I publish these net worth updates to keep us accountable, inspire others and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

A coupla big changes for these updates as we kick off a new financial year.

But before I dive into that, I have to talk about the big milestone for July… which was moving into our new home 🏡.

We got the keys on the 9th and I couldn’t be any happier with how it’s all turned out. Yeah, moving sucks and it took a few weeks of setting everything up until it felt like home… but man… there’s just no better feeling than being settled in your very own castle with your wife 💑!

It’s such a far cry to where we were just 12 months ago. Working, eating and sleeping in a tiny bedroom in SE London whilst flat sharing with 3 roommates. But going through all that just makes this feeling so much sweeter. Mrs FB and I have always rented in pretty modest apartments since moving out of home because it’s all we needed. But this house represents our future. We have two spare bedrooms atm but hopefully, they will be filled in the not so distant future 🤞.

It’s the little luxuries like a walk-in wardrobe, ensuite and open plan kitchen that just makes us feel super appreciative of the position we’re in.

I feel like we’ve ticked off some major milestones in 2021:

- Got back to Australia ✅

- Started my freelance business ✅

- Sold investment property 3 ✅

- Got married ✅

But buying a home was the big one (wedding close second 😜) and it really feels like we’re embarking on the next chapter of our lives.

Net Worth Update

Righto righto,

So this update has been a long time coming. Because whilst the purpose of these net worth updates has mostly been about keeping us accountable and giving some inspiration to others. A major component of them is to give a practical guide as to how we’re going to fund our retirement once we hit FI.

And the net worth figure alone doesn’t really tell the whole story. I have been thinking all month about what to include and exclude in these updates moving forward and come to the following conclusion.

- I’m keeping the net worth number to be as transparent as possible. It’s not the best number to determine FIRE status but it does give a complete picture of our finances so it’s staying in

- The PPoR is going to be included as an asset

- There’s a new chart (below) that will show our FIRE progression. This will only include income-producing assets and will not include our PPoR

- The same chart will also include how much money we’ve spent each month

- I will include a 4% line that will show what our portfolio could theoretically redraw in retirement

- Once the 4% line eclipses our expenses, I will officially declare us FIRE and it will be the end of these updates

So without further ado, here are the new charts

I’ve reworked the net worth visual to give a more complete picture and show exactly how we arrive at our number each month.

A few things to note:

- HECS debt has been included. This has actually been factored in from the start but I’ve never put it in the charts because I was lazy

- I’ve separated the PPoR from our investment property (IP). The reason behind this is because the equity of our IP is a part of our FIRE number whereas the PPoR is not. We’re planning to sell our last IP this year so hopefully it will be less confusing once that happens

- You need to hover (or click, for the mobile users) over each part of the bar chart to show the exact numbers because the visual got too messy if I forced it to display all the numbers

The FIRE portfolio represents all of our income-producing assets (minus any debt associated with them). The above portfolio is what will generate the income for us in retirement. You might have noticed that I haven’t included Super in this portfolio.

Why’s that you ask?

Because that’s not our strategy! We decided to pay more tax and become financially independent outside of Super as opposed to doing the 2 pot strategy that the Aussie Firebug calculator works out for you.

And before you comment, yes yes yes. I know. The two-phased strategy is the quickest and most tax-efficient way to reach FI for Australians (as my calculator demonstrates), we just don’t want to have to draw down our pre-super pot. Plus it makes a lot more sense the closer you are to your preservation age. A bit harder to stomach when we first started this journey in our mid 20’s.

Now, this chart is actually the most important one and displays the two metrics that determine if we have reached FIRE.

- How much money are we spending to maintain our lifestyle

- How much money can we draw from the FIRE portfolio to fund this lifestyle

A few things to note:

- The expenses are all over the place because we’ve had a few one-off items this year like the wedding and buying a home. Now that we’re in our house, the expenses should start to be more consistent

- We’re using the 4% rule for this calculation and I’ve gone back and done the rough calculations for the last 6 months so the graph looks a bit prettier (as opposed to just having one data point). So for July 2021, our FIRE portfolio is $721,461. Four percent of that = $28,858. Divide that number into 12 and we get $2,404. So theoretically (using the 4% rule), our FIRE portfolio could fund a lifestyle of $2,404 a month right now.

