Welcome back to the third annual Aussie FIRE survey results!

In case you missed last year’s results, you can grab them here.

This year’s survey added a few more asset classes and more detailed expense breakdowns. I was going to add time intelligence to some of the visualisations but I ran out of time. If you’re interested in the historic relationship between the 2021 and 2022 datasets please message me. I have withheld the Longitudinal Survey Identifier (LSI) from both datasets for security reasons but they are available upon request. I would welcome further analysis between last year’s survey and this one.

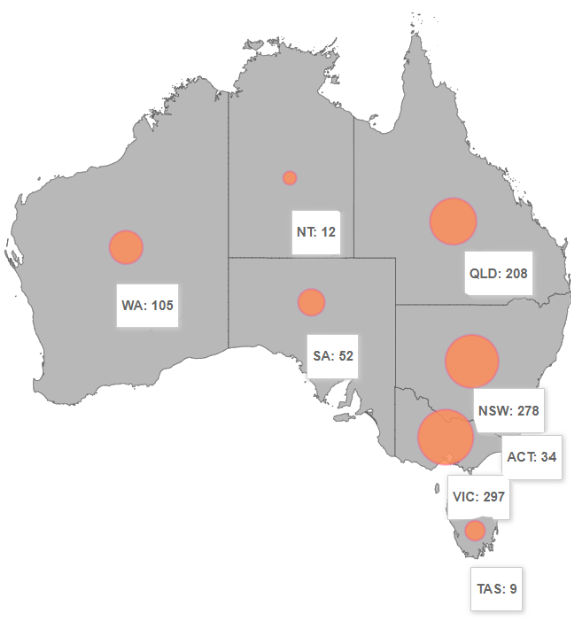

I’m so happy to report that the survey had 1,025 submissions across 18 countries.

The results are broken up into six sections:

For maximum slicing and dicing of the dimensions, please check out the FIRE Dashboard (interactive dashboard using the data from the survey)

Feel free to download the anonymized results of the survey here under the Open Database License (ODbL). I really look forward to seeing what you find—if you share on social media, make sure you tag me and I’ll give it a shout-out!

Enjoy!

Aussie Firebug

Geography

Age Range

1,024 responses

How old are you?

Sex

1,025 responses

Sex

Relationship Status

1,025 responses

Relationship Status

Are you DINK?

550 responses

Are you DINK? DINK = dual income no kids

Kids

848 responses

Do you have kids?

543 responses

Do you want kids?

Education

1,025 responses

Highest level of education

Employment Status

1,024 responses

Employment status

Industry

1,021 responses

What industry do you work in?

Living Status

1,025 responses

Living Status

PPoR Worth

685 responses

How much is your PPoR (Principal Place of Residence) worth?

After-tax Income

1,019 responses

What’s your AFTER-tax income per year?

1,019 responses

What’s your AFTER-tax income per year?

1,019 responses

What’s your AFTER-tax income per year?

Net Worth

1,025 responses

This wasn’t a direct question. The figure was calculated from other fields

Housing Expenses

960 responses

Estimated housing expenses per year?

How much do you spend on rent/interest repayments, rates, utility bills a year? If you’re filling in this survey as a couples/households, enter your combined expenses.

*Don’t include your mortgage repayments or investment property expenses here. Only interest repayments if you have a loan.

934 responses

Estimated housing expenses per year?

How much do you spend on rent/interest repayments, rates, utility bills a year? If you’re filling in this survey as a couples/households, enter your combined expenses.

*Don’t include your mortgage repayments or investment property expenses here. Only interest repayments if you have a loan.

Holidays Expenses

977 responses

Estimated travel/holiday expenses per year?

How much do you spend on travel/holidays a year? If you’re filling in this survey as a couples/households, enter your combined expenses.

807 responses

Estimated travel/holiday expenses per year?

How much do you spend on travel/holidays a year? If you’re filling in this survey as a couples/households, enter your combined expenses.

Childcare/schooling Expenses

374 responses

Estimated Childcare/schooling expenses per year?

If you’re filling in this survey as a couples/households, enter your combined expenses.

363 responses

Estimated Childcare/schooling expenses per year?

If you’re filling in this survey as a couples/households, enter your combined expenses.

Transport Expenses

954 responses

Estimated transport expenses per year?

How much do you spend on petrol + maintenance if you have a car? Or, how much do you spend on public transport if you don’t own a car.

