Late update this one.

Even though I’m only working part-time, it was a pretty busy April/start of May.

Two major updates:

- We sold IP3 🎉

- We have gone unconditional on another PPOR (the first house we got accepted on fell through due to a bad B&P report)

I’ll make another post that dives into the numbers from the sale of IP3 similar to the one I did for IP1 which you can read about here.

The market conditions were just too good to pass up and we received two offers that were in the range we were happy with so after a bit of back and forth, we accepted an offer and had a smooth sale process.

It turned out to be an investor too which was surprising. The agent we used to sell the house had told me that 90% of the sales were going to first home buyers and not investors. This worked out perfectly for our long time tenant who was very worried about finding a new place because apparently, new leases are hard to come by.

It’s just crazy what Covid has done to the real estate market.

This is why we were even more stoked to finally go unconditional on a PPOR after a successful B&P. Yeah, we paid more than we would have liked to but that’s just the way the game is being played at the moment.

We ended up paying $515K for a 4 bedroom house that’s 10 years old in the area we wanted. We realistically could be in this house for 15+ years. I reckon this place would have sold for around $420K fourteen months ago but oh well.

I know there’s a lot of people sitting on the sidelines waiting for a crash to happen and you know what, they have very good reason to believe that one might be just around the corner. I mean, investing fundamentals are cactus right now and nothing seems to make sense.

All I’ll say is that you need to make the right decision for yourself and nobody else. Sometimes it’s not about money either. Paying so much for a PPOR was definitely not the best financial move for us. Renting a smaller place would have been a lot better money-wise. But we’re getting married in a few weeks and hopefully having kids in the coming years. I love the fact that we’re in such a strong financial position to be able to get the house we wanted without any financial pressure whatsoever.

To me, that’s why we invest and care for our wealth in the first place. Not to make the most money but to live a happy life.

I honestly can’t wait to move in and finally, finally set up a home just the way I want without any restrictions. We’ve always rented/lived at home so this will be the first time in both our lives where we can bring Mrs. FB cats into our house, decorate and design our living space, hang some pictures of our travels on the wall etc. It’s very liberating and I’m definitely going to show off the home office/battle station once I’ve fully set it all up 😁

Net Worth Update

The share market did all the heavy lifting in April and we managed to crack the $900K mark, woohoo!

One loose end we finally managed to clear up was sorting out the rest of our money in the UK and closing all of our accounts. Our bank accounts have been a mess since we’ve moved back to Australia and a huge priority this year for me was to streamline our investments/bank accounts.

Selling IP3 was a big improvement and now we only have IP2 left to offload which I plan to do at the end of the year.

We’ve also changed our personal banking to UP which unfortunately isn’t a supported bank with Pocketbook (the software we use to track our expenses). Add the new accounts I’ve had to set up for my new business and things have been getting unwieldy very quickly. We basically haven’t been tracking our expenses very well for the last couple of months and it’s crazy how many things slip through the cracks when you’re not on top of it.

On a positive note, my new consulting cheques should start coming in next month so I’m really keen to get back on track with investing and not just building our house deposit.

Properties

Most of the property updates have been covered above. I’ll be adding the in-depth article from the sale of IP3 in future updates.

Property 1 was sold in August 2018

Property 3 was sold in April 2021

*DISCLAIMER*

The current value of our properties is a rough guesstimation based on similar surrounding properties. I only really update these when we get an official bank valuation