- I’m lumping cash and real estate equity into the 4% rule to make it easier. We plan on selling our last IP this year anyway so the FIRE portfolio will be made up of some cash but mainly shares in the future

- You’ll notice a bit of a dip for this month for our 4% withdrawal. This is because $106K of cash was poured into our PPoR and we’re not including that asset in our FIRE portfolio because it doesn’t produce any income. We also had to pay stamp duty in July which was around $18K cold hard cash 💸😢

And that’s it! I will keep the FIRE Progress chart rolling every 6 months so it doesn’t clog the visual too much.

What do you guys think? Does this paint a clearer picture of our FIRE progress and how we plan to become financially independent? Are there any other key bits of data you’d love to see included in these updates?

I’d love to know your thoughts in the comment section below 🙂

Properties

No updates this month.

Property 1 was sold in August 2018

Property 3 was sold in April 2021

*DISCLAIMER*

The current value of our properties is a rough guesstimation based on similar surrounding properties. I only really update these when we get an official bank valuation

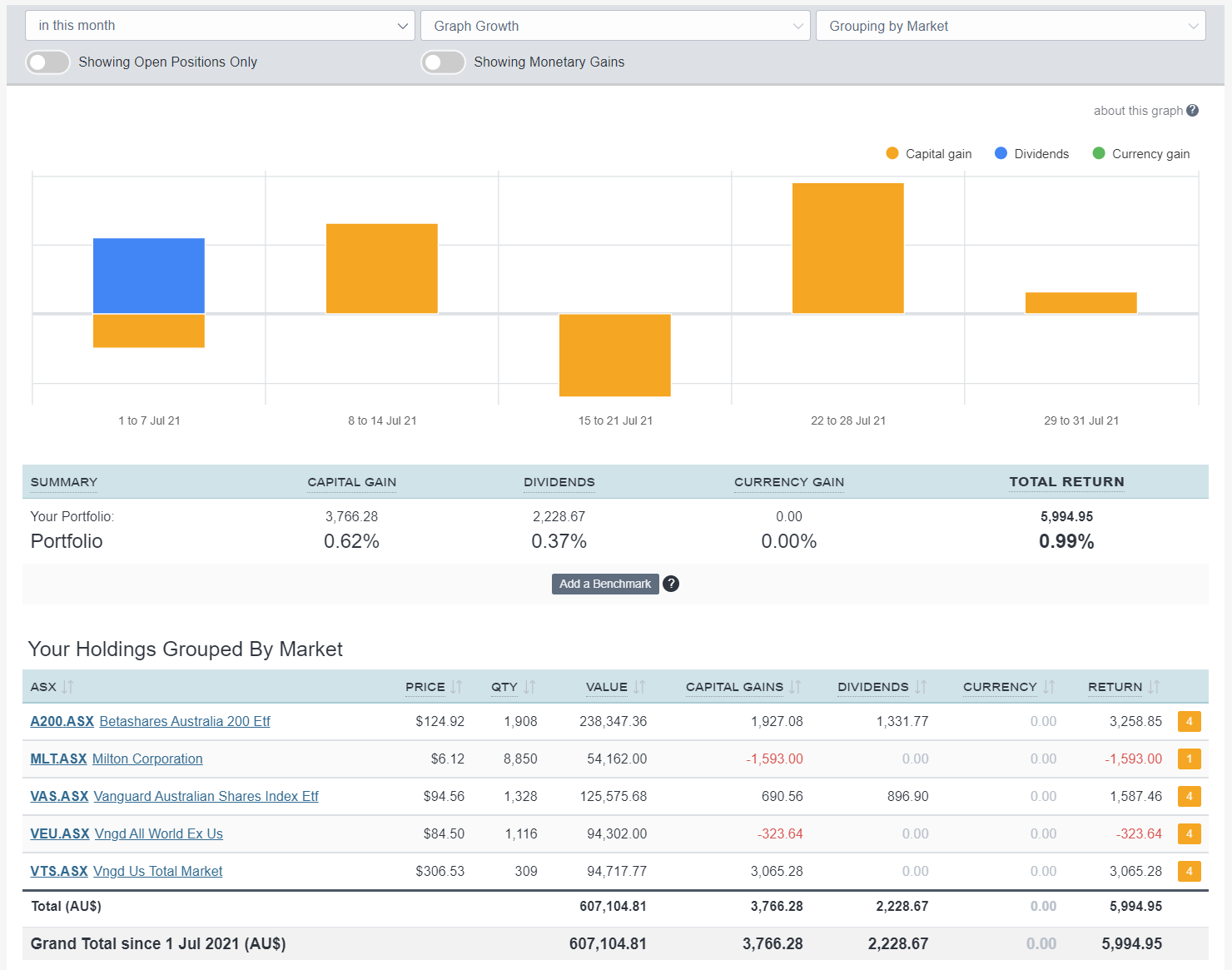

ETFs/LICs

The above graph is created by Sharesight

With the house finally settling in July, it’s time to jump back into the share market.

