I was chatting to a friend the other about these net worth updates, and he mentioned something that I hadn’t really thought of before.

“I really like the progression table at the end of your updates mate. When I first read the title of your net worth posts, I thought you were pumping up your own tyres a bit ya know. You see the big $900K figure and think it’s almost impossible to get to that at your age without winning the lotto or something. But I really liked seeing those graphs at the bottom and the table that shows what happened each month. It made it a lot more relatable and actually showed the path you took which is cool”.

I realise that there has been a lot of new readers to this blog over the last couple of years and I haven’t explained the purpose of these net worth update for some time now.

It’s a bit scary to put all your numbers out there (even if I am under a veil of anonymity) but I started to publish our (Mrs. FB and I’s) net worth mainly to keep us accountable and for it to be at the front of our mind at least once a month.

What gets measured gets managed.

The older I get the more I love this quote. It’s not just with money either. Have you ever tried to increase your bench press without recording what you’ve been lifting? Have you ever tried to lose weight without weighing yourself consistently and checking progress?

You can still make improve without measuring a KPI but it’s a hell of a lot easier to progress once you have a well defined metric that you track consistently.

This was my main motivator for recording my net worth in the first place.

The other reason I publish our NW online each month is to help other people by giving them the blueprint that we used and show that reaching financial independence early in Australia is very doable without winning the lottery, having a high paying job or inheriting a wad of cash.

It’s my way of giving back to the community a bit and paying homage to the FIRE bloggers that came before me. Creator’s like The Mad Fientist, MMM, Mr 1,500, Our Next Life etc. all had a prolific impact on my life without asking for anything in return.

It’s one of the main reasons I started AFB in the first place. I was getting so hyped up reading about all these internationals reaching FI that I wanted to create a similar example for Australians.

There’s nothing worse than reading about these so-called self-made millionaires on realestate.com.au that have somehow managed to amass millions and retire in their 20’s without actually sharing specific numbers or a detailed account of what they did (other than the stereotypical stuff like skipping breakfast, making your coffee at home and somehow getting approved for 20 loans without maxing out your lending capacity).

I’m not saying they didn’t do it, but there’s 100’s of these stories in the media and more often than not, the couple featured have conveniently gone on to start a business ‘helping’ others out or have just written a book.

This brings me back to these net worths posts. I’m a dude that likes to get into the nuts and bolts of things. I publish monthly updates showing everyone exactly how we are building our snowball and what our position was at the very beginning so you can all see that we’re practising what we preach and maybe inspire a few Aussie’s that like to see the cold hard facts.

If you’re a fan of these updates please let me know in the comments. Or if you want to see me add anything moving forward, that would be cool too. I’m looking to do a bit of a redesign once our house settles in July so I can maybe add in a few things moving forward from that July update 🙂

To help new readers from this point onwards, I’ll be adding this little summary at the start of each NW post.

I publish these net worth updates to not only keep us accountable but to hopefully inspire other Aussie’s out there and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. Getting wealthy enough to retire is easy but it takes many years of being consistent and sticking to a plan. The table at the bottom details our entire journey starting from being $36K in debt all the way until we reach 🔥

Net Worth Update

The big needle mover for this month was actually getting back to nearly full-time work in my business. I won another contract in April which meant that my hours went up and there were two weeks when I was working in a full-time capacity. The invoices that were raised at the end of April came in during May and combining those with Mrs FB full-time income bumped up the net worth a fair bit.

I still have to pay taxes on my income though so it’s not as large as it seems.

The share market also had a great month and there weren’t too many expenses that came in other than the quarantine bill for our stay in Adelaide during January.

Properties

Argh man, I still haven’t gotten around to doing the numbers for the sale of property 3. Just too much on atm. This update is late AF and I’ve got a few articles that are close to being published (survey results are next guys I promise).

It’s just been crazy during the last month or so. I’m actually writing this update up in Queensland because we’re tying the knot in a few days 🎉.

There was so much drama around getting here (we’re from Victoria) and we have recently bought a home that settles in July. Throw in extra hours in a business that I’m trying to get off the ground and the fact that we’re living between two houses atm… I just can’t get settled and back to a routine where I do my best work.

But that’s enough of me being a cry baby 😂 . I just can’t wait to get into our new home and set everything up. Not having to plan for the wedding in another state during COVID will relieve an enormous amount of stress and anxiety too 😅.

