Before we get into the month of Jan, the annual anonymous FIRE Survey is back and open for submissions.

There was so much to improve on from last years survey (yes I did manage to add Super this time around 😅), better-structured questions and logic design flow were the main ones and I’m really excited to see what sort of analytics we can get out of this year’s dataset.

I did some homework on how many submissions we would need to achieve statistical significance. If we assume that there are 100,000 people pursuing FIRE in Australia (probably a lot less tbh), we need to have 1,056 submissions for this dataset to provide a 95% (industry standard) confidence level with a 3% margin of error of the community.

1,056 is the target gang 🎯!

It only takes 10 minutes to fill out and there have already been over 350 submissions so far 👏. A big thank-you in advance to everyone who participates 🙂

We’re back baby!

I can’t even tell you guys how good it felt getting off the plane in Adelaide and hearing that Aussie accent. For the first time in 2 years, I didn’t have to concentrate on my pronunciation of certain words and it was nice to get acknowledgment after an enthusiastic “Cheers Cobba” when the police officer helped us with our bags. You really don’t appreciate something until it’s gone but nothing beats the laid back, easy-going, always up for a laugh Australian attitude ♥!

First time I’ve ever been to Adelaide actually, and I would really like to go back because the city looked really nice! It killed us a few days/nights when the weather was a perfect 28 without a cloud in the sky and we were stuck in hotel quarantine. We stayed at The Playford Hotel in the CBD and we could see this killer little rooftop bar from our room and I did contemplate knotting together a few towels and trying to swing down for a beer or two…

I’ve gotta say, we didn’t have high expectations for what hotel quarantine would be like. You always hear the worst stories, and as I mentioned in the previous months’ update, we were part of the ‘Aussies in Quarantine Facebook’ group (lol) which constantly had nightmare stories about families getting stuck in a tiny 1-bed apartment, horrendous food and rooms where you couldn’t open the window (brutal). Well, you could imagine the surprise we got after reading all this negativity when we finally got to our loft apartment at The Playford. That’s right, our room had an upstairs loft, spa, Juliet balcony, king bed and 60 inch TV with every streaming service known to man available for us to use 😁. But that wasn’t even the best part… the in-house chef-prepared meals was the show stopper 🤤.

I’ve had room service before, but we were getting 3 chef-prepared meals a day delivered to our doorstep. We had to throw on the mask after 30 seconds and collect the little bundle of joy. It was honestly the best part, we were guaranteed a little hit of dopamine each time that little knock came. There was a menu on the TV so you knew what each meal was, but the surprise was half the fun. And the meals only started to repeat after around the 12th day. I’m talking 11 different types of breakfasts before it starting to repeat. Just epic!

Here are a few pics of the room and some of the meals so you can get an idea.

Hats off to The Playford and SA government for making a shitty situation as comfortable as humanly possible. Just like with most things, it’s only the bad stuff that makes the news, unfortunately. For every one that complained about conditions in quarantine, there were probably a thousand others who had more than ideal situations. It’s half the reason I don’t really watch the news anymore. It’s just story after story of the worst shit out there or giving a tiny minority of complainers a platform to spew garbage.

The first week of quarantine was actually enjoyable you know. Plenty of free time to relax and just wind down after all the flying and travelling we had been doing in the previous months. And you don’t feel guilty about not going out and enjoying the day. The staircase was a lifesaver for exercising because it opened up the walking path and made it easier to rack up the kilometres instead of cutting circles in one room. It also doubled as a little pull up bar from underneath which was very handy. After the first week though, things started to get a bit flat and we were more than ready to leave on the 14th day.

We tasted freedom on the 19th of January and left the Playford at the crack of dawn to board our flight back to our home state, Victoria!

We’re from Gippsland in Victoria which is south-east of Melbourne and even though I’ve done the trip from Tullamarine to Latrobe Valley a hundred times, I don’t think I’ve ever felt better seeing the ‘Next Exit’ sign on the M1 with our home town’s name.

The first week back was full on! We had friends and family that we hadn’t seen in over 2 years, nieces and nephews we were meeting for the first time plus trying to sort out our living situations all made for a hectic return in the best possible way. Mrs. FB had to return to work at the end of January which added even more pressure to get everything done as quickly as possible.

We’ve decided to buy a home this year. Not an investment property, but a home that we can raise a family in for potentially the next 10-15 years. I’ve crunched the numbers and compared rental prices for similar houses and believe it or not, it’s very similar (cost-wise) to have a mortgage instead of renting atm because of how low-interest rates are.

