I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

We managed to fit in a quick little end of season snowboard trip in September 🏂.

There was a killer deal going and after being cooped up inside the house for so long, we didn’t particularly care that the snow wasn’t great, or that all the runs weren’t open. We just wanted some adventure back in our lives.

Mrs FB was still on school holidays and I decided to take advantage of my newly found freedoms being a freelancer with a decent amount of passive income flowing in from our portfolio. I remember saying to Ms FB on the chairlift…

“Isn’t it incredible that we can do this on a Monday… like I know you’re on school holidays atm, but the fact that we have the option to do this without financial or work worries is incredible. It’s the little things like this that made us pursue FIRE in the first place!”

I even tweeted about it because a lot of FIRE content focuses on how to get to financial independence but not so much about the life it can create for you.

My WHY to FI.

To be able to book a spontaneous trip to the snow on the weekend and enjoy these killer views on a Monday morning. #LivingLifeAndFeelingFree pic.twitter.com/Ff2azHEzYp

— Aussie Firebug (@AussieFirebug) September 27, 2021

And we haven’t even reached full FIRE yet. But the flexibility of being a freelancer with a portfolio that covers more than half our expenses is bloody liberating. Mrs FB has begun the process of weaning off full-time work starting from next year which is very exciting 👏. She’s moving from full time to 4 days a week which will be huge. Just dropping one day a week adds an extra 52 days off a year. And it also helps both of us adjust to a life that’s not dominated by work commitments which is fun to think about.

Net Worth Update

It’s as if the market gods knew we were really, really close to the $1M mark 😂😅.

Not a great month with the downturn in the markets and me not clocking up that many days for my business. We also had the improv snow trip and the endless amounts of furnishings we’re still getting through for the house (when will it end?).

Our expenses continue to level out after all the massive one-off purchases from earlier this year.

*Investment income is simply 4% of our FIRE portfolio divided by 12

Properties

Our last investment property (IP2) has officially hit the market now! Really keen to see how it performs and depending on how quickly it moves, there’s a chance that we might have everything settled before the end of the year. Really exciting to think about a completely passive portfolio 😁

Property 1 was sold in August 2018

Property 3 was sold in April 2021

*DISCLAIMER*

The current value of our properties is a rough guesstimation based on similar surrounding properties. I only really update these when we get an official bank valuation

ETFs/LICs

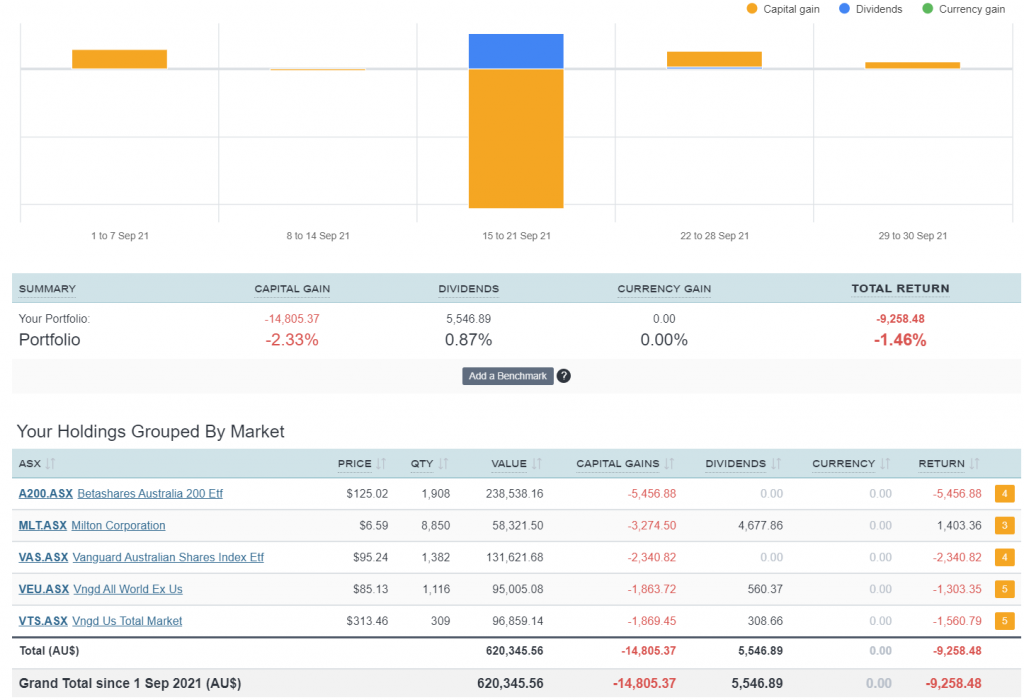

The above graph is created by Sharesight

A decent dip in September but I can’t say I wasn’t expecting it after all the gains we witnessed in August. We purchased $5K worth of VAS in September too.

