In the middle of 2017, a colleague of mine asked the entire IT team if they wanted to buy some Bitcoin. He was pretty into it and had been explaining to us how it all worked. The conversation went something like this:

“Hey guys, my friend is buying some Bitcoin and if you want him to purchase some for you then now is a good time. I can set you guys up with your wallets and everything and then we can transfer some Crypto to each other and I’ll show you the transaction on the blockchain. You guys in?”

Now you might think I’m a sporty outgoing personality type (which is true) but at my core, I’m a massive nerd 🤓. And although I had been reading about Bitcoin for a few years I was still very much intrigued by the blockchain technology that powered it and I wanted to see for myself what all the hype was about.

So nearly everyone in the IT team bought $100 worth of Bitcoin in September 2017 when the going price was $4,763 AUD. I was rather unimpressed that there was a $5.50 transaction fee (5.5% of the investment!) just to buy the bloody thing so I only ended up with ~$94 bucks worth which at the time was 2% of a Bitcoin.

This was just a bit of fun to see how it all worked. We bought enough to muck around, but not enough to move the needle… or so I thought.

The 2017 Boom and Bust

The next few months were crazy!

We would come into the office each week and the first point of call was talking about the price of Bitcoin. It was skyrocketing!

Our $94 turned into $150 in a mere matter of weeks. And then $250, and then $450. We all had a laugh that this was our ticket to early retirement (they didn’t know about my blog 🙈) and we were only a few weeks away from buying a Ferrari.

Bitcoin peaked on the 16th of December 2017 at $25,506 AUD and our initial investment of $94 dollars had turned into $510 in less than three months.

Now I understand that it wasn’t a lot of money because our initial investment was so low but the return on investment was out of this world. Everything is hard to quantify if you don’t have a point of reference. I understood that even though we only made ~$400 bucks, the rate of return over that short period of time with zero effort was likely never to be repeated again in my lifetime.

And then came the crash…

Our tiny slither of Bitcoin which was valued at $510 in December 2017 plummeted back down to earth and bottomed out at $96 dollars a year later in December 2018.

This was my first taste of the Bitcoin rollercoaster everyone talks about.

Post Crash and General Feelings

A few of the guys in the team had actually sold their Bitcoin at around $450-$500 which was pretty much the peak in 2017 so they were very happy.

But I never had any intention of selling mine.

First and foremost, I was curious about the tech. However, I had a lot of reservations about the practicality of Bitcoin as a currency and if I’m being honest, I didn’t really think it was going to take off. I kept racking my brains on what problem Bitcoin was actually solving for me as an Australian. I understood the utility of this Cryptocurrency for other countries where the government was freezing accounts. And there was definitely a utility for criminals to send and receive value anonymously. But I could do everything I wanted to do with Australian dollars almost just as quickly as Bitcoin and with fewer fees.

I just couldn’t see this thing taking off.

I didn’t really understand what Bitcoin was back then. What it could be and what it represented.

But I had this hunch that it might be worth holding onto moving forward and the worst-case scenario meant that I’d lose my initial $100 bucks… not a big deal.

If I’m being honest, I was actually hoping Bitcoin and the other cryptocurrencies would eventually disappear. I was receiving a fair few emails from readers asking me about it and I originally just thought it was a Ponzi scheme. No intrinsic value, hardly any utility for Australians, high transactional fees etc. It also seemed complex and I couldn’t be bothered learning about something that I thought was going to be a relic of the past within a few years. I never included my tiny amount of Bitcoin in my net worth updates because I didn’t want any more emails.

But crash after crash Bitcoin continued to rise from the ashes to reach new heights.

This new ‘thing’ just wouldn’t stay dead…

Down The Rabbit Hole

The biggest turning point for me to do a deeper dive into the world of Bitcoin was when it surged again in late 2020. I was personally getting a lot of requests to do a Crypto podcast as well as a bunch of threads popping up in the FIRE Facebook group.

It was around this time that I read Why I’ve Changed My Mind on Bitcoin by Nick from the ‘Of Dollars and Data’ blog. I really value Nick’s commentary and that article really cemented the idea that there might be more to this Bitcoin thing than meets the eye. If Nick was writing about it, it was worth another look.

I decided to commit to educating myself on Bitcoin so when I eventually booked an expert on the podcast, I didn’t sound like too much of a n00b.

A quick side story….

I actually was in communication with Alex Saunders from Nugget news about coming on the podcast. He was one of the most recommended Australian authorities within the Crypto space and had built up a huge following online. Everything looked legit so I sent him a few emails. I nearly fell off my chair a few weeks later when my mate sent me an article that said Alex was being taken to court for potentially millions of dollars owing to his community 🤯.

Holy cow. This Crypto space was like the wild west.

Another name that kept coming up was an Australian who was living in the US, Vijay Boyapati. Vijay wrote the very popular book ‘The Bullish Case for Bitcoin’ and was very good at articulating his ideas during interviews. I reached out to him and he agreed to come on the podcast last year.

His book really changed what I thought I knew about money.

The mistake I made when I first came across Bitcoin was that I didn’t know the history of money. You need to really understand how money came about in the first place to give you the context of why the invention of Bitcoin was a game-changer. Explaining this could be an entire blog post on its own (or maybe a few posts honestly) but if you’re interested, Vijay’s book is a great starting point.

The history of money is more of a psychological deep dive into how humans interact and trade with each other. It’s super fascinating stuff and it challenged some core beliefs I had previously.

I started watching Michael Saylor’s videos on YouTube and I really enjoyed the ‘Decoding Bitcoin’ series from the Australian podcast The Passive Income Project.

The more I read, the more I realised how little I understood about money. I know a decent amount about how to become financially independent, but the mechanics of where money came from, how it’s created and why it works is an entire discipline.

Risk vs Reward

For me personally, the risk-reward proposition for a small amount of Bitcoin is quite attractive.

And it’s for this reason that we have now allocated 1% of the portfolio to this new asset class (we currently have around $12K of Bitcoin). And I’m seriously thinking about upping that to 2% in the future but let’s start with 1%.

This is the way I look at it – the worst-case scenario is that Bitcoin becomes worthless and we lose 100% of our investment. It’s only 1% of our portfolio so while I don’t like wasting money, it’s not going to ruin us financially. The upside for this investment however is unlimited.

I don’t know what’s going to happen in the future but I’m fairly confident that Cryptocurrencies are going to play some sort of role in our financial lives moving forward. I don’t know if Bitcoin will be the dominant player in 15 years but it’s the horse I’m backing for now.

I was very close to spreading that 1% across the other top 10 Crypto (by market cap) but I’m just not as educated on them and lacked conviction.

I think Bitcoin has a major ‘first mover’ advantage with its network but its crowning jewel is the decentralised nature of the protocol. I’ve read that other Cryptocurrencies are not decentralised and there are actually a few people at the top running the show. From my understanding, the whole point of using blockchain technology is to be decentralised. If you want to create an app, community, new system or whatever and it’s not going to be decentralised, you’re much better off using traditional technology with a normal database. That would be a lot more efficient as the processing power required to run the blockchain can be quite high.

