I share these net worth updates to stay accountable, seek feedback on our strategy, and prove that achieving financial independence in Australia is feasible without relying on extraordinary luck or wealth. The table below tracks our journey from $36K in debt to reaching our goals. 🔥

We secured the lease for our co-working dream in November 🥳.

This was the first step towards our goal of creating a community-focused shared environment for small business owners and entrepreneurs.

There are so many unknowns when you start a venture like this one.

- What’s the demand?

- How much do you charge?

- What are the ongoing costs?

- What type of permits do you need?

I thought adjusting to life without the stability and assurance of a full-time job was challenging enough. However, pouring money into such an unknown project tops it.

But here’s the rub: it’s so bloody exciting!

There’s a profound sense of fulfilment that comes from being in charge of your own destiny.

I’ve also noticed something very interesting when discussing this idea with friends and family. People love to point out all the things that can go wrong and rarely see the potential upside.

And it’s not like they are doing it deliberatively to be nasty. There seems to be an inherent truth about humans: our operating system is wired more to avoid losses than to actively seek gains.

Many people are comfortable remaining in their 9-5 jobs, contributing to their boss’s dreams, rather than taking the leap to pursue and build their own.

That’s not to say there’s anything wrong with the old 9-5. But I do wonder how many kick-ass products/services have remained unrealised because those capable of starting them were too risk-averse to take the plunge.

FIRE has given us the financial courage to give this a go without worrying about my family suffering if it fails.

And even if we do fail, the satisfaction of having a crack will remain. In the end, it’s the effort and the journey that counts.

Net Worth Update

Wowee!

What a huge month for our portfolio, Super and BTC.

This is coming off a three-month slide that saw our net worth decrease by over $76k!

That encapsulates the essence of the volatility game in the stock market. It’s the reason we earn the returns we do as investors. Not everyone can withstand these fluctuations, and those who can are rewarded accordingly.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Booking another Bali holiday for next year saw a spike in our spending in November.

