Pay Less Tax Part 2- Salary Sacrifice

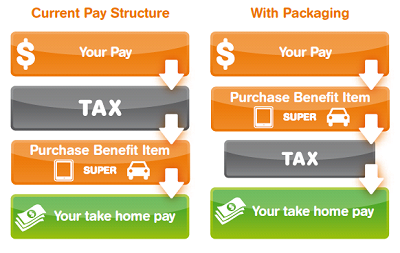

Part two of my Pay Less Tax series which focuses on various strategies for lowering the amount of tax you pay here in Australia. You can check out Part One – Buying Assets In A Trust if you missed it. This strategy is pretty straight forward, you buy stuff with pre-taxed dollars lowering your taxable income which results in you paying less tax that year.

What Is Salary Sacrifice?

Salary sacrifice, also know as a salary package is an arrangement between an employer and an employee. The employee sacrifices part of their salary or wages in return for the employer providing them with benefits of similar value.

The key thing to remember here is that you’re using pre-taxed dollars when you sacrifice.

Lets consider someone who is earning $80K and needs to buy a new computer worth $4K. At $80K per year, this person would receive $60,853 dollars after income tax.

They could pay for the new computer out of this post taxed income of $60,853 which would then bring them down to $56,853.

If their employer let them salary sacrifice the computer to bring their taxable income down to $76K per year, they would receive $58,233 dollars after income tax PLUS their computer.

That’s a difference of $1,380 dollars saved. Imagine if you did this or something similar for 30 years. That starts to become a serious amount of saved taxed money that could be invested or spent elsewhere.

You really have to check what you’re company is offering when it comes to salary sacrificing. I’m pretty certain (please comment if I’m wrong) that most companies allow you to salary sacrifice into super. There’s a limit of $25,000 a year before tax contributions.

Make Sure You Check

There are no restrictions on what your employer can package for you so it’s really best to check with them. I know a place that allows their employees to salary sacrifice their home loan! Yes that’s right, their bloody home loan. I’m not sure of the details but can you imagine if you could pay off your home loan using pre tax dollars every year. Unfortunately my work only lets you salary sacrifice super which is no good to me for now. So go check with your employer. You might have an expense coming up soon that you could potential pay for using pre taxed dollars.