ETFs/LICs

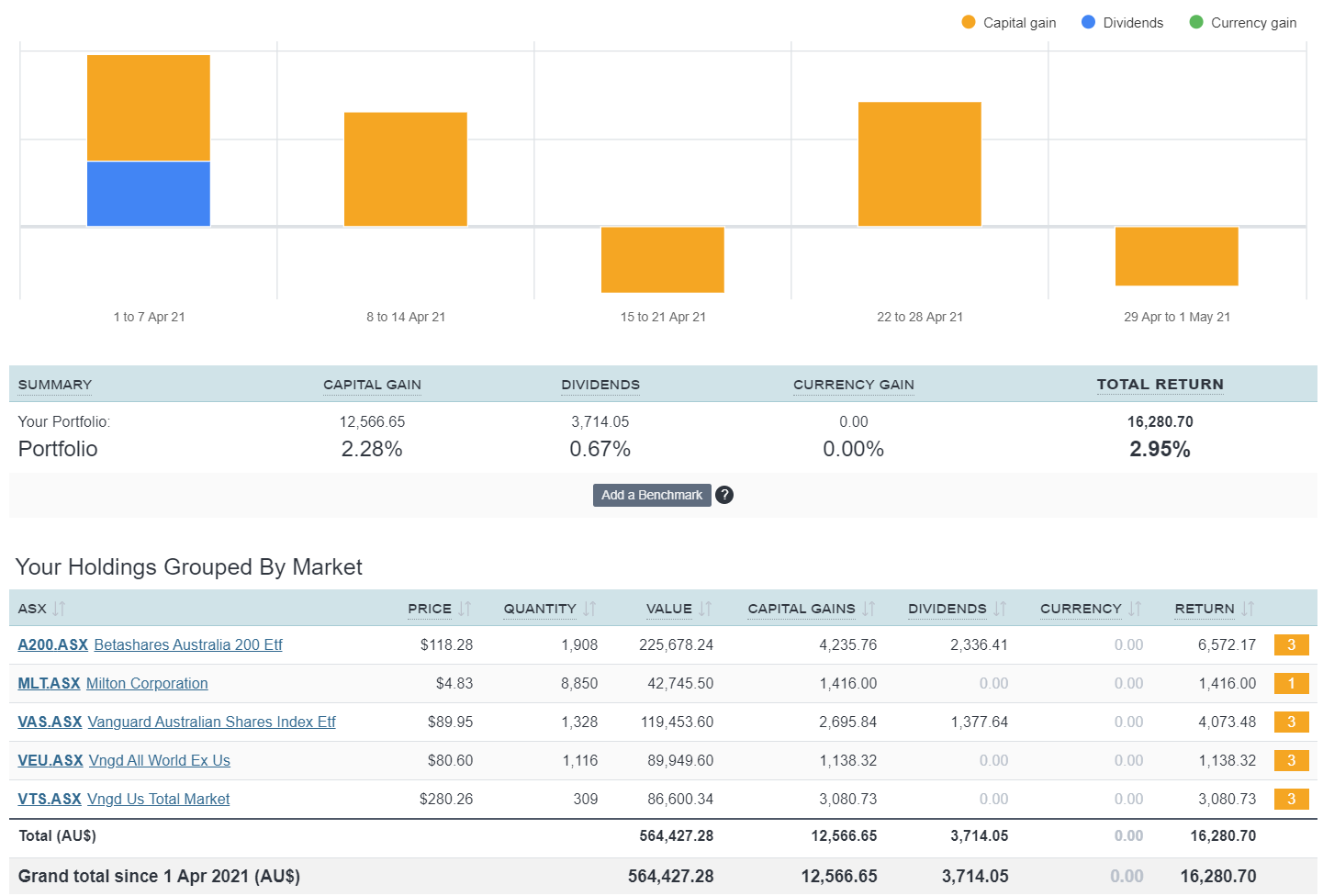

The above graph is created by Sharesight

We didn’t buy or sell any shares in April as we were continuing to build our house deposit. However, now that we are unconditional, I’m really looking forward to getting back into the swing of things with our share portfolio. I’ve got some big plans with how we’re going to debt recycle the PPOR and I really can’t wait to settle on the property and get cracking.

Congratulations AFB on the big purchase!

And as you say, being able to make that with confidence, and without any pressure is the reward for years of effort and mindfulness.

Looking forward to hearing about your new stage as a homeowner! Great that you have the flexibility to just leave the ETFs and LICs to continue to compound as well.

Cheers mate 🙂

Well done on the PPOR! 🎉

Will you be including your PPOR value/debt numbers into your net worth number?

Absolutely! We don’t actually settle until July so you won’t see the numbers come in until I drop the July update.

