How tf is it the end of September already!?

Man, I remember thinking about this once in a lifetime Euro trip (that we’re currently on) for years and now we only have a few more months here before we head back home… and that’s if we are even allowed back home 😅. The Aussies in London Facebook group is littered with stories of flights being cancelled at the last minute and there’s already a big backlog of ex-pats trying to return. I’m 🙏 that things open up a bit next year and we can make it back without too much hassle.

On a positive note, we managed to sneak in a late Summer trip to the Greek Islands/Italy in September.

We booked a one-way ticket to Kefalonia with a group of 6 mates for some sunshine, beers and bulk Gyros 😀

The Island was stunning with some of the clearest water I’ve ever swum in. And it was relatively cheap too which was a bonus. I’ve heard that If you go to the more touristy/popular islands like Santorini or Mykonos it’s a lot more expensive. But to be honest, anything that isn’t London is pretty cheap lol. The 6 of us would all go out for dinner ordering a small feast with drinks in a stunning beachfront restaurant and the bill would be ~ €80 👌.

We stayed in Kefalonia for 5 nights and then caught a 30-minute flight to another Greek Island called Corfu to explore that bad boy.

We loved Greece! Very friendly people, the weather was amazing (a lot hotter than I thought it would be for Septemeber) and the food/beer was phenom.

The other couples we were travelling with had to fly back to London but Mrs FB wasn’t ready to leave the sunshine just yet so we jumped on Sky Scanner to look at flights. I’m lucky that I can work from my Laptop in my current role which means we can do a bit of travelling whilst I work which is a big bonus.

We decided to head to Sicily for a few reasons.

- It was hot

- Pizza/pasta

- My Nonno/Nonna are from a small town in Sicily and it’s been on my bucket list for a while to see where my dad’s side of the family come from

It’s pretty insane to think about how many families uprooted their entire lives to migrate to Australia all those years ago. It’s something I find hard to relate to growing up in a country like Australia where opportunities are everywhere. But of course, this isn’t the case for most other counties as I’ve witnessed first hand over the last 2 years.

Can you imagine what they would have gone through? Leaving everything they’ve ever known to move to a foreign country that speaks another language, all the animals are trying to kill you and it’s upside down 😜

So when we landed in Trapani, I hired a Vespa and Mrs FB and I took off around the Sicilian countryside to my Italian grandparent’s home town of Calatafimi.

It was a bit anti-climatic when we did arrive at our destination because there’s really not much going on in the town… which is why I guess they decided to migrate in the first place right. But it was very cool to walk the same streets that my Nonno and Nonna did 70 odd years ago.

We spend the rest of the week in Trapani where I worked during the day and Mrs. FB hit the beach. We went out for dinner in the old town that had otherworldly Italian delicacies 😋.

Net Worth Update

Not much action going on here.

The markets had a little slump and we’re back to one income now that Mrs. FB furlough payments have stopped. She might try to find some work before we leave but has actually booked another girls trip with her mates to Cyprus for next week 🙄 so I think it will basically just be my contract up until the start of December and then we’ll both be unemployed 🎉. So I can’t see us saving too much over the next few months. Any gains will most likely have to come from the portfolio.

Properties

No changes in the properties this month.

Property 1 was sold in August 2018

*DISCLAIMER*

Various data sources (RP data, Domain.com etc.) are used in combination of what similar surrounding properties were sold for to calculate an estimate. This is an official Commonwealth bank estimate and one which they use to approve loans.

