We’re on track to increase our wealth by $100,000 dollars over the next 20 years by strategically changing the use of our home loan.

Not by taking on more debt.

Not by changing our asset allocation.

Not by increasing our risk tolerance.

2 transactions were all it took for us to start deducting interest repayments on part of our home loan.

This is a strategy known as ‘Debt Recycling’ (DR).

This article has been on my mind for a while but I really wanted to go through the process firsthand before writing about it. There are a few different ways to do DR but I’ll just be covering how we did it because I don’t know all the nuances with the other methods.

So let’s break it down!

What Defines Debt Recycling

DR = Turning non-deductible debt into deductible debt.

In our case, we wanted to be able to claim our PPoR (Principal Place of Residence) home loan interest as a tax deduction.

Without DR you can’t claim interest from your PPoR loan like you would with an investment property (IP) loan.

How We Did It

*Please note that all the examples in this article will be simplified. Things like rate changes throughout the year, loan repayments and when we officially started DR will remain constant to make it easier to explain.

For simplicity purposes, I’m going to explain our method of DR without our Family trust. I’ll add in the family trust later so everyone who does have a trust can see how we did it but I want to make it simple to start with.

IMO, DR works best when you have a lump sum that you’re planning to invest anyway. That was the position we found ourselves in after we sold IP2 and had over $200K in cash.

We also bought our PPoR last year and I was planning to DR part of our home loan so I made sure that we split it into two parts.

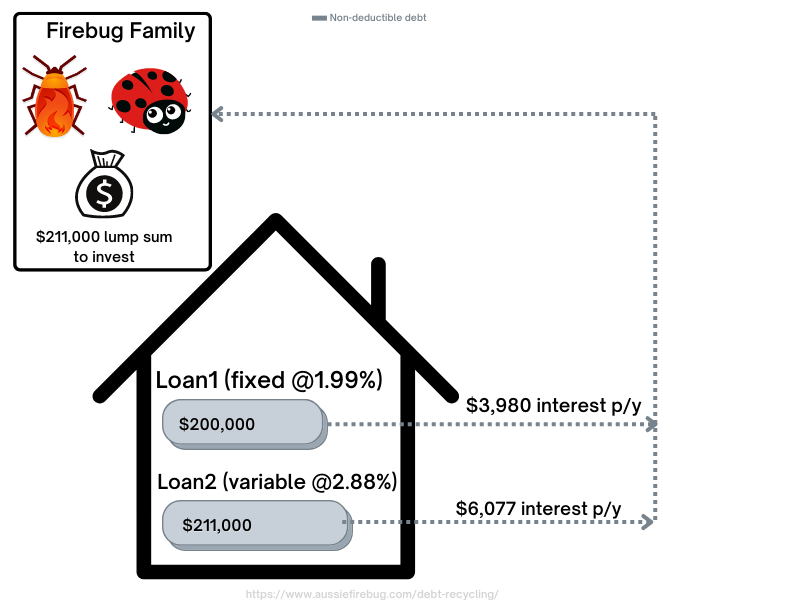

Here is how our situation looked before DR.

As you can see in the above picture, Mrs Firebug (Ladybug in the picture 😂) and I have to pay ~$10K of interest a year for both our home loans (which are secured against our PPoR). These are real numbers (sorry Melbourne and Sydney folk 🙈) when we first settled on our home.

We can’t claim that ~$10K as a deduction because the use of the borrowed funds were for our PPoR and not an income-producing asset.

We also have a lump sum of $211,000 from the sale of our investment property that we would like to invest.

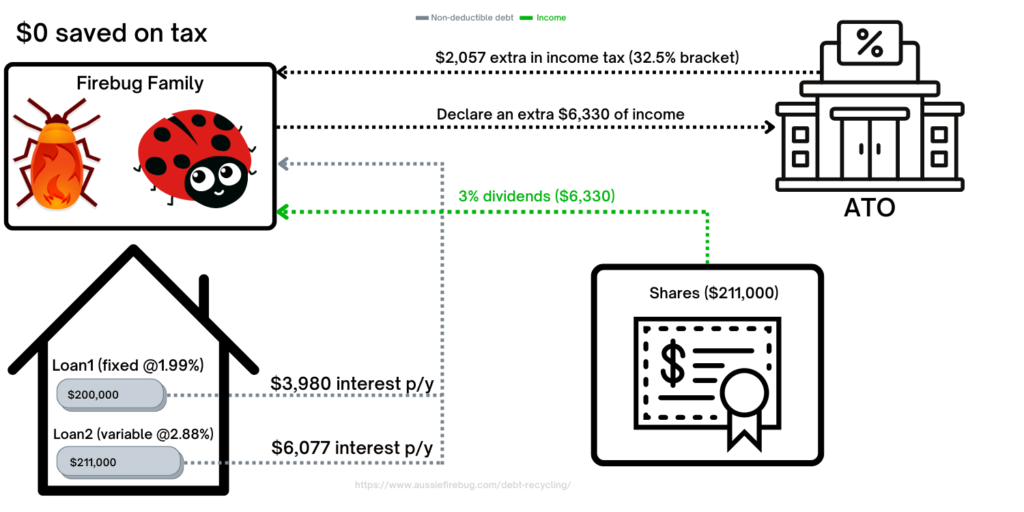

For illustrative purposes, below is how it would have looked if we skipped DR and just invested our cash in shares.

There’s nothing wrong with the above picture but the Firebug Family doesn’t save any tax on their PPoR home loans.

The point of DR is to change the use of the borrowed money for deductions.

We were able to change the use of loan 2 by completely paying it down and then redrawing it out to invest in shares.

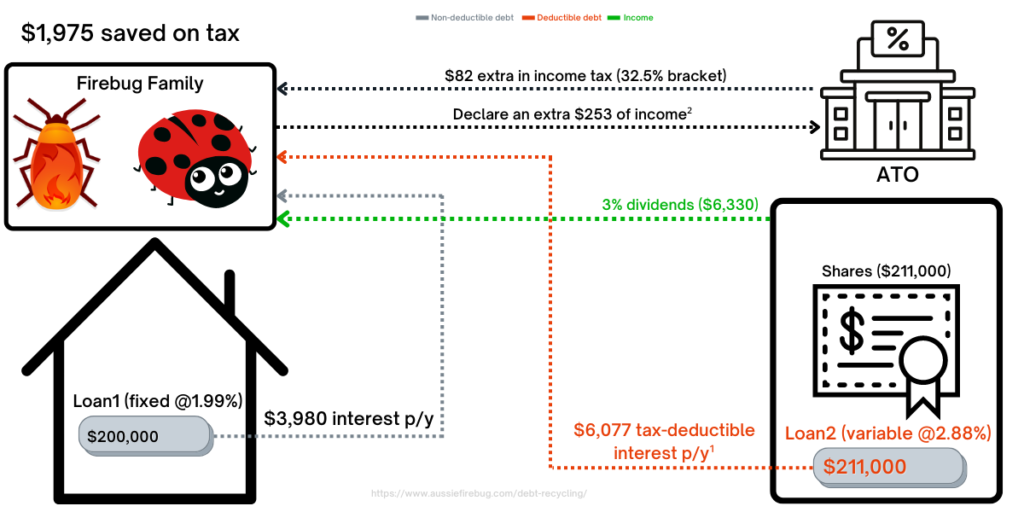

This is how it looked after DR Loan2.

¹ Loan2 was paid down and redrawn to purchase shares. Loan2’s interest payments are now tax-deductible

² The Firebug family received $6,330 in dividends but can deduct $6,077 in expenses from Loan2 and thus only need to declare $253 in additional income.

As you can see in picture 2 we were able to change the use of Loan2 to become an investment loan.

We then used this new loan to buy income-producing assets (shares) and are now able to claim a deduction on the accrued interest saving a total of $1,975 on tax.

But how exactly did we repurpose the loan?

In one word… redraw.

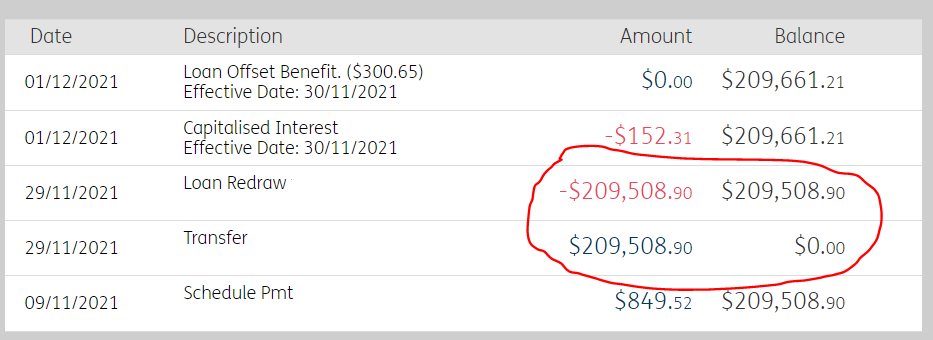

Once we sold IP2 and had the large lump sum, I simply paid down Loan2 completely and then redrew it back out.

