My (f)unemployed dream came crashing down in March… that’s right, I messed around and got myself another… job 😲

But this time it’s different. And I’m really excited to share some of the details with you guys (I might even make a pod about it).

This shouldn’t be all too surprising considering Mrs. FB and I are not financially independent yet but I had been thoroughly enjoying the abundance of free time during February. It was nice to just have a little break and stop to think about what we want to do next.

If you’re an experienced FIRE devotee, you’d know that meaningful work is a staple for all humans and whenever anyone in the FIRE community talks about the retire early part, they’re not referring to never working again. But if you’re new around here, I can totally understand that you might think that stopping all forms of work is the goal because of the word retire in the FIRE acronym. But it’s really about freedom, choice and having control of our most precious resource of all… our time.

So given that fulfilling/meaningful work is awesome, and is something I plan to do until the day I die, I had been thinking long and hard in February as to what my next move was work-wise. It’s an interesting thought experiment that I’d encourage all of you guys out there reading to try.

What would you do if money wasn’t a concern?

Money is still a concern for Mrs. FB and I (not FI just yet) but we’re so far along the journey that it almost feels like I could try my hand at anything and still be ok long term as long as it made some sort of income.

In the past, I had given serious thought about really ramping up AFB content and increasing the monetisation of the site and podcast. Hell, the increase in general podcast popularity in the last two years, especially in terms of advertising maturity would have probably been enough income each year from the site/podcast to be able to coast to the end goal. This thought popped back into my head but I kept thinking… do I want to do AFB as a proper job? And if I was being truthful to myself, the answer would always come back as no. AFB is first and foremost, a passion project. And I intend to keep it like this all the way until we have reached FIRE. Plus I couldn’t see myself enjoying the idea of spending my days behind a microphone/keyboard all the time.

At my core, I’m an extrovert nerd who loves sports, keeping fit and solving puzzles. My career in technology has always been a good fit, it’s just that the full-time nature of the job always felt like I was giving up way too much of my time each year.

So the longer I thought about it, the more I was leaning towards starting my own business as a freelancer in the data services and analytics space (my specialty).

And that’s what I ended up doing!

I landed a contract for 3 days a week in the project space which was so much more exciting to me. A lot of my old job was admin/operations which were never my thing. I like to solve business process problems utilising technology. That’s my jam and I tinker around in that space during my free time anyway. It’s the sort of work I’d been doing during the last 2 years in London but the pace of those contracts were a little too intense. I’ve been working 3 days a week since mid-March and my work-life balance atm is honestly on another level. 3 days of work and 4 days free every week is a serious game changer holy shit.

I feel like I get so much done during those three days too. How many people do sweet f’all from Friday lunchtime to knock off? Isn’t it a bit crazy, I’m sure there have even been studies done on how much work actually gets done past 12 PM each Friday yet most people piss fart around the office chatting or trying to look busy just to clock up their hours (I’ve been guilty of this too). I have so much more drive and purpose with my work these days. I don’t feel like I’m trading my time for money anymore because I’m scratching that extrovert collaboration itch of my personality with this type of work.

And that’s the big update from March. I’m going to work this freelancer gig for the foreseeable future to satisfy my love of solving problems with technology that allows for plenty of free time to work on other creative projects like AFB and anything else that pops up 🙂

Net Worth Update

Have you noticed a trend when it comes to FIRE related forums such as Reddit/Facebook/Whirlpool that 90%+ of the questions asked by newcomers are about investing? I’m almost certain that people discover FIRE and think that we all must be the second coming of Warren Buffett or something. That’s the only explanation as to why we can retire early right? In reality, it’s a high savings rate and usually a decent income that builds the foundation of the portfolio all the way up until around 70%-80% of the end goal, and then compounding does its thang.

