I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

We finally hit it…

November was the month the Aussie Firebug household joined the two comma club and recorded a net worth of over a million dollars! I’m pretty sure we actually hit it in September but since I only record our net worth on the last day of every month, the market pullback at the end of September meant we missed it.

It’s a bit of a pointless milestone but something to celebrate nevertheless. I always knew I wanted to be good with money growing up but I never had an overarching goal that helped guide me in this endeavour until I discovered the concept of financial independence and then FIRE later on.

The concept of money is actually quite abstract if you think about it. I had a really interesting chat with Vijay Boyapati on the AFB podcast the other day which made me really ponder such thoughts such as what is money? And how does anything come to be a medium of exchange in the first place?

I made a connection early on in my life that everyone wanted more money and I thought people who had lots of it must be doing something right. I wasn’t really aware of the different circumstances and advantages that some people had which enabled them to get more money easier than others. Things like connections into good-paying jobs, a stable household that fostered learning and development, or sometimes just straight-up rich parents giving their kids everything.

I simply thought money was desirable, and those who had worked out a way to get a lot of it were smart… and I aspired to be one of those smart people. I had a secret money goal of becoming a millionaire before 30 in high school after reading countless articles on moneymag.com.au, Yahoo Finance, realetstae.com.au etc. They glorified the status of millionaires so much and really emphasised that if you were to obtain this elite financial achievement before 30, you were very special.

Our consumerism culture partly relies on the glorification of wealth to an extent. The marketing machine constantly pushing money, wealth and exorbitant lifestyles down our throats in Ads, Music videos, reality TV etc. Endless consumption is the fuel of a capitalist society which also drives the growth of assets which plays a huge part in why we are able to retire early. If everyone lived a FIRE lifestyle, none of us could retire early.

Oh, the irony!

Modern-day consumerism culture definitely had an effect on me growing up. I just kept correlating wealth with life progression which is funny because I live by a completely different life philosophy these days. The million before 30 was nothing more than a dream that didn’t have any tangible outcomes associated with it, I just wanted to get there.

So I fell a bit short of my meaningless high school dream but Mrs FB is still 29 so I can live my goal through her at least haha.

But wrapping this point up, whilst the status of millionaire is nothing more than an arbitrary term (that’s probably lost a lot of meaning in recent years anyway due to inflation), it’s still a decent achievement and one that the wife and I stopped to celebrate.

Net Worth Update

The share market was decent in November and we weren’t hit too badly by Christmas spending either which made for a sold month in terms of savings. But the real needle mover for the net worth came from the sale of IP2. The reason we had such a big jump was due to the fact that I hadn’t updated its valuation ($205K) in some time and the price we sold it for ($250K) was more than I thought we were going to get.

This should theoretically be the last big jump the net worth every sees since we’re 100% passive now in index funds.

Spending is higher than usual due to Christmas and a few bits and bobs for the house.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Properties

IP2 has officially been sold which means we’re officially 100% passive investor now🥳🎉

We were extremely happy with the price we got and the selling process was a breeze (markets still hot in SE Queensland). We did pay a fair chunk in selling fees but there wasn’t much I could and tbh, the price was so much more than I thought we were going to get that I decided to just take the convenient option and just pay someone else to do it.

I’ve had a few people ask me why we sold and it really boils down to simplifying our life. I have a limited amount of mental bandwidth each week and whilst IP2 (or any of the other properties for that matter) wasn’t that much work, it was still more work than what our share portfolio requires. We just have shifting priorities these days.

The investment properties were 100% about making us money. I use to really enjoy researching and investing in property but those days are long gone. We’ve reached a point now where I don’t feel compelled to hustle for every buck like I did 5-10 years ago. I’m focussing more on lifestyle design these days. And managing the properties were a small drag on this lifestyle so we struck whilst the iron was hot and exited our last IP in November.

Property has been an amazing asset class for us and I’m still a big believer that it can be an incredible wealth-building tool for the right investor… we’re just ain’t the right investor these days and that’s all there is to it!

I’ll be removing this PROPERTY section in these updates from now onwards.

