I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

We kicked off 2022 with some travelling which almost didn’t happen.

Mrs FB and I are aspiring parents and basically, everyone has told us to get in as much travel/activities/sleep-ins as possible before a future newborn comes onto the scene (we’re not currently expecting atm). The original plan back in August last year was to get in one more overseas trip before the potential avalanche of responsibilities from parenthood hit us 😂.

It was originally going to be Japan because we missed it due to Covid in 2020. But as the months went by, the restrictions weren’t easing up enough for us to risk it plus Omicron went bananas later on in 2021. There’s was the whole ‘getting stuck’ over there risk, hotel quarantine (already paid that once 🙃) and probably the most likely risk of them all… getting a half baked Covid experience.

I’ve been thinking about what the world is going to be like after Covid for a while now because it doesn’t take a rocket scientist to know it’s not going to be the same.

Think about how much airport security changed after 9/11. A lot of the world was affected by that event. And whilst 9/11 was unprecedented, Covid is really on another level in terms of impact and severity which is saying a lot.

I mean… what sort of restrictions are going to be sticking around post-Covid? Will masks become the norm (people voluntarily wearing them)? Number restrictions on large gatherings?

I remember how much fun I had at Octoberfest back in 2019. Will that be the last Octoberfest of its kind… ever? There’ll be more festivals in the future but I’m not sure they’ll be the same. Our descendants might be able to look at photos of our generation and easily know if the picture was taken pre or post-Covid.

It’s a bizarre thing to think about really.

Anyway, back to our travel struggles…

So we axed Japan because things were getting worse, not better and I’m pretty sure Australia wasn’t even on the ‘allowed’ list to enter the country 😅.

We flirted with the idea of New Zealand but they didn’t want us either 😢.

So we ended up deciding that we’d have a look around our own backyard instead. Having never been to Western Australia, I was a bit disappointed that the borders were still closed because it was our preferred destination… oh well, next time I guess. South Australia and Tassie were next up and we were in luck with these states coming from Vic. I remember getting a slight scare in mid-December when the SA/VIC government started to mandate a combined total of 3 Covid tests before entry. It was originally 1, then it went to 2 and then 3 and I thought “Ahhh man, it’s just a matter of time before they lock us out”. Thankfully that didn’t happen and were able to cross the border to start our January holiday.

We hit up Adelaide first and I was really impressed by the city. Beautiful gardens and parks, great spots to eat and drink, plenty of recreational activities, world-class beaches just up the road and affordable housing from what I’ve heard. It’s no wonder that Adelaide always ranks highly in those ‘worlds most livable cities’ studies.

I really enjoyed hiring the orange bikes/electric scooters to see the city. Was a lot of fun.

I also caught up with Loch aka Captain Fi.

He was kind enough to help organise an impromptu FIRE meeting in Adelaide with less than 48 hours notice 😅. I think we had around 10-15 people come and go throughout the night and it was one of my highlights of January. Getting out there and meeting Aussie’s from the FIRE community has been one of my goals since returning home. Last year was hard with all the restrictions but I’m really hoping 2022 can be the year of FIRE meet-ups! I’m planning on hosting a few in Gippsland and maybe even Melbourne 🙂

A big thanks to everyone who attended the Adelaide FIRE meet-up. I’ll be back one day for sure!

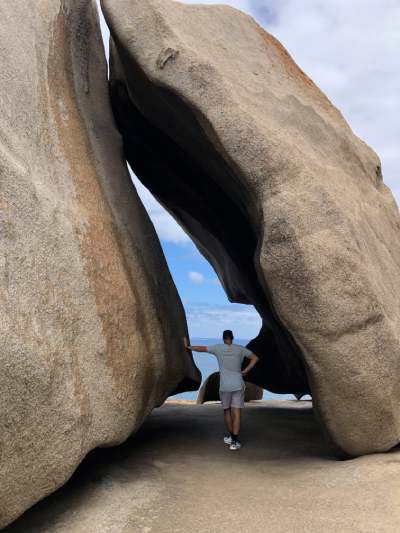

We headed to Kangaroo Island (KI) next but unfortunately had caught a bout of bad weather and couldn’t do everything we had hoped. It was still a lot of fun though. Here are a few shots.

After SA we headed to Tassie to meet up with our family and do some sightseeing.

I had already been to Tassie about 7 years ago and I remember being really impressed with Hobart’s Salamanca markets and Mona museum so I didn’t mind going there again. Plus we were exploring around the island to heaps of places I hadn’t been to before anyways.

Here are a few shots.

We had such a great time sightseeing around Tassie.

I also managed to have another small impromptu FIRE meet up at Preachers in Hobart. It was such a cool little bar with a great bar garden and I really enjoyed meeting more people from the community. A big thanks to everyone who came out and had a drink with us.

