I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

A very quiet March for us this year.

We had one of our best friends tie the knot and I’d almost forgotten how much fun big weddings are 🥳 . The wedding was originally scheduled for 2020 which was when we were overseas, so one of the small benefits (for us 😜) of Covid was that the date was pushed back due to the restrictions. We were incredibly lucky to pull off our destination wedding last year but so many of our friends had to delay/push theirs back. I’ve heard that some of the more popular venues have a backlog of more than 2 years 😱. It’s pretty incredible how Covid has affected so many different industries in different ways.

Another thing that’s been on my mind this year is buying a new car. I know I’ve spoken about it but I’m in a real dilemma of choosing a cheap reliable petrol car that will get the job done or waiting a tad longer to splash out a bit on a new EV (electric vehicle).

This decision is partly financial and partly wanting to join the EV revolution that I think is just beginning.

I’m just guessing here but I reckon fossil fuel cars will be dead by 2030. Petrolhead enthusiasts might still be buying them but just look at the trend of renewable technologies. Solar, wind, thermal, storage etc. are all getting better and cheaper and it’s only a matter of time before it makes sense financially to make the switch. It’s already happened with solar panels and with the amount of new EVs being produced each year, batteries will surely be joining the party soon.

There’s a premium to pay at the moment but I just love the self-sufficient concept of electrifying as many things in your life as possible and harnessing the energy of the sun.

Some car manufacturers are also talking about a Bi-directional charging capability for new EVs. So in theory you could charge your EV at home during the day from your solar panels and use some of the battery at night to power your house. Your car could double as a home battery when you’re not using it. I think this could have enormous potential for old degraded batteries that aren’t suitable for cars anymore. Imagine if you could recycle old degraded car batteries into a home storage solution! But I’m no electrical engineer and there might be technical reasons why this is hard to do/impossible so we’ll just have to wait and see.

Regardless, the potential of EVs is exciting to think about and maybe there will be some kick-ass rebates in the not so distant future.

I’d love to know if you’re stuck in the same predicament and what your thought process is in the comments below 🙂

Net Worth Update

The share market bounced back which was the main contributor to our gains this month.

But the big news from March was our purchase of Bitcoin.

You can read about our decision in this detailed article here, but in a nutshell, we bought Bitcoin for three reasons:

- I’m personally interested in this technology and get joy from seeing how it works and participating

- Speculative play. The value proposition of Bitcoin is favourable IMO

- It’s a vote for a more democratic financial system

There was some talk about the energy consumption concerns of Bitcoin that I didn’t address in my article. And that’s a fair point which is ironic considering how pro-renewables I am.

I posted the below on Facebook which basically sums up how I feel about it:

Bitcoin uses a lot of energy, no getting around that. But what about the energy the current system uses?

Here is a study that suggests that the banking industry uses twice as much.

We still need to address how crypto is powered but most people gloss over the inefficiencies of the current system it could one day replace.

Maybe the energy concerns will be the downfall of Bitcoin, who knows?

But when was the last time a new technology that offers a better solution to a current system was not adopted because it used a lot of energy? And if the report is accurate, it actually uses less than half of the energy it takes for the current system to run anyway! I understand that you can’t really compare the current financial system to Bitcoin just yet but surely you have to acknowledge that the modern-day banking industry uses a shit load of energy to keep the lights on.

Bitcoin (or another cryptocurrency) could offer a superior solution in the future for less overall energy and I think it’s important that the naysayers keep an open mind with regard to this point.

Also, for the pro-Bitcoin/crypto people out there in the FIRE community. For the love of God, can we stop being so bloody aggressive in the comment section when people have valid concerns about this new technology?

It pains me to see how cult-like some of the responses have been. Especially when someone is clearly just trying to learn a bit more.

Dismissing questions and concerns with “WRONG” or “You just don’t get it, HFSP lol” doesn’t help anyone. In fact, if you can’t explain the reason why you bought Bitcoin or another crypto, odds are you’re only buying it in hopes that you can sell it for a profit later.