These were my rough calcs for a ~$500K house in my town.

| Renting | |

| Rent (yearly) | $27,040 |

| Bills (yearly) | $2,400 |

| TOTAL (yearly) | $29,400 |

| PPOR (Primary Place of Residency | Notes | |

| Principal (yearly) | $16,008 | Assuming a 2% interest rate over 25 years with a 20% downpayment ($400K loan) |

| Interest (yearly) | $7,968 | This number will change slightly each year but it’s roughly this much |

| Bills (yearly) | $2,400 | |

| Rates (yearly) | $2,500 | |

| Water (yearly) | $900 | |

| Repair & Maintenance (yearly) | $4,000 | Guesstimating this one |

| TOTAL (yearly) | $34,576 |

I haven’t factored in stamp duty (such a bad tax) and a few other bits and bobs but the numbers are so much better for home ownership vs renting compared to a few years ago. I’ve spoken about opportunity costs before and sinking a lot of your capital into a non-income producing asset (a PPOR) can delay your journey towards financial independence but we’re at the stage of our lives now where stability and other intangible factors are taking priority vs what’s going to make the most financial sense.

Even this quick and dirty example above makes for a very compelling (numbers-wise) case for homeownership in the current environment. If we wanted to rent a property valued at around $500K, it would roughly be $30K a year. We would never see this money again. Homeownership would still take more money out of our pockets each year (~$35K), plus the stamp duty and buying fees, but a lot of that money would be retained through equity. Whatever we pay in interest will be gone, never to be seen again. But the principal payments act as a sort of savings mechanism which makes it a lot more palatable.

I’ve got a few projects in the pipelines as to what I’m going to be doing work-wise this year. Nothing has materialised yet but I should be able to provide some updates in next month’s article. I might even do a dedicated post about it.

Net Worth Update

Getting dangerously close to the $900K mark now 😁

The big bump this month came from a mistake I made when I signed up for a fixed contract with the last company I worked for in London. Like a rookie, I didn’t opt-out of the UK pension for that job 🤦♂️. So I was receiving pension payments (equivalent to Super payments for us Aussies) each paycheck for the last 6 months. And now that money is stuck in the UK until I turn 60 🤦♂️🤦♂️🤦♂️

If anyone knows how to either

- Get the money transferred to my Australian Super account

- Get the money transferred to my Australian bank account (the better option)

I would be very grateful if you could share the details.

I rang up the mob where my UK pension was being locked away and they have told me that I can transfer it to my Aussie Superfund once I turn 60 or if I have health issues.

So basically, I discovered this little locked treasure too late and it turns out I have ~$12K AUD stuck there. What I should have done was opted out of the pension scheme which would have resulted in more money outside my pension account… I would have paid more in tax of course but we are planning to reach financial independence long before our preservation age so I’m happy to pay a bit extra.

Anyway, this $12K bump was added to the old net worth along with ~$20K from the share market and a little bit of cash and Super to round off an excellent jump to start the year.

Properties

Boy oh boy how things can change in a year.

So as I mentioned above, we’re currently in the market for a home in our little country town of about 20,000 people that’s 2 hours away from Melbourne with one of the main economic drivers of the area being coal-powered power stations that are shutting down over the next 20 or so years… you know, not the most sought after real estate in the world I would have thought.

Well, well, well… let me tell ya. My town (and surrounding towns for that matter) are experiencing the hottest market that people can remember… ever.

Most houses between $400K-$600K are not even going to market. They are selling before they hit the internet and one agent told me he has a waiting list of 20 cashed-up buyers ready to pull the trigger. I understand agents can add a little mayo sometimes but in this market, I don’t think they are exaggerating 😑.

I have been looking at homes since the start of last year and I know what similar types of houses were selling for then and what they are being sold for now. I reckon real estate has jumped at least 20% within the last 12 months in my home town.

And it’s not just here either. I have been receiving a few pamphlets from real estate agents up in Queensland (where we have our remaining two investment properties) asking me if I’m looking to sell. If you’re a regular reader of these updates you may have remembered me talking about selling one of the Queensland properties in August last year. I had a few appraisals done and wasn’t exactly blown away so I thought we’d sit of them for a bit longer. Well, the new appraisals have come in and the market up there must be really picking up as well because the ballpark estimates that I’ve been receiving have been very good IMO and I’m probably going to offload one property this financial year if everything works out.

It’s pretty insane that this has happened, right? Who could have predicted that house prices around the country it seems, would have gone through the roof during a global pandemic 🤯???

I’m no fortunate teller, but I really don’t see house prices going down anytime soon. The market can definitely slump, and stagnate over many years. But the major factor for a big crash comes down to interest rates IMO. Because if people aren’t forced to sell, they won’t!

Even if house prices do slump, there’s almost an unbreakable psychological law in Australian real estate to never, ever, ever sell for less then you bought it for. Even if it takes you 20 years, ignoring inflation, ignoring buying and selling costs, ignoring opportunity costs… it’s simply unthinkable to sell your house for less than what you paid for it.