The above picture shows the balance for Loan2 to originally be $209,508.90 on the 9th of November 2021. I paid it down to $0 on the 29th and then used the redraw facility to pull the $209,508.90 back out straight away. Redrawing from a loan is considered new borrowings by the ATO.

I was very worried that the loan would automatically close so I went down to an actual branch to ensure that it didn’t. The girl that helped me actually knew what DR was which helped a lot.

And that’s basically it.

We essentially are in the exact same position we would have been without DR but now Loan2’s debt is tax-deductible.

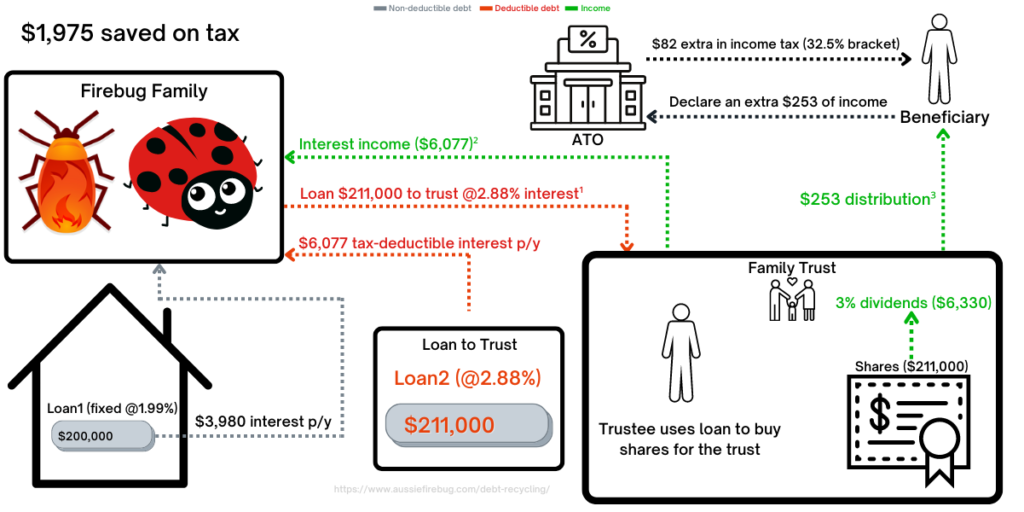

How We Did It (With The Trust)

The concept of DR remains the same, it’s just more complicated with a trust. (like a lot of things 😅)

Here’s how we did it.

¹ You need to make sure that the terms of the loan allow for changes in interest rate to be the same as what the bank is charging you. In this example, it’s constant at 2.88% when in reality the interest rate would fluctuate. The loan agreement between the Firebugs and the trustee needs to be in writing and on arm’s length terms too.

² The Firebug Family pay and receive the same amount ($6,077) so their tax position is nill.

³ The distribution is only $253 because the trust had to pay $6,077 in interest to the Firebug Family. The distribution will be taxed at the marginal rate of the beneficiary.

There’s a lot going on in the above picture but I hope it makes sense. Leave me a comment below if you need something explained in more detail.

What If I Don’t Have A Lump Sum?

Not everyone will have a large sum of money to completely pay down a split of their loan. We implement a dollar-cost averaging strategy which means we don’t save up large amounts to drop in at once. The sale of IP2 presented a rare opportunity for us to execute our DR strategy but I understand that won’t be the case for most people.

Annoyingly, I actually had some examples and financial products that are suitable for people who want to do DR whilst DCA’ing. But since ASIC doesn’t let people like me talk about those sorts of things without paying them money, I unfortunately had to delete this part out of the article :(.

Terry W Tips and Future Podcast

I reached out to one of if not the best SMEs (subject matter expert) for DR in Australia for his top tips. I’m also teeing up another podcast with him to do a DR specific episode. Please let me know in the comment section what you want us to cover and I’ll try to add it in 🙂

If you want to know more about Terry, check out the first podcast we did together here. He also has his own podcast which you can check out here.

Terry’s top tips 👇

- You can only claim interest if borrowing to buy income-producing assets

- You need to avoid mixing loans as this will reduce tax savings

- Split loans first before repaying

- Repayment needs to be done once in full

- Redraws can be done in stages

- If borrowing to buy non-dividend paying shares the interest could be a cost base expense so it would still be worth splitting and recording the interest as it will reduce CGT.

- Written loan agreements on arm’s length terms are needed if the borrower and the investor are different

- Never redraw into a savings account with cash as it will cause a mixed loan

- Avoid paying into a share trading account with cash in there as this will cause a mixed loan.

- It is possible to debt recycle with any loan that has redraw, but some loan products are better than others, so see your broker about this.

- Debt recycling is a tax strategy so only registered tax agents or tax lawyers can advise on it.

- Advice on what to invest in would be financial advice if it involves shares or super as these are financial products so only an AFSL holder or authorized representative could advise on this.

- It is possible to debt recycle with investment properties too.

Conclusion

It’s important to note that DR didn’t change our investments, amount of debt, asset allocation or anything else really. We simply changed the use of the borrowed money.

I used the 32.5% tax bracket but this strategy would save you even more money if you have a higher marginal tax rate (I forgot to include the medicare levy too which would have made the tax savings even more impressive).

There’s also a pretty good chance that interest rates are going to rise in the next couple of years.

More interest = more deductions for us.

Oh, and if you’re wondering how I came to that $100,000 number in the intro. I simply punched in $1,975 into a compound interest calculator for 20 years at 8 interest. There are a bunch of assumptions right there but it’s impossible to know how the interest rate will move over that time period and we plan to redraw equity out of Loan1 and Loan2 which will mean more deductions. Essentially, we don’t ever plan to pay off our PPoR loan. I eventually want to DR Loan1 and then continuously redraw equity for the foreseeable future (Thornhill style!).

This strategy is something that took less than a week to sort out but will be saving us money for as long as we have debt against our PPoR.

Pretty cool if you ask me 🙂

Are you doing DR? I’d love to know why or why not in the comments section below.

As always,

Spark that 🔥

Nice! I have been waiting for this article! One question for you/Terry. I get the whole point about it being the *purpose* of the loan that’s important (and hence why clean splits are necessary).

What about the brokerage account you use though – does that need to be “empty” before you start? I’m guessing not, but thought I’d check.

If there is a reason for that being needed though, be great if Terry could explain it.

Don’t quite understand how it $1975 tax saving. Effectively by keeping 211k you would have saved 6k in interest without tax. Now with dividend you would need to pay tax but interest expense will offset it. Basically all we are punting on is that dividend + capital gains will be higher than interest cost and we save tax compared to normal investing

I think the idea though is that if you’re doing this over 10+ years then the compounding gains and dividends from that investing will (over time) easily offset the interest paid. And the more you earn (including from passive income), the higher the tax bracket you’ll be in, the more the deductions help.

That’s exactly what we’re punting on (which has historically been the correct play).

If you think you’re better off paying down debt vs investing then you would never entertain the idea of DR.

Hi Firebug and Terry:)

At minute 37 you covered what happens if the loan is in 1 name but investments are in two names. What happens if the loan is in 2 names but investment in 1name? E.I loan $50 000, investm person1 20 000 and person2 30 000? Thank you

If A and B borrow and the investment is in B’s name then B will generally be the one to claim the interest in full.

I wrote about that here

Tax Tip 79: Interest Deductibility for 1 on title 2 on loans https://propertychat.com.au/community/threads/tax-tip-79-interest-deductibility-for-1-on-title-2-on-loans.5838/

How is the punt going now with high interest rate ? debt recycling only works if difference between interest you pay to the bank plus additional cost associated with your account is lower then the return you get from your stock investment in long-term.

Now, most people may not like it but fact is that if someone try to copy this method for the stock and if the stock you bough goes out of business then you end-up with 100% debt and same if you end-up investing in one of the low performing LIC or stocks that survive but average return is lower than bank interest rate… !

VTS is one of the exception where average return in past were in excess of 10% based on sharesight (10 year +) so could make you earn the difference of 3% to 5% on your investment on long-term only.. In my opinion.

obviously past performance isn’t reflection of future performance so check before going to VTS as American tax law needs to be considered while investing in VTS.. !

Higher interest rates just mean more deductions.

You may be confusing DR with borrowing to invest?

Hi Terry,

Instead of buying Shares, can family buy Investment Property?

Hi James

Its all about the ‘use’ of the borrowed funds. Deductibility depends on the use to which the borrowed funds are put. If borrowed funds are mixed with cash this can create tax issues and may result in the loss of 100% interest being deductible.