A huge reason why we’re able to have a high savings rate is that we don’t conform to societies pressures and expectations to always buy the latest and greatest and consume as much as possible… most of the time 😅

It’s okay to splurge every once in a while on something you value highly… Which just so happens to be an engagement ring for Mrs. FB 😂

I’ve never really understood the whole diamond ring thing but ya know what? I know Mrs. FB better than anyone else in the world and she would never spend that much money just because the marketing machine told her she needs it. As long as she’s happy, I’m happy and god knows how much I’ve spent on weird obsessions over the years that she never understood but that’s just what a relationship is all about… understanding and compromise.

I actually read an incredible blog post in March that did make me step back and reassess what’s actually important in life and how money is simply a tool that we can use to become free but is not as high in the pecking order as you might think.

It’s a long read but trust me, it’s one of the rawest and most sobering articles I’ve ever come across in 7+ years of consuming FIRE content in all formats.

Living a FI was one of the earliest FIRE bloggers on the internet and he has rarely provided an update since retiring early in 2015. This isn’t an article that you can skim through, dedicate half an hour of reading time and check out his latest post here. I won’t ruin it for you but my biggest take away from reading it was there needs to be more consideration to how your partner is feeling during and after the journey towards financial independence. Because I don’t know about you, but I’d rather be broke in a happy relationship vs FIRE’d without my life partner.

I remember feeling a bit down when Mr Money Mustache revealed that he had split up with his wife a few years ago. I mean, I respected this guy so much (and still do) and thought that his philosophy on life was one that I could look to for inspiration and mould my own around. He’s written about the breakup a few times and reiterates that their way of life did not contribute to the relationship breakdown but man… it’s hard not to wonder… Especially after reading the Living a FI update and all the issues he faced once he reached financial independence and quit his job. There’s a whole other mental side to this movement post-retirement that doesn’t really get talked about much. Food for thought.

But yeah, the engagement ring plus my outfit for the wedding and a huge tax bill for AFB really smacked the old NW around for this update. Shares/Super really pulled through though so the damage wasn’t too bad

Properties

Property… Ugh…

I feel like Mrs. FB and I have done pretty well since we’ve been back home. She’s back teaching, I’ve started a business and have found work, the wedding in June is all systems go, we’ve sorted out a whole bunch of life admin work and tied up many loose ends in the UK. The last major piece of the puzzle is finding a PPOR to call our home.

And we were so close to ticking this off in March 😩

Long story short, we found a place that was right where we wanted to be, had all the features we needed, was within budget and our offer had been accepted. But the building report was not satisfactory and the most annoying thing about this heated market is the inability of buyers to negotiate. I won’t get into the finer details, but the vendor was making it really hard for us to get the deal done. Wouldn’t share engineering reports, kept changing the reasons as to why the defect was occurring, and completely ignoring other issues that were raised. Our gut told us to walk away from this deal which is what we ultimately ended up doing but I won’t lie, we were pretty shattered. I’d even started to imagine our future children running around the backyard lol. Emotions come into play so much more with a PPOR as opposed to buying real estate for investment purposes solely.

And it’s not like the vendor has to address our concerns right? Buyers are lining up around the corner for these type of properties and because we were asking too many questions, it was probably just easier for them to accept a slightly lower offer 🙃. I’ll probably meet the couple who ends up buying that house at the pub in 20 years time and they’ll tell me that they haven’t had any issues with it… 😤. Ah well, everything happens for a reason and it helps me sleep at night imaging that we dodged a bullet but who really knows.

So we’re back at square one now and I’m starting to realise why so many couples just get sick of the whole process and end up either buying something that they don’t love or overpay. We’re not at that stage yet but it’s easier now for me to relate.