Ah man, so close to the magic million dollar mark! Hopefully next month you get through it!

At the end of the day though it’s just another number, the hard work has already been done and you’re reaping the benefits of that with stuff like the flexibility of being a freelancer, the missus moving to part time, and the snow trip. Whether you’re just under a million or just over it, who cares!

Congratulations, you love to see it!

Tantalising close haha. I’m not even sure if we’ll crack it in the next update. But It looks like we’ve sold IP2 🥳 so that should definitely put us over the milly mark by the Nov at latest

It can be tougher than we feel it should be bouncing below that psychological point, but rest assured on the other side of it, you will wonder what the big deal was.

It just becomes another day. If it’s any consolation $988,000 exactly was my last monthly total prior to hitting that million dollar threshold, and pushing onto further in the journey.

The flexibility you’re experiencing is wonderful, and great to see you take full advantage of it!

Cheers mate.

Yep, all about the flexibility and freedom these days 😁

Congrats! I’ve invested in index tracking ETFs, but don’t know a lot about LICs. Where would you recommend I learn more? Do you have a preference between the two?

I lean towards ETFs these days but there’s nothing wrong with LICs IMO. Both are suitable products to reach FIRE in Australia 🙂

The thing I really like about your journey is that you don’t just focus on the financial accumulation.

You’re actually proactively adjusting your lifestyle to get closer to FIRE – freelancing, partner dropping to 4 days etc.

Keep doing this -!because $ at the end of the day are a means to an end..

On the finance side you will love not having any IP. It is just so much easier and less stress. Good move – you will only regret not having done done it sooner.

Thanks Rc2.

That’s what it’s all about for us. I know a lot of people will say there are more interested in the FI part of FIRE but we’re the complete opposite. I couldn’t care less about how much money we have, it’s all about using the freedoms that money can provide to live a better life.

AFB, love that it is all coming together for you & Ms AFB. What a way to spend a Monday!

I am curious about something. I too own VTS & VEU. Vanguard usually pays a divvy 4 times a year: Jan, April, July & October. How did you get so lucky to get a divvy in September??

MLT’s farewell bumper dividend (it’s right there in the Sharesight report).

The ex-dividend date is in September Tanya 🙂

It’s the journey, not the destination, which makes for a life worth living. After all, isn’t life about the building and experience of it all…?

To me, that means end destinations are the end of a journey, thus the big decision in life is rather… what do I spend my time doing,

On a side note, I see you’re still actively investing in both A200 and VAS. I laugh at myself as I’m in the same boat due to a form of what might be decision paralysis.

Any particular reason why you’re still holding on the VAS?

Love that Erik!

We hold both A200 and VAS just for a bit of management hedging. We feel more comfortable spreading our holdings between Vanguard and Betashares.

You’ve done the right thing by choosing to indulge in your freedom mate; after all it’s priceless!

As for the psychological mark, i reckon it’s the process that counts more than the outcome. The tree of your labour will bear fruits soon mate. Keep it up!

Thanks Mr. Moy 🙂

Great Update!

So close to the big milestone.

What are your plans for SOL since the MLT merger?

We’re selling SOL once the last IP is sold. Then paying off part of our PPoR to debt recycle.

Man I love your stats and graphs it is probably the best layout of any of the FIRE blogs I follow. Congrats on the great progress you will hit that milly soon!

TYSM 🙂

Oooh Love the interactive charts and graphs, very cool!

We thought we were going to hit the big 7 figures but the market seems to have slowed down so it’s teasing us just out of range! (And renovations are expensive… far out, buying a house is NOT cheap! (but we love it)

Great article 🙂

Thanks MMP!

