I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

We officially launched the co-working space in March.

This was a big moment for the team. After dreaming about it for over 18 months, it was very cool to see our vision come to life.

Something unexpected that crept up on me was the almost full-time nature of this venture. I’ve been at the space nearly daily, ensuring everything runs smoothly and doing walkthroughs for potential customers.

For someone who hasn’t needed to leave the house for five consecutive days in almost four years, it’s been quite exhausting, to say the least 😅😮💨.

It’s been a stark reminder of how draining a full-time job can be—even when it’s just working on a computer, for heaven’s sake!

Honestly, I’m tried just thinking about how most people manage five days a week, non-stop, for over 40 years, dealing with kids and everything else 😴.

Physical activity was one of the first things to suffer when we opened up. Since then, I’ve only managed to hit the gym once a week, which isn’t a great habit to fall into.

We’re working on a solution by trying to arrange for two university students from the area to help run the space. In exchange, they’ll get free study space for the year. This should free up some of our time, and I’m hoping to get back to spending three days a week on my data business.

In other news…

I’m looking forward to dedicating more time to AFB content in the upcoming months. There are a few podcasts currently being edited and plenty of unread emails, but my family and other ventures have been my priority these past few months. I promise new content is on the way soon.

Thanks for staying patient 🙏

Net Worth Update

Another exceptional month for BTC, accompanied by strong performances from stocks and Super, resulted in a fantastic month overall.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

I had some big bills to pay for the business but our lifestyle expenses were very low in March.

Shares

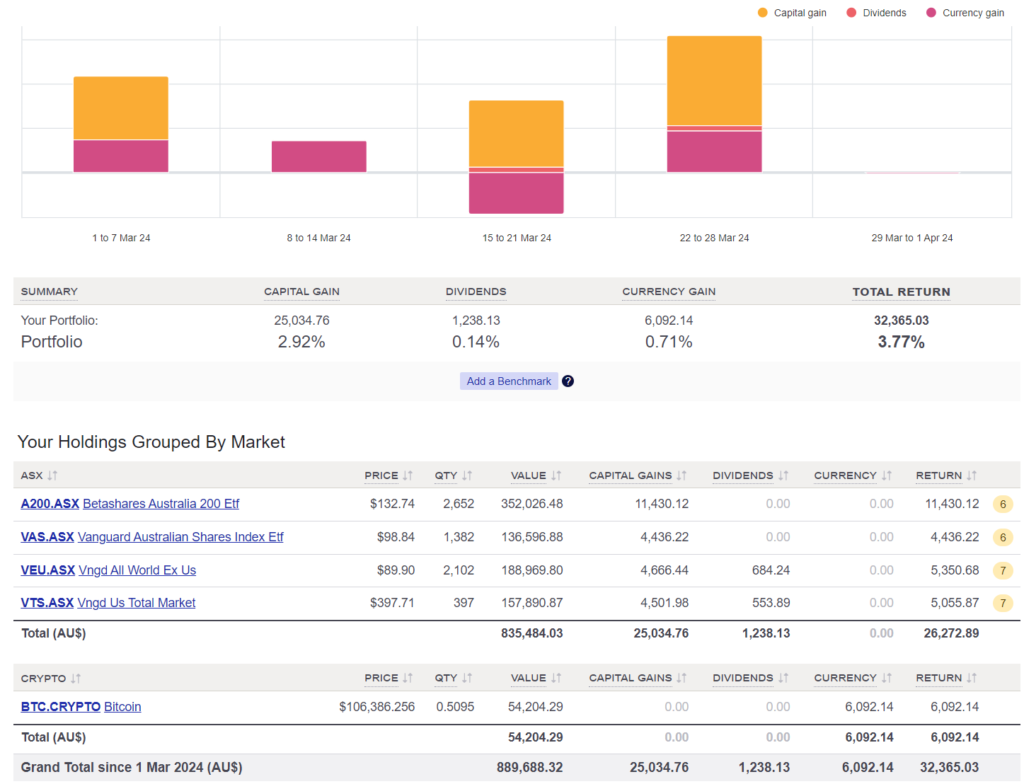

The above graph was created by Sharesight

Some nice dividends were announced in March which will hit the account in April.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

Great to hear the space is up and running! Sounds exciting but tiring 🙂

Aw man you almost have a total of 500k in the Aussie share market. That’s really gunna help with future income (past performance is not indiciative of future performance).

Hearing ya on the gym front too, work kids and study have hamperrd my time. It’s a double whammy not only cause of lost gains but lost money by not utilising the membership! One time the trainer called me a voluntary donation giver and that hit me right in the (soft stomach) feels. I have faith you can turn it around, that uni student idea seems like simple genius.

I’ll get back it soon! Sometimes ya gotta sacrifice to get going ya know 🙂

Quick one, how do you show previous month on sharesight? It only has current month and the last month (current date minus a month)

Looking forward to the podcasts

Well done on your venture mate. Look forward to hearing about your business adventures. Keep up the 🔥 burning.

What is the legality around paying someone with services instead of say minimum wage? I have no expertise in this but I’d be careful about it.

Good question. We will look into this better any formal agreement is made.

I was going to comment the same Herman, not just for the legal side but for worker’s compensation insurance so they and you are covered if there is an accident with them or a customer. It’s tricky, but surely there are some lawyers and insurers in the group who can answer this?

Still no plans to purchase an IP again? 😊

Not at this point.

Shares fit our lifestyle perfectly right now. They don’t require much mental bandwidth for investing, which is great because most of our energy is focused on our new baby and growing my business.

Bring on the poddy’s! Need my fix 🙂

It’s coming I swear!

Cant wait your bitcoin become a meaningful proportion of your portfolio without you doing a single thing 😀

At 5%… I’d say it’s already a decent slice.