And so we have reached the final NW update of 2020.

WHAT. A. YEAR.

I finished my contract in early December before Mrs. FB and I jetted off to Sweden for Christmas and some sightseeing.

I’ll be honest… the last couple of months in London were a real struggle for me. The second lockdown plus our housemate testing positive for Covid in November (which resulted in us being locked inside for two weeks) really got me down. It felt like a weight was lifted off my shoulders when I finished up work and secured my bonus. We’re going to miss this amazing city and all the friends we have made here a lot, but because of Covid/lockdown, the goodbye was a lot easier and we were keen to get out of the UK if I’m being truthful.

With that being said, I made it into the office during our last week to see that killer view one last time… and I actually managed to get Mrs. FB a guest pass too. She got to see this beautiful sunset with me on my last day which was very special.

After saying our goodbyes and packing up our London life it was off to Stockholm to squeeze in one last trip before returning to the motherland.

We originally wanted to do a Scandinavian tour that also included Iceland and Norway to end the year but given the current environment, I’m just thankful we at least got to see Sweden. I was super interested to see how the Swedes were handling Covid because they were one of only a few countries that didn’t implement strict lockdown measures. It was a bit weird to be walking in and out of shops without putting on a mask in Stockholm and tbh, you wouldn’t really know that there was a global pandemic if it wasn’t for the signs.

The Swedes have a bit of social distancing already built into their culture (they rarely stand close to each other in general) which was a common explanation I received from asking the locals what they thought about their country’s response to the situation. That and their government seems to trust the citizens to do the right thing and for vulnerable people to isolate.

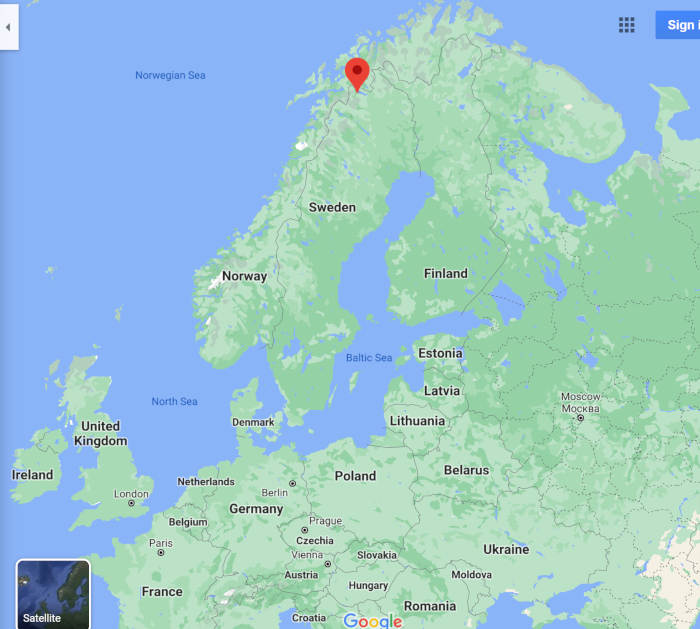

We then made our way up north to a town called Abisko to see the northern lights. And when I say up north, I really mean up north.

I was staring at the map when we got to Abisko and I’m pretty sure it’s the furthest away from home I’ve ever been (in terms of distance). We went there with the sole purpose of seeing the aurora borealis dance across the sky which has been a bucket list item for many years.

If you’ve ever been this far up north, you’ll know that it starts to get dark around 2:30 PM 👎 which feels so unnatural. I honestly don’t know how people live up there. I can handle 6 hours of light for a few days but I could never do a full season.

Anyway, the first night was -4°C and full of clouds. We couldn’t see any stars which is a bad sign. We lasted around 2.5 hours on the lake (you have to head down to the lake to reduce the light pollution from the town) before we called it quits at around 10:30 PM freezing our asses off!