Property 1 was sold in August 2018

Property 3 was sold in April 2021

Property 2 was sold in November 2021

Shares

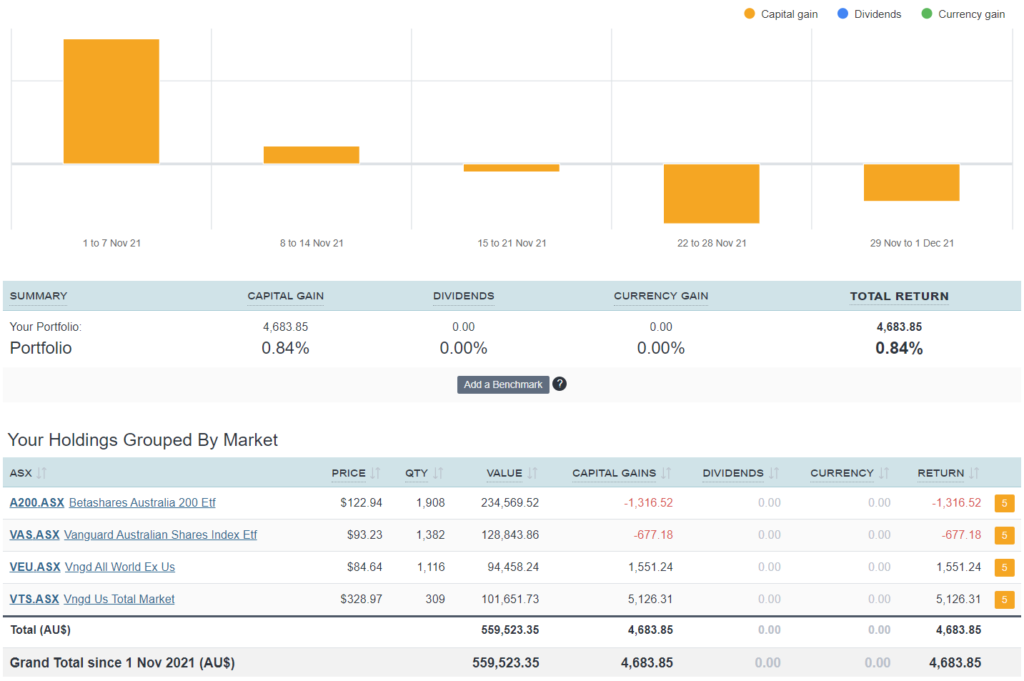

The above graph is created by Sharesight

SOL was officially sold in November for three reasons.

- SOL was originally Milton before the merger and with our exposure in A200 and VAS, I thought there was too much overlap and wanted to simplify our holdings. Selling Milton (that turned into SOL) was the obvious choice because we didn’t have that much money invested in it.

- The concept of legislation risk hit me like a mac truck when franking credit refunds were on the chopping block back in 2019. It turned out that Labor didn’t get elected but I remember thinking how pissed off I would have been if the rug was pulled out from under me during retirement… I decided that ETFs pose a slightly lower risk profile compared to LICs because of the structural differences between the two. I wrote more about this here if you’re interested.

- We wanted to execute our debt recycling strategy and needed a bit more cash to fully pay down the first split of our PPoR loan. Once IP2 settled and we had a decent chunk of cash, SOL ended up proving the rest of the $$$’s we needed to fully pay down our first loan. This wasn’t really a reason for selling SOL per se, more of a convenience and good timing.

With the sale of SOL we are now back down to 4 holdings. But now comes the hard part…

dropping ~$210K into the markets 😬

I swear the older I get the more I realise that good money habits and solid investing is 95% psychological.

I know what I should do. I have mountains of research and studies to comfort me in my decision and it should be made quickly with conviction… but I just can’t help and fall prey to the dangerous game of trying to time the markets 😅

The money has been transferred to our Pearler account for a few days now and I just keep checking the markets thinking how nice it would be for a dip. A 10% drop would be ideal, 5% would be lovely… hell… I’ll even take 2%!

ANYTHING!

No one wants to buy at the top and the decision is extra hard when it’s a lump sum. I’ve even answered questions like this a bunch of times on various AFF podcasts on what I would do in their situation but I’m telling you guys… when push comes to shove and you’re faced with the decision yourself… it can be difficult to execute the gameplan lol.

I’ll probably drop it in sometime this week but it’s so hard for me not to try and find the bargain. I’m often fighting my inner monologue that goes something like this:

“There’s always another crash Matt… just wait a little bit longer… Bitcoin had a crash the other day… Have a quick Google on what the experts think are going to happen… wow, so many of them are predicting GFC 2.0… yes… yes… keep going down the doom and gloom rabbit hole”

😂😂😂 it’s a brutal feedback loop.