But back to the housing part of this update.

The new home settles in July so right now we’re rocking an insane amount of cash in the portfolio in preparation for the 20% deposit. I’m going to dedicate an entire article on how we plan to convert that debt to be tax-deductible (debt recycling) because the idea sounds simple but it’s actually quite complicated once you look into it.

I’ve also been thinking about what we’re going to do with the PPOR debt and equity in these updates.

Do we count the PPOR in our net worth even though it doesn’t produce an income and won’t help us reach FIRE? Do I include another graph that shows our passive income vs expenses each month? Do I remove the PPOR completely?

I’ve been thinking about doing a bit of a revamp for a while now and I think the July update will be a good time to add in a few things people have been asking for.

So if there’s been a number or chart that you wish were included in these updates, please let me know in the comment section below.

Property 1 was sold in August 2018

Property 3 was sold in April 2021

*DISCLAIMER*

The current value of our properties is a rough guesstimation based on similar surrounding properties. I only really update these when we get an official bank valuation

ETFs/LICs

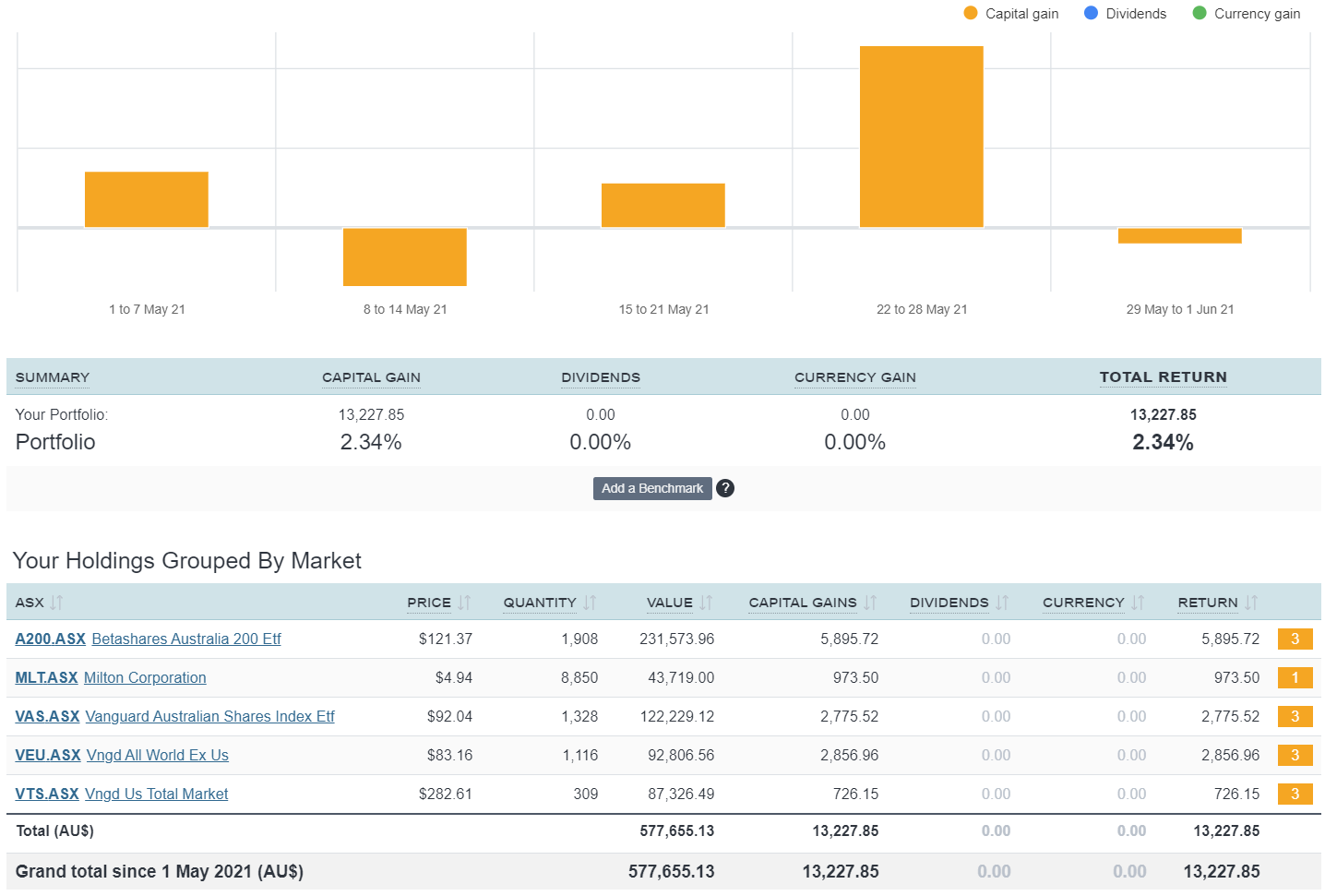

The above graph is created by Sharesight

No buys again this month. As soon as the house settles we will be back to a regular schedule.

