I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

October was a great month for a number of reasons.

Regional Victoria COVID restrictions started to ease up and we were afforded a lot more freedoms which have been a real blessing. We had planned a weekend away with a bunch of friends that unfortunately had to be cancelled a few months ago. But due to the easing of restrictions, we re-booked the trip to the high country and just hoped that nothing else would pop up.

My mate Jimmy organised this trip which was a weekend away in an old school log cabin at Tamboritha… which some of you guys out there reading might remember from school camp! Most of the group went to the same school growing up and it was a trip to be back at Tamboritha as an adult nearly 20 years after our school camp there.

The high country was beautiful and one of the best features of the trip was the absence of phone service. The campgrounds were so remote that no one really looked at their phone for the entire weekend which was refreshing. We played a whole bunch of boards games (any Secret Hitler fans out there?) and cards and everyone was just living in the moment. I’d really forgotten what it’s like to hang out with people without mobile phones.

Negative 2 degrees in the morning was a bit rough, especially considering the showers were semi-outside lol. But overall, an amazing get-away with a great bunch of friends (and kids) that was much needed after all the recent lockdowns!

Net Worth Update

Oh so close… again 😅

Another month of just falling short of joining the two comma club see’s the old NW land in the high 900’s at the end of October. This is a much better result than I had anticipated considering our holdings in SOL (which came about after the Milton merger) had a decent pullback. I’m sorta kicking myself about not selling Milton before it merged… We’ve actually sold out of SOL now (mid-November) for two reasons.

- We wanted to sell Milton anyway to move to a pure ETF portfolio. This was mainly due to simplicity reasons (VAS, A200 and MLT covers a lot of the same companies)

- We are gearing up to do debt recycling after we sell our last investment property (IP2)

But if I had just sold Milton before it merged we would have been up around $10K, but it’s easy to look back and make all the right moves… I can’t really complain after what happened with MLT (the special dividend and insane jump in share price) and we’re still way up even with this $10K pull back so… meh.

The major driver for the increase in OCT came from good old fashion hard work and savings with a little bump from our Super accounts.

Pretty normal month on the expenses front.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Properties

IP2 has been on the market for less than a week and we have 4 offers, all of which we’re willing to accept 🎉🥳. We just have to accept one now and sort out the settlement date which is super exciting. We should have everything wrapped up by the November update I think 😁. This was the final piece of the puzzle for us to execute our debt recycling strategy so I’m really excited to nip this in the bud.

Property 1 was sold in August 2018

Property 3 was sold in April 2021

*DISCLAIMER*

The current value of our properties is a rough guesstimation based on similar surrounding properties. I only really update these when we get an official bank valuation

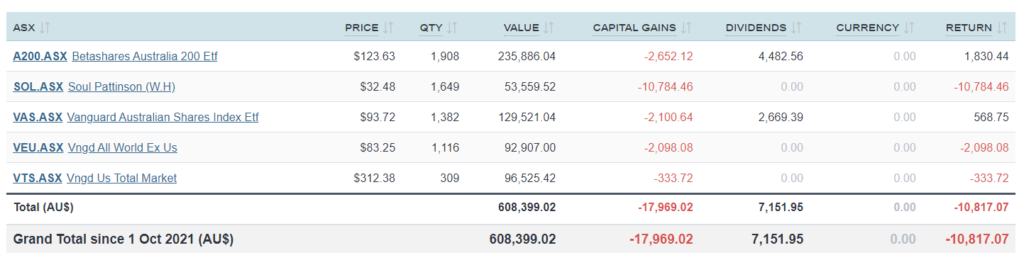

ETFs/LICs

The above graph is created by Sharesight

SOL KILLED us in October… but as I’ve mentioned above, we already make a lot of money with the special dividend from Milton (not shown in this screenshot) and the recent share price jump. So if I zoom out a bit, MLT was still a great investment and I’m more than happy to offload SOL even though it’s dropped this much in the last month.