One of the FIRE community’s greatest strengths is explaining financial concepts in an easy to digest manner.

$12K of Bitcoin has joined the fold.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Another high month for the blue line.

Shares

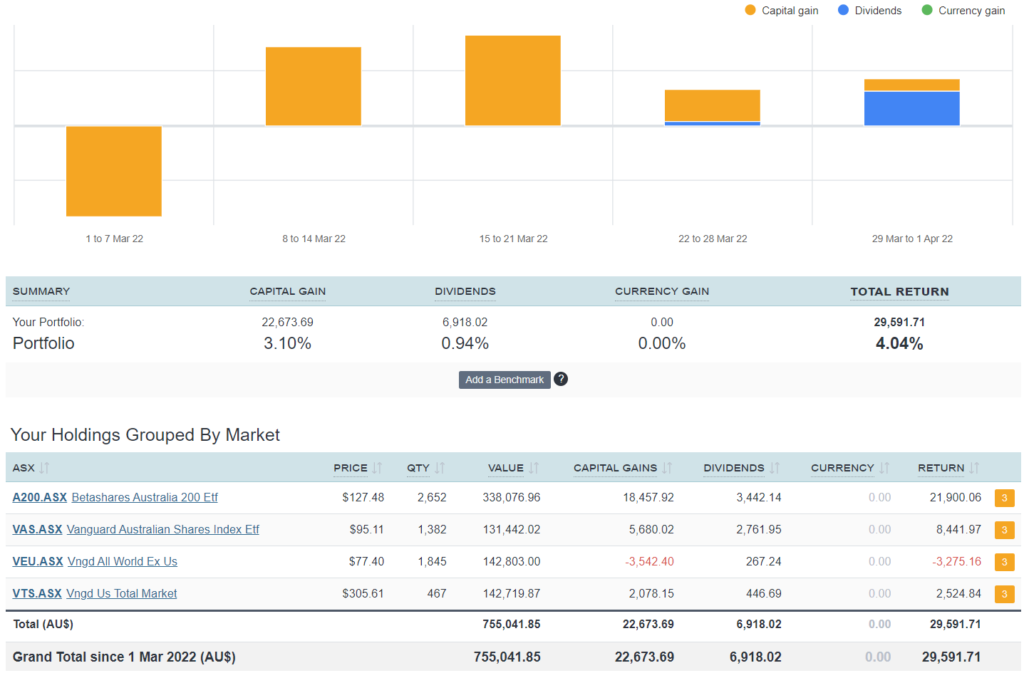

The above graph is created by Sharesight

No new shares in March.

Thanks so much for your regular, inspiring updates. The bitcoin addition will definitely continue to be a major talking point!

Btw I think you might need to update your sharesight image – it looks like it’s from Feb?

Good catch. I’ve just updated the Sharesight image for March 👍

Can I just ask how did you wealth increase $31.7 k in a month? I could only see ~$600 in. share price gains and ~$2,600 in investment income. I think I am missing something? Did your house price or super increase in value? I am interested in your FIRE strategy 🙂

Hi Martin,

I forgot to update the Sharesight image in this update. I’ve edited the article and now the correct image is showing.

Great to see the updates continuing!

Strongly agree with you comments on Bitcoin – if you’ve bought it, you should be able to articulate why – even if it is for more speculative reasons.

And it’s okay for that thesis to be tentative, we’re only about a decade or so into its life.

💯!

I get concerned about news article suggesting petrol vehicles will be banned in the not too distant future. I like in a high density suburb and part on the street like many others. No extension cord will be long enough for charging and I don’t fancy queueing for hours at a charging station. I’m hoping that before the plug is pulled on petrol cars the infrastructure around community charging, battery charging time etc will be solved. Perhaps future vehicles will have an easy to change battery so it will be one-out, one-in and we can charge the flat one in our homes or garages.

