Property vs Shares: The Ultimate Guide

Preface: When I talk about shares in this article, I really mean ETFs. I don’t buy individual shares or day trade.

Collingwood vs Carlton

Sydney vs Melbourne

Magic vs Bird

Just some of the biggest rivalries the world’s ever seen.

But in the investing world, there is not a more hotly debated topic among avid investors. Property vs shares is a topic that everyone seems to have an opinion on, no matter how ill-informed they are.

Owning 3 investment properties and nearly $90K worth of ETFs (shares), I feel I have tasted the best of both worlds (and the worst) and can give you perspective to what I’ve learned over the last 5+ years of investing in these two asset classes. Both are great when used right, with pros and cons for various financial situations/types of investors.

But which one is right for you?…

Contestant 1: Property

The hometown favorite. This guy has been around longer than the stock market has existed!

You can touch and feel him, and your mum most likely loves the idea of you being with him. He has a strong track record in Australia and there is a firm belief that his value never goes down.

Now for realz:

Property is a great investment class but you need to be the right type of investor and have the financial stability for it to be used correctly. It’s an active investment. You’re going to have to do some sort of work to keep this investment running. You can minimize the work needed by hiring people but there are still headaches trust me.

However! Property has BY FAR the most potential to accelerate your wealth compared to shares for three reasons.

- Cheap leverage

- Ability to physically add value to your asset

- Skill and experience actually mean something (more on this below)

Cheap leverage is often misunderstood. Too often an article is published with statistics on how shares have outperformed property by comparing the % of capital growth and rental/dividend returns.

This is a dumb way to compare the two because I don’t know any property investors that buy real estate outright. It’s almost always bought with a loan. Which means the asset is leverage.

But what does this have to do with returns you might ask?

Here’s an example (for simplicity we are ignoring buying and selling costs and tax):

Property 1 is brought in 2016 for $500K with a 20% deposit of $100K. That same investor also buys $100K of shares in 2016 too.

Fast forward 1 year and the house is now worth $600K and the shares worth $150K

Let’s make it simple and say that the shares have no dividends and that the house had $0 net gain/loss factoring in everything.

The shares made a whopping 50% return in one year. The property on the other hand only made a 20% return.

Which investment did better?

Going percent wise the shares beat the pants of the house. More than doubled its return. But hold on.

If we actually compare how much money each investment made, it tells a different story.

It cost the investor both $100K to buy each asset. Property made a total of $100K in a year whereas the shares only made $50K.

This is because of the power of leverage. You technically can leverage with shares but not for the same cheap rate and you get nasty margin calls which you don’t get with property.

The ability to physically add value to your asset is where I would say active investors have a clear choice with which investment they choose.

Sweat equity is a proven wealth building technique that’s been around for centuries. You would have to be extremely unlucky to physically add value to your property and not have it go up in value.

Experience and skill is a very interesting point to look at when comparing shares and real state.

The entire premise of index-style investing goes something along the lines of:

“It’s impossible to beat the market over a long period of time unless your names Warren Buffett. Even if you do manage to do so, it’s almost always luck. People spend all day every day studying stocks and graphs and still get it wrong. So what hope do you have as an ordinary Joe Blow? Don’t even try to become a master of the stock market because there is only such a very very small percent of humans alive that seems to be able to get it right the majority of the time”

Now, here’s the difference. Skill and experience actually matter in real estate.

A skilled and experienced property investor has a very good chance of repeating his/her success over and over again. In fact, they most likely get better at it as times goes on. The same cannot be said for the stock market (except for those very rare people like Buffett). A skilled and experienced property investor will beat the pants off a skilled and experienced stock trader over a 7-10 year period 9 times out 10.

You can’t really be skillful in picking stocks. You definitely can’t be skillful in picking ETFs either. Sure, you can be smart about your allocations to reduce risk. But it’s not like an ETF investor of 30 years is going to blow out a brand new ETF investor in terms of returns. In fact, they should get relatively the same return. And that’s not a bad thing either.

Contestant 2: Shares

3 things.

- Diversification

- Low buy in and selling costs

- Easy peasy with hardly any management required

Have you ever heard the phrase ‘don’t keep all your eggs in one basket’?