ETFs/LICs

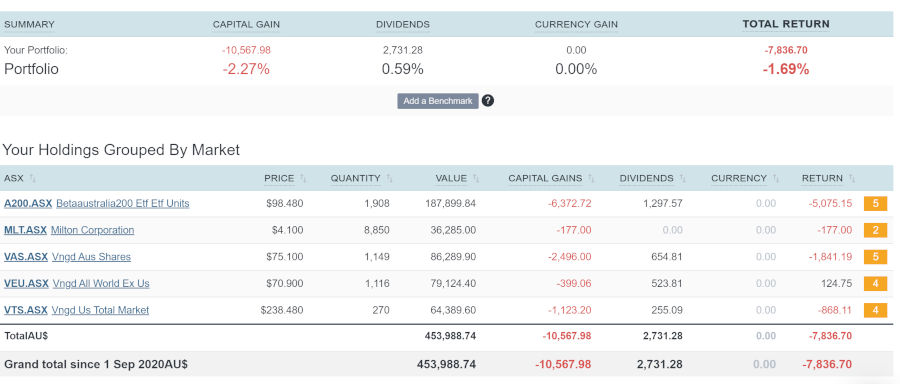

The above graph is created by Sharesight

We bought ~$34K of VAS last month which might surprise some of you since we have been investing in A200 so heavily for our Australian weighted part of the portfolio. The reason we decided to go with VAS this time around and not A200 is to spread out our risk a little bit. The MER between both A200 and VAS is largely irrelevant for a modest portfolio. And it’s really a race to the bottom with fees anyway so the chances of them going even lower in the future are high. I also like the idea of investing in multiple companies. The A200 piece of the pie was starting to become very large so I just went with VAS this time around.

To be honest, there wasn’t a whole lot of thought behind this decision. I think both A200 and VAS are suitable financial products for any Firebug to build their snowball with. I logged onto the computer the other week to do our monthly purchase of shares, seen that the Australian part of the portfolio was the most underweight, looked at the A200 piece of the pie and just thought “hmmm… I’m feeling VAS this time” 😂. I’m definitely not an investing genius (as you can probably tell) and our investment strategy is incredibly vanilla and boring.

Other than that, the markets took a bit of a tumble but nothing out of the ordinary (especially this year).

Hi AFB, Sounds like a fantastic trip/holiday etc!

I hope to be able to Experience it Also.

My Partners Mum and Dad came from Italy to Melb Aust in the 1950’s.

I have so much admiration etc for what they achieved, endured, etc etc.

It’s an amazing story, They left Italy after experiencing the 2nd World War, Dad came out here first, and Mum a year later!

People were Dif then in many ways, especially the Aussies, of which i am one.

Melb had nothing compared to now. Thay have both passed on now, Mum just recently.

I could go on about the Cultural Dif’s for many pages etc! Not to mention Coffee/Espresso for one.

Mum’s Brother is still with us at 92 yrs old and fighting fit. He came to Aust a yr later to join his Sister. People who experienced what they did are very Rare now. They made Melbourne a better place.

I find them for want of a better word Awesome overall.

On a Dif note, can i ask your opinion on Vanguard VGS, you dont have it in your Portfolio?

Thanks.

Brad

34 grand worth of shares bought in a month. What on earth? How big are these contracts you are on?

Sounds like I am in the wrong industry.

I’d say the purchase was fueled by his cash reserves but software developer + contract = dollarydoos. There are junior contract roles in Melbourne advertised at $400 a day, let alone experienced and in Lun-dun

Correct. Although I work in data (currently working as a BI Dev), not software.

Yeah kills me every month reading how many shares they buy. I think it’s been 3 months since i’ve bought any and not for lack of wanting to save for it.

I remember that feel Trav when I was reading a few US bloggers stuff many years ago. Best not to compare yourself with anyone else though. Each journey is different and we’re all dealt a different hand

There was a build-up of savings. Contracting is good money but it’s not that good lol.

💯💯💯

The immigrant mentality was something else Brad. As an Australian (or any first world country really), my generation has more wealth and a higher standard of living than any time in human history by a mile. The constant pessimism about opportunities and cost of living gets under my skins a little.

Can you imagine telling those migrants back then what kind of life their grandchildren would be able to live in Australia? Most of my mates have a home, two nice cars in the driveway, a job that earns them enough money for a comfortable lifestyle, international holidays every few years… And yet I still read/hear all the time about how it’s too hard for someone to move an hour out of central Sydney because they don’t want to be away from their families/social circle 🙄

The backbone of this country uprooted their entire lives to move to a foreign-speaking nation dreaming about a better life for their family!

In comparison, I have not had to sacrifice diddly squat to where I’m at. There’s a quote I really like about previous generations helping younger ones.

“If I have seen further it is by standing on the shoulders of Giants.”

The reason I’m able to stand so high is because I’m standing on the shoulders of my parents and they stood on the shoulders of their own.

To your question about VGS. I went with VTS+VEU instead of VGS. VGS is a suitable product that can act as the international part of any Firebug’s portfolio. I’m a fan of it

Looks like an awesome holiday there AFB, glad you’re making the most of your time in Europe! Starting to warm up again down here so hopefully we can hit the beaches sometime soon as well. I gotta admit, that gelato photo has me feeling jealous!

As you say it’s gonna make pretty close to zero difference whether you go with A200 or VAS, might as well spread the investments around a bit!

