After much thought and consideration, I’ve decided to end my ‘Ask Firebug Fridays’ segment after the announcement from Australia’s financial services regulator.

On the 21st of March 2022, ASIC (Australian Securities and Investments Commission) published new guidelines for ‘Discussing financial products and services online‘.

These new guidelines have major implications for content creators in the FIRE and personal finance communities.

This is why I wanted to share my thoughts and opinions on these new guidelines and what they mean for AFB moving forward.

What?

In a nutshell, ASIC is cracking down on unlicensed creators who they think are giving financial advice or are seen to be ‘influencing’ their audience.

Their definitions and examples for what constitutes ‘influencing’ are clear as mud.

They don’t even give a clear answer to what defines an influencer either, having followers ‘In the thousands’ apparently 🤷♂️.

But who’s an official follower anyway? Someone who listens to one episode of your podcast or YouTube video? An email subscriber? A Twitter follower?

You’re probably thinking they’re only targeting people giving specific or dangerous advice right?

Well, you’re in for a rude shock.

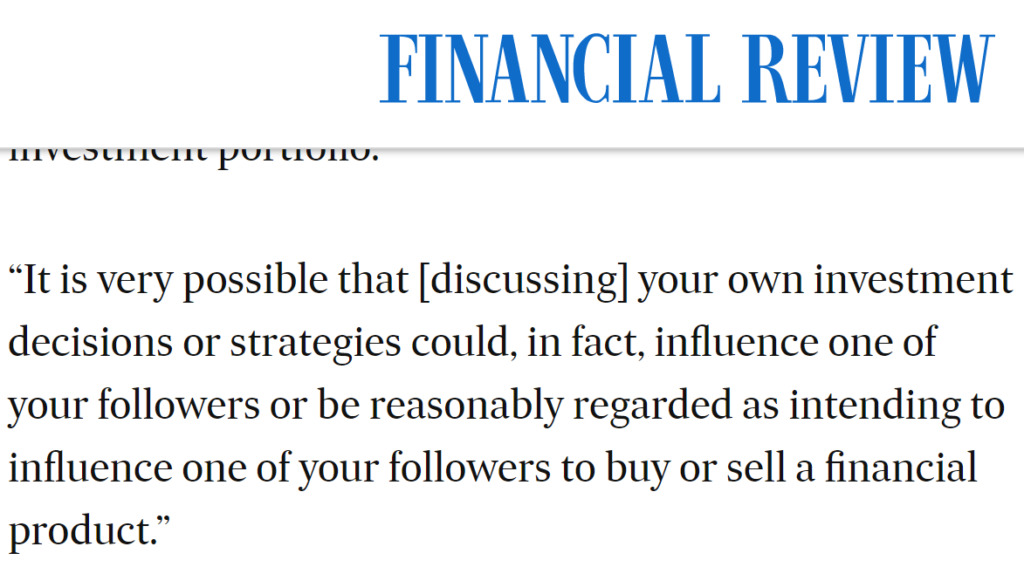

We can’t even discuss our own investment decisions or strategies apparently 🤔.

It gets worse.

So… discussing financial products online such as “shares” or “ETFs” without a licence is now illegal…

WE CAN’T EVEN TALK ABOUT ETFS?!

🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩🚩

This is kinda a big deal.

Stopping people from discussing ETFs is starting to drift into the totalitarian type of conversation. And I don’t say that lightly, but a government that restricts people’s right to discuss certain financial products under the guise of ‘it’s for your own good’ starts to remind me of that book that George Orwell once wrote.

Maybe you’re not worried about these specific new guidelines, but it’s the precedence that they set that should cause alarm. No one cares about anything until it impacts them.

What would you say if one day ASIC released guidelines prohibiting unlicenced parents from talking about money and investing with their children?

That’s perhaps hyperbole, but these new guidelines are one step closer to that dystopian future.

My other issue is there are so many questions and definitions that have been deliberatively left unanswered or are so vague that no meaningful conclusion can be drawn… but let’s move on.

Why?

Let’s give ASIC the benefit of the doubt and say these new guidelines were introduced to protect investors.

This is a good thing!

If an investor loses money after receiving bad advice from an AFS (Australian Financial Services) licenced professional, theoretically they should have a pathway to recoup some of those losses.

If an investor loses money after receiving bad advice from someone on TikTok… bad luck.

AFS licensees have to adhere to a set of minimum requirements which provide important protections for investors if something goes wrong (aka a lot of expensive insurance).

With the explosion of online financial content in the last few years, it makes sense for ASIC to take a closer look at what’s going on. Most content creators are producing honest/useful stuff, but I have to admit that there’s been a trend of creators clearly making content primarily for monetary benefits.

You know what I’m talking about. Creating content for the hell of creating content to make sure their channel stays fresh in the algorithm. Releasing rehashed stuff every second day basically repeating what they’ve already said 100 times.

If content creators are receiving a monetary benefit, there will always be some bias no matter what.

“Show me the incentive and I will show you the outcome”

– Charlie Munger

I love this quote and it’s highly applicable to this situation.

Content creators that make money from affiliates and/or sponsors will always have a conflict of interest no matter how small.

And this applies to me too guys. I try my best to be as unbiased as I can but we all have some sort of bias no matter what (sometimes at the subconscious level)! This is especially true when you’re getting kickbacks.

I think the ‘why’ behind ASIC’s new guidelines is fair enough and makes a lot of sense viewed from this angle.

Having said all that…the way ASIC has chosen to crack down on these bad actors is heavy-handed at best, and oppressive at worst.

How?