Property 1 was sold in August 2018

*DISCLAIMER*

The current value of our properties is a rough guesstimation based on similar surrounding properties. I only really update these when we get an official bank valuation

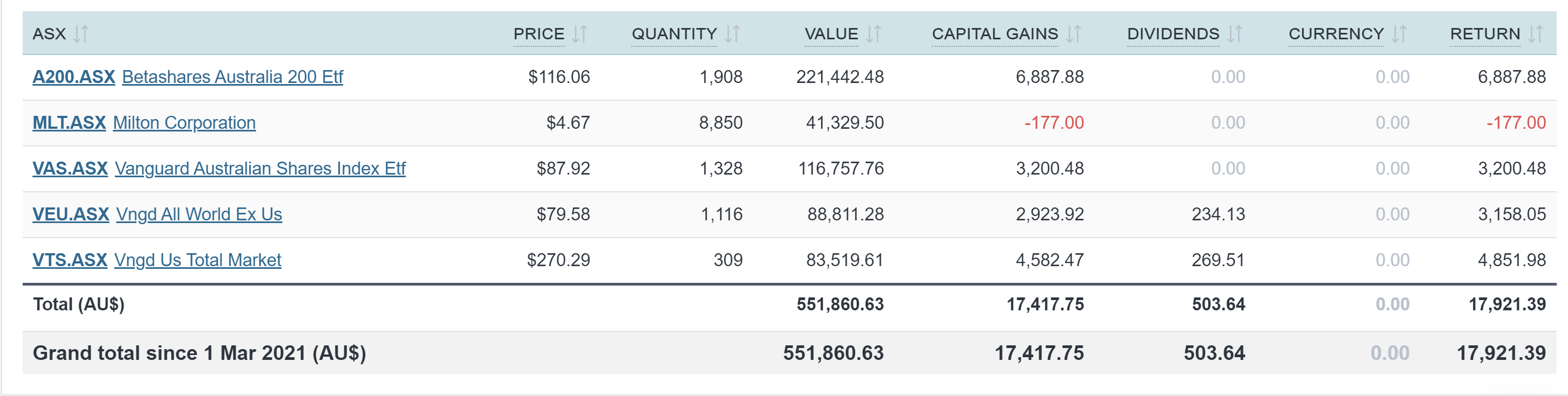

ETFs/LICs

The above graph is created by Sharesight

We continue to build up our PPOR deposit and didn’t purchase any more shares in March.

Congratulations to you and Mrs FB

Thanks Serina 😊

So glad you didn’t get rushed into making a bad property decision, I agree, best to wait it out!

Will be checking out those blog links, and agree man I was a little sad after reading about MMM divorce. I wasn’t in such a long relationship as him but was pretty gutted after mine ended and I can’t help but feel the passion I put into CaptainFI may have been a contributing factor

Hi,

Do you have a business website? Would love to check out what you’re doing.

Thanks,

Lucy

https://captainfi.com/

Cheers boss. You can’t blame yourself mate, especially if it’s just doing something that you love.

Well done on creating your own job mate, I had the feeling you were going to go with something along those lines rather than heading back to the 9 to 5 grind! Hope it works out for you!

That livingafi post was interesting, my biggest takeaway was that sometimes situations change and so does what we want. There’s only so much that we have control over, and as much as we might be on the same page during accumulation phase it might all change when it comes to retirement.

At the moment I’m planning on complete retirement when I hit my FIRE number or soon after, but there’s a long time between now and then and it’s entirely possible that my or our priorities may change, either out of necessity or by our own choice. And even after we pull the pin on work, there’s still plenty of time for us to decide we want to do something different. We’ll see what happens!

I’d say bad luck on the house, but if the vendor isn’t sharing information about a known problem I’d say you may well have dodged a bullet there. Hopefully something ideal comes along again soon!

Thanks HIFIRE,

Mate, I’m LOVING working for myself atm. I’m actually back working at my old place but I have a completely new outlook at work. It’s so different when you’re building a business compare to just checking in and out. I’ve ramped up to near full-time hours now but the first few months was around 20 hours a week and it was bliss.

I had that work stimulation but plenty of free time for walks, exercise and relaxation. Best of both worlds.

And yes, I felt like we dodged a bullet too (at least that’s what I tell myself to sleep better at night 😂)

Love reading your updates. I think you did the right thing with the house. Just because it’s a bubbly market you shouldn’t have to stand for that stuff, it would leave a bad taste in my mouth for years.

