I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

Not a whole lot to report for August.

The month was mostly just us continuing to set up our home in lockdown which meant bulk orders to Kogan, Kmart and Bunnings.

I was never really that into plants before but boy oh boy how things have changed. It’s incredible what an enormous Monstera in the kitchen can do to the feng shui of a room 😂🌱

I’ve also finally managed to start a project that’s been on my mind for probably over 10 years… a nerds man cave!

Here’s the progress so far.

I’ve got a few more things to add but I’m really happy with how it is coming together. The AFB podcast has not been consistent over the last few years because I never had a creative space where I could focus on writing/recording pods. I can’t tell you how different the vibe is when I start work or create something for AFB in my new room compared to the set-up in London.

I have heaps of other projects that I can’t wait to get stuck into. I want to build a little garden shed with my old man, a veggie garden, bike racks in the garage and many more. I guess this is why people say that there’s always something to fix/improve when you buy a house 💸

Oh and I’ve sorta become obsessed with turning every conceivable object in our home into a smart device lol. I’ve always been interested in home automation and now I can finally put some of my research into practice. One project I’ve got high on my list is to turn our garage door into a smart door. Google home (on my phone) knows my location and will be able to open my garage door within 100Ms or close it once I’ve left the house. It’s completely unnecessary and ridiculous but I love it lol. It also doesn’t cost a bomb either (around $70 bucks).

I’m keen to hear from you guys in the comment section below if you’ve set up any cool home automations?

Net Worth Update

Ahhh man… C’MON 😂😂😂

Sooooo close to the big 1 mil this month but alas, we will have to wait a little bit longer. Reaching the million is nothing more than an arbitrary figure and doesn’t actually mean anything but it’s still a nice milestone to hit and does make us stop and look back at how far we’ve come.

The share market went bananas in August plus Mrs FB had a pretty big tax refund which meant a hefty amount of cash contributed to an overall excellent month for the net worth.

Oh and I almost forgot but another huge shoutout to Milton for continuing these epic returns over the last few months. We (Milton shareholders) got a special dividend plus the share price went up and Milton return 15.6% in the month of August!!! I got really lucky with this one considering I’m selling it soon. I don’t know a whole lot about SOL but I was going to sell Milton anyway so the recent gain has been the cherry on top!

The FIRE portfolio continues to grow and is now at an all-time high of $760K

Our expenses dropped off dramatically as we returned to ‘normal’ life post-wedding/buying a home. They’re probably a bit low because of the lockdowns but we’ll see.

Properties

No updates this month.

Property 1 was sold in August 2018

Property 3 was sold in April 2021

*DISCLAIMER*

The current value of our properties is a rough guesstimation based on similar surrounding properties. I only really update these when we get an official bank valuation