Congratulations on passing the milestone, AFB! It’s such an unusual sensation of both change and nothing particularly feeling that different, isn’t it?

I sympathise with your position re lump sum, versus averaging in. Perhaps we should only listen to lump sum advocates who can demonstrate they’ve done the hard yards? 😉 I would have no compunction at all about averaging in – potential downside regret avoidance is sometimes valuable!

Welcome to the much easier life of all passive ETF investing!

Thanks mate 😁

Congratulations on the milestone! Very inspiring and a great achievement.

Grazie Eleanor

Congratulations and welcome to the club AFB! Its a wired feeling when you reach this milestone, as you don’t feel any richer than last month haha. It will be allot easier and stress fee now you don’t have to worry about investment properties.

Good Job, and wish you smooth seas and full sails to your next million.

So true. Nothings really changed lol.

Congratulations

Great milestone

I want you to know that these emails have been hugly motivational to me

I’ve been lurking in the shadows for a while and appreciate you opening your financial life up.

Looking forward to seeing what you put the lump sum into

Kind regards

Richard

Thnaks Richard,

I love reading comments like this. I remember how inspired I was reading all the US bloggers back in the day. Cool to be able to give back 🙂

Congratulations on the milestone!!

So, looking at your time line it took you around 11 years from Jan 2011 to get $1m. That’s impressive!!! I’m so motivated by your post to top up a simplified model VAS+VGS as well as some other satellite shares/LIC/thematic ETF to keep things a bit interesting.

I’m also a sucker for timing the market and sadly missed the drop last week due to busy work. Can’t believe VGS rose $4 in a week! (~3% gain).

I look forward to your future posts. Don’t get lazy because you got the extra comma!

Congratulations again.

Firstly congratulations on getting to 1 million. The next 1 million will be easier. I don’t really know what my financial worth was when I was your age, because I was not tracking in those days.

I also like your more simplified investments, as it makes life more relaxing. It seems as if you have already made some reasonable gains selling your properties.

I find that with larger investment placements using 3-4 tranches soothes my market timing demon. Somewhat like dollar cost averaging. Having a process is a plus for me and helps with the possible buyers remorse type issues.

Hi AFB really love reading your blog for motivation. I believe you combine finances with Mrs AFB and that this is your household net worth in which case your net worth milestone just reached is 500k given it is for both of you (1mil divided by two). I’m assuming you both contributed equally or is it a different split for example 700k for her and 300k for you or vice versa depending on contribution percentages? I know you’re big into trusts structures which goes right over my head but would be good to know how the split of the net worth actually works under your trust structure. Thanks again for your content as love reading and listening to the pod.

Thanks James and don’t worry I won’t!

Congrats AFB!

Massive milestone to hit.

🥳

Well done hitting the milestone. I’m looking forward to see where you put the cash from the investment property as I sold an investment property in the US last month and have been pondering what to do with the money. Also itching to see your story on debt recycling 👍

Thanks Brent. It’s coming!

Well done! I shared the same secret dream (though now more than 20 years ago!).

I’m a big advocate for averaging in. At least it gives peace of mind you’ve got some in and you’ve got powder for dips. However, when I go back and do the calculations, invariably I would have been better just to do the lump sum on day 1. The old adage, “Time in the market vs Timing the market”! What’s the next milestone, another comma?

Psychology gets the best of us Brett.

Hmmm good questions about the next financial milestone… probably once the passive income exceeds our expenses.

Well done. With only 4 ETFs now you will continue to get a lot of “Why do you have A200 and VAS?”. Just an idea, combine those two on your pie chart and call each one by their generic name as it illustrates the concept of better. ie. Broad based Aust. ETF (ie A200, VAS, IOZ), USA Broad Based ETF (ie VTS, IVV), Global broad based ex US (ie. VGE, IVE).

Just a suggestion.

This would save me answering a lot of questions haha… hmmm… I do like seeing the specifics of other peoples portfolios though. Maybe I’ll add a disclaimer.

Hey, because you have your PPOR included in your net worth, is it your intention to update it’s valuation periodically? I don’t for my PPOR currently, even though it’s would have increased significantly. It’s hard to know what to do with a PPOR….

Great call amber PPOR is a Liability even if debt recycling is involved in my opinion it should not even be ion the chart

I reckon it’s fine to include it (mine is fully paid off) . Just curious on updating the figure.