I don’t think they’ll ever ban petrol vehicles… it will just get to a point where it’s going to cost a fortune to buy and drive one IMO.

Spot on, electric is coming but other options will remain. There are even synthetic fuel plants being invested in right now so petrol cars will have green alternatives. As these are made from electricity, they will be more expensive than EV. Porsche has said only 80% of its future models will be electric, some will remain combustion engines and they are investing in a synthetic fuel plant.

Future fuel options for vehicles are likely to be: Electricity, Hydrogen, Ammonia (for heavy transport trains and ships), and synthetic fuel (carbon free petrol).

https://www.gov.uk/government/news/government-takes-historic-step-towards-net-zero-with-end-of-sale-of-new-petrol-and-diesel-cars-by-2030

Never say never!

Aussie has some geographic problems uK doesn’t. (population density, size) even so, a give the EV tech time to develop and up the carbon footprint ante, and anything could happen

Petrol cars sales have already been earmarked to be banned in many countries. Norway is leading the charge with this with 90% of new cars being EV & ICE cars sales to be banned by 2025. Things will happen a lot faster then a lot of “industry experts” believe. Be careful where you get your information. Also, it’s important to know from previous comment above (sounds like more misinformation) that Tesla super chargers around the world take about 10 minutes to charge about 250 miles. For people living in the city with no where to plug in overnight & only drive around the city will prob only have to charge once a week & doesn’t take very long. Tesla is the leader in every aspect of EVs so please be careful with your research as oil industry pays a lot of money to journalists for writing misleading articles.

I haven’t seen anywhere that is going to ban petrol cars in the foreseeable future – but lots of European countries are banning new petrol car sales in 2030 or soon after. This is often framed (or with dodgy headlines) so you think you’re going to have to throw your petrol car in the bin! There are also heaps of cool things being worked on such as charging pods that hide away in the footpath or wireless charging.

On the topic of EV’s and home batteries… Matt, there’s already lots of work being done around repurposing EV batteries for home use. Once batteries are too degraded for vehicle use they still have more than enough life for home use. The rate of delivery a car needs is so much higher (think ~70kW versus ~7kW if you turn every single thing in your house on at once, otherwise more like 3-4kW) and I’d expect in the future most EV batteries will be ‘recycled’ to home or grid storage. Definitely check out Fully Charged Show on YT if you want to explore more EV and related tech.

It’s pretty common for inner city suburbs to have a fair bit of high density housing, so I’d be very surprised if this didn’t get taken into consideration when it comes to working out where charging stations need to be placed. Also, many shopping centres have charging stations now, and as the take-up of EVs grows it’s likely that they’ll install more. I think we’re also likely to see workplaces install them as well.

Just curious the update says – No new shares in March and Sharesight has $600 of Cap Gains, but the rolling networth has 30K Shares?

Is 2.5K Super employer contributions for both of you monthly, or employer, plus personal, plus CG?

“$12K worth of Bitcoin comes into the portfolio, $30K Shares, $2.5K Super”

With an ev. I recommend the Nissan leaf it has a new technology called ev to grid. This means you charge your car by day using your solar panels and then use the car battery by night to power your house. This is much cheaper than a Tesla power wall. The technology is in the process of being approved for the electricity grid in Australia. Once this is up I will be in. You can read more on the Web search ev to grid.

V2G requires a bi-directional charger and the only approved bi-directional charger in Australia at this time is Wallbox Quasar, which is being brought to the Australian market by JET Charge. Retail pricing hasn’t been confirmed yet but they’re expected to cost around $10K. The first batch of Quasar’s arrived this month but the allotment was gobbled up by commercial customers running trials for VPP, etc.

Yes, it is around 50% cheaper than a Tesla PW2 and gives you access to the 40kWh/62kWh battery of the Leaf/Leaf+ but it is still a big chunk of coin and as for any residential battery storage, on a pure financial basis they rarely stack up. Yet.