I’m not an expert though so please if I’ve got this part wrong, let me know about it in the comments. Why would you use blockchain tech if whatever it was you were building didn’t need to be decentralised?

End Goal

I’ve used the word ‘investing’ a few times in this article but I’m hesitant to call anything to do with Bitcoin an ‘investment’.

I’m not even sure I know what to call it.

It’s not really investing but I think it has graduated past gambling at this point. There’s definitely a heavy amount of speculation but every investment in history has had some degree of speculation by definition.

It’s now possible to generate an income from your Cryptocurrencies but this isn’t something I have experience with so I can’t comment on the practicality and risks associated with staking.

The way I see it, we have two potential scenarios that can play out:

- Bitcoin succeeds and is adopted worldwide

- Bitcoin fails and becomes worthless

The goal is scenario 1.

We don’t have any intention of converting our Bitcoin back to fiat currency. This technology either works or it doesn’t. And if it does work, we should be able to use our Bitcoin for future purchases.

It’s more of a store of wealth than anything. Of course, I want the value of Bitcoin to go to the moon now that we own some. But the main strategy behind this purchase is for us to be able to actually pay for future expenses using this Bitcoin.

Think of it like money that buys more the longer you hold it. An interesting concept given the current rate of inflation.

This is different from our shares portfolio which is being built to generate passive income for us.

But Why?

If I’m already living a great semi-retired life and am on track to reach full financial independence within the next few years – why bother with Bitcoin at all?

That’s a great question!

There are a few reasons

- I’m interested in the technology and personally get satisfaction from participating

- I’ve concluded that the upside of Bitcoin succeeding far outweighs the downside of it failing given a small allocation within our portfolio

- It’s a vote for a better system

Points 1 and 2 are pretty self-explanatory but I want to expand on point 3.

When I was trying to think of the utility of Bitcoin back in 2017 I didn’t really understand how inflation worked and how it is used by the government.

I’m not an expert so I’m not going to try and pretend to know all the complexities of our current financial system but it doesn’t take a rocket scientist to know that inflation is rising in Australia. Your dollars are buying less each year even factoring in wage growth.

One of the main problems with the way our democracy works is that politicians are incentivised to be shortsighted. They are constantly slapping on band-aids rather than actually fixing the problem.

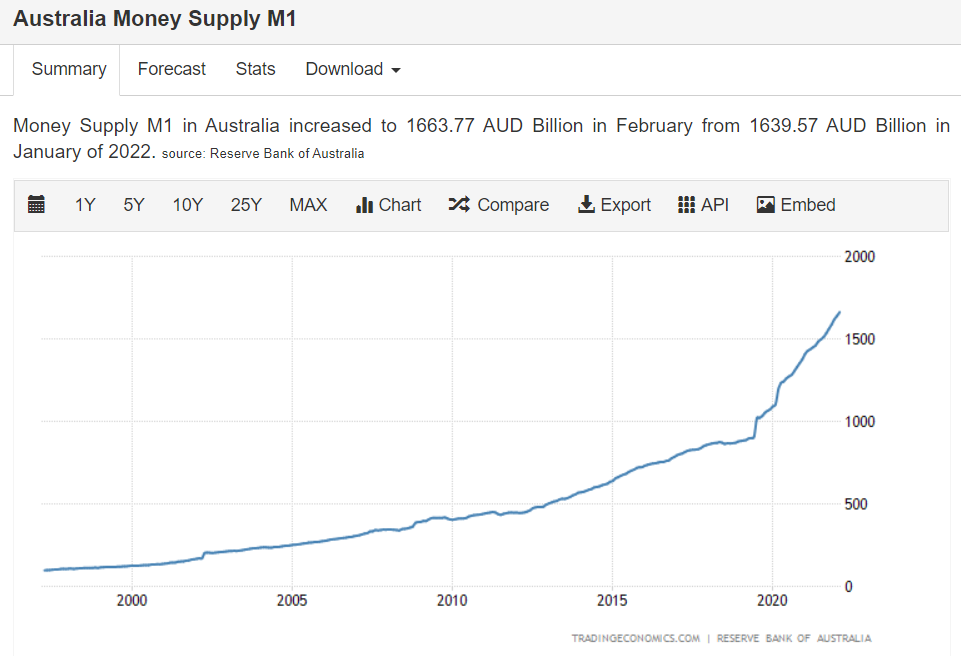

An obvious example of this is how much money has been created over the last few years. But this quick sugar hit doesn’t come for free. Someone always has to pay the bill. And all this printing has started to come back to bite us in the ass.

Inflation is a hidden tax.

People hardly even know it’s happening.

But make no mistake about it, high inflation without wage growth means you’re losing purchasing power. Your hard-earned dollars are becoming less useful and the rate at which they depreciate is out of your control.

I don’t like the fact that short-sighted politicians are happy to fire up the money printer at the expense of fiscally responsible savers that have built up a safety net. Is it too hard for them to maybe tighten their belts a bit in bad times? Why does it seem like every solution these days is to start making it rain at the first sign of the economy slowing?

I’m not saying I have all the answers, I’m just pointing out that the relentless drive for continuous growth is punishing responsible savers through the debasement of our currency and rewarding speculators loading up on cheap debt.

The more money that is created, the less purchasing power we all have.

Bitcoin flips this narrative.

The amount of Bitcoin that can be created is set in stone. It can’t be changed.

Part of me wants this experiment with Cryptocurrencies to succeed because I think it presents a superior financial system that can’t be screwed with by corruption and greed. Both of which are unfortunately innate traits of human beings.

Converting my fiat currency to Bitcoin is a vote for a better system.

Conclusion

We’re officially in the Crypto game (technically have been since 2017 😜).

I’ve really enjoyed learning about Bitcoin over the past few years but it was the history of money that really caught my attention. I find it absolutely fascinating how humans created and used money in past generations and I think the history of money is a prerequisite to fully understanding the utility of this new technology.

Over the last two years, the risk/reward proposition has shifted for me personally and I now consider a small amount of Bitcoin in a portfolio to be perfectly appropriate for any Australian looking to reach financial independence.

You’ll be fine without it of course but I think we’ve reached the point where most people can rationalise someone having a small amount. This is a lot different from years gone by when a lot of well-regarded reasonable voices would have publically shamed anyone who even thought about ‘investing’ in Cryptocurrencies. I must admit that I was secretly judging people who were buying it back in the day too 🙈.

We live and learn and I can admit when I was wrong.

I’d love to know what you guys think about Bitcoin in the comments.

Are you starting to believe? Or is it still a huge Ponzi scheme?

As always,

Spark that 🔥

Finally!

Bitcoin is not investing, Bitcoin is saving.

Listen to Stephan Livera podcast, he has many great episodes that will help you build up your conviction and many that will explain technical details to your inner nerd.

While you’re at it also don’t stop at allocating 1%, set up DCA and join the DCA army

https://stephanlivera.com/episode/288/

You didn’t say how much that initial $94 investment in Bitcoin is worth now?