And the only thing that will ever force people to sell for a loss is if they can’t meet serviceability which brings us back to interest rates.

So whilst it does suck to try and find a house in this market, as long as we find the right house, I’m not too worried about paying a bit extra because I really can’t see house prices coming down that much (if at all). The biggest issue we’re facing atm is stock on the market. I’m hoping that when job keeper ends at the end of March and when the COVID tenant protection laws finish, there will be a lot of people listing their homes to capitalise on this hot market. I don’t expect a price drop (it would be nice), I’m just hoping for more options to choose from because at the moment we can’t even go to an inspection without the house already being under offer 😩.

I’d love to know how the local markets are where you guys live in the comment section below 🙂

Property 1 was sold in August 2018

*DISCLAIMER*

The current value of our properties is a rough guesstimation based on similar surrounding properties. I only really update these when we get an official bank valuation

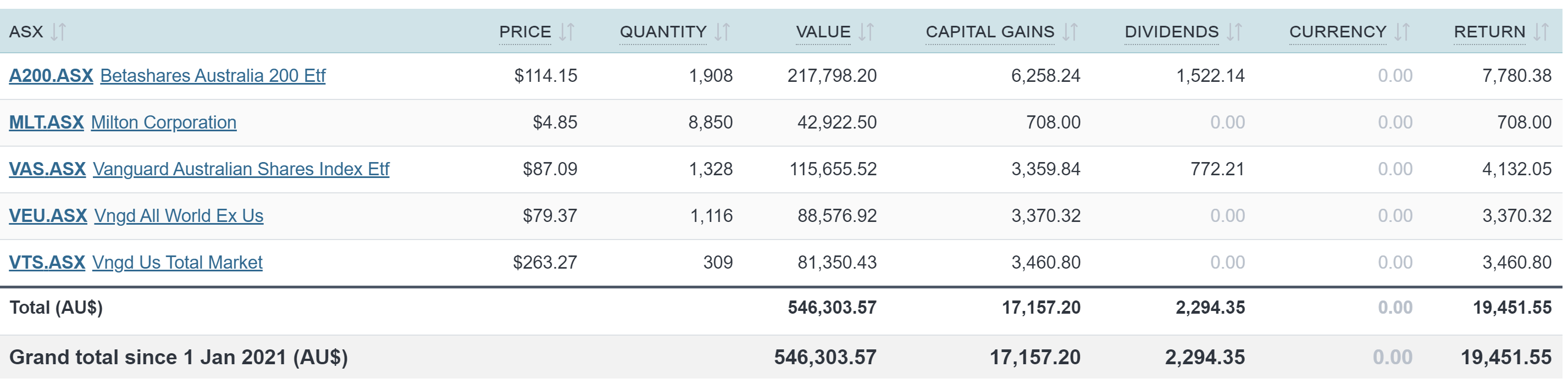

ETFs/LICs

The above graph is created by Sharesight

A solid month with some great dividends in January 💰

As I’ve mentioned in previous months, we have put a halt to buying shares for the time being with all our savings going into the house deposit when we find the right one. So the portfolio will continue to tick along at the current splits for the time being. Once we have our house, it will be back at it again!

Question is – when does it end? The property market is the same here in Brissy.

I dont understand why our generation is borrowing up to their eyeballs to line the pockets of Boomers and Gen x’s? and then what happens we do the same to our kids? and they do it to theirs?

in 3 generations time you’ll be paying $3M for single dwelling with a shared kitchen and bathroom and an average wage will be $150k. Madness

It’s the million-dollar question mate. I can say though, the country is still miles better than Melb/Sydney for affordability… and they are both better than London. So there are quite a few levels to this game it seems…

Welcome back mate! Ah the first couple of months after you return home, so many people to see, so much stuff to get done! That hotel food doesn’t look too bad at all, I’ve seen a lot worse that’s for sure. The hotel room looks awesome too, maybe someone at The Playford is a fan of the blog? 😉

In terms of getting your money back from your UK pension fund, yeah good luck with that. There are some workarounds with it I believe but you have to setup a SMSF with rules that mirror the UK pension rules, ie you can’t get access until you’re over 55 with pretty much no exceptions to that even if you’re disabled. And you’d have the hassle and expense of running a SMSF, because the big super funds typically won’t take your money if you’ve got a QROPS portion.

Other than that I don’t know of any ways of getting the money back here, if you hear of any please let me know cause I’ve still got a pension account over there that I wouldn’t mind moving here! I’m kinda surprised that they’re telling you 60 though, I was pretty sure that 55 was the age you could start getting access.

Best of luck with the property buying, I’m on the other side of Melbourne from you and property prices around here have really shot up over the last year or so. It’s worked out pretty well that we built our place a few years ago!

+1 for anyone who knows a way to get the UK pension back into Aus super accounts.

