Another month in lockdown another update with not much going on 🙃

It’s feeling a little bit like groundhog day here in London. The same old song and dance where the days are melting into weeks and then slowing into months.

For those of you reading who are working from home, does anyone else feel like they’re actually working harder during lockdown? I swear I’ve put in way more hours over the last few months than usual. Maybe it’s something to do with not “knocking off” and heading home. For some reason, I tend to get on a roll at the end of the day and I’ve found myself in a groove with work at like 7ish most nights. I’m getting a lot done but no overtime, unfortunately 👎.

I’ve also got a tonne of Podcasts and articles coming up. I recorded a bunch last month and they’ve just been in the editing room. I’ve just finished a monster post for a project that will be revealed soon so I finally have spare time in the evenings to hop back on the podcast and blog train.

Speaking of podcasts, I was delighted to be a guest on the Passive Income Project podcast the other week.

I spoke with Terry about a bunch of stuff and it was really nice to hear that the Aussie Firebug podcast was actually one of the inspirations for Terry and Ryan to create their own show. I think the show was recorded at some ungodly hour of 4 AM AEST to accommodate my time difference which was much appreciated. Although it meant that Ryan was unable to join us but Terry and I had a really great conversation.

I’d love to meet up with the boys when I’m back too. I got good “I’d have a beer with this bloke” vibes from Tez 🍻

Net Worth Update

Big gains again this month mainly from our share portfolio and savings.

It’s crazy how much you manage to save when you are forced to eliminate the travel and pleasure parts of the budget. We’re definitely tight for London standards but quite lavish compared to how much we usually spend back home.

We had a nice bump from Super too.

We’re slowly crawling our way back to our January all-time high of $770K. The markets are so volatile atm that I just can’t help but feel there’s going to be another drop before the end of the year. It’s funny how stuff like this always seems to happen during or leading up to an election year 🤔…

Properties

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

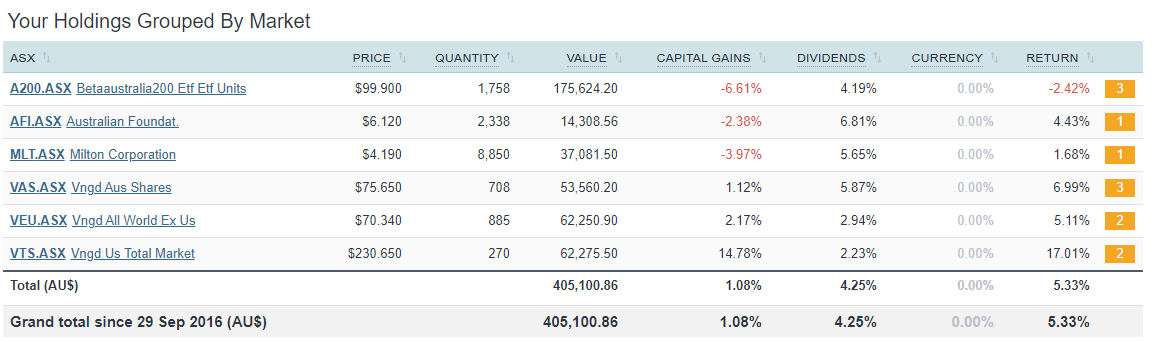

The above graph is created by Sharesight

Green across the board!

Still a fair way off the all-time highs of January this year but making up some ground at least.

We bought some VTS ($5K) for the first time since February 18th 2018 🤯. A few of you might find that strange considering I published strategy 2.5 not too long ago that basically said we were going to make the shift to IVV instead. The reason why we are sticking to VTS, for now, is because there have been more whisperings of Vanguard Australia being in the process of making changes to their US-domiciled funds. I’m 🙏ing that VTS is one of these funds.

If I were starting from scratch I’d probably just go IVV though.

We haven’t needed to buy VTS for over two years because firstly, we made a switch to focus on Aussie shares for a while and secondly, it’s been an absolute beast and is currently our best performer by a mile.

An annualised return of just a touch over 17%!!!

Insane.

