Welcome to the very first Aussie FIRE Survey results!

Firstly, I know that half you guys read this blog on your phone but if you can, please come back to this post on a desktop or something with a bigger screen because the visuals look so much better and the dashboard was designed to be viewed on a desktop.

I’m really keen to run this at the start of every year and release the results along with the dataset for the wider community. I was inspired by the extremely popular Stack Overflow Annual Developer Survey Results that they publish each year for developers. Essentially, you can read where people are from, what technology is used the most in the community, what coding languages are hated the most and a whole bunch of generally interesting tidbits.

I had this idea mulling in the back of my head for years and thought wouldn’t it be cool to run an Aussie FIRE Survey each year and share the results! One of the greatest strengths of this community is that we are willing to share and talk about what is normally considered taboo subjects. I’m probably on the extreme end of the scale of what people are willing to share but the beauty of the survey is that anyone can fill it in completely anonymously.

The results below are both extremely fascinating and interesting. What I also hope that this annual survey can achieve is to give a little bit more help to would-be Firebugs who are trying to start their journey but don’t have a measuring stick.

Think about it, if you read something online about person X saving $30K a year and investing in VTS without any context, you don’t really know if that’s a lot of money for them (they could be earning $250k per annum) and what their circumstances are that made them choose that ETF.

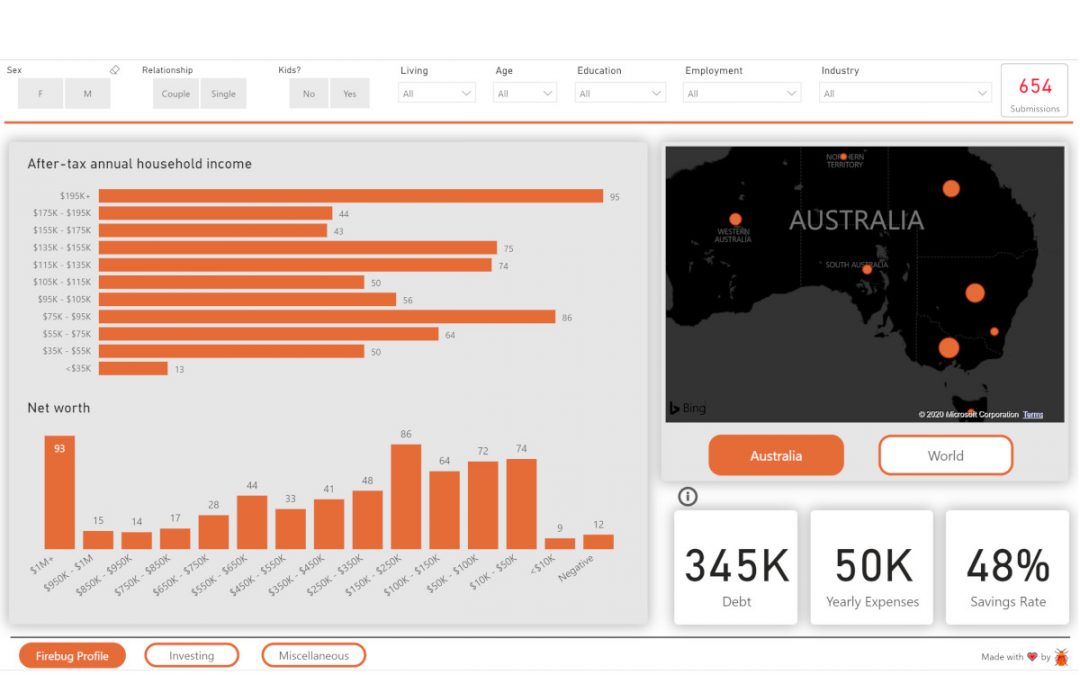

At the bottom of this page is the FIRE survey dashboard where you can slice and dice the data to suit your needs. The richer this dataset gets, the more specific you guys will be able to drill down to your situations and get a feel as to where the rest of the community is at. You might be a 28-year-old single lad from Melbourne that’s earning between $80K-$100K. It might be of great interest to know what others in your situation are doing/are at with their journey.

That’s the idea anyway. I sorta stuffed up the survey when I ran it in March because I forgot to include some key questions (like super 🙈) but I already have a heap of improvements I will make when I open up the survey again at the end of this year.

The survey had 654 submissions across 9 countries and the results are broken up into four sections:

- Firebug Profile

- Investing

- Miscellaneous

- FIRE Dashboard (interactive dashboard using the data from the survey)

- Methodology

Feel free to download the raw data from here (Open Database License (ODbL)).