Kind of silly with the history between Australia and UK and commonwealth and you can’t transfer funds from 1 pension to another….

Great update again and looking forward to hearing how the property purchase goes!

Good to be back mate.

Haha, maybe someone did read the blog over there. I looked into the QROPS because it appeared like you could transfer it back. But like you’ve mentioned, you have to be a certain age (I thought it was 60 but it very well could be 55).

We went on our trip one year too late it seems. We could have avoided COVID and snagged a bargain property… ah well, can’t win em all.

Glad you scored some good digs and food for your quarantine stint. We quarantined at The Pullman Adelaide when we came back in November last year and it was excellent. (We went over in Sep for my father-in-laws funeral, took as 2 months to get a return flight after a couple of cancellations; the trip cost us $5.5k flights over, $18.4k flights home, $4k quarantine .. ouch!!)

I have three UK pensions with AVIVA (and a US IRA … argh!) and that’s my understanding too. None of the Aussie retail super funds are QROPS approved anymore, so unless you setup a restricted SMSF, your UK pension is stuck until age 55.

At 55, you can withdraw 25% tax free as a lump sum and then choose what to do with the rest. You can move it to a drawdown pension (tax free gains while it stays invested, withdrawals are taxable), purchase an annuity (regular taxable payments), or take the other 75% as a taxable lump sum.

The returns on my UK pensions have been pretty crap, thanks to big drops in 7/2020. Since 2/2019, the largest of the three UK pensions has grown just 0.4% (it dropped a whopping 33.1% in 7/2020), the next returned 14% (dropped 10.1%) and the last 5% (dropped 10.2%). So I’m definitely planning to take the 25% tax free lump sums when I’m able to in another 4.5 years, then I’ll probably slowly drain the remaining 75% to minimize tax.

here in the leafy eastern suburbs of Melbourne prices are booming, due to a lack of stock on the market and low interest rates and cashed up middle class people whose jobs weren’t effected at all by covid. I worry about how my kids will ever buy a house. we were considering selling our investment one bedder but am going to hold for another 12-24 months just to see where prices go, even though we’re dealing with a non-paying tenant right now.

I’m hoping that when the tenant COVID laws finish, a lot more stock will appear on the market. At least we could have some options.

Welcome back to Straya mate, great that you enjoyed your time, albeit in quarantine in RADelaide or Adelaide as the capital of the free settled utopia, South Australia, is spelt. Sorry I saw your Adeliade typed twice to think it was a typo 🙂 You are so true about the news and stories about quarantine. So it is great to see feedback on your meal and room, which I am sure the staff at the hotel would love to hear. Puts a few entitled tennis players in their place. Did your flights back get cancelled or rescheduled at all?

I am relatively new to your blog and did not get to complete last years survey so will now. Getting close to 7 figures with your net worth. Hopefully this time next year will be a milestone to celebrate

Good to be back 🙂

I’ve edited the misspelling 🤭

Don’t even get me started on those tennis players lol. Read last months update to hear about our flight disaster, but basically, we had to switch flights in Sweden and our suitcases got stuck in London. We flew to Adelaide but it was the only flight going at the time and it was important to just get back into the country. A bit of a nightmare but we made it at least.

It depends on what the markets do but we might be able to break 7 figures by the end of this year… we’ll have to see.

i approached my Super Fund in Australia, i think it was with MLC at the time, and they arranged the transfer of the UK pension/super balance to my Australian account.

I wasn’t Ill and i was definitely not over 60.

From memory i filled out a couple for forms, sent them to the company and got a statement when the funds arrived

How long ago was that Shane, the rules changes in about 2015 I think so you couldn’t do it that way any more?

We’re on the Central Coast of NSW, half way between Sydney and Newcastle. The property market here is crazy too. Rentals are very hard to come by with people offering to pay 6 months rent upfront just to get a place. A decent 3-4 bedroom is renting for $650 per week with often hundreds of people turning up at each open house. I was talking to friends in Muswellbrook, Forster and Port Macquarie yesterday and apparently it’s the same there too. Crazy stuff!

There’s legit 0% vacancy rate here in my home town… wtf

I must be an exception to that rule – never sell your real estate at a loss. I offloaded two investment properties in North Qld last year (pre-covid) because I waited for the market to recover from the GFC for TEN years and it showed no sign of doing that. The opportunity cost of having my money tied up in ever decreasing assets was not helping me sleep at night. I sold one house that I’d paid $740k for for $550k and another that I paid $320k for, I let go for $199k. I have one remaining (in the same town – yes I also broke the “eggs in the same basket rule”) which may go for a $80k profit so I’m going to hold it for a little while longer. It is quite freeing knowing that those ball and chain houses are gone. Even if I made a loss. I have other profits from RE that I think about to ease the pain. The only RE I will ever hold again is PPOR.

