Interesting to read though

We are just as shocked as you are about the housing market. In the area that we have our rental property in, the rent seems to be dropping but the housing prices have been pretty consistent. What a crazy world.

We’ve also been toying with the idea of taking out that $10k in super but don’t know if it’s worth the hassle, have you found it quite difficult, or worthwhile?

It was the easiest thing the government has ever done… almost as if they wanted Super to prop up the economy considering how lax the eligibility laws and process were 🤔…

100%. It’s almost like they didn’t want you to use welfare and prefer you to use your own money for your future retirement. Weird that 🧐

“The pubs are open”. Jeez I wish they were here in Victoria, and I don’t even go to pubs much. We’re back in stage 3 lockdown, although at least we’re not in Melbourne where it’s basically a police state with curfews and the like. Not happy Jan!

Hope you have a great time on your UK road trip, there’s so much to see over there. One weird thing we found is that it seems to take so much longer to get somewhere than it would in Oz, even if you’re travelling on a Motorway. Not sure why, but a journey that would be 3 hours over here is more like 4 hours in the UK.

I would imagine the property market is pretty split at the moment. Less expensive homes are apparently holding up in price fairly well or even going up in value, whereas more expensive ones are going down. I’d imagine part of this is all the handouts on offer at the moment, I think between the various schemes there is something like $45k or more on offer to first home buyers so they’re probably out buying or building cheaper homes which keeps the price steady or even increases it. Meanwhile the people who own more expensive homes may be finding that the mortgage is pretty hard to pay at the moment and they want/need to sell to free up their finances a bit. You’ve also probably got some people looking to move out of more expensive Melbourne and into regional areas which would explain this as well.

Hmmmm very interesting.

Yeah the speed limits are a bit weird here hey. The weather’s been kind to us so far too. 🙏ing it holds up

Property continues to be strong because:

1) You can lock in an interest rate as low as 1.99% for owner occupied so serviceability for anyone still employed is as strong as it has been since 2001.

2) Government incentives and bank support to help people bridge what is hopefully a relatively short period of pain has resulted in a net inflow of cash into resi property as a segment

3) Rental yields in most places are higher than the cost to purchase on an interest only basis (even after accounting for significant rental drops) so it helps serviceability of existing investors and incentives renters to shift into ownership

4) where else do you put your money? gross yields of 3-5% on property + potential for capital growth over the long term is better than what most other alternatives offer i.e. cash, bonds in a low interest environment

5) the market is more balanced than most people think. If unemployment is 15% maybe half of them are in ‘trouble’, the other half will have savings / equity / partner still working etc. that means there’s an effective ‘at risk’ of like 7.5%… for every one of them there is a first home buyer or a prospective buyer like you and I who have the savings / job security that we will jump in if given the chance. This is exactly what is happening. There’s no mass exit of people and a lack of buyers like potential buyers want to believe… the market is more balanced than you think, and your example of wanting to buy is exactly one of the reasons it is remaining so

As for taking money from super… bro I’m disappointed. You’re investing in unleveraged ETFs inside and outside of super – so you are buying effectively the same assets.

The difference being you went from a upfront 15% tax and zero tax afterwards vehicle to a 32-45% yearly tax on dividends + CGT vehicle outside of super. You could have just as easily slightly increased your drawdown rate to be slightly higher in your pre-65 life and eat into that capital before switching to super at 65… your net worth will be much larger this way vs. what you’ve done and it will have no impact on your monthly income levels whenever it is you switch from an accumulation stage to drawdown. I don’t understand your rationale at all.

Great points Mick!

I haven’t seen the data but I do too feel like there’s a bunch of people waiting on the sides for this crash to happen and as a result, the prices won’t slide back that far. Only time will tell I guess.

I’m sorry to have disappointed you mate, now I feel like I’ve let down my old man haha.

I’m well aware of the two-phase strategy of inside and outside Super to reach FIRE in Australia… I did make that calculator over 5 years ago! And yes, I do understand that it’s the most tax-efficient method but our decisions to reach financial independence outside of Super goes beyond the spreadsheet.

We don’t want to do the drawdown method due to psychological reasons and sleep at night factor. I don’t feel comfortable building up a big snowball outside of Super and having to draw it down to $0 as we enter our preservation age and access our Super. So much can change over the next 30 years and I’m not just talking about the government changing their laws. I’m also talking about our situation and maybe wanting to do things a bit differently. I don’t want our money locked up in Super even with all the tax benefits.

If I could, I’d drain my entire Superfund and put it in a higher tax environment.

Sometimes it’s not all about the money or highest net worth…

Great update mate!.

I think we will see Australian properties impacted by Covid in around 6-12 months time. The current Initiatives like Home Loan payment deferrals, early access to Super, Job Keeper payments etc wont last for ever.

On another note, I would love to get your thoughts on ‘SSP Harvester’.

I have been using OnMarket for the past few years and its been a great way to jump into Initial Public Offering (IPO) investing. They are now offering a service called ‘SPP Harvester’ which gives you access to Share Purchase Plans (SPP) by buying you 1-share in 300 of the largest companies on the ASX. So essentially from my understanding is that they take the SSP share discount and sell for a profit on your behalf. Do this for 10 companies that offer a 10% SSP discount and you may have doubled your money. The service seems a little expensive, and it’s a new strategy that has never been tested but the concept sounds great as your not exposed to fluctuating share prices. You should def check it out and provide some thoughts on it as I think the FIRE community would be interested

Future governments will raise super preservation age, there’s no doubt about that. I haven’t been eligible to take it but if I was I would’ve.