And because it’s been such a strong performer, it has rarely needed an injection from us to maintain it’s targeted weighting of 15% in our portfolio.

Hi, thanks for the post.

I remember listening to your podcast with Peter Thornhill where you said it was the first big sharemarket drop you have experienced, that resonated with me as well. How are you dealing emotionally with the huge swings in the market value of your share portfolio?

I agree that there could be another big drop in the sharemarket before the year is out. The sharemarket, the US in particular, seems to have lost all connection with reality given the economy is basically shut down and unemployment is at levels not seen since the great depression. Yet it is still near all time highs?

Let’s hope the Fed will pump a few more trillion into the economy if we do get another drop in the market and prop up prices for a bit longer. I sympathize with those who hold the view that all this central bank intervention is killing capitalism.

Anyway, they are strange times we are living in and I am getting cynical in my old age :). Thanks again for sharing the update.

No worries David.

We handled the huge drop this year surprisingly well (touch wood).

There’s something to be said about still being in a job though. Also, even though the data suggest not to have a whole lot of cash, it was super comforting having around $70K of dry powder in the reserve when shit hit the fan in March.

All this pumping of money is just insane, isn’t it? I’m trying to read up on MMT a bit more as it claims to be able to explain how this isn’t going to end badly.

Great to see the portfolio ticking back up again, long may that continue!

I was finding for a while that I was working longer hours by logging back in after the kids had gone to bed. Now I’m consciously trying not to do that because I don’t think it’s good for my work/life balance, and I really don’t want to get into the habit of being switched onto work mode all the time.

It’s a trap!

“Oh the computers right there… I might as well smash out that bit of work I was going to do tomorrow morning… ”

sigh

Offset Account Question:

What are your thoughts on putting above $250k (gov guarantee) into the offset account? And have the PPOR fully offset with one account?

I want to keep the accounts simple but having above $250k would add risk we could split it but this would only be for comfort. Any other ideas that you have come across?

Good question. I’ve never had over $250K in cash so it’s never come across my mind. What’s stopping you from investing it?

Hi AFB,

Hoping you can clear up my confusion. When you add up your networth pie it equals 765,944… what are the liabilities that are being deducted to get the 736,970 number (-29k)? Also, you have saved 16k cash this month however your ‘cash’ allocation has decreased from prior month (-87$).

Is this a typo or am I missing something? thanks and sorry for being nosey.

Cheers!

Hawk like vision dude haha!

HECS debt is not visible in these updates (I should probably add it in) but it’s factored into all the numbers.

Our cash savings didn’t go up by $16K because we spent around $8-9$K and bought around $5.5K worth of shares. So our actual cash reserves stayed pretty similar due to our spending (and investing).

Hope that clears it up mate 👍

Sounds like $16k is income rather than savings?

Comparing to last month, this month’s gain would seem to be $5.5k savings invested (VTS purchase), $4k super increase, and $25.5k share increase – but hard to know as all the numbers don’t add up!

Hmmm that sounds wrong. Sometimes I can stuff the charts up but the overall net worth number is always correct.

lol if I could fool myself to put it out there that I was saving $16k a month, I wouldn’t listen to anyone trying to put some sense into me either. Good luck with it, I look forward to seeing what you come up with next month!

Yeah it’s around $16K in savings. But some of those savings went into shares.

You’ll always know how much my shares went up by looking at the sharesight graph 👍

Next months update is just around the corner so stay tuned 😁

haha yeah ok that makes sense now. cheers!

U cant include what you spend in yer net worth mate. u sure this is yr net worth and not how much ya spent the past 10 years on booze ya dog? working outs fucked but the answers good mate promise yeah ok mate weve heard that before sizing up me mate Stevos shed the dickhead

lol. Bloody Steveo!

Hey AFB,

I love reading your posts for a while now. Thanks to you I am about to reach my 1st 100k if it wasn’t for this pandemic it would have already happened few months ago.

Thanks for putting out the content to motivate us.

Also if you need help with editing the podcasts hit me up. I am a video producer by profession so can help you out with that. 🙂

Aye same bro, I am only a couple k off the big 100 too. Congratulations!