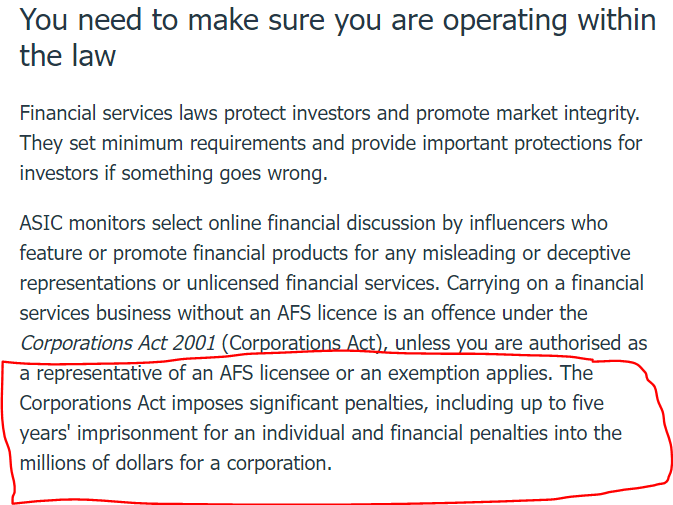

ASIC’s solution to regulate an influx of online financial content creators is to make them pay for a licence (which can cost tens of thousands of dollars a year) or threaten litigation to the tune of $1M+ dollars in fines and up to 5 years in jail… 🙃

To say that this is harsh would be putting it lightly.

To put that into perspective, Australian gangster Mick Gatto has served less jail time than the maximum sentence ASIC can dish out…

A financial content creator might serve more jail time for talking about ETFs, than Mick Gatto… 🤔

I’m starting to think we’re losing the plot here?

Lazy Policy Personified

Let’s recap so far.

ASIC’s solution to a few bad apples within a thriving community of online financial content creators is an all-encompassing blanket rule that will crush independent media.

It’s sorta like dropping a nuclear bomb to get rid of an ant nest in the backyard.

Overkill doesn’t even come close to what these new guidelines are and the only people who are going to be left standing are the big media corporations that can afford to pay the licence fee which can be as high as $30K a year.

Here’s an idea. Why didn’t ASIC just come out and say that anyone who monetises online financial content needs to hold an AFS licence?

It’s a lot more specific and tangible and would weed out people who are only in it for the money pretty bloody quickly.

But no. In typical government fashion, the corporate watchdog releases new guidelines that are so vague and light on details that 99% of online financial content creators are caught in the crosshairs.

I understand resourcing constraints and ASIC doesn’t have the time to monitor everyone and everything but surely there’s a happy middle ground.

A few bad apples shouldn’t ruin it for everyone.

Is The Cure Worse Than The Disease?

The public opinion of the financial sector has been in tatters ever since the royal commission in 2017.

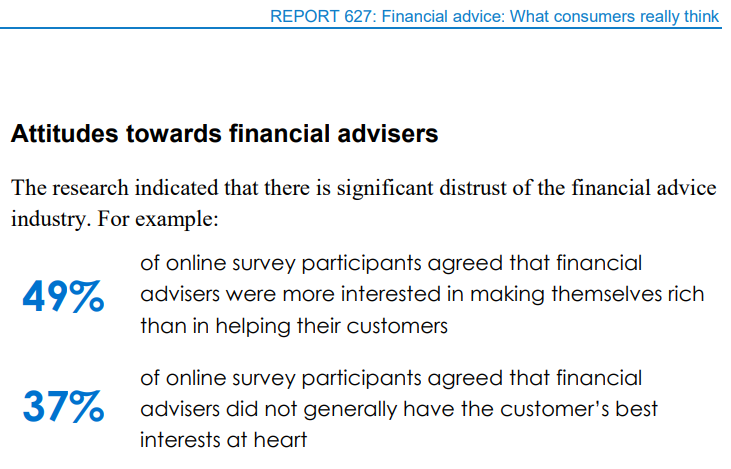

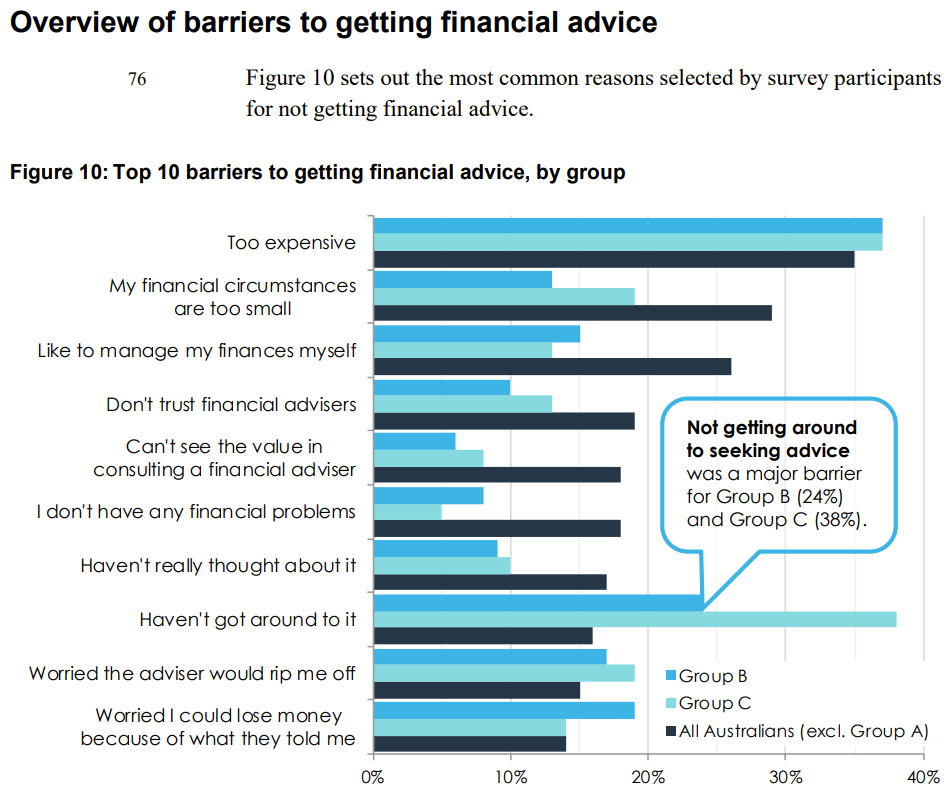

ASIC released a report in 2019 titled: Financial Advice: What consumers really think which found that 49% of those who were surveyed didn’t get advice because they thought advisers were more interested in making money for themselves. On the other hand, 35% didn’t get advice because the costs were too high.

A lot of people are being priced out of financial advice and even more, don’t trust financial planners. The data backs this up time and time again.

I’m not saying regulation is a bad thing, but I think these new guidelines are doing more harm than good.

The truth of the matter is that legislators have made the costs of offering financial advice so high, that the people who need it the most can rarely afford it.