I’m just getting my ducks in a row to execute the debt recycling strategy that my accountant and I have cooked up. More details on that in the coming months 😁

Congratulations on moving in. Love the new graphs and plan for tracking. Any bets on when you think you’ll be FI?

Thanks Frank,

Hmmmm tough one to answer because our circumstances have changed. I’m not working full time anymore and this will probably be Mrs. FB last year working full time too. Maybe another 2-4 years depending on what the markets do. I guess only time will tell.

Hey AFB

Thanks for the update and congrats on the house.

For your FIRE graph, I wonder if you should use a rolling average for expenses? Might give you a graph that more clearly shows progress?

I’m also curious how you plan to handle a mortgage and potential risk of rising interest rates whilst actually FIREd

Hopefully 7 figures soon.

How will you decide which shares to sell to fund your retirement in future?

Thanks.

I don’t think we’ll actually need to sell any shares in retirement. But if we did… I probably sell off shares to rebalance the portfolio splits to our desired weightings. Most likely the US and World-ex US shares (VTS/VEU) because they typically don’t produce as many dividends as our Australian component.

I thought about a rolling average… I’ll see what I can cook up for the next update.

I’m not worried about interest rate one bit. We have enough money to wipe out our mortgage in three days if we wanted to (after selling some shares). I think it’s also important to note that the odds of us only having income from the shares portfolio in retirement is extremely low. This website/podcast generates ~$30K a year, my freelance business makes a decent amount for the 20 hours a week I’m putting in and I reckon Mrs. FB will probably take up some sort of part-time gig mainly for the social aspect eventually.

So while we are still aiming for full FI just using our portfolio… the reality is we will almost definitely have other sources of income once we FIRE anyway. I feel financially independent right now if I’m being honest. Or coast FIRE if you will…

I love these updates! Thanks AFB

Congratulations on all the big achievements this past year AFB – and now closing in on $1 million! Buried the lead! 🙂

I really like the visuals, I think that’s a sensible and clear way to separate out it all, and retain the key progress to FI focus.

Can recommend averaging the monthly expenditure, which is what I do on my blog, but exactly what works best will really depend on the volatility of your spending after these last few extraordinary months.

I’ve messed around with rolling 1, 3, 5 and 5 year averages in the past. That ‘notional’ monthly income measure is a positive and motivating one to introduce.

Thanks FI Explorer,

I might do a rolling average… it will probably be a better metric tbh.

Maybe we will hit the big $1M by years end… I guess we’ll have to wait and see 😁

Do you know anyone who is using the two pot method, in your FI calculator?

I suppose it is the best method, but it is a like scary thinking about eating into the capital. I was thinking I would using the two pot method but only use dividends and work a few days a week? What are yours thoughts on the two pronged method?

I personally don’t… but if I was say, 45. I would seriously consider it. I’d be maxing out my Super every year and then put a bit into my Pre-Super pot so I could bridge the gap if needed.

The two-pronged method is cool, and it’s the reason I created that calculator. Because I hadn’t seen many people discussing it online before. At the end of the day though, the best strategy is something you’re most likely to stick to and execute. You need to be comfortable with the strategy or it’s a lot more likely to fail over time.

🙋

My wife and I are doing this. Read about the two pot method on Mr Money Mustache years ago, made sense to me.

According to his calculations, if you can save roughly 50% retirement accounts and 50% taxable accounts, you can make your pre-retirement accounts last about 20+ years. I’d only need to bridge about 15 years, so I reckon that’s a decent enough buffer.

I haven’t heard anyone refer to the two pot method before, but that is pretty much what we are trying to work to at the moment (age M50 and F54).

We have $1.25M in super, so are trying to work finances outside of super to taper down to a 0 day working week in 3 to 4 years time.

FA was still pushing to put additional in to super because of the tax benefit. But of course that needs to be balanced with it being trapped there until the big 60 is reached

Congratulations for your wedding and new home purchase! Love the graphs. A line showing the rolling average monthly expenses, to compare against the 4% would be great. Although your recent major one off expenses would throw the average quite a bit. Love your work!