I bet you’re glad you didn’t exit MLT!!

My thought exactly!

Great refresher of why you do what you do.

Reading the comments so far, you might need to split the difference and put NW with and without the PPOR.

The long table is great – def a good reminder/motivator when targets seem far away or markets are turbulent. And the charts are gold too!

All the best with your upcoming nuptials and growing your business

My thoughts exactly!

LOL! I was about to make the same comment!!

Last year, I needed a good dividend stock. I had borrowed to invest and wanted some cashflow to help with the repayments.

Being an avid follower of your blog, I checked out MLT, It fit what I wanted so I bought 10000. Thanks so much for what you do!

With the net worth, I personally track two numbers, total net worth and investment net worth. Thanks again!

Holy mackerel!

What luck that we didn’t sell them before the merger happened. This is the most exciting thing that’s ever happened to our boring portfolio lol

Hey bud – nice to see the NW Update, I always try and read it and the table is very nice too- I agree on KPIs and measurement goals. If you didn’t have the blog to keep you honest/accountable what system do you think you’d try implement to capture your net worth ? A monthly excel spreadsheet?

The only thing I’d like to see included going forward is some figures on side incomes – as a percentage each month roughly how much do things such as the blog contribute? I think this would help people understand what’s achievable from their own salary vs the benefits of putting in extra time to carve out a side hustle. I know looking back I do wonder if thats a point of difference between you and I in me being able to reach a similar level of wealth invested in growth assets.

Cheers for the update – always appreciated your nuts and bolts approach – keep at it mate.

Thanks TeeBee,

Even if I didn’t have this blog, I would still update our NW spreadsheet each month. Just updating it will keep you accountable and you’ll make the adjustments.

Monthly income would be interesting… I’ll see what I can do 🙂

Congratulations to you and the soon to be Mrs! Here’s hoping all goes smoothly!

I couldn’t agree more about tracking your progress with whatever you’re working on. I do this with my running, the exercise that I do, my weight, the portfolio and all that sort of stuff. If you’re not keeping an eye on it then you’re not likely to reach your goals!

In terms of how to report on your PPoR, I keep a net worth figure that includes it and another one that just has our investments.

Thanks make. I can report that it all did go very smoothly and we’re over the moon to be officially married now 😁

Great job as always. I never see your figures as bragging. I think they’re honest and inspiring.

Re: your PPOR and counting it in your fire figures I would included it minus the cost of the property we want to retire in.

So if you want to retire in that property, or one of a similar value, you may as well exclude it.

For us it was our last PPOR that helped us fire as it was a massive place in the U.K. we renovated, sold and took the tax-free profit. I included its value minus the cost of our cheaper fire home.

We have just lean fired (work optional) in Greece in our late 40s. Life’s great.

Congratulations on your house purchase and impending wedding!

Thanks Sunny 🙂

Are you in the Greek islands? We went to Kefalonia and Corfu last year and it was sooooooooo nice. We have to go back one day

Regarding how to account for PPR I decided the most honest and useful way for a homeowner to calculate their net worth for FIRE was as follows. Exclude your PPR entirely, but include all your liabilities. The reason is that your PPR is not income producing, but your loan does cost you. This gives you the real reading of your net assets delivering you income. It also penalises you if you upgrade your PPR and take on more debt (which is the right dynamic for FIRE).

I think this is better than putting in your PPR equity (which isnt income producing), or excluding your PPR equity (which ignores the level of PPR debt you have).

Will be keen to hear how you do it.

Thanks for the suggestions Ax… I’ll have a think

Hi AFB,

Thanks for publishing a new update. I always enjoy reading your posts but don’t often comment.

On the topic of information and plots, I think PPOR should be included in net worth because it is an asset that can potentially give you options down the track eg. downsizing or relocating, as well as sense check whether your total asset type distribution matches your goal.