Please tell me what questions you’d like to see in the future version of the survey and just general tips or recommendations for me 👍

Enjoy!

Firebug Profile

Geography

*This map may not rendering on mobile phone screens

There was no surprise that the majority (621) of submissions came from Australia. I was actually shocked that 8 other countries contributed. I’d love for this survey and the results to become more global in the future.

I was pleased to see my home state of Victoria coming though with the most submissions for the Aussies 🤘

Age Range

No surprises here. I knew from my Google analytics that the majority of my audience fell between 20-40 years of age.

Sex

I'm currently working on some content that's more female focussed because finance and investing seem to be heavily skewed towards a male audience.

Relationship Status

I was thinking about FIRE for singles just the other day. It's definitely possible but a lot harder to do. Take our situation living in London for example. We pay £900 a month in rent that gets us a bedroom with an ensuite. Everyone else in the house pays around £700 and they have to share the downstairs communal shower. All the big-ticket items like living, food and transport costs can be shared between a couple whereas you're paying for everything if you're single.

Kids

Considering the age range that filled out this survey this result doesn't surprise me too much.

Was a bit surprised to see so many maybes tbh.

Education

Close to 70% of the respondents are university-educated 🎓. No wonder so many smart people live in the comment section!

Employment Status

What industry do you work in?

This one is super interesting because there seems to be a lot of people in the tech industry that are drawn to the concept of FIRE (I fall into that stereotype 🙋♂️). But the data is showing a lot of diversity! I probably could have guessed the top two categories but the rest was very interesting to see.

Annual Household Income (after-tax)

Holy moly some of you guys are earning a mint! I'll have to add more upper tiers in income for the next survey since the highest submission was for $195K+ 🤑

Net worth (excluding your home equity)

So the way I interpret the above data is that there must be a lot of people either at the start of their journey building up a solid snowball of around $50K-$200K and also a lot close to the end in the $1M+ range.

Living Status

I would have guessed the renters were going to take out 🥇 place here actually.

Investing

Have you reached FIRE?

How many years have you been investing for?

Financial Planner?

Top 10 ASX listed products owned

DRP/DSSP

I was a little surprised at how many people use DSSP actually.

How do you own your investments

Miscellaneous

Top 10 banks respondents hold their mortgages with

Side Hustles

Please note that the below figures are the annual median income after tax and not the averages. There were a few massive submissions that would have blown out the average completely so median seemed to be more appropriate.

hmmmm I think I need to get into Amazon FBA 😂

FIRE Dashboard

Here is what I believe to be the very first interactive FIRE dashboard generated from user data... ever!

There's probably someone out there that's already made one but I've never seen it. I'm really happy how the dashboard turned out and it's only going to get better each year as I add enhancements and features. The more people fill out the survey the richer the dataset will become which will make the insights and analysis more accurate.

Most things in the dashboard are interactive. You have the filters at the top but you can also click on each visual and it will affect the others.

Here's a quick little video explaining how it works.

I'd highly recommend viewing the dashboard in it's fullscreen mode. If you're on your mobile, please come back to this bad boy on a desktop. Trust me... it's worth it 😁

Feel free to have play with the PowerBI file here. There were some assumptions made in the dashboard but if you're interested in how the data was put together, the PowerBI file has everything you need.

Methodology

This report is based on a survey of 654 Firebugs from 9 countries around the world.

-

- The survey was fielded from the April 5 to May 1 2020.

- Unfortunately there wasn't a timed component in the dataset which means I could not qualify responses. I plan to add a timer for the next survey to fix this.

- Respondents were recruited primarily through channels owned/ran by aussiefirebug.com which included: Aussie FIRE Discussion Facebook group, Aussie Firebug Twitter Account and Aussie Firebug Blog

- All income figures are based on AUD. There will be changes to this in future surveys as I'm aware international salaries should ideally be converted to a base currency

- Net worth figures are in AUD

- Some visuals do not always take into consideration all the answers due to visual issues. There were 87 distinct values for banks for example. Reducing that to a top 10 is more visually appealing. You can always download the entire dataset if you want to know all the submissions.