By the government opening up the early access to super so quickly it will become the new norm for every market crash. Also, if you invest in quality companies that pay minimal dividends and reinvest in themselves, eg. CSL, the extra tax side isn’t an issue. Sell down once in retirement stage

Well done on finding the rooftop pub. Also, congrats on getting married next year!

Interesting to see your partner has taken advantage of the early access to super. Have been thinking about this too as snowballing outside of super seems to make a lot of sense. I’ve been really surprised by how many people have questioned doing this in nearly all circumstances, arguing that there are tax advantages to super. Thank you for putting together your early access to super podcast – appreciate the thoughtful discussion on this.

I’d say that pulling money from Super ealry is not the right move for 99% of the population. FIRE is extremely unique in this regards as there are some people who will actually get a tax benefit from having the money outside super vs inside.

I wish I could understand the property market. Sold our big beautiful house The first week that auctions were cancelled at the absolute lowest end of our acceptable price range as I could only see property crashing – or even being unsaleable for 6 months. Turns out I could not have been more wrong. But in some ways it is still early to make a call as once jobkeeper and mortgage deferrals end we may see the real impact. However, I did say at the time when I accepted the low offer that if I ended up being wrong about property prices then that is a good thing as the world is in a better place than I feared!

I heard both sides of a housing conversation recently. A fellow I was in line behind was talking to another about putting in a low bid for a house from an older couple. He was surprised they didn’t take it, citing they are old and can’t stay there for ever (aging, health, super pension down) and the market will go down in coming months etc. And somewhat ridiculousy, “because they bought it in the 80s for $80,000 so they will still make a huge amount on it anyway”, as though buying price indicates current value somehow?

On the other side my retired mother intended to sell and downsize in 2020. She went back and forth with early COVID. Someone made a very low offer and she decided, if this is how it will be I will just stay here for a few more years (no mortage). Adding to this, the development she was considering buying into was post-posed at least a year.

Prices won’t go down if here is limited supply. Sure, forcible sales by banks would increase supply and push prices down because people will just hold as long as they can and wait a recession out. But given how soon after the Royal Commission we are, I don’t believe we will see the level of ruthlessness from banks in the GFC which would increase supply (I work for a bank). Also somewhat more unique to this time, people are often being put on reduced pay, reduced hours, or “furloughed” rather than completely made redundant, in addition to government support, therefore they can hold out longer than a old-fashioned recession too.

As someone with a young family, I would not want to be renting, full stop. I would not be trying to time the market if i knew I wanted to start a family in the next year or two. A proper desposit and have a large emergency fund to draw on gives you security over fluctuations in the property prices. Property could drop 70% and it would not impact me at all except on paper. Not everyone has the same values to could emotionally bear the unrealised loss. But for me the security of never having to pack up my kids and move with only a few months notice or worry when they destroy the house, is priceless.

I totally agree with that last paragraph Del, we have rented a lot and moved around a lot (including moving three little kids oevrseas and back again), and now living in our own home gives us the security. Renting may make more sense on paper for some, but I hate the thought of being given a month’s notice and having to move again.

💯💯💯

I’m one of those people who are happy to wait it out. We still have two investment properties and I was in the middle of trying to sell one earlier this year. But when COVID hit I was like… Eh… Guess I’ll just wait it out then. I wonder how many people are in the same boat?

If I remember correctly, the place you were trying to sell was on the Gold Coast?

If so, I think you will be glad you didn’t sell at the time. I think due to a range of factors that have already been mentioned about sea changes, flexible working conditions, low virus transmission and who can forget – great weather; Lifestyle areas like the Gold Coast are about to boom. I’m in southern GC and houses are selling before they even hit the market. You don’t even know they’re for sale and all of a sudden they have a SOLD sign out the front- and this is with our border closed to all NSW and VIC. Imagine when it’s open!

You’re correct! I really hope you’re right about them selling like hotcakes. I might have to make some more enquiries now that you’ve mentioned they are selling so fast…

we have a bit of a different approach, have knocked down and rebuilt recently and now live in the PPOR which is worth a lot and on which we owe little (<$100k). This maybe isn't the smartest way to do things but it gives us security in having a home in a good school zone (public of course) to raise our three kids and protects us against having to move (hubby is self employed so variable income). When they're older we will sell and downsize, releasing $1mil plus of equity which we can then invest.

Great to hear the pubs opening up again in London mate! Miss having a cheeky pint when I was over there

Was curious to know which area in Australia are you looking at for your property purchase?

I’m based in Sydney and there hasn’t been any house prices dropping here at all (prices are still way too high atm though), just staying stagnant at the moment.

I do believe it’s been due to the government assistance and the bank’s support programs to defer mortgage repayments but who knows when this will end and more importantly what the recovery rate will look like

P.S Make the most of the European summer before it gets cold in about a month’s time 🙂

I’m from Latrobe Valley in Vic and we’ll be looking to buy there mate.

Interesting to hear about Sydney and don’t you worry, I’ve been basking in the sun every chance I get 😁. And as John Snow would say… Winter is coming ❄

Curious what you took the $10k super out and spent it on, or where did you put it?

My wife also did the first $10k and I put it straight into the share market. In two minds whether I will do the next $10k at this stage.

It’s going straight back into the share market Matty!

As always, love the content.

Thanks Ana 🙂

Who is your new broker? I just signed up to SelfWealth from your resources section. Thanks for the information!

How are you saving 10K+ a month in cash?

By saving more than we earn.

My Target portfolio on self wealth suddenly being 0% aligned had me worried

@Aussie Firebug you mean by spending less than you earn?

lol yes!