We got around on more of those orange scooters in Hobart which I really liked. Seeing a city on those scooters or a bike is 100 times better than driving around IMO. One of my favourite things about Hobart and Adelaide is that you can get anywhere in the city on a bike/scooter within the hour. Having lived in a bigger city like London I really appreciate the smaller size of our Australian cities. Even Melbourne and Sydney are a lot more compact compared to New York, London, Tokyo etc.

I remember being a bit shocked when we went to a friends place for drinks in London once. We punched the address into City Mapper and the designated route said it was going to take over an hour to get there 😐. That’s a crazy amount of time to get from one place to another in the same city. I still maintain that riding a bike is the quickest way to get around in London but even so, you’d have to be pretty fit for some return trips around the city and most people aren’t going to ride their bike to a party lol.

Speaking of bikes, I had no idea that the MTB scene in Tasmania was so prevalent. I’ve recently started to hit the trails with my nephews and it’s been an absolute blast! I managed to get Mrs FB on a bike and the trails at St Helen’s were awesome. I’d love to come back one day and hit up Blue Derby for sure.

Net Worth Update

The cruel mistress of market timings punished me in January after I obviously angry her by holding onto our lump sum for too long 😂

After lump summing > $200K at the start of Jan, the markets started to dip and went south pretty quick with a slight recovery towards the end of the month.

This dip in the markets is the main reason for the drop in our net worth this month. Our share portfolio took a beating along with Super.

It was also a really expensive month again (inflation maybe?) and we didn’t save that much money.

Man, I forgot how much holidaying and eating out can really add up quick. A key difference these days is us having a mortgage whilst holidaying. When we were in London, we could sub-let our room before heading off on an adventure for a few weeks. But these days, it’s a double whammy of expensive accommodation plus our mortgage 💸. It’s still been worth it IMO but just reinforces my point of view that owning a PPoR is bloody expensive and can really clamp you down financially and geographically.

No changes to the FIRE portfolio.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Expenses continue to be really high for the second month in a row. This is mostly accounted for by our holidays but I’ve noticed our grocery bills have been insanely high over December and January. This is partly because I bought a new BBQ and have been hosting a lot of dinners with my mates. Playing host is super fun but can be really expensive too. Inflation has definitely had an impact on our expenses though.

I remember back in 2018 we would consistently spend around $4K – $4.5K a month for everything. It’s been hard to know what our baseline is atm because last year had so many one-off purchases (wedding, PPoR). It might take another year to see what it will look like. Will be interesting to see how this graph changes over the coming months.

Shares

The above graph is created by Sharesight

We didn’t make any purchases in January. We are saving a bit of extra cash in preparation for buying a new car later this year. The 2nd hand car market is still crazy and I’ll like to put it off for as long as possible but it’s something we’ll have to buy eventually.

Does anyone have any recommendations for a solid family car (SUV or wagons are preferred)? I’d love to hear about them in the comment section 🙂

I know you asked for something bigger but I’d highly recommend the i30. Great size for little one, boot is good size for pram and all baby gear. Plus great for fuel economy.

Hyundai i30 wagon has been great which we got with kids in mind. Huge boot, very reasonably priced for the extras you get. We went diesel but I’d suggest going unleaded. It stinks too much.

An i30 for a family? As long as it fits the pram and all the baby gear then we’re good.

I need to test one out because I just immediately assumed it was going to be too small. I’m really glad you made the comment Bryce. We didn’t really want to get a big car anyway.

My bestie had three kids and drove a Barina for years. Big cars are optional 🙂

So I’m discovering Lacey!

This opens up a lot more options for us 🙂

We had a diesel VW Golf for the kids from birth to the eldest being 10 before it died. We had a big stroller that we kept in the apartment foyer for local walks etc, and a smaller, more transportable one for the car.

Then we recently upgraded to a Subaru Forrester, we just needed that extra space for transporting bikes and holidays.

We have had an i30 wagon for ten years. Kids now 12 and 14. Great size for everything we have done at all ages, and doesn’t feel like a truck.

Do you reallly need a car now? Especially with higher costs and uncertainty, would you be able to just rent a car for a while eg for holidays and long trips?

We have 2 kids (almost 3 and almost 1) and we love our Mazda 3 hatchback.

It even fits most furniture when we find something secondhand on Facebook Marketplace (although you need to remove the child car seats for that 😉). I can imagine us needing more space when the kids are old enough to go camping but I’m tempted to try to get by with a roof rack even then!

Plus, beware that even if you take extra good care of the car, the kids will cause LOADS of wear and tear and it will constantly look like a mess

The ‘mid sized’ car I booked for a Sunny Coast holiday was driven away by another punter and the hire car company only had an i30 left…

After a long weekend with me, the missus and two teenage boys I returned home and traded the Jackaroo on one…now has 280K on it and passed down to my youngest who is about to start his own family.

We had an i30 for the first 4 months of our newborns life, we ordered a hybrid RAV4 when I was 4 months pregnant but they have a huge wait at the moment.

It wasn’t as bad as I was expecting. I actually think getting the capsule in and out of the i30 is easier than the RAV.