Because he shouldn’t have to. Grab your calculator, punch in the current going rate for BTC (e.g. $30,000) and divide by 50.

What he also didn’t say, though, was how much BTC he bought for his 12K. That would be way more interesting.

Mined my BTC back in 2014/2015. Sold the hardware and some BTC to get my net position to 0. Now HODL the rest

Me too – I bought my first Bitcoin a couple of months ago. It is currently 0.25% of my net worth but the intention is that my crypto exposure will ultimately be between 1% and 2% split between Bitcoin, Ethereum and Solana.

One thing that caught my interest when reading up on how everything works was general tax opinion that even spending Bitcoin directly on goods/services will trigger CGT events (from what I could see crypto is treated as capital rather than FX).

Of course I knew that selling crypto for AUD would be a CGT event but if every use of it as currency will also have tax implications then the future could become messy.

If you purchase cryptocurrency with the sole purpose of buying a personal use asset, then it is exempt from capital gains, for purchases under 10k. The longer you hold the crypto, the harder this is to prove.

https://www.ato.gov.au/Tax-professionals/TP/Cryptocurrency—investment-or-personal-use-asset/?page=1#Cryptocurrency_as_a_personal_use_asset

They will have to sort this out if Bitcoin is to become successful. No way it’s going to work if the ATO wants CGT every time you spend some.

It’s going to be interesting to see how it plays out

I had 23k transactions to process last financial year. Data fees make it manageable

Won’t put more than 1% of my retirement funds in bitcoin thats for sure, my heart can’t stand the roller coaster ride !!!!!

Can anyone tell me the investment case? The best hedge against inflation is investment in companies with strong pricing power. I agree that constant money-printing is debasing fiat currency, but I’m not sure if crypto currency is the solution. I would think volatile falls in the price of of crypto could be damaging enough to any savings plan, especially when the typical ‘retail’ investor may not have the psychological fortitude to hold on when the swings in pricing come about.

Still, with all of that said, what’s the actual ‘investment’ case for crypto? I’m keen to hear what people more knowledgeable than I am have to say.

I’m also curious about this point. And how something that fluctuates so much in value can be used to hedge against inflation? (I’m also curious about the down sides and ethics of it. It seems to mainly help criminals who don’t want money to be tracked, and also attracts a lot of scammers who can steal Bitcoin, and there’s the energy use side of things. So it’s hard to know who is a trustworthy source on the matter.)

You know cash is the most criminally used means of exchange? Will you stop using fiat because criminals use it? Dumb reason, right?

2% of bitcoin in 2019 was used for criminal activity according to Forbes.

Bitcoin is not anonymous. It actually tracks every transaction since the beginning of time, and forensics accountants will ruin you. Better to use cash if you want to be anonymous.

Power consumption is a problem, but currently 60% renewable sources. Governments should look to incentivise this to bump those numbers up. Changing to proof of stake consensus mechanisms will reduce power consumption by 99%. Eg ethereum, which uses about half the power of bitcoin (80Twh per year), this will mostly vanish in the upcoming upgrade.

Regulation will help with scammers.

It’s not an investment. Bitcoin is a saving technology, it’s the only place you can park money without being raided by the government.

Investing is hard these days, most companies are going down in real terms, but you can’t see through distorted picture created by the money printer, if returns are less than 20% then you’re losing purchasing power.

Look at S&P500 in gold terms, ATH was 20 years ago.

You don’t have to struggle, just reduce your exposure, stocks drawdown by 1% too, so if you only have 1% of Bitcoin you won’t see if it goes to 0, but you will when it goes 10x or 100x.

200 Weeks MA never went down for BTC, if you combine it with DCA it becomes quite fool-proof. Fluctuations are not the problem if you have long-term view.

Criminals prefer USD, but even if they did like BTC, would you abandon mobile phones because they are used by criminals?

Nothing wrong with energy consumption, it’s one of the most efficient ways to consume and store energy for the future. Energy use will continue to grow and that is ok. Proof-of-stake is no different from the current system, i.e. useless.

Cool, thanks for the replies. It’s got to know it’s not used for illegal activities that much. Some other stuff I read suggested it was, but maybe that’s outdated now, and I guess it depends how you measure it. One figure quoted by somewhere suggested 45% of transactions/activity were criminal, but I can’t find the article, and it’s always hard to interpret when there is so much bias around this topic.

I wouldn’t really call it an investment Ted.

We primarily bought some because:

1. I get joy in learning and participating in this groundbreaking technology

2. We’re speculating (not investing) that it’s going to be worth more in the future

3. I think it’s a better form of money than fiat.

While you’re here, nice work on the blog and podcast. I’ve been listening to you for a few years now.

I think your three points are grounded in common sense and therefore you shouldn’t be surprised if things don’t turn out. On the other hand, if Bitcoin (or other crypto-currencies) do continue to increase in value in the years ahead, I’m happy to leave that for those braver than I. I’m sticking to the purchase of cash-flow and will still do okay even with no exposure to Bitcoin.

I follow the development of crypto-currencies though and so continue to learn about it.

Thanks for the kind words mate and you have a very sensible approach 🙂

Perhaps have a listen to a recent Lex Friedman podcast featuring Michael Saylor – it was put up just this week. This may answer some of your concerns. Otherwise Fidelity have a piece : https://www.fidelitydigitalassets.com/bin-public/060_www_fidelity_com/documents/FDAS/bitinvthessisstoreofvalue.pdf?msclkid=21e90175be2411eca5f5276c7f64dd85

Beyond Yijay’s book, the next accessible step is Saifedean’s ‘The Bitcoin Standard’ to really put the wind up you about value investing in fiat terms.

I bought 20,000 Dogecoins for $9.20 US in 2014 from an internet forum called http://www.dogeforsale.com no exchanges back in those days, I sold it during the hype and did a home renovation I had.

“I think we’ve reached the point where most people can rationalise someone having a small amount.”

I think itsvery important for readers to understand that you are in a comfotable enough position FI-wise to be able to allocate a portion of your investments in higher risk assets.

Newcomers to FI who are still building the CORE of their portfolio need to understand that as you core (lower risk) investments grow larger, you can start to build out the SATELLITEs which are higher risk and/or deviate from traditional investments.

There is more than one way to invest safely.

I personally think the earning up to 15% interest in crypto on USD or AUD stablecoins with no drawdown is more safe than having to deal with the draw downs of a stockmarket dividend strategy that will produce less yield.

Oh for sure.

But in saying that, I think I would have still come to the same conclusion if we had 1/4 of our portfolio. A small allocation (in % terms) doesn’t sound as crazy as it did 5 years ago.

Nice write up Matt, since having a mate semi-retire at 40 because of bitcoin and I also bought, held and then sold back in 2017 I now do the same and have for a year or so making Bitcoin 1% or more of my portfolio for the same reasons.

Exciting!

I thought it would have been the software engineer that saw the beauty in the bitcoin code that brought you too the light. Every time I explain how bitcoin works, it reblows my mind about how ingenious it is, eg consensus methods.

