Australian Financial Independence Calculator

There are countless sites/articles/forums about financial independence (FI) on the world wide web. I’ve often come across really clever, well developed calculators that offer a really good visualisation on how long you have to go before you reach FI. But the longer I searched for the best calculator the longer I realised that they were all geared towards other countries.

One of the main reasons I created this site was to offer my fellow countrymen quality information that was tailored for an Australian audience.

The biggest issue I had with every single one of these FIRE calculators out there was they didn’t factor in our Super system. The US system, which is the main system upon which I found almost all of the calculators accounted for, has a fundamentally different way their citizens can withdraw from their retirement accounts.

To put it simply, in the US you only need one portfolio to be at a certain amount before you are considered FI. But because you can’t access your Super before your preservation age (99% of the time) you end up with two. Your Super portfolio and a portfolio outside of it.

So what’s one to do? Do I just keep plugging away at my personal portfolio until I reach my FI number? That seems like a waste since Super has such a big tax advantage. You’re not likely to beat the 15% tax breaks on your Super.

But I don’t want to put money into Super because I want to retire young! And I won’t be able to touch the money until my preservation age (60 for me).

Decisions decisions decisions!

Introducing The Australian Financial Independence Calculator

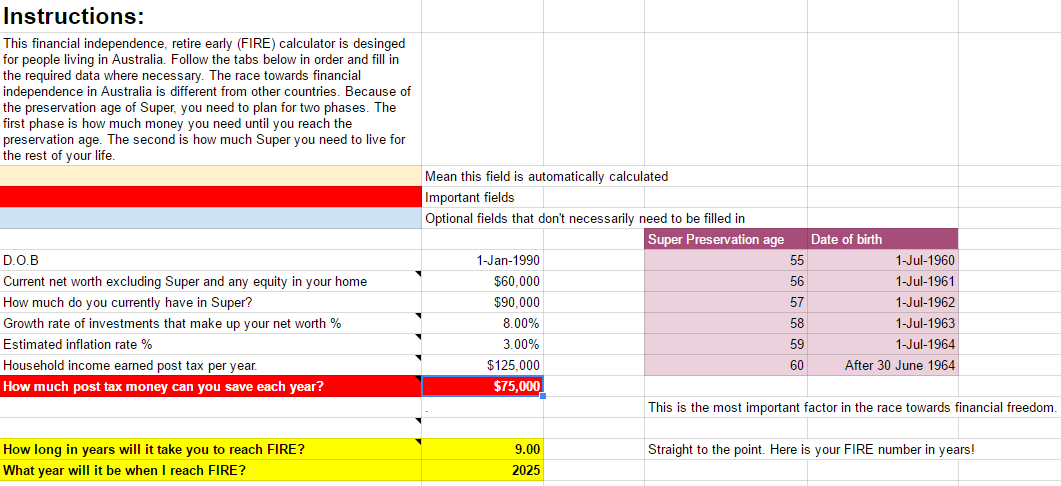

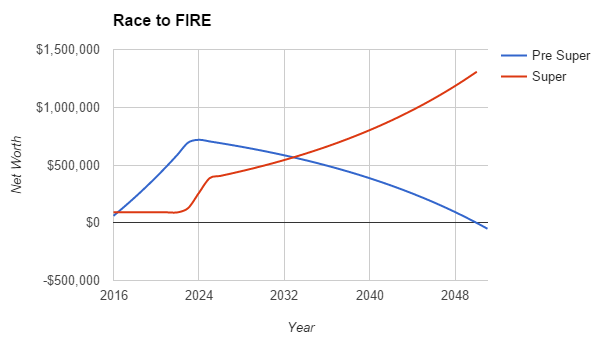

The above are two screen shots from the calculator showing the basic settings and the graph that it generates.

You will notice there are two lines in the graph. The Pre Super number is what you will be living off until you can access your Super. The Super number is obviously what’s in your Super.

In a nutshell, the most optimal way to reach FIRE here in Australia is to:

-

- Step 1. Have enough money to survive until your preservation age (when you can access Super). No matter how much you have in your Super, you won’t be able to retire early and pursue your other goals in life if you don’t have money coming in to live off. Step 1 is not meant to last you forever though. It’s only meant to last you until when you hit your preservation age and can then access your Super. You will notice in the above graph that your Pre Super number goes up and up and up…and then slowly tapers off past $0. This is by design. You want your Pre Super number to be at $0 when you access your Super.

-

- Step 2. Have enough in Super to cover all your living expenses forever! You will notice that the red line (Super) has a number of dips.

-

- The green part of the line indicates how much Super you currently have at the start. This will move slowly up (depending on how much Super you have) over the years as your super grows from compounding interest until you hit the pink arrow.

-

- The pink arrow indicates the time you have reached your Pre Super number. When you have reached your Pre Super number you theoretically should be able to live entirely off that number until preservation age (assuming all conditions stay the same). This means that 100% of your after tax income will be going into your Super account until you reach your Super Number.

-

- Your Super number is not actually your FI number. Your FI number will be reach in your Super account at the very start of your preservation year. But no sooner than that, because that is the most efficient and fastest way to reach FIRE. The calculator works out how many years it’s going to take you to reach your Pre Super number and then does some cool math and works out that you need a certain amount in your Super for it to grow into your FI number the year you can access it.

Pretty cool huh!

Video Of The Calculator In Action

Work In Progress

The calculator has some flaws. It’s a work in progress. If you find a flaw please let me know and I’ll try to fix it.

Download Now

Enter your email address and not only will I send you the calculator. I will send you updated revisions of it ever time I fix a bug or the laws in Australia change.