We booked a photo tour on the second night because we had read that they will drive you to the best spots and you need a good camera to capture the lights properly. The tour wasn’t cheap at around $170 AUD a head 💸 but we thought “What the hell, when are we ever going to be here again”. Off we went into a chilli -7°C night chasing the aurora in the minivan. We pulled up to a few different spots but the issue remained… more… god… damn… clouds. Try as we might, the heavens just wouldn’t play ball and we ended up finishing the tour seeing diddly-squat. The tour guide did give us some good pointers and basically said that to see the lights, you just need to be patient. Abisko is one of the best places to see the aurora because it’s situated between a mountain and a lake which means the clouds have a tendency to clear up to reveal the magic of the lights that sit behind them. I headed back out to the lake after we got back from the tour just in case the clouds cleared up but I could only last until about 1 AM before calling it quits.

Google weather was predicting that our third and final night was going to be clear up around 11 PM and I was absolutely HELL BENT on seeing this goddam spectacle. And just my luck, this night was also the coldest of the three with weather dropping down to -10°C plus wind 🥶. I bought some firewood from the shop and put on 100 layers of clothes and headed out to the lake at around 8 PM to start a fire in the pit.

The annoying thing is the town has a ‘webcam’ live feed pointed at the sky which you can look at from your phone/laptop in the cabins. It’s theoretically meant to show you when the lights are visible so you don’t have to sit down by the lake in the cold all night. But the issue with that feed is that the camera picks up lights that you can’t see with the human eye. I was down on the lake for a few hours before a lot of people from the town came down because the live feed was showing green streaks in the sky. But if you looked up, you couldn’t see anything 😕… it was at this point that I started to wonder if the aurora was just made up by the tourism industry 😅.

Mrs. FB tapped out around 11 PM and I pushed on into the night waiting, hoping, praying that I would see a glimmer of green. I kept updating Google weather waiting for the sky to clear up but frustratingly, every time I did, the predictions were continually pushed back 30 minutes and before you knew it, 4 AM was upon us and I had to wave the white flag.

We left Abikso sad and exhausted after not being able to see what we went there for. But in a weird way, I guess that’s what makes the northern light so special. You aren’t guaranteed to see them and you’re very lucky if you do. I’ll try again one day but after failing this time around I definitely have some pointers for anyone out that wants to see them.

- Don’t plan your trip with the sole purpose of seeing the lights

- I’d personally go to the Norway city of Tromsø next time. Abikso is meant to be one of the best places to see the lights in the world but there’s literally nothing else there. At least you have a lot of other activities to do in a city

- The odds of seeing the lights as epic as they are advertised on tourism ads are extremely unlikely. Our guide said they only really come out like that and dance across the sky a few times a season. You can get some good photos with a proper camera but the naked eye experience can be a letdown

- Try to stay for at least a week to ensure you have multiple chances of seeing them

- Don’t trust any website/app. The accuracy of forecasting the lights is incredibly low.

We then caught the overnight train to a snow mountain called Åre. It had to be one of, if not the most scenic mountains I’ve ever been to because of the unique sunrise/set that lasts for hours whilst you’re snowboarding. It also has an incredibly pretty little snow village that looks like something out of a movie.

One of the most impressive things about this mountain was the fact that it had a train station in the middle of town.

I’ve never seen that before. It must have a really gradual incline up the mountain for a train to work right? Whatever black magic the Swedes were casting, I was very grateful it was there because it made travel super easy for both up and off the mountain. We caught a sleeper train off the mountain to our friends home town of Ängelholm to spend Christmas with her and her family.

We almost had a meltdown in Åre when we read on the news that Singapore had stopped transit flights from the UK after a new strain of Covid was discovered 😩. Our ticket home departed from London on the 2nd of January and included a stopover in Singapore before flying to Adelaide… It was so hard to figure out what our options were and if we were actually allowed to fly home. Because things were moving so fast, Singapore Airlines couldn’t really give a definitive answer on anything. What a nightmare. After a really intense 4 hours of phone calls and panic Googling, we decided to switch our first leg to leave from Copenhagen instead of London. Thank God Singapore Airlines had an available flight from Copenhagen that they let us switch to free of charge.

Christmas was very fun and NYE was a bit boring which was fine, our focus was well and truly on getting home at that stage.

On the 2nd of January, after two years of being away, we finally boarded the plane that began our journey home.

Arriving in Singapore was an experience I’ll never forget. We got out of the plane to 6 people in full on hazmat suits lol. I’d heard about how serious Singapore was taking Covid but it was still pretty surreal to go through it.

