God damn did I need a month like February!

It’s been pretty hectic since we got back into Victoria in late Jan. Just from a life admin and reunion point of view. So many people to see and catch up with, trying to figure out our living situation, Mrs. FB preparing to head back to her teaching position, unpacking our boxes from the storage shed… 🤪

It’s such a privilege to not have to stress about jumping into another job straight away. Mrs. FB miraculously kept her teaching gig for the two years we were away, but she only had a week and a half to sort out everything before jumping back into full-time work. I, on the other hand, have been enjoying a time rich, low stress, slower pace unemployed lifestyle since we got back 🙊.

It’s not like I haven’t been keeping busy, far from it actually. But you forget some of the little pleasures in life when you’re too caught up in your job sometimes (aka me last year whilst contracting). The autonomy of planning my day around my needs and wants (rather than my bosses) is a freedom that I plan to have from here onwards. I still wake up early, but I usually go for a leisurely stroll and throw a podcast or audiobook on these days. When the suns beaming, there’s no better way to start my day! I find myself jumping onto the computer around 9-10 to start some work, whether that be wedding stuff, new business venture work (update soon), house hunting, AFB content or just life admin. I can head to the gym after lunch when there’s no one there and can get stuck into anything else that’s important later on in the day when it suits me. Working from home and being able to do everything on a computer that’s connected to the internet has really changed the game.

I’m back into a great routine with eating healthy Monday-Friday, consistent gym sessions and have started to roll again at my local Brazilian Jiu-Jitsu gym.

My sleep quality since being back home is 10 times better compared to those last few months in London during the lockdown 👎. The stress of that job plus not being able to exercise or go outside for two weeks destroyed my physical and mental health last year in November. Man, I shudder just thinking about that situation 😣 and what a privilege it is to be in the position we’re now in.

So yeah, February was rad 🤙

And there’s plenty of stuff in the pipeline that I can’t wait to share with you guys.

Oh, and there were two achievements to celebrate last month.

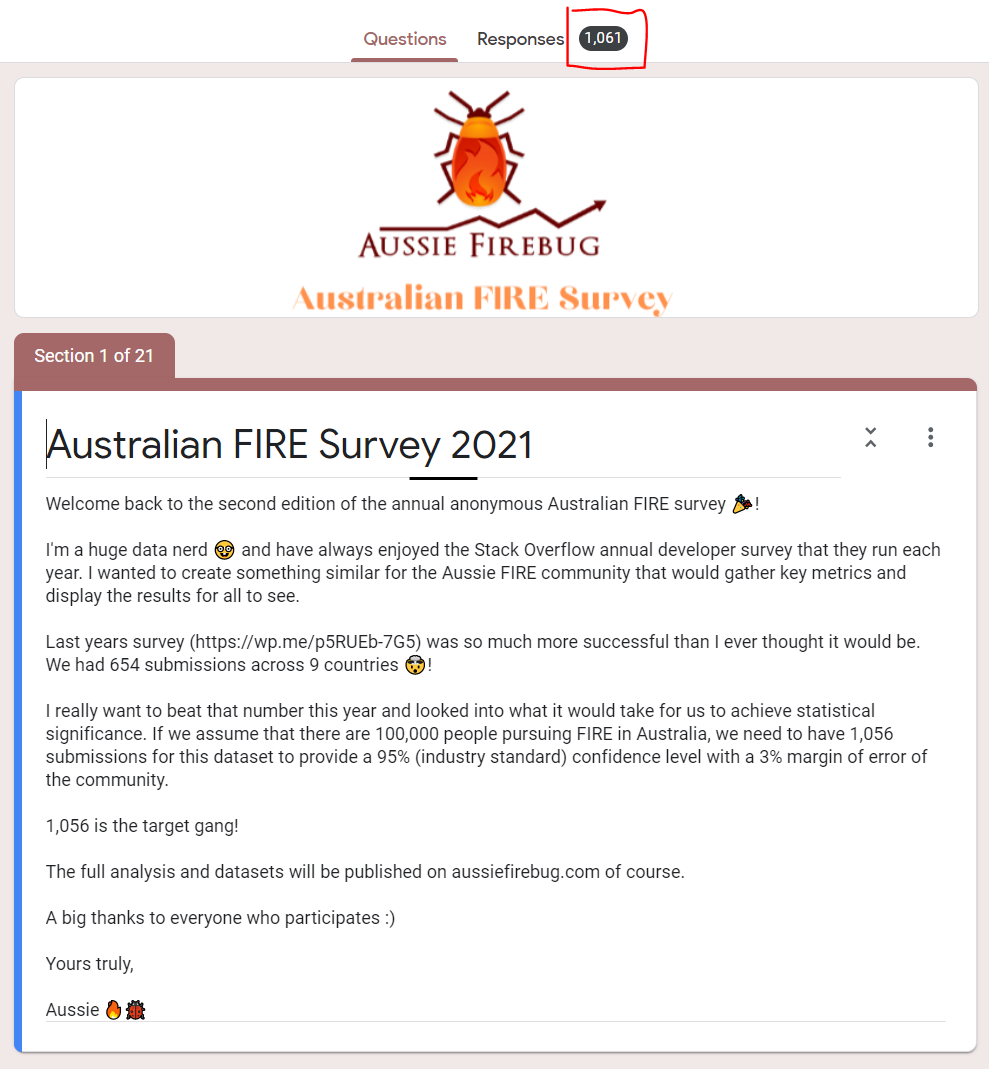

Firstly, we have exceeded our goal of 1,056 submissions for the 2021 Aussie FIRE Survey! This now means that there are enough submissions for the dataset to have a 95% (industry standard) confidence level with a 3% margin of error of the community 👏.