If you use 15kWh overnight at 26c/kWh, it would save you $3.90/day and take you 7 years to recoup the $10K it will cost for the charger alone. On top of that you need to factor cost of capital and degradation of the Leaf’s battery life, which will greatly affect re-sale value.

As an alternative, you can install a much larger solar system than you need to rack up enough FIT credits to offset your overnight power usage.

The Sharesight image was wrong I’m afraid. I’ve updated it now to the correct one

Regarding the ‘cult’ comment for BTN fans, i would add there’s also cult worship among FIRE people towards ETFs. Sure, they’re perhaps a good place to start, but FIREees shouldn’t rule out direct investing. It’s quite a dogmatic community. You’re only one of a few I still follow, i think Fire can be a negative space. I enjoyed the chat with your wife, she should come on more!

Eyyy this is a good point! People just love to make a cult out of something lol. Generally speaking though, I’ve found the crypto communities to be less forgiving to newbies. That’s just been my experience though.

Hi Firebug – a question, and maybe you can’t answer. You mention expenses of around $6500 this month and about $2500 investment income. How many days are you working and how much do you earn? If you can’t answer because you’re already saying a lot, no prob 🙂 Just curious as I’m living on a very tight budget in order to save like you guys

Re Bitcoin, i missed that article. I can understand, Bitcoiners are always DMing me on insta haha..

Hey AFB! Just curious, your investment income is around $2,500 every month, but the dividend returns were almost $7,000 in March. Is the $2,500 the part of the dividends you are drawing down for expenses and the rest is reinvested? If not, where is the $2,500 coming from and is it actually being used for your expenses?

Per the FIRE graph where the ~2500 is quoted “*Investment income is simply 4% of our FIRE portfolio divided by 12”

I’m working around 3 days a week atm at 7 hours a day. I earn $120-$150 an hour depending on which project I’m working on.

RE: BTC… as a data/tech guy I had a feeling you probably already had some BTC floating around and held off because of all the above mentioned reasons about people playing in camps, it is sad to see but it happens. I similarily hold a small percentage and even sniffed around at mining in 2015/16 (funny to think what could have been) and to this day avoid almost all conversations about Bitcoin with just about everyone.

I am curious as to your approach and if you have any concerns in regard to asset protection.

– Will you approach BTC purchases in a systemic fashion similar to regular ETF buys (eg: not care on price, chuck in your DCA monthly)? If so would you buy more regularly in smaller amounts to smooth out the big waves that come with volatility?

– Are you a hardware wallet/cold storage kind of guy or will you be using a custodial/hot wallet like the native one provided on an exchange like Swytfx? Reason I ask is at smaller amounts I feel like this doesn’t concern people that are dabbling, but I’m wondering as the cash value becomes sizeable would you have concerns over the exchange folding and things getting murky if you aren’t using cold storage? The whole ‘not your keys not your crypto’ thing… it kinda just reminds me of CHESS brokers vs custodial micro investing apps but with some added spice.

Interested to hear your thoughts

Great questions.

1. We have allocated 1% of the portfolio to BTC and will top up if needed each month. Some months we might need to top up, but if there’s another surge I doubt we’ll have to buy for a good while.

2. I feel like the exchanges have matured a lot in the last couple of years (this could bite me in the ass one day haha). I have around 70% of our coins in the exchange and the rest in another wallet (Exodus). That’s it for now. I’m curious to hear your thoughts on this mate.

Hi AFB,

Thanks for the update and congrats on the entry into Bitcoin.

Just drove home from Ballarat to Adelaide and threw on the Podcast with Mrs FB.

Me and my 15 yo son enjoyed it, he was intrigued that 30 somethings could be working part-time!

Anyway, your podcast created some good discussion in the car given he has $62k in shares and earns $2.5k in dividends pa reinvested.

Sorry to say it also sent my other half to sleep in the back (which isn’t a bad thing….)