Hi AFB,

Great work. Dealing with stats is something that makes me shudder as I remember all the engineering classes I’ve ever taken on the subject. Some really good insights here – I particularly was interested to see the breakdown of ETF ownership showing that VAS is significantly ahead, and also that the gender participation is majority male. While I have a small blog and social media presence, our readership is somehow opposite – an estimated 80% of my following is female! Have no clue why, because I blog anonymously People often assume that I am a female. Not that my gender matters, I just thought it was interesting – perhaps the way I write is more approachable to a female audience? Probably a good topic for a future post. Back to the stats thing, do you think 650 people is a large enough sample size to be representational of a population in the tens of millions? I understand it’s a niche community and not everyone is going to participate – but it would be good if you could keep this thing open and get say, 10,000+ entries!

Cheers buddy,

I was actually super stoked with the amount of submissions we ended up getting 😅 but yeah, the model is only going to be as good as the underlying data. But we start with baby steps.

I’m hoping to get more and more submissions every year. And am sure you’re well aware of science behind sample sizes and margin of error. We’re not looking at the whole population which as you’ve pointed out is tens of millions, we would only be interested in the FIRE community. How big is the Australian FIRE community…? I’ve got no idea. But the dataset will continue to improve each year and the model will follow.

I can’t wait to open it again at the start of 2021 with some improved questions and validation!

Well done. Thus would have taken a lot of time

Thanks MMA. Yeah, it took a lot longer than I thought. But now that I have a template, next year’s survey and post should be about 10 times quicker because I won’t be starting from scratch.

Would be interesting to do some real stats on these findings and see any trends and relationships across all the data. Run some of the correlations in SPSS or R (or get somone to do it! 🙂 )

The dataset is there for anyone to download 🙂

It would be great to have a data scientist comb through it

Very cool AFB!

It’d be interesting to see how the various figures compare to the general population.

I was really surprised at which banks people have mortgages with. The big 4 banks and ING make up the top 5, but usually there are rates which are a fair bit lower on offer from some of the other providers like HSBC, Macquarie etc. There’s a lot of agonising over a few basis points of cost difference between A200 and VAS, but it seems like people are paying a lot more than that difference on what is likely a much larger sum of money by using the big banks and their higher rates.

💯💯💯

We are currently with Macquarie and the difference in interest rates per year compared to CBA (who I started with) smashes the difference between MERs for most of the popular ETFs.

This is really amazingly good. User friendliness, the design, all excellent. Well done.

Gracias 🙂

Smart people don’t always go to university

Ain’t that the truth!

For a lot of people it would have been smarter not to go to uni. Far too many graduates have taken on massive debts and will never earn an income beyond what they could have earned without that debt and, as they spent several years accruing that debt and not working and saving, are years behind their non uni educated compatriots when it comes to achieving life’s milestones such as a house, kids, retirement and so on

This is brilliant AFB. One can use this to benchmark their FIRE journey, savings rate and what not. This is an information treasure trove. Congratulations for this super work!

Cheers boss.

I can’t wait until I run it again at the start of next year to be honest. Heaps of questions to add and frame some of the old ones here in a different way to get the data a bit cleaner.

Hopefully, we get more submissions too 😁

Thanks AFB. Some hard work put in there, good on you.

Thanks Tash

I am intrigued about the comment about singles. Does it mean much of the info I read is made for couples? I always thought FIRE would be much easier as a single, unless the couple doesn’t have kids or doesn’t plan to. And even so, I always think of FIRE as something you achieve as an individual. You never know if your relationship will last forever.

Yes and no.

Kids throw a spanner into the works as far as finances go but from my experience, working together as a team is far more efficient money-wise than doing it solo.

Think about the big three expenses most Aussies have.

1. Housing

2. Transport

3. Eating & Drinking or Holidays depending on your lifestyle

All three/four of those things can greatly be reduced by working together in a relationship. I mentioned the renting example which is obvious but there are plenty more examples.

If you’re single and live in a remote area where you need a car you obviously have to buy one yourself. If you have a partner you can share. Buying groceries and cooking in bulk is a lot more efficient to do so with two people compared to one.

You can always share with another single person but it’s just not as easy or realistic to do so compared to being in a relationship.

The big risk is, of course, breaking up. But being in a strong relationship has played a HUGE role in our journey and there’s no way I’d even be half as wealthy if I didn’t have Mrs. FB beside me. Not even close!

There are also heaps of intangible financial benefits from being in a relationship that isn’t as obvious at first. A lot of my single mates here in London spend a SHIT LOAD on dating women during the week hoping to find the one. Or buying nice clothes to impress etc. Sometimes I’ll wear the same t-shirt 5 days in a row lol.

You can definitely do FIRE single but IMO it’s harder to do so.

Agree with most of your points there! Easier as a couple as long as your partner is on board with FIRE too.