I’m working with another reader on something really special for displaying the results. Can’t wait to share it.

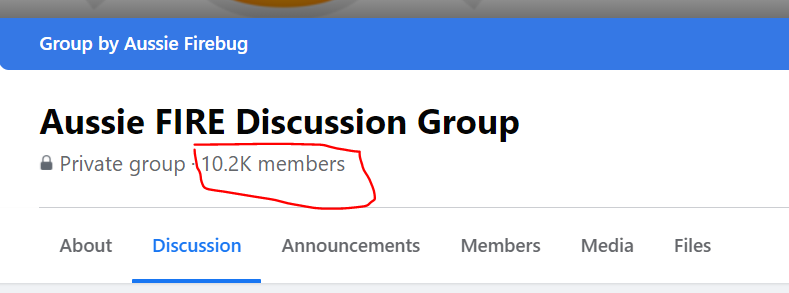

And lastly, the Aussie FIRE discussion group clicked over 10,000 members sometime during the last month.

Not bad considering the group is only 15 months old!

I’m always telling people to ask FIRE related questions in that group because there are just so many smart people from all stages of life that can provide a different perspective on a bunch of stuff. It’s a bit of a treasure cove in there actually. The only issue is that a lot of the really good stuff gets lost. I’ve been thinking about creating something else that deals with that specific problem but there’s just so many other projects I have on this year that I might have to chuck her on the back burner.

Net Worth Update

It’s a miracle that we finished February in the black considering I haven’t been working and I’ve spent a fair amount on setting up my home office. Mrs. FB is really holding down the fort these days in an otherwise pretty boring month net worth wise.

Haven’t cracked the $900K mark just yet. Maybe in March? We’ll see.

Properties

So a lot of data has come out since my January update that confirmed my suspicion of an insanely heated property market (countrywide apparently).

We’ve been looking and looking and when we finally do find a house that’s within our budget and in the right location, it’s legitimately sold within 24-48 hours. And usually for more than what the seller wanted for it. I’m not even kidding. There was one house that an agent rang us about (hadn’t hit realestate.com.au yet) on the Friday for $450K that we liked, so we offered $445K that night. The agent rang us the next day to say there was a cash offer for $460K… FFS.

But we really liked it, and what’s an extra $20K over a 25-year loan anyway? So we considered throwing in $465K later that day only to hear from the agent that there was a bidding war going on and it was now over $470K… I mean… wow… they only wanted $450K but ok. Can’t really compete with that, especially since it was a cash offer.

I’ve already come to terms that we will be overpaying. And 2020 prices are long gone now. We have the money and are willing to pay these prices, we literally just can’t secure a place atm lol.

Having said all that, we may have found something very recently that’s looking the goods… I don’t want to jinx anything so I’ll just leave it at that. But if it all works out, I’ll of course let you guys know all about it 🙂

Also, I’m really close to listing one of our investment properties. Just working out a deal with the tenant atm to see if they would be willing to break their lease early for a cash incentive. The markets just too good atm to not try and offload at least one property.

Property 1 was sold in August 2018

*DISCLAIMER*

The current value of our properties is a rough guesstimation based on similar surrounding properties. I only really update these when we get an official bank valuation

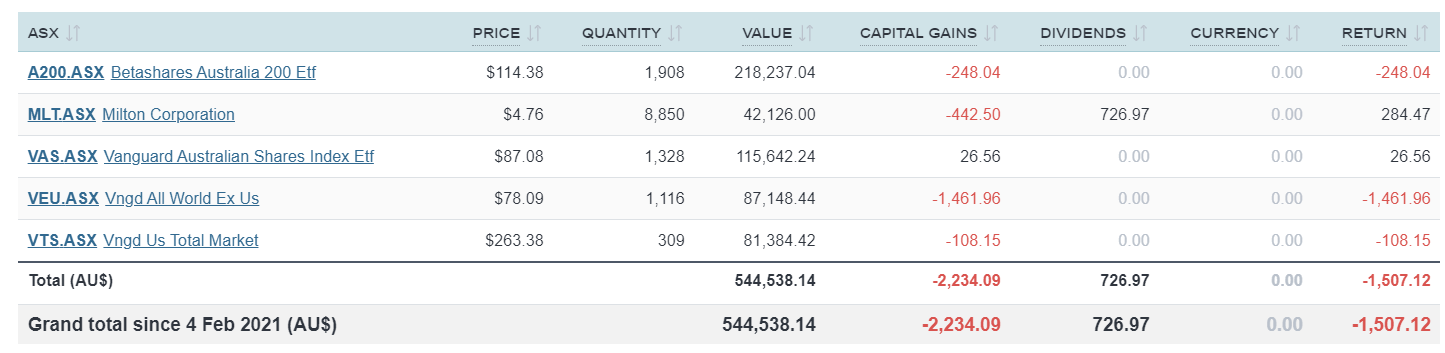

ETFs/LICs

The above graph is created by Sharesight

A bit of a nothing month for Feb.