Next step, you can earn up to 6% interest per annum on your bitcoin and other crypto, in apps like Celsius.network, they really have a focus on security.

I started with 99% shares and 1% crypto. And now it’s reversed. I think, why risk drawdowns in the stock market, which I can achieve the same returns without draw dawns simply by sitting in AUD or USD stablecoins? The risks are different, but once you understand them, I think crypto income has the edge over the stock market dividend strategy.

Feel free to reach out to me personally and we can chat if you have some questions 🙂

Love the write up. Dabbling in bitcoin has been on my radar for a while now but I always saw it as more of a gamble which goes against my grain. This has made me think about it again.

I would love a Bitcoin / crypto 101 guide to how you actually made the investments when you have a moment!

1. For small amounts, Binance. Over 10k usd, FTX. Both have no fees on deposits from your bank. Then go to BTC/AUD market and buy. Heaps guides around.

2. Security needs to be at the forefront! There’s no givesies backies in crypto. Register a new email address for crypto exchanges only and nothing else. Use authy 2fa. Set withdrawal whitelist so withdrawals can only go to your addresses. Bookmark exchange sites, because Google can show phishing sites. For more piece of mind on large amounts get a hardware wallet. Backup recovery seeds on crypto steel and keep safe (eg bank security box ).

3. Earn interest on your crypto with trusted apps like celsius.network.

4. Keep records because the ATO wool come knocking.

the worst thing at step 4 in our current market interest is calculated in the value in AUD at the time it was generated and you need to declare that interest on it, then when you convert again back to AUD that capital gain/loss is then calculated again at the value with an acquisition cost of zero then best to wait a year for that 50% discount, but the current ATO rules are a pain for that double-dipping in the earning interest bucket, especially if the coin earning interest drops and you paid all that interest, so pending the investment can magnify losses especially if you pay all that interest on the way up just have the value drop pending on the investment. So earning interest can be really bad if the market is overvalued during bull runs.

Is Coinspot similar to Binance? I chucked $100 in there a little while ago for fun but I wouldn’t mind putting a little more in after reading this.

Coinspot used to be a rip off in fees. I just checked, they aren’t too bad now. FTX/Binance marginally cheaper.

Thanks pip.

I’ll think about it but I’m very hesitant to create such a guide. It might give off the wrong impression that I’m trying to get people to buy Bitcoin 😅.

There are plenty of great guides out there online anyway 🙂

I also think self custody is a good reason in times like the Canadian government freezing banks/assets because it doesn’t like your protest (in this instance, but what else could it not like?

Yep.

I’m surprised Crypto didn’t sky rocket after that.

Interning article! What are the tax implications of crypto? What are the best places to buy crypto in Aus? Thanks

I recommend FTX for larger amounts.

Trading crypto for anything (another crypto, fiat), is a capital gains event.

Earning crypto thru staking, mining, liquidity pools, DeFi etc is income.

Sorry to be a downer but scenario 2 is much more likely. You say that the attraction of bitcoin is the distributed nature. Whilst that’s fine in theory it doesn’t hold up in practice. The holdings of bitcoin are *incredibly* centralised, see for example – https://nypost.com/2021/10/26/bitcoin-ownership-concentrated-in-a-few-hands-new-study/ – and there are plenty more references around.

A good summary of the case against Bitcoin (and Crypto) is this piece from Stephen Diehl.

https://www.stephendiehl.com/blog/against-crypto.html

I’m not sure if I agree with the NY Post article.

Just because less than 10,000 people own 1/3 of all Bitcoins doesn’t take away from the decentralised nature of the protocol.

Just because ownership is concentrated doesn’t mean it will destroy the value of BTC.

If Jeff Bezos or Elon Musk dumped all their shares at once, the price may fall in the short term, but there is still a finite amount of shares available to purchase and both businesses will still operate irrespective of who remain owners over the long run.

BTC is fixed at 19M out of a total of 21M in its code used by every node. Hence the finite amount available ensures a rising value measured in Fiat money which is not scarce.

That scarcity is what ensures the long term value of BTC and why it won’t go to zero.

This is not the same as it not being volatile as BTC can easily lose 80% between peak to trough as log dormant accounts can dump more than the market can absorb in the short run.

The decentralised nature of BTC proof of stake is how it preserves its value overtime because any node can independently validate the blockchains accuracy in concert with other nodes using the same code.

This consensus approach is strengthened by adoption by large institutions and countries to protect that integrity of that code.

So BTC has both the strength and the confidence of enough people to outlast any of the fiat currencies backed by empty promises & unconstrained supply.

This is in stark contrast to centralised exchanges that can be attacked and corrupted with no independent validation.

So I firmly believe Scenario two is extremely unlikely at this stage of maturity and widescale adoption.

Hence, I am HODL my mining profits into BTC.

I’m still yet to have anyone explain actual utility of crypto. And if you can’t explain it in a way a normal person could understand….

How is crypto different to any other currency speculation? Or gold and silver if you want to avoid inflation?

It is a database ledger than can never be altered, every transaction that has and ever will be added to that chain will be there forever, it can not be manipulated.

For instance, take gold and silver there are stories of mints around the world that “hold” counties’ gold that asks for a week’s lead time to see your country’s gold to ensure your serial number matches your purchase, there are stories they just remelt existing gold and stamp your serial number on it, so they can have serial numbers on paper and not hold all the physical gold they are meant to.

On the converse, bitcoin can not have the same manipulation and can be verified through the database.

At the end of the data paper money, physical metals, collector items are based on trust when used for the preservation of value in those systems

It’s the utility of the technology. It’s like trying to put a price on the internet in the 1990 when no one owns it. People are still profiting from the internet tho. And it will continue with crypto.

Utilities: self custody government freezes bank accounts/assets -like what they did in Canada. Cheap-instant transfer of money world wide. Lending/borrowing. Smart contracts – exchanging contracts can be trustless because exchange it executed to predetermined code. Tracking fraud or quality in supply systems. Micro payments to content producers. Public database systems – property titles, settlement systems, voting machines, medical records etc. Being sovereign over my own data and getting it back from Google. Web 3.0

Look at it this way Toby if you where in any of the 45 or so countries in the world that have inflation above 10% to 340% or a government that enforces capital controls on you, having a digital asset that you can self custody that can not be corrupted or changed buy governments or corporations, has a fix amount 21m its now at 19m, that anybody in the world with an internet connection can buy from you would look pretty appealing.

Keep in mind CPI even in Australia is not the real figure you need to look at if you would like to maintain you lifestyle. For example if you what to buy a house in a nice area or invest in the sharemarket to fund your retirement, buy private health insurance for your family the inflation is above 10%.

Over the last 10 years gold has not performed well, that may change in the future but as the gold price goes up miners mine more gold and bring back mines that have been uneconomical to increase supply eventual pushing down price.

I’m not a Bitcoin maxi but check out its performance over the last 5 and 10 years its been the best performing asset in the world, its getting more popular with individuals and corporations (where talking about it hear, this is not a Bitcoin blog) and the supply is diminishing.