Thanks Nadine. I think a rolling average will be making an appearance in next months update 🙂

Hi AFB,

Congratulations on the house purchase and wedding. Just a question that I’m curious about with regards to your personal views on tax minimisation and how your ideas have changed over the years with regards to not doing your 2 pot strategy.

Over the years I’ve gotten the impression that tax minimisation is a big part of how you plan on reaching fire as quickly as possible (use of family trust, mortgage debt recycling on your primary residence), yet you aren’t maximising your súper which is probably the easiest and cheapest tax minimisation strategy you could employ.

I don’t mean this as criticism, just really curious as to your reason for not taking more advantage of super. I completely get that super is something you won’t be able to access for a number of years, so I understand building a decent portfolio outside of it, but am curious as to why you changed from your 2 pot plan that you mentioned above 🙂.

Thanks in advance, love the inclusion of your monthly expenses and all the best as you continue on the journey!

Cheers,

Canuck Expat

Hi Sherry,

Thanks for the congrats 🙂

I’ve changed my tune to favour simplicity over the years. The trust wasn’t a mistake per se but given the chance to start over, I would have opted to just go 50-50 with my wife. Debt recycling is an interesting one because it is extra work but I just hate the idea of having so much money sitting against a non-income-producing asset. And once it’s set up, it’s pretty straightforward.

We never wanted to do the 2 pot strategy. I was just curious as to what the most efficient and quickest path to FIRE was for Aussies which lead me to do some modelling and ultimately the creation of the Australian FIRE calculator.

If we were in our 40’s or 50’s the 2 pot strategy would be a no brainer. Seeing the light at the end of the tunnel would make it a lot easier. But starting this journey in our early/mid 20’s meant the gap between the present and our preservation age felt like an abyss.

What if our priorities changed and we wanted to have access to our wealth in our 40’s?

What if the government changes the rules?

There’s just so many years before we can get to it that we both felt like paying the extra tax was a worthwhile trade-off.

It’s all so circumstantial though.

I hope that answers your questions 🙂

I have family in Toronto and always love downing some poutine every time I visit them 🤤

Go Blue Jays!

Love your updates. I believe you have reached Flamingo FIRE 🔥 You could coast / wait it out for the remainder of the journey if you wanted to. Congrats on the new house, looks 👌 Have you considered a 3.5% SWR to be on the safe side given your age and time horizon?

Cheers Ric.

Yep, we’re pretty much coast FIRE at this stage.

I haven’t considered 3.5%. In fact, if anything, I’ve considered raising our SWR to be above 4% given that the creator of the 4% rule changed it to be 5% in this low interest rate environment.

And the odds of us earning nothing else in retirement is almost 0. I feel FIRE right now. We’re just got to wait until the portfolio grows a bit more before I officially declare full FIRE.

Congrats on the house guys! Really liking the charts and further data introduction. How do you track your expenses again?

“Once the 4% line eclipses our expenses, I will officially declare us FIRE and it will be the end of these updates”.

This news makes me happy and sad at the same time 🙁

Thanks Mitch.

I currently use the UP API to pull our expenses into a spreadsheet and just add everything up for the month. I’ve used PocketBook in the past though.

And yes haha, these updates will come to an end one day. Once we’ve reached the goal, it’s on to something else!

upbank API is public if you wanted to automate that process. You can find some open source projects here already https://github.com/topics/upbank

Yep my script use this API. It’s all automated already 😊

Congrats on the life achievements this year. I’m hoping to hear of mini FIs in the future to fill those rooms! I love your graphs. Is there any chance you could post a link to your template spreadsheet that includes graphs?

Thanks Adrianne.

Are you talking about my net worth spreadsheet?

Yes, the Net Worth bar graph and the 4% withdrawal rate line graph please.

You can download my net worth sheet by entering in your email at the end of these updates. But I don’t actually have these charts in an excel sheet, unfortunately. They are all coded into this website I’m afraid.

Hi AFB, what do you include in your monthly expenses eg IP expenses, brokerage etc or just general living expenses?

Hey,

I don’t include any expenses that are not related to maintaining our current lifestyle. So investment property-related expenses will not be included in these graphs. Business-related expenses will not be included either.

Interest repayments for our PPoR will be included, but principal treatments won’t be. And then everything else we spend money on will be included.

Things like:

– Food/drinks

– Holidays

– Transport

– Insurances (not for the IP though)

– Entertainment

etc.