No buys again in October. Getting everything ready for debt recycling now which should see us drop in ~$200K in the coming weeks. Watch this space 👀.

When do we get to see your debt recycling strategy in more detail

Once I’ve executed it. I’m adding to the post as I go through the process. Hopefully before the end of the year 🙂

Congratulations on being on the edge of getting IP2 off your hands!

Great read and nice to see the continued progress! 🙂

Hitting that double comma figure will come – one day the market will just quietly do it for you in the background, as you pay attention to other things!

And from there, things will just slowly build, hopefully.

I really like your new graphics too!

Thanks mate.

We’re SO close to having everything set up how we envisioned it many years ago. It’s a great feeling

Good to see you looking after the mental health with a trip away, I’m looking forward to a few of those this year and next with the threat of lockdowns hopefully!

So very very close to 7 figures, hopefully you break through in the November update!

💯 AHF!

I’ve obviously posted this update really late, but let’s just say it would take a monumental drop in the markets to keep us out of the 2 comma club by the next update 😜

Thanks AFB – I find your posts and podcasts very inspiring 🙂 So so close to 7 figures now!

Given you home in the country was relatively inexpensive, I wondered if you had considered keeping the IP for debt recycling? And why/why not use only the principal place of residence for debt recycling instead of including the IPs in this strategy?

Keep up the great work!

Because there is no tax benefit.

…in using the IPs.

Thanks Bee FI!

I’m not sure you can do debt recycling with an investment property 🤔

My understanding of DR is to turn non-deductible debt into deductible debt. Our PPoR loan is the obvious choice in my mind to do DR for.

So… I guess we don’t really need IP’s to do DR is my answer. Hope that makes sense.

Cheers

Yep, debt recycling is the conversion of non-deductible debt into deductible debt. Investment property debt would generally already be deductible debt

I guess when you have a smallish homeloan, there wouldn’t be as much equity to leverage for your debt recycling. IF you had equity in your IP, this would have given you access to more leverage and therefore more $$ to access for the debt recycling strategy?

Good on you mate. Very soon after you’ve reached the double comma milestone, it would seem as normal as anything else 🙂

Reg. the debt recycling strategy, are you referring to accessing equity from the PPoR to invest in etfs? Keen to understand further.

Cheers

Thanks Mr. Moy.

Basically, we have a split loan for our PPoR and we’re about to pay off one part and re-draw it back out to invest.

There’s an article coming up once we’ve done it.

Cheers

So encouraging! Great work AFB!

Grazie 🙂

Well done AFB!! I am uncertain about what to do with my MLT turned SOL shares …. sitting on them for now until the 12 month CGT discount kicks in.

BTW, love your beautiful donut pie charts!! What do you use to create them?

Thanks Eugene,

I use Google Charts mate

I enjoy reading articles about personal investing. It’s just out of curiosity – why invest so heavily in ETFs when you can pick and choose your favourite holdings? If you just wanted to get ‘the market’, you can even mimic that in your direct holdings and save on ETF MERs and also benefit from any SPPs you get offered as a ‘direct investor.’ Anyhow, i really liked your discussion with Owen and am now following you 🙂

Because if you want to have shares in your name you’re gonna pay brokerage fee for each purchase. For a hundred of different shares it really adds up. Another reason is that it’s a passive strategy that doesn’t require your attention at all, while your suggestion requires active management, regular rebalancing, etc

Thanks David 🙂

Yeah, basically what Sergey said.

I could replicate the index but it would be a full-time job buying, selling, rebalancing etc. And can you imagine how much work there’d be at tax time 😱😱😱

Thank god ETFs exists is all I can say lol. I think paying < 0.1% of the portfolios in management fees is incredibly cheap. I'm glad you enjoyed my chat with Owen too 👍 He's a smart dude!