Its worth keeping an open mind and doing some research on BTC.

The utility of BTC in particular as a store of value as “Digital Gold” is the finite amount of 21M enshrined in the code run by every node.

No more can be made unless the majority of nodes agree to change the upper limit.

BTC is a digital collectible with an increasingly difficult cost to produce which is like silver and gold as oil becoming increasingly difficult to find.

Hence that inherent scarcity is why it can preserve value like other traded commodities when messing fiat currency terms.

Here’s my 2 cents… noting I’m probably wrong, but here goes…

Most of us like to collect money – and it doesn’t matter where it comes from really. But it’s ultimately a zero-sum game, I have what you don’t. It’s not actually investing in anything.

Bitcoin is a great tool – with pros and cons like all money, to exchange value – but it can’t be a source of wealth in itself.

To create wealth, you need to finally put your money into something that is useful for others.

If you make a fortune buying and selling bitcoin, and then build a house, you’ve converted that bitcoin back into wealth – but where did your ‘fortune’ come from? – you just gathered that wealth from others who had earned it (by providing social value) – you did nothing and neither did the bitcoin – until eventually you sold your bitcoin and redistributed it back when you built the house… the bitcoin itself didn’t do anything but provide the medium.

When you ‘invest’ in bitcoin, your speculating on a currency, not investing in an asset.

Bitcoin may not end up being used as a currency it may be used as a utility for instance match a record for proof of homeownership linking that blockchain bit in your name and for that you only need 0.00000001 bitcoin which is only 0.000579 AUD at the current price.

The utility is more important than the current stock market buying up and down at the moment which ramps up because there will only be a finite amount ever released to ensure the value is preserved.

You can also think of it as speculating on the future utility of value.

Its different from saying buying pokemon cards or collector cars that go up in value over time for similar scarcity reasons, in the end the trust that is being established on that chain 13 year strong is showing the value and security of that database unlike many overs over the years.

We’ve already seeing Bitcoin the asset, this decade we will learn about Bitcoin the network.

Jack Mallers, Strike just announced a deal using Bitcoin’s Lightning Network embedded in Shopify and NCR.

Ligntning Network can guarantee instant transactions globally whilst remaining decentralised and fees 90% cheaper then what Visa & Mastercard can do.

Hi Simon,

My question would be if you use the utility for a record of home ownership why would they necessarily need to use Bitcoin, why not Etherium or Cardano?

Title records and settlement systems would be better designed on platforms using non-fungible tokens (NFTs) which follow a particular smart contract standard on the either the ethereum and cardano blockchain.

NFTs allow each token to be uniquely identifiable which is obviously a requirement for records systems.

Bitcoins are not uniquely identifiable, in fact no coins actually exist, we just interact with wallet balances. It would be like doing a bank transfer for $1000 to your mate and asking, how many hundred dollar bills did I send? None, my balance went up and yours went down. This makes it fungible.

What the wealth value of house in Ukraine right now?

Bitcoin is also better than filling up suitcases with cash and dashing across the Ukraine border.

I largely agree with that Emdee.

It’s not really investing at all and our end goal is to eventually spend our Bitcoins on real-life stuff in the future. Or just delete our wallet when it’s worthless 😂

Hi Emdee, well said, couldn’t agree more.

Companies (Stocks) provide some sort of service or product. The imput of material or wages is less than the sale price so a profit (value) is made or created.

Problem with looking at Bitcoin as a currency is that it tends to follow equities / riskier asset trends but unnlike stocks or companies does not generate cash flow.

You can generate staking income in crypto at 70-150% per annum, but holding a “tulip coin”

Interest rates in CeFi or DeFi are 8 to 18% on AUD and USD stablecoins. These yields are higher with no drawdowns, and I think are less risky than a dividend share portfolio.

Shares aren’t what they used to be. Most USA companies do share buybacks instead of paying dividends because CEO pay is linked to share price. More shares can be just as easily printed these days as well.

To invest in a cryptocurrency is to invest in that coins protocols, it’s ecosystem, community, utility and revenue streams.

I first bought bitcoin in 2014 and think to myself I should have bought more, I believe we will be saying the same again before this decade is out.

It is important to put in the work to understand this asset and why its volatile otherwise you run the risk of being shaken out on large price swings.

I largely ignored Bitcoin until I bought my new computer. Now I mine Ethereum and bank my earnings as BTC in a hardware wallet once a month. So far, I have accumulated 0.025778 BTC = US$1,118.13 after seven months using the power of my solar panels to defray the primary operating expense of electricity.

I will probably buy some BTC directly when it crashes again to much lower levels than currently. In the meantime, I am arbitraging the higher value of ETH for BTC to HODL.

The value of BTC is underpinned by its scarcity with a fixed amount of 21Million coins locked into the Code. Unlike other Cryptocurrencies, BTC has proven itself resistant to attempts by dominate players to change the rules to suit their goals. The proof is BTC is still using the same ledger since the start recording every transaction ever made using a single node. The failed forks were Bitcoin cash and Bitcoin Gold which have relatively little support by owners and miners.

You need to treat BTC as an alternative collectable and as catastrophic insurance. In the same way a few gold coins enabled refugees to bribe a border guard to let them flee a war torn country to a safe land.

A form of portable gold that is easily transferred out of the country and has been successfully used by Ukraininans fleeing the invasion when their existing bank accounts and credit cards are frozen.

Great setup Keith my brother in-law does the same 6 – 3080s mining ETH then coverts to BTC to hodl

I have tried to get my head around Bitcoin, so many q’s and obstacles for it to become a main currency.

What does seem to happen though is lengthening cycles which I agree with, so as time goes on it is longer between the all time peaks that have happened prior.

I’ve got a small amount, pehaps 2% in bitcoin and even smaller amount 0.5% invested in forex trading because that is also highly speculative. If either go to zero it won’t matter – it will be a trial failed.

Thank you for sharing and joining the global shift. I do see crypto/Bitcoin not only as protection against the money printing madness, but also as a vote towards “real” democracy.

Important to say, that there are means in crypto world which allow for a passive income without the growth of an underlying asset. Plenty of staking and lending platforms.

More importantly, you can get even 5-8 % APY on AUD (and not a tokenised version like TAUD, USDT etc), so why would anyone bother having it sitting in a bank account?

…people need to learn about this area more and start questioning what is the government actually doing…

How do you get 6-8% on AUD?

BlockFolio / FTX has 8% on any asset in their wallet and it applies to fiat as well, not just crypto. Past 10K in the wallet in total value, the interest is capped at 5% so depending on how much you park there, you’ll be somewhere in between.

Nexo doesn’t have AUD but has other fiat currencies (EUR, USD, …).

Of course these are centralised applications and companies running them are prone to hacks, regulation and lack of insurance to various degree.

Some Defi protocols will allow similar or higher returns on tokenised FIAT but bring also more complexity of moving things around with additional coins for fees etc.

