by Adam Preston | Jul 1, 2024 | Podcast

Summary

Today on the podcast, we have Amy and her partner Matt from FI Freedom Retreats, a five-day financial independence retreat in Bali.

This was a passion project born out of Amy’s love and gratitude for the F.I.R.E. movement and community.

Heads up, I recorded this podcast in January this year and haven’t released it until now because I’ve been distracted with other things. This means there’s a good chance there won’t be any spots left in the retreat for this year, but I think you’ll still find our conversation interesting.

Some of the topics we cover in today’s episode are:

- Amy’s fear-based relationship with money (00:02:29)

- Geo-arbitraging in Mexico, Thailand, and Bali (00:09:37)

- Matt & Amy’s experience with healthcare while living in SE Asia (00:14:42)

- 90% savings rate in SE Asia (00:22:45)

- Why Amy started FI Freedom Retreats (00:35:41)

- Matt & Amy’s top tips for pursuing FI and living your best life (00:46:36)

Links

by Adam Preston | Jan 15, 2024 | Podcast

Summary

Today we’re joined by Ana Kresina, Head of Product and Community at Pearler and the Co-host of the ‘Get Rich Slow Club’ and ‘ETFs for Beginners,’ podcasts.

She’s also just become a published author with the book “Kids Ain’t Cheap”.

Some of the topics we cover in today’s episode are:

- Ana’s FIRE journey (00:03:37)

- Hitchhiking through Europe (00:07:09)

- Why Ana wrote a money book around raising kids or preparing to raise kids (00:10:02)

- The importance of normalising money conversations with children (00:23:12)

- Philanthropy and teaching your kids why giving matters (00:35:41)

Links

by Adam Preston | Jan 8, 2024 | Podcast

Summary

Today’s episode is something a bit different.

Terry, the host of the Wealth Time Freedom (WTF) podcast interviewed me a few months ago. The response was so positive from that episode that I decided to repost it on my show.

In this episode, Terry asks me about becoming a dad, my recent pivot with work and my new perspective on FIRE.

I found it to be a great conversation, and I hope you’ll enjoy it too.

Links

by Adam Preston | Dec 18, 2023 | Podcast

Summary

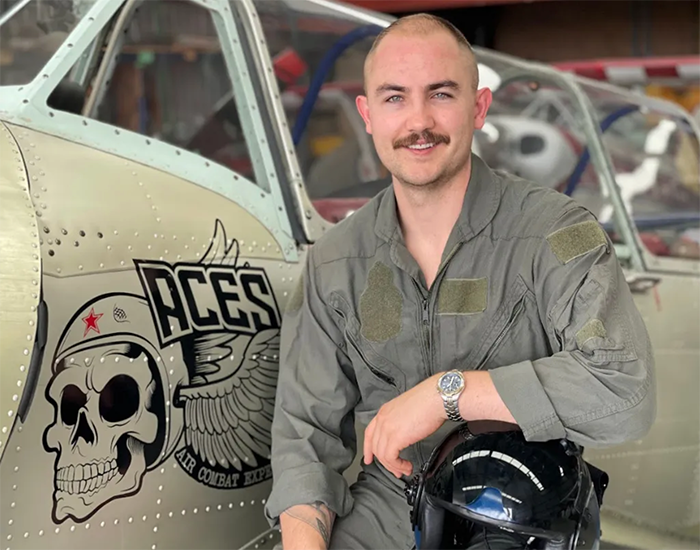

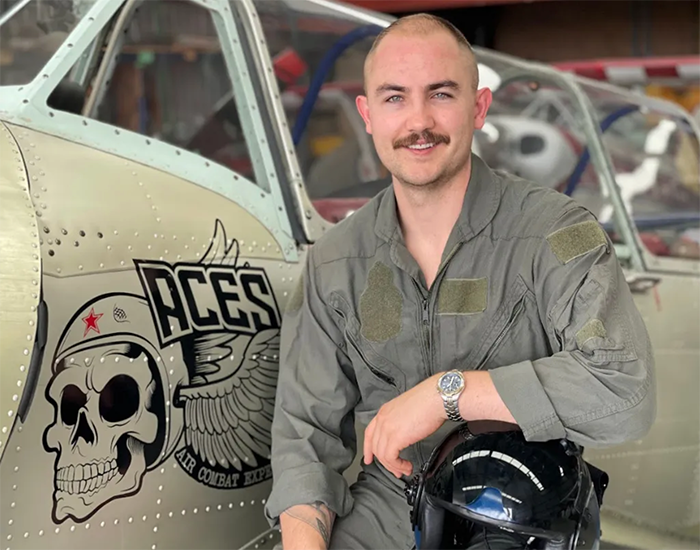

Today, my guest is fellow FIRE enthusiast/podcaster/blogger, Captain FI!

He’s actually been on the podcast before but I had to take that episode down due to ASIC’s 2022 guidelines.

Cap came and stayed at the Firebug household after attending the Rask event in my hometown. It was a lot of fun meeting and greeting others from the FIRE community and it was extra special to do so in my own backyard.

This was very much an improv podcast and I didn’t have any set questions.

We had a general chitchat about Captian Fi’s financial journey and other topics relating to FIRE.

Some of the topics we cover in today’s episode are:

- Who is Captain FI? (00:02:36)

- Investing a big lump sum into the share market (00:04:47)

- Finding a financial planner (00:16:01)

- Investing psychology (00:26:24)

- Reaching financial independence (00:41:26)

- Does your FI number include a paid-off house? (00:43:43)

- Selling shares to pay your living expenses (00:45:46)

- The psychology of spending (00:52:26)

Links

by Adam Preston | Dec 11, 2023 | Podcast

Summary

Today, my guest is none other than my accountant, Clayton!

Clayton and I have talked about doing this podcast for a while. I pay him thousands of dollars each year to help with tax planning, structuring our investments and businesses and other strategic decisions that ultimately help me reach FIRE sooner.

I thought it would be interesting to chat to him about what role an accountant can play when someone is trying to reach FIRE, and explore why certain decisions were recommended for our family in terms of tax advice and planning.

Some of the topics we cover in today’s episode are:

- The difference between an accountant, a tax advisor and a financial planner (00:05:36)

- The role an account can play in someone’s journey to financial independence? (00:09:08)

- Common financial structures for people wanting to improve their situation (00:11:56)

- Some of the advantages of a financial trust structure (00:14:13)

- The difference between tax minimisation and tax evasion (00:16:52)

- How can people get the most out of their accountant? (00:22:30)

- Easy things you can do to help you at tax time (00:26:58)

- How do you find a good accountant who’ll work with you to build wealth? (00:34:33)

- What are the main things to consider when starting a sole trader/freelancer business? (00:36:54)

- How often does the ATO actually audit people? (00:49:10)

Links

by Adam Preston | Jul 27, 2023 | Podcast

Summary

Today my guest is Carl Jensen who is better known in the FIRE community as Mr. 1500.

He’s a family guy living in Colorado with his wife and two young children and managed to retire at the ripe old age of 43.

Some of the topics we cover in today’s episode are:

- The story behind the name “Mr. 1500” (00:02:06)

- Investment philosophy and strategies (00:07:25)

- Carl’s interest in Tesla and EVs in general (00:18:44)

- Balancing frugality and fulfilment on the path to FI (00:23:49)

- The biggest benefits of achieving FI (00:26:31)

- How Carl handled the cultural challenges of pursuing early retirement (00:39:04)

- What Carl wishes he knew when he started his journey to FI (01:09:58)

Links