I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

Super late update for May.

I’ve had a lot of family commitments lately and work has been surprisingly busy. As a result, AFB content has been on hiatus.

I’ve still been recording podcasts though and I have some really good ones coming up in the next few weeks (the first one hopefully drops this Friday).

I got the spicy flu (COVID) in May which knocked me out for a few days. I felt tired AF for 2 weeks and still can’t shake this annoying cough. Not bad though all things considered.

The timing was pretty bad because I had another BJJ (Brazil Jiu-Jitsu) tournament I was meant to be training for. I lost so much fitness from COVID and only had 2 weeks to get back in shape.

I wasn’t at my best but I still had a great time competing.

BJJ tournaments with mates you’ve been training with are the best!

Net Worth Update

All investments were down around -$20K for May with the only saving grace being 2 big invoices that were paid for my freelance gig. That, along with our other income sources miraculously saw the NW grow by $5K this month. I have a hefty tax bill coming up though so the cash reserves will be taking a beating soon 😅.

Our cash holdings continue to climb in preparation for a few big-ticket items in the not so distance future.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

One of our most inexpensive months so far since becoming homeowners!

Shares

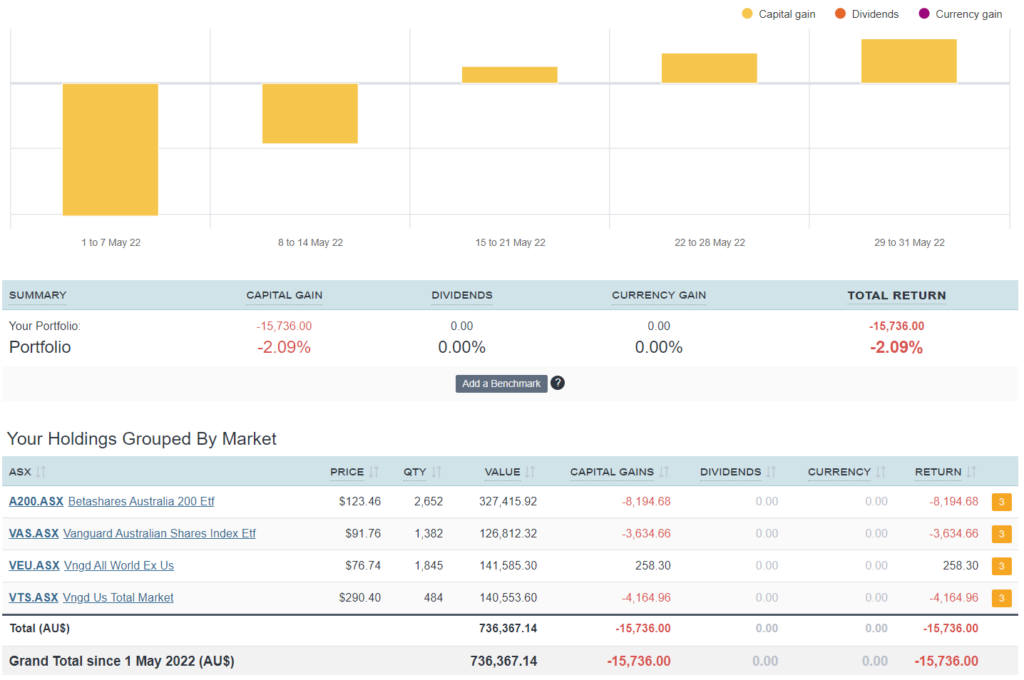

The above graph is created by Sharesight

Oooft!

Down $15K ain’t pretty but as all accumulators should know, a bear market is precisely what we look forward to!

We bought $5K of VTS in May as this was the holding most underweight in our portfolio at the time.

Mate your timing with the lump sum into shares and then again into Bitcoin is crazy unlucky haha but your optimism continues to stand tall and perceivably unshakable. I truly admire that. Its going to interesting watching how that unfortunate-timing pans out in the future and to see if it really matters much at all, in the long run…

I know right 💀💀💀

But I’ve had a lot of luck over the years so it all works out haha.

Well done again mate for staying strong in these uncertain times. Keep that savings rate going whilst you both can! Question for you, do you still have any LIC’s in your portfolio as I read in your 3rd strategy, or are you solely topping up ETF’s as per you target portfolio balance.

Just ETFs these days boss. LIC are still cool though 🙂

Good to hear you made it through your bout with Covid ok, as well as all the BJJ ones! Bit of a bummer with the way markets are at the moment, but that’s the way it goes from time to time. Must be nice to see the freelance income hitting the bank account!

Mate… I’m pumped that the prices are so low haha.

I just wish I still had my big lump sum from the start of the year 😭

Have you gone down the big Rona yet mate?

Yep the fall in the market works out well for us accumulators even if it doesn’t feel great when your portfolio is down a 6 digit amount! Oh well, not the first time, won’t be the last.

Despite having a kid in kinder, another in school, a wife who is out and about a fair bit, as well as myself being fairly social, we still haven’t had the Rona yet! No idea how we’ve avoided it given so many of our friends have had it, but it’s gonna happen sooner or later I figure.

And a week later, I’ve tested positive. Reckon I got jinxed! Hopefully it doesn’t knock me around too much!

So far the rest of the family is testing negative, will see how things go.

Ohhh no!

Well, we’re all going to get it sooner or later anyway. Just a matter of time.

Would you have the same outlook if you started your investing journey in 2007 in stead of when you did.

Timed the market well with your initial investment.

No idea mate.

The financial world was a different place pre-2008.

Question my friend, you are still invested in both VAS and the Betashares 200 (with the lower MER). I thought the plan was to transition away from VAS and over to the Betashares entirely? Perhaps you answered this in another blog post but I haven’t seen it! Cheers mate

Hey AFG,

love your content have actually been following and using your strategy for years as after too much information yours lead to action as it just made sense 🙂

i have been getting to Peter Thornhills philosophy of investing and I know you are also a fan, key question.

WHY ARE THERE NO LICs in your portfolio?

I’m now reading your 2019 article about buying AFI and MLT but i don’t see anything in your portfolio.

Is following Peters advice and buying LICs out of date, or has EFTs now just become so much better than them?

Was going to buy AFI and SOL (as they merged with MLT) but based on what your doing just put all in A200 makes more sense cause cheaper fees.

Is the reason you dont hold any as both the LICS have been trading at a prenieum for some time?

Love some feedback from your great mind, before I just reinvest all into EFT or LIC 🙂

Hi Andrew,

I’ve listed my reasons for going 100% ETFs in this article here.

Cheers