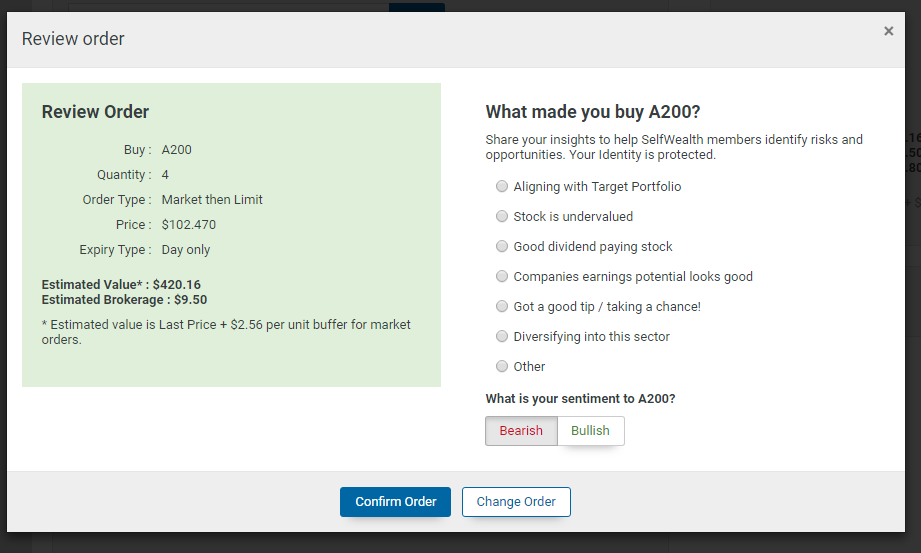

The stock market gives you the ability to buy things called ETFs which is a slice of a lot (>200) of companies bundled up into one very convenient share. So instead of buying 200 individual shares. You can just buy things like ETFs and you get that vast diversification in one transaction. Couldn’t be any easier.

And the good thing about the stock market is the low buy in and sell costs. I pay $20 for around $5K of ETFs. Times that by 40 and I would have paid $800 for $200K worth of shares.

Think about how much it would cost you to buy a unit for $200K. Probably around $10K if we use the 5% rule.

And then you would have to sell it for anywhere between 2-3%.

When you want to sell shares there is another brokerage cost of around $20 per sell (depending on how much you sell).

This low buy in and sell costs are very convenient when compared to real estate.

And the last point I want to make is also one of the most important points. How little of your time and effort you have to put in for it to make you money.

You buy some shares, ETFs of course and turn on DRP (dividend reinvestment plan) .

You sit back.

Walk the dog.

Go on a holiday.

Get married.

Have a child.

And check up on your shares after about 7-10 years and get a pleasant surprise that on average, they have increased by around 9%

They only thing required during these 7-10 years is declaring the income earned through dividends on your tax returns which you can download electronically. No need to keep your own records.

THAT’S IT.

You didn’t have to manage anything and your investments returned a respectable 9% over 7-10 years. This extremely low management style is a phenomenal advantage.

Pros and Cons

Property

| Pros | Cons |

|

|

Shares (ETFs)

| Pros | Cons |

|

|

So Which Ones Right For Me?

It all comes down to what type of investor you are. Are you an active or defensive (passive) investor?

To quote The Intelligent Investor by Ben Graham:

‘The defensive investor is unwilling, or unable, to put in the time and effort required to be an enterprising investor. Instead of an active approach, the defensive investor seeks a portfolio that requires minimal effort, research, and monitoring.’

My rough guess is around 95% of people are passive investors.

That’s because the majority of everyday people don’t really care for finance in general and would rather be doing others things they find interesting.

But since you’re on this blog, it means you find finance stuff interesting. What a sad bunch we are ?!

If you’re a passive investor I think the answer is clear.

Shares are clearly suited for the passive investing style while still giving the investor a great return.

Coupled with great diversification, low buy-in and selling costs, no loan stress, liquid asset (can get your money out in 2-3 days), it makes for the ultimate passive style investment!

But if you’re in that very small group of investors that want to take an active approach, you’ve gotta ask yourself.

Are you REALLY an active investor? Do you REALLY want to manage your investments for potentially the next 10-15 years? Will your circumstances change? What happens if you have a few kids? Do you still want to be managing your investments on 4 hours sleep?

Do you have a lot of capital lying around for a deposit?

How’s your cash flow position? Could you afford to pay an extra $1,400 a month when you don’t have a tenant in?

Is your job stable?

Do you have a big cash buffer in case anything goes wrong?

If you answered yes to all the above then maybe you are suited for investing in property.

I have made money using both investment classes. They each have their own merits and downfalls.

Whichever one you choose to invest in, just make sure you educate yourself before taking the plunge.

Good luck!