Who should we be prioritising?

The 22-year-old that’s just finished her marketing degree and is trying to make some good financial decisions for the future?

Or the 64-year-old multimillionaire Boomer who owns 7 investment properties?

Why do the legislators think online financial content creators are so popular?

We’re filling a gap in the market that has been created largely because of overregulation.

Some regulation is needed, but these new guidelines are going to wipe out good education material that helps bridge the gap between “I don’t know anything at all” to “I feel confident discussing my financial future with a professional”.

That’s where we content creators thrive! We make stuff relatable and give personality to what can otherwise be a dry topic.

Casualties

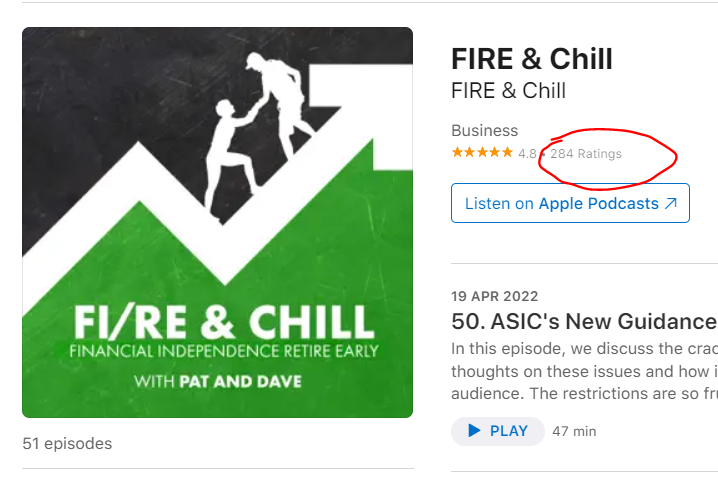

One of my favourite podcasts ‘FIRE & Chill’ decided to shut down in April because of these new guidelines.

Sad day today.

Our last episode of FIRE & Chill just went live. @PattheShuffler great working with you over the last 2 years mate, had lots of fun!https://t.co/jejn9MId6H

— Dave Gow | Strong Money Australia (@strongmoneyaus) April 18, 2022

This is a podcast that averages 4.8/5 on 284 ratings on iTunes and has conservatively helped 10’s thousands of Australians with financial literacy.

Here were two guys making relatable content, for free, that had great reviews.

Another victim of these new guidelines was John Palmer from the very popular YouTube channel ‘INVEST for the future’. John spoke about investing fundamentals drawing from his decades of experience and never charged any money for his videos.

“I know everybody would still like the videos to be there, but I just can’t afford to take the risk”

-John Palmer

Family Finance is another creator that had to delete a bunch of content. She now can no longer give an opinion on financial products 👎

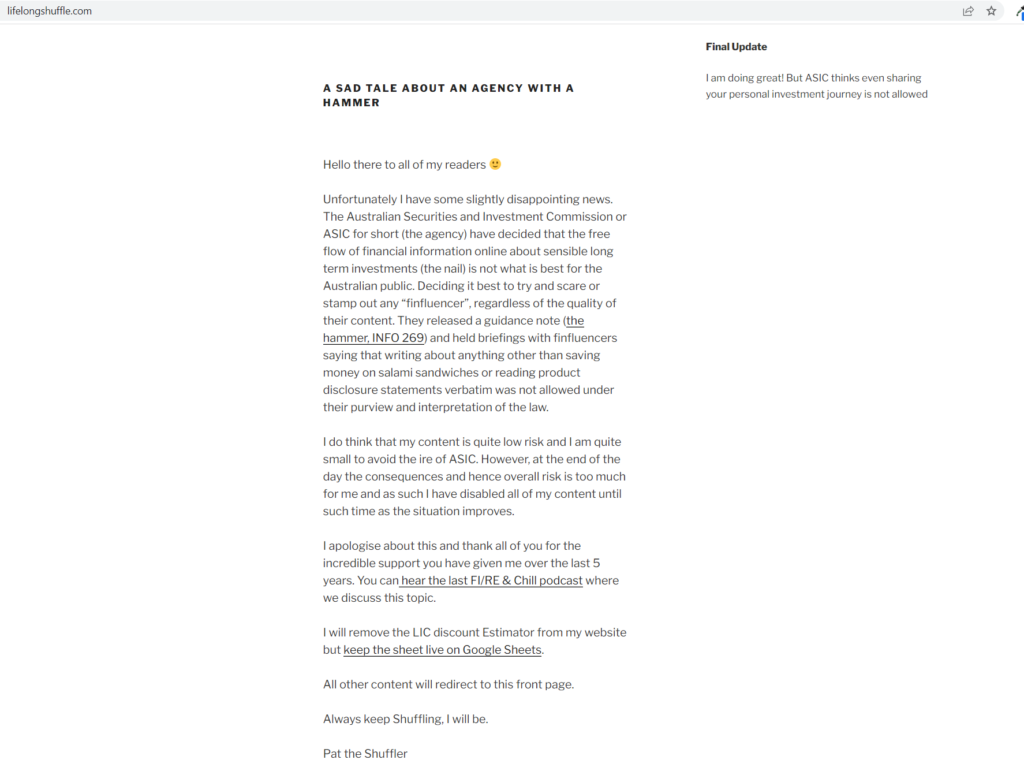

The Lifelong Shuffle blog is another one that has gone into hibernation because of the new guidelines.

I could go on and on showing other examples of great content creators that have been impacted by the new guidelines but I think you get the point.

The new guidelines are inadvertently snagging 99% of fantastic freely available Australian-specific resources.

Below is an AFR article titled ‘These young investors don’t want ‘finfluencers’ to go‘ which tells us what we already know. Many young investors don’t trust the financial industry and are looking for alternatives.

As I’ve previously mentioned, 49% of Aussies don’t get advice because they think they’re being ripped off and 35% think it’s too expensive.

You’d think that ASIC would be putting more time and energy into ‘cracking down’ or improving the professional industry where the public has clearly lost trust?

Yet, ASIC is targeting online financial content creators who have amazing repour within their communities that don’t charge a dime.

I want to repeat this point because it’s important.