Congratulations on the PPOR. It may not be the “best” financial decision but it provides a security that is worth much more than money, especially once children are involved. I look forward to reading about your debt recycling strategy. We have been debt recycling on a small scale for a couple of years. I have finally convinced the other half that it is something we should be using on a grander scale to pay down our mortgage.

Thanks Joce!

Congratulations on the house purchase. I’m looking forward to the debt recycling discussion. We are looking at doing this with our property.

Ditto!

Cheers Cath.

Heaps of people are interested in it. I can’t wait to share how it goes in an article/podcast

Congratulations and well done. Did you buy in Melbourne,

Thanks. Nope, back in my hometown in Latrobe Valley, regional Victoria.

Congratulations on the house.

Thank you for sharing all these details over so many years, it’s always refreshing to receive your update and both see how you’re doing and gain tips on what I could improve on.

Looking forward to the next chapter of watching your financial growth whilst raising kids and setting up your own home.

Thanks Andrew 🙂

I’m looking forward to what the future holds too!

Congratulations on the house purchase, hopefully it’s a great place for you and the Missus to raise a family!

Hopefully the timing all worked out with selling off the IP during this FY when you have lower than usual income so the CGT won’t be as bad as might otherwise have been the case?

Cheers HIFIRE.

You’re right onto it mate. I was really keen to offload one of the properties before the 30th of June this year for that exact reason. I’m so happy that we managed to do it for the right price too. The market conditions just fell into place for us. We got lucky I guess.

I’m booked in to see my accountant this Friday to discuss the trust distributions and how this sale affects the modelling. There are a few moving parts this year. I can’t wait until it’s simplified into just shares but that’s a year or two away still.

Hey FB! So cool and congratulations on the home, super exciting times! I wanted to ask you, and it may not be something you share, but are you able to show how much you actually have invested in your index funds vs how much has been capital gain?

Very exciting times Stacey.

We’re currently up $167K from the share market. So that would mean we have invested roughly $430K cash. But a lot of that cash has come from property gains… which makes it tricky to work out.

I might do a post that details exactly how much we have actually saved vs how much has come from the markets.

A family home for $500k. That’s amazing.

If I wanted to live near my work in Sydney $500k would buy me a 30 year old studio ‘apartment’, ie… a hotel-room sized room where I would be able to touch the stove from my bed.

It would have been closer to $420K 14 months ago! That’s country living for ya though

Great update, looking forward to hearing about the PPOR – what deposit, LVR, how and how much you plan to debt recycle, was it difficult getting a loan on just Mrs FBs income ( assuming that’s what you did or did you count investment income?) , what is the house owned in ( trust or name/s) etc etc . How will that pie chart look next month, maybe not much red and more orange………

– 20% deposit

– 80% LVR

– Debt recycle plans are being formulated. A lot could happen here… I’m meeting with my accountant to do some modelling this Friday. I’m keen to discuss the results with you all once it’s done but there are a lot of moving parts.

– Mrs. FB could have got the loan herself without me

– House is owned in Mrs. FB name

– A lot more orange for sure… but we don’t settle until July so the pie won’t change much until that update

congratulations on your new home. Got it for a bargain!

Thanks. It was actually quite expensive for the country but we’re happy with it

Hi ,

Can you give us a view of how you intend to debt recycle please?

The actual implementation is very confusing please.

I plan to do a big article on this once I have a plan in place. I’m meeting with my accountant to do some modelling because there are a few moving parts to our situation. Stay tuned!

Congrats, mate! Without giving too much away, are you somewhere in regional VIC, maybe close to where you lived at home?

Yep, Latrobe Valley mate

Hi

Two questions:

What does PPOR stand for?

Will you buy your house outright?

Primary place of residency (PPOR).

We plan to have a mortgage for the house.

Congrats on the PPOR which is a very important milestone to settle in life….On investment property considering we are in a property boom till interest rates are low for few more years and the benefit of leverage it should give better returns then same money invested in shares hence can you explain your logic around selling the investment property ?