AUD tokenisation is fairly limited from what I’ve seen, there is only TAUD on Celsius with 7.1% apy.

The rest is focused on tokenised USD which brings an additional risk of exchange rate going against you.

For anyone doing a lot of transactions, it’s worth investing in some crypto-dedicated software (koinly is good) as trying to find an Accountant that has even a basic understanding is hard.

Hey mate, just wondering if you can touch on how you bought your Bitcoin and how you’re storing it?

Would love to hear how you’re approaching it.

Keep up the good work!

I’d rather not say specifics due to ASICs new interpretations around ‘Finfluencers’. I have two wallets. One is on an exchange, the other is on my laptop only.

You’ll be glad to know ASIC can’t do anything about crypto Finfluencers until their regulated products.

Must be a sign; it’s your calling 😛

Ahh no worries mate.

I hope you can continue with the blog / podcast without having too many issues.

👍

If you haven’t done so already I’d highly recommend getting a proper hardware wallet and self custodying your keys. Cold card is fantastic in conjunction with some software like Sparrow or Wasabi. While only a 1% allocation, BTC can move fast and before you know it, you might have a significant amount in a hot wallet which is much less secure than holding your keys offline. You’ve done well to put in the right kind of research early, avoiding shit coinery and you’re thinking about the nature of the investment in a really healthy way. The more you learn, the more conviction you’ll have, perhaps one day the allocation will be higher 🙂 As Greg Foss says, BTC is the greatest asymmetric return he’s ever seen in 35 years of trading risk. It’s a credit default swap on sovereign collapse. HODL!

It’s been on my mind for a while actually. I just have to stop being lazy and get a cold wallet.

Do you have any recommendations?

Yep! ColdCard is a great hardware wallet. Bitcoin only (reduces attack surface) and uses air gapping (where you load transactions to and from the computer via a microSD card after being signed on the device), it’s still possible to connect via USB but defeats the purpose.

Other gear I’d buy at the same shop (coinkite) is a steel backup, centre punch, Power-Only USB Cable that you can plug into an iphone/USB wall charger, a micro SD card, and if you don’t have it, some way to load the microSD onto your computer. You can paired the coldcard with software like Electrum, Wasabi or if you want to go deeper and nerd out, look into Sparrow.

This is a pretty deep end approach, but IMO you’ll learn about how BTC works and how to secure it properly. BTC Sessions on YT has great tutorials on this kind of stuff.

If you want a much easier entry point, just grab a Trezor One, it’s much cheaper and arguably a little more entry-level. At the end of the day, any step that takes your BTC off an exchange is a good one, even if it’s a hot wallet on your phone like Muun. BTC is about sovereignty, if your BTC is on an exchange, it’s not your Bitcoin, it’s only an IOU. Not your keys, not your coins!

How do you get 6-8% on AUD?

Firebug, how did you buy bitcoin within our Trust structure? Did you/can you buy via self wealth?

Most exchanges will do onboarding in a trust structure.

Love that you’ve joined the BitCoin train. Just a quick question, is there going to be a monthly finance update soon? I look forward to reading those each month. TIA.

I’m curious about the inflation argument for justifying 1% Bitcoin. I completely agree that in coming years fiat currencies will be debased with higher inflation. However, does having only 1% of your wealth in Bitcoin really change the outcome significantly when 99% of your wealth is still in fiat currencies?

Also your point about short sighted politicians printing money at the expense of savers is a bit dangerous. Firstly the RBA is independent of the government, and secondly the recent money printing has helped save us from certain recession. The UK tried austerity after the GFC and it failed miserably. This money printing has benefitted the FIRE community massively as it has propped up the value of investments that would have otherwise sunk – despite the risk of inflation. Yes it has been bad for cash savers but I doubt this affects anyone reading this comment.

Having said all of that – I have no argument against 1% Bitcoin for ‘speculation’ purposes.

The environmental effects of crypto are atrocious, in particular bitcoin which is one of the least efficient. Be careful that your greed doesn’t cloud your conscience.

Power consumption is a problem, but currently 60% renewable sources – I’m sure you could name worse industries.

Consumers of power are only polluters because governments fail on their renewable policies. It’s not a matter of asking people to switch off their aircons or crypto miners, it’s a matter of asking government to take more action on renewable energy and delivering.

And let’s face it, we can’t ask that of the current government. So it’s up to us voters to put in power a government that will.

I recommend you look into the subject yourself instead of reading headlines. The subject is not as simple as Bitcoin Bad. This machine greens is a good documentary, or alternatively take a look at Lyn Alden’s work on the subject. https://www.lynalden.com/bitcoin-energy/

Hey mate, have you considered that through owning Block (SQ2) in the index you would have some exposure to BTC already?

No, I haven’t thought about this Ben. I’d imagine the % would be pretty low though right?

It is interesting how polarizing Bitcoin is given it has now been in existence for a while. I would never put a large percentage of my investments in it but I don’t understand the other camp who aren’t curious at all.

Recently Bitcoin has dropped to $20K, and even though it is constantly fluctuating, and might go up. I am not sure if to purchase it or not, it sounds risky and not as “safe” as other traditional investments. Any tips for a *possible* beginner crypto invester?

Same rules apply.

1. Never invest more than you can afford.

2. You might cut your hand catching the falling knife, but long term holders usually find themselves in profit.

3. Once you try crack, why would you go back to pot?

Great Comment.

1. Crypto should be only a maximum of 5% of your portfolio with the high risk of loss of value with potential huge upside IF you are able to hold for a long term. Basically this is lottery ticket money where you have high hopes but don’t actually expect a return.

2. The trick to catching falling knives is to wait until the blade hits the ground and has wobbled a bit before you reach out for the handle. That is you need to wait until the price has bottomed for a considerable period of time to wring out the weak hands unable to withstand the loss of capital and ONLY invest when the price starts moving up off a solid base of despair.

3. Because hard drugs can be extremely detrimental to your physical and mental health in a way less potent narcotics on a social basis.

Hi Aussie Firebug,

I was once an avid follower of fire and listener of your podcast when you first started out and thought to check in.

Looking at the broader macro picture I urge you to re-consider your current crypto allocation and index strategy.

Indexing has benefited from lower and lower gravity applied to the stock market through forty years of falling bond yields/interest rates. We are now at the end of that cycle. No strategy outperforms indefinitely and things often move in cycles and revert to the mean.

There are no certainties but this next decades appears will be very inflationary in waves which will lead to rising yields and rates which will crush the positive momentum game of indexing.

Crypto currencies likewise are in a very large bubble due to risk off environment created by near zero interest rates, government stimulus and money printing.

Not hoping to spread any fear and honestly wish you the best of luck with future investing.

Bryan

Hi Bryan,

With everything you’ve said, what are you investing in?

Do you have any resources I can check out for further reading?