Many young people have lost faith and can’t afford advice in the industry that ASIC regulates largely due to over-regulation. Content creators start to fill this void and collectively rack up millions of views, downloads and sessions from a generation hungry for financial knowledge. The numbers don’t lie. If people didn’t like what the content creators were making, they wouldn’t watch, listen or read.

Shouldn’t we want financial education to be accessible for everyone and not just those who can afford it?

More regulation sounds good in theory but the data suggests that it isn’t working.

I have no doubt in my mind that ASIC had the best intentions when they came up with these new guidelines.

But as the old Portuguese proverb goes…

The road to hell is paved with good intentions

Rules for thee but not for me

One of my biggest gripes with this whole fiasco is the hypocrisy.

ASIC’s position is that unlicensed content creators might ‘influence’ investors to make costly decisions yet ASIC themselves are publishing content that’s detrimental to wealth creation.

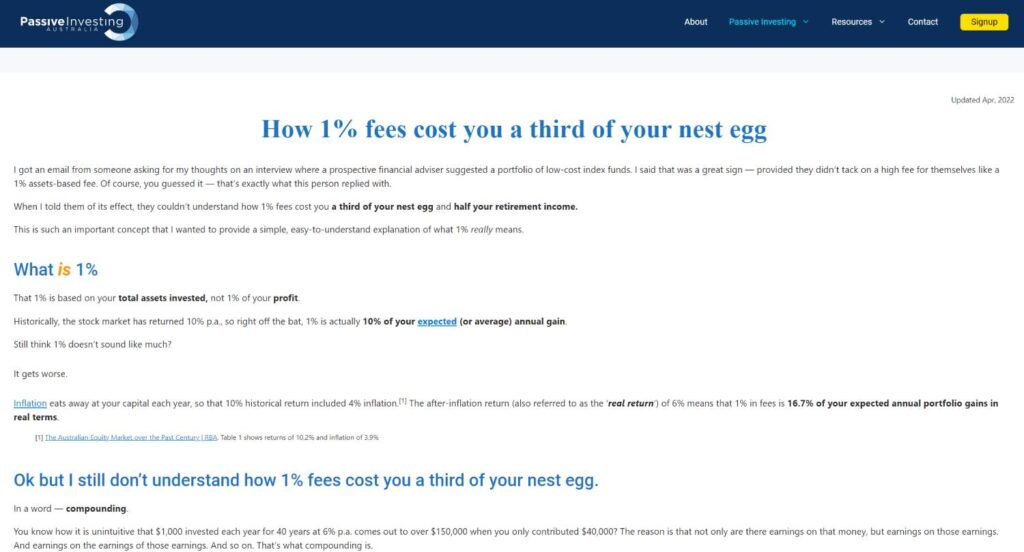

Case in point, the Moneysmart website.

Moneysmart is a Federal Government website, brought to you by ASIC.

To be fair, they have a lot of great free resources and tools but their advice for financial fees is downright terrible.

Here’s a cracker.

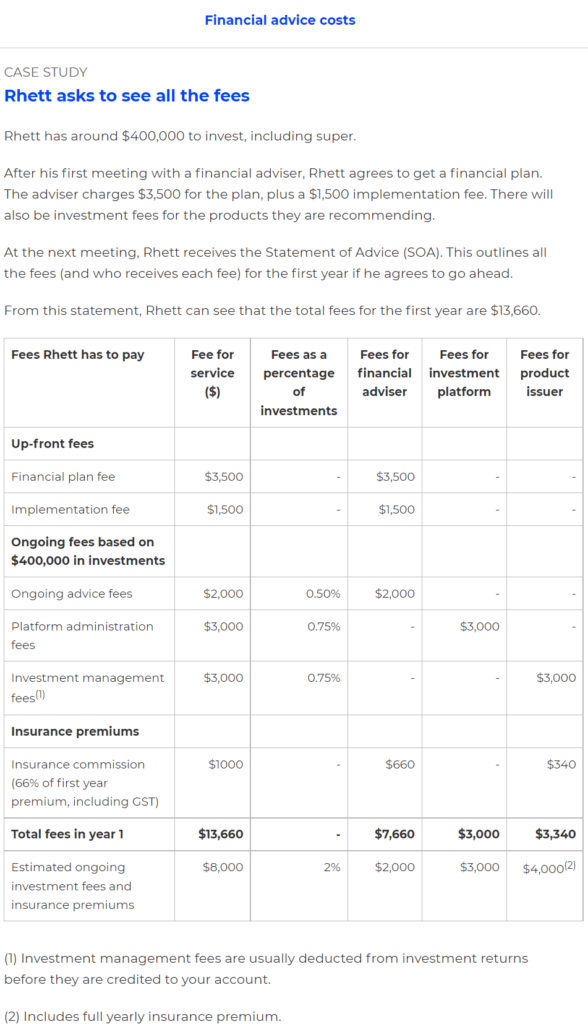

I won’t go into all the details but the important part is what they’ve published as the fees for this case study.

And I want to remind you that the title of this article is ‘Financial advice costs: Pay the right price for the right financial advice’.

Rhett’s total fees for the first year are $14,000 (Moneysmart’s aggregate column is wrong). This is made up of:

- $7,660 for the financial adviser

- $3,000 for the investment platform

- $3,340 for the product issuer which includes full yearly insurance premiums

$14,000 in fees is 3.5% of Rhett’s original investment.

Worst still, this case study estimates investment fees and insurance premiums to be $9,000 (another summing error) per year ongoing perpetually. And $2,000 of that being the fee for financial advice regardless of changes needed to be made or not.

All up that’s an ongoing fee of 2.25%.

90% of people will have no idea if 2.25% is high or low which makes advice from a government-run website like this so insidious.

How on earth is ASIC justifying this content when they know better than most that normalising these fees serves to further line the pockets of advisers and product issuers rather than the investor.

This is a huge problem because so many people are going to read a case study like this, that is backed by the government and just assume that paying an ongoing 2.25% in fees is reasonable.