A boom isn’t guaranteed. Selling the IP fits into our investment strategy and we don’t want to manage properties anymore even if they do yield a higher return.

Oh, and thanks you very much 🙂

We’re stoked for the new place

Congrats Firebug! Big moves for you and Mrs. AFB! I’d love to hear how you are going to approach your home loan/ how you built the deposit against investing more, did you use FHSSS etc but I just wanted to say I cracked open your August 18 NW post from this one. It was when I started investing and I wanted to see what your ETF section of your protfolio was at. One of your lines in there caught my interest.

“VTS continues to DOMINATE.

It has had a total annualized return of 26.16% (or $14K of gains) since I first bought it in 2016 and has been my best performer by a mile. I almost want to sell it to lock in those gainz because surely it can’t go much higher. And if you look at the incredible bull run of the US…surely it’s gotta come down at a certain point. But timing the market is a suckers game so I will sit for now.”

At the time it was at 206 bucks – now at 280. Well done on your patience bud, keep paving the way with Strategy 2.5.

Cheers,

Tom

Cheers Tom,

The home loan is a really interesting question that I’ll have a better answer to once I meet with my accountant to do some modelling to determine how exactly I’m going to structure everything.

I didn’t use FHSSS, we just stopped investing for a year and built up the deposit that way.

That’s really cool that you found that line mate. Just goes to show you the power of sticking to the plan hey.

Hi AFB, Is there are reason you hold A200 and VAS? Is it to capture a bit extra of the ASX 201-300 but still being heavy on the ASX200 and lower fees? Not sure which blog post to read to find it, there’s so many! Thanks!

Started with VAS. Went to A200 because it was less than half the price. Bought more VAS to spread management risk across to products that are basically the same. No other reasons.

Congrats AFB!

BTW, looking fwd to results of the survey you conducted few months back. Cheers mate.

Congratulations on the PPR! I’m also looking forward to the debt recycling post (or podcast) once you’ve worked through the detail. Given interest rates are so low I was about to take a chunk of money out of my PPOR offset account to invest in indexed funds but then I read about debt recycling and stopped in my tracks. Since then I’ve been a bit stuck because I’m not clear on the best way to go about it or where to turn for good advice.

Congratulations mate! Just wanted to acknowledge all the great work and the information you have been providing via this medium. Much appreciated and take care of yourself!

I really appreciate those kind words Shreyas.

Thanks a lot 🙂

Congratulations on the house! I just started investing and read your blog on the different ETFs that you are investing in. I considered VTS and VEU previously, however realized that we need to submit W8-BEN forms (US Domicile) every FY which will be hectic, what are your thoughts on this?

Every 3 years isnt it?

How to complete, or if with NABTrade they sort it for you

https://www.aussiefirebug.com/filling-out-a-w-8ben-e-form/

Cheers mate.

The W8-BEN form is every three years and takes 15 minutes. The hassle of this form is probably the most overblown annoyance within the whole Aussie FIRE community 😂. In saying that, it can scare people off. So those people are probably better off going VSG+VAS or VDHG.

Congrats on PPoR Firebug ,

Can I ask whereabouts IP 3 that you recently sold was ?

Cheers mate.

IP 3 (and IP 2 for that matter) are located in SE Queensland.

Congratulations on your achievements! Sorry if it’s been asked before, why do you invest in both A200 and VAS and so heavily in Australia compared to VTS and VEU? Thank you 🙂

Thanks Chiara,

We have a preference for dividends and as such have a high allocation to Australian shares.

Been a while since you’ve posted. You ok AFB? 😃

I had a bit on this month Mich 😅

Things should start to slow down by the middle of July I reckon.

Congrats on the PPOR! I had a question, would you say over the last few years you averaged a certain amount into investing in shares every month? or a certain amount each year? Whats that average if you can share?

Cheers Humma,

We aim for $5K a month into the markets. We haven’t invested for a while because we’ve been building our house deposit but we should get back on the horse next month.

I absolutely love how diligently you answer all question! Thank you for sharing! and Congratulations to the gorgeous couple!