I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

First off, I want to address a mistake from last month’s update.

I forgot to record the sale of 87 VTS units on 08/12/2023 in my personal spreadsheet during an extremely busy December period. Although it was recorded in Sharesight, I forgot to add that sale to my Google Doc File, which is where these updates are ultimately calculated.

I’ve updated the February figures, and all future updates will now include the VTS sale.

Special thanks to Pat and David for spotting the discrepancy and bringing it to my attention.

In other news…

I’ve been pouring my weekends into making our co-working space dream a reality, and we’re almost at the finish line for our big launch in April!

This project has been so much fun.

I’ve gone into business with one of my best mates, and we’re both building this dream to address a core problem in our lives.

We work from home and want to connect more with other creatives in our community.

The best part about this project for me was the incentives from both parties involved.

Of course, we need to cover our costs, and turning a profit would be a bonus, but what truly matters is creating an amazing communal working environment for us and other locals. At this point in our lives, this pursuit holds greater value than any financial gain.

And that’s the cool part. We are both in a fortunate position (financially speaking) to start pursuing fun and fulfilling projects that ignite the soul.

We worked all weekend last week, but it didn’t feel like work at all. I was with one of my best mates installing sound baffles, pumping Kanye on the speakers, talking smack, and dreaming of what this place could turn into!

If I think back to my previous ~10 years in the corporate world, work was never this fun. Ever!

On the other hand, I’ve hardly had any free time in the last two months (the podcast is coming back soon, I swear😅).

Between my Data business, the co-working dream and tending to my 5-month-old daughter… it’s been a tad hectic.

But at least we have secured our first member at the space 🥰.

Net Worth Update

Another big month for all our assets across the board, especially BTC.

BTC has surged to occupy more than 5% of our portfolio, a significant jump from its initial position of less than 2%. This year, it’s seen an incredible rally, and it’ll be fascinating to observe its trajectory in 2024, whether it continues to climb or perhaps takes a dip.

We don’t have any hard rules about when we would consider selling off part of our BTC split.

From the beginning, I’ve always said that I’m looking forward to actually using our BTC one day and not just hodling it indefinitely.

But I can’t lie… If BTC truly went to the moon, I would, at some point, have to reconsider our strategy and potentially sell some of it down to rebalance the portfolio. It would need to get up towards 50% of our portfolio, though, so it’s a long way off.

That’s only in an environment where I couldn’t spend BTC directly.

It’s a shame Tesla stopped accepting BTC as payment a few years ago. We would have legitimately considered paying for the new Model Y in BTC instead of fiat.

Maybe Musk will bring that feature back one day 🤞.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

We had a pretty low month expense-wise, but I spent quite a bit of the company’s money onboarding my first staffer, which was exciting!

The demand for data engineering work with government departments continues to grow, and onboarding some help was part of my overall dream of having a small local data team.

Shares

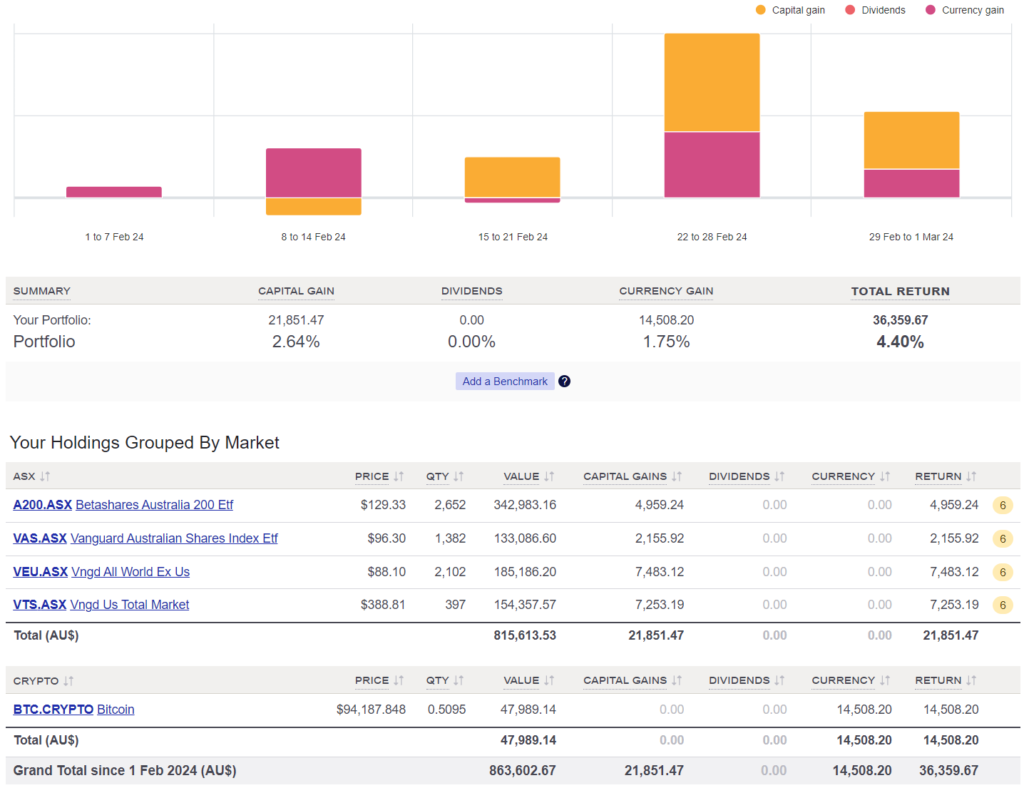

The above graph was created by Sharesight

It seemed like the whole world was on the rise in Feb.