Mimicking the herd invites regression to the mean. If the stock market is near all time highs with ten years of returns already priced in then indexing right now is inviting a lot trouble. In the immediate short term there are few things other then cash that won’t be hammered by rising rates. I believe the best strategy for medium term is very patient active stock picking. Basically buy oil stocks when you hear oil has gone negative, buy ag businesses during drought… do the opposite of the crowd and be like water to whatever opportunity presents itself. Having listened to you I think you could well if is something you are willing to start reading a lot and learning. I recommend starting with The Essays of Warren Buffet.

A few helpful principals:

– Rule #1 don’t lose money. Rule #2 don’t forget rule #1

– Know your circle of competence

– Buy with a margin of safety

– Be fearful when others are greedy, and be greedy when others are fearful

– Remember that just because other people agree or disagree with you doesn’t make you right or wrong – the only thing that matters is the correctness of your analysis and judgment.

– Mr Market is your friend, everyday he will offer you a price to buy or sell you can choose to completely ignore.

– Good ideas are rare – when the odds are greatly in your favour, bet heavily

– Find your ‘fat pitch’ and swing hard – look for opportunities where you have a big advantage, and swing hard at these ones. Most investors swing too often.

Best of luck

Bryan

Hi Aussie Firebug et al,

Just wondering about the platform/method of purchasing bitcoin.

I was looking into using Binance, but felt a bit apprehensive when I was asked to enter my driver’s license details, place of residence and biometrics. I understand that it is done to enhance security and make the platform less prone to money laundry and things like that, BUT I worry about identity theft with all my details being in this honey pot that is Binance for hackers; I also read that Binance is registered in the Cayman islands and shared client data with the Russian government last year. I know that other minor players in the investment work, like Pearler (which I use) hold identity details in their database, but I kind of feel safer with a Australian business which seems far more regulated…any thoughts about all this? Thanks heaps

Valid concerns Isaac.

I guess I’m a bit more optimistic that it won’t get hacked 🤷♂️

Funny enough my Super account just got hacked the other week and scammers got a whole bunch of identity information for a lot of people.

My MyGov account has been locked as a result. It’s causing all sorts of issues with my activity statement 😤

It’s just one of those things at the end of the day. We have to have a level of trust.

Hi

I think your first instinct was right, and you’ve been mislead by others when you did your research at the end of 2020.

Firstly, its not that decentralized, because the majority of miners are just 6 large mining groups. You could achieve the same level of decentralization with even better performance by having 6 trusted people run rasberry pis. The proof of work, which bitcoin is (and doesnt seem about to change) is so incredibly wasteful. The cost and time per transaction make it a practical non-starter for any real world day to day use.

Secondly, the network can handle a maximum of like 6 transactions per second. Now they’ll tell you they have a plan for how to do more transactions off the chain with plans to store just part on the chain which can verify this to increase this. But its always in the future and introduces so many new problems.

I think there is a massive issue in that its described as a currency yet used as an investment. More importantly, all the discussion is around the ‘price’ of bitcoin and not the adoption. To be a useful currency you need enough adoption to be able to use it and a stable value so that you could actually use it. As far as i can tell while the volume of transactions and the value has gone up and the % of criminal activity with them has gone down, this is just due to the large levels of speculation. It has not become more useful as a currency. Go look at r/bitcoin all the discussion is about HODL and how past performance means it has to go back up.

As you said it does not solve any meaningful issues for people in Australia. But this is also true of most major economies. It cannot acheive widespread use without appeal in these countries yet has no appeal to them.

Being deflationary is actually horrible. The system is not fairer. It benefits only early adopters. It is simply creating (if successful) a new class of 1%ers. It encourages and benefits those who can buy early and hold without selling. Long term, this locks wealth into the early adopters. Maybe you think thats fine, but personally, i think my kids and grandkids should not be disadvantaged by how its set up.

Our current monetary policy we have say over by chosing our govermnet. Now, maybe you dont like the monetary policy, and may be you would never be able to effect change to our monetary policy. But is that unreasonable?

Final few points:

-if most people are happy with our current monetary system (or ambivalent to it, or dont understand it) then why would they care to change to bitcoin.

– Even if there was a desire to, its so hard to use and set up. Do you honestly think you could set up your parents to use it, their neighbours, your neighbours etc?

– There are so many risks to holding substantial wealth in bitcoin. If its stolen, compromised or otherwise scammed you have no recourse.

– a government would be able to pretty effectively ban it. Just like the ATO policies make it impossible to treat it like a currency. It’s hard to see government’s seeding control of their monetary policy to bitcoin

– the technology is well known. Anyone can (and does) make their own coin. There is essentially no reason to use any one coin over any other. The only advantage bitcoin has is the first mover advantage.

Sure people could argue that there are solutions to many of these problems, or more typically that there will be but its so new (its 10+ years old now its like 9 months younger than the original iphone). But that doesnt provide a good case for it. Just because you think some aspect of our current system is bad doesnt make this one good and it is instead heavily flawed.

If you havent seen them already, I recommend line goes up (https://www.youtube.com/watch?v=YQ_xWvX1n9g) which looks at the movement and motivations its largely about cryptocurrency and only 20% about NFTs. And https://www.youtube.com/watch?v=J9nv0Ol-R5Q by Professor Weaver which goes into more the technical issues.

Thanks for the comment Michael,

I can tell you’ve put a lot of effort into that comment so I’m going to try my best to address your points.

1. Miners are only a part of the reason that the Bitcoin protocol is decentralised. Nodes validate transactions and it’s funny you mention the raspberry pi because you can set them up to be a Bitcoin node for $200. Miners = solves the PoW and adds the new blocks. Nodes = verify and propagate the block.

2. I can only begin to have a meaningful conversation with you about energy concerns if we both first agree that Bitcoin has utility and value. If your position is Bitcoin has no value or utility, then it won’t matter what I have to say. Do you think there’s any value/utility with the Bitcoin network?

3. There are technical problems that need to be solved. But this is true for almost any new technology.

4. We both agree that plenty of people are using Bitcoin as pure speculation. This doesn’t help progress the technology, I agree.

5. I disagree with you that the fixed amount of Bitcoin is a negative. It’s a major reason why I decided to buy some and I think it has the potential to be a far superior system to fiat. It’s lightyears more democratic than what we currently have. Firstly, the government doesn’t have the power of issuing paper money. The RBA is independent of the government. They are linked and you could argue in recent years that the RBA’s independence is a bit of a joke, but technically speaking they have autonomy from the government and non-financing of budgets.

The whole point of a decentralised store of value is that the rules can’t be changed unless there is a majority consensus.

That’s pretty democratic in my opinion. I’m interested to know why you think the power of money creation being controlled by less than 1% (way less) of the population is fairer?

6. I don’t think people are happy but most don’t even realise that inflation is just another form of tax. What do you think is the better political play? Ask people to pay more tax to fund whatever initiative they’re doing or borrow the money and cause inflation? Both options will cost the taxpayer but one is more upfront than the other.

7. The technology was invented less than 15 years ago. The internet was invented in the 1960s. Things take time.

8. Lots of risks. No argument from me there.

9. Yeah maybe. A big risk for sure but it’s still worth giving it a go IMO. The government has tried to kill a lot of useful technologies in the past for political reasons. That doesn’t mean people should stop innovating.