Hi Firebug – I didn’t mean to suggest buying 300 separate holdings. But in a broad market Australian ETF like VAS you’re effectively deciding that it’s a good idea to have 20% of your money in the big 4 banks and 6.5% in Rio and BHP. That may or may not be a good idea. Plus today it’s exposure to Information Technology is only 5%.

I’ve seen a few experts say you can hold 15-25 companies and cover ‘the market’ that way.

And let’s say you have $100K in VAS – what’s the difference between buying $8000 shares in CBA directly and having the same amount through the ETF? Maybe ease of accounting, but not really as these days there are so many tools to keep track of transactions. Plus there are clear benefits from holding directly (eg Macquarie are doing a SPP for shareholders right now at about 10% discount to the current price).

I can’t say what is best, but I question investing in such ETFs after you’ve gained some experience, especially as you’re not really as diversified compared to selecting your own holdings across multiple industries.

Yeah, I enjoyed your discussion with Owen, you have a very good radio presence!

This is actually a good point. Broad-based Aussie equity ETF’s are not that diversified. You could try and balance this out by buying individual shares. You can also add other ETF’s to balance out the financials over-weighting (e.g. EX20). Not a recommendation just using as an example to illustrate the point.

Thanks Mate!

I’ve heard a few people say you can be pretty diversified with just a few holdings too but from the research I’ve done, I can’t see how that’s possible.

The majority of stock market gains over the long term only come from a small number of stocks, some research suggests it’s only 1%. There are other great articles about “The Skew” here and here.

To quote Ben Carlson from ‘A Wealth of Common Sense’:

“The very nature of a market-cap weighted index means that the performance will be driven by something of a winner-take-all scenario. The cream rises to the top and the losers tend to fall by the wayside.”

We use ETFs to invest in the whole market because of the odds of us selecting the correct stocks for the next 50+ years is incredibly low. So low in fact, that study after study suggests that the bulk of professionals can’t do it either.

Here’s another good article from JL Collins that might interest you.

I’m a huge believer that 99% of investors (retail or institutional) will fail to beat the index over the long term (20+ years) so I’d rather just invest in the whole market so it’s impossible for me to miss out on those shooting stars that eventually account for the bulk of all gains anyway.

Hope that made sense David 🙂

Cheers

Hi FIRE

Nice to hear from you and I see your post has attracted so many new comments. This must be one of the most read blogs in FIRE now.

I’ve also read that many professionals don’t beat the market, and it appears true. However, is that because of their lousy ‘stock picking’ or because they buy and sell too often and have a higher turnover, and they charge 1% or more for the privilege? (that 1% MER really takes away your gains over time).

Because an alternative to the professional fund managers are all the people who run investor services, and the ones that I’ve seen do beat the market.

Not that I think getting ‘the market’ is the right goal, but it’s a talking point.

I think the Australian situation is different to the USA especially since around 2008. The USA market has flourished and that’s because their top 10 are growing companies that are global in nature. Our top 10 as I said last time is banks and miners, essentially cyclical in nature with a few exceptions.

People are happy to get the market in a general Aussie ETF, and that’s something which will grow with time, but they are denying the active nature of investing so heavily in the banks and miners.

Maybe they’ll come up with a new method for choosing the best Australian companies. Like QUAL from VanEck but for Australia, now that’d be cool 🙂

Thanks, I’ll check those links tomorrow as it’s getting late.

Btw I did read one article where they suggested the best strategy was simply not to sell (ie that you only buy stocks). If you have enough in savings to cover an emergency, I can see that happening as people make mistakes when deciding when and why to sell etc.

ETFs definitely remove that decision issue. Though it’s still ‘active’ as for example, if you have money in A200 you’ve chosen Australia as being a top choice for your money and you’ve chosen to indirectly invest in BHP, Rio, the banks.

I read a nice comment from a blogger in the USA – his opinion is to invest in other markets. Like, if you have your house in Australia and you work here, why ‘triple up’ and choose shares here too. I think he has a point.