The brokerage account doesn’t have to be empty, but if it is not empty and not all the funds are used then apportionment will be necessary.

e.g. you borrow $10,000 and still it in your commsec account to buy income producing shares. The commsec account has $1000 cash from before. So in total there is $11,000 in there.

If you buy $11,000 worth of shares, that pay dividends, then 100% of the interest on the $10k loan should be deductible. But if you only buy $10,000 worth it shares you will only be able to claim a percentage. It would be 10,000/11,000 which equals 90.0%

10,000/11,000 equals 90.9%

Well done firebug. I have quizzed my broker about this. Currently as my loan is fixed for another year, I have been informed that to split the current PPOR loan of $500k to 2 x $250k loans would involve break fees at this stage. The $500k loan is fully offset with my cash. Wondering if I should pay off $250k then redraw, rather than offset for investment purposes?

I’ll speak to my account too. Just didn’t want to feel trapped by one more year of fixed rate charges to miss out on 12 months of DR.

What’s your current rate? Sometimes it’s better to keep the fixed-rate considering the current environment (rising rates).

Do you have a spare $250K in the offset and were you going to invest that anyway?

Yes we do. that was the plan….to invest a large chunk and then monthly buys from here on out. Just wanting to align with the correct strategy and steps for debt recycling.

If i pull out $250k for investment purposes from a PPOR loan leaving $250k offset only, the loan hasn’t been split. I believe this one off investment withdrawal if named correctly could then be classed as a withdrawal for investment purposes and thus debt recycling? In hindsight i should have applied for split straight up

Its a matter of running the numbers

you would have 3 choices

a) wait

b) invest with cash,

c) break the fixed loan and claim interest

with c) there is a cost of paying extra interest but there could be tax savings this year and for the next 20 or 30 years even.

Hey Firebug,

Just to clarify – with rising interest rates does DR become more or less effective?

More effective.

High interest rates + high marginal rate = high deductions.

Hey Firebug, was wondering this too. What happens if your interest exceeds your dividend returns though? Say if you pay interest of $1200 pa but only get dividends worth $1000? Can you still claim the $1200, or you can only claim the $1000?

You can claim the whole $1,200. It just offsets your other income at that point.

Thanks! So in effect it would be negative geared then right?

You can only claim interest expenses if the debt has been used to produce income.

Here’s the ATO’s statement regarding ‘dividend and share income expenses’:

“You can claim a deduction for interest charged on money borrowed to buy shares and other related investments that you derive assessable interest or dividend income from.”

“Only interest expenses incurred for an income-producing purpose are deductible.”

This reads as not being able to claim against your personal/job income. If the interest bill exceeds the dividends for the year, then you can either

A) carry the extra $200 over to the next year,

OR

B) add the remaining $200 interest to the cost base for your shares when you sell them.

I don’t think this is applicable if using the Family Trust structure as the trust doesn’t have enough to pay back the interest.

I suppose at that point, the trust can sell off enough shares to pay for the interest?

Cheers for another great read! I only started DR a couple of years ago too. I’m presently increasing my split loan every 2 months to buy more shares as I pay down my mortgage as fast as I can. I actually find the process enjoyable and love tracking the progress.

Hi Firebug,

Thanks for the info! Total newbie question here, but isn’t this the same as borrowing money to invest in the stock market? I’ve always read that that’s high risk and a bad idea. Is this somehow different?

Thanks!

I think the difference is since you’ve paid down your mortgage first, you’re not borrowing anything *extra*. Your net position is actually better, because you get the tax deductions from borrowing.

Hi, thank you for the article. I understand how to DR, I am only wondering, what is more worth atm in the below case:

Marginal tax rate: 34.5%

Variable loan: 100 000, I can sell my $50 000 worth shares (paying approx 5% dyvident before tax) and then put money in the offset acc (3.89% and growing).This will stop interest charges over that amount ($approx 120 monthly) That means quicker repayment of the loan. On the other hand, I can do the DR, but I am not sure how would I gain here? Could you help me understand?

No. DR is fundamentally different compared to borrowing to invest.

Look at pictures 2 and 3.

The amount of debt we have doesn’t change.

What we invest in doesn’t change.

The only difference is the amount of tax we pay.

Debt Recycling is certainly borrowing money, but it doesn’t necessarily need to be done in relation to purchasing shares. It can be done with any asset that produces income or capital gains.

Borrowing does create risk. But with debt recycling the overall debt is remaining the same.

E.g. You have a $100,000 loan and $10,000 cash. You want to invest $10,000.

The 2 methods would be

a) Use $10,000 of cash to invest, Debt is still $100,000

or

b) Debt recycle $10k by splitting and paying down the loan and now borrowing $10,000 to invest.

The debt is still $100,000

but now you have interest on the $10k loan split being deductible.

No overall increase in borrowings but some additional tax savings.

In the Trust scenario, assuming there was no other trust income, what would happen if the dividends weren’t enough to cover the interest payable to the firebug family? You would need to give the trust another loan/gift to cover?

Also, is DRP able to be incorporated into this somehow? Or is the cash always required to cover the interest.

Thanks for the write-up.

Good question. I’ll leave this one for Terry. This is the first year I’ve done DR so I’m not sure of all the finer details.

Hey Matt, Firstly thanks for publishing such a diligently researched resource, I love the powerBI breakdown for your EoY.

I, like a lot of people I expect have a fixed loan coming off in Nov and I’m looking to restructure.

As I already have a trust I’m keen to know how your first year of DR went in that structure. As I’m getting towards the top end of the 37% individual and have 4 kids under 11yrs it’s appealing.

The trust is a separate tax payer so think of it as another person. If it had invested and the income was less than the expenses it would have a loss, a negative income. A loss of one person cannot offset the income of another person so the loss would be trapped in the trust and could be rolled over to future years.

But where there is a loss how is the interest able to be paid? If the income is not enough to pay the interest the trust would need to borrow more money, from a related party, to pay this. This is basically capitalising interest. This will also create further deductions making the loss bigger too!

So now that interest rates are rising and the income is likely to be less than the interest the strategy utilising the trust will become negative geared depending on lending. Does it remain financially viable to do this? The loss will be trapped in the trust, i.e. not be claimable against personal income from the high income earner. If the strategy is to borrow more from the lender to cover the loss and claim the interest cost, capitalise interest costs , does this run into conflict with part IVA?

Awesome awesome awesome! And love the visuals.

My only concern…. Borrowing against shares involves margin calls in the stock falls. How do you manage your liquidity risk in an environment where stocks are falling and you have to post the cash against ~$200k in borrow stocks? What your strategy around cash reserve if the bank come calling for service margin calls?

The loan is secured by the property still rather then shares, so no margin calls as its not this type of facility

DR doesn’t involve margin calls since it’s not a margin loan. It’s a property loan secured against the PPOR.

As others have mentioned. There are no margin calls because the original loan was secured against our PPoR.

So we’re getting all the benefits of a PPoR loan (low-interest rate, no margin calls) PLUS the ability to deduct its interest.

Win-win scenario!

Hi mate probably a silly question but does debt recycling work if I were to take 17k from our redraw to invest does that still make the interest tax deductible on that part of the loan even though i havent paid it off ?

Cheers

No this would not be DR – the 17k would need to be used to pay down the loan, then split back (typically in the form of another loan) prior to investing. Depends on your institution how simple this is. AMP Masterlimit is flexible solution.

This sounds like it is just borrowing to invest rather than debt recycling. If you redrew on an existing loan it would be a mixed loan so you would have to apportion the interest.

If the loan was say $400,000 limit and you redrew $17,000 the percentage would be worked out by 17000/400,000 which equals.4.25%

so 4.25% of the interest on that loan may be deductible if the $17k was invested in something that was expected to pay income.

Great article. I was waiting for this article from a long time before I do the DR. I have few questions:

– Doe the DR work only with Variable Loan Accounts? Or can I use Fixed loan account as well?

– I paid my loan account when it was variable. didn’t redraw anything. Recently, I converted it to fixed interest rate as the interest rates were going up. If I redraw from this loan account, would it still be considered DR?

– My bank (STG) does not support transferring money directly from the Loan Account to a Investment Accounts so can I transfer money from my loan account to offset and then to the investment account? Would this still be DR?

Thanks !

Thanks 🙂

Can you redraw from a fixed account?

If you can redraw it could work… I honestly thought redraw wasn’t available with a fixed account.

I believe you can transfer it to an offset but it can’t have any money in it or else it might become a mixed account. You should transfer the redrawn amount into accounts with nothing in them (including your brokerage account).

Hey Mr FB,

Thanks for your reply.

I could redraw from my Fixed loan account, may be because I paid it up when it was still a variable account?