Shares

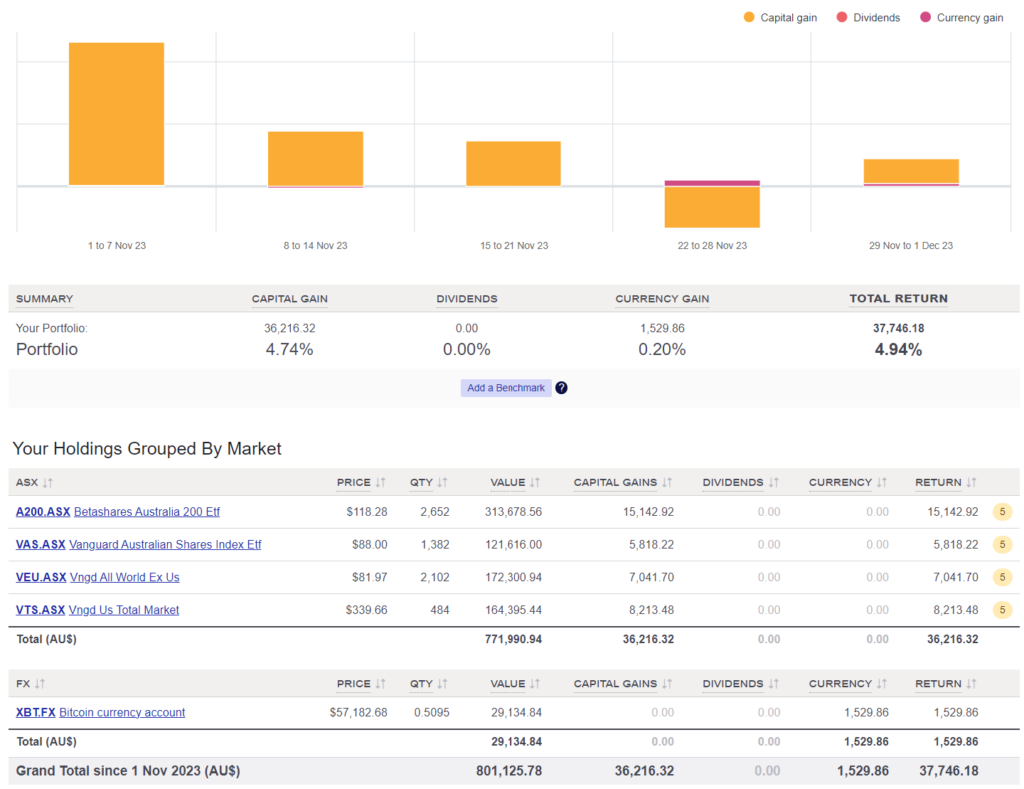

The above graph was created by Sharesight

It seemed like the entire world was on an absolute tear in November.

VTS has a whopping 5.26% gain in a single month followed by our Aussie shares (~5.05%) and then VEU (4.26%).

BTC continues to climb up and up increasing in value by 6.04%.

We made no purchases in November.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any impact other than some extra accounting work once a year.

The way things are going, if you liked November, you are going to love December

Looks like a Mr MM down under with the start up environment. Remember he had a brewery installed…

Watch the WeWork Movie

Lol, I’ve gotten a couple of emails about the comparisons.

With 3 pubs less than 100 meters away, I doubt we’ll be needing a brewery but ya never know 😉

“Don’t let other people’s fears become your own” is something I say to myself whenever someone tries, with good intentions of course, to discourage me from taking a calculated risk. Good luck with your new venture!

Thank you Ro 🙏

BTC is going to be your best friend very shortly.

Just letting you know that episode 88 with captain FI was my favourite episode ever to listen to!! Fantastic dynamic and discussion, great ep

Thanks Eliza,

It was a great conversion between friends with a similar mindset.

I guess that having a backup (your portfolio) allows you to think and pursue new ventures without the risk of ending up in a disadvantageous financial position.

I suspect I will also be taking bigger risks once I’m financially independent but yeah, I’ll stick to the 9 to 5 grind for a while longer.

And yes, finally some juicy market returns to get excited about.

I’ve read every financial independence book under the sun and my biggest takeaway out of all of them is the sole title of one of those books “Just keep buying”.

Cheers,

Gabe

Thanks for this..

Just wondering why you include your PPOR in your net worth calculations as it’s not an income producing asset.

I’ve seen other people in the fire community not including it in their calculations and I’m wondering what your thoughts are on it.

Thanks in advance,

Conor

I include it in our Net Worth calcs but not in our FIRE portfolio. That’s just the way I like to do it 🙂

Hey AFB,

Have you weighed up paying off the $390k PPOR debt using part of the shares?

Yep. We’re more comfortable leaving that capital in the markets.

Congratulations on the signing the lease – regardless of what happens it will be an amazing experience, so more many new things to learn / apply / tweak and an amazing moment to realise a dream. Honestly whilst the whole thing sounds scary I think just being able to co-work with different people will add so much for your work life. Also loved your podcast with the Passive Income boys helped give the experience the journey mindset.

Thanks Skushii,

I’m going to re-post that podcast on my chanel. Terry told me they got a lot of positive responses from that one.

Hi, for people like me who don’t know much about this concept, can you please explain what a co-working space is and how does it provide benefit, value and profitability? Thank you.

A co-working space is a shared office where people from different companies work together, offering benefits like lower costs, networking opportunities, and increased flexibility, making it a cost-effective and collaborative option for businesses and freelancers.

Hey Aussie Firebug, firstly thank you for all you share, its truly inspiring.

Fellow Aussie starting out here, I have some investments in vangaurd but only through personal investor. I would like to invest internationally. Do you have any recommendations and/or links for an online third party broker?

Thank you in advance and sending love to you and your family