Quick question – are your monthly net worth updates as an individual or a couple?

They were just me up until late 2016 when Mrs. FB and I joined our finances. Now all the updates I post is what our shared wealth is

Good to know. Thanks!

Great points AFB, very interesting!

I’m still not too convinced it’s FAR easier however.

Yes there are things that work much better as a team but there are things inherently more expensive for a couple than a single, no matter how frugal both of them are. Your bar simply raises because it’s simply two of you. If someone started their FIRE journey as a couple they wouldn’t notice it as much.

1. Housing

I can’t talk about London, but in Sydney I can live right in the middle of the city as a single for 325/week. It’s pretty cheap for the location. I could go even cheaper but then it would either go below my acceptable bar or I’d have to invest in a car which could defeat the savings, would have less access to transport. I don’t need nor have a car, also other things such as distance.

I couldn’t possibly share this same room with a partner else because a) there would be no lease for my room as a couple b) even if it had, it would be impossible for couple to live in a room like I do, so small it is c) even if both A and B were possible, the rent would automatically go up on a couples lease anyways.

We would end up searching for a bigger house with less rooms, hence more expensive. Depending on the place we’d have to buy a car. So many other factors, none of them cheaper.

2. Transport

I don’t have a car so that doesn’t change to me, but even if it did I’m not sure impact is so huge unless you have lower income.

3. Eating & Drinking or Holidays depending on your lifestyle

Cooking and groceries are easier to keep on a routine for sure. But again you are 2 hence you are buying twice the groceries. I can live on dirt cheap groceries cooking food for the week and can’t see a huge impact on my FIRE. Holidays: you still need two plane tkts instead of one, yes you may save in hotels but again I don’t see a lot of impact, you are still eating for two, doing other things for two.

Also I don’t think a couple would be able to account their past cost of becoming a couple if they started their FIRE journey during a relationship.

I am single and wear the same t-shirt 5 days in a row sometimes too, I only buy clothes once\year if at all and still can go on dates, I only once a month max, if at all. I don’t see this as extra difficult is just how I am. But maybe also why I’m single hahaha. Still having lots of fun tho.

To me the biggest factor on a couple’s advantage is the double income period. That makes it undeniably easier. But when it comes to that I just think “pro rata”, I’m still considering how much I’m FIREd as a single even if I was with a partner.

But as a single, with all of that I’m still able to FIRE rather comfortably in less than 10 years or CoastFIRE in less than 5 which I think is still awesome and easy.

Fair points. Everyone’s situations different I guess. Thanks for bringing your perspective 🙂

2 high income earners will always do better than a single. There’s also things like life admin that can be shared which saves time. And time is money right.

If you ever meet a partner on the same wavelength you would understand.

Fascinating data and great work with the dashboard, looks great and very intuitive to use.

I found it very interesting that for every single income category (excluding <$35k), the Savings Rate was basically unchanged (between 40-50%). If everyone had a similar lifestyle with similar expenses, then saving rate should drastically increase in line with income. So this shows that the dreaded "lifestyle inflation" is certainly at play here, as much as we try to fight it/deny it!

Interesting!

Lifestyle inflation is a thing… and this might not bode well with some people but I think it’s already happening to us, to be honest. I use to think I’d stay at the cheapest hostels my entire life when I was just starting out on our FIRE journey… but man… things change hey.

Sometimes you do want a little bit of luxury. I guess the bigger point is that you understand what you’re giving up by choosing the luxury whilst also being in the financial position for it to not impact your freedom.

Great job Firebug. Love the visualisation!! You could get a bigger sample sizes by approaching other fire bloggers to share the survey to their communities in future surveys. I’m sure people would be keen 🙂

Sounds like a plan Wendy 🙂

I’ll put the feelers out towards the end of this year I think.

Great visuals! Had a lot of fun with the interactive dashboard.

One thought for future surveys – would be interesting to see how many years people are into their FIRE journey.

I’ll add it in next year mate!

Nice work AFB!

Interesting to see a huge representation of males a relationships driving the fire.. Same sex couples aside, I would have guessed that females in relationships would be just as likely to be leading the charge to fire.

Great job with the survey! Also, I’m guessing most of the overseas folk are Aussie expats (like me)

males *in relationships

Cheers mate.

Yeah I suspect most are expats like you said

Brilliant idea! I didn’t participate for some reason (must have checked out on emails or something….) Is love to help out on the female audience side of things if you need some ideas. Another question to add might be what people intend to do more of/less of when they retire.

Thank’s Kirsit!