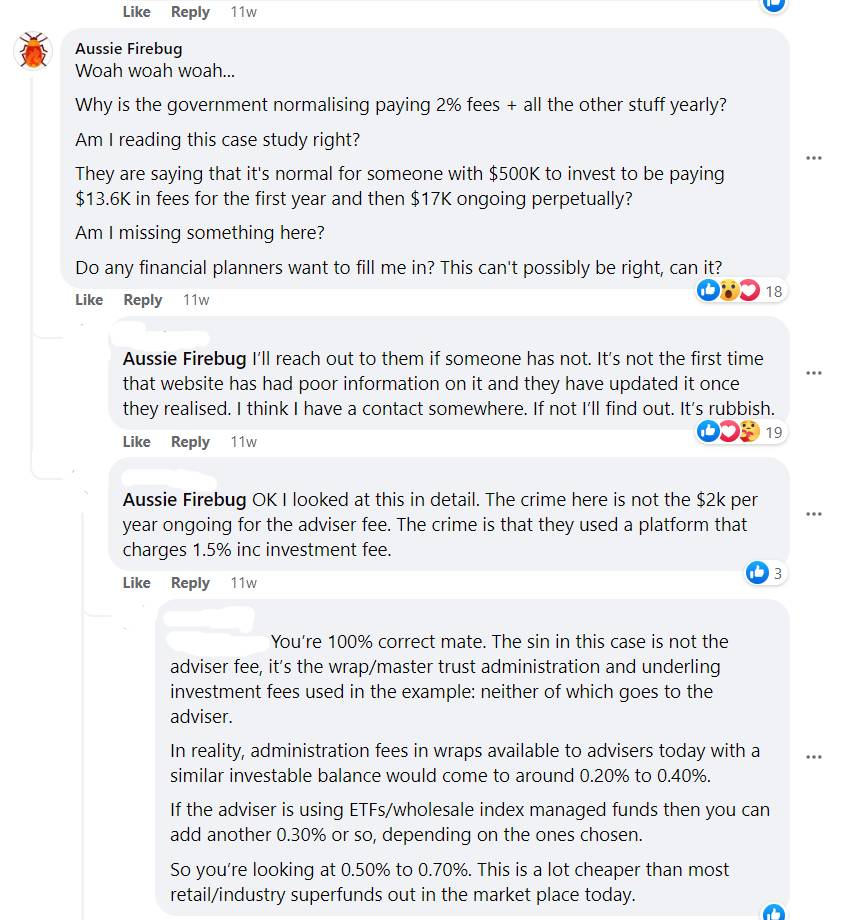

In fact, this exact case study was posted in the FIRE Facebook group where most of the professional financial advisors also agreed that the case study fees were too high.

But as most of us know in the FIRE community, fees play an enormous part in your wealth creation journey.

A great explanation of this can be found here on the PIA website.

How on earth did the responsibility of not being ripped off, fall to a bunch of content creators without any formal education in finance.

It’s almost as if ASIC wants to normalise these fees so AFS licence holders can still profit after paying an arm and leg in regulatory costs impose on them by the very same organisation…

I wonder what would happen if the majority of the population became financially literate and stopped paying these high fees 🤔?

One could speculate that ASICs’ main source of revenue would dry up pretty quickly.

But that’s just speculation of course…

The End of Ask Firebug Fridays (AFF)

These new guidelines have already claimed a few scalps in the FIRE community and AFF will, unfortunately, be added to the list 😢.

I started this FIRE Q&A back in 2018 after getting hundreds of emails from readers each month. I was putting so much time and effort into answering the same questions that I thought a public Q&A podcast would be able to spread the knowledge better.

The AFF segments are clearly in breach of these new guidelines which unfortunately means they will have to be removed.

I’m going to leave the episodes up for the month of July and then remove them from my podcast RSS feed.

If you want to keep an offline copy for yourself, use this link here.

The AFB podcast will be restricted to the interview style format which will focus on the journey, mindset, and life philosophy. I’ll have to tip toe around discussing specific financial products.

We’ll see how it goes.

What Can We Do?

If we want to make real change we need to communicate our message to the legislators that make the rules.

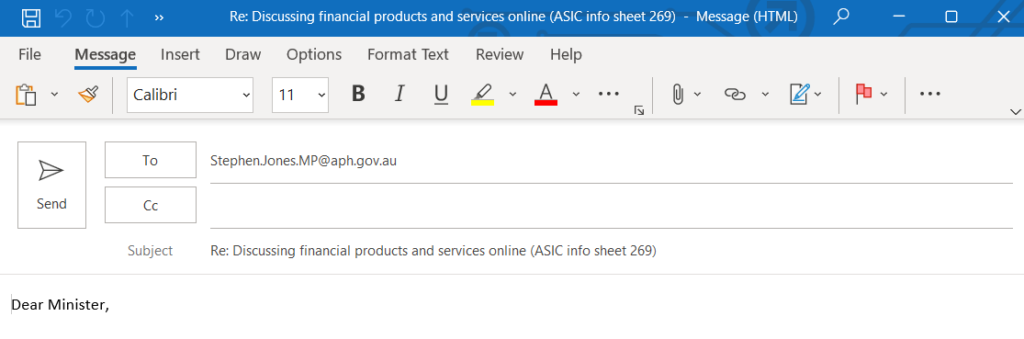

Stephen Jones is the Federal Member for Whitlam and the Minister for Financial Services.

He has real power over how the legislation is written. ASIC merely enforce the law, they don’t make them.

Emailing his office is probably our best bet.

His email address is [email protected] but if you’re on a computer or smartphone, clicking the below link will automatically create an email filling in all the important fields.

If you’re going to send me an email, here are some key points you might want to include:

- Introduce yourself and the issue

- Explain why this issue is important to you

- Include an ask (suggest a change or alternative)

- Be passionate and polite

- Request a follow-up

Wrapping Up

These new guidelines won’t affect me or my family that much. I might have to shut down a part-time hobby I enjoy which is creating content for the Australian FIRE community.

It’s the next generation that I’m worried about.

I can tell you right now that if these guidelines were in effect back in 2015 I would have never bothered creating AFB at all.

There’s a bunch of teenagers growing up right now that will become interested in their financial future in the next couple of years.

Who are they going to relate to?

It sure as hell isn’t going to be a middle-aged Aussie Firebug that’s hopefully blogging about the perils of raising children by that point.

The next generation of Australian financial content creators will most likely never appear because of these guidelines.

The finance industry will keep trucking along and there will be some bigger financial media corporations getting around but it won’t be the same as the independent grassroots movement over the last 10 years.