We’ve sold at a loss as well, and I echo your sentiments. Rental realestate is waaay too risky for us, especially being FIRED.

Thanks for sharing Lisa.

It’s better in the long run to offload properties that aren’t performing. So you probably saved yourself money. But you are definitely in the minority.

I’ve been around mum and dad real estate investors my whole life (friends and family) and every single one of them would never even contemplate selling a house for less than what they paid for it unless their hand was forced. In fact, most of them would happily forget about it altogether for years on end and then come back a decade later. In a weird way, this is positive of an illiquid asset. People can’t panic sell like they can with shares. It’s a crazy mentality though!

Hi AFB,

First time poster here – are you able to do a comparison on renting vs buying including the opportunity cost of not investing the deposit, stamp duty etc?

e.g. $100k deposit + $ +$5k a year; all invested in B&D portfolio *25 years

Your sums seem pretty good, “only $5k more a year to own”, but that doesn’t account for what you would have earned keeping all that in nice, juicy ETFs. Where I am at the moment, $500 a week gets us a $1million home, so it is crazy cheap to rent by comparison 🙂 Your small rural town is much closer to being a real choice, but I don’t know how I would feel about buying in peak FOMO market with interest rates at historical lows. Word on the street is the bond markets are pricing in interest rate rises from H2 2021, maybe it is worth waiting till the crazy has gone out of the air to find a place?

Cheers, love ya work 🙂

PS Forgot to add, is 2% for life of the loan realistic? Surely the calc’s should assume something closer to average of past 15 years, 4-5% maybe?

If I am lucky, I hope to buy somewhere in 4-5 years, and I have some personal bias that things will cool down between now and then 😮

Who’s to say the interest rates won’t go lower? No one really knows, do they? If I were a betting man, I’d probably say that they will eventually rise but I’m not sure if they make it back to 4-5% for a very, very long time. Are you going to be sitting on cash for the next 4-5 years or are you still investing?

Hi AFB,

Yeah the future is hard to predict 🙂 If I was a betting man though, counting on 2% for the next 15-25 years seems madness. Lower seems very unlikely, my guess would be 1-1.5% higher in the medium term. I don’t think we are ever going back to 5-7% levels until (if) all the debt gets inflated away. I guess what I am saying is, doing your sums with 2% assumption does not seem very FIRE-like or honest with yourself.

I am not sitting on cash – all in on a 70-30 balanced ETF portfolio.

Good to hear you’re in Australia- best place to be right now) Done the survey, noticed it has got lots of asset types but missing Managed Funds. While you were away, Vanguard Australia really upped their game – check out their new website and Personal Investor. Can buy/sell Vanguard ETFs as well as managed funds with zero commission but 0.29% annual fee (in addition to ETF fee).

I’ll add managed fund to the survey next year for sure!

Hi Damo,

There’s a lot of factors at play when trying to do an accurate comparison. We have opted to rent our whole lives because it made sense financially and gave us the freedom to travel. But our priorities have shifted and stability is something we’re willing to pay a premium for. So this isn’t really a financial decision per se.

I’m totally with ya comparing the $1M property to $500 a week. I’m assuming that this property is closer to the suburbs or even in a city? I remember looking at the price of our 4 bedroom flat in London and working out what we all were paying in rent and being blown away by how little yield the landlord was getting. It’s actually diabolical over there when it comes to real estate prices. It’s such a better deal to rent vs buy in London it’s not funny. But as you acknowledged, the country fairs a lot better for homeowners.

We’re not in a rush to buy, but it would be nice to have settled into a home this year at some point. I’m always keeping an eye out and I’m hoping that more stock hits the market in April/May 🤞

Hi AFB,

I got the feeling it was an emotional decision rather than financial 🙂 You are only human, and if you are like me (or most of us here I am guessing), owning a property is just something that feels right.

But, as a finance blog, it would be good to see a “best effort” at truly calculating the cost of owning vs renting in this scenario. For crude back of envelope calculation:

Assume $150k for deposit, stamp duty etc

Assume $5k a year invested monthly (cost difference between rent/buy)

Assume 9% return on average (typical of 60/40 balanced ETF portfolio over long term)

After 25 years, renting gives you a $1.7 million portfolio.

Will your country house be worth that much in 25 years? Maybe /shrug.

A little scary on how much even a modest house truly costs us 🙁

The house we are renting is actually in the outer suburbs of Perth, but absolute beach front. Not a bad deal considering the cost to buy – but at some point I would still like to. But if prices keep doing what they are now, I am seriously considering just never buying. After all, it doesn’t take a large portfolio to generate enough returns to cover rent in perpetuity. /shrug. Tough choices either way.

Cheers,

Damo

Hi thanks for your content. May i ask why do you hold vas and a200?