I operate two figures a net worth & a fire number (excludes PPOR value)

Same here. My FIRE value is the revenue generating assets. Then FIRE + PPOR for an overall wealth figure.

Great question.

I don’t intend to do that but it would technically make sense. You’re right about the PPoR… it’s a hard one. I include it in our net worth to give readers a holistic picture but I leave it out of our FIRE portfolio because it’s not an income-producing asset.

Congratulations!

I kind of feel like your my twin so it’s been really inspiring to be investing alongside you. We also hit the 7 figure club this month and I’m a huge data nerd as well, can’t wait to meet up sometime if you’re in Brisbane!

Well done mate.

Thanks Twin 😂😁!

Dude… your website is next level! Very aesthetically pleasing. Did you design it yourself?

And congrats on the 7 figures too 🙂

Congratulations to you Matt and Mrs Firebug!!!!

Welcome to the club. The first million is the hardest 😂

We were unexpectedly gifted some money earlier this year and I held my breath and dropped it in a lump sum. But it sure was stressful, so I feel your pain.

I love reading your updates and thanks again for being so transparent.

Here’s to the next million! 😊

Thanks Jodie 🙂

Well done guys!! It’s such a huge milestone from a mental perspective and a massive inspiration for us followers. I’m only just half way there and it still seems soooo far away…..this update has just thrown another log on my fire!

Glad to hear Benny. Keep up the good work 🔥🔥🔥

Well done Mr & Mrs FB!!!

Thanks Pete 🙂

Matt, it’s not possible to know when to buy… You can guess, but do you really need to take all that extra research time, and all that added stress? The simple fact is that if you are going to buy a bunch of ETFs and sit on them for a decade, it doesn’t really matter when you buy. My philosophy is don’t stress, just buy when convenient and hold for years and years.

Remember also that the longer you sit on that cash at a crazy low interest rate, the more you are delaying the start of growth and dividends from ETFs. If you wait long enough, you could put a significant dent in any advantage you enjoy from waiting for the right time to buy.

This is a great comment Geoff with valid points. I’m leaning towards a lump sum but it’s a bit scary haha

Well done AFB nailed the first mill! In regards to dropping your money in the market. Step back and let your wife do it for you as I’m sure she will have less inner chat about it and will just get it done. I’ve never had to put that much in all at once, but when I have done lump sum payments and WASTED time angsting over them when I look back I couldn’t tell you A) The amount invested, B) The price per unit. But I can see that over time the fund itself has increased in value. All the best, Ruth

This is a great strategy Ruth! I’ll have to get her on the laptop tonight lol. Hope all is well over the pond 🙂

good onya mate. We love what you do !! been following since lock downs in Melb. Def got us thinking and currently we are selling our IP in Perth . What a market that hasn’t been for 15 years……

Thanks Paul. Yeah I’ve heard Perth has had a rough period for a while now. Any bumps with the Covid surge these last two years?

Just found your podcasts and love them your doing a great job

Quick question

I’m wanting to buy some vanguard s and p 500 as it’s an international transaction

Do I need a broker to set it up or can I go through vanguard direct ?

And what are the risks

Hi Steve,

I’m not sure I 100% understand. Do you want to invest in the S&P 500 through an ETF? There’s a lot of risks involved and I couldn’t do them all justice in a comment.

Congratulations on hitting the 7 figure mark, even if in some sense no different to being at 999,999 it’s still a great achievement to get there early on and a testament to the work you’ve put in.

If it helps at all I put a lump sum into the market probably close to a decade ago now, yeah it was a little nerve wracking but I didn’t want it sitting in a bank account earning nothing and took the plunge. I think there were a few dips in value below what I put in but I knew it was always going to be a long term investment and thought of it as being if I didn’t put it in now then I ran the risk on missing out on big gains rather than worrying about the potential losses. It’s worked out fine over the long term which is what I really care about. Hit me up if you want to have a chat about it!

Thanks HIFIRE,

I’m pretty sure we’ll take the plunge soon and won’t look back but it’s still a tad hard to do haha. It’s cool reading everyone’s stories about them grappling with the mental angst of lump-sum investing. Comforting really and I appreciate the chat too 🙂

Congrats AFB! Great milestone and I’m with you about simplifying your life. I have gone so much to have one bank, one investment broker, and one Super fund in Australia!