Maybe we’ll look back and say that the last decade was the golden age of free-flowing information driven by a small bunch of enthusiastic finance nerds on the Internet…

As always,

Spark that 🔥

Another totalitarian way to keep people financially uneducated and uniformed by the system. They finish school without a basic life skills so they plod through life as debt slaves. This must continue, they can’t have glitches in the matrix

This makes me so sad, and also angry! There has been so much amazing content created that has helped me a great deal over the past decade to get our family out of debt and start building our future, and my own confidence and passion for finance. It’s so disappointing to see that the next generation won’t have access to the same simply explained information, or be able to see what others are investing in to use as inspirational case studies or starting points for research like I did.

Recently as we started to build more wealth I thought about using an advisor and had initial meetings with 3… All 3 tried to push me in the direction of different niche products with high fees and few advantages over what I currently have in our portfolio, and it’s only through the knowledge I’ve built following content creators like you that I was even savvy enough to realise that’s what was happening!

And yet, the dodgy property and crypto spruikers are still able to do as they please! It definitely feels like ASIC are barking up the wrong tree with this one

Property is not a financial prodict regulated by ASIC….go figure !

Thanks for the support Christie.

Unfortunately, your story is all too common. The industry is a mess and they decide that the real problem is content creators.

Makes no sense.

This!

What a well-written piece. This issue has enraged me so much. As someone who has been interested in my financial future since I was 17, without parents who could teach me anything more than “save 10-20% of your pay”, I’ve had to navigate all of the information out there with a massive amount of skepticism. I always found the “this is what I’ve done with my money” type of content to be the most helpful and valuable … and authentic. Not to blindly follow but to go along the journey with lots of lessons learned. With a lot of content from overseas, having local Australian content was even more relatable and specific. It gave me the courage to take that first step and to invest rather than sit on the sidelines, without having to drop $3-5K upfront for financial advice. I’m 40 now and in a great position financially but, like you, I despair that this will contribute to further wealth disparity.

Well said Bianca.

I have emailed Steve now. We don’t want war and peace of paid financial advice. Just the good financial hygiene built into lifestyle is enough for most of us.

Thanks Alano. Every email counts!

I agree its unfortunate a “one sized fits all” approach has been taken by ASIC but the amount of hyperbole around crypto coins and the recent experiences of many “investors” in these products has most likely forced their hand. Perhaps some smart operators with a AFSL will sign up the good podcasters/content producers but I doubt. The last banking commission brought in a lot of rule changes for financial “planners” and wait until mortgagees start complaining about “how the banks lent them a million dollars to buy a home that has lost 30% in “value”.

Literally just after I commented I got a newsletter from Dave (Strong Money Australia) to say he now has a partnership with Pearler and can keep publishing under the protections of that post the ASIC announcement… so I imagine a handful of creators will get those sorts of partnerships, and many others won’t and will disappear…

The industry pays the fees to ASIC who set the rules. How is that not a conflict of interests?

Outrageous! We need to stand up and say something people. I urge everyone to email Minister Stephen as suggested, it only takes a few mins but by doing nothing we are allowing this happen in some respects. We lost our life savings and super due to so call licensed accountant and financial advisors and its only been through Podcasts and other online services like AFB that we have been able to rebuild for which we are very grateful for. Our future generations will definitely suffer if these new laws are enforced, not all of us have parents or ones that know anything about finance and to take these online services away is so wrong.

The Problem is people making the decisions, its a generational issue.

The boomers as we call them, are so far out of touch with reality. It seems as if they are just trying to help their mates out by keeping the investment advisory industry going.

If you look at the history, the policy decisions taken by boomers –

– Free education in the words best schools, universities. Now you have a sell a kidney to get an education

– Lower Income Taxes as their generation started getting more wealthy

– How capital gains and taxes on property work in the current times are all geared towards keeping the wealthy – wealthy

The system isn’t designed to allow someone who isn’t already well off to even compete.

Advise me if I’m wrong, but does this legislation only cover Aussie content providers? So we will all still be able to get bad advice from overseas providers which would have to be the biggest percentage on line?

In a theoretical sense I think it would apply to all content accessible from Australia, but in practice it would be impossible to enforce or prosecute anyone providing such content from outside Australia.

Thank you so much for article and all your content. And especially for advocating for financial literacy. I hope you also find a way of keep writing unrestricted material for the benefit of whoever wants to be money smart (without relying on the gov website hahah). Thank you!

Will miss AFB.

However, Instagram and Facebook are full of ‘influencers’ whom are talking about finance with little or no knowledge or experience.

All you have to do is look at some of the portfolios people are running on Pearler…

I’m not leaving completely Leigh. Just shutting down the Ask Firebug Friday’s segment 👍

Your blog and other great Aussie blogs have helped me navigate residential and commercial property investment, shares, SMSF and soon ETF’s too.

Over a decade ago my wife and I were persuaded to see a financial planner. $6500 for the initial report and then keep him on the drip feed at $500/month. Well that was a terrible experience where I felt he was fixated on filling his pockets and looking to pimp me out like a prostitute to his mortgage broker mate and insurance broker friend.

After just a few months we cut ties.

It was a horrible car crash in slow motion that so many financial planners rehearse and hunt for.

Now I am keen to direct family and friends to podcasts, online blogs and resources and many great books.

So sad and frustrating that ASIC (no doubt hounded by greedy spruikers and ‘advisors ‘ want to censor so much goodwill and community

Agree with you 100% had a similar experience. Promised something magical but was was nothing special and I took it over and have done fine with the help of AFB and others

It’s unfortunate that your story is all too common Mark.

I don’t blame the Financial Planners. I think they are just operating in the framework that’s been set out by the government. Of course they are going to get angry at the FIRE community for providing free education. Trust has been lost in the industry but the regulators just keep pushing for more regulation.

It’s insane.

Very well written – I agree with pretty much everything you’ve said and think that ASIC have definitely gone too hard with a complete lack of nuance here. Sad to see sites like yours forced to go this direction – I think you provide a valuable resource of education – and genuine financial education is something severely lacking in our world of spruikers and marketers. I hope this isn’t the end and that some common sense can be found.

Thanks a lot Simon.

Genuine financial education is so important, I 100% agree. Just because you have a licence doesn’t mean you’re going to give genuine advice ESPECIALLY if you charge a recurring fee.