I’m glad you enjoy the content Martyn 🙂

Yep. It didn’t feel right so I’m glad now that we walked away. It’s easy to feel that way now though since we have just gone unconditional on another house 🎉

Couldn’t care less about that other joint now lol

You’re right about that linked blog being worth the reading time! It really hammers home the importance of “partner sync” along the journey. Respect to him for being able to adapt to the changes life has thrown at him. His numbers are interesting, although I know living on USD 30k in the US is a different proposition to living on AUD 30k here.

It should be noted that he is closer to lean FIRE vs traditional FIRE. $30K in the US is still bare-bones IMO but everyone’s different.

An interesting read on FIRE and relationships. My wife and I have basically hit FI in the past few months and I have been unemployed for the last 7 months since being made redundant. She is still working full-time as this is what she wants to do which is fine by me. As we discuss more and more our lives in the future I am finding how we imagined our lives would look won’t necessarily be how we live them. I’m beginning to appreciate that living the reality of an FI life comes with its own challenges. It’s so important to be transparent with each other and appreciate each others unique needs, desires and motivations not just in the accumulation stage but also after having reached FI.

BTW – I reckon you definitely did the right thing with the house. We were in a very similar situation to you 10 years ago where we passed on what looked like a perfect house because the building report came back with a number of defects. Anyway we ended up with one that was heaps more suited to us and in a better location!

Nice one!

We ended up with a better house in a slightly worse location but $30K cheaper so I’m taking that as a win 😁

Congrats. Three day work and four day weekend is awesome! I’ve been doing the same for over a year now. It’s such a different feeling to working 5 days a week.

.

I too read about theivingfi update, I used to love reading his blog posts.

its interesting and seems to

be a pretty common experience, when people have all the time in the world to spend together, sometimes they realise that they don’t want to do that! I don’t look at these typically as a failure, or anyone’s fault. More like what happens when someone is in a job that no longer suits, and they need to leave.

Cheers Sean. Three days a week is the bomb hey! I’m closer to 5 now (hours have picked up and I’ve got another contract) but I’m loving it still. I have a lot of drive atm and working on your own business is so much fun. I look forward to work every single day (not kidding).

Maybe it won’t be like that forever but right now it’s great.

I like you have had the pleasure of working when where and how I like…..

I’m sorry to say that you have quite a journey in front of you.

I have been dabbling in shares since I was 18 and property since 30. I can state clearly that if you are prepared to get your hands dirty than property wins hands down.

I believe in the compound story which is why I buy and hold. At property number 6 and 2 owned outright I am done.

Sure i am 50 but with wife and 2 kids going well, I spend my days doing what I need to to keep my property productive and the rest of the time is mine.

Like you if I need some cash I do a short gig and then take my time back in chunks.

Shares are okay but limited in what you can value ad.

I cop plenty of criticism for my personal position but I had very little at age 30.

20 years later, done.

Good luck with your journey but to me, property has been the key to success.

All the best

The graphs/graphics don’t seem to be loading for me. Have tried a number of different browsers

Hmmm… not sure mate. It’s working for me and on my Mrs. computer.

We’ve bought in 2 property booms – the Melbourne boom of 2014 and the Brisbane boom that was just starting in 2019. In Melbs 2014, we ended up going regional, as melbourne prices were increasing $50k every weekend at auction. Even though we have still done well in regional, I wish we hadn’t felt pressured as the property didn’t tick every box and we’ll be selling as soon at the tenants leave.

