by Aussie Firebug | Jul 17, 2024 | Net Worth

I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

Super quick update for June.

It has mostly been Groundhog Day for us during this cold Victorian month.

Family, business, gym, Jiu-Jitsu and House of the Dragon every week.

In June, I hired my first full-time employee for my data company, which is exciting. The junior data engineer helps relieve some pressure on me to fix every issue and aligns with my vision of building a small team to solve problems and have fun with.

Lifestyle businesses can be a lot of fun, but they can also end up consuming all your spare time, which I’ve worked hard to free up through passive income. I found a great book to tackle this called Buy Back Your Time by Dan Martell.

I love running the data company and being part of the new co-working space in town. However, I don’t want these activities to take over my life. Hiring people to handle jobs I don’t love doing is a good solution to combat this.

Net Worth Update

Not much to report on here. Decent month overall, but the cash reserves took a hit.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

.

Shares

The above graph was created by Sharesight

It’s always nice to see the dividends hit the account. BTC takes a dip in June.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Networth

by Adam Preston | Jul 1, 2024 | Podcast

Summary

Today on the podcast, we have Amy and her partner Matt from FI Freedom Retreats, a five-day financial independence retreat in Bali.

This was a passion project born out of Amy’s love and gratitude for the F.I.R.E. movement and community.

Heads up, I recorded this podcast in January this year and haven’t released it until now because I’ve been distracted with other things. This means there’s a good chance there won’t be any spots left in the retreat for this year, but I think you’ll still find our conversation interesting.

Some of the topics we cover in today’s episode are:

- Amy’s fear-based relationship with money (00:02:29)

- Geo-arbitraging in Mexico, Thailand, and Bali (00:09:37)

- Matt & Amy’s experience with healthcare while living in SE Asia (00:14:42)

- 90% savings rate in SE Asia (00:22:45)

- Why Amy started FI Freedom Retreats (00:35:41)

- Matt & Amy’s top tips for pursuing FI and living your best life (00:46:36)

Links

by Aussie Firebug | Jun 8, 2024 | Net Worth

I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

I turned 35 in May, which firmly places me in my mid-thirties and the start of what some might call middle adulthood (35-49).

I’ve always been a ‘man with a plan’ kinda guy, and turning 35 got me thinking back to when I was 25, wondering where the younger Matt expected to be in 10 years’ time.

I had a few milestones I wanted to achieve:

- Married ✅

- Kids ✅ (one is a start)

- Home ✅

- Millionaire by 30 ❌

- Win a seniors flag ❌

- Live overseas ✅

- Reach financial freedom ❌

- Escaped the corporate grind ✅❌ (I still do some ‘grindy’ stuff for my business)

- Maintain good health and fitness ✅

- Write a book ❌

- Buy a Tesla ❌

There was probably more, but that’s all I can think of.

The 25-year-old me would probably be quite shocked that I haven’t reached FIRE yet. We were on track to get there well and truly before 35 with no show-stoppers in the way.

I had the right job, a low-cost-of-living area, and an amazing partner who was on the same page.

What happened, dude?

Well, heaps, actually.

The main factor being how fantastic meaningful work, blended with a better work-life, could be. This combination greatly diminishes the urge to race towards financial freedom.

I would have loved to have sat down and told my younger self to head overseas sooner rather than wait another four years.

That trip was the catalyst for a lot of great stuff that’s in my life right now.

I’m still working on the rest of the list that isn’t tied to a specific age (this includes my football career 😅).

You bet I’ve been watching the latest Model Y price drops with great interest.

I think the Tesla might turn from a red cross to a green tick any month now 😎🚗

Net Worth Update

Decent month all around with the big influx of cash coming from a recent contract.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Our passive income has never been this close to covering our expenses! It won’t be long before it crosses over. At that point, I might reduce these updates, as my goal was to continue them until our passive income exceeded our expenses. I’ll write more about this as we get closer to reaching this milestone.

Shares

The above graph was created by Sharesight

Solid month all around.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | May 11, 2024 | Net Worth

I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

April was yet another hectic month.

Honestly, I only have myself to blame, having started a new business on top of scaling up my data-focused one.