We fit a rather large pram in the boot (albeit just the frame due to aforementioned capsule which acts as car seat and then clicks into the pram), though it didn’t leave much room for much else which was a pain.

Probably the biggest thing was how much leg room you lose for the passenger once the car seat is installed, my husband had to drive everywhere as even at 180cm he was pretty uncomfortable in the passenger seat. Honestly it’s still pretty squishy even in the RAV. Capsules do take up more room I think so if you are planning on just doing an infant car seat may not be as bad.

Overall the RAV4 is a great car so far and pretty well priced for a Toyota and hybrid, we have driven 650km and only just used over half a tank which is pretty impressive and appreciated given the price of fuel!

I have heard good things about the Hyundai SUVs too so might be worth checking out.

Good luck with the entry to parenthood. It has its hard moments but don’t let people scare you that your whole life is over.

Isuzu MUX was the cheapest big 4wd we could find. We had a commodore and the rav 4s or other mid size cars where not an upgrade in size. 2 kids, car seats prams surf boards, I t all fits… depends on what you need. We will keep this car for at least 10 years

Future family car. You can’t go past the Subaru Forester, very reliable and enough room for adventures and prams. Aim for 2013 onwards as they got the CVT transmission and where a lot more economical.

I’ll second this, best value for money IMO. Recently bought a Forester as a family car and couldn’t be happier. Amongst other thing all wheel all the time makes for a great (and safe drive).

Great to hear of your travel mate. Yeah, the markets were in a panic mode a bit and it most likely will happen again in future as interest rates are anticipated to rise not in distant future – so just stay the course! Two thoughts –

1. On car – you’d easily save few grands just by buying a used car that has low kms on it. It’s a depreciating asset and the moment a car is owned, the price falls down over 10% – i’d take advantage of that (and you’d still have the usual warranty)

2. On monthly expenses – the way i’ve been tracking mine is to broadly categorise them into usual and one-off expenses. That will give you a solid picture of what your usual expenses look like that you can use as reference for FIRE planning (obviously with kids expenses added 😉 ). The one-offs will have the items like wedding, an unplanned event etc. It’s just another way of looking at what your running expenses are and how much you’d like to keep as rainy day fund. Adding everything skews your expenses trend i reckon.

The only issue is that there seems to be more and more ‘one offs’ these days 😅. We’re not even parents yet ffs 😂

Second hand car market is banana. A friend selling his 3 YEAR OLD Range Rover for $3k less than he paid for it. The same guy has a new Cayenne coming and is told he can sell it for more than he paid for it six months ago.

Hiya, love your work! With someone with two kids, we still get around in our Honda Jazz 🙂 I don’t get the idea of a bigger family car until they’re bigger. Ours are 6 and 3 and are fine.

Awesome. We don’t want a big car. I just assumed you had to get one because literally all our friends and family have a mid-big car with kids. I should have known not to blindly follow the crowd 🤦♂️

I love my jazz Honda hybrid (I had a from new Subaru Forrester prior for 10 years but I’d choose the jazz anyday) we were going to upgrade it when our second kid came Along but so far so good, even the bugaboo cam and scooter fit in! I have seen Jazz wagons in Vic which they don’t have in WA. Thinking of importing one over when my girl kicks the bucket!

We have a 2018 Mitsubishi Outlander PHEV now with 90k kilometres on it. Takes dogs, two children, mountain bikes etc around well enough. It reliably does 35k a day electric. Bought for 32k 18 months ago. If you live somewhere flat it’ll do 40-45km electric. So we get 1000km a month c/o electricity at 45 dollars a month and less if I charge off the solar during day. (Cf petrol at circa $2/litre atm, so $200) You have to look at your use case though. Almost all of our driving is around town (Newcastle). For occasional long trips it’ll do 10l/100km fully loaded. There’s nothing big enough full EV for our use case currently and they’re still too expensive new. I’ll swap to EV in about two-three years. There’s a new PHEV outlander which will be all around better out this year but will cost 60k new I think.

I went to Canada for my honeymoon over the break for 37 days to snowboarding. Definitely wasn’t half baked, one of my favorite snowboard trips yet.

Nice! What mountain dude?

We are also looking to get a new car but paralysed by the rapidly changing PHEV/hybrid/EV market. We camp a lot in an old Nissan pulsar and all was well till recently when our towbar started bending down with the weight of 4 adult bikes and 1bike dragged itself to death on the road. Camping was fine because I am really good at packing and the sedan has a large boot. We also carry a kayak on the roof but sometimes wish we had 2. The stuff expands to the room you have. But now the oldest child is adult sized being jammed with him and a car seat for the youngest in the back sucks on long journeys. We look at people with suvs and people movers enviously thinking they have heaps of room but even they have trailers and heaps of stuff on the roof. I like the idea of a hybrid or a phev but they all sacrifice cargo space. You get that when you have 2 engines and a battery instead of just one. I’m not sure the perfect option is out there at the moment. The electric ford ranger Ute is coming but when? And how pricey will it be? Unless you are doing a lot of camping it’s amazing how you can cope with a regular sized car for years with small kids. If you need a lot of room you can hire something for extra people and stuff but it is awesome to have a bike rack for family trips on trails etc. I’d be interested to hear of any hybrid or phev owners who can camp out of it with a decent sized tent and all the gear.