The Brisbane 2019 boom one saw us get gazumped on a house a few hours after we’d actually signed contracts and 2 weeks of negotiating. After telling us congratulations, the agent then spent the afternoon shopping our signed contract around to get a better price (holding off getting the seller to sign ours). We got outbid by $30k by COB that day, after being told it was sold to us that morning. To make it worse, they sold to a developer who turned the cute cottage into townhouse set up with no parking or outdoor space. After licking our wounds for 6 months, we stumbled across a better house, on a bigger block, in an excellent location… and no one else showed up for the auction! We thank our stars everyday the other one fell through 🙂

Ahhh the joys of buying a house. It’s crazy that the biggest financial cost of most peoples lives isn’t more tightly regulated and transparent. I wonder if it will ever change one day?

What would you say is your average income per month from your investments in ETFs/LICs? I can see that it was just under $18k this month? Thanks!

That 18K isn’t income, it’s just the net change in value since last month (i.e. his holdings increased in value by 18K).

Changes way too much. Sometimes we make money, sometimes we lose money.

I really enjoyed your update – where the “missing out on the house” is concerned I can only tell you having bought 4 PPOR over a 30 year period one thing I know for sure……the house that is meant for you, the right one will always present itself. If something is difficult or feels off it just honestly is not the right one.

Thank you for sharing the link to the LivingAFI blog post – that was such an emotional journey to read through and I felt all the feelings for sure. He’s an incredible writer and I loved his raw honesty. It’s so true, you can make plans now but you never know what is around the corner that will make you have to pivot and readjust your priorities. It’s all part of the journey I guess.

Thanks Lisa 🙂

Funny enough, we have now gone unconditional on another property that was better for $30K cheaper 🎉. A little bit further out of town but it’s still a net positive in my book. And I knew this house was the one as soon as we went through it so you’re right in that regards.

I’ve been following your blog for ages and really enjoy it. It’s been great following your and Mrs FB’s journey so far.

At 54 years old, the RE part of FIRE is one thing that hasn’t resonated with me as much. I went back to work 3 days a week after having a child 15 years ago. It’s a job I love, in healthcare, working with amazing people. I used to say I worked part time, but now I call myself “semi-retired”. Like you guys, I worked hard for the first 15 years of my working life to set this up. I was frugal (still travelled and worked OS like you) and if I’d got the investment part right I could have done it in 10 years.

Four days a week off gives me the balance I need, keeping my mind stimulated, raising my daughter and following other passions.

Keep up the good work (and blogging).

💯 Annabel.

Meaningful work is amazing! I’ve always said that the RE part in FIRE for us means to retire from the rat race per se. I need that mental stimulation from work and I’m an extrovert too. I love collaborating with other passionate people 🙂

AFB, this article is a gem. Your focus on psychological aspect of money is appreciated and your confidence in digging deeper is rousing. Here, you embody Mad Fientist in a never ending search for meaning behind everything which only makes me excited for your future updates.

The chatter on investing such as splitting hairs between VAS and A200 is a tedious journey many find themselves on. The cause is unwillingness to learn and expend our horizon with expectation that someone will give us an answer we are seeking. If we get it, we are dissatisfied as we don’t know what to do with it.

You’ve hit the nail on the head, our time is precious. Life brings many joys and one of the greatest is willingness to learn and expend our thinking. Eric Allen once said, “Everyone is my teacher” and that can’t be truer. Every experience, interaction and observation teaches us, if we allow.

What an extremely well written and flattering comment Vlado 🙂

“Everyone is my teacher” I love that quote and so true!

Well done on the new job. I agree with you wholeheartedly around the importance of finding the right job. Today is the first day of my new job. A job a year ago I wouldn’t take as a lot would see it as a step down. However it’s the exact job I need right now, and a huge relief. Making huge inroads towards FI has meant like you we can afford not to have to climb the ladder, and can pick and choose what we do from here on in for paid employment.

It’s the ultimate reward for years of hard work, commitment and discipline.

congratulations on the engagement and upcoming wedding! 😍😍

never thought about relationships and FI/RE myself; my wife and I are working towards FI also but we have a bunch of side hustles we want to work on later down the track which I hope we can work on together; that’s our goal, anyway.

keep up the good work 👌👌

Thanks mate 🙂

AFB: “Down $7k this month after buying an engagement ring.”