978 responses

Estimated transport expenses per year?

How much do you spend on petrol + maintenance if you have a car? Or, how much do you spend on public transport if you don’t own a car.

Food/dining Expenses

1,004 responses

Estimated food/dining expenses per year?

How much do you spend on food and going out to eat a year? Think about how much you spend on grocery bills a week plus any restaurants you frequently visit.

978 responses

Estimated food/dining expenses per year?

How much do you spend on food and going out to eat a year? Think about how much you spend on grocery bills a week plus any restaurants you frequently visit.

Other Expenses

960 responses

All the other expenses per year?

Everything else you spend money on should be included below. Sports, pets, entertainment, insurance, shopping, medical etc.

Have you reached FIRE?

1,025 responses

Have you reached FIRE?

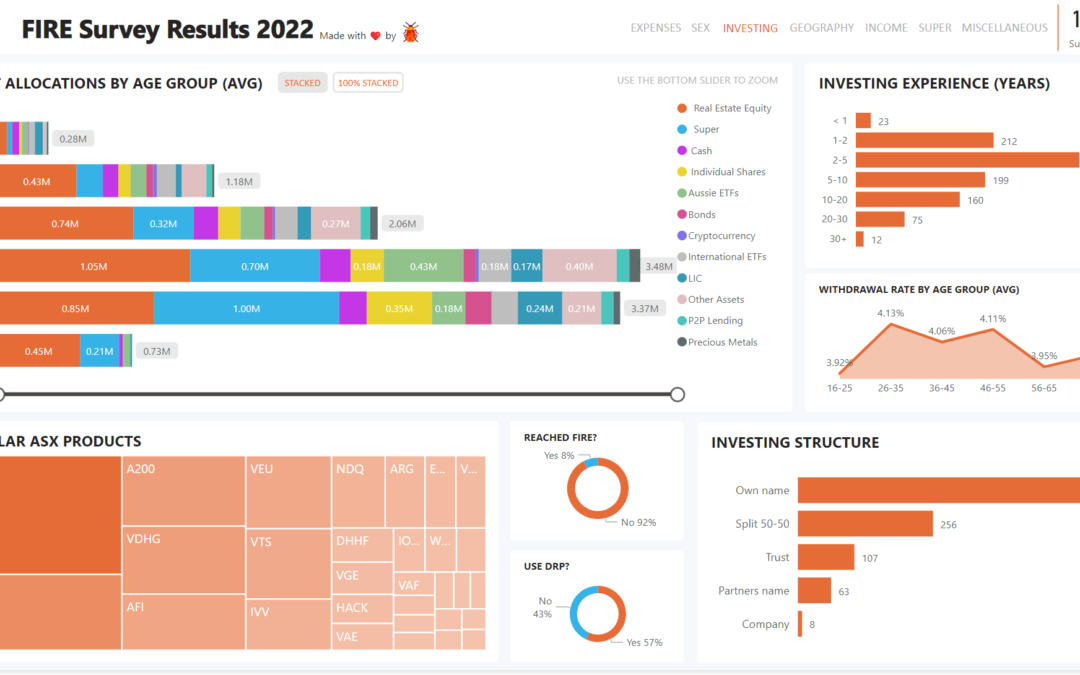

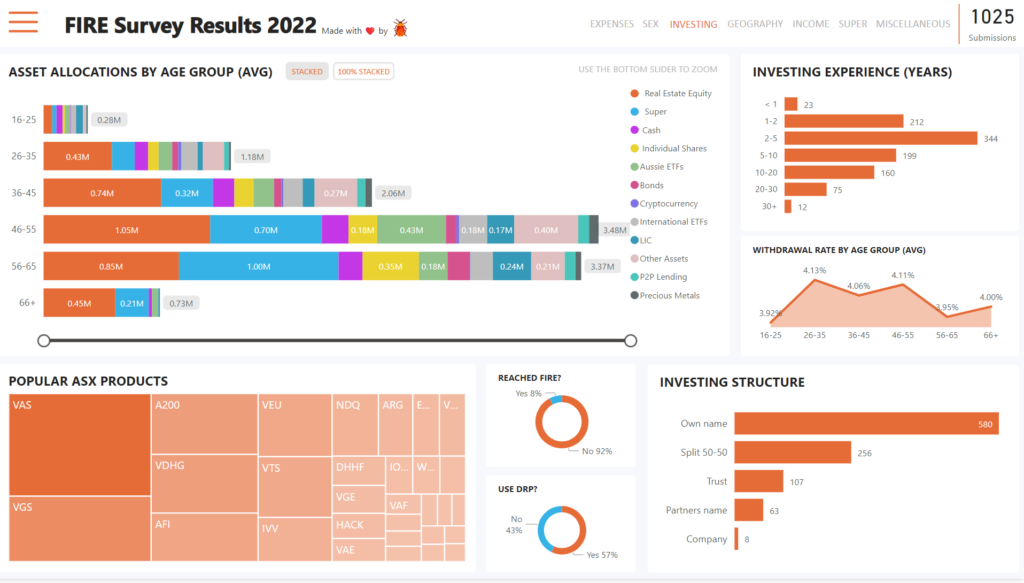

Investing Experience

1,023 responses

How many years have you been investing for?

FIRE Number

999 responses

How much in todays dollars would you need invested to be financially independent?

E.g. if you needed $1.25M to be FIRE. Enter in 1250000

Withdrawal Rate

1,006 responses

How much are you planning to withdrawl from your portfolio to live on each year (as a percentage)?

Cash (Median)

948 responses

How much do you have invested in CASH?

LIC (Median)

260 responses

How much do you have invested in LICs? LIC = Listed Investment Companies

Aussie ETFs (Median)

834 responses

How much do you have invested in DOMESTIC ETFs (companies in the ASX)?

International ETFs (Median)

603 responses

How much do you have invested in INTERNATIONAL ETFs (companies listed outside of the ASX)?

Individual Shares (Median)

588 responses

How much do you have invested in INDIVIDUAL SHARES?

Managed Funds (Median)

130 responses

How much do you have invested in managed funds?

Bonds (Median)

78 responses

How much do you have invested in BONDS?

Defined Benefit (Median)

37 responses

How much is your DB worth?

Annuity (Median)

7 responses

How much is your annuity worth?

Invetment Property Equity (Median)

369 responses

How much are your investment properties worth – How much do you owe on your investment properties?