Anyway, I’m still waiting on the Debt Recycling article, is the ember still lit or has it been extinguished???

Yoooo!

I’m glad to hear the young fella was intrigued 😁. And damn, $62K in shares at 15? He’s might reach FIRE before 20!

I’m working on the DR article today. I just have to tee up the podcast and it’s a wrap… so there’s a 90% chance it drops in May. It was meant to be April but my freelance business went into overdrive so a lot of AFB content has fallen to the wayside.

Of the net worth $1,040,491, how much ball park actual money put in ?

That’s a great question and I actually want to do a proper article about it… but just off the top of the dome… I’d guesstimate around $510K cash in. The rest being returns

“Here is a study that suggests that the banking industry uses twice as much.”

Careful not to align with the crypto-bro whataboutism logical fallacies 😛

The banking system provides actual value to humanity, Bitcoin/Crypto does not. If it were to disappear tomorrow, no major societal system or construct would be impacted. On the other hand, imagine if humanity lost access to electricity services tomorrow. Now that, would be pretty impactful/jarring to humanity.

And this is fundamentally where we disagree.

Everyone that complains about Bitcoins’ energy consumption is basically making a value judgement.

Is the Bitcoin network’s electricity consumption an acceptable use of energy?

Ultimately the answers that anyone gives to that question depends on their beliefs about the utility of bitcoin.

You don’t think it has any value, I disagree.

When I bought my current Mazda 3 in 2007 (new) I promised myself I would hang on to it for at least twenty years before considering another new car (which will likely be the last car I ever own, given my stage of life).

With five years left to go on that promise, and the moves towards EVs / HPEVs, I’m now thinking I’ll keep the Mazda for as long as possible while manufacturers build up their ranges and (hopefully!) prices come down due to competition and just not being the new kid on the block any more. I’ll be happy if it lasts me until around retirement, which is still at least 8-12 years away, depending on how my super performs. It may also depend, though, on what starts to happen with trade-ins, as I can’t see manufacturers wanting to take a trade-in on a vehicle that can’t then be resold.

That’s a good move IMO. The competition for EV’s has just started to pick up. A lot of car manufacturers were waiting to see if electric really was the future. I’m pretty sure we’re past that point now with a whole bunch of EV’s hitting the market over the last 18 months from all sorts of brands.

Hi AFB,

Great article again! you seem to be in a great point in your life now with a great work life balance, and the recent podcast with Mrs AFB sounded like you both were starting to reap the rewards – so kudos!!

Just a quick question, why don’t you include Super in your Fire Portfolio number? Super in general seems to be an afterthought for a lot of people but its basically a DCA into low cost ETFs (but in a tax friendly environment).

Dave

(bonus question – is the EV cult the next BTC cult?)

Thanks Dave!

We don’t want to do the drawdown strategy until we hit our preservation age. So Super is just a bonus for now. As we approach our preservation age we’ll most likely pump more into Super but for right now, we’re building the portfolio that will fund our lifestyle outside of Super.

I think the adoption of EV’s is going to be a lot more straightforward than crypto IMO. It’s going to get to a point where it’s cheaper to buy/run an electric car over an X timeframe. People will migrate over just to say money. BTC’s adoption has many more variables not to mention how disruptive it is to the current system.

thanks for the reply, just one comment/response regarding “Super is just a bonus” – i think you should have a read of https://www.aussiefirebug.com/?s=calculator clever bloke over there has prepared a calculator showing how to mix in and out of super investments to RE earlier (lol)

To be honest i think your current work/life balance is the optimal one, couple of days work to keep the mind active and sharp but enough time off to enjoy life, you might never retire if you keep enjoying things as they are – a little ironic

😂 cheeky!