Thanks

No worries. I started with VAS, went to A200 because the MER was less than halve at that time. Then decided I wasn’t comfortable with so much of my wealth in Betashares so tried to even it out a bit with more VAS. They serve the same purpose in the portfolio and owning both is a bit redundant but, meh.

Hey AFB,

Thanks for everything you share. Started reading your good late last year and found it very informative.

One question, the income that you report every month from share ( eg $19.5k this month), is that just the value of the share increasing is our is it the dividend payments? Some of the additions are pretty sweet some months like $30k plus just from shares, just curious. Thanks

K

No worries K, I’m glad you’re enjoying the content mate 🙂

The share growth is the easiest to track because I include a screenshot of my Sharesight account each month. Have a look at the image directly under ETFs/LICs. That will give you a breakdown of the capital gains and dividends that made up the share growth for this update.

Hope that helps 👍

Welcome home! The Aussie Firebug looking to buy a home… this can only be a precursor to one thing…. 😂😂😂 only joking Cobba just pulling ya leg

Honestly though, I am happy to rent for now in the accumulation phase, but I do want to eventually buy 10+ acres and retire with a hobby farm and space to raise a family… something which isn’t exactly reflected in my ‘FIRE’ plans that well yet. Back in my hometown this kind of land would only really set me back 300k or so, maybe 500k with a decent four bedroom house on it. So I will most certainly be looking for a mortgage with today’s interest rates, and then keeping the different invested in the ETF portfolio

Haha… you could be on the money mate 🤫

$500K for a nice 4 bedroom house? Nice! Current interest rates make it hard to say no honestly.

Welcome home mate from a fellow Victorian! The QROPS rule change is a royal pain in the butt — yet another loss of our rights. Maybe the best thing to do is find a cheap platform and leave it in Vanguard tracker fund until you’re of age.

RIT has just escaped to AU by the skin of his teeth. If you don’t know his blog it’s a fantastic FIRE resource.

http://www.retirementinvestingtoday.com/2021/01/toto-ive-feeling-were-not-in-kansas.html

Yep, QROPS rule change sucks.

Nice blog, I’ll have to take a squizz.

Cheers

You may find a little useful information here …

1. https://www.gov.uk/guidance/check-the-recognised-overseas-pension-schemes-notification-list#history

2. https://www.onlinemoneyadvisor.co.uk/pensions/pension-transfers/pension-transfers-australia/

3. https://www.onlinemoneyadvisor.co.uk/pensions/pension-transfers/qrops-pension-transfers/

It looks like if you hold an SMSF and register it with HMRC as being compliant with ROPS then you can make the transfer within 6 months of leaving the UK with (maybe) no tax penalties. it wont get you the money outside of super but … it may get it into Aus at least. Setting up an SMSF is cheap enough expecially if you just do it for 1 year. You can then transfer out of SMSF, into your usual fund, shut down the SMSF and happy days.

Real estate here in Oz is a rigged game, especially in the resi space. Politically the govt needs a strong and healthy market for jobs in the sector – both directly and indirectly. And financially the big 4 banks need a strong and healthy market to grow their loan book and revenues. Not saying it won’t ever drop or crash – but the real estate sector would be one of the last economic bastions to fall.

I wouldn’t exactly say it’s a rigged game… the prices are very high, there’s no denying that. But how does the government lower the prices without the economy suffering? I’ve read a few bits and bobs about how all this money printing is slowly inflating away the debt bomb that’s been building. I could see something like that being plausible but still, it’s pretty insane hey. The worst part though is property prices in Melb/Sydney don’t have a candle to London 🤯. How does this all end? No one knows ⁉

https://www.canstar.com.au/superannuation/uk-pension-transfer-super/

I’ve been here the whole time and have felt more than a little grumbly at times about not being able to go anywhere, but your description of quarantine and arrival reminded me about things that make me happy to be in Australia. I don’t have one molecule of patriotism, and I think nationalism is stupid, but I am nonetheless super-glad for where I’m from and where I am 🙂

Welcome back!

Thanks Sianzilla, it’s good to be back 👊

I’m not overly patriotic by any stretch, but man, Australia is an awesome country. And you appreciate it so much more when you live somewhere else that’s for sure.

So you’re from Morwell?

I live in Newcastle and we (wife and infant) have been looking for our second home for about 8 months.

We listed our 2 bedroom townhouse for sale a month ago and 5 days later we sold it for what I reckon is the record for the property type, nearly 650k.

At first we thought we might be looking at mid 600s for a 2 bed (with room to extend) or 3 bed house. Then we started offering low 700s on places that sold days later for mid to high 700s.

Just 2 weeks ago I went to an open for a place in new lambton that was advertised for 800 one week, then 930 the next. Fair enough I said, they had lots of interest. Well far out, it sold at auction on Saturday for 1.61 million. We are so screwed.