You know those movies where the army sets up a makeshift camp with quarantined off areas and there will be a bunch of people trying to get through all different stages of security… yeah it was like that. The only thing that was missing was a dude with a huge hose blasting naked people down before they’re allowed to enter 😂. I’ve got some videos of the whole ordeal that I’ll be showing my kids one day I’m sure. Crazy times!

We finally got to Adelaide and were ushered away to The Playford hotel in Adelaide where I sit typing up this post in quarantine. We have been really lucky with our hotel which includes an upstairs loft, big 50 inch TV and spa 🤩. We’re apart of the ‘Aussies in Quarantine’ Facebook group and some of the stories we have been reading have been horrific

And with that, our overseas adventure has come to an end. We’re now onto the next chapter in our lives and even though we’re stuck in this hotel for another 10 days, damn it feels good to be back home 🐨🦘♥.

Net Worth Update

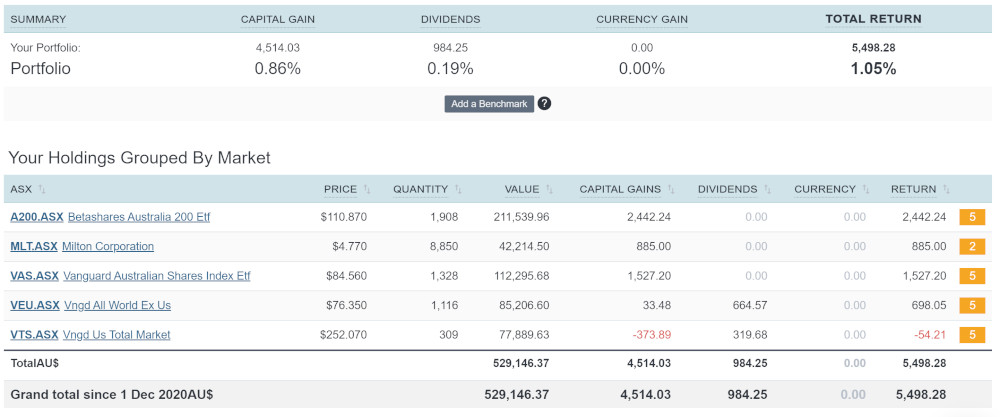

The NW had solid contributions from our share portfolio and Super this month. But the big bump came from my bonus I received which was £20K.

We started the year at $770K and finish at ~$860K. A $90K increase in net worth is the lowest yearly jump for us since 2014-2015 but considering we had one of the worst stock market crashes in history, I’m very happy with those results.

I thought we might be on track to crack a mil in 2021 but this is looking less likely now unless there are some big gains coming up. I used to dream about becoming a millionaire before 30 when I was a kid and you know what, I came pretty damn close. Mrs. FB is keeping that dream alive though as she won’t hit the big 3. 0. until late December this year.

There are two big factors that will have major impacts on the net worth for us in 2021.

- I’m officially unemployed 😁. This means no fat London contracting checks anymore. Mrs. FB is back into fulltime teaching in two weeks which means we’ll be on a single salary until I figure out what I want to do (I’ll have more on this in the next update)

- We’re going to buy a home this year 🏡🎉. This will have a pretty big impact on our net worth because I don’t classify a PPOR as an asset. It doesn’t really make a difference to us in terms of reaching our FIRE goals but the deposit we use as a down payment for a house will essentially be removed from these updates. I’m looking at debt recycling atm because the plan is to put as much money into the home loan as possible and either withdraw or use a line of credit to get that money back out so we can invest it but have that portion of the loan be tax-deductible (AKA debt recycling). I haven’t been able to sink my teeth into the finer details just yet but please rest assured I will be making an article detailing my experience.

Properties

No changes in the properties this month.

Property 1 was sold in August 2018

*DISCLAIMER*

The current value of our properties is a rough guesstimation based on similar surrounding properties. I only really update these when we get an official bank valuation

ETFs/LICs

The above graph is created by Sharesight

Not much going on here.

We didn’t buy any shares in December and won’t be buying any for a while now. The priority has shifted to buying a home and increasing our deposit for when the right property comes up. We were looking at spending around $400K-$450K but house prices have jumped significantly in 2020 and I think we won’t be able to get what we want for under $500K.