It’s starting to get cold in London dude… Missing Australia more than ever now

So jelly that you got to explore some beautiful islands and I’m glad you got to see the gorgeous cobble stone streets your nonna is from, that’s always nice. I honestly just love how beautifully simple your portfolio is. Have you ever thought about adding another LIC for diversity (Much like you having both A200 and VAS) ?

Cheers FDU,

I’m happy with the products we currently have. No intention of changing them any time soon.

Hey mate. Trip looks amazing.

I think you should live a little and have a direct holding in SIQ. Great business, PE at 12 so cheap and over 5% ff div yield.

Have a crack

Cheers MMA,

Eh, I don’t really like having a crack when it comes to investing lol. Maybe one day I’ll dabble in a direct holding but I’d rather just reach FI using the passive index approach and then maybe I’ll live a little with house money lol.

Hi Firebug,

Just wondering if in your super part of the pie chart – is that both your and Mrs Firebug’s super? Or is hers not included? Also now you are working in the UK are you still contributing to your Aussie superfunds? Or do you have different ones now?

Just curious 🙂 thank you

It’s both of ours. Not contributing at all atm. Will probably get back on it next year 👍

Love the photos, makes me nostalgic of my time in Europe many years ago.

Also that’s one hell of a monthly share purchase, haha. Nice work, keep it up!

Cheers Scotty,

This was a particularly large buy because of a cash reserve build-up. They’re usually around $5K per month

Was planning on going to Sicily next year to see the roots where my mother and my grandparents came from. Great photos in your summary. Unfortunately with the way the world is, we’ll be holding off for a little while.

Hate to say it but Govt wont be letting any overseas into Australia till the start of 2022 at this stage.

Enjoy going back listening to some of your podcasts on my daily walks.

Keep up the good work!

Cheers Tom.

I hate to say it, but I think you’re right 🙁

Hey mate, big noob question. What does “IP” stand for? Eg “2 IPs went up and saved well”

IP = investment property

Ahhhh You half Sicilian, that explains the frugality!, (running a 3/4 Sicilian Nonno/nonna combo myself). From what I can see in your ‘from a distance’ pics you don’t seem to be running the excess body hair but! I was pretty much already shaving in primary school, and even now I still can’t grow a moustache as good as my nonna!

Thats awesome you got to to there but, def on my bucket list too. I got kids now though so won’t be a while yet but it will happen!

Haha that gave me a good laugh Ococ!

I’m thankful I don’t have to deal with the body hair 😂 but we absolutely loved Sicily 😍 and we’ll be back at some stage… maybe with kids one day ☺

Oh man, those photos of Greece and Sicily… Just gorgeous… Hello from Lockdown Melbourne where the furthest I can travel is my local Woolies supermarket, less than 5km from my house I hasten to add… Are we into our 8th or 9th week of lockdown 2.0? I can’t keep track. Anyways, it’s always wonderful to visit The Old Country. Hopefully, I can get back to Europe by 2022 (can’t see it happening next year unfortunately). At least Europe isn’t going anywhere and will always be there. Enjoy these great moments AFB!

Cheers Jeff.

I’m missing Australia so much now the weathers starting to turn shithouse in London. And there are talks of another lockdown on its way so we might be scooting out of here at just the right time… It would be blind luck if we manage to get back home in January to a Covid free country where things are starting to open up.

Steady as she goes, nice. Also FYI, bug report, scrolling in Safari seems to break on some of your articles, this one included. Requires the page to be reloaded to try to get it to scroll beyond a certain point. It was conveniently around the Cannoli 😂. I think it is the scroll-jacking that this site uses

Keep up the adventures, enjoying it both financial and travel!

I’ve been experiencing the same issue with Safari.

Love the content as always, but this the new format is super glitchy and annoying. Any chance of going back to the old system?

I’ve made a change mate. Try to load the page again and let me know if it’s better

Thanks for the tip, Adam. I went looking through my themes options and low and behold there was a “Smooth Scrolling” option that I have now disabled. Any chance you could give it another goa and let me know if it’s fixed?

Unfortunately not mate. Tips to repro seem to be slow scrolling with a bit of start/stop (like you would if you were reading an article normally). It locks up along the way. Ends up removing the scrollbar. Also another sure fire way of reproing is attempting to scroll back up

Hmmmm. I’ll have to debug a bit and check back with you mate. I’ll try clearing the sites cache now

Hey mate,

Just a quick question. I read all your blogs, Fbook posts, books recommended and it is all great.