No worries dude, I’m glad you’re enjoying the content 👍

Nice work joining the 6 figure club! I’m actually using a new tool to edit the podcast these days and it has greatly increase my productivity. So hopefully I’ll be able to pump out a few more each year

Hey AFB

Is there any word on the VEU being changed as a US- domiciled fund? I emailed Vanguard a few months back and they said it was not on the agenda.

Thanks.

I would be really annoyed if they only changed VTS and not VEU. But now that you’ve mentioned it… I’ve only heard about the change for VTS. I just assumed VEU would follow suit too

Quote when I asked Vanguard in September about both VTS and VEU being domiciled.

“I can confirm that this is being looked at by our ETF team but i can’t confirm any details on when this may become available as of yet.”

Hey mate,

You mentioned that if you were to start again you’ll go with IVV I assume because of DRP and avoiding filling up the form every 3 years. That’s in lieu of VTS. What about VEU though? Would you do IVV + VEU? Would you consider IWLD?

Good question.

I haven’t actually found a good alternative to VEU just yet. IWLD is ok but VGS+A200 would also work.

Just hoping Vanguard changes the domicile so I don’t have to think about this stuff haha

Hey AFB – great stuff as always! Also enjoy your pods, keep up the great work!

In line with your reflection on VTS vs. IVV (if you were starting from scratch, etc), I noticed that a couple of times you vaguely mentioned that if you were to start again today, you probably wouldn’t have bothered with the Trust structure, so would you mind elaborating on why that would be the case?

Cheers

Will do Pete.

Trusts just complicate things. You don’t need them and while they can be beneficial, I’d rather spend my time and energy increasing my income and/or savings rate. Those two things have a far greater impact on your wealth!

Great stuff as always Firebug. How long until you reach your FI number and will you continue the blog after this ? I hope you are still supporting Spurs over in London !

Well, it depends on what the markets do but I’d say around 2-3 years away. A lot can change though so we’ll see. I don’t plan to continue to blog after we reach financial independence. Maybe an occasional post here and there but that’s it. I want this site to be an archive of our journey to FIRE. Once that goal is reached it’s onto the next one 🙂

Hey AFB, great update once again mate! Always nice to see the portfolio ticking upwards again 🙂

I definitely hear you with the working harder from home scenario! Having never worked full time from home myself, I’ve found that work was blending into home life and lines were being blurred. This has been a big topic of discussion at my work and we even had a guest speaker at one of our “lunch and learn” online Zoom sessions who had been working from home full time for nearly a decade. He gave us some great pointers, tips and tricks.

First, he wanted us to recognise that “Covid WFH” was not the same as working from home full time remote in normal times! It’s a stressful time with lots going on in the world, and especially with people having kids at home, parents especially are being asked to work essentially two full time jobs. Best few pieces of advice were 1) Set clear boundaries – have a designated work room or work desk, so you can “go to the office” 2) Set a schedule and stick to it – schedule breaks for lunch, going for a walk, etc, 3) Dress up for work! Hard to “show up” if you’re still in pyjamas and dressed for relaxation!

I found this blog post especially useful as well. Hope that helps! https://blog.hubspot.com/marketing/productivity-tips-working-from-home

Great comment Papa.

It’s been a bit hard in London because I’ve been working, sleeping and mostly eating in one room and it’s starting to get to me.

I can’t wait to get back to Oz and actually have a semi-decent room/office set up. I can’t set boundaries in our flat and it’s sucks 👎

Hey AFB.

I was just wondering as you also use Sharesight, the last couple of distribution payments from VAS and VGS I’ve had to manually work out the franked and unfranked amounts from Vanguards Tax Estimates PDF and then manually enter them into Sharesight.. this use to be automatic but since the start of 2020 Sharesight seems count the entire distribution as unfranked.

A question I should probably ask Sharesight themselves but I was just wondering if you’ve had the same issue?

EDIT: Sorry just VAS.

Hmmmm interesting Scott. Yeah it’s more of a Sharesight question, unfortunately. I’ll have another look at my Sharesight now