Thanks for the tip, the offset account does not have any other money apart from the redrawn amount.

I also have a special scenario. Because my loan splits were smaller, I had paid the extra money into the multiple loan splits and then have redrawn them into a single offset account (which is linked only to one loan account). Planning to transfer this amount directly to an investment account. I don’t think that should be a problem as the DR amount would still be same though coming from different loan accounts. I can prove that this money came after redraw and claim tax though the loan is fixed now?

Question with who claims the interest, in a low interest rate environment, is it better to invest in the low or nil income persons name to take advantage of full franking credit refund?

I’m leaning towards the higher income earning but I haven’t done any modeling.

But there’s other factors when it comes to who’s name you should invest in.

This is more of a legal question as it relates to ownership structuring as well as tax.

On the tax side if the income is greater than the expenses it might be more effective in the lower income earners name. However if negative geared in the higher earners name.

but remember that incomes will change over the years and what is negative now will be positive at some point (otherwise no point in investing)

On the legal side you have to consider control, estate planning, succession, asset protection, family law and many more things.

When you say nothing in the brokerage account too. Are you implying no funds in the settlement account or no actual stocks in the brokerage account too, meaning you’d need a new brokerage account?

I understand most brokers are ok with multiple trust accounts for example AFB Trust no1 then AFB Trust no2 but many don’t allow multiple personal accounts.

No funds but I’ll clarify with Terry.

Nice post, love Terry’s tips as the cherry on top! It is not that often you hear the caveat that it should be income producing investments ie shares that you expect to pay dividends.

The one point of the article that didn’t make sense to me is “Repayment needs to be done once in full”. I would have thought if you have split the loan and are clean with that split (redraw directly to brokerage account) the trail is quite clear, so why the need to pay down fully once?

Thanks Kate,

I get the clarification in the podcast 👍

You want to avoid mixing so any account the borrowed money goes into should ideally be empty.

Great article as usual Mr FB.

We are doing a similar thing except we borrowed money specifically for investing. We had a 250k mortgage on our PPOR, and a 200k mortgage on a very positive geared investment property in Sydney.

We borrowed 250k on that investment property, and left the money in the loan. We are able to redraw this money in minimum of 2k amounts and pay it directly into our share trading platform.

We have previously been saving $2.5k a fortnight. Now we just pay the $2.5k off our mortgage which is dropping fast, and redraw the 2.5k from the investment loan to buy shares.

Our home loan will be paid off in under 4 years.

We think this will give us the best possible outcome of owning our own home while increasing our investment holdings and providing a tax deduction without increasing debt.

Cheers

This is exactly what we do! I think it’s a great overall plan 👍

Very excited to hear you’ll be talking with Terry W.

I’d be interested to know his thoughts on capitalising the costs of investing using the deductible loan.

Capitalising interest is tricky. The high court has said that the interest incurred on interest (from capitalising) will be deductible if the underlying interest is deductible. .eg. if the interest is $1000 and you do not pay it the next month it might be $1100. that extra $100 will be deductible if the $1000 would have been deductible.

but..

The ATO can apply Part IVA, the anti-avoidance rules, to deny a deduction if it is part of a scheme with the dominant purpose of gaining a tax advantage.

So if a trust with no other income capitalises interest it might be fine. if an individual capitalises interest on an investment loan so they can use the money they would have used to pay the interest to instead pay off their non-deductible loan then they may have a potential problem if the reason for doing this was to save more tax.

Firebug, can you ask Terry to explain this tip:

“Avoid paying into a share trading account with cash in there as this will cause a mixed loan.”

I thought that if you redraw your entire loan into your trading account and spend at least all of the redrawn amount that it wouldn’t matter if there was already cash in the trading account? As long as all of the tax-deductible value was utilised?

It would be fairly rare to be able to buy shares + brokerage fee that exactly matches the amount you have redrawn from your home loan. So either you are going to have some left over in the brokerage account (which isn’t ideal) or you’ll need to top up with some non-tax deductible dollars to ensure that the tax-deductible value is fully exhausted?

If you do start with a $0 balance trading account and you end up with some $ left over after you complete your trades, should you transfer that back to the loan? I can’t imagine you could let it sit there since it has t been used to purchase income-producing assets.

I’ll bring it up in the pod Hayles 🙂

I came here to ask this exact question. I DCA from my redraw monthly for DR and every month I make sure I buy enough units to cover the amount transferred then add a little extra (like $20 – $80) from my personal account to cover the brokerage fee plus the additional amount from the last unit that pushes it over whatever the redraw amount was. This is surely much cleaner for the ATO than not fully investing the money you’re going to be claiming you’ve invested at tax time. Would love you to cover this with Terry in the pod, AFB.

You are right in that it is likely that if you borrow to buy some shares you will have some borrowed money left over in the brokerage account after the transaction. You might transfer $10,000 in to buy 100 shares that are trading around $100 each but end up buying them for $99.70. so you would have $300 left over.

In this situation you have borrowed $10k but only borrowed to invest $9970 so there is $30 left in the brokerage account. You would only be able to claim 9970/10000th of the interest or 99.7%. This is close enough to 100% to not to worry about the difference. interest on $10,000 at 5% would be $50 per year. so $49.85 of this interest could be claimed. You could round it up to $50.

But where the amount is more substantial you would need to apportion it.

Hi Terry,

In this instance, if I transfer $30 (or basically whatever balance remaining in trading account after buying shares – asssuming it was empty before transferring the DR amount) back into the split loan just to keep it clean, would there be any issue?

Technically it might. The loan could be seen as a mixed loan and paying into it will reduce all portions used, sort of mixing it further.

But the percentages involved will generally be in the fractions of 1% so it won’t really matter.

But if you borrowed say $10,000, transferred to the commsec account and just bought $6,000 worth of shares if you transferred the remaining $4,000 back into the loan it could be an issue as it is 40% of the loan.

You would want to get tax advice before doing this.

Thanks Terry! I have a one day delay for my funds going in to my account (no OSKO with my bank frustratingly) so my discrepancy is often more than it would otherwise be as I can’t predict what the units will be trading at tomorrow. Also, do we need to account for brokerage? For example what if I do 3 trades – that’s $28.50 in brokerage, and that fee isn’t an ‘income producing asset” – it would be more like trying to claim on conveyancing costs when buying a property wouldn’t it? Am I maybe safest just to always claim 99% going forward, or should I call ATO for advice? Thanks again.

Hi Es

You can borrow to pay the stamp duty and conveyancing on an investment property and claim the interest and it works the same way with shares. the brokerage fee is a capital cost but you can still borrow to pay it as it relates to the production of income if there are dividends.

There is no point in asking the ATO for tax advice like this as you won’t get a sensible response and it will not be binding anyway.

You also can’t just pluck a figure out of the air and use it as a basis for claiming costs – well you could, but it wouldn’t be right and wouldn’t help

Hi Terry

I understand that we can transfer our loaned money into an empty Pearler account and purchase shares (DCA).

As there is likely to be remainder funds following each purchase this can be left for the next months purchase.

In regards to dividends – to avoid contamination, is it best to have them paid directly into seperate personal savings account instead of auto invested into broker account ?

Thanks for the article! Just wondering why you had two loans in the first place, before DR started? I thought maybe it was to prepare for DR to begin later, but then I see one is fixed and one is variable, both at a different rate. What happened there?

It was in preparation for DR. I fixed one because the rate was so good that’s all.

The rates for fixed were lower than variable which was a bit odd I thought. Pretty happy with our decision considering they’re heading up now.

Great article as always.

I do question your logic though- it looks like you could have fixed both loans and significantly reduced your overall costs (considering your variable loan is around 1% higher and nearly double the cost) – unless youre on the highest tax bracket I don’t see the benefit in paying double the interest on that investment loan and not fixing the full amount when you had that chance.

Have you run those numbers? Thoughts?

Thanks Bee,

Hindsight is 20/20.

Of course I would have fixed both loans if I knew that the variable interest rate was going to go up this much.

Interest rate movements are out of my control. But what I can control is when and what I invest in.

I knew that we were going to have a large lump sum last year and I knew we wanted to invest that in shares.

Splitting the loan and making ~$211K of it tax deductible was a bonus ontop of what we were already going to do anyway.

As someone that is likely to purchase their first home in the next 6-9 months would you recommend setting up a split loan in advance given the rising interest rates? And does one have to be variable or can both be fixed? We are pre-approved for $800k so would you split evenly it just split for the amount in what you would want to invest e.g. $200k ?

I can’t recommend anything mate.

If I were in that position, I would create the splits in advance and make sure one of the splits was the same size as my lump sum. Can you redraw from the fixed interest account?

Would you be happy to share some examples and financial products that are suitable for people who want to do DR whilst DCA’ing PRIVATELY by email rather than publicly on the website to keep ASIC happy?