This is my exact predicament. I really want to get an EV but they just don’t make sense from a financial point of view. If only we can hold off on a new car for 5 years 😂😅

Whistler. Didn’t move about because wife is pregnant. She still snowboarded.

I’ve done niseko and furano 19/20 for a month, but this whistler cat boarding was the best snowboarding day of my life:

https://imgur.com/a/73nReZa

Duuuuuuuuuuuude!

Those shots are epic. Look at all that POW 🤤🤤🤤

For transport, if wanting to haul around bikes, camping gear, other passengers, going on holidays etc – medium sized SUV particularly with 4WD would be recommended. Mid size ones include Subaru Forrester, Honda CRV, Hyundai Tuscan, Kia Sportage, Nissan X-trail, Mitsubishi Outlander, Mazda CX5, and Toyota RAV4 come to mind. Most medium sized SUVs, even second hand ones are kind of expensive these days. Personal favorite is the Subaru – constant 4WD and no turbo engine. Possibly X-Trails might be good value, Mazda / Toyota hold their value. The Korean units could also be good value. Alternative could be something like Renault Koleos which is built on the Nissan platform. Honda CRVs are very practical, and Mitsubishi’s often underrated.

Great info Victor.

I don’t think we’ll need all that just yet. I’m also grappling with the fact that electric cars are starting to take over. They’re still way too expensive to make sense from a financial point of view but I feel like the price will drop dramatically over the next 5 to 7 years.

One good thing about the Honda CRV is that the doors open out a full 90 degrees – great for getting bulky items like kiddie seats in and out. 🙂

Def know what you mean about the size of foreign cities. I once went to the 360 degree observation deck of a very tall building in Tokyo and it was cityscape to the horizon in every direction!

I’m also wondering what the “new normal” will turn out to be post-Covid. I’m currently booked to attend a conference in Melbourne in October with several thousand attendees so waiting to see what happens with that.

How did you find Tokyo? I’d love to go one day

Yeah AFB, absolutely loved it and would like to go back one day. Instead of flying in and out of Tokyo, I wish I had flown into Tokyo and out of Osaka (or the other way around) and taken the bullet train between them stopping where I wanted to along the way e.g. Kyoto. You can buy a cheap foreign tourist railpass before you leave home to get the bullet train stuff sorted.

Hey AFB, was great hanging out mate and finally being able to share a couple of cold beers! Car wise, I have had an old 2006 model forester since 2012 and its never skipped a beat. I will eventually get a landcruiser once I have bought the farm because the priority is buying the land and getting some form of liveable accommodation on there before splurging on cars. Literally zero complaints about a subaru forester – they are great cars and has been perfect. I could imagine they would be great for up to two kids, but anything bigger you might want the landcruiser

Likewise dude!

How’s the efficiency on the Forester? Uneladed?

Great update, as always.

I personally would look into larger cars for safety reasons.

Everyone seems to drive a large ute or SUV now and you don’t stand a chance if you’re driving a Honda Jazz or similar and happen to get in an accident (Nothing against the Honda Jazz btw).

Subaru outbacks seem like a solid option IMO.

Cheers Gabe.

I hate the fact that you’re right. We seem to be going the way of America in the car department. Everyone’s driving SUV’s or huge pickup trucks!

Love my Pajero

Our 2007 VW golf is rapidly dying and the second hand car market is not good value at the moment. So we actually looked at buying new, for the first time ever. I did the sums on owning a Tesla just for fun, but then it ended up only $1600 more per year then a Mazda 3, due to the almost zero maintenance (just tyres, maybe brakes), slightly cheaper rego and petrol. With 3% finance it means we’ll slug the cash that we had to buy a car into shares and over 7 years pay something like $6000 in interest, and at the end of it have a car that still has some value, rather than a petrol car which might be almost worthless. Not sure how the sums will go for you, but fun to explore!

Woah that’s pretty cool.

Can you share your numbers please?

I don’t like the idea of a Tesla just because I think this family will have a fair bit of wear and tear over the next 10 years. I’d rather buy a solid car that I don’t have to worry about as much. A Tesla is my dream car but that’s a few decades away I think

Yeah, I thought an electric was still >2-3 years away for us (family of 5 in a VW Golf, 3 kid seats across the back). I compared the yearly costs for purchase price, rego, insurance, maintenance, and depreciation. I haven’t included tyres costs as I’m assuming they’ll be identical.

Tesla Model 3 base model = $63,375 (2.99% interest over 5 years = $1139/mo, interest lost = $993 p.a.), QLD registration = $678.65 p.a. (slight discount from petrol), insurance with Budget Direct = $1380 p.a., depreciation = $5,584 p.a. (I think it might actually depreciate a bit less in real life, particularly in 5-10 years when more manufacturers stop making petrol engines and there’s a glut of second hand petrol cars that are no longer economical), cost of fuel = a bit of an unknown, will charge with solar panels, maybe $500 or less a year?