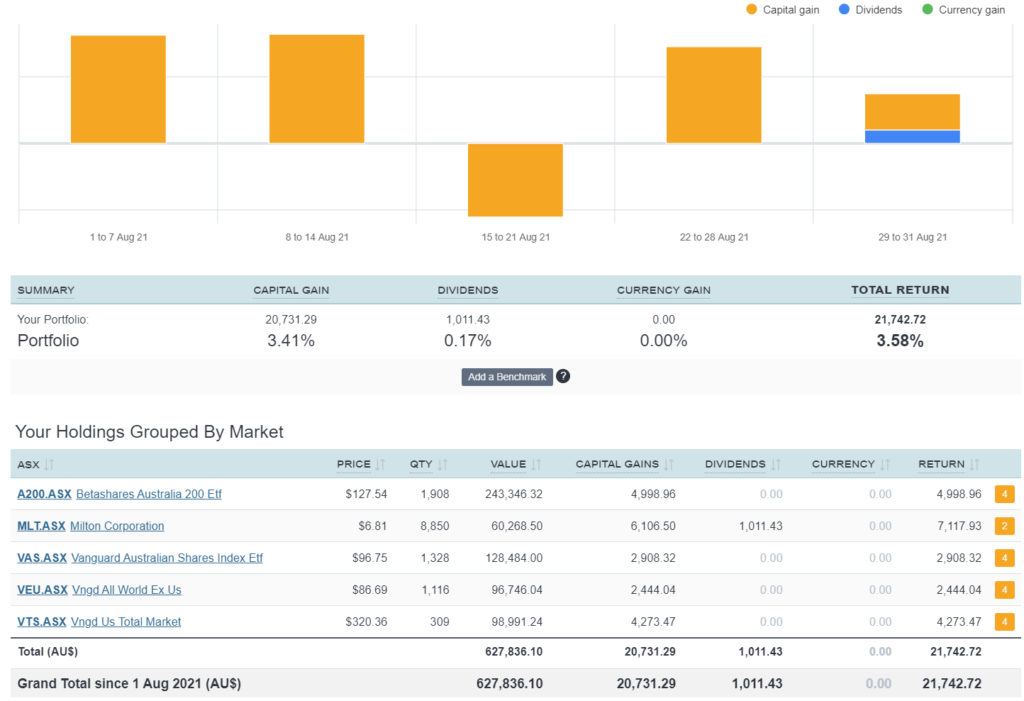

ETFs/LICs

The above graph is created by Sharesight

Huge returns all around! The market can’t stay like this forever, but since it’s impossible to know when the next drop will be, buying for the long term seems like a great choice IMO.

That man-cave looks fantastic AFB!

That’s great….and commiserations on the slight undershoot on a very big milestone – but it will come! Numbers can always seem like they are bouncing around just to tease you, I’ve found with my FIRE portfolio journey!

Thanks FIE,

I’m pretty sure we’ve hit the Milly now (Mrs. FB just got paid). But I’ll wait to see what the numbers look like next month.

why do you have asx200 and VAS isnt it pretty simular?

A200 has lower fees and I wanted to diversify out of Vanguard a bit

My 2 cents, with your propety holdings, job, super exposure & share % allocation. Your exposure to Australia seems excessive. May i suggest you consider moving your milton funds to a global disruption/growth fund such as Lakehouse, HYGG(Hyperion), or LPGD(Lofus Peak).

Will also give you some more growth potential, tech and currency diversification as well

*Loftus

🙄🙄🙄🙄🙄🙄🙄🙄🙄🙄🙄

I’ve been thinking about turning Milton into VTS/VUE for some more diversification for sure

Do you ever find your sharesight data doesn’t match your actual totals? I use NABtrade and it doesn’t match exactly with sharesight and I don’t know why.

Also man so close to $1million must be so exciting.

Congrats on nearly hitting the first mill mate, hopefully next month!

I’m liking the man cave, but only one extra monitor? You don’t need to go full evil villain or superhero here but at least have two plus the laptop! 😉

We haven’t done a huge amount of smart home stuff apart from some Arlo security cameras and Sonos speakers. I’d like to do a bit more but can’t really justify it to myself let alone the wife.

I’m happy with a big monitor and a smaller one to the side for anything extra. I REALLY love the simplicity and cable management of a simple setup. My favourite part of the whole set-up is the one USB-c cable that can run everything from my laptop. Sooooooo clean!

Yes I find that too. But it should be exactly the same once the markets have closed.

@Tashagetsfrugal, I use investsmart and I sometimes find it is different from my bank and I need to manually align the systems.

I don’t know if these issues are the same on sharesight – but I thought I would mentioned them here.

a) stock code changes – both system don’t seem to like that and require manual intervention

b) If checking during trading time it will be slightly different – as The system stock prices updates are not the same e.g. InvestSmart has a 30 minutes delayed.

c) reinvestment plans ( Need to add these automatic purchases to invest-smart)

Paul Hibbert YouTube channel for all your home automation fun. 🥸

The first million is the hardest one. 😉

Checking that channel out right now.

Cheers

Great work as always. Your fire progress chart Expenses Vs Investment Income, is the investment income your dividends plus IP2 income? or how is that calculated?

Look forward to these each month

I’m also Interested in knowing how investment income is calculated. If it includes rental income, is it net income after expenses?

Cheers Wombat.

It’s just 4% of our FIRE portfolio to keep it simple.

Great month AFB! Surely your sweet stack of satoshi’s would get you over the milestone ?

Oh yeah… haha I forgot about those… I’ll wait until it’s official next month (pending another GFC) 🙂

Love the man cave space, and well done on being sooo. Lose to millionaire status.