Yes – are you able to email?

We are selling our investment property and will have a lump sum but also want to consider doing DCA in the future as well.

Check out AMP master limit facility. It would work well for a DCA debt recycling strategy.

Another option is Terry’s simple loan structure, this could work well for DCA. Once you’ve used all the smaller splits restructure combining the small splits into a single split and then break of another set of small splits from the main part of the loan.

https://www.propertychat.com.au/community/threads/tax-tip-13-simple-loan-structuring-strategy.2601/

Debt recycling doesn’t really involve any financial products. It involves credit products and a financial services licence isn’t needed but a credit licence is needed to recommend a financial product.

One ‘product’ to get some credit advice on is the AMP Master limit facility. You use the standard AMP products but this facility allows for the splits to be readjusted over time, without having to reapply each time, as long as you stay under the limit.

You can check out this article that I wrote about 5 years ago Strategy: Using AMP’s Master Facility to Debt Recycle https://bit.ly/3glFuZp

This is a really nice and easy way to explain it and the pictures help a lot too. Now I just need to get the mrs on board with shares not being scary and risky..

Does a debt recycled loan split have to go straight from the split loan account into the brokerage account?

Ie a non bank lender only allows redraws into a ‘registered account’, the redrawn money goes into that account, then from there to the brokerage account. Is that still ‘clean’? The amounts redrawn, and paid in and out of the account, are clearly identified in the references, are for identical amounts (an unusual number and to the cent, not just a round number like $10,000 or something) and processed as soon as possible once transactions have cleared so it is all pretty transparent. Just not direct.

I’ll check with Terry mate

The ATO seems to accept that borrowing and parking money in an empty offset account from where it is soon used to invest doesn’t break the connection between borrowing and investing. But I have only seen this view in a few private rulings. There is no published ATO advice on this that I know and and no cases, except the Domjan case at the AAT where it was implied it would be ok, but not outright said.

So you can take a chance that it will be ok, or get you own private ruling if you want certainty.

Hey AFB loving the content, I’m doing it exactly how it’s printed in Motivated Money. There was a few complications getting started but I’m on track to hit $100k invested by next year and will relax the borrowings as I’m only a year into the strategy.

So one thing I don’t quite get – I’m $60k ahead in the PPOR mortgage and smashing much more than the minimum monthly repayment. How do I DR this?

1. Create a 2nd loan of $60k – ok, bank will be sweet with that

2. Buy ETFs with the $60k – now seems a good time to go in more!

3. Ok now there’s 2 loans to repay every month – PPOR mortgage and DR investment

4. Reduce repayments on PPOR and make the minimum monthly on the DR loan?

This is the last dots I can’t quite join up. Help?

Also there’s about $400k in equity below the 80% LVR that is not leveraged at all. Obviously some opportunity here up to the point of cash flow limits?

In an ideal world for me, the split loan would be changed to interest only (IO).

Anyone who does DR must make the assumption that investing will outperform paying down debt over the long term (which historically has been correct).

If this isn’t your position then you would never do DR. You’d just pay down the loan and then invest without leverage.

So with that assumption, turning the split loan into IO would work best as long as that doesn’t affect the interest rate or anything else.

Does that answer your question?

It does, thanks.

I take it that DR is effectively using the capacity to repay above the PPOR minimum monthly to take on additional debt for investing purposes, because really it’s about servicing additional debt, but for investment purposes.

So even without DR, it means leveraging equity to borrow for investment – up to the capacity to service that debt.

Very nice.

How about a redraw to increase leverage on a marginal loan / NAB equity trader.

Maximizing purchasing power (and risk if one can digest it).

Separate question: If I (higher tax bracket) borrow / redraw the money from my wife’s and my mortgage does the tax consideration work for myself i.e. can I claim the interest % on my return, or does it get split 50/50 (same ratio as mortgage is held)?

Good question. I’ll raise it with Terry in our podcast

The investor is the one that claims the interest and other expenses. So if X and Y have a loan and they redraw and Y invests this borrowed money in their name then Y will claim 100% of the interest on this loan split even though both X and Y are on the loan. I don’t think any onlending agreement between X and Y is needed but some tax advisors do.

If X and Y are on the loan and the money is being used by Z, then Z has not borrowed so cannot claim the interest and neither can X and Y. To get around this the ATO will allow Z to claim the interest if X and Y lend Z the money that they have borrowed under a written agreement. The agreement should be the type of agreement that 2 strangers would enter into and the interest rate needs to be at least the same amount that X and Y are paying the bank.

Z could be a company or a trust or another relative or a stranger in this case

Fantastic article, been looking forward to this! Shame about ASIC and the DCA products, would have loved to hear about them.

Question: How does this place you for future refinance? Is the loan that is invested in shares “locked” or can it be moved to a new lender without the ATO having opinions about the purpose changing?

Great question. I’ll ask Terry in our up coming podcast mate

Can’t wait for the episode!

I think there is some confusion over ASIC and ‘DCA products’. What we are talking about are tax strategies and credit products here. Dollar Cost Averaging is not financial advice per se. If someone wants to invest periodically in something that is possible and there are loan products which may suit that better than others. What they invest in is up to them or something they can get their own financial advice on.

If a loan that has been used to invest is refinanced it generally won’t change the deductibility of interest. The borrow should be concerned about mixing loans though. So joining loans together that have been used for different things or by different persons/entities can resulting mixing, but keeping the same splits can avoid this.

Thanks. Looking forward to the podcast.

The main loan is paid down to zero.

The new split loan with offset is for investing.

How would this strategy vary from regular DR?

What do you do with the dividends if you wanted to reinvest instead of paying down the non investing loan? Can you put them on the offset account?

If the main loan is paid down to zero, can’t you just redraw from that account? I’m not sure you need to split it.

You can do whatever you want with the dividends. They don’t need to be used to pay down the loan at all. You can reinvest them into the market if you want.

Thanks. That makes sense RE: dividends.

I guess the dividends can stay in the brokerage account and then use them to buy more.

The main loan only has $60k available for redraw and I wanted to keep it seperate (emergency fund).

The split loan will be $150K +.

One more quesyion. Do you take the money out of the split loan as you need it or pull the whole lot out and put it in the Offset account and then transfer from the Offset account to the brokerage account when you buy shares ?

I believe you have to pull the whole lot out and invest it all at once. Could be wrong but I’ll check with Terry

Thanks

Income from an investment should ideally go into the offset account attached to the non-deductible debt as this will speed up the debt recycling process and save non-deductible interest. There is no tax reason to segregate investment income.

But if you are investing in shares you might want to get some financial advice on whether to receive dividends or reinvest dividends. Taxwise both will be taxed the same. If dividends are reinvested those dividends are still taxed and the deductibility of interest on loans will still be the same, but there will be less cash with which to debt recycle the next round.

I must be missing something and its driving me crazy!!!

I get that by DR one can claim interest paid to the bank as a tax deduction, thus resulting in less tax paid to the taxman. I get that.

But i would only be paying less tax because my overall income is less. The interest i would pay to the bank has significantly eaten into my dividend income.

Taking your situation.

If your $211k investment made you $6330 in dividend profit, then you pay $2057 in tax, youve still made $4273.

If you made $6330 in dividends but had to pay the bank $6077 in interest, this means overall you’ve only made $253 profit.

Yeah, you only pay tax now on $253 and not $6330. But thats only because youve made $253!

Is the idea that by DR we accept that the dividend income and interest paid to the bank (which we wouldnt have to pay it we just invested our surplus money), more or less cancel eachother out?? And we are therefore seeking profit via capital gain??

I also dont understand the logic of ‘not taking on more debt’.

If you intially had a homeloan of $411k, then loaded your $211k into it, you now have a $200k debt.

If you then take $211k out again, you now have $411k debt again. Yeah, its not more than what your initial HL debt was, but its still more than the $200k you got it down to.

In this situation are we saying… yes… technically one takes on more debt….. from $411k to $200k, then back up to $411k….. but practically no, because ones net situation is neutral (or in profit if the investments do well)?

Arrrgghh!

Ive read enough stuff that assures me this is a good strategy, but it still hasnt fallen into place in my head yet!

Would LOVE an explanation.

Thanks.

I’ll let someone else elaborate in more detail but I think in your summary you are forgetting that without DR you are paying interest on the full loan without any portion being tax deductible. The key with DR is moving your loan from non-tax deductible, to tax deducible.

So the simple answer is that the tax deduction from the loan interest is (more or less) going to be your value add as you are able to claim the interest on the DR portion, vs no deduction on any interest.

To re-word the above – your calculations seem to ignore that the same interest is due with or without DR, the DR benefit is derived from the now tax deductible portion of the DR loan split. The income side from the shares remains the same with or without DR.