Holy moly! It’s not that crazy in my home town thank god. That’s insane!

Around that area, yes.

Oh welcome back to Aust indeed! It was refreshing to hear about your experience on the quarantine, as the posts in that FB group definitely is more negative. And how lucky you even managed a flight back?? I didn’t read mention of your quarantine costs either, does that bill come through in Feb?

Love your calcs on rental vs buying. – I’ll need to do the same when I leave UK back for home.

Looking forward to your next updates!

Quarantine bill is going to cost us $4K. There is a payment plan though, so we’ll be paying it off over 6 months.

I’m glad you’re enjoying the updates mate 🙂

Great to hear you are back n Adelaide! I love this city and there are some dynamics that will make us boom – Defence & Hi-tech in particular!

Hi AFB,

On the shares front, not sure if I have missed something! just curious if you switched brokerages?

I have indeed mate, I’m now with a company called Pearler.

Hi AFB,

Why did you switch?

Is it better than Selfwealth?

Thanks!

It’s does everything Selfwealth does and more! The auto investing feature made me come across.

Gday bug, I’ve recently gotten onto Pearler as well (and I’m only just starting my FIRE journey in my mid-20’s). As a newstarter would you recommend I start investing in the Pearler targets you’ve created (35% A200 and VAS, 15% VTE and VEU) I’m keen to follow a similar path to you and earn some decent dividends down the line but not sure how much DRP can enhance that now. Or would you recommend as a starter to just dump into VDHG and not worry about allocations?

Cheers mate love your blog.

Hi Alex,

I can’t recommend anything but I will say that if I were starting from scratch today, I’d probably go with either VGS+A200 (or VAS) or just everything in VDHG. IMO, both are great options and more than suitable products for reaching financial independence in Australia. I’d spend way more time optimising my expenses and trying to increase my income too.

Hi Firebug, I’m new to the blog and new to the investing world. I’m curious to know why you would go with VGS+A200/VAS or VDHG over you current strategy (A200+VAS+VTS+VEU)? Thanks mate, hope to hear from you!

Purely to make tax time a bit easier and avoid the W-8BEN form. I’m happy with our current combo but yeah, VGS+A200 is even easier. And VDHG is even easier than that! Splitting hairs here though. All three options are great IMO

Hi there. Employment and immigration (as well as interest rates) are also factors that affect the housing market. With Jobkeeper finishing up soon unemployment may worsen, although if this happens the government will just extend Job keeper or throw more money around. Immigration, of course, has been hit hard and will rebound when international travel opens up again.

For me this all points to further strength and no wonder there are forecasts out there of 15-30% growth over the next 12-24 months! Very interesting times we live in…

hey mate,

great work in setting up the survey. lookin fwd to the survey results.

Cheers Binga, I’ve got something really special for showcasing this year’s results. Can’t wait

Welcome home! Bad luck about the pension – hubby has the same issue because he missed the boat transferring prior to the legislation change in 2015. At the moment we’re just waiting for the rules to change, although he does have a health issue so might be able to mcguyver some kind of work around. Would be interested to hear if you have any success!

Great details about the Quarantine in SA, the place looks nice and the two levels would have reminded you of the UK!

When I first arrived in the UK, I chose to opt out of the UK Pension because at that time, I was only planning on staying here for two years / wanted the money to spend on needs and wants as I was on the Working Holiday Visa yet during that time I meet Tom who is now my husband and currently on a Spouse Visa. Since around 2018, I decided to sign up for a UK Pension as I will be in the UK for the long-term. Did Mrs FB sign up for a Pension too without realising?

I had a feeling if I did sign up and leave the UK within the two years like you, I wouldn’t be able to access until I hit the relevant age. In a way, I have this with my Super because I have no plans to return to WA as my husband is from Wales and is a proud Welshman who doesn’t want to leave!

It did remind us of London a little. Mrs. FB did the smart thing and opted-out. It was just me who dropped the ball 🤦♂️

Great and these things happen, on the bright side it was only two years and something to look forward to in many years time! Who knows, you may come back to the UK to live or stay for long periods and this money could assist your time.

Hey AFB,

Thanks for everything you share. Started reading your good late last year and found it very informative.

One question, the income that you report every month from share ( eg $19.5k this month), is that just the value of the share increasing is our is it the dividend payments? Some of the additions are pretty sweet some months like $30k plus just from shares, just curious. Thanks

[Posting this again as I think it might have gone unnoticed earlier ]

K

G’day AFB,

It’s been interesting to see your changing attitude around PPOR over the years, agreed that sometimes it’s hard to rationalise the bad debt, but equality what price to you put on stability as you get older and look to have a family. To that end I’d be interested to understand your strategy around investing once you have a mortgage, will you focus on smashing down the loan before continuing to invest?

