I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula for retiring early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

We managed to squeeze in a winter escape to Bali in June.

In my July update from last year, I briefly discussed the extent of Bali’s transformation, and this recent trip only reinforced that impression.

Bali has always been the Bogan capital of the world to me. But that reputation needs serious reform.

Don’t get me wrong, you’ll still occasionally bump into the southern cross-tattooed, foul-talking drunk bogan in Kuta. But further up the coast in Legian and Seminyak lies pure paradise.

I was quite surprised to learn about its stellar reputation worldwide as well. Americans often choose to travel over 20 hours to vacation in Bali instead of opting for more “local” destinations like Mexico or the Caribbean.

Crazy!

During this trip, I was also on a reconnaissance mission. I have a strong desire to permanently incorporate a Southeast Asian destination into my lifestyle at some point.

In my line of work, I possess a unique superpower: the ability to perform meaningful work without being physically present. This blessing allows me to escape Victoria’s winter for a few weeks every year, all while maintaining a sense of productivity.

During a laid-back holiday like in Bali, I tend to get a bit bored. I reach my limit after a week or two of pure relaxation.

However, incorporating a few weeks of meaningful work into my stay changes that dynamic. That’s why I was eager to find a cool co-working space.

I found a place called GoWork (a rip-off of WeWorks haha) and it was awesome!

It cost me $14 AUD for the day but they have monthly rates which work out a lot cheaper.

Kudos to the interior designers responsible for this space as well. I took numerous pictures, drawing inspiration for when I eventually have the opportunity to venture into starting my own co-working space in Latrobe Valley.

In other exciting news, I’m thrilled to announce that I am finally organising a meetup for the FIRE community in my hometown of Traralgon.

The good folk at RASK are coming down as part of their roadshow tour. They’ve asked me to talk at this event and I thought it would be a great opportunity.

There are only 100 tickets available and 28 have already been sold.

You can use the code “15OFF” until this Friday to get 15% off.

Net Worth Update

In June, everything experienced an upward trend, but the main increase came from the renewal fees for my data platform license for another year.

I license the platform on an annual basis, and it has been 12 months since my client initially signed up.

I am currently working on two promising leads, and I am hopeful of securing the next contract before the end of the year which might mean another big bump but we’ll see.

.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

The expenses during June were relatively normal, as we had already paid for the Bali trip in the preceding months.

Shares

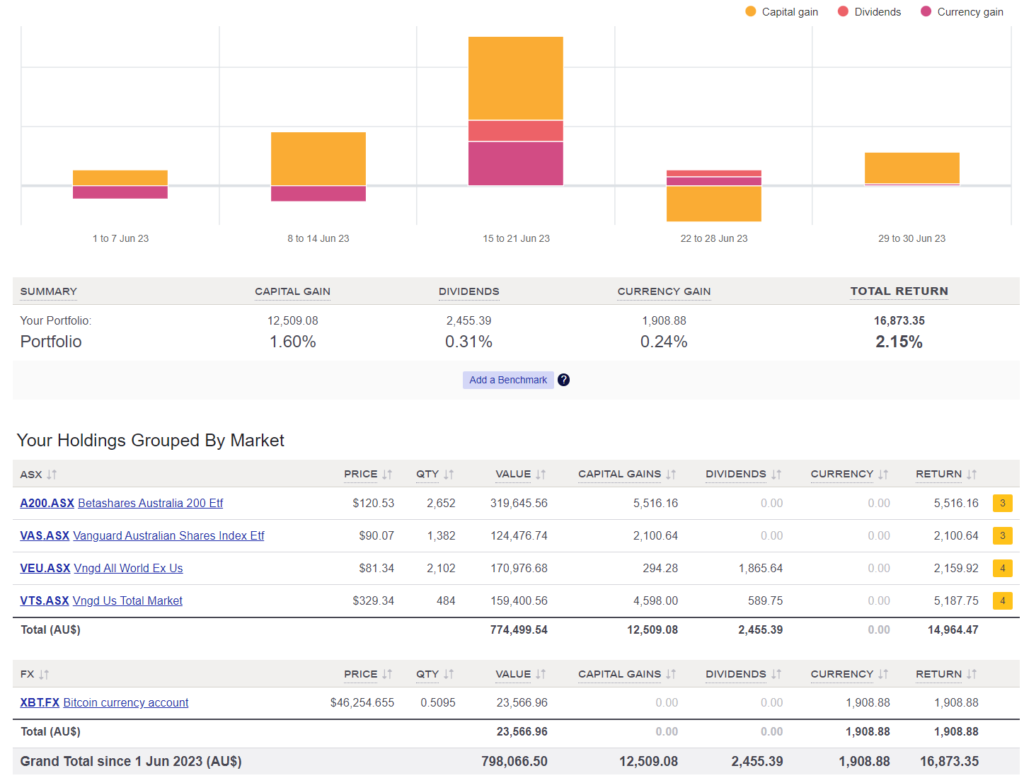

The above