I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

It’s been a while since I logged into AFB/recorded any podcasts.

The whole ASIC fiasco got me down a little honestly. It feels like the whole community that has helped so many people are being vilified because of a few bad apples.

I also felt the need to lay low and watch what others were doing in the FIRE/personal finance space. I’ll be dropping a podcast very soon that will cover my thoughts on ASIC’s new interpretations and how that’s going to affect AFB content moving forward.

In other news.

My freelance business is really starting to take off. I’m getting more business than I want (first world problem) and I’m starting to create a data product that I’m really excited about. This influx of work has been the other reason I’ve taken my foot off the AFB creator pedal last month.

It’s usually a juggling act between AFB content, my business and travelling. Some months I’ll record 5 podcasts and write 3 articles and other months I’ll be lucky to produce 2 pieces of content.

Freelancing has been a blast but I’m slowly getting pulled back into the ‘normal’ everyday office politics and BS. There are always going to be boring/pointless parts of the job regardless of what you’re doing but I’m trying to minimise that stuff as much as possible.

I find the greatest joy in building something that creates value with colleagues who are just as passionate. I’ve spoken about it before but I really like the idea of having a small team that can help me build data products/services and foster a kick-ass work environment! I fell in love with the culture when I worked at a few different startups in London during our overseas trip. Trying to replicate that is high on my goals list for the next decade ahead.

Net Worth Update

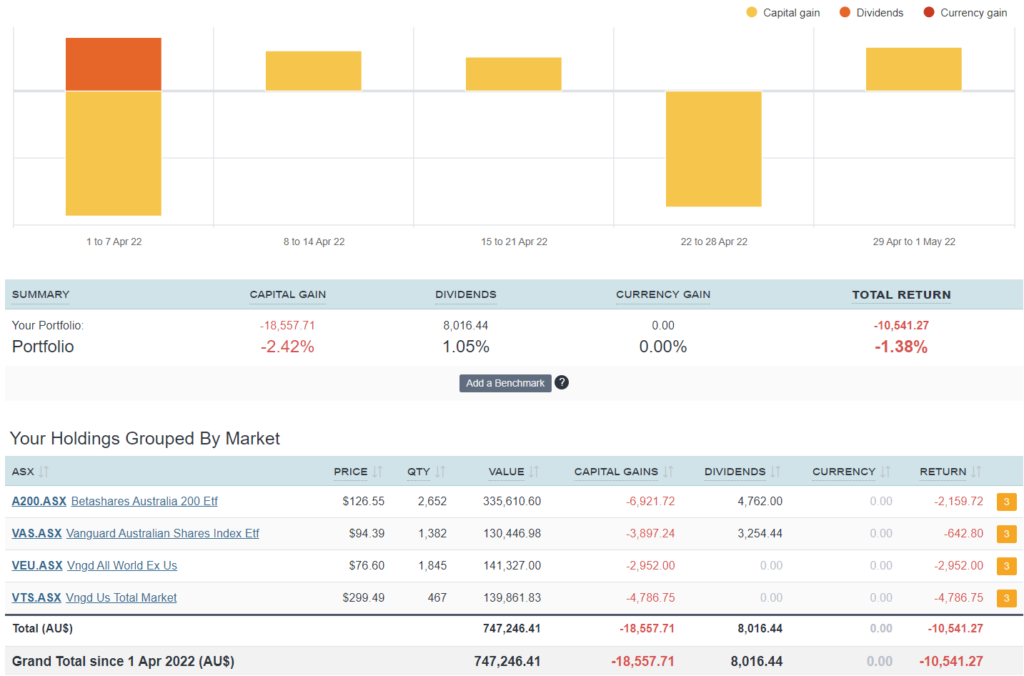

Not a whole lot to report with the old NW. It was a down month for shares and Super which saw us slide backwards around $10K.