Love the updates. One thing I can’t work out though – your expenses are net of tax yet you calculate your 4% SWR gross of tax. How do you reconcile this? Sorry if this has been answered already, Thanks 😀

No worries Dermot.

Who said I calculate our 4% number gross of tax?

Here’s the breakdown.

I expect that our FIRE portfolio will return 8%-9% over the long term. Let’s go the lower end and just say 8%.

We’re allowing 2.5% for inflation which leaves us with a real total return of 5.5%.

This leaves 1.5% for taxes and a bit of a buffer.

1.5% of $1.25M = $18,750

Let’s assume we don’t work at all once we hit the magical $1.25M (highly unlikely) and will be relying solely on the income produces by our snowball.

A 4% withdrawal rate = $50K split between two people.

We wouldn’t pay a cent of tax up until $18,200 each which brings us to $36,400. We now have to pay tax on the remaining $13,600 which is currently taxed at 19c per dollar. But we can also take advantage of the 50% CGT as part of our withdrawals that will be coming from selling shares. So now our tax liability is calculated on $6,800. At 19c per dollar, that equates to $1,292 owing in taxes between us.

Our buffer of $18,750 easily covers this.

We also hold our assets in a trust which allows us to distribute the income in a tax-efficient manner. I have self-funded retiree parents that could mean that we don’t pay any tax at all. But I’ll ignore that fact for argument’s sake. Another piece to this puzzle is franking credits. But I’m not smart enough to know exactly how they will absorb our tax liabilities but I’m sure they help the situation further.

I’d also like to point out that the creator of the 4% rule (Bill Bengen) changed it to actually be 5% given the current ultra low-interest rate environment we find ourselves in.

I personally think 4% is extremely conservative given the fact that every single person I’ve met that has already FIRE’d, somehow makes money that’s separate from their portfolio (which they never intended to do but it just happens).

I was seriously considering changing our numbers to be 5% but I thought I better just stick with 4% to allow some room for error.

Anyway, those are my calcs mate. Hope that answers your questions 🙂

Thanks so much for the breakdown AFB!! Seriously – I have struggled with the this for a long time and no other blogger has explained it properly to me. This is gold!!! I have have something that I can play around with with my own number, can’t thank you enough mate 🙂

Congratulations on the house mate, I found it was a real relief to not have to worry about potentially having to move at some stage and my wife loved the little things like being able to hang up a picture wherever she wanted!

I think the new charts are great, breaks things down nicely and gives a clearer picture of where you’re at. As others have said you may want to use a moving average for your expenses, although if you’re not really anticipating any more big expenses for a while the actual monthly figures probably works ok.

Thanks mate.

Yeah I don’t foresee any huge expenses coming up. But maybe an average will work better anyway… I’ll have a think.

You can’t really put a dollar figure on the feeling you get when you have a home. It’s simply wonderful to come home each day into our little castle that’s been set up exactly how we want it. I seriously LOVE working in my home office or watching TV in the lounge room. We are really spoiled that such a nice home is pretty affordable in the country.

Hi AFB,

I get that you are not focused on the super for building wealth but wondering why the $147,076 is not being included in your FI number. Where is this being accounted for? At some point, once you reach preservation age etc. this amount or more will be available to you guys.

Hi Peter,

It’s accounted for in our net worth number.

And yeah, we will be able to get our hands on it eventually. But the strategy is to reach full FIRE outside of Super so it’s most appropriate to leave it outside of our FIRE portfolio for now. If things change, and we decide to do the draw down method, I’ll add it in. But it’s staying outside for now.

Graphs work well. Plan on incorporating this into my spreadsheet.

Quick question – what do you include in expenses as i’ve always struggled with this particularly whether or not to include PPOR and IP repayments?

You’ve probably thought of this but if a portion of your IP is in your wife’s name best to sell when maternity leave comes around…..just reading between the lines. Cheers

Thanks Stuart,

Our expenses only include things that cost us money to maintain our current lifestyle. Our IP expenses do not help us maintain our current lifestyle. Living in our PPoR is a part of our lifestyle and the interest repayments will be included in these graphs. The principal repayments are akin to forced savings and therefore won’t be a part of our expenses.

The property is held within a trust so the tax liabilities are a bit easy to handle given we can distribute them to family members.

Congratulations on your new home! I was just wondering about the $2228 dividends you received from your ETFs. Is it for the last three months or six months? I am investigating the feasibility of living on dividends when on FIRE. Thanks.