No. The overall income in both situations are the exact same.

Looke at pictures 2 and 3.

The amount of interest paid and the income are the exact same. The only difference between the two situations is that the we can claim the interest in picture 3. That’s it.

We still would have had to pay it either way. Look at pictures 2 and 3 again. We have to pay $6,077 in interest if with do DR or if we don’t do it.

Ok so this is the part that may help you.

Anyone who decides to do DR are essentially saying that they think investing is better than paying down debt (from a returns point of view).

If you think you’re better off paying down debt, DR isn’t for you.

With that assumption established.

We had a lump sum of $211K that we were going to invest regardless of doing DR.

We’re comfortable with debt and think investing will work out better for us over the long term as opposed to paying down our PPoR loan.

So instead of just investing our lump sum, DR gives us the opportunity to turn part of our home loan into deductible debt. We can claim this interest which means we don’t have to pay as much tax.

The real magic is the differences between picture 2 and 3. Look at them again. It should be enough to tell you what you need to know.

I hope that anwers your question Cam 🙂

Hi Cam

Think of it this way. You have a $100,000 loan and $10,000 cash and the interest rate is 5% pa.

If the $10,000 is in the offset you pay interest on $90,000 = $45

But if you use the cash to invest you will pay interest on $100,000 = $50

none of that extra $5 in interest is deductible.

Instead you debt recycle.

You pay the $100,000 to $90,000 and borrow $10,000 to invest.

the $90,000 loan gets whacked $45 in interest. none deductible

But the $10,000 loan gets $5 in interest and this is deductible.

You have now saved yourself about $2.

And you have no more debt than when your started.

You might think this is a lot effort to save $2.

lol

It is, but really it is not much effect once set up. Just transfer money 2 extra steps. You will then save this $2 each year for the next 10 to 20 years perhaps. You will be doing it more than once and the compounding affect will kick in.

I had the same quandary as Cam, so I went to Excel for help 🙂

Baseline position is two Loans (A for $200K and B for $211K) resulting in Annual outgoings of $10,057

Option 1 (Pay off Loan B) results in Annual Outgoings drop to $3980

Option 1 is favourable compared to Baseline with improvement of $6077 in Annual outgoings

Option 2 (Direct Invest $211K in Shares) results in Annual outgoings dropping to $5784

Option 2 is favourable compared to Baseline with improvement of $4273 in Annual outgoings

Option 2 is not favourable when compared to Option 1 Annual outgoings and not accounting for capital growth on the newly acquired asset

Option 3 (Debt Recycle Loan 2 for $211K in Shares) results in Annual outgoings dropping to $3809

Option 3 is favourable compared to Baseline with improvement of $6248 in Annual outgoings

Option 3 is not favourable when compared to Option 1 Annual outgoings and not accounting for capital growth on the newly acquired asset

*** Option 3 is favourable when compared to Option 2 with improvement of $171 in Annual outgoings when Loan B interest rate is at 2.88% (i.e. less than investment yield) ***

Option 3 becomes unfavourable in Annual outgoings when compared to Option 2 when loan interest rates increase beyond investment yield (e.g. at 3.5% interest it becomes $712 unfavourable to Option 2, 4% interest it becomes $1424 unfavourable to Option 2)

So perhaps the headline figure of $1975 saved on tax is not what should be emphasised, as opposed to the $171 annual outgoings improvement (line above with *** on it). Like any investment, you’re relying on expenses over time being less that CG+Yield

Hi Joz,

If you want to DR then option 1 isn’t a consideration at all.

Option 1 is only a consideration when you’re deciding between paying down debt or investing (which is an entirely different debate).

Historically, investing has out performed paying down debt in the long term (10+ years).

So it’s really only between option 2 or option 3 but let me take a look at all options anyway.

How so? Even without accounting for captial growth, the outgoings for option 3 is still the best out of all three options (annual outgoings = $3,809)

How are you calculating $171?

Option 2 outgoings = $5,784

Option 3 outgoings = $3,809

Option 3 saves $1,975.

Option 3 will never be unfavourable no matter what the interest rate is.

Option 2 and option 3 are the exact same except for the fact that option 3 turns non deductible debt into deductible debt.

So no matter how you slice or dice it, option 3 will be superior in all circumstances.

Thanks for writing up such a detailed page. I recently discussed a debt recycling strategy using an existing portfolio on Reddit. It potentially helps people to debt recycle without a big lump sum and to make up the “mistake” of not knowing about deb recycling ealrier. Would love your feedback and possibly if you could help to share that with more people if you think it makes sense.

Cheers,

Do you have a link to the post mate?

ah, sorry, I forgot the link. Here it is: https://www.reddit.com/r/fiaustralia/comments/v5vp3o/using_existing_stock_portfolios_for_debt_recycling/

Cooke don’t believe everything you read on the internet.

You mentioned you might sell shares only to borrow and buy back the shares and think this will be ok as it is not considered a ‘wash sale’ as you will be paying CGT.

It is not whether it is a ‘wash sale’ or not that is important. That phrase is not even used in the legislation so it doesn’t really matter what the definition is. But what you have consider is the anti-avoidance provisions under Part IVA. This gives the ATO the power to cancel out tax benefits if they are caused by a scheme with the dominant purpose of generating a tax saving.

So ask yourself why are you going to sell only to rebuy the same shares. If the reason is so that you can claim the interest then it could be a scheme with the dominant purpose of gaining a tax advantage.

Any separately when you bring forward CGT you are losing part of your capital so you will have less compounding going on in the future. e.g. if you sell an asset worth $100,000 and pay $20,000 in tax and then buy back that asset or similar assets you would only have $80,000 of that asset compounding at say 4% pa. – this is something you could seek financial advice on.

Thanks Terry for the advice on the tax aspect. I’ll update my post to quote your reply to share with others.

Totally agree with your point about CGT. I emphasized it in my post.

Just want to say thanks again for all the knowledge that I have learned from you. Been a huge fan of your tax tips.

Just had a read of this and am also very interested too, it might be a good one to run by Terry prior to the podcast if you manage to get around to it. Sounds like it would be right in his structing/taxation wheelhouse.

Great idea. Aussie Firebug, do you think you could make it happen?

Chris, Aussie FB, Joz.

Thank you all for your detailed and considered responses.

Me and the missus sat down and went through all this last night, reading an re-reading your posts, crunching some numbers and finally… it clicked and all made sense! we could tally up the numbers right!

Now we just need to dig a little deeper and decide whether we want to make more coin or continue living debt free.

(which we currently do and have honestly really enjoyed).

We dont really want to go back in debt (we’re adding extensions soon) but now we can see that financially it can be of more benefit.

We’ll sleep on it.

Thanks again.

Hi Aussie FB, Thank you for sharing. This is really great. I think I understand the whole concept as I followed TerryW and your content for quite a while.

The timing is great as I am working on my strategy of DR (of course will seek professional advice once I am clear about my goals).

I have done a similar drawing / diagram like yours. There is one thing I couldn’t get my head around.

Is your loan 2 (2.88%) is P&I or Interest Only?

If it is variable interest only (assuming last for 5 years), that’s quite simple to know that the loan agreement to Trustee will be variable interest only using the same rate.

However if it is variable P&I which you need to pay down the loan. Did you structure the loan agreement to trustee as P&I as well? so that the Trustee will paying down the loan to you as the lender

Maybe this has been asked and answered above. Please share your thoughts. Thank you.

Ooooo this is a good question, David. Hmmm, I see the issue with a P&I loan. Let me add it to the list for Terry mate because I’m not sure of the answer.

The way I draft the loan agreement for someone to onlend borrowed money is to make it like a LOC facility so you can pay PI, IO or even let the interest capitalise. You would ideally match the loan with the bank as otherwise one party would end up making a profit and things will be hard to calculate.

e.g.

If you borrow $100,000 from the bank and onlend this to the trustee of the trust to invest make sure the interest rate matches. If you pay $123 in interest to the bank make sure the trust pays you $123 in interest that month. If you are paying PI and the trust paying IO there would be a mismatch. You pay the bank $123 and the trust pays you $100 so now the trust owes you $23 more than you owe the bank and the next month its its interest to you will be different to the interest amount you pay the bank. this will be hard to calculate and you would end up making a profit and that profit would be taxable income

Nice post! Been waiting for some official comms from you on this.

If your investment strategy is DCA, could you just split your current PPoR loan out into an amount that you would regularly invest e.g. $5k per month, then simply pay it all off, re-draw the $5k and invest? Assuming the split investment loan wouldn’t close after paying it down, you could do this each month, right? (or could pay down $4999 and redraw that if you’re worried the lender will close the loan account).

