Summary

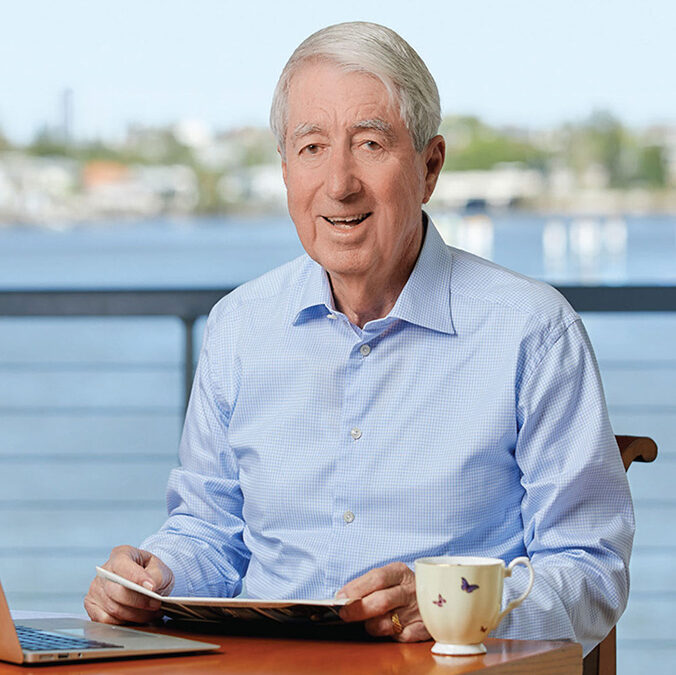

Today my guest is a legend in the Australian personal finance space. Noel Whittaker has been educating Aussies in money management and investing for over 50 years. He’s probably most famous for his international bestselling book “Making Money Made Simple” which has sold over a million copies worldwide!

Some of the topics we cover in today’s episode are:

- Noel’s upbringing and first investments (00:02:19)

- What made Noel become an author? (00:13:41)

- Noel’s investment choices and experience (00:18:08)

- Noel’s thoughts on Australian Superannuation (00:26:50)

- Annuities in Australia (00:42:46)

- The big issue with Lenders Mortgage Insurance (00:48:37)

- What’s happened to the financial planning industry and how would Noel fix it? (00:50:38)

Links

- Website – www.noelwhittaker.com.au

- Book – Making Money Made Simple

- Book – Retirement Made Simple

I thoroughly enjoyed the podcast. Thank you AFB and Noel. I have got all of Noel’s books so far, except the last one on Retirement. That will be my next purchase.

Thanks Louise 🙂

Great pod, AFB! Noel just talks sense. It was interesting to hear his backstory as well.

Awesome work – Loved the old Noel Whittaker books

Pre-Barefoot he was the go-to guy

Great podcast! And, wow, how sharp is he for an 82 year old!!!

I know right! If I’m half as coherent at that age I’ll be doing well.

Always love listening to Mr Whittaker, such a can deo attitide!

Thanks for this one, I really enjoyed.

The first money book that I read and only one in my house as a kid was Noel’s Making Made Made Simple. This was in the 90s. I read this when I was about 13 years old and I think this was instrumental in my financial journey. Noel would be a great guest to have back on in a future pod with questions from the community I think.

Thanks Nat.

I’d love to get Noel back on one day for sure

Agree with above post. Noel’s book Making Money Made Simple had a profound impact on me in the 90s. I read it two decades ago and it set the foundation of my financial journey.

My husband and I are now in our 40s and by following his simple advice over the years, our annual passive income are now higher than our expenses for our family of 4. We have achieved FI. Excluding our returns from super, our passive income are approximately 80-100k p.a for the past few years.

I have read his retirement book and am now maximising my concessional contributions while also making some non concessional contributions.

Please get him back again to discuss retirement strategies!

I’m glad you enjoyed it HP.

I’ll see if he wants to come back on 🙂