We hit that milestone in august ourselves. It felt a bit underwhelming as it’s just a number (and we have a lot of work still to do to get to financial independence)

Thanks as always for inspiring my own networth updates.

Congrats Frank 🙂

Man cave is brilliant AFB, love it! Worthy of the r/battlestations for sure haha!

What are you using for the automation and how did you handle the garage door? The meeros opener?

Thanks Mitch,

I’m a Google Home operator and I was just ganna set up the Kogan device (https://www.kogan.com/au/buy/kogan-smarterhome-wireless-garage-door-opener/)

Hi AFB

Can i ask? What are the Tax ramifications after selling Milton/Sol ?

I am also considering doing the same.

Thanks. Brad

There will be some cap gains that the trust will have to distribute. But I have two self-funded retiree parents who will most likely be able to receive the gains tax-free. I’ll have to sit down with my accountant and work it all out.

Are you sure about selling SOL to buy more A200? 😂 😭

Seriously dude SOL is a diversified conglomerate that hadn’t missed a dividend in its 100+ year history and has been increasing its dividend every year for 25 years. It’s capital growth has also been impressive.

With an ETF like A200 you’ll always get a more lumpy dividend return. Wouldn’t you want to have a holding like SOL as a satellite holding at least?

If you’re still committed to ETFs in a few years time you could still sell SOL and there’s a good chance you would have collected more capital growth and income growth from a really low cost base.

I don’t know it’s your life man. But in my humble opinion (and all my opinions are humble ;-)) what you’re planning on doing sounds like cutting off your nose to spite your face.

I agree. I’ve held SOL since 2007 and it’s a gift. They are also quite ethical. That launched Soul Private equity and it was a dud so they bought all the shares back.

They are nicely diversified with some quality investments and MIL will only add to that.

Basically your MIL shares are now MIL+++

I’ve got no issues with lumpy returns if they result in a superior overall return.

All the books/literature I’ve read seems to suggest that hugging the index is the best strategy for the majority of investors.

What makes you think SOL can outperform the index? And let’s remember one of the most important lessons in investing…

“Past performance of a fund is not a reliable indicator of future performance”

Can you please do analysis of MLT and SOL and the merger? I own both and have been relishing ever since, even my accountant asked “Where did you find out about SOL?” Also research Robert Millner the man behind both MLT and SOL you’ll be impressed! I can’t comprehend why you would sell!

I’m really not interested enough to do the analysis. I’d love to read about it if someone else does it though lol!

Pro tip – never buy anything from Kogan. They price gouged during lockdown, they sell grey imports as genuine items, they haven’t repaid their jobkeeper money. Their monitors are rubbish

I’ve been really impressed with the price and quality of the products tbh. I’ve also managed to pick up some refurbished items like our Google Home and nest wifi for half price! But maybe I’ve just been lucky?

So close, if you get your IP revalued it might have tipped you over the mil mark, not many properties haven’t gone up in value since 2018.

Home automation – highly recommend getting a robot vacuum – amazing little gadget! if you’ve got a decent sized lawn you can get a robot to cut that too, will do it every few days and keep it overall in a better condition than you would with a push/ride on mower!

All over the robo vacuum Dave! We have a Robo Rocks S5 max and it’s amazing. One of my favourite party tricks is asking my Google home if Rob (that’s his name 😂) can clean the kitchen. And then the look on peoples faces as he rolls on in from the other room is priceless!

Hi there

I’m a bit confused.

Do you have a mortgage on your home in Gippsland or did you buy it outright?

Where do you capture the Mortgage expense each month?

They’re already in the monthly expenses.

I don’t count principal repayments as an expense though, only the interest repayments.

Mortgage. It’s in the liabilities column.

So close to the 1 million mark. Great work mate. I’ve been following a long for a number of years now. Inspired me to pursue financial independence and start my own blog as well. Keep it up!

No worries Matt. Congrats on the new blog. All the best with your journey!