These are what I think are good visualisations (most of which you already have):

1. Pie chart of asset allocation (all assets included in the net worth, including PPOR and superannuation)

2. Net worth growth with time

3. Expenses and passive income with time. The passive income could be lumpy but a 3 month average over time might work.

Best wishes for your wedding and future life together with Mrs FB.

I was also thinking that separating expenses into 3 groups (essential, non-essential and work-related) can give more clarity on when it’s possible to RE.

Also, I don’t read that big, detailed table you include at the bottom.

I was thinking of including our expenses and income monthly now. A line chart showing how much we’re spending vs how much passive income is coming in would be sweet

Hi mate, love your graphs and simple info. Why hasn’t your investment property 2 valuation changed in the last 3 years? I would have thought Real estate values have risen all around the country in past few years. Phil

I’d imagine it has. I just haven’t updated it in a while. We’re planning on selling it this year anyway so I’ll probably just wait until we sell to see what it’s worth

If your debt recycling perhaps leave PPR in? Otherwise exclude it. Love your updates and congratulations on getting married. There are some things money can’t buy! Would love to know what your new business is.

We’re planning to DR Belinda.

My business is in Data and Analytics. It’s my profession but winning contracts on my own now and working on fun projects that interest me is the main point of difference (vs being on the books getting told what to do)

I couldn’t agree more – what gets measured gets managed. I also like “You can’t improve what you don’t measure”. It really is so motivating to see someone else’s incremental progress, especially if they are just normal people and there are no “secrets” involved that they then try to sell. When we were in the accumulation phase each monthly progress updated didn’t feel like much, 1% here, 2% there, but after a few years the total of all of these little increments really is life-changing. I really think it helps people who are at the start of their journey stay the course.

Well done on setting up your new business and buying a house. I know from experience how stressful international moves and setting up a new base can be.

All the best for the wedding, I hope it all goes smoothly!

please remember what william cameron said: “Not everything that counts can be counted, and not everything that can be counted counts.”

Thanks so much Mrs. Flamingo 🙂

It’s been a very busy couple of years 😅

A) Extra info to include in the table:

– Income and expenses per month. This would help people see what is possible based on a normal income.

– Networth broken down by asset class. It’s in the summary but would be interesting to easily see in the table.

B) Treatment of PPOR

In the past I’ve been a fan of excluding it, but preparing to sell mine is making me reconsider. A sudden cash inflow from a sale doesn’t make much logical sense if it’s been ‘off book’ the whole time.

PPOR does also (eventually) contribute to FIRE because once paid off it dramatically reduces your expenditure and hence how much you need to draw down during decumulisation.

It’s also informative for your planning to see where your cash is going, size relative to net worth, etc.

My current thinking:

– include the interest payment in expenses

– include the principal payment in investment

– include the equity in net worth, broken out into its own column

– include the offset in cash

This is pretty much what I’ve been thinking…

PS. Are you still in London mate? How’s it all been going?

Congrats on the upcoming wedding Mr and Mrs FB!

Love your updates (in no way do I see it as bragging) FB and don’t want to see you change a thing.

Thanks Marc! I promise that any changes I do make will be for the better. You’ll see!

Thanks again for sharing your numbers this months and keeping it real. It’s extremely motivating to see real people do it (and share their story with measurable steps). I’ve been tracking our progress now on our blog for a few months now for our own purposes, but I do hope one day it may help someone else realise they can do it too.

Keep up the good work.

Thanks 😊

Nice article mate. I particularly like that your blog is simple but, that you add flair creatively throughout with your thoughts and words. I enjoy the graphs but, more so I enjoy your thoughts.

I’m contrary to most comments (so far) but, I wouldn’t add PPOR to the calculations. Not due to the fact that it is not an income generating asset (as you rightly point out) but, predominantly from simplicity perspective. Having to estimate equity, deduct costs etc. causes clutter and devalues the overall punch of the number.

Would love to hear a bit more on your business adventure. How you started it and why? What are you long term plans? Separately, deeper psychological learnings you’ve made over the years of chasing FIRE would be fascinating to read. How have you changed as a person (if at all)? What you value now vs at the start? Etc.

Thanks Vlado.

I’m been thinking of doing a pod on the new business actually. Those are some deep questions you’ve raised and it would take me a while to write them down in this comment. The why of FI is an interesting topic that has changed for me throughout the years. I might want to touch on this again in a podcast I reckon.