Mate I have a pretty odd piece of feedback – in your opening statement it says “ The formula to get wealthy enough to retire is easy but it takes many years of being consistent and sticking to a plan”

I’d argue changing the word easy to “simple” instead. If it were easy, everyone would be doing it …Just my 2 cents.

Congrats on taking the next steps in life with house and marriage. Amazing progress you’re making in all areas of life.

I agree!

I’ve made some changes to that part based on your feedback. Let me know what you think 🙂

As you can see I am still quite new to investing and FIRE. After some research I found that A200 and VAS seem to be pay dividends quarterly. It seems to that dividends income alone will unlikely to cover the living costs when on FIRE. Is your plan to sell down some of your holdings to cover the rest? Thanks.

Hey,

Yeah that’s plan B. To sell parts of the portfolio to cover our expenses. But in all honesty, the odds of us not having another form of income that’s separate from the portfolio once we hit FIRE is less than 1% so I think the bulk of our income will just come from dividends and a bit of fun work that also happens to make a few bucks.

Aha that makes sense. Thank you!

Hi AFB, I’m particularly interested in how you’ve setup your debt recycling – will you be providing a few details on that?

I’m almost at that point of getting my finances in order to do it for our PPoR, so any tips you have would be great.

Love these updates and your general blog, keep it up!

Big update on that coming up mate. Just getting everything in order.

But in a nutshell.

I have split the PPoR into two loans. I plan to completely pay off one loan (~$200K) and redraw the money out straight away to invest in shares and thus converting the debt to be tax-deductible.

I’m going to do a podcast with my accountant I think (if he’s up for it)

Like others have commented, congratulations on your new house purchase and other major events in your life. Consider this net wealth update to be one of the most significant in terms of the evolution of the journey to FIRE and probably helps to answer one of those perennial debates about owning your own home versus renting on that journey. Whilst having your own home is not necessary for the achievement of FIRE, it sure does bring about a number of other benefits (feeling of security, stability, room to grow etc) that’s more difficult to achieve with renting. The other turning point is the measure of FIRE with respect to the degree of coverage of living expenses based on a methodology. So definitely agree with the way forward from here.

Thanks Victor,

I have to admit, 5 years ago I was pretty keen to just rent forever. But priorities change… feelings shift. Now that we’re in our home… god damn.. I wouldn’t have it any other way!

Out of curiousity, if your PPoR was say 50% more than you needed to live in long term, (eg a sub-dividable section that you would sell eventually), would it make sense to consider a portion of your PPoR as income producing and to be included in the Fire portfolio? Given that the land will be going up in value over time.

Ummm… you could do that if you wanted to I guess. There are no hard or fast rules for calculating your FIRE number. This is just the way we do it.

We’re are aiming to fund our current lifestyle. If I were planning to sell my home in the future and wanted to fund my future lifestyle living in a smaller house, I’d just factor that into the numbers.

The FIRE Progress chart looks awesome. What charting software do you use for that? Cheers

Cheers.

All the charts are free and can be found here

Hey Aussie Fire dude I’m new to your website and very intrigued by reaching FIRE. Just wondering how you factor in mortgage payments on your PPOR and reaching FIRE. Are you going to add in your repayments to your expenses and build your shares portfolio to a point that it can pay down your mortgage along with your other expenses? Or are you hoping to smash down your mortgage therefore reducing expenses before reaching FIRE? I’m interested to hear if this has changed your strategy at all as I currently have a mortgage and no investments. FIRE seems almost unreachable for me personally when I factor in mortgage repayments, I would need somewhere between 2 and 2.5 million invested based off the 4 percent rule to pay my current lifestyle.

Hi Preegz,

Great question.

I only count interest repayments as an expense because principal payments is really just money going into another asset (PPoR). I would never count buying shares as an expense because it’s an investment. I treat building equity in our PPoR the same way.

I also never plan to never be debt-free. I’d like to borrow against our PPoR and invest it in shares for the foreseeable future. It’s basically an equities loan but with the benefit of a really lower interest rate and no margin calls. I’d love to switch our mortgage over to interest-only at some point but will have to weigh up the consequences (potentially higher interest rate and fees etc.).

I’ll be paying interest on our loans forever (most likely) so that part needs to be accounted for to maintain our lifestyle.

hey congrats on the new home. I like the new graphs. I am doing the same thing. I include the PPOR into my total but, similar to you, don’t include it when I am calculating my FIRE amount.