Precious Metals (Median)

88 responses

How much do you have invested in PRECIOUS METALS?

P2P Lending (Median)

50 responses

How much do you have invested in P2P LENDING?

Cryptocurrency (Median)

361 responses

How much do you have invested in CRYPTOCURRENCY?

Options (Median)

13 responses

How much do you have invested in OPTIONS?

Other Assets (Median)

160 responses

How much do you have invested in OTHER ASSETS? List the dollar amount you have tied up in other assets that have not been listed above.

Most popular ASX Products (Top 20)

868 responses

Which of these ASX listed products do you own (if any)?

Do you use DRP?

1,011 responses

Do you use DRP (Dividend Reinvestment Plan)?

Do you use DSSP or BSP?

1,017 responses

Do you use DSSP or BSP? If you don’t know what these are, select no

Investment Structure

1,014 responses

How do you own your investments?

Super Balance by Age (Median)

1,017 responses

How much do you have invested in SUPER?

Relying on Super?

1,024 responses

Will you be relying on Super to reach financial independence?

Max Super?

1,022 responses

Do you max out your Super contributions each year?

SMSF

1,025 responses

Do you operate a self-managed super fund (SMSF)?

Most popular Super Funds (Top 20)

946 responses

Which Superfund(s) are you with?

Financial Planners

1,025 responses

Have you used a financial planner?

189 responses

Was the financial advice worth it?

189 responses

Was your financial planner independent (as legally defined by ASIC)?

Most popular Trading Platforms (Top 20)

978 responses

Trading Platform

Most Popular Side Hustles (Top 20)

376 responses

Which of these side hustles do you do (if any)?

Debt Recycling

1,012 responses

Do you participate in debt recycling? Select no if you don’t know what debt recycling is.

This report is based on a survey of 1,025 Firebugs from 18 countries around the world.

-

-

- The survey was fielded from November 1st to December 1st 2022.

- Unfortunately, Google forms doesn’t have a timer option which means I was unable to validate submissions

- Respondents were recruited primarily through channels owned/ran by aussiefirebug.com which included: Aussie FIRE Discussion Facebook group, Aussie Firebug Twitter Account and Aussie Firebug Blog

- All income figures are based on AUD.