We haven’t bought any shares since November as we wanted to concentrate on building the house deposit so not too much to add here.

Good to hear you’re settling back in, there’s so many people to see and so much to do when you get back from an overseas stint! And it’s great that Mrs FB had a job to go straight back into without any hassle as well, makes life a lot easier.

Regional real estate has been on fire (dad joke for you there!) for the last year or so, it’d cost you a lot more than $470k for a house over my way I can tell you that! Hopefully you get something sorted that ticks all the boxes, and best of luck on offloading one of your current properties.

Oh and thanks again for having me on the podcast, seems like there were a few people interested in what HIFIRE has to offer!

Awesome update mate and I didn’t know you’re into BJJ! Chess and BJJ, best combo ever! How long have you been training? I’ve been doing it for a bit over 3 years and love it.

The property front is insane. We’ve recently relocated to the Whitsundays and are looking for a large block of land and prices are nuts here too. I think there are a lot of people from Sydney and Melbourne who are taking advantage of working remotely, selling their overpriced apartments and relocating outside the major centres. Plus the low interest rates means banks need to lend more volume to make the same profits. Surely it can’t end well and I think selling the investment property is a smart idea.

Looking forward to more great content and if you’re up for another game of chess then let me know!

I started rolling over 2 years ago but only got in 3 months of training before we left for London. I wanted to keep it up over there but with all the travelling we were doing and Covid hitting, I could never string it together consistently. I’ve started back again but am very much a white belt. I haven’t been to a grading yet but my goal over the next 2 years is to get my blue belt. My coach just got his black belt from Rickson Gracie last year so there’s been an influx of members at the gym.

We’re getting married up at Airlie Beach in June, you should come down for a beer mate. We could have a game of chess in person!

It’s been a whirlwind!

And I keep harping on about it, but it’s so relieving not working a full-time job atm haha. I’m just about to start up again but the last few months have been golden to just sort our life out. It was a pleasure having you on mate 😊

Hey AFB, I really enjoy reading your monthly updates. Thank you for being so transparent with your journey.

Have you ever thought of sharing an additional screenshot of your Sharesight portfolio that includes the overall percentage returns of your share portfolio? Not just the monthly one 😊 I’d be interested to read that too.

Your wish is my command.

Here are the portfolio’s returns since the beginning.

Total $ returns.

Total % returns.

Awesome, thank you. Any chance you might like to include them in your future monthly updates too?

Hmmmm. I already have a lot of graphs and pie charts lol.

Maybe I’ll add them to my EOFY updates 🙂

Hey AFB! Good to hear you getting a mini taste of early retirement 😉

Good luck with property… gee it sounds a bit ridiculous. All I’d say is don’t make any knee jerk reactions out of FOMO. Like Vince Scully told me, overpaying $30k on your house almost negates a lifetime of lattes

Something that helped me heaps with sleeping is called a Silva Centering exercise too, if your having any issues. Cheers

It’s been a real treat buddy. But I’m keen to get back into my next project I think.

We will definitely be overpaying to some degree, but I’ve already made peace with this market haha. Lifes all about timings, and unfortunately for us, we’ve hit a boom time 💸💸💸

I’ll check out that technique and report back mate.

So glad you’ve had a good month back to refocus. Lots of really exciting things in the future it seems. We are about to tick over to 900k too. Fingers crossed the perfect house comes up soon.

Congrats Frank!

Osss bro, keep up the training 🙂

🥋🤙

Mate most people in Vic are pussys you just need to tell your agent upfront who you are and how much your balls are really worth mate show em some of these charts. Keep your missus at home and show em you got options and your ready to settle man to man with a handshake. me mate Steveo builds for a living in case you run outta options and his looking for work at the moment

Thanks for sharing your story! good to see you taking control of your finances. If you were’nt saving for a house deposit how would you invest 250k cash based on your experience?

250k in vdhg.

No worries.

15% in US, 15% in World and 70% in Australia. That’s my splits though, not everyone is comfortable with that much weightings in Oz which is fair enough.

Is the reason you weight so highly in Aus due to those sweet, sweet dividends?!

Yep.

Welcome back down under maaaaaate!

It’s good to be back cobba 😁

Hi AFB:

Do you use WordPress to make your website?

Good job!

I do mate. I’m glad you like it 🙂