We have ~$70K in cash right now and I hate holding this much without doing anything. I’m obviously a big fan of having an emergency fund of around $25K (that’s what we’re comfortable with), but anything past that feels like wasted gains. We do have an offset that makes holding a lot of cash much more attractive (vs storing it in a HISA) but the amount of money being created all around the world worries me a lot. I don’t want to be holding the bag if inflation gets out of control.

Thanks for the amazing photos and great update AFB!

Those are some once in a lifetime experiences, it sounds brilliant, and good tips on the Northern Lights excursion!

Also, while all that was happening, a $30 k uplift, so that must have felt satisfying!

Lots of time to write and plan in hotel quarantine? 🙂

Cheers mate.

Lot’s of time indeed. Feels great to have no pressure to jump into anything straight away as well. Really enjoying the idea of slowing down a bit as we’ve just been so busy over the last 24 months.

Aussie FB,

Thanks for the great read.

Is this net worth a combination of your and Mrs FBs worth?

P.s what work do you do to get a 20k bonus!?

Congrats and HNY

One of the best posts yet in your adventure! Congrats on getting to Sweden, I was supposed to fly Jan 2 for a fortnight to visit my daughters in Gothenburg, but it got cancelled due to the new variant. Booked again for Jan 31st but now Ryanair are showing no flights until end of March! You were also very lucky to get flights home to Oz without being bumped, I’m due to fly home in March but have read lots of stories of Aussies unable to get flights. Looking forward to your debt recycling posts; something I’ll probably do when I do get home!

Thanks Brent.

We actually went to Gothenburg for a few nights which I forgot to include in this update! What a small world. We have been so incredibly lucky with all the travelling we were still able to do.

No worries Tim and I’m glad you enjoyed it mate.

These updates use to be just mine but I joined finances with Mrs. FB back in 2016 (Oct update I think). So everything you see in these updates since then has been a combined effort.

I was working as a freelance data consultant in London. Mainly in Data engineering/analytics.

Awesome pics there AFB! When you said you and Mrs FB have been gone for two years that really hit home for me… I remember reading the blogs of when this was just an idea, and to say it’s been two years already! It feels crazy to think that time passed so quickly, kinda scary too. Good luck in 2021 mate

Cheers Beau

Welcome Back! – looking forward to more of your content in 2021.

We are currently renting / looking to buy in the next 8-12 months, so we will be very interested in your experience, especially debt recycling.

It’s good to be back 😊

I’m really looking forward to finally be in a position to be able to actually do debt recycling after reading about it for years. Really keen to provide a real-life working example of how we go and what the benefits were.

Not sure why you wouldn’t classify your PPOR as an asset?

I’m a ‘Rich Dad Poor Dad’ disciple and look at things slightly different. Anything that puts money in my pocket = an asset. Anything that takes money out of my pocket = liability.

A house that you live in is an asset by definition and in a traditional sense but it costs you money and doesn’t provide any cash flow. It doesn’t really matter if you consider it an asset or not tbh. It’s all about cash flow and having the portfolio generating enough to cover our expenses. We’re essentially replacing our rent with P&I repayments because of how low interest rates are atm.

Happy NY & welcome home.

Having been lucky enough to see the lights in Abisko I am devastated for you! Look forward to following your debt recycling plan & all that is to come in 2021

Thanks Zoe,

We’ll get there one day I’m sure. I’m really keen to document our debt recycling experience because there aren’t too many well-documented ones out there if I’m honest. I lot of theory and numbers but not a lot of actual experience.

I hope you have a great 2021 too 🙂

Yes seems strange to me, It does not really make sense accounting wise or comparison wise.

How do you count money in offset or redraw above the Home Loan? Margin loans on shares that do not pay dividends? or even stocks that do not pat dividends?

But I suppose if FIRE is how much I need from passive income to live than it make sense e.g. a person renting will need more than someone who fully owns their house.

That makes sense. I guess one consideration when thinking about your PPOR (not you in particular) is that the PPOR could provide good cash flow eventually (“delayed” cash flow?) if you choose to sell up and move to a cheaper area. For example someone moving from a city to a regional area. If the city PPOR is held long enough you could invest the difference from selling/buying regional adding to your passive income. I think though this would be more of a “cream on top” thing supplementing an existing passive income strategy.