Ah the man/nerd cave… Just wait until kids come along and your man-cave goes out the window, to be taken over as a kids play area!! See that garden shed you’re building with your Dad??? That’s where your man-cave will end up!!! Bloody kids… Still, it’s nice to have dreams while you can. Ah dear…

Haha well, that’s hopefully a few years away at least. We have two spare rooms atm so I’m hoping I can be in here for a little bit 😂

Hey man, I know the frustration of trying to reach that arbitrary number of $1 Million. When I reached it, it felt like all the other days of shuffling! But it’s still cool to reach it and you should be proud of that milestone. Hopefully next month you can hit the big mil.

Also sweet office set up.

Thanks TSL 🙂

Well done, almost at that milestone. Man Cave is looking good!

I just got around to setting up a dual monitor rig in the last week after over a decade of using a single monitor. I can’t believe I waited so long, I now can’t imagine going back to just one screen.

Cheers.

Yep, having two monitors is one of those things where you can’t believe you’ve lived this long with it 😂😂

Hi AFB, how do you get your investment income? Is it just dividends?

Congratulations on the great progress and your home!

It’s simply 4% of our FIRE portfolio.

You can read up about the finer details in lasts months update.

Cheers

Hi AFB,

Good on you mate; you’re just a teasing distance away from being the proverbial Millionaires 😉

Reg. your Super, have you opted for maxing it out? or has it been the usual contribution through the years? As for a person in a decent income bracket, Super is one of the best avenues to ensure disciplined savings and wealth creation as all contributions are taxed at flat 15% regardless of your tax rate. Moreover, your money gets an uninterrupted runway to compound till formal retirement age.

Would love to know your thoughts!

Cheers.

Thanks MM,

Super’s always a tricky subject. We’ve never maxed it out and understand that we’ll be paying more in taxes for the privilege of freedom sooner.

We’re happy with this trade-off but if we were a bit older, SS into super would be a no brainer IMO.

Hope that helps 🙂

Cheers

Haha Can totally relate about the plant comment. I’ve developed a bit of an unhealthy obsession with them since getting a place.

They do look great though… and provide fresh air. Well… that’s how I’m justifying these days anyway 😂

Well done on the house and oh so close to the Majic 1M. Well done. Good effort for the 2 of you, as it is a combined salary input of both Mrs FB and yourself into this joint venture. I wonder how it would have been if you were single…just a thought.

Thanks Greg,

I can say with almost certainty that I’d be nowhere near the $1M dollar mark without Mrs FB. Not even close. Things cost a lot less when you’re sharing them with someone else. Rent in London is a great example. Mrs FB and I shared a room, but everyone else in the house was solo.

Cheers

Hey AFB love your work mate and really appreciate all the updates. I was just wondering do you see an issue besides being less diversified with just owning both VTS and A200 and not VEU

I’m 22 and i started my FIRE journey about 3 months ago I’ve more or less been following your ETF plan

VEU you are missing a lot of the world. You might consider VESG as an ethical all-rounder.

I’d also go with IVV rather than VTS (simply because the tax return is easier and you aren’t giving more money to the USA government)

I own VEU mate.

Nearly $100K’s worth!

Is it not showing up on your device or something?

Cheers

Hey AFB, I was mean if I were to invest in only VTS and A200 50/50%

do you see any issues in doing that ?

Hmmm I’d probably want some more internation diversification other than the USA… but that’s just me.

Well done on the office and the change of format for these posts. Was a bit different to get used to last month but I love it now 🙂

Thanks for the feedback Dan 🙂

Good luck on the:

1) assembly – hmm this should take 20 mins … 90 mins later … just one more piece … hang on why doesn’t it fit … oh it says piece 5a …. hang on where is piece 16b? ( Beer helps in these scenarios )

2) Where did all these boxes come from? The Recycle bin is going to be full for the next 3 months

3) At least you will have 20 new Allen keys but none of them will be the same size which does not matter because you can never find them anyway.

OMGGGGGGGGGGG

This is SPOT ON 👏👏👏😂

The recycling bin filled to the brim two months running LOL

Congrats on a solid month. The 1 mil won’t go anywhere, it’s just waiting for you! I can only imagine how many hours you spent thinking about your man cave and browsing Pinterest lol, looks great though!

Cheers FDU!

It’s been on my mind for many years lol. Really happy to see it come to fruition

Where did all your dividend go with the shares? it all shows $0.

Not sure I understand mate.

The Sharesight graph is just for August FYI. Most of our ETFs didn’t have dividends in August