Overall yearly cost is approximately $9136.

Compared to a Mazda 3. Purchase price $29,811 (3.3% loan would be $539/mo., interest lost = $513.40 p.a.), Qld registration = $751 p.a., insurance $760 p.a., servicing = $316 p.a., petrol = $1500 p.a., depreciation = $2705 p.a..

Overall yearly cost is $7090.15.

The main things in favour of the Tesla is maintenance, which is apparently pretty much nothing. I might have forgotten some items, but it works out for us. It’s a bit of a splurge and if it was purely financial it’d be better to just go for a Corolla or RAV4, but we think it’ll give us good value, it’s super fun to drive, it will maintain value in 10 years, more environmental, and could apparently last more than one million kms (not sure on how likely that is, but that’s the theory, apparently). So we will definitely trash it (kids 6,4,2) but we’ll hold onto it for long enough that it won’t matter too much. And for camping we do a car swap with my aunt.

(My previous comment that a Tesla was $1600 more per year then a Mazda 3 was based on electricity being free, which isn’t really a fair comparison, but it feels like it’ll be free.)

A bit of a left field not so common car suggestion that has worked well for us and that we purchased to coincide with having a baby, a Skoda Yeti. They’re compact yet roomy especially the boot because of their boxy shape, good fuel efficiency, and favourably priced.

Love these numbers mate. Who did you go with for the car loan?

Hey mate, Just moved to Melb Docklands from Sydney, Haymarket. No car , just E-Scooter, GoGet car,Uber/Ola and Public transport ( free trams in the city ). We have not owned a car since relocating from Perth 2017- 5 years . Our yearly budget for car rentals/transport is $5000p.a. – that is what we spent on a car in perth 2016. In reality we spend about $3500 per year and zero expenses. ( guessing $5000 p.a. to maintain a car is kinda low now) . Anyway , no kids makes it easier.

We bought a Mitsubishi Outlander brand new in 2016 (before we found out about fire lol). It hasn’t had a single problem so far and if you go with a 5 seater the boot space is huge.

I’ll check it out Barbara 🙂

10 year warranty on Mitsubishi is attractive. We sold Subaru Forester (great car IMO) and waiting 12 months for a Hybrid RAV4.

Resale value is important because cars are a depreciating asset.

Your net worth should now also include the value of your PPoR less loan should it not?

Another Great update!

In regards to a car I feel the family car has grown parralel with the size of baby/booster seats.

See if you can find a pic of yourself (or siblings) in a baby seat back in the day and compare the size of the seat to the ones on the market today. Obviously this is for safety reasons but definatelty something I didn’t realise until we had kids.

We still have a Mazda 3 with the 2 baby/booster seats. Still fits but if we were to have one more child we would have no choice but to upgrade to a bigger vehicle to fit the seats in (something our parents generation wouldn’t have needed to do as the baby seats were much smaller)

On that note try and get a car with isofix and see where the strap clips too. Some go to the roof and some our friend complain about that (due to restricted vision etc).

Greats points Ococ… a lot to think about

We had kids very young at 21 and had no money (2007 gfc). We drove a late Mazda 323 and it was great, I have no complaints. We are 35 now and our kids are just a few years away from leaving the nest. We now own a i20 which I love and we use for 90% of our driving, and a Nissan navara which we needed up until recently for my husbands weekend side business (it was a great business write off). We also do a lot of camping with the kids/bikes etc. With his business winding up and us not using the car as much we are about to start renting it out via car next door for an additional income stream.

We’ve just moved to Adelaide, we love it here although the rental market is really competitive, especially with dogs as the landlord can refuse applicants if they have pets here.

We bought a new SUV when we moved here you might be interested in. It was the Mitsubishi Outlander Plug-in Hybrid (PHEV), I know that you were interested in EVs from one of your episodes. We got a 2017 model and can get about 30km from the battery which is good for work and shopping before the engine kicks in for longer road trips (research PHEV vs Hybrid), the SUV supports our outdoor life too.

My wife and I are about to crack the $200,000 mark in ETF assets so am looking forward to compounding interest to see some good increases.

Hey Matt, do you find the PHEV has been worth the extra cost for only 30km of range?

I think so, a large amount of our driving is in the city for commuting and shopping so we can do weeks with no refuelling and if there’s a public charging point near your destination then all the better. I don’t think we’ve recaptured our costs yet but we’ll have the car for awhile so there’s time. Also it can become a fun obsession, trying to drive as efficiently as possible.

It probably isn’t… but I just think petrol cars will become so obsolete in a few years… I wish the technology was a bit more mature.