You’ve mentioned there can’t be any money in the savings account or share trading account before re-drawing or buying shares, respectively. Can you just move any residual money in those accounts out before starting the DR process each month? Also is it possible to re-draw directly from the investment loan split into your share trading account?

Thanks Levi,

That’s a lot of splits and I think some banks only allow a certain number of splits so it might not work.

I’ll ask Terry about the rest of your questions since I’m not sure mate.

I meant there is only one 5k loan split, and you redraw the 5k (or $4999 to keep the loan open) – then rinse and repeat this each month as you get paid your wages?

Hi Levi

If you paid off investment debt and redraw it you would loss the deduction on the amount paid off. What you need to do is to pay off the non-deductible portion and do that. It is possible to debt recycle in small amounts and to do that you either need a large lump sum of cash or a flexible lender.

If you had a large lump sum of cash you could split the loan to say $100,000 and pay it down to $0 in one hit. Then you could redraw say $5k per month and invest that. This will avoid mixing.

If you don’t have $100k to pay in one hit you would need to split the loan each time. but most lenders have a $10k or $20k loan size limit. So you would split the main loan so there is a $10k split, pay it down redraw invest (which could be in 2 lots of $5k) and then repeat when you have saved up another $10k.

That is going to be a lot of splitting and a lot of splits, but you could potentially join splits together later on if they have been used by the same person for income producing assets.

Another way is to split in advance. You could do 6 $10k splits if your lender will let you. Then debt recycle those splits one at a time.

See these articles that I have written

Tax Tip 13: Simple Loan Structuring Strategy https://propertychat.com.au/community/threads/tax-tip-13-simple-loan-structuring-strategy.2601/

Tax Tip 319: How to Debt Recycle when Investing in Small Amounts? https://www.propertychat.com.au/community/threads/tax-tip-319-how-to-debt-recycle-when-investing-in-small-amounts.55831/

Hi mate,

Epic read. I am currently in the process of doing the same thing.

Just curious as to what shares you purchased with your money. I am looking at following the idiot grandson portfolio.

Cheers Trent

Hi Trent,

I think I wrote all about it in my JAN or FEB net worth updates 👍

Thanks for this post

I m currently investing in wife’s name who isn’t working

So paying no tax on dividents

Is DR still worth it?

What happens if dividents dont cover interest payments?

Do you have to be on variable rate for such split loan?

What happens if someone has to sell some of the shares for some unforseen event?

I wouldn’t have thought so… if you’re saving on tax then I don’t really see the point. I’ll ask Terry

If the divs don’t cover the interest then you can just deduct it from your wage.

I was under the impression that you couldn’t redraw from a fixed interest account but apparently, that’s not right. I bring it up with Terry on the podcast. The important part is the ability to be able to redraw from the account.

I ask Terry about selling the shares too.

Sagar it is still worth your wife debt recycling even if there is no tax, and that is because

a) the interest will be a cost base expense and reduce CGT when sold (if not claimed against income)

and

b) investments will grow in value and at some point the income will be over the tax free threshold amount and tax will be saved.

Thanks for your reply Terry

I already have PPOR and planning to refinance next year when fixed period expires

PPOR is under my name

Share portfolio is in wife’s name

So to debt recycle do I need to sell everything before refinancing and buy again and then refinance under both name?

That will create lot of tax burden !

Anyone in brisbane who can set all this up?

Certainly no need to sell anything. You need to seek out a lawyer and get an loan agreement drawn up if someone other than the borrower on the loan with the bank is different from the investor. Most solicitors should be able to draw up a loan agreement but they probably won’t know what debt recycling is.

So when the debt is fully recycled will you have a fully deductible investment loan of 410k?

Will you then pay down that investment loan so you end up with no debt?

Yes.

The plan atm is to never pay it off. But our risk tolerance could change in the future.

A lot of people do this (as did I over the last 30 years) and it all works until it comes into question by the Banks. You see, banks are required to lend for purpose ie. PPR home loan is to pay for that asset, not another and is priced and provisioned accordingly.

When Banks learn of incorrect use of funds in the wrong loan type they are obliged to increase the interest rate and fee structure to that if investment purpose.

So yes, you can still do it and the DR process works but know you also take on the risk of incurring a higher loan interest rate and fees loan if you are reviewed. The ‘experts’ should be also advising this too.

How would they possibly know what you did with the money you redrew?

The loan is still secured against the PPoR in their eyes no?

This is a possibility. However, the purpose of the loan hasn’t changed. It is just the use of the subsequent redraw money that has changed. If you are redrawing directly from the loan to a brokerage account it should be visible to the bank as to what you are doing. so they could potentially increase the interest on the loan so it is at the investment rate.

So far I have not had any client tell me this has happened to them. One client did receive a please explain type email but their wording was vague and the client replied that the purpose of the loan had not changed (without lying) – the loan purpose was to buy a main residence and that is what they did.

But even if the rate went up the client is still better off debt recycling than using cash to invest as by using cash they would have higher non-deductible debt with none of the extra interest being tax deductible.

Hi FB,

Excellent post. Do you know what happens if the PPOR that is debt recycled is sold or rented out as IP down the track? If not, Can you please ask Terry in your podcast?

Example: Say property is worth $800,000 and outstanding mortage is $500,000 and I have debt recyled $400,000

Scenario 1: Sell PPOR for $800,00

A) Do I have to pay any capital gains since I debt recycled?

B) If yes, is there any way to avoid paying capital gains tax? E.g. sell the shares & repay the loan of $400,000 or pay the loan amount out of pocket pocket, etc.

Scenario 2: Rent out PPOR and convert it into an IP

A) My understanding is that I cannot claim tax deductions twice? Is there any other potential issues that one should be aware of?

Great question SN.

I’ll bring it up in the podcast

hi SN

If the security for the loan is sold mortgages need to be discharged to transfer title. This usually means loans have to be paid out, but this will mean deductibility is lost so a better strategy would be to keep the loan open and substitute the security. Sometimes this is easily done, other times it is harder to do. If you plan ahead long enough and have serviceability it should always be possible though.

Note that a loan is not the same as a mortgage.

Debt recycling doesn’t affect the capital gains position on the sale of a main residence. It can still be exempt from CGT.

If you debt recycle you are reducing the loan that was used to purchase the main residence so if it is later rented out there will be less interest to deduct against the rent. But the interest would be deductible against the share income instead.

There are probably heaps of other issues to consider as well. But I don’t know what you don’t know.

Thank you Terry.

I’ve set up DR in a somewhat similar manner but I’m confused with some of the statements you’ve mentioned by Terry W and I’ll be looking forward to the follow up Podcast.

I had paid off most of my PPoR (less $50k) so had a lot of equity sitting there doing nothing in my PPoR.

Moved to a new bank where i set up two loans that are linked to my PPoR.

Loan 1: PPoR loan @ 2.14 % variable for the remaining $50k owed.

Loan 2: Variable interest only investment loan @ 2.44 % for $200k.

When you create an investment loan its created as a line of credit so you don’t start being charged any interest until you start drawing the money out. The interest is paid on the money that is redrawn.

I always thought if I applied for a $200k investment loan once it was approved and the money was available I would start being charged interest on it. By having it as an investment loan I’ve been able to redrawn $20k per month to buy a 50/50 split of VAS and VGS for the last seven months and have almost deployed all the capital with $60k still available as redraw in the investment loan.

My issues came with the following two statements;

“Never redraw into a savings account with cash as it will cause a mixed loan”

and

“Avoid paying into a share trading account with cash in there as this will cause a mixed loan”

This is because the $200k investment loan (loan 2) needs to be transferred out as a line of credit into my everyday account (not a “savings” account) which I then transfer into my broker account which always has few dollars in it from non round share purchases. I can’t see why this is an issue or how it creates a “mixed loan” if the transfering is all visible and clear. Try and get into more detail around this with Terry W when you have him back on.

I’ll get clarification with Terry BPH 👍

This is because the $200k investment loan (loan 2) needs to be transferred out as a line of credit into my everyday account (not a “savings” account) which I then transfer into my broker account which always has few dollars in it from non round share purchases. I can’t see why this is an issue or how it creates a “mixed loan” if the transfering is all visible and clear.

It doesnt matter if it is a savings account, everyday account or investment account or offset etc. If other money is in the account you will have a mixed loan.

Think of it this way, an analogy. If you get some milk say 20ml and park it in with orange juice, and then immediately take 20ml out and put it in your tea would it taste funny? It would probably be a mixed liquid with some juice and some milk. So too with parking borrowed money in with cash. when you take it out you cannot say you solely took out the borrowed money

What’s the issues that arise from creating this mixed loan situation?

If the loan is mixed you cannot pay off each portion separate from the other portion. If you have orange juice and milk together in a jar you cannot pull out the orange juice separately – but the ATO allows mixed loans to be unmixed if you know the portions and refinance that loan into the relevant portions.