Dude I love your net worth updates! I remember thinking ‘why would anyone care about reading someone else’s net worth update???’ But a couple years later and your updates is the one of the things I look forward to reading the most. Just seeing where you guys are at, and the decision-making and how it evolves over time. It’s relatable and insightful. Thanks!

My favourite bit is the net worth graph. For me, that was inspirational because I discovered your blog a few years in, and you could se the mighty J-Curve taking affect, and how your money was starting to do the lifting for you. It encouraged me to get cracking with my own journey so that one day my money could lift for me. Which it is now!

Thanks again!

Awesome comment Dickrog. Put a big smile on my face this morning 😁

Hi Aussie Firebug, as others have suggested, a breakdown of income would be useful. You say you are trying to show people how to achieve fire without a high-paying job. I thought you did have a high paying job! Have had the thought – of course he can achieve it, he’s had such a high paying job! Maybe I have this perception from some numbers you gave while working in the UK, Or perhaps this is because it’s a combined income from primary work and side hustles. Either way would be good to see the breakdown and how much having a side hustle can help. Thanks

Hi Carly,

It’s true that I have a high paying job (above the national average) but it’s not that much over.

I was interested to know for sure so I logged into MyGov and had a look through my last 9 tax returns (I lodge my first full-time tax return in 2012).

I have averaged $98K throughout my 9 years of full-time employment and have a median of $93K. These figures will jump up when I lodge my next return but those are the numbers so far. These numbers include all my incomes (blog, other websites, dividends, rent).

I was on a really high day rate overseas but I didn’t work for the full year. I would take on a contract for a few months and then go travelling.

My partner’s numbers will be a lot lower than this too. It would be interesting to do a post on how our incomes have changed and what effect that has had on the NW

Pleasure reading your update as always. I think you should include your PPOR for sure. At the end of the day it influences your income, expenses and maybe even what your portfolio looks like.

Love the updates anyone that gives negative feedback about networth posts is just distracting themselves from their excuses.

Yes of course include PPOR in net worth, PPOR does produce an income its the rent which you are paying yourselves.

Loving these updates mate. There’s already so many suggestions about PPOR so I won’t comment on that here but congrats on the wedding, house, job and new business.

No wonder these updates takes so long to come out 😛 (it’s already nearing the end of June!!)

Cheers mate,

This last month was particularly busy. I should be right by mid July

Only when your passive income exceeds your living expenses can you truly considered to have achieved FIRE.

I would be interested in seeing which assets put the most cash in your pocket after expenses (ie. Rental property, ETFs, website income)

Also, the tracking of expenses by essential & discretionary lets you grade the quality of your FIRE from lean to Fat.

Thanks for all your updates.

Cheers Keith.

I’m thinking of a line chart with expenses and passive income so everyone can visualise the passive income line creeping up and up over the next few years and eventually eclipsing the expenses. I might even break down the passive income into dividends and cap gains… I have to see how it all looks. I don’t want to make it unreadable.

Hey AFB. Keep the updates coming mate. Love seeing you guys doing so well & you have given both my wife & I huge inspiration and plenty of education in what it takes to succeed & reach FI. Congrats on the soon to be wedding & hope everything goes to plan.

My thoughts when it comes to the old PPoR debate is a bit different to most but we include both the mortgage (when we had one – we don’t like owning property) & our vehicles. Why? Well even though the PPoR & the vehicles are not income producing & are definitely not assets, we treat them more like a store of value such as gold, crypto, growth stocks or even cash. Because if one day we decide we want to sell everything up & Geo-arbitrage, we can quite easily purchase income producing assets with that money once sold. So to us anything that can be sold for cash can be used for assets. It provides options & if you’ve taught me anything it’s that that’s what FI is all about.

Takes a bit more work to try & estimate their actual worth but the value, even though it’s not income producing, provides plenty of options for people who think outside the box (Fire Crowd). In my very humble opinion.

But at the end of the day, does it really even matter as long as you achieve your goals?

That’s a good point, Ben. The way anyone calculates their net worth doesn’t really matter. I more important metric is passive income vs expenses really. Thanks for the comment

Congrats on the upcoming knot-tying and thanks for all the great content.

In terms of metrics, it would be interesting to see the amount of passive income generated by your assets vs the cost of holding those assets, particularly if you’re using debt recycling on your PPOR.

