by Adam Preston | Jun 19, 2023 | Podcast

Summary

Today’s episode is very special to me personally.

I’m speaking with my dad about how he grew up and what money and life lessons he learnt along the way. He’s probably had the biggest impact on how I view the world (along with my mum) and set the foundations early on for me to be in the position I’m in today.

Some of the topics we cover in today’s episode are:

- What life was like growing up in Melbourne with immigrant parents (00:02:16)

- How Tony learned about money management as a child (00:13:08)

- Leaving school at 15 to help contribute to the family farm (00:19:26)

- Life lessons learnt from Tony’s immigrant parents (00:23:29)

- Comparing the housing market in 2023 to the 1970s (00:29:13)

- Learning about property investing (00:35:44)

- Stock market investing (00:48:15)

- Tony’s essential life lessons (00:53:47)

by Adam Preston | Jun 9, 2023 | Podcast

Summary

I’m excited today to be having a conversation with Bryce Holdaway and Ben Kingsley who co-host the very popular podcast called The Property Couch.

Some of the topics we cover in today’s episode are:

- How Ben and Bryce originally made a connection (00:02:00)

- Property investing guidelines and regulations (00:12:37)

- Their investing strategy/philosophy (00:23:25)

- The Australian housing and rental crisis (00:48:56)

- Active property investing vs passive share market investing (00:37:03)

- Are property investors adding to affordability issues or are they being used as political scapegoats? (00:56:45)

- How The Property Couch podcast got started (01:20:33)

Links

by Adam Preston | Mar 31, 2023 | Podcast

Summary

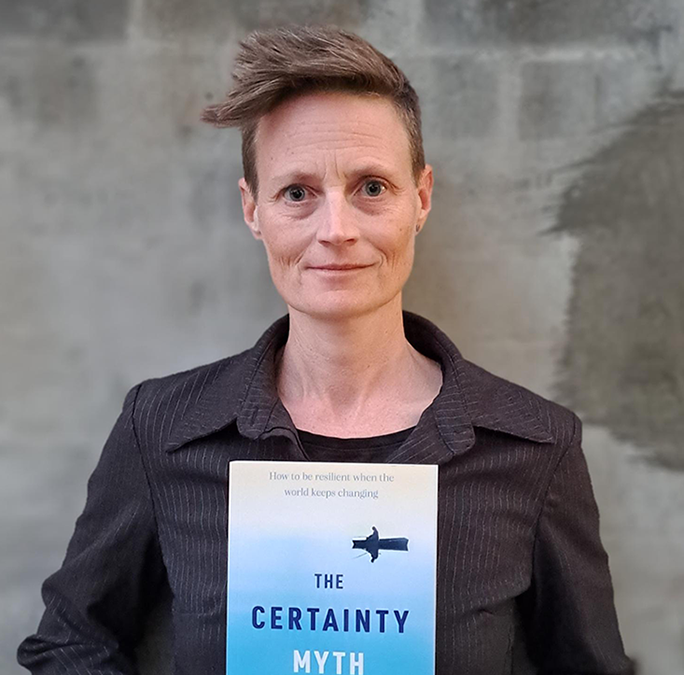

My guest today is Dr Toni Lindsay.

Toni is a clinical psychologist who works primarily with people who are at the end of their life or have a severe illness (usually young people!).

In her own words: “My work has shaped how I think about all this FIRE stuff!”.

Toni is also the author of multiple books but the one which probably has the most application with FIRE would be “The Certainty Myth: How to be resilient when the world keeps changing”.

Some of the topics we cover in today’s episode are:

- What does Toni actually do in the field of clinical psychology? (00:04:02)

- What motivated Toni to write “The Certainty Myth”? (00:15:54)

- How Acceptance and Commitment Therapy (ACT) can help with the journey to FI (20:19:00)

- The relationship between uncertainty and anxiety and how we can better manage this (00:55:54)

- Cognitive flexibility – how flexibility can be an antidote to uncertainty (01:01:43)

- How FIRE plays a role in resiliency (01:10:54)

- How Toni’s experience with mortality has shaped her FIRE journey (01:21:50)

Links

by Adam Preston | Mar 10, 2023 | Podcast

Summary

Following on from the previous episode, this is part 2 of the debate.

There’s been a few potential Super changes put forth by the Albanese government lately and I wanted to get two different viewpoints on the podcast to debate the pros and cons of the changes. I also wanted to talk about Super as a high-level concept.

What exactly is Super?

What’s the purpose of Super?

Is Super fulfilling its job? etc.

We have two returning guests joining in today’s discussion. CIO of The Motley Fool Australia, Scott Phillips and Economist Dr Cameron Murray. I’m playing moderator between these two as they give their different opinions on some of the following topics:

- Are you for or against opening up Super to allow members to buy a home? (00:01:33)

- Is confidence being eroded when the government keeps tinkering with the system? (00:08:20)

- Is it just the rich getting richer? (00:15:08)

- Is it a good idea for the government to invest in capital projects? (00:18:43)

- The proposed Super cap (00:31:35)

Links

by Adam Preston | Mar 3, 2023 | Podcast

Summary

I’m so excited for this one today.

There’s been a few potential Super changes put forth by the Albanese government lately and I wanted to get two different viewpoints on the podcast to debate the pros and cons of the changes. I also wanted to talk about Super as a high-level concept.

What exactly is Super?

What’s the purpose of Super?

Is Super fulfilling its job? etc.

We have two returning guests joining in today’s discussion. CIO of The Motley Fool Australia, Scott Phillips and Economist Dr Cameron Murray. I’m playing moderator between these two as they give their different opinions on some of the following topics:

- What is the purpose of Super? (00:03:26)

- Is there an alternative to the current Super system? (00:11:38)

- Thoughts on how we could fix the Super system (00:19:27)

- Do we actually need to have both Super and the Age Pension? (00:39:48)

Links

by Adam Preston | Feb 26, 2023 | Podcast

Summary

Today my guest is Queenie Tan. She’s a 26-year-old Sydneysider who has amassed over 350K followers on various social media platforms. Raised by a single dad in Sydney, Queenie was earning $400 a week after she moved out of home at just age 19. A few years later she was able to save a $100,000 property deposit and now at age 26, has a net worth of half a million dollars.

Some of the topics we cover in today’s episode are:

- Queenie’s upbringing and relationship with money (00:02:12)

- How Queenie built her net worth to $500K by age 26 (00:10:03)

- Dropping out of uni to start earning money (00:15:40)

- Changing jobs every couple of years (00:21:11)

- Queenie’s thoughts on the term “Finfluencer” (00:46:28)

- Financial content creators and the ASIC guidelines (00:51:09)

- Sydney housing markets and financial freedom (01:05:34)

Links