That’s very true. It’s all a bit of semantics though hey. I’m just really into cash flow and the thought of having so much capital tied up into a non-income-producing asset doesn’t sit well with me. Even though the likely hood of downsizing later in life and cashing out is very high so I can see both sides.

It doesn’t add money in your pocket, yes. BUT, it stops your money (paying rent) going out of your pocket once you have paid off your PPOR whether fully or partially… It’s all about the net or disposable income after the expense.

Also if you sell your PPOR (or downsize it), then where do you account for the increase in cash? It doesn’t magically pop out of nowhere.

I’d rather earn $9 less tax then save $2 but that’s just me. It’s all semantics anyway so who really cares?

One way I get around this on my spreadsheet is by using “Current Assets” and “Total Assets.”

Essentially detailing what are my assets that are quite liquid and can be sold relatively quickly, so here I include cash, shares, managed funds etc. Total assets include my home equity, super and early stage company investments.

Just a different approach I like to use to map out financial liquidity.

Welcome back mate! What an amazing two years, and it’s great to see that even at the end you were able to sneak in another adventure. Shame on missing out on the Northern Lights, but not much you can do about it.

It obviously depends a lot on the employment situation for you both, but I wouldn’t be at all surprised to see you guys crack the mill mark by the end of 2021 if you include your PPoR. At this point though so much is going to depend on market returns rather than your savings rate.

Best of luck!

Cheers mate.

Yeah who knows right. I really want to offload a property this year and I’m pretty confident that we’ll be able to sell either of them for more than what they were last valued at 2 years ago. So that could be a decent bump.

Long time reader, first time commenter. Congrats on finishing your London adventure so successfully despite all the challenges of last year. Out of interest, does your NW calculation include a provision for the CGT (and any fees etc) that would be payable if you were to liquidate your investments?

Great question!

Thanks Tony.

Nope. None of that is factored into the NW. It’s just assets – liabilities in the calculation.

I have had a look at the train line on google earth.

It is very careful use of terrain yo keep the slope low.

Hey Mate! Welcome back home. I have been reading your blog for a long time and just wanted to say thanks for all the inspiration and help throughout this journey. Coincidentally I work here at the CBD in Adelaide, if you ever get a chance to stay over after finishing your quarantine period, it would be a great pleasure to meet with you, have some coffee and say a face to face thanks for everything 🙂

A prosperous new year to you and Mrs. FB

Hey Bruno,

That’s a lovely thing to say mate and it makes me happy that I can provide some inspiration to readers 🙂

I’ve had a few people reach out about catching up in Adelaide and now I’m a bit bummed that I won’t be sticking around when we’re allowed out. We get out of the hotel at 6 AM and our flight back to Vic is at 7:50 which leaves no time to explore Adelaide or meet up with anyone 🙁

I’ll have to come back though and see the city properly because this is the first time I’ve been here. It would be cool to do a meet up one day.

Have a great 2021 mate, all the best

Hi Mate,

No worries at all, that’s a great opportunity for you to come back indeed… Let me know whenever you are coming, we can have a few beers together.

Have a safe trip back home to VIC, your family might be very excited about your coming back.

Cheers

Bruno

I lived in AK and saw the Northern Lights many times. You’re not missing out on anything *lies*

Glad you made it home (and welcome back)! Psyched to hear what comes next for you 🙂

😭😭😭

Big year for many reasons this one… a lot of stuff is coming 👊

Love reading your updates! Great to see you pushing a million, with some more QE or or buying a bitcoin or two you should easily get there this year.

Anyway, just letting you know that Northern Sweden is actually a lot closer to Australia than London. Some airlines actually fly over the Arctic to get from East to West quicker (for example Russia to Canada).

Looking forward to your next updates!

Now at the fear of eye rolls, and much groaning, but why not sell an IP or 2 to assist you with a PPOR purchase?

Oh, and welcome home…😉👍

I’m planning to Jeff! I’m going to be enquiring about both properties this month and hopefully, I can move one this year 🙂

It’s GREAT to be back

Cheers Rich,

I actually have 2% of a bitcoin (bought back in Feb 2017) and it’s nearly at the point where I could add it to these updates 😂.