Mrs. AFB doing the math in her head for how much the ring was: “wait a minute.”

😛

lol, I was thinking the same, but to be fair he does say “plus my outfit for the wedding and a huge tax bill for AFB”, so it’s not all gone on a huge sparkly ring! ✨😂

lol

Hey mate, take some of those property inspection reports with a grain of salt and get a second opinion. When we got an inspection back for a apartment we were serious about in Bondi Beach they said the roof/joists and framing was in a bad state, that there was evidence of termite damage and other horrible and expensive sounding issues. We were very keen on the place and asked a trusted builder friend to inspect everything and provide a non binding verbal appraisal of the issue. He said the roof was absolutely fine, some old minor termite damage and the joists/framing was going to last another 100 years. We owned that property for 7 years with no roof issues and made $350,000 in capital appreciation. We were very close to pulling out of the sale at the time due to some over cautious property inspection report and who knows how long it would have taken to find the next suitable property and how much extra we would have had to pay.

Good advice mate and it’s something that we ended up doing. Unfortunately, the nature of the defect was pretty black and white. It was either not going to be an issue ever or be a complete disaster to repair (potentially issue with the slab). No one could tell us if it was actually going to go bad in the future but the risk was always there. It would have been better if the vendors would have been willing to share the reports. The whole thing was suss 👎

Congrats mate!

Have you contemplated building? You then get exactly what you want (assuming there is land available where you want to settle)… Just a thought. Cheers.

Not really tbh. It was a last resort. I’ve built before and there are just too many hidden costs IMO. I like to see and feel what I’m buying plus we didn’t really want to wait around for it to be built.

I think people don’t realise the real life hack is working part time. I work 3 days a week too and so does the wife. We have no plans to ever retire and FIRE has kind of fallen on the back of the mind and we don’t give it much thought anymore. It’s unreal that tomorrow is the last work day of the week then we will go away to Tassie for a holiday.

Some friends and family think we are mad since we are both only 30 but we are the ones getting to enjoy our lives. Not to mention we both love our jobs a lot more!!! My top tip to anyone in FIRE is find a challenging job that keeps you stimulated and try to get it 3 days a week and you’re set. No need to save so aggressively as retirement isn’t as urgent……. I’m personally happy to retire when I’m in my 70’s at this rate.

That’s awesome dude! Not all industries allow for 3 days a week unfortunately but totally agree that dropping down from full-time work can be a game-changer that doesn’t require decades of savings/investing.

Hey AFB

A great write up for net worth and a that article from ‘Living a FI’ was definitely hard hitting to say the least. Made me realise that work is definitely a main conversation topic with a neighbours and some friends.

As people have stated here it seems that working a few days a week after your portfolio starts ‘paying some bills’ is the way to go and something we hope to do in the future.

You have definitely put yourself in a great position when kids come along though and you and your future children are going to reap the benefits. My wife and I both work full time and the kids are in day care (just made me think your portfolio will have also saved yourselves a fortune in day care fees, even if you do decide to send them 3 days a week). But the fact that you and/or Mrs FB will be able to spend over half the week (as opposed to ‘just the weekend’) with your future kids is something not to be understated. Congratulations on putting yourselves in such an enviable position at such a young age!

Thanks a lot Ococ, really appreciate the kind words 🙂

Congrats on the engagement! I’ve been a freelancer for a while and the freedom is insane, I’m sure you’ll just grow to love it more and more.

Cheers FDU!

Can confirm, loving it more and more 😁

Hey mate,

Awesome pods, cheers for the Aussie translated content.

Super quick question – is your net worth a combined accumulation with mrs FB? Or is this your solo net worth?

I’m a solo investor and am not too far off from your net worth, so am very curious to compare our monthly journeys.

Cheers,

Bec the graphic designer 👩🎨

Hi Bec,

It was just mine up until around October 2016. After that update, it’s been a combined effort 🙂