Meanwhile, my daughter continues to grow and bring us joy. There’s nothing better than waking her up each morning to see her beaming smile. It’s been beneficial to have that clear divide between work and home, thanks largely to the co-working space.

Funny enough, home/work separation has been the number one feedback we have received when asking members what they like about the co-work.

We put a lot of emphasis on building a community, incorporating natural light, and creating a beautiful work environment. However, nearly everyone has mentioned that they just can’t get work done at home—too many distractions, chores, and kids around during school holidays make it nearly impossible.

I can also relate to that in other aspects of my life.

During Covid, maintaining a consistent workout routine at home was a struggle. At the gym, it’s a whole different story. I’m there to get shit done!

There are fewer distractions, and seeing others crush their workouts is a huge motivator.

I hope things will start to ease up so I can spend a few weekends focusing on AFB content again. It’s been a while, and there are some fantastic topics I’m eager to write about.

Net Worth Update

In April, all assets took a hit except for cash.

One significant invoice came through in my data business that really bolstered our figures this month. It almost offset the downturn, but the markets were too harsh, and we still had a significant deficit.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

It was a relatively normal month with no major expenses or out-of-the-blue hiccups.

Shares

The above graph was created by Sharesight

The Aussie dividends hitting the account is always a nice feeling!

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Networth

by Aussie Firebug | Apr 15, 2024 | Net Worth

I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

We officially launched the co-working space in March.

This was a big moment for the team. After dreaming about it for over 18 months, it was very cool to see our vision come to life.

Something unexpected that crept up on me was the almost full-time nature of this venture. I’ve been at the space nearly daily, ensuring everything runs smoothly and doing walkthroughs for potential customers.

For someone who hasn’t needed to leave the house for five consecutive days in almost four years, it’s been quite exhausting, to say the least 😅😮💨.

It’s been a stark reminder of how draining a full-time job can be—even when it’s just working on a computer, for heaven’s sake!

Honestly, I’m tried just thinking about how most people manage five days a week, non-stop, for over 40 years, dealing with kids and everything else 😴.

Physical activity was one of the first things to suffer when we opened up. Since then, I’ve only managed to hit the gym once a week, which isn’t a great habit to fall into.

We’re working on a solution by trying to arrange for two university students from the area to help run the space. In exchange, they’ll get free study space for the year. This should free up some of our time, and I’m hoping to get back to spending three days a week on my data business.

In other news…

I’m looking forward to dedicating more time to AFB content in the upcoming months. There are a few podcasts currently being edited and plenty of unread emails, but my family and other ventures have been my priority these past few months. I promise new content is on the way soon.

Thanks for staying patient 🙏

Net Worth Update

Another exceptional month for BTC, accompanied by strong performances from stocks and Super, resulted in a fantastic month overall.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

I had some big bills to pay for the business but our lifestyle expenses were very low in March.