That is absolutely appalling .it is clear that the financial adviser industry do not want any transparency .your blog was a shining light in this area.i suspect more people are going to fall prey to scams as a result of lack of financial literacy .

If only the TGA could regulate “wellness influencers” as effectively as ASIC is trying to stomp on financial content creators. Like it’s OK to put out a tik-tok talking about cutting out gluten from your diet can cure you of cancer and hey, click on this link to an amazing supplement that will do nothing but give you expensive wee, but god forbid someone talk about ways to invest your own money in things that are themselves quite strictly regulated already 🙁

💯!

You’d think the government would care more about health than finances, but apparently not.

You should try and get one of the AISC bureaucrats on your pod or better still the MP himself to explain this dog’s breakfast of a policy.

I’d love to… but it would probably point an even brighter spotlight on my blog if I did that… Let me have a think about it

Reading through the linked ASIC page, it appears you can’t say that an asset is likely to go up. So essentially, an ‘influencer’ can only discuss mechanics.

But what is a ‘discussion’? What is ‘carrying on a financial services business without an AFS licence’? What is an influencer?

Terrible news. Instead, ASIC should crack down on created content that does not adequately carry disclaimers.

It’s deliberated vague so they can shut anyone they want down that’s not paying them $$$

Matt, this is such a shame.

I’m now FIREd (or perhaps that should be FIRaWUtbaTAd – Financially Independent; Retired at What Used to be a Traditional Age – early 50s), and your spreadsheet was the first tool that helped me confirm that I could actually be close to being able to take that step – and was what allowed me to discover FIRE.

I’m financially savvy – people look to me for advice (and I always say “this is not financial advice” in a stern voice – even to my children), but in a traditional sort of way, and there’s so much in the FIRE community that is not traditional that if people get their advice from “traditional” sources, will not get a chance to put in place early enough to get the benefits early enough.

I didn’t really know about FIRE until I discovered your spreadsheet, and it really helped me think about pulling the pin from the daily grind much earlier than I otherwise would.

You having to pull the pin from the content you create must be shattering for you, and I’m not going to make it less so by confirming just how valuable it is – even for financially literate people who aren’t young!

Thanks for all your hard work to date, and for kick starting me on the journey. 🔥

Thanks for the lovely comment Bernard. I’m not going anywhere just yet but these guidelines are going to discourage future content creators that will no doubt take over the space when I pull stumps.

We need more young people talking about this stuff. I won’t be relatable to younger generations forever. A new wave always comes along but I fear these new guidelines won’t allow it.

This makes me so frustrated!! These regulations will only push people towards overseas unregulated material. Somehow someone forgot that they can’t regulate peoples thirst for knowledge. Young people don’t go to financial advisors they ask the internet and they go on social media to get information. Will ASIC’s next steep be to regulate what we can view on the internet? Hello China 😡.

Just curious – what does ASIC aim to achieve through this? Is it the same tone like Gary Gensler in USA calling out “Investor Protection”. We all know what they mean through that. They want us common people to be less knowledgeable on financial products and want us to be corporate slaves? Our education system already are producing only the corporate slaves and for all I’ve grown up – never have I been taught about Finance, Financial Independence, Money, Economics including basics of reading a candle chart in any college curriculum or school levels. This is such a sad state if all Government wants us to be naive and just plough through working hard, saving hard and keep spending based on marketing gimmicks. I seriously can’t wrap my head around on understanding the “why” or the motivation behind ASIC doing these things.

No, you got it right. “Investor Protection” AKA “Protecting Corporate Investment”. FI has always been about educating people to spend LESS on marketing gimmicks and more on assets that generate wealth. Imagine if everyone was financially literate what it would do to corporate profits. 99% of the useless shit marketed would lose its market.

Corporations ARE the government now through their lobbyists. Thus ASIC is essentially an arm of biggest corporations and their biggest shareholders.

They want us dumb, drugged up, sick and slaves to the corporations. Then we can’t resist any tyrannical new orders they give us, just like this one.

What does ASIC aim to achieve through this? The official story is they’re safeguarding “the average Australian” against “wolf of wall st” style scams run in the digital age through influencer’s. But the penalties they’re threatening are way to over the top.

As someone who no longer lives in Australia, it’s so clear what a nanny state it is, through and through … I’m so glad I don’t live there any longer.

… AFB outlines a different theory above “It’s almost as if ASIC wants to normalise these fees so AFS licence holders can still profit after paying an arm and leg in regulatory costs impose on them by the very same organisation…

I wonder what would happen if the majority of the population became financially literate and stopped paying these high fees 🤔?

One could speculate that ASICs’ main source of revenue would dry up pretty quickly.

But that’s just speculation of course…”

Hey Firebug, long time listener, first time caller. What you’ve done with AFF has been wonderful for the financial literacy and agency of so many of us looking to take ownership of our own financial future. Thank you so much for these segments, I’ve emailed the Member for Whitlam and will encourage all the friends I’ve got hooked on Aussie Firebug to do the same.

Great work my friend, and thanks.

Lengthy email sent. Dave (SMA) also referenced a different person a few months ago who I emailed as well.

All I can say is this blog and several other Aussie content creators changed my financial future for the positive.

The examples ASIC lists directly contradict what you say, it is not illegal to discuss financial products, it’s only illegal to recommend financial products and/or promise returns on them (which it always has been) or promote trading service while being affiliated with what you recommend. Saying “I’m shutting this down because of ASIC” is indirectly admitting to wrong doing.

“it is very possible that [discussing] your own investment decisions or strategies could, in fact, influence one of your followers or be reasonably regarded as intending to influence one of your followers to buy or sell a financial product”

AFB lists his investments in his networth and that could arguably influence someone to buy similar products. Shit, even I seriously considered buying BTC after AFB said he did… (I haven’t … yet)

In any case, it’s not “indirectly admitting to ‘wrong doing'” … shutting this down is saying ‘this isn’t worth the risk of potentially going to prison for 5 years’. I mean, do you have a Personal Finance blog that you’re not shutting down?

Hi Egor,

I suggest you re-read the article. I have screenshots that back up my claims mate.

ASIC is on record saying that discussing ETFs could be illegal. This is unprecended.