We’re continuing to build up our cash reserve for a new car in the not so distance future. I’m still having a really hard time choosing between a traditional ICE vehicle or a new EV. The longer we wait, the more attractive EVs become. But can we wait another 2-4 years? Probably not 😅

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Our expenses were up a lot in April. The reason for the big jump was us pre-paying for a trip to Bali. We fly out in late June for 8 days of holidaying 🏝🍻

Shares

The above graph is created by Sharesight

No purchases in April but I’m publishing this article in mid-May and I just can’t resist the current sale atm so we’ll most likely be putting through a buy order soon.

Really admire your “Big Picture View” of the Net worth of your life’s financial pathways. A minor question…do you still reinvest the dividends /payments from your shares ?

Thanks Chris 🙂

Yes, we reinvest everything :). The only thing that’s changed atm is our cash buffer. We’re saving up for a new car atm so it’s going to be high for a while.

Have you considered a second hand EV? U

Try the Good Car Company (https://www.goodcar.co/) – who import, on bulk, second hand EVs.

Also consider the Total Cost of Ownership (TCO) as a 20k premium may pay back quicker than you’d think assuming you hold onto the car for long enough.

They’re still really expensive. I need to wait another 2-3 years I reckon.

I hope you continue with the blog and podcast, they have helped so many people including myself discover the path of financial freedom 🙂

Thanks Mitch 🙂

The majority pay for the sins of a few. This a bit like the advice profession as a whole! Hope you find a way to continue on.

Yep! I’ll find a way to push on.

Sorry if you’ve answered this before. I noticed that 2 of your ETFs look very similar (the 2 australian ones). Is there a strategic reason for this? Any intel would be good.

They are the very similar. From memory he decided to stay with a200 as it has a lower fee.

Also I recall some blog posts on spreading risk across different ETF providers. Vanguard is a huge provider but for some it helps them sleep at night. You can search past posts.

Definitely get the ev. I just put an order on the xc40 pure electric. Can’t wait

Hi

What is the ASIC fiasco you refer to?

I must have missed this.

ASIC said that “finfluencers” (financial bloggers and influencers) need to be licensed & regulated just like professional financial advisors, so we can expect blogs like this one to stop talking explicitly about financial products and strategies.

It also restricts their ability to generate income. Some will have to close down.

There’s a lot more detail but that’s the nub of it AFAIK.

I have an upcoming article/podcast that will explain everything Tess.

Based on your sharesight info, do the figures mean that the recent market bloodbath means all capital gains + dividends have all been wiped out?

At the date of your comment, I think the answer was pretty close to yes. But there has been a rally lately so a lot of it is back now. Gotta love the rollercoaster of the share market 🙂

I love how you’ve come full circle. ETFs to LICs to ETFs again. Pretty much the exact portfolio breakdown as me minus a few bonds. Now that VAS is at a loss, you should sell and put it into A200. Keep it simple. The capital loss will follow through for any future capital gains that might occur.

Good to see you’re still at it.

Yo Detrimental!

Man, that’s a name I haven’t seen in a while. How are you going mate?

Are you still active on Reddit? We should do a catch up Podcast 👊

Doing well man, almost ready to fire! Yes still around on reddit a bit, but a bit less so these days.

Sounds good! hmu

I came across your Facebook group, your website and the podcast – I’m so in awe and loving it mate. I work pretty much in tech space too particularly in data. If there is anything that we could collaborate on to build something – if be all ears.

Thanks for the kind words Sam.

Data rocks!

Are you more front or back end with data?

Hi, The dividends were $8016.44, does this include the franking credits? if not would you mind telling me how much franking credits there were?

Thanks,

Gavin

I believe Sharesight factors in the franking credits in these reports Gavin.

I find your stuff very interesting but it seems very late to provide an update on the previous month of May when the current month of June is almost over.

Life gets in way!

We should be thankful he spends a lot of time updating us and giving us insights into FIRE based on his experience.

Life gets in the way!

We should be thankful he spends a lot of time updating us and giving us insights into FIRE based on his experience.

I’ve had a lot of family commitments lately mate. I try my best though!