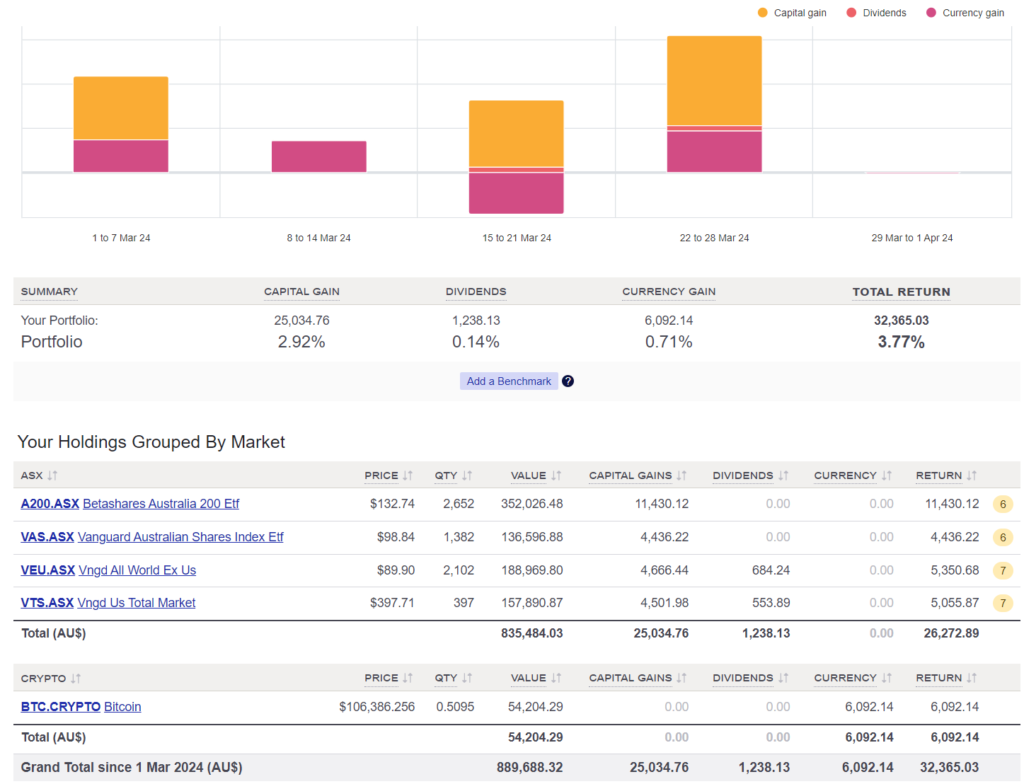

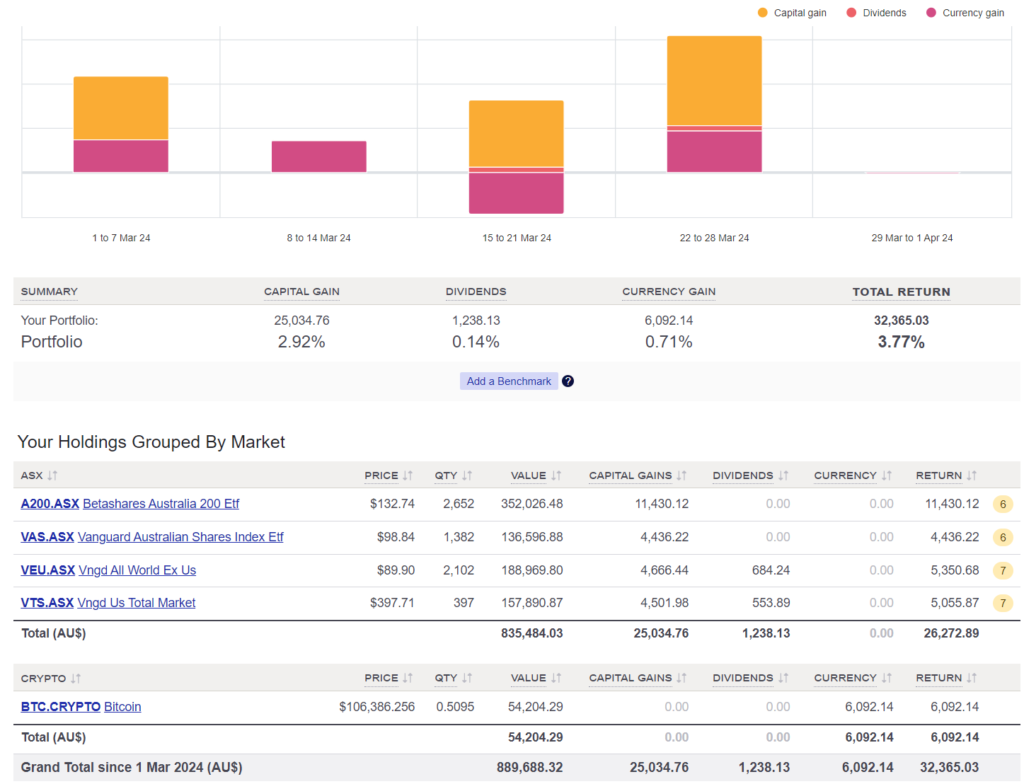

Shares

The above graph was created by Sharesight

Some nice dividends were announced in March which will hit the account in April.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Networth