I really enjoyed the “travel” portion of the blog post. My husband and I visited Iceland in December 2019 and had the most wonderful experience. I went into the visit with the mindset that the Northern Lights would be the gravy, not the meat of the trip so I wouldn’t be disappointed. Iceland was like being on another planet and we saw the most incredible sights. But…..we didn’t see the “lights” and honestly I was okay with that. I know I will visit countries in the future (once Covid calms it’s farm) and we will try again. I know the frustration though so I was sorry to hear you missed them. The Scandi countries are super expensive with a capital “spend the kids inheritance” so it is a shame when you don’t get the prize of seeing the Northern Lights. I’m glad you enjoyed the rest of youradventure though and I’m excited to hear about what’s next for Mr. & Mrs. FB xx

Thanks Lisa,

Iceland was one of my ‘must-see’ places before we left at the start of 2019 and it did kill me inside a bit not to make it there. But it’s one of those places that I think I’ll appreciate just as much when I’m older vs going in my 20’s.

And I’m definitely hearing ya about the Scandinavian countries being expensive AF 💸. The three weeks in Sweden cost an absolutely bomb haha.

This is too funny. I went to Iceland to try and see the northern lights. Was there for over a week. Biggest let down of my life. I have renamed them the Northern Lies because I don’t believe they exist. All locals always see you need some special camera and the naked eye can’t see them. What’s the bloody point then?! Just photoshop the hell out of a photo and you’ve got one of the wonders of the world… I likewise went to Åre. Incredible place!

I’m originally from Alberta, Canada, and yes the northern lights are definitely real 🙂 and you don’t need a special camera to see them. Unfortunately though it is really hit and miss, but when they are fired up they can be pretty spectacular. Glad you made it back to Oz safe and sound!

Cheers mate.

How often did they come out on average during Winter?

Really depended on the year, but probably a minimum of 20-30x per year. We lived at 54 degrees north, so not super far north. They would be very green in colour and dance like crazy sometimes.

Funny, until I moved to Tassie I had no idea people actually paid to take trips to go see them 😂.

You can also see Aurora Australis down in southern Tas, but it’s pretty hit and miss.

Hope quarantine is going as well as it can for you and Mrs AFB

Lol. I don’t think enough people know just how lucky you have to be to actually see them in all their glory. I spoke to some other Aussies in Åre who just came from Abikso too and they managed to see them but they weren’t bright and didn’t dance across the sky like in the ads.

Hey Aussie Firebug you can also see the lights in WA – down south. Beautiful part of Australia – pristine. Cheers Lynda.

Wow, I did not know though. Amazing!

What a wonderful post! So interesting to hear about your trip to Sweden and see the photos, and glad everything was mostly fine on your trip back to on Australia—have heard horror stories about that. Anyway, congrats—here’s to a successful 2021 for you guys!

Thanks Katya 🙂

We totally lucked out with the hotel 🙏

Mate get some bitcoins up ya instead of a house easy money mate some of the boys been dabblin and they can help yer get started with ya missus money. Nothing beats staying home with the missus breadwinning stock up on booze and enjoy ya ultimate spready to the gods yer dog

Cheers cobba,

I’ll be sure to stack a few tinnies in the shed for when I’m back on the punt 😁

Welcome back to the land of living, 28 days later. The issue of purchasing your PPOR vs renting is one of those ongoing FIRE debates, however, there is something to be said about the feeling of stability and security of having one’s own home, especially if planning to have a family. It might be pertinent to sell off the Investment Properties to realise the cash, build up the deposit, and minimise the potential ETF sell off (also would improve serviceability). With interest rates so low borrowing the money is likely to be the cheapest option, especially if you can target a repayment that was consistent with the rent being paid. Then would focus on paying down the loan using a debt recycling strategy. (Must admit, would be a bit of a shame to flog off the ETFs, probably better to sell of the IPs).

I’m looking at selling one of the IPs. In a perfect world, I’d sell both IP’s at the right price. Use all that money to pay down as much of the mortgage as possible. Take out as much money as I can using the PPOR as collateral and invest said money in the markets. I’m really looking forward to implementing debt recycling now that we’re looking to buy.

welcome home.