Hey, I have a question. when I look at your numbers I am always a little confused how you calculate it. you have:

Stocks: $607,534

Investment Property: $69,791

Superannuation: $147,067

Cash: $44,136

which equals $868,528

Adding the difference of your PPOR and the debt, you get $106,087

Then the total is $974,615, which is $18,303 less than your headline number. What is the difference?

You’ve forgotten the HECS debt (in the liabilities bar chart) of ~$18K. Deduct that off the $974K and you’ll get the number at the top of the article.

Hi AFB,

Good on you and congrats on tying the knot and moving into your home.

The stats are very helpful. Just one suggestion on monthly expenses vs.4% rate. to ease out the spikes it makes better sense to only include the expenses that are essentials/routine and not one offs. That will smoothen out the graph and present a better picture on how you are tracking.

Cheers,

Mr. Moy

Cheers Mr. Moy.

I’m thinking an average might work better. I don’t want to exclude one off’s (if they’re genuine one off’s that are a part of maintaining our lifestyle… but then I guess they wouldn’t be one off’s would they 🤔) but the last couple of months have been crazy.

I’ll see how it pans out over the coming months

Congrats on the home purchase mate! I recently bought a place myself with a loan that includes a pre-approved master limit. This product makes it super simple to create and increase sub loans for debt recycling. Cant wait to read your up coming article on the topic.

Wouldn’t be the AMP product, would it?

And thanks mate 🙂

Hi AFB,

Great update as always, and really liking the spreadsheets you’ve created and shared on here. One question I have is in regards to how you’d potentially reflect any cash you have in a mortgage offset account, do you count the full mortgage as a liability or and the cash as investment? Or would you just count the outstanding mortgage minus any amount in an offset account as liabilities only?

Thanks Olly,

I count all of the debt as a liability and any cash in the offset as ‘Cash’ in our assets column. I also count equity as either Real estate equity (for investment properties) or PPoR equity (for our home).

Cheers

Hi ,

I am new to FI and have been majorly holding cash. While I believe ETFs/Index funds are the best approach to long term investing , I have been caught up with the notion that the current market is inflated. Which is holding me back to start investing in ETF or do any investing at all. So do you recommend a staggered approach in entering the market – to get things rolling. I fear for a correction right after I enter the market with all my savings . Appreciate your guidance – love you work . Cheers

This also sums up my situation, your thoughts on this would be great – acknowledging that it is not financial advice 🙂

Hi Dk,

I wrote to AFB a similar question back in October 2019 (note: Pre COVID recession) and this is what he said back to me – I’m sure he won’t mind me sharing it here.

“This is a really common question and it comes back to the psychology of investing and your investing strategy. Are you investing for the long term? How do you handle volatility? If it were me, I’d invest half of it straight in and Dollar Cost Average the rest (to help me sleep at night).

There’s always a risk of a recession. But the market always goes up over the long term. ”

It’s important to note that at the time of investing (Oct-2019) it felt like the market had been up for a very long time, it was over inflated, and many speculated that it was due for a correction at any moment.

Anyway, the investments are up 32% since Oct-19. It worked for me. You could argue that if I had waited for the COVID fall in markets, I could have bought at an even more optimal rate, but there’s no way to know what the future holds, but we do know that the market go up over the long-term. Hope this helps!

Great comment mate! Thanks for sharing your experience

thanks for the response !

Hi DK,

I can’t recommend anything but I know from experience what works for me when I had a big lump sum.

DCA into the markets monthly helped me sleep at night and ensured that I wouldn’t regret it as much if the market tanked. In hindsight, I would have dump 50% straight in and DCA’d the rest over 12 months.

But that’s just me. You might be different.

Hope that helps 🙂

“But this house represents our future. We have two spare bedrooms atm but hopefully, they will be filled in the not so distant future”

Well done mate. I’ve been following your journey for years and it’s awesome to see the evolution and maturity of your views and outlook over time.

My wife and I also purchased a home as a DINK couple six years ago.

Now, as the proud father of 2 young boys, I can tell you that filling the spare rooms with little humans is an absolute joy and really solidifies the drive to be financially free and optimise for life happiness.

Its not just the FI destination, but the journey you need to enjoy.

Well done on growing the blog and Aussie FI community, all the worldy travels, the consultancy business, the wedding and the forever home purchase. You’ve been a busy boy. Proud of you mate 🍻

Aw-shucks Papa, what a lovely comment 😊

It’s been a biiiiiiiiiiig year that’s for sure.

Cheers mate

Thank you for sharing this. I really look forward to your updates, appreciate the time you put into them, and especially like the changes you have made this month. Easy to follow and relate to. Great job.