I’ll add it in for next years survey 🙂

Amazing! Great easy-to-understand interface. I’d like to take part next time. Good job!

Thanks Hunter

Interesting data. As someone who’s seen decent returns from a portfolio established by a financial planner, I was interested to see so many people said it wasn’t worth it.

Even more interested to see that the survey results showed 117 people had used a financial planner, 72 said it was worth it and 120 said it wasn’t? So 117 people have used a financial planner, but 192 people said weather or not it was worth it? Slight numbers issue there, maybe?

Glad someone else brought this up too. I use a financial planner who has been holistic and has helped me achieve great returns.

I also think the denominator should be 117 as only those who answered yes to actually using a financial planner can speak as to whether it’s worth it.

Better quality control will be implemented for next years survey. For whatever reason, only 117 answered the “Have you used a FP?” question yet more answered the “Was it worth it” one which doesn’t make sense. The data is what is it though and with improved quality controls in the next one, I should be able to iron the DQ issues.

Not too bad for a first attempt though 🙂

Nice work, interesting stats.

I’m surprised how many people have a joint post-tax income of over $195k+ that seems really high, basically means both people need to be making $140k each minimum. We probably knew this anyway but if you compared these incomes to some generic stats on median wages for the entire country, this community is right up with the 1 percenters.

According to the bureau of statistics the median income for the financial year 2016/2017 is $48,360 before tax. Most of us in the FIRE community are pretty lucky.

I was a little shocked by this too. I wonder if could have worded the questions a bit better… I have a heap of improvements to make on how the questions are structure to get better data so I hope next years results are cleaner.

Awesome product for the first edition!

Unlike some others I reckon the 600 odd submissions is an outstanding turnout considering how small the FIRE community is in Australia.

Keep up the great work!

Thanks David,

Yeah I was so happy with what we got. Considering how hard it is to get anyone to do a survey without an incentive these days. Would be amazing if we can crack 1,000 next year 🙂

I love all this data stuff. Thanks for the work you put into this. I think you need to create additional higher categories for:

1) Annual Household Income (after-tax)

2) Net worth (excluding your home equity)

I am so surprised to see that many people earning $195K+ after tax. Maybe I am out of touch with wages, or people entered their before tax earnings? On the other side of the coin, I think that $1M net worth excluding the home is not really high. I would have expected to see $3M+, $5M+ and $10M+.

Yes agree I’d be very surprised if the data on household income and net worth is correct, especially if you correlate this with the wages and other info we got.

Possibly some people entered gross income. And possibly some people counted the home equity in net worth, or forgot to subtract debt. I don’t think 3-5-10m would be realistic for a majority of 25-30yo, even if course the blog would skew MUCH wealthier than the average.

I tend to agree… There was a lot of data clean up I had to do in the PowerBI file which made it obvious that some of the questions people misinterpreted. This is useful in itself really because I know what questions to re-think for next year so we can get more accurate data.

But then again, maybe there’s just a heap of really rich people in the FIRE community lol 🤷♂️?

Great points. They have been noted 🙂

Great work. Some very interesting insight into the Aussie FIRE community, and the dashboard is awesome. I would love to see how these results change over time as the FIRE community grows.

I imagine it would incredibly difficult to do as the data would need to be pseudo-anonymized somehow, but it would be interesting to have a longitudinal aspect to this. How many people drop out of FIRE, and how many stick it out and move from the group concentrated at < 250K net worth up to over$1M and how long that takes. We have individual data points from bloggers such as yourself, but it would be incredibly interesting to see evidence of this in the wider FIRE community.

excellent suggestion I reckon – but you’re right that survey responders would need to be willing to be identified (internally in the survey, not in public) eg by email address to do the longitudinal analysis.

I’d love to see that too but keeping it anonymous is paramount. I’ll have to have a think to see how this could be achieved.

That is awesome work AFB. I’ve been following the blog since last 3 months and had no idea this survey existed.

One way to get some understanding would be to ask survey respondents whether this is the first time they are responding, or create categories (1-3 years, 3-5 years etc.) as we go down this journey.

All the best!!

Cheers mate,

I’ll consider that for the next one 👍

Hi AFB

If possible maybe at the start of the survey ticking a box whether participant is happy to be contacted afterwards or not. If yes they just provide email.

Good work pulling this together.

The # of people with $1m net worth excluding home equity doesn’t sound right.

Eh. I thought the after-tax income was more of an outlier tbh. The data is what it is.

Victor, I think the number of people with $1m net worth excluding home equity is realistic. There are older people who completed the survey.