Also an example which is the epitome of a patronising attitude to financial information for the masses can be found on this web page about investment bonds from Macquarie Bank https://www.macquarie.com.au/advisers/strategic-fit-of-investment-bonds-part-1.html. Before you can access the page, you need click through a popup dialog box which says:

“Important Information – Restricted to financial services professionals

The information on this website is provided for the use of financial services professionals only. In no circumstances is it to be used by a potential investor for the purposes of making a decision about a financial product or class of products.

In order to proceed, please confirm that you are a financial services professional by clicking ‘I accept’.”

When that is exactly the kind of detailed information finance nerds are looking for, rather than the vague marketing stuff, which lacks real details, that most financial product sites publish.

Dude .. sorry to hear this.

To be honest, the content about FI that I find most interesting is *not* the stuff that discusses investing strategies. What I do find interesting is the stuff around human behaviour, living your best life, not being a slave to the rat race and all the rest of that good stuff. I think you could maintain a high quality content site, without ever discussing what specifically you’re investing in.

It’d just be a shame for the people who *are* late to the party and are looking for guidance on what passive investment products are out there…

Thanks mate.

It’s funny because that’s what happened to me too. I started reading blogs to understand the nuts and bolts. But once I understood the basics, I was much more interested in lifestyle design and what people did after they had reached FIRE. The human side to it.

But yeah, sucks for people just starting out.

Sorry brother! I look forward to seeing how it continues to play out. May even get to hear about you moving overseas to avoid ASIC….

Hey Mate, Thanks for all your advice over the years, have looked forward to each article/podcast you’ve released. Very inspirational and I’ve always found your advice to be balanced. You hit the nail on the head, online content has been filling a void for people that don’t trust financial advisors and want to get started in investing without paying financial advisors high fees. So crazy that the very reason for avoiding high fees and using low fee investing/advice is what ends up ending the possibility of giving free financial advice! #dont hate the player hate the game!

I agree wholeheartedly with everything you said and have enjoyed your posts tremendously along with others who have so generously imparted their own knowledge and story. Email sent to Stephen already!

Hi AFB, thank you for breaking this down and sorry to hear of the impacts that the new regulations have brought. I am a long-time listener and first-time poster. Your blog, self-journey, and podcast have provided a fantastic platform for which I started my investment path. I have emailed the MP and hopefully some change can come from all of this. All the best and will continue to read and listen to what you are allowed to post.

Hi AFB, ASIC were established in the late 90’s and didn’t act while the financial industry runamuck ripping off hard working Australians for years. This ruling is an absolute joke. Ive recently turned 50 and its been a breath of fresh air to see the many young bloggers like AFB trying to help all Aussies get ahead. You’re right, the next generation will get ripped off with 2% plus fees and being charged. Who will they look up to? Crypto, NFT influencers? Thanks for your articles, they have been very informative and like other similar blogs, have helped me on the path to building a great nest egg for my family. I’ve been reading your blog for years, keep up the great work however you can.

Thanks for the support Dave 🙂

Hey AFB,

Sorry to hear you’re having to shut down the ask firebug fridays session. I’ll email the MP above, is there anything else that could be done? Could you group together with other like minded credible content creators like fire&chill, money flamingo, etc and get a license between you

Or get a VPN & start the Bali FireBug podcast

There are a few options that I’ve been mulling over.

I really want to keep my independence and not be associated with another media company or fall under a big brand… but at the same time, I don’t want to be thrown in jail haha.

We’ll see how things pan out.

Long time reader, first time commenter. I just email Stephen Jones about this. You’re completely right about ASIC not writing the laws but I think it’s important to note that Ministers have the ability to direct how legislation is enforced (i.e. is it a priority or not). Beyond the fact that the new Government has a large list of other pieces of legislation that it will seek to publish, it would probably be easier to persuade a Minister to direct a different level of enforcement than to change the legislation in the short term. Either way, ASIC’s measures are heavy handed and will just reduce the access Australians have to financial literacy and that’s bad for everyone.

Longtime listener, first-time commenter. I really think that we can have a WIN-WIN here. My view is that ASIC and the legislators hear the horror stories and ultimately, have a narrow view of fixing the problem. There is a gap in the market that has been filled by content creators. Indeed, there is a way to ensure content creators are vetted for their credentials and/or experience when it comes to investing. Sadly, there are people out there that are not savvy enough and need protection. More importantly, they need to weed out the pariahs out there that prey on people’s retirement.

Ultimately, it comes down to money, is the government willing to invest to fix the underlying issue? Probably not unless there is enough push from the public.

Thanks for putting a call to action! I think if enough people reach out, we should have a positive change.

I think I’ve only ever email a politician once before in my life, but I just sent one now. With the current climate I’ve been reading and thinking a lot about my personal situation, and to find out this has happened makes me really sad.

Australia’s economy is great if you’re 55 and have paid off your house. Not so great if you’re 30 and just started a family.

it is good ASIC catching up with this influencer and taking them to court. Now, you may be open to your portfolio and openly talk about ETFs (mostly) but law can’t be constructed separate for ETF and separate for LIC and separate for individual stocks so though ETF like VAS or A200 or VSO or VGS covers massive market and traded by insto so no one can simply influence their prices but at the same time limitation of law will take all etf same as stock to avoid any confusion in my opinion.

so though few good writer like yourself may not be able to openly promote/talk about etf it is in best interest of community at large particularly young ones that this law is not just created but also implemented to strictest possible way in my opinion. there are way too many dodge stock pumper influencer on twitter who even today pump stocks and they needs to be made accountable for it in my opinion.

We’ll agree to disagree but I think these guidelines do more harm than good.

Thanks for the comment though.

If I were someone who frequents tin foil for my hatting needs I’d almost think that the powers that be want to keep everyone working, paying maximum (employee) tax instead of pursuing financial freedom and actual wealth. But I guess in reality, we can again thank crypto for this. Plagued with scams and just blatant illegal activities by some of the related services businesses.

It’s a sad day whenever a governing body puts a law in place dictating what a free citizen can or cannot say, but our society always ends up catering to the irresponsible minorities, who, for example lose their money on the promise of a 10% weekly investment return or something alike.

It’s the same reason I am not allowed to use my barbeque for the majority of summer.