Investing is a mental game and I want to challenge you to put the cash on the home mortgage. I know you don’t plan on doing this from your podcasts I’ve listened to but I thought I would plant the seed. As time passes I believe you will want to pay it off early and I will be excited to hear you say “I wish I did that earlier” 🙂

I agree with Mike, consider the mortgage. Work out how long it will take you to pay it off if you put the cash in and then double down on paying off the rest. After that your payments will be yours to invest however you like forever.

I also want to know what is your plan for your super and where do you think it will will be by the time you are 60/65?

Valid points Alex. We just want to focus on building the portfolio over paying down down atm. That might change in the future though.

Super is just a bonus to us. It doesn’t really form part of the official FIRE plan. I think We’ll be able to access it at 60 🙂

Thanks Mike… funny you mention that because we actually did use the money to pay off the first split in our home loan… but we ripped it straight back out to invest with (part of our debt recycling strategy).

We don’t have any intentions of ever paying off our PPoR but if we ever do you’re well within your rights to come back with an “I told you so!” 😁😂

I worked hard to pay off my house early…… before i read peter thornebills motivated money….. and because i was always told that’s what i should do.. Have done the maths and debt recycling would have been a far more profitable venture. After twenty years my house payments were well and truly eroded by inflation and amounted to cents on the dollar. Thanks for bringing his book to my attention and letting me be inspired by your own venture. I am now well on the way to getting where im going. The takeaway for me is a long term view is neccasary and education on money key. Congrats on your achievments!

Congrats mate! It’s only onwards and upwards from here.

As for investing the lumpsum cash, have you thought about Dollar Cost Averaging?

Cheers. Yep, we have. I think we’re leaning towards lump sum though.

Congratulations to you and Mrs AFB! You guys have been an inspiration to my partner and I – truly the ones that inspired us to begin our FIRE journey. This is extremely rewarding to see you guys have succeeded. Onwards and upwards!!!

Thanks a lot, Nicole. Such a nice and wholesome comment 🙂

I’m also very honour to have play part in inspiring you guys to start your FIRE journey 🔥🔥🔥

Congratulations AFB!

Just want to say thanks for sharing your journey, you were the first FIRE blog I came across. I’m now on my own journey towards FIRE and have started an Instagram account to inspire and educate others as you have.

Thanks again

No worries LadyFire 🙂

Paying it forward is the way to go!

Great update, and congratulations! You could always do half lump sum and half DCA.

I debt recycled a few hundred thousand $$$ in July/August this year and did just that: lump summed half of it, and then did a quick DCA of the rest over the 2 months (NAB Trade had a deal where you get $1000 free brokerage for 3 months so I was just buying brokerage-free in $5-10k blocks) and thought it was good…and then the market tanked in September >.<.

Oh well it's all recovered now and my debt recycling shares are about 3-4% up so it's all good. As you know, the problem of timing the market is that while you're waiting if it goes down you're afraid it'll go down further, and if it goes up you have regret you didn't buy previously so you feel that you have to hold out even longer for the next possible future drop! It's actually a relief having finished the debt recycling process, rather than checking the market 2-3x a day, and being sad every time the market went up lol!

I’m feeling ya Kevin. It soooooooooo hard not to wait for a little dip.

Congrats FB on reaching the milestone!!!

New reader here – is your networth for both you and Mrs FB? Or is it your portion of your combined net worth?

Once again, congrats!!

Thanks Jen.

I combined our net worth’s back in 2016. From that point onwards it’s been a combined effort.

Cheers

Congrats on hitting the 1m Matt and Mrs FB. Good effort, I hope a lot of other young people out their are watching your journey and taking away some good life lessons. Well done.

Hello and congratulations on reaching this milestone.

I’ve been following your podcasts for a few years now and have found it very motivational!

You speak about shares and compounding all the time, would you have a figure in mind for how much your shares have made you since the inception of your portfolio?

Thanks A Hoss,

Sharesight tells me that our portfolio has made $144,499 since its inception. But our properties have made a lot more so I’d have to work it out. That might be a fun article actually… watch this space 🙂

It would be very interesting to see how each of the different “wealth creation strategies” have contributed to your net wealth now.

Would love to see a comparison between savings/ property investment/ etfs/ single shares.

Yep, I’m interested in that too now that I think about it.

When is your 1st 2022 update ! Can’t Wait !!

Just dropped 🙂