- Net worth figures are in AUD

- Some visuals do not always take into consideration all the answers due to visual issues. There were 78 distinct values for banks for example. Reducing that to a top 20 is more visually appealing. You can always download the entire dataset if you want to know all the submissions

-

Really interesting results! And looks like i have some catching up to do on Super! 😬😆

Great to see the results.

Thanks for making the data available.

Great use of PowerBI for visualisation.

I think I was surprised last year, and continue to be amazed this year that such a small percentage of people have an SMSF. I thought that it might be correlated with the small percentage of people in the survey who have reached fire, but it doesn’t look like there’s a strong relationship. I would have thought that people who are into FIRE and into managing their investments – particularly in Australia, and particularly who have used your spreadsheet, would be managing their own SMSF, but I guess I’m an outlier 🙂

There’s a bug in the Geography tab of the PowerBI dashboard (I think in the underlying map component, mapping data to the map, but maybe in the data) that means the VIC doesn’t show up on the map).

Hey Bernard, I think SMSF’s aren’t really all they are cracked up to be – I’ve heard unscrupulous advisors / property spruikers usually bang on about them because it allows them to get a commission on selling someone real estate or other crap products through their super, which is like accessing a whole new moneypot most people can’t get to

Hi CaptainFI, I agree like most (all) financial products out there, there are unscrupulous spruikers recommending them for all the wrong reasons. And since you mentioned property – at the risk of stepping over an ASIC line – property in an SMSF is… tricky, because if you need to convert it to cash, it’s really hard to sell 1/10th of a property, but it’s really easy to sell 1/10th of your VAS holding, for example.

But as an investment vehicle, where you have control of the investments and the strategy, an SMSF (with or without an advisor) can deliver you outstanding returns, and exceptionally low fees. Mine is simply ASX listed shares and ETFs (was originally just shares, until I realised that it was a lot of luck paying off, not just research in successfully picking shares), and is transitioning to ETFs as I stop riding my luck. It has returned 10.23% since inception in 1995 after fees (roughly 0.05%) and taxes, and that is good enough for me (since it beats pretty much any public fund out there, and that includes the GFC and COVID crash).

Thanks Bernard.

VIC is showing results for me. Maybe refresh the page?

See https://i.imgur.com/PTiOdid.png from the geography tab. For some reason, no circle appears in VIC for me?

Oh, that’s weird. Maybe it’s your screen size? Are you on a laptop by any chance? It’s showing on my screen.

I’ve worked it out – it’s Edge (Dev). Works in chrome. Trust Microsoft not to support their own tools in their own browser 🙂

Something that has turned me off it is watching my father in law get his SMSF audited twice. That’s with a paid accountant looking after the details. Never got an explanation of what the concern was.

Hi Bernard,

I think for the majority of people, whether you invest or not, managing your own super is not something which is a simple or basic thing to do so they leave it in the hands of a fund (myself included).

I work very closely with the super industry and can tell you a lot of SMSF’s simply end up being rolled back into a normal super account as people jump in thinking they’re the bees knees, only to find out they may be more work than they’re worth or they don’t understand the rules associated with them which leads to audits, bad investments etc. The Govt released an updated version of Superstream (v3) messaging last year which now allows SMSF’s to electronically rollover in/out of their fund, and funds are taking advantage of that update knowing that they will get a greater influx of wound up SMSF’s.

If you have an SMSF and manage it successfully then all credit to you. I think if you have the time or the money to pay someone to manage it, and structure it correctly they can work really well.

I’m personally a bit of a lazy ‘set and forget’ type investor which is why I have a single account with a big name fund

Gerry, you’re right – it’s not a simple or basic thing to do. I started right after I completed a project delivering software that produced advise for a company who had tied advisers selling product (on up front and trailing commission – it’s what put me off financial advisers 30 years ago, but that’s another story), but I learned a lot about investment and financial planning then – enough to be silly enough to think I knew what I was doing.

More than once I’ve looked at rolling back into industry funds, but every time I’ve done the analysis, I’d be giving up a couple of percentage points of after fees returns, and that compounds a fair bit over 50 years (25 years down, at least 25 years to run).

That said, I’ve got the effort and cost down to pretty minimal effort and pretty minimal cost, but it’s taken quarter of a century to get there 🙂

What I think is interesting is that (I suspect) a lot of the Aussie Firebug audience spend time managing their outside super investments as part of their fire goals, but don’t bother with their inside super investments.