A PHEV interests us greatly. What were the main cons/pros of owning the PHEV Outlander? We’re seriously considering one

Always good to read your updates. I now have a PPoR in the city (Perth) that I live in part-time and rent out on Airbnb the rest of the time (I travel for half the year, or at least did until the Rona) I also house sit for about half the time I’m in Perth and rent out on Airbnb again. Netted $20,876 last year on the apartment. I would highly recommend the MG ZST, when I got back from Sweden last September I was looking for a two year old car, and found I could get the MG for about the same price as a similar specced two year old small SUV. It’s a decent size, and great 10″ screen that has Android Auto functionality, and it’s very safe with lots of safety features.

How are the repairs for the MG? I thought I remembered someone mentioning that they are costly to repair.

I won’t need to worry about repairs for 7 years as it comes with a 7 year warranty! First service tomorrow (10k) so will see what service costs are like.

2nd hand car…I’m in the same position, looking for my 17 year old daughter atm. Its a tough market.

Depending on budget, the new RAV4 Hybrid (which is now 3 years old) we have found this to be a great car for us – however I feel its almost just as expensive now as when we purchased back in 2019. There’s a lot of good cars out there, enjoy the adventure 🙂

It’s sooooooooo hard Stu! I wonder when the second hand car market will bounce back 😢

Hey man – Long time follower, second time leaving comment. I always enjoy reading your content, as I respect your transparency and your approach to life. I am 1-2 years older than you are, and we are kind at same life stage as well. I like the fact that you pursue FIRE but also you know how to enjoy life. Continue with great work. Continue to have fun with your Mrs and value family and fun over everything else including money. I just had a baby and yes ..life is never going to be the same. REALLY try travelling as much as you can. Try to fit one more oversea trip before Mrs gets pregnant. Lots of unexpected can happen once you have one more member in family. For a SUV, I will recommend Kia. Check their services and warranty. Difficult to beat that.

I appreciate the comment AQJD. I’ll be sure to check out the Kia and I’m glad you’re digging the content 🙂

I’ve got a 9 month old, so feel i can weigh in here.

You can still holiday until the Mrs is about 5 months from that point she wont be up for it. Keep smashing the holidays. If you are planning on doing anything around the house, get it done now.

I still have unpainted walls from 9 months ago, haha!

We now have a cleaner once a fortnight, this goes against everything i stand for wrt. FIRE….. but its cheaper than a divorce.

Getting pregnant might take 1 night or 3 years to fall pregnant… ignore family pressure as best you can. We were closer to the latter.

As for car, we were traveling to my parents place while work from home, so they could look after the bubs.

We have a Mazda 6 wagon. It was packed to the roof. Babies need lots of things!

Its much cheaper than an SUV of similar size, and uses less petrol/tyres/brakes etc because its a lighter vehicle.

We got the Atenza(top spec), so it has radar cruise, LED headlights(must for night driving), and all the safety bells and whistles that you’ll need when you only have had 4 hours of broken sleep. (It’s saved us more than once).

Wrt. car purchase the 2nd hand market is crazy right now. Either wait until supply improves (~12 months), otherwise I would probably go new, as the prices for a 3-5 year old car thats travelled to the moon and back is not much cheaper!

Cheers Dave.

Good to know. Will be definitely something to look into. Don’t need to carry as much stuff. Usually just golf clubs and the dogs on the back seat. Just never at the same time. So could even end up with a Corolla hybrid.

This is a fantastic comment Chris 👏. I had to laugh at the cleaner part. Mate… if it saves your marriage, it’s the best investment you’ll ever make 😂!

I really would love to get a fully electric vehicle but the technology just isn’t cheap enough yet. I feel we’re 5 years too early 👎

Hey Matt, I like the sound of a Gippsland based FIRE catchup!

I would recommend the Toyota rav4 if you’re looking at a medium SUV, especially the hybrid version

Great update. Thanks for sharing all that you do and hope to meet up sometime. I’m in Melbourne as well and recently married. Definitely understand the pain of those ‘one-offs’ lol. I’m slowly convincing my wife that there’s a different way to live than the usual 9-5. We’re both pretty pragmatic and practical people without too much expenses so we’re making our way there. It’s good to be on the same page about where we want to go.

As for cars, I recently bought a Toyota Yaris Cross and it’s been great so far. Not too large but definitely a bit roomier than a standard hatchback. We’ve got a petrol only version but still has good fuel economy. Grab a hybrid if you can for even more fuel savings.

FIRE meetup in Melb would be sweet!

I can empathise with your lump sum fiasco…. I also made our largest share purchase in Jan right before the dip. I was devastated for a brief moment and then remembered that it will all be fine over the long term.

lol @ Captians ‘rooftop garden’… looks like a potential hydro ‘side hustle’ to feed the portfolio.

Hey AFB!

Thanks so much for this update! I’d really encourage you to think about if you actually NEED a second car? We are a family of 5 and have managed between bikes, public transport and one car. It’s super do-able, good for the environment and the financials! Don’t get trapped into the bigger/better/more trap with kids/families.