Btw I’m really looking forward to what you have to say about debt recycling. I’ve started looking into it for us but I’m pretty confused by all the different ways to set it up 😱

Also curious what approach you are taking in terms of the deferred tax on your income. Will you set aside the % owed to tax as you receive the income so it’s there when the big tax bill comes? Or invest like it’s all yours and sell some shares come tax time to pay the ATO? Over 50% of my income isn’t taxed till after EOFY so I’m curious how others manage this 😅

Cheers Aorati,

I use Xero and have to pay my tax bill every quarter atm. I really just do what my accountant says to do but it’s all so new atm I haven’t gotten into a groove yet. I’ll have a better answer for you in 12 months time 🙂

Hi AFB, looking at your ETF Holdings on your Sharesight and the Calital gains are at 2%, why so low? I know you have been investing for quite some time and I understand as you add in more each time you invest it can make the CG’s look small but I just can’t wrap my head around yours is sitting at 2%

The Sharesight chart is showing the gains for the month of May only – annualized it would be 24% – a great month!

It’s only for one month Bec. 2% annualised for one month is pretty sweet if you ask me 😁

Congratulations Aussiefirebug on impending wedding and your new home, so happy for you both and wish you the very best😊. I love your podcasts and blog,I’ve learnt so much- you have such a great way of explaining things. Like you I began reading bloggers from OS and wished there was an Aussie site and I found you, so well done, and you sharing your journey is generous, not ‘ pumping up your tyres’- it never came across that way! Thanks so much.

Thanks Margie 🙂

It would be great if you could show what your income was on any given year. This would be really helpful in seeing what that income can realistically achieve. I think it would also help people decide if they need to spend more effort on increasing their income, or reducing their expenses.

Loving the work so far!

I think a lot of people would like this Jonathan. I’ll add it to the list

Thanks for the blog AFB. Something I’d be interested in seeing and you also may find useful if you don’t already have it ,is a breakdown of your income sources (even just percentages), and your income:expenses ratio. Not only is it something that goes to the heart of FIRE (ie. passive income > expenses = FIRE), but it is also something that is important and often overlooked, is gaining insight into how easily (or not) you can adapt with changes to income. For example starting a family, an unexpected redundancy, or even deliberately choosing to go part time to enjoy the fruits of our FI journey. I’m also guessing that a big factor in your decision to start your own business is the confidence you get from knowing that a significant part of your expenses, if not all, are covered from other income sources.

Cheers Ian,

I did start to include a breakdown of our income in our yearly expenses posts.

I’m going to start including a passive income vs expenses chart somewhere in these updates. Just need to work on how it’s going to look.

That 2% is gains for the month, not since he bought.

Hi AFB,

I’ve been reading this blog since before you were famous.

I think I got onto it in early 2017?

It inspired me at the time and I started keeping track of our net worth in a similar way.

It’s helped me a lot over the years to keep focussed and honest with myself. Having to redo the net worth on the first of every month, and record what happened that month and why, has been brilliant for us.

So thank you for this website!

We are on a slower journey, due to having 4 children and me being a stay at home mum.

But I’ve found extremely effective ways to make money on the side, both passively and non-passively, and I’m always looking for ways to increase our NW.

I haven’t mirrored your investments themselves, and I’ve stuffed up with certain decisions over the years, but we are relatively young(mid 30’s) and we still track well. Our NW has more than doubled since I started to keep track of it like this.

I have really appreciated your transparency with discussing your numbers and decisions. I actually love to do that myself, but most Aussies are incredibly shy with talking about money… and most people I know don’t have much money and think we should be living it up and throwing money around if I tell them anything about our position. They don’t get that the reason why we have anything is because we don’t!

Thanks for the kind words Jessone. It makes me smile to know you’ve gotten something out of my ramblings 😊

Hi AFB,

Some thoughts on how to present your data:

– breakdown you net assets over time by key asset classes (will show what is driving growth to an extent)

– could you breakdown what drives your table of $ change (I’m thinking key categories are market growth, your extra $ invested, dividends), presented as a time series it would show how much is due to your monthly efforts vs market vs passive income)

Anyway, some thoughts, I’m still experimenting on best ways to visualise my data.

Good ideas David but I’m not sure I have all that data on hand in an ingestible format. I’d have to do a lot of digging and probably write it all down with the dates for it to work. Not sure I can be bothered. Let me have a think

I always enjoy these NW updates. Thanks for sharing.