If all of us read and cogitate “die with zero” this will help balance relationships, fire planning and a healthy relationship with good debt and investing. It all depends on how early you start and if you partner we’ll and seek good mentors in real life or otherwise with Barefoot guide, Die with zero, Rich Dad poor dad and similar legends. Capture the surplus early and reap the long term benefits

I just spent wayyy to long playing around with this haha awesome work Collecting and presenting the data AFB!

Cheers bro.

I could have made 100 more visuals but I have other priorities.

I have the keys to link this year’s dataset to last year’s so I could have visualised some over the years differences. Like Are people changing asset classes, are they holding more cash or how much their spending habits have changed etc.

But it takes a lot of work and I just had to move on haha. Maybe I’ll have a crash next year

Thanks for sharing Aussie FB. I find it interesting that there are some people with reasonably high net worth, yet not that many that have reached FI. I’d be interested in seeing what the current net worth/expense looks like to see how far people are along their journey. Or maybe for a future survey if people have reached coast or flamingo fire and are going for a semi retirement lifestyle.

That’s a good option to add. I’ll add a flamingo FIRE option next year I think 🙂

Would love to know this too. I’m 50 and discovered FIRE and Matt’s material at the beginning of 2020. Simply becoming intentional has accelerated my financial position incredibly. 3 yrs in I’m at 73% of my number. For context – high income, live in inner-city and walk to work, no car/no regular transport costs. One kid, one husband (employed).

Aussie FB – Bug/mistake in the ‘Were they worth it?’ bar chart for Financial Planners somewhere. The numbers shown are almost the same (94, 95), but the chart shows as if a lot more people said ‘no’.

Good spot. That’s really strange. I think it’s just how that Google Charts library handles it. I’ll see if I can tweak it so it doesn’t look weird.

Hey Matt,

Link from power-bi is broken, it leads to /australia-fire-survey-results-2022, change it

2022 is the correct year mate.

Hey Matt

Mammoth effort compiling all this data!!! It’s bloody unreal. Pretty cool to see you’ve got some international listeners and followers.

FYI you’re just missing an ‘s’ here – https://imgur.com/a/n2xSxO9

Cheers cobba

Thanks Elim.

I’ll change that typo now 🙂

If all of us read and cogitate “die with zero” this will help balance relationships, fire planning and a healthy relationship with good debt and investing. It all depends on how early you start and if you partner we’ll and seek good mentors in real life or otherwise with Barefoot guide, Die with zero, Rich Dad poor dad and similar legends. Capture the surplus early and reap the long term benefits

Thanks for putting this together! Nice to see I’m in the middle for nearly all categories. Must be on the right path.

Thanks for putting this together. I can see how you have refined and improved this survey over the years. Great work!

Have you achieved fire? I would love to know more about the 79 responses that have achieved fire.

It would have been interesting to ask this group.

How many years since they fired?

What is their withdrawal rate?

Do they still work?

Have they changed their withdrawal rate or flex rate after retiring

Agree. And ‘Length of FIRE journey’? I think most of us remember that moment we discovered FIRE and became intentional.

No worries Nat.

Those are great follow-up questions. I’m actually thinking of removing questions moving forward though. I don’t want the survey to take more than 5 minutes. People just don’t have the attention span these days haha

Thanks Matt. I was really looking forward to seeing the results of the survey. I’m particularly interested in the Super results. My son was born in 2008. I wasn’t contributing to super at the time that everything was heavily discounted at the height of the GFC. When I resumed paid work I felt like I needed to catch up so made extra contributions. I’ve been maxing out my super for at least 10yrs now. Good to know I’ve more than caught up!☺️

Any chance you could add age bands to the Net Worth Section?

Leave it with me James 🙂

Great survey of FIREd and FIRE aspirants. It’s interesting that so few of us (myself included) use a financial planner. My question: Maxing out on super contribution refers to concessional contributions only? Please advise.

Another interesting response is that of Cryptocurrency, that despite all the hype, the amounts invested (or gambled) by respondents represents only ‘play money’ compared to total net worth… that’s very encouraging.

Paul, I think you’ll find “max out super contribution” refers to the current $27,500 pp/pa concessional contribution (employer contributions + your top up to $27,500.

Fantastic work. Looking forward to joining the survey next time.