Thanks Carezoo 🙂

Hi AFB,

I understand the actuarial basis for the 4% rule in that it practically ensures you don’t eat into your capital. However if you were willing to deplete that capital over your retirement period and could accept a little market risk, then you could look at something like QSuper’s Lifetime Pension which pays as much as 6.16% pa from ago 60, increasing with inflation.

With this product, the Pension Payment increases in real terms if the investment pool returns more than 5%, and reduces if investment returns are less than 5% (historically the return has been >5% in 17 years out of 22).

Note that your payments would have to drop by around 35% before income equals your 4% approach (1 – 4%/6.16%). This could happen, for example, if the investment pool delivers a zero return for 7 years running.

The government is pushing industry to come up with more annuity style products, so I expect by the time we reach retirement age, we’ll have more options like QSuper out there.

Very interesting. I’ll be honest, I haven’t really looked at products like this before. Thanks for writing this up. I need to do some Googling I tink 🙂

Yep, it’d be great to hear your thoughts once you’ve done some research. Obviously a 6% SWR would make a massive difference to when FIRE status is achieved (assuming it remains at that level – another variable to monitor!).

Hi Matt!

I’ve listened to all your pods, as I’ve been consuming all the Aussie FI/RE material this year. I’ve adopted the FI goal and should be there by the end of FY21-22. Thank-you for the content creation.

First time commenter…

I’m struggling to get an accurate valuation on my PPOR. So far I’ve tried three remote (“desktop”) valuations, two by banks and one by a mortgage lender, and have gotten a variation of up to 7%, which I consider too inaccurate. I’m reluctant to pay for a full valuation because I’m not sure I can justify the $100s of expense for information that doesn’t have any actionable purpose. I’m skeptical on an agent artificially inflating their valuations to encourage use of their services, and the most variable (and highest) estimate so far was from the mortgage lender, so I feel like I can only rely on lenders for accurate valuations and they largely just want to do them remotely and won’t invest in a full valuation unless I’m applying for a financial product.

How do you do your property valuations month-to-month (for net worth calculations) and yearly (for a more formal estimate)?

No worries Mick!

Tbh, I haven’t updated the properties value in years. I use to just use the CBA estimator thingy on their app. Now I just update it when I either move banks or when I sell. It’s all a bit of a guessing game until you sell tbh.

Sorry if that’s not useful.

Hi Matt,

You keep a large amount of money in cash. How do you combat inflation?

Howdy,

We also have a fair amount of debt and other assets along with the cash. I’m happy with this mix to combat inflation but others may be different

Hey AFB,

Bit of a random question – I did search through past posts but couldn’t find the answer – I was just curious what you studied at University and what type of job was your first one out of University?

Apologies if this has been mentioned somewhere but I am fairly fresh out of University, currently working my first job in the tech industry, and was curious about how your career progression started?

Thanks so much and congratulations on the recent flurry of achievements!

Hey Zach,

I studied a Bachelor of IT at Monash that was extremely vague and didn’t really hone in on one area which was a blessing and curse. I took an interest in the Databases and machine learning classes. Basically anything with data. I also enjoyed the Java programming units.

I got a job as a Web Dev/DBA out of uni and progressively transitions to what would now be called a data engineer/BI developer. A lot of moving, cleaning and modelling data to create analytic solutions.

I worked within a small IT team so I’ve touched a lot of different technologies. Servers, virtual machines, networking, sysadmin stuff, scripting jobs.

I’ve recently (last 2 years) moved into the cloud data space. Working with technologies like Spark, Python, Power BI, Azure, AWS.

Career sort of went

– Web Dev/DAB

– Senior BI Developer

– Data Engineer

– Data consultant (Strategy, architecture, engineering, analytic solutions)

What are you studying mate? What are you passionate about?

I prefer this calc over the 4% rule:

https://www.noelwhittaker.com.au/resources/calculators/retirement-drawdown-calculator/

Well done on your recent achievements. The best part of your update to me sounds like you’re prioritising for happiness/peace of mind for you and your (future) family. Multiple streams of income, great work/life balance, simplicity over tax efficiency, etc. This comes through in this months update. it s a real credit to you.

💯

Thanks KDM. Yeah my priorities have definitely changed over the years

Why are the returns and dividends in your sharesight portfolio screenshot not there?

Love your work, thanks for the incredible value in the blog and all your efforts!

They should be there. Can you see the picture?