Another great update AFB! I cringed when I clicked the link of self-made millionaires lol Because I actually reached out to them when I was contemplating my next investment move. To date, I haven not made up my mind as yet. They seemed to be legit people and even have a podcast dedicating to commercial property. So what is your view in their business if you don’t mind I am asking 😛

Cheers Gordon,

I don’t know those guys from a bar of soap. They were just the first article that appeared in Google when I searched for something like young self-made millionaires from property Australia lol.

I’m sure they aren’t making it up. But articles that get published like that are classic clickbait. You have no idea what advantages those people were afforded growing up. Absolutely everyone has some sort of advantage. There’s really no such thing as self-made and those articles are usually published not for educational purposes, but essentially as an advert for a business.

“We retired in our 20’s. Pay us money and we can show you how to do it too.”

I’m sure that their business does great work and helps out loads of people but the point I’m trying to get at is that I like to see cold hard facts when it comes to success stories like the one I linked to in this post.

It just makes me feel funny when people who have been successful start a business and call it a passion project to help people out but still charge money for their services.

Why can’t they give away their services for free if money isn’t an issue…? 🤔

A lot of these stories follow the same pattern.

1. Become amazingly wealthy at a young age

2. Start a business helping others become wealthy because you’ve made so much money that you don’t need to work anymore

3. Shop your story around on various media outlets giving a vague and unspecific account of how you did it

4. Charge money to people you’re trying to help become wealthy

I’ve got no qualms with anyone starting an enterprise and making a bucket load of cash. But I can’t help but feel like those stories are not designed to truly help people, but rather grab their attention and funnel them into their business for more profit.

I’m not picking on that specific couple (they were just at the top of Google), I’m more talking about those stories as a whole.

Haha Cheers AFB. I will let you guys know when I bite the bullet and venture into the deal.

Look forward to your update on debt recycling. Knew this thing for a long time but always reckoned it is too hard to get my hands on. Finally someone I trust was planning to dabble in 😂

Btw, congrats on the house purchase!

Cheers

Gordon

Congrats AFB, enjoy the day. I’ve been following you for a number of years. You are a great inspiration of how Aussies should manage their finances and I refer my work colleagues to your blog all the time. There is no doubt the debt recycling strategy works, I’ve used it with success myself. Regardless of age, people can make big in roads using your investment strategy. Keep the articles coming.

Hi FB! We’ve been following you for a little while now and you’re the reason we have started our ETF journey! Yay! We wondered if you’d be able to share how much of your own money is actually invested into these ETFs, as opposed to just their gains/worth. Just to give us an idea! Also would you have any contacts for good tax accountants dealing with international tax law as my partner is American living in Aus with me! And We’ve had to be so careful about the way we invest because of his citizenship! Be good to have a trusted agent involved.

Hi Stacey,

We’ve made $175K from the share market. The rest has been cash… BUT… a lot of that cash has also come from the gains we made in property. Bit hard to work out.

I’ll probably do a dedicated post on it all. At a guess, I’d like to think around 60-70% of our net worth has been pure savings.

Oh and I, unfortunately, don’t have a contact for you I’m sorry. Maybe post our question in the Facebook group. Plenty of smart people in there.

Hi Mr. and Mrs. AF. Firstly Congratulations on the wedding. Wishing you both all the success in the world. I am trying to start my FIRE journey and have just done a little investing. I just signed up for Sharesite, thanks so much for that! I did not know about them before your post. I was just wondering how come your graph does not show any dividends. Is there a way to get them to automatically re-invest and they are thus not show? Was just wondering and sorry if it’s a silly question. Thank you so much for everything you guys do, you are such an incredible inspiration.

Thanks a lot FIRE starter.

No such thing as a stupid question mate. The SS screenshot is only for the month of May. We didn’t receive any dividends in the month of May (we usually get around 4 payments through the year).

If we had a dividend, it would show in this screenshot.

Hope that helps 🙂

Hey mate, in pod 28 ask fb fridays (34.20) you mentioned you were going to post a few visuals on debt recycling and document the process/post an article. This concept is very exciting to learn about and I want as much info as poss before siging up. Any info on where I can find it would be much appreciated. Thanks in advance. Alex

That article is in the works. Check this out from Dave at SMA though, it’s really good.