10. Time will tell. I agree with you. I think one network will become the standard but it’s too early to know for sure.

11. I’ve watched the line goes up video and I agree with 90% of what he says. I’m only a fan of Bitcoin’s potential at this point and I have no desire to dabble in the other coins or NFTs. I’ll check out the other video though so thanks for posting it 🙂

Cheers

Thanks for the reply.

1. I guess at the end of the day, I see the decentralisation as not a particularly huge benefit and one needed because of the lack of trust. There is so little transparency over who is operating the nodes, that it’s not clear that they arent vulnerable or could not become vulnerable.

Also, if it takes $200 to set one up, and we assume there are 50k nodes (based on an online estimate i saw) then that’s about $5,000,000 to set up 25k nodes and have a majority. Considering botnets, that is possibly something plausible for a large criminal syndicate and definitely plausible for a government actor to do. Particularly if bitcoin value was to go particularly high.

2. The reason i think its wasteful is inherent to the design of the system. As far as i can tell from your post, the primary benefit you believe of Bitcoin is it’s potential as a deflationary currency. I dont think proof of work, the distributed ledger, etc i.e. the key parts of the crypto technology are necessary for this idea. It seems you would be equally served if Australia just adopted this monetary policy.

3. As you’ll see in that second video i sent you the core idea of the blockchain or hashchains is pretty old maybe 40-50 years. The satoshi whitepaper, was 2008, or 14 years ago. Most technologies, particularly those that have been the massive amount of capital (money and brain) that has gone in to crypto would have seen better development over this period. Even if I was to accept that solutions to these problems are likely.

Given the primary focus of the majority of people in this space is to make a quick buck rather than focusing on solving these obvious issues all the focus has gone into spinoffs and ponzi schemes. So I think there is good reason to doubt we will ever see much movement on these issues beyond proposed solutions from individuals.

4. Just to add, that i think the fact that so much of the space is speculation and or scams actively counts against bitcoin ever becoming a proper currency. One the momentum is not there to do so as the incentives dont lay in that direction and two the damage done to the brand by the speculation adn scam will make it hard to ever legitimise it as a currency.

5. ” The whole point of a decentralised store of value is that the rules can’t be changed unless there is a majority consensus.” So like a democratically elected government like we have in Australia which could remove the RBA and take back direct control if that was the will. Decentralisation doesnt seem to have much to do with it.

Ultimately, I just dont think a deflationary currency is better.

” I’m interested to know why you think the power of money creation being controlled by less than 1% (way less) of the population is fairer?”

Because 1) we elect a government who could change that system if it was desired, 2) those people deciding that policy are known and publicly accountable and 3) unless i am a billionaire there is no way I would have any meaningful say in bitcoin policy once it has mass adoption (i mean I can buy shares in Apple and vote but its the institutional investors who get say over the board, remuneration, etc not me). So in short I cant see how its doing anything but rebuilding the same system in a different way. It’s not one person = one vote, the more money you have the more say you will have in how the network is run.

6. I think inflation has more than just that purpose. The main one is to get people putting their money to work (whether that’s buying things or invetsting) rather than hoarding it under the mattress.

7. The internet was instantly useful. Crypto currency has not been. There is not one good concrete application for it today (beyond speculation uses and or promises of future use).

9. I just dont think underlying technology is useful. It stems from a worldview that we cant trust anyone. But you end up with a system that is so vulnerable because there is no way to regulate it and undo bad actions/actors. All of the stuff they want to build on top (andthis is not directly applicable to Bitcoin which is the only one you care about) require trust in code written by third parties which is shown repeatedly to be a mistake https://web3isgoinggreat.com/

10. I just dont think one network will become standard. As the technology is known, anyone can create one, including governments. The best case is that 2-3 becomes the defacto standards, but i have strong doubts.

Thanks,

As an addendum.

I do not think you are taking a huge risk. I just dont think its one worth advocating for, for the reasons i’ve outlined above, among others. You can clearly afford it if it goes to 0 or near 0. my recommendation, if you are set on this, is not really re balance ever (which perhaps is your plan as you say you never intend to sell). Perhaps the goal is 1-2% of new investments you make with future income is bitcoin, rather than trying to balance it at 1-2% of your portfolio, as given its volatility i think that would be a big mistake. I would personally exclude it from my net wealth calculations, but as long it remains under 2% of total net worth, then its pretty meaningless and your graphs make your weightings clear.

I also own some crypto (i went the route of holding the top 5 by market cap with proportionate holdings and then smaller bets on another 5 -> to the moon baby). However it was a one off gamble. My motivation was simply that i believe the bubble hasnt burst yet and there will be at least one more major rise in the value of these coins in the next 2-3 years. Hence i considered it worth risking a little bit of disposable income on the chance of a 3-20x gain. Also my wife had FOMO and this small amount in has convinced her not to believe the day to day hype, so was a useful teaching tool about risk.

Currently down 60%, was up 150% about 8 months ago which was the peak.

Great post, good read! I also started at about the same time (I bought my first BTC in 2017). Used to have my BTC on the likes like Nexo and Celsius, but since Celsius stopped all withdrawals in June, my passive income has been hit hard. Currently, I still make 12,500 USD per month, whereby our family expenses are at 9,500 USD. So far so good. But a lot of trust was broken by the CeFi firms. I am now focusing on dividend investing (my All Weather Portfolio with my 40x buy-and-hold-forever stocks, with an approx. value of 600,000 USD, currently yielding about 24,000 USD per month). Not quite enough yet, but this should increase to about 36,000 USD by Q2 2023. Keep up the good work – awesome posts. Cheers from Singapore, Noah

Thanks Noah 🙂

Hi Matt,

Which exchange do you use? I’m tossing up between coinspot and binance.

Also, when you buy do you buy it jointly with Steph or in the name of the lower income earner?

Cheers,

Ale

I know I’m very late to this post.

I don’t think it’s “either” BitCoin (or Crypto) is going away – or to the moon. It will be around and continue to jump around with demand (like any other commodity).

And that’s essentially how I see it – a commodity. It is not like a Share in a company which produces revenue. It’s not like Property which produces rental income. Those assets derive value because they produce value.

But with a Crypto, when you wish to sell, the only way to make a profit if there is someone who will buy it for more than what you bought it for originally. And that’s it’s problem – it’s all down to “supply” and “demand”…

Let’s then look at demographics – according to Statista, 88% of crypto is owned by young working aged professionals. That group often have mortgages and student debt so are sensitive to interest rate rises. Interest rates reduce their free cash – and their demand for more speculative assets (such as crypto and shares).

That’s why if you look back to the last systemic shock (Covid), Crypto actually fell away initially (job uncertainty means no one is buying). But when the feds dropped interest rates and flooded the market with capital, it sky-rocketed. Interest rates rose, and crypto backed off. Now that it looks like rates are falling again, crypto is going back up.

Just so you know what you’re dealing with. It’s a “good times” asset – not a “bad times” asset that it’s usually painted as.