This is awesome mate, great work.

Had a good laugh to the results regarding whether seeing a Financial Planner was worth it.

Ahh, I had a feeling you were tinkering away on something like this, part reason I sent you that project a few weeks back 😉 Will need to come back to this when I have the time to watch the video but the data snap shots are interesting for sure and it looks like you put a bunch of time into this bad boy. I filled it out myself so it’s intriguing what other peoples situations are like.

Great work!

I found this very interesting, and was heartened to see that I am around the median for my cohort in terms of net wealth, income, and annual expenditure despite having only recently started on the path.

One aspect I would like to see displayed in such information is whether people have received any assistance from parents etc in reaching the point they are at, and if so how much and what type (eg house deposit, early inheritance). It’s not really something I like asking on a public forum!

Thanks Helen,

I’m looking to add in more questions next year 🙂

Aussie Firebug. This is amazing. Thank you for pulling this all together!!

No worries dude! Next years will be even better 😁

Wow, great read! I am new to the community and its good to know I picked one of the most popular ETFs (A200)

Wow, what a great tool. I know everyone is on their own individual journey but it’s fab to have a benchmark especially with all the demographic info so you can compare apples with apples. I would love to participate if you run the survey again next year.

Thanks Emma,

Make sure you sign up to the newsletter if you want to receive my emails. I’ll be sending out the new survey at the start of 2021!

Great work AFB, impressive!

Do you consider to include gross instead of net income in future surveys? It looks like people misinterpreted the question and went with gross wages. Gross income is the most known figure (before tax, including super) for anyone on a salary. Just my two cents though 🙂

Cheers mate,

Income tax is so hard to account for so net was easier to use. But I understand that people might have just entered in their gross amount… I’ll have to have a think about how I approach this in next years survey.

Thank you so much for your work on this.

For the next survey, I would love to know more on the kids question. Did people answer no because they already have kids, but aren’t having more? Because they are over 65? Because they are under 20 and don’t want them right now, but would consider it in 10 years time? Or are most FIRE people committed to a child free lifestyle?

Noted

This is A W E S O M Aussie Firebug! Even though you haven’t been producing as much content and have dropped of the Podcast scene more recently, I’d still rate your podcast no. 1 compared to the other FIRE pods I’ve been listening to. Can’t wait for you to get back to Aus and increase the content 🤗

Thanks a lot Jess 🙂

I can’t wait to come back home too. I’ll finally have my good mic back haha.

Hi AFB

What a great survey this is. Love the podcasts but mainly your articles and how transparent you are with numbers.

Very impressive how many people are net worth 1mill compared to the number that have been investing for over 20 years. There must be some people who are extremely quick accumulators.

To really be able to use this as something you can compare yourself with I was thinking.

1 – checking where people started from. Eg. If they had student debt verse not or if they received any inheritance.

2 – if possible some type of graph showing the average net worth of people verse their age (or against number of years they have been investing)

Im sure your future surveys will have even more participants and give even greater data.

Great work.

I’m glad you enjoyed it Priyesh 🙂

Thanks for the great feedback. I’ve got plenty of improvements I’m going to do for next year and I’ll add these into the suggestion pile.

Cheers

Hey AFB,

This is a very interesting read. I’ll be sure to show my17yr old who is the one that introduced me to FIRE and does Yr12 Economics, so she’ll love reading these results.

Thank you for all your hard work.

I look forward to participating in the next survey.

No worries and thanks a lot Jodie 🙂

Great work. I think it wouldn’t hurt to collect data such as super balance, mortgage balance? If too personal you can make it a range ie $100K+, $200K+ and so on

Thanks! Super will definitely be making an appearance in the next survey 🙂

Very cool! Also the first time on your website, so I’ll now read the other stuff you have on here. Good job mate.

I’m 30, a recent-ish export from India, and earn roughly $120-140K post-tax; seems like I’m in the middle range and will take me a while to get up to some of the big boys out there earning $195K+! Inspiring no doubt.

Hey Matt,

As we are nearing the end of 2022, I was just wondering when your next survey will be as I would like to take part and see the most up to date information from other followers.

Thanks – Joel

The survey is out atm Joel. Open until the end of November 🙂

Hi AFB, did I miss a link, or is it just for mailing list/FB community? I’m old-school and RSS your blog…

Sorry, just listened to the pod, have it now thanks.

Link here Mrs. ETT 🙂

LINK

your blog is Great and help me alot.Thanks for publish.See my blog here:

https://pushcapital.com.au/