We ended up getting a Kluger that seats 5 and has a fold down back row so seats up to 7. This comes in VERY handy as it allows us to manage with one car when parents come to visit or we have play dates or after school activities now that our kids are a little bit older. We also had no problem fitting 3 car seats across the middle row either.

Maybe just something to think about?

That’s a great thought experiment. Honestly, we could get away with just one car… but realistically, it would cause a headache and would probably end up with Mrs FB divorcing me so I’m not sure it’s worth the risk 😅😂

Awesome update as always Matt.

Don’t overlook the Camry hybrid for size of car and plenty of boot space.

I have a 2012 petrol Camry that is still chugging along after 8 years ownership and putting some cash aside to get a hybrid version when it eventually dies.

Great pics from the holidays and Inspire us more and more.

As a family just shy of 50. Inspired us to get our shit together and aim for something useful.

Cheers

Hi Shane,

I have a 2012 Camry Hybrid, agree its really spacious inside but those batteries in the back really eat into the boot space and prevent you from knocking the back seats forward. Im not sure if the newer versions have the same issue or where they store their batteries but its something to check out when/if you do go for a hybrid

I’m still rocking my 2011 Camry Hybrid. Absolutely love it! Runs like a dream over a decade later and it’s really fuel-efficient. The only thing that sucks about it is the boot space (or lack thereof). I should check out the new ones because I’m a big fan of Toyota.

Thanks 🙂

Hi AFB, great work with the updates.

I agree with Shane regarding a Camry. Unless you need more than 5 seats I reckon a Camry is a great option. They are a bit like VAS/A200 – reliable, simple, cheap, hassle free, but will do everything you need (including large boot).

There is an american website called truedelta that has reliability info for a lot of models which is great if you are interested in some reliability data.

cheers

Hi Aussie firebug

I was reading your strategy 2.5 and you mentioned:

“An internationally diversified portfolio consisting of 60% Aussie shares and 40% international

Buying IVV instead of VTS moving forward for DRP and Australian domiciled.”

But I noticed you haven’t bought IVV yet. May I ask why?

I’m new to FIRE so I’m really curious as to why you haven’t switched to IVV yet

Thanks

😊

Sharp eye there Jaikanthi.

I had heard a few whispers online that Vanguard was going to domicile both VTS and VEU in Australia. I don’t want to buy IVV only to have Vanguard turn around and change it. That’s basically it. I’m still waiting on them to do it though 🤔

I really hope they at least re-domicile VTS. I’ve often wished I could swap them for IVV but with no tax implication.

How are Melbourne or Sydney any less sprawling than London? Have you been to Melbourne? 😜 It’s a textbook sprawling city with endless suburbia. It can take well over 1 hour by car, or 2+ hours by public transport to get from one side of Melbourne to the other. I live in Melbourne and I’m envious of the compact size of most European capital cities (London is an outlier really) and the fantastic public transport they have.

True!

But I’m only talking about the city part. For example, I wouldn’t consider Berwick to be in ‘Melbourne’ even though there’s a metro line and it is technically ‘Melbourne’.

It could sometimes take you nearly an hour to get to two places in zone 1 in London.

Hey mate, big fan! I started my FIRE journey about 3 years ago after coming across your blogs and podcast and look forward to new episodes on Spotify.

My favourite podcast was your interview with Nico from Bonusbank which was my intro into matched betting (I no longer match bet, but conservative estimate is $30k net profit over 2 years).

In relation to cars, I highly recommend the VW Passat wagon which is very kid friendly and a very comfortable ride as well. I would even argue that a wagon has more storage and practical than a mid sized SUV when it comes to kids (previously had a VW Tiguan and BMW X3).

Best wishes for the future!

Thanks for the kind words, Joseph.

I’m really happy that you had a positive experience with matched betting! I’ll have to check out the Passat too.

Cheers

You’ve living the life now mate, awesome stuff! Instead of all this interstate tripping around though maybe come over the other side of Melbourne for a Geelong FIRE meetup and see a bit of the Bellarine and Surf Coast while you’re at it! Plenty of great scenery here, then there’s the Otways only an hour or so away and Port Campbell/12 Apostles another hour down the track. Easy long weekend trip!

In terms of buying a car we have two kids and have absolutely no problems with hauling them around in our 5yo Toyota Corolla. Part of the key to this was not having a monster pram, we spent a few hundred dollars more on buying a Babyzen Yoyo and saved ourselves thousands by not having to buy a much bigger car to haul it around. And if you buy a used one then you can save yourself a fair chunk of money by not buying new, and in 5-7 years time if electric cars have taken over you’ll be ready for the switch without paying the premium now.

Spot on with the pram comment.

Some prams take up a stupid amount of space!!!

I’ve had a few people for Geelong hit me up actually… I’m planning on doing a few FIRE meetups this year and Geelong will have to be on the cards for sure.

I concur about the 5-7 timeframe for EV’s. They are JUST starting to really take off atm. Such high entry costs still 🙁

How many kids ares you planning?