Hi Matt,

I’ve never been against homeownership, but I think not enough people sit down and analysis if they truly need or even want to buy a PPOR when they are so young. It’s just something that Australian culture tells us is the right move. I’ve personally benefited so much by renting in my 20’s but yeah, now my priorities have shifted.

The strategy will be to put down a 20% deposit and then debt recycling all the non-deductible debt away over the next few years. Once the PPOR debt has been 100% converted into an investment loan, at this stage, I’d be happy to just keep it leveraged and even pull out more equity to invest into the markets over time. We’re very comfortable having debt and being debt-free is not a goal of ours.

I’ll be doing a big post about all this which will go into details, but yeah, that’s it in a nutshell.

Cheers

hi AFB,

i am avidly looking fwd to your debt recycling & FIRE blogpost.

im at a situation where ive completely debt recycled ALL of my owner occupier loan. yay!

ive got an IP to which ill be moving to couple of years down the line. the IP loan is 3 times more than my debt recycled PPOR loan. so ill get a chance to debt recycle more when I move into my IP.

here are some points Id appreciate if u could cover in that debt recycling blogpost:

– i realise u r comfortable with having debt. how much debt are u comfortable having once u have reached FIRE? its a personal question and wud vary with each individual, but interested in knowing a ballpark figure u have in mind. cos interest rates will eventually go up. for poor folks having 700k and more of debt recycled home loans, the loan interest will be quite sizeable once interst rates start to creep up eventually.

– if you are looking to pay off some “debt recycled” debt, do you foresee to pay them from ur dividends, or sell some capital to pay off a big chunck? the CGT, even with 50pc discount will suck, but what to do. is there a better way?

not sure whats the right tactic once full debt recycling and lean/anemicFIRE has been acheived lol

Cheers mate,

It sounds like I could learn a thing or two from yourself, having done it already.

1. A figure doesn’t really come to mind. I’ve always been comfortable with debt and I’ve never been one of those people who needs to eliminate all of it to sleep comfortably at night. I don’t think we’ll ever own an extremely expensive house (even by country standards) so I can’t see us ever debt recycling more than ~700K (in today’s dollars) as a guess.

2. If I’m understanding correctly, we are looking to use the lump sums we receive from the two investment properties to pay down the PPOR a fair bit and then split the loan for debt recycling purposes. Once we have that investment loan, I don’t think we’ll ever pay that down unless interest rates went crazy. In such a situation, I’d like to think we’d have a decent emergency fund by that stage so probably just funnel savings into the debt recycled debt plus a bit of the emergency fund. Haven’t thought about it too much though.

When did you start purchasing Us/EU shares? I read through your strategy 3 and was wondering how to incorporate international ETFs into a set and forget strategy

We started to buy international shares at the very start of our sharemarket journey back in 2016. The original plan was 40% Aussie shares (VAS), 30 US shares (VTS) and 30% world minus US (VEU).

We’ve upped the Aussie part of the portfolio as we really like Aussie dividends but that’s just us. There’s not going to be a perfect split for everybody, you need to do what you’re comfortable with… or alternatively, you can just buy a set and forget fund like VDHG that does the rebalancing for you. ETFs like that are designed to be set and forget.

Hope that helps 🙂

Hi!

Bit of a personalised question here… I’m 22 yrs old and have been aiming to buy my first property over the last few years. After listening to your podcasts, I’m no longer certain this is the best option for me.

I’m participating in the First Home Super Saver Scheme, so ideally this would have to be a home and not an investment property – I’m not concrete on this but I think I would be able to live in the property for 6 months and then have it rented out from thereon. This would allow me to benefit from the FHSSS and the First Home Buyer’s grant. What attracts me to property is the leverage and ability to have rental income pay off the majority of the loan.

In your experience, has the rental yield been great for your investment properties? I would like to do some working holidays after purchasing a property, would the rent put me in a comfortable position to be able to do this whilst having a mortgage?

And finally, would it be wise to keep money out of investments whilst saving for a deposit? I’d prefer to gradually grow my portfolio (as opposed to selling when it’s time to buy property) and if there is a market downturn, I don’t want my money to be stuck if I want to use it as a deposit.

Love your podcast, keep up the great work!

Hi Dean,

Cool to hear you’re liking the content mate 👍

Where about’s are you looking to buy?

My experience has been that real estate has crappy yield but can be very good for capital growth. I personally wouldn’t save for a house deposit buy putting that money into the markets. Too much can go wrong. But that’s just me and it doesn’t mean it’s the right thing to do.

Hope that helps mate 🙂

Hi Firebug, I’m new to the blog and new to the investing world. I’m curious to know why you would go with VGS+A200/VAS or VDHG over you current strategy (A200+VAS+VTS+VEU)? Thanks mate, hope to hear from you!