Yep, houses are basically a money pit lol. But we love ours 😁

Ah you where so close to the big $1Mil!! I can see the market downturn effected you as well.

I am glad to see you enjoying a little of your hard earned wealth. It took me a while to start enjoying my money, but life is to short to sometime be to fully dedicated to FIRE all the time.

Hopefully you will hit the next big milestone next month.

So true. Some people can become FI but never take the next step and actually enjoy their newfound freedoms.

Hey AFB, Any comments on what you’re going to do with your SOL shares after the merger?

Selling after our last investment property settles

The first mill is always the hardest. You’ll be cruising from here on end

https://esimoney.com/the-sixth-million-is-the-easiest/

👊

Nice one mate, congrats! So close.

Quick question: Mrs FB is a primary teacher, isn’t she? I think I remember that. How does a teacher move to 4 days a week? Just curious. Maybe things have changed at school since I was there but 10 year old me could never imagine that happening.

Great question. I’m not exactly sure haha. I’ll get her to respond tonight once she’s home. Hold tight 🙂

Hey mate, did she give any details about this? Don’t mean to pry, I’m just super curious about how it would work for a teacher 🙂

Hey Zip, when I worked as a teacher, there was usually a fair bit of flexibility to work different FTE, depending on the willingness of other staff and the school leadership to accommodate it. Probably 30% of my colleagues worked some form of part-time. It was particularly common for women returning from maternity leave. But yeah, might be a different situation for Mrs Aussie Firebug?

That’s interesting, thanks for the insight! I’ve never heard of it myself, but good to know it’s a thing.

Sorry for the late reply Zip, here is Mrs. FB response:

“I have an ongoing position at the government school that I work at. I spoke with my Principal and asked to drop down to 4 days a week (0.8 time fraction) and he agreed to let me do that. He just said to keep in mind that I may not be able to go back up to 5 days depending on who the Principal would be at that time. For example, if he left the school as he will most likely retire within 5 years.

He is very flexible and also gave me 2 years off without pay when we moved to London.

We have factored in that when the time comes to take maternity leave that I will only be paid at the 0.8 time fraction amount.”

Let me know if you have any other questions 🙂

Cheers

Hey Mr FB, enjoying your updates as usual. I’m interested to know your thoughts and plan regarding the Milton amalgamation (probably not the correct word) into Washington H. Soul Pattinson and Co. Ltd? I was looking into buying Milton yesterday and saw the news on their website

We’re selling SOL very soon Nick. Moving to a pure ETF portfolio 👍

Cheers for the reply. Yes, it’s looking that way for me too (staying with ETFs). How have you found the US tax navigations with VTS and VEU? Is it pretty much a 15% straight CGT? Or there’s more to it? I’m tempted to sell and buy IWLD instead for simplicity.

No issues with VTS and VEU once the W-8BEN-E form is filled out. The only real issues I’ve seen is to do with inheritance or something. But since we invest in a trust, this doesn’t affect us anyway. It would be great if Vanguard AU could just go ahead and change them to be domiciled in Australia already. BlackRock has done it with their products before so I don’t see why Vanguard couldn’t. I think they will eventually.

So close to $1,000,000. As frustrating as the down turn was, all good things must come to an end at some point. Love the visuals they make the article super digestible. Keep up the good work, the big 1 mil mark is just around the corner.

Hi AFB,

Curious as to why you’re going back to an all ETF portfolio and opting out of LIC’s? Sorry if you have already covered this topic elsewhere and I missed it.

Just simplifying things

Impressive collection of wealth ;). I recently went into mortgage neutral state and now looking to start investing for retirement. I like your collection of ETF excluding VEU as I prefer to stay invested in developed countries but currently both these ETF are trading at a high PE or High P/B ratio so I am worried that it would be wise to start this two etf now or wait until market correction happens in next six to 12 month time.

I noticed that you are using selfwealth as a broker but why paying $9.5 per trade when you can do the same with $3 per trade on Chess sponsored broker Stake?

As your portfolio is simple wouldn’t it be better to save further with brokerage?

eagerly waiting to see your october update and hope you reached above milestone figure .. ! Good luck

Thanks ASXGJ1,

I didn’t think Stake was open yet? It will probably put pressure on all the other brokers to lower their fees anyway. I’m with Pearler FYI 🙂