But I am confused with 1 thing. When we calculate the net worth, let’s say now you are around the $800k Mark, that is not actually what you would have if you sell all your shares/IPs, etc right? There will be CGT. So when we use a calculator for Fire or track monthly expenses, we actually need to take in CGT into account as net cash in hand?

Do you have any resources on strategies to stretch this across a few years pre-fire to minimize tax impact?

Also, I wanted to check if I am tracking my expenses correctly?

-Cash = Anything in saving/offset account etc and net increase is basically more income saving than the monthly expense

-House (value of the property based on valuation – morgage owed to the bank) = Positive if value of property is up or more money flow into repayment minus interest

Stocks/ETF= Straight forward and net + or negative can be tracked on share sight etc

Super = change in balance +/-ve

Net of all these would be your monthly net worth.

Hi Amid,

You’re right about the CGT stuff.

To be honest, I think it’s more about how much income your portfolio is able to produce rather than the net worth. I have been thinking about that lately and I’ll probably include a passive income tracker as part of these updates starting next year maybe. Because ultimately it will be that passive income that sets us free.

I think your expenses tracking looks good mate 👍

Seems crazy to imagine hanging out on a beach in Greek island right now! We are in WA and only island we can visit is Rottnest island 😂

I hope you enjoy last part of your Europe trip and not work too much, before coming back to reality!

Thanks FMT. It’s been amazing and we’ve exceeded expectations for travel this year considering all that’s been going on. Unfortunately, I’ve been getting smashed on the work front. This has been the most demanding year of my life due to a lot of things but the company I’m at atm is extremely demanding (which is why AFB stuff has been slipping :(…).

I can’t wait to finish in December and then enjoy a few months off before starting my next work adventure next year.

what are your ETF % for A200, VTS, VEU, VAS – i’m looking to getting into etfs would

30% VAS/A200

35% VTS

35% VEU

work – i want focus on international markets.

You can hover over the visuals to get a % breakdown. Those splits look ok to me.

How do you get an official CBA house valuation each month? Is there somewhere online that does this?

I’ve actually moved on from CBA (I’ll remove that text under the properties stuff on the next update). So I don’t get those valuations anymore 🙁

Hey AFB, loving your blog, thanks for teaching me so much!!

Just a quick question I know you have revised your investing plan a few times, whats your current desired percentage of each ETF: A200, VAS, VTS, VEU and MLT?

No worries Ellie 🙂

Currently, we’re aiming for

A200/VAS: 70%

VTS: 15%

VEU: 15%

Hi AFB, it looks likely I’ll be moving to LDN to work for a few years – not sure if you’ve been asked this yet but did you look at investing in a S&S ISA while you were there, and if so, why did you decide not to do it?

Big article coming up all about investing while in London 🙂

Will drop before the end of the year 👍

AFB, these are amazing photos! I’m especially jealous of the descriptions of the amazing meals, and the pic of the cannolis! Probably a hard question, but any particular favourite restaurant, food or dish in your Euro travels?

So happy that you and Mrs. FB are able to travel and live your dream trip. These are the moments that make life worth living, so congrats on your acheivements.

Travelling has been my number one splurge category since I started earning money, and I don’t regret any of those dollars spent, as those are the kind of memories that I will treasure and reminsce about into my twilight years. In particular, I remember visiting the country of my grandparents years ago and being overcome with so much emotion, wonder and gratitude when I visited the graves of my uncle, grandfather, and other family.

Even in the midst of this virus, we are living in the best times in the history of mankind, and we’ve been especially lucky here in Australia, literally on an island away from the rest of the world. The silver lining of the restrictions on international and inter-state travel is we’ve *had* to discover local travelling spots in-state as opposed to our usual overseas holidays, and its been amazing to get to know our own backyard.

🙌 totally agree Papa!

I’ll cherish these moments/photos forever and it’s really cool that I have been able to have a little online diary for all these years. I look forward to showing these pictures to our future kids one day.

Yeah, an impossible question about the food/drink mate haha.

We had clam chowder in a little fishing town right up north in Scottland that I’ll never forget. It eas run by two women who were wives of fisherman and it was incredible. They just had it set up as a little food truck… amazing 🙂

Gyros on the beach in Greece was amazing but I think more so because of where we were and how good a mood I was in rather than the food being exceptionally good.