It also requires apportioning the interest which will become increasingly difficult and complex if you deposit more money into a mixed loan

Hi Terry,

Is this something a taxation agent may be able to review and correct for me?

Yes they should, but not all will.

Here are 2 relevant articles from 7 years agoL

Tax Tip 44: How to Un-Mix a Mixed Loan https://bit.ly/34DX6JT

Tax Tip 45: How to work out the Portions of a Mixed Loan https://propertychat.com.au/community/threads/tax-tip-45-how-to-work-out-the-portions-of-a-mixed-loan.4410/

Hi FB,

It’s a really great article and explained nicely with simple illustrations! The idea of DR to use for investing in stocks is amazing and something I would like to learn more about.

Could you please tell me if you redraw your Loan 2 to invest in stocks, is it still considered as a loan against PPoR?

Also, you mentioned in the conclusion: ”Essentially, we don’t ever plan to pay off our PPoR loan. I eventually want to DR Loan1 and then continuously redraw equity for the foreseeable future (Thornhill style!)”. I want to understand a few things here:

1. Can we do redraw on fixed interest loan, i.e. Loan 1?

2. From the amazing tips from Terry W: “It is possible to debt recycle with investment properties too.” – What does this mean and how is this possible?

I read Peter Thornhill’s book (Motivated Money) in 2020 when I started investing in stocks and building my FIRE portfolio. I think I didn’t understand the DR concept as it was a complex topic for me as a beginner, so I skipped it for later. I am going to go back to the book this long weekend.

Thanks for helping building the FIRE community in Australia. I am so looking forward to the podcast.

Thanks Shelly,

It depends on who you’re asking.

Loan 2 is a loan against the PPoR according to the bank.

Redrawing from a loan is considered new borrowings by the ATO and therefore Loan 2 is an investment loan in the eyes of the ATO.

1. I didn’t think so but I’ve had messages from people saying you can so now I’m not sure.

2. I have no idea haha but Terry will break it down in the up-and-coming podcast.

Cheers

“if you redraw your Loan 2 to invest in stocks, is it still considered as a loan against PPoR?”

if the security for the loan is the PPOR then it will be a loan against the PPOR. But that doesn’t really matter as it is the use that counts for tax purposes.

“I read Peter Thornhill’s book” I had a look at this after recording the podcast. It is not really possible to do it like he described in the book because such a loan product doesn’t really exist. He describes a LOC that increases its limit automatically when you have paid down the non-deductible portion.

Firstly, these days you should rarely use a LOC because it will have a high interest rate, and be at call (usually – not a fixed 30 year term, the bank can demand repayment within 30days), and hurt serviceability, not ability for offset etc.

But you could potentially set up something similar using the AMP master limit facility.

It could be potentially dangerous though as increasing a loan that has already been used could potentially cause mixing. So I would like to split first, use and later join the splits together – if need be.

We had a similar scenario – we cleared approx $300K after selling an IP. Our twist is that we move out of our PPOR in the future and rent it out, so we didn’t want to lose the tax deductibility by paying down the loan/changing purpose etc. In the end we settled on taking out a $300K loan via NAB equity and having our funds sit in a 100% offset, with the $300K plus our contribution gradually paying off the nab equity loan. Rate is higher but we liked that nab equity becomes an enforced timeframe of ten years which is when we want to retire. Bonus is we are in effect only paying interest on $40K of our PPOR loan but paying full repayments so it’s getting smashed, which is very satisfying to see.

Good stuff! Thanks for the article.

Am I right to say that with the rising interest rates and likely dropping dividend rates, a drip-feed type DR strategy (i.e. DR by saving in chunks over time) is not favourable compared to a lump sum type DR strategy?

What happens to existing DR if any following situation happens:

– Sell the PPOR

– Refinancing the PPOR

– If the PPOR gets converted to a rental and a new PPOR is purchased

– If the PPOR gets converted to a rental but remains the PPOR from a tax perspective (i.e. renting somewhere else)

Thanks Panda,

I’ll make sure to ask your questions when I record the pod with Terry mate.

Cheers

What happens to existing DR if any following situation happens:

1– Sell the PPOR

2– Refinancing the PPOR

3– If the PPOR gets converted to a rental and a new PPOR is purchased

4– If the PPOR gets converted to a rental but remains the PPOR from a tax perspective (i.e. renting somewhere else)

1,I covered above somewhere

2. You can maintain loan split and maintain deductibility

3. There will be less interest to claim on the property once it is rented out. So it might be best not to debt recycle until you move

4. as above. less interest to claim against rent, but you have more interest to claim against the income from the shares or other assets you invested in.

Hey, great article!

Does it work if the borrower is also the individual trustee of the family trust (no corporate trustee)? The loan agreement can’t exactly be at arms length if both the borrower and trustee are the same person?

Good question. I’ll add it to the list for Terry mate

You can borrow and onlend to the trustee under a written arms length agreement. If the onlender and and the borrower trustee are the same person there are some legal issues so I asked the ATO in a private binding ruling for a client and the ATO said a written loan agreement is needed and can be used even where the lender is person A and the borrower is person A as trustee. Furthermore they said without the written agreement they would deny the interest deduction.

This is a private ruling so no one else can rely on it other than the taxpayer that lodged it, but it might give some good guidance.

best to seek your own legal advice.

Well put together mate. Just wanted to point something out that Pat reminded me of a while back…

When debt recycling, the interest rate on the loan is very important. In this scenario, the interest costs have increased by about $2k precisely by turning it into a split investment loan vs keeping that as a normal 400kish home loan with the lower rate. You with me?

In that case, the tax savings need to amount to almost $2k to breakeven. Which means the interest payable needs to be about $6k annually (to save roughly $2k tax @ 33%). That would need a debt recycle amount of $300k or so to come out ahead.

I’m still debt recycling (can’t refi to a lower rate home loan anyway lol). But often a super low rate home loan will come out equal to DR or in some cases better, depending on the rate for the split used for DR. Hope that’s making sense haha. People often forget this part, myself included.

Dave, usually the interest rate wouldn’t change with debt recycling as you are using the same loan before and after, just putting money in and redrawing it.

Cheers boss.

The increase in rates wasn’t due to the split (or turning it into an investment loan), it was due to going variable as opposed to fixed. I could have split the loan but opted for fixed on both splits and they would have been the same rate.

Hindsight is 20/20 of course. If I had known that the variable rate was going to rise this much this quickly, of course, I would have stuck with fixed.

You can still do DR with a super low home loan rate. The market movements between fixed and variable were the difference in this example but it’s not something I could have controlled or foreseen with certainty.

But without that future insight, debt recycling still made sense because we were going to invest that lump sum anyway. Better to get some tax advantages along the way 😁

Yep that makes sense, thanks mate.

Just probably worth pointing out the importance of interest rate because people get all hot under the collar about DR and think the tax deductibility trumps any interest rate savings which obviously isn’t the case.

HI Dave

I don’t understand what you mean. Interest rates will not change with debt recycling. You are re-using the same loan on the same term. If you borrow to invest though you might end up paying a higher interest rate as most lenders will give you the investment rate.

You don’t pay anymore interest with debt recycling, you just convert non-deductible interest into deductible so the tax savings are the extra bit that you wouldn’t otherwise have received had you not debt recycled.

It seems some think you set up a LOC on your main residence which increases as your non-deductible loan decreases. But such a loan product doesn’t really exist. If it did it would result in more interest being payable.

Its a matter of running the numbers

you would have 3 choices

a) wait

b) invest with cash,

c) break the fixed loan and claim interest

with c) there is a cost of paying extra interest but there could be tax savings this year and for the next 20 or 30 years even.

Really enjoying this discussion.

I’ve got a couple of questions about the mechanics of moving the money around.

I’m setting up to borrow to invest. My main mortgage is paid down to zero so I’m creating a seperate split loan with the sole purpose of investng in shares, ETF’s etc. My current mortgage will stay open for a 2nd emergency fund.

I’ve set up a savings account that will act as the offset account only to the investment mortgage account.

I’m hoping I can transfer directly from the investment mortgage to the brokerage account.

1. If I can’t, would it be OK (tax-wise) to transfer from the investment mortgage account to the affset account then to the brokerage account to buy shares?

2. Where is the best place for the dividends? i.e. in the offset account, investment mortgage account or a totally different account?

3. Down the road if the investment mortgage account has say 20,000 owing. If I then transfer 20,000 from my main mortgage to investment mortgage account and then withdrawn all the 20,000 for investment purposes, will this 20,000 now be tax deductible?

Red, I think you mean loan rather than mortgage? Mortgage is the security for a loan.

If you loan is paid down to zero already it won’t really be debt recycling but just borrowing to invest.

1. I answer this above I think. It might be ok, something you should seek your own tax advice on.