Regarding your comment about being diversified from a few holdings, I thought the idea was that a few holdings is good when you’re researching hard into the top companies like what Berkshire Hathaway do.

But on the other hand how diversified is someone really in A200?

Anyhow, thanks again and I’ll read the links tomorrow (please note I’m writing this before reading the links, but we can always continue another day).

Have a nice Sunday

Love the new style of graphs etc

Thank you for sharing so freely.

My pleasure Sarah 🙂

Soooo close!!! Its crazy the property market at the moment, they are flying off the shelves like a Black Friday sale.

Actually insane. Perfect time to offload IMO. But knowing what property has previously done, I probably left thousands on the table by selling 😅

Keep up the great work. November’s gotta be your month for sure.

Yeah buddy!

Congratulations!

This is very inspiring and encouraging, your blog was one of the first ones I read back in 2018 when I started investing, I read ALL your posts back then.

I’ve been following your financial journey and it’s great to see what’s possible.

One question, where and how did you see Milton’s pullback ? I kind of noticed percentage-wise that something happened, but I’m still not much of an expert in doing some analyses. I noticed that Sharesight didn’t convert MLT to SOL , and I was wondering what I needed to do.

I appreciate that this may be a very basic question for this audience.

Thanks

https://community.sharesight.com/t/mlt-and-sol-merger/397/9?fbclid=IwAR2KDuY-vyQmw9p3yUNQGT0OD9VMFD6XNYZqlaMmlh2DUQD3A9N_vezuL4M

Thanks Wombat, this was very helpful

Thanks Alex 🙂

I used the link that was posted by Wombat too.

So Milton turned into SOL. And if you google ‘SOL ASX’ you’ll be able to see that SOL has tanked in the last couple of weeks pretty bad.

You can also use Sharesight to see the performance of any stock over time.

Hope that helps mate

How do you calculate the cost base when you sell the SOL shares that have come from MLT?

Trying to find an easy example but its impossible!!!!

Hmmmm good question. I’m almost certain Sharesight will be able to handle this but I’ll probably double-check with my accountant first. I might post a little video after I sort it out. Maybe post something on Sharesights forums. There’s some really smart people in there.

Tiny piece of feedback, for what it’s worth. In the FIRE progress graph, I think it would be much more interesting to show the actual investment income you earn each month, rather than an estimate based on a % of the total portfolio. It would illustrate what kinds of dividends you’re receiving over time, plus give a sense of how ‘lumpy’ and varied dividends can be as an income source. Would be a very useful gauge for those thinking of going down a similar path with ETF investing!

Other than that, love your work.

Good feedback mate but we’re planning on using the drawdown method combined with dividends.

I might include a yearly graph that shows the dividends over the last 12 months or something like that… that would give an indication of the lumpy returns for sure.

Hi AFB thanks for sharing 🙂 Can I ask what you do with your dividends? Do you spend them or reinvest them along with the $5K you invest each month, so 5K+divs?

Yep we reinvest them 🙂

Amazing work AFB! Thanks for all your content. Learning heaps.

In your strategy 2.5 pod episode. You mentioned changing from VTS to IVV. You didn’t end up doing this? Why?

I’m also concerned about VEU tax drag and US estate tax. What are you thoughts on this?

Thanks Ellajaz,

There were whispers that Vanguard was going to change VTS and VEU to be domiciled in Australia which is what Blackrock did with IVV in 2018.

So I’ve just been lazy and waiting for them to change it for me. It’s very annoying that they haven’t made this change yet which a lot of their investors will benefit from. I’m sure they’ll change it one day. In the meantime, I’ll just have to keep filling out the form every 3 years 👎

As far as VEU tax drag goes… are you referring to the Aussie shares within VEU? Because you can fill out the W8-BENE form for VEU too and not pay extra in taxes.

If you’re talking about the lost franking credits in VEU then I don’t really have any concern over this since it’s really, really small.