Have you thought about trying to see the aurora australis – southern lights. I saw them once on a clear night in Launceston many years ago. May want to check in your own backyard before looking for the northern lights. Have you looked into the tax year? Since you have arrived there are only 6 more months left in the financial year, you might be able to sell some things and as you are earning less, pay less tax. Just a thought

You make a very good point. It’s probably better to wait until a good solar wind year and try to see them in Tassie…

I’ll be meeting up with my accountant as soon as I’m back in Victoria to discuss all the options

You can see the Southern Lights in AUS/NZ instead :o)

This makes a lot of sense actually.

Glad you made it home safely mate. The trip sounded amazing and you’ve inspired me to take on something similar when this all blows over a little!

Out of curiosity have you discussed the debt recycling with an accountant? I’ve been trying to work out how it would work borrowing money to invest in a trust and can’t work out how it would work regarding tax.

Look forward to the next update. I’m optimistic you’ll reach the two comma club before 30!

Thanks Lachlan,

I haven’t gone over it with my accountant yet. I’m already in my thirties (31 to be exact) but Mrs. FB turns 30 in December this year.

Hey mate, great post and sorry to hear you didn’t accomplish your dream of seeing the aurora borealis (yet).

I live in Sydney and I’m also looking at buying a house at some point to raise a family which would affect my road to FIRE, specially here that houses cost >$1M (you are very lucky to be able to find one for around $500k).

I’m keen to hear more about you thoughts around that, including:

1. How long do you thing buying a house will delay your retirement?

2. Explain a bit more about debt recycling with pros and cons

3. What is your ultimate retirement plan and how much longer do you think for you to reach it?

4. Are you guys planning to have kids, and if so how do you account for that in your FIRE plan?

PS. I don’t expect for you to answer all of that in here, maybe you can add to you next posts 😛

Thanks for the great content and good luck on your journey!

Thanks Lucas,

1. At current interest rates… it won’t delay it. In fact, it might actually work out to be cheaper than renting atm which is insane.

2. Big post about this will be coming with real-life numbers and experience once I start the process. Stay tuned.

3. To be able to do work because I want to and not be motivated by money. Even though we’re not financially independent just yet, I’ve essentially reached the early retirement phase of the journey right now actually. Full FI will be another 2-3 years away (maybe longer, who knows that the markets will do).

4. We want to but I don’t want to jinx anything. If they happen, great. If not, oh well. I have no idea how much kids costs but we’re in a position that allows for maximum flexibility. If the cost of raising kids is a lot more than I think it will be, we will just have to increase the size of our snowball to compensate. I’ll cross that bridge if/when we get to it.

Hi AFB,

Welcome back home!

Looking forward to your post / podcast on Debt Recycling.

Also, keen to you know your views and experience on getting contracting gigs in australia. Unsure if it is as lucrative in aus as it was in uk for u. i hope it turns out be.

all the best on settling back in at home!

Thanks Inba,

I can’t wait to write about all the stuff that’s going to happen this year 🙂

A lot is going on for us in 2021 and it should make for very interesting articles.

I’ve followed you for a while and had no idea you were a fellow Adelaidean! Even online Adelaide really does only have 3 degrees of separation! Good luck with quarantine!

Haha! I was about to say the same thing. Crazy eh! Welcome back anyway you guys!

I’ve also been following him a while and he has stated many times he is from Country Vic. I would say they are in quarantine in Adelaide as it was the most economical way to get back on Aus soil.

That or I have my wires crosses with another bug branded FIRE blogger.

I’m actually from rural Victoria. We flew into Adeliade because that was the only flight we could jump on (we were lucky to even get onto that one). It’s the first time I’ve been here actually but a few people have reached out for a catch up so I’ll definitely be making my way back here one day. It’s torture to be stuck inside overlooking this beautiful city when the weather is this good.

Oh got you! Well glad you got to see some of it on your way home, even if it was mainly from a window view haha. 🙂

Welcome home!

Your quarantine sounds like you’ve hit the jackpot!

Sorry to hear you didn’t see the Northern Lights 😣

I saw them in Banff walking home from the pub! Doesn’t always have to be those perfect conditions.

Very Rich Dad Poor Dad of you.

Good luck with house hunting! What state are you looking at settling in?