2 – pretty much any car will do 2 adults 2 kids, just make sure if you’re taller it’s got enough space (child seats especially baby capsules take up a amazing amount of space!).

3 kids closer together in age or extra people in the car is where it gets interesting.

3 booster/seat/capsules across the back you’ll need a full sIze car.

Otherwise, the smaller cars now are wider than the small cars of old and actually pretty spacious.

As for to get a Tesla or not – just do the sums. Check insurance pricing too. I’ve wanted one for ages and finally pulled the trigger last year on a pre owned model S (means I’m less worried now about that first scratch 😉). Charged the car yesterday off solar, so probably cost me around $8 for the fill… (forgone feed in cost). The S being a hatchback is really flexible on carrying stuff, but it is full size.

Personally – it’s now the daily driver as it’s sooooo cheap to use and I hardly use the brakes at all. And of course the acceleration is fun too 😁

Great points Simon. I’ll get that Tesla one day! Maybe not for a few more years though 😁

Hey there.

With the car – the Toyota RAV4 Hybrid. Amazing and you will save money on fuel with it being half electric.

Also, no amount of sleep-ins now will compensate for the lack of sleep you get as a parent. Someone needs to be honest about this! Ha, ha.

Another great update AFB – the market has been a rollercoaster up and down every day recently!

We’d also love to go to WA or overseas, and I think travel will return to similar conditions as before covid, but we just have to patiently wait it out.

For cars, I can also vouch for an i30 – have used it for my 2 kids (4 and 2.5). It fits everything we need, except when the kids were younger and we’d go on holidays (both to the airport or driving trip) where you will struggle because of the amount of baby stuff you have to lug with you. In those cases, we borrow a bigger car. Just make sure the pram you get fits the boot, they can vary quite a lot when folded. The boot is quite deep and even with our double pram a lot of other things can fit if stacked properly. The rest goes in the rear footwells. Now the kids are bigger it’s even easier with the i30.

I too contemplated upgrading to an SUV or wagon but we just never felt a strong need to. The kids regularly make a mess of the car, my wife is an inexperienced driver and has had a few gentle scrapes, so I’d rather just keep beating this up until the need for a newer, maybe bigger, car is stronger. Also in Sydney it’s great for fitting in tight parking.

Hope you have a great month ahead!

Might want to check any IP/life/TPD insurances you have regarding mountain biking if it’s something you are going to do more of. ALthough I think if you take it up a long time after you take out the insurance, and had no intention so f doing it at the time of acquiring the insurance that is ok.. not really sure, possibly depends on the insurer. I just know that taking out new insurances is difficult/options are limited if you are a mountain biker.

Good point Elise. I’ll be sure to check up on it

I bought a new Hyundai i35 in 2012 when my kids were little and I still have it, although I think it’s called Tucson now. Very reliable car and big enough for a pram and all the baby gear.

Prior to that I had a Toyota Kruger, which is another good one to consider.

Auto correct just got me and of course it should read Toyota Kluger 😜

Thanks for the update AFB, I have been bemused that most of the comments responding to your update have been advising on cars for you and Mrs FB to buy, rather than commentary relating to the dip in the markets just after you dropped the >$200k in.

By the way, did I miss the article on your debt recycling strategy that you promised in some previous Net Worth Updates as I was really looking forward to reading it?

Keep firing!

Ha! That is funny now you’ve mentioned it.

Debt Recycle is coming I swear… just have had a bit on lately

Hey FB,

Any chance of you firing up the Debt Recycle article?

Thanks,

Rex

Subaru Forrester or Outback. Subaru’s are great reliable cars with 5 star ANCAP ratings standard

I will second the Forrester choice. Ours is 5 years old and has not missed a beat, Subaru are very reliable and safe

Hi FB,

I have been following for a little while, thanks for the content and congrats on your journey to date!

I am keen to nerd out on Excel for a moment – how do you set your data up in your Net Worth ‘Stacked bar Graph’? I noticed that this graph is not in your Net Worth Sheet that is emailed.

Thanks

Hi Aaron,

Are you referring to the stack bar graph on the website?

Hi FB, the stacked bar in your monthly Net Worth updates.

With Assets and Liabilities

Hey AFB,

Long time follower!

Glad to see you visited Tasmania but you missed the north, definitely worth another trip down at some point.

However, a trip to the hanging garden is always worth it 😉

Thanks for another great update mate

I highly recommend a Mazda CX-5! I bought one a year ago and am so happy with it. Really reliable and nice to drive, also cheap to service and has plenty of space.

Jeep Grand Cherokee MY14 onwards are good value, alot of bang for your buck, able to tow, can carry 4 adults with ease about $20k cheaper then any equivalent toyota or mitsubishi. Best mum car we ever got.

Get a Diesel if you do a bit of driving and petrol if its around town.

They all come mated with a 8 speed transmission which is really good on fuel.

Parts can be a killer if you buy in Aus, usually just order direct from overseas for half the price.

Toyota rav 4

Cheap to run

Very reliable

Good space

Great resale

Good luck