Huge returns across the board.

We did not buy any shares in this month.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

love the update mate. You should consider reading out your net worth updates for the pod. I’d give it a listen!

Cheers Dickrog. I’m way too busy atm. I’ll be back on the podcast around mid year I reckon.

Looks like you’ve spent $16k on BTC and it’s returned you 200% return in two years. That must be the best performing asset you have.

Sharesight reports that our BTC has delivered an astonishing annualised return of 92.65% over the past two years.

INSANE 🤯

Nice post AFB. Would love to see an episode live from the co-working space!

Yep. A Live podcast is coming 👀

Have you ever disclosed your yearly income? Such things should be private on the one hand, but on the other that’s the secret to your success. You can’t ‘retire early’ if you don’t generate enough cash, and you’re specialised in tech, data it seems. So once you have high end skills, then it’s all quite inevitable as the cash comes in. For me, how to earn more would be something interesting to read about as that’s how all the “fire” people do it, no one does it on $60K a year. If you’re on $60K a year, you can be frugal and minimalist, but you’ll be working till 60+, and that’s what the ‘gurus’ leave out

Check this post out: https://www.aussiefirebug.com/savings-review-19-20/

I’ve published around 3 of those types of posts. I wanted to resume them, but it was hard during our trip overseas and with Pocketbook shutting down. Now, I’m too lazy to go back and reconcile all the numbers.

Off the top of my head, I’ve probably earned around ~$100K on average during the last decade. I had two years in London where I doubled my hourly rate, but expenses were also nearly doubled too.

I also wrote this article a while back that touches on how to increase your income here:

https://www.aussiefirebug.com/the-importance-of-increasing-your-income/

How much was your net worth when you decided to retire?

It depends on how you define retire. If you go by the dictionary… I haven’t retired.

My definition of RE in context of FIRE was always Retire Early from the Rat Race.

I stopped working for money at the start of 2021 when our Net Worth was $890,905.

RE = Recreational Earning was the term I heard the other day.

Thanks for the update, and the coworking space looks great,my wife would love the plants :).

On a another note, I couldn’t locate a link to your business name/website.

I logo is literally a plant haha.

Which business are you after? Our co-working space?

Your data engineering company.

Congrats on the working space progress – you must be getting excited about the impending opening. I’ve also seen crypto jump up in the portfolio percentage proportion to the extent where I really should pull my finger out about moving my holding off the exchange and into a wallet but it seems like such a pain. What you said about wanting to use your BTC transactionally was interesting but wouldn’t the CGT implications become an issue – more so for multiple small transactions rather than one offs like buying a Tesla?

Cheers Steve.

You do you, but I’d make moving my coins off the exchange a top priority. It’s a quick process, about 5 minutes, but setting things up and fully understanding it might take a bit longer, a few hours at most.

I’m keeping an eye out for when the Australian government decides to catch up with other countries like:

– Japan

– Germany

– Singapore

– Switzerland

– Portugal

In these places, if you use your BTC (without converting it back to fiat), you’re not hit with capital gains tax (in some, you need to have held onto it for at least a year).

It’s pretty unreasonable to expect folks to cough up capital gains tax every single time they use cryptocurrency. It’d never gain real traction with such restrictive regulations. I get why governments might be hesitant to throw their support behind cryptocurrencies, but I reckon it’s only a matter of time before they have to act (it might not necessarily be BTC, but some crypto will take the lead eventually).

Yes, I’ll edging towards making walletisation a priority! My reading of the ATO guidance is that even the payment of BTC for the network fee of moving coins from the exchange to a wallet is a CGT event that needs to be reported so I’m also hoping the policy changes.

There is a CGT exemption for personal use assets acquired for <$10k. So part of your BTC stack can be classified that way. But I'm no accountant, so no idea how to use that correctly

Hey mate, love the updates. We are in a pretty much identical stage of life as you guys with pretty much identical net worth – though different assets. We are heavier invested in BTC and PPOR and plan on converting some BTC to shares in the upcoming 18 months. Just a matter of picking a time we’re happy with. Good having your interests aligned with Larry Fink!

Hey mate, I’d be interested to know why you are thinking of converting a certain % from BTC to shares? Trying to generate some income?

It’s probably been asked before but why did you dispose all your investment properties? Thanks

You can read the blog posts for details.

https://www.aussiefirebug.com/investment-property-2-has-been-sold/

Shares are better suited to our lifestyle, as they are more passive.

The coworking space looks nice – lots of light and appears to be spacious and airy. Best wishes for the grand opening!

TYSM 🙂