Cheers Mrs FDU.

We’re going to be buying in the town we both grew up in (rural Victoria).

Some excellent content on this site and well done on such a great achievement in a short few years.

However you have no exposure to Crypto or specifically Bitcoin, this would act as great diversity.

Cheers Dave. I actually have 2% of a bitcoin lol. Maybe I’ll add it into these updates as it’s nearly worth $1K these days

Welcome back Downunder Mr. & Mrs. AFB. It sounds like you guys had the adventure of a lifetime. If international travel is still out of the question come winter, consider heading to Bruny Island right in the middle of winter. With the low light pollution in Adventure Bay and a clear night you’ll see the Southern Lights with ease. It’s beautiful. And you’ll probably be wearing a t-shirt after your experience in Sweden haha!

PPOR is certainly on the agenda for us as well. Try as I might, the Rich Dad description of an asset hasn’t avoided the inevitable purchase. And while is might not be an investment for our portfolio, it will be an investment in my other half’s sanity and happiness which will help us stay the course with our actual investing. A commonly overlooked factor with investing is just because the numbers add up doesn’t mean you can bring it into reality. At some point we need to buy a PPOR and I doubt anyone has failed to meet their investing goals by doing something that prolonged being able to work as a team. 4-hands build faster than 2 and sometimes a PPOR keeps the team together. Strange as it sounds.

PS. Let me know if you’re still after any audio help.

Cheers,

Dylan.

So true Dylan. Life exists outside of a spreadsheet!

I will definitely get your help mate. I’ll flick you an email once I’m out of quarantine and have my good mic. Cheers boss

Excited to hear your new plans for 2021!

Welcome back Mr. & Mrs. AFB.

Long time reader, first time commenting.

Question about your super. Please don’t answer if you think they are a bit personal.

1) How do you manage your super. Are you in one of the default plans or do you manage your own investments inside your super?

2) Do you make additional contributions? Like salary sacrifice.

3) Do you consider super as something on the side that don’t bother paying much attention now that you are young or do you actually pay as much attention as the other investments?

Thanks AFB and you don’t know how much I wait for your emails.

Cheers,

Diego.

Good to be back Diego,

1. I’m with Vision Super, Mrs. FB is with Vic Super. We are both in the most aggressive option (100% equities)

2. Nope

3. Because we will reach FI so young, Super does not form apart of our strategy at all. It’s a nice bonus if we make it to 60 but we’ll reach FI long before then. We’ll pay some extra tax for this right but that’s ok with us.

Cheers

Hey AFB. I stumbled upon the FIRE community a couple of weeks and have been binging on your podcast and blog ever since!

Ive always been into saving for the future but just didnt know much about investment strategies.

Question. Do you think 1 year or less is too short term to put my savings into an index if i plan on pulling them out for a property deposit after that year?

Maybe this will help you.

https://www.visualcapitalist.com/stock-market-returns-time-periods-1872-2018/

Good luck.

Welcome to the club Danny!

I would never put my property deposit into the market if I needed a year later. The time frame for investing in the market (even for a low-risk option like Vanguard ETFs) is usually around 7-10 years. Anything sooner than that and you risk a big crash happening before you need the money.

HISA or offset would be where I’d put my money mate.

Hi AFB, what was your profile on SelfWealth? I think I read it somewhere but I can’t seem to find it again. Thanks

Howdy,

I don’t use Selfwealth anymore. I’ve moved to a broker called Pearler now 🙂

Interesting find! Pearler does not charge fee for ETF.

Do you happen to have an invite code?

Thanks.

Nevermind, I found a code:

CAPTAINFIBETA

Just to double check, as you mentioned that Mrs FB is still on track to be a millionaire by 30, though your net wealth is the two combined right? So it’ll be 500k instead?

On a side note, I always look forward to your monthly updates! Hopefully we get Jan soon!

You’re right, it’s combined. I like to think of us as one ‘team’ and she might be under 30 when we reach the $1M mark. Jeff Bezos’s net worth, for example, was always reported on his combined wealth he shared with his wife. And it wasn’t until he got divorced (and his ex-wife took her share) that he lost the title of worlds richest man. All semantics though, it doesn’t really mean anything tbh.