The 2 pot method means you have to draw down the first pot which isn’t something we want to do. It’s a different story if we were older. Because we were so young when we started, the number we needed in our outside Super pot was pretty close (a few hundred thousand dollars difference) to our FI number anyway so we just decided to reach FI outside of Super altogether. It wasn’t the most optimal way to do it but I think it’s pretty reasonable.

And I don’t consider the RE part of FIRE to mean never working again. I’ve always associated it with doing work that brings meaning to your life. It doesn’t matter if it’s paid or not IMO.

Everyone’s interpretation of RE is slightly different.

Hi AFB,

Noticed that you own about twice as much A200 as VAS (~200% by quantity or ~250% by $ value), but the dividend payout for A200 in March was only ~25% more than the VAS dividend, even though both are fairly similar.

Why do you think this is?

A200 is a newer fund. Check this thread out.

Hi AFB,

I discovered this site recently and must congratulate you on staying true to your passion project through all these years. First of all, great blog with “actionable” tools. I feel that the consistent “transparency of your own progress” can help readers turn this into practical actions. I must add that what I found most useful was to track your journey with the blogs featuring your thought process through each stage of the journey. Interesting and useful to the say the least and a far cry from the tsunami of get rich quick (BS) abundantly present on the internet that promise 180 degrees of life change through a 2 hour webinar – LMAO

Now, getting into the finer details, I’m very interested in how you hold both VAS and A200, with the latter growing exponentially (in your portfolio) over the past couple of years. I had to dig through previous updates and discovered that you started moving towards A200 in July/August 2018. At the time you cited the MER comparison where A200’s 0.07% was half the cost of VAS’s 0.14%. It appears Vanguard has since slashed VAS’s MER to 0.10%, however you continue to hold both nearly 4 years on !!!

Any particular reason for this? With a 3 basis point difference in their management fee, and a 66.66% overlap, what is the reason for holding both? Is there a major difference in how the top 200 Australian companies pay out dividends compared to the top 300? Keen to know your thoughts. Cheers.

Uz

It probably doesn’t matter to hold both, and Firebug might have capital gains considerations and transaction costs to factor in.

Personally I don’t invest in Australian ETFs like A200 (what’s the point?) but for some busy people it can be nice to set and forget.

Thanks for the kind words Uz.

As you’ve stated, I originally switched to A200 because it was a lot cheaper but honestly, with the why fees are going, there’s a decent chance that both funds end up MER so small that it won’t be relevant to us in the coming years.

The overlap doesn’t affect performance so we’re happy to hold both plus I kinda like spreading the management risk between two companies instead of just one.

And that’s about all there is to it 🙂

Your article about power consumption of the banking industry v crypto is very misleading. In todays world I think it should be labelled “fake news”.

Bitcoin processes 230k transactions per day, VISA alone process about 150 million transactions per day. If bitcoin were able to scale up to that number (it can’t with current tech) then it’s power usage would be off the charts compared to VISA so please don’t fall for that argument it is so clearly false and a blatant attempt to persuade the gullible.

There is a lot of interesting tech in crypto, mostly in Ethereum and other smart contract networks, and I am closely following their migration to Eth2 with Proof Of Stake consensus, which dramatically reduces power consumption and allows staking your tokens to earn interest which for a FIRE advocate like myself is very appealing.

Which token wins in the long run I do not know but I refuse to buy any crypto based on Proof of Work, as by design it is an incredibly inefficient technology that consumes vastly more power than existing technologies.

It wasn’t my article Adrian. It was a research report that did a bloody good job (IMO) of addressing bitcoin’s power consumption concerns.

What part of the report do you actually disagree with? They provide sources for their data. Do you disagree with their conclusion or are you questioning their datasets?

You say the PoW is incredibly inefficient by design but I’m wondering if you read the report? Because as it points out, that’s a feature of the bitcoin network, not a bug.

As per the report:

You’ve also mentioned transactions and scaling but I’m not sure you understand how bitcoin’s transactions scale compared to the traditional banking industry (that’s the impression I got with your example, if I’m wrong then I apologise). Luckily, this too was also addressed in the report.

I haven’t researched Ethereum as much as Bitcoin but it too sounds like an exciting piece of technology. I’d love to learn more about it and the PoS consensus if you can point me to some good resources 👍

Cheers

“Because as it points out, that’s a feature of the bitcoin network, not a bug”

A really inefficient algorithm is a feature not a bug therefore it is ok to waste heaps of electricity?

POW works basically like a race, a bunch of computers all race each other to solve a problem (validate a block). The one that solves it wins, all the others effort (power consumption) is thrown away, completely wasted, spewed as heat out into the atmosphere.

The “feature” of this is that it is quite secure as it uses so much power that hacking it would be too expensive. The “problem” with this is that you could achieve exactly the same result with one computer accepting the block and marking it as valid as long as you were willing to trust that computer. POW trades efficiency for a lack of trust. It may be secure(ish) but it sure is expensive and bad for the environment.

“Bitcoin’s energy consumption scales not by transaction count, but by network economics”

That sentence is nonsense. Bitcoins energy consumption scales exactly in line with how many computers are competing in the race to solve the block. The problem is Bitcoins transaction system cannot scale. The blockchain is a linked list, each block must go on the end of the list and only then can the next block be added beyond it (as each block cryptographically links to the previous block). There are only so many transactions that can go in a block and it takes about 10 minutes to solve the race so you basically have a fixed number of transactions per hour that is possible no matter how many computers you throw at the network. This is why transaction costs for bitcoin are so enormous, there is no scaling ability.

If I am buying a coffee in Sydney with bitcoin, that transaction has to go into a block and be raced for by ALL the computers on the network before my transaction is actually validated. So a computer in Sydney and New York and London all have to know about the transaction and race to validate it. VISA on the other hand can set up regional authentication servers, so when buying a coffee in Sydney between 2 banks in Sydney the transaction doesn’t have to be processed by a VISA system in London or New York.

Etherium’s POS system is attempting to solve this by allowing multiple blockchains at once and various other mechanisms which aren’t working yet but have promise.

In my opinion Bitcoin just isn’t it. Its old tech, it’s very inefficient and the only reason people like it is because the line goes up.

Isn’t this the whole point of Bitcoin though? To transfer value from one user to another without the need of a third party?

You say it’s inefficient, others would argue that it’s the price to pay for a truly secure decentralised network.

Many systems have inefficiencies but that doesn’t stop them from being valuable. If you’re arguing about the utility of Bitcoin and its network, well, that’s a different argument.

Mate, I’m honestly not trying to be a smart ass. But you’re literally agreeing with the research report – Bitcoin doesn’t scale by transactions (which was the example in your original comment), it scales by network economics (or by how many computers are on the network trying to solve the problem as you put it).

I’m interested in learning more about ETH though. Can you please point me in a good direction so I learn more?

Security via Bitcoin

Scalability via Lightning

You can use Lightning already at Sydney airport to buy a coffee instantly

Ethereum will cost you $20 transaction fee atm on top of the coffee price.

Ethereum is entirely different network effects and is basically the worlds computer doing millions of tasks (txns) daily.

It’s like a Sass product. pay per use.

Still valuable and holds value but it’s not a Apple to Apple comparison they are designed differently as a feature.

Hey AFB – just wondering if you’re going to do a post on your debt recycling for your PPoR (if this happened – you mentioned it in a article when you purchased your house)? And how much of your PPoR debt is tax deductable? Thanks!

About half of our PPoR has been debt recycled. The article is coming I promise. I got smashed in my freelance business in April that’s all.

Can you please explain how you your networth improved so much ie 7k divedend and 22k capital gain. I am really confused and would love to learn more about how that worked? I’m newish here and Love your what you do with your website and podcast.

Hi Jane,

The majority of our gains in this update came from the stock market (including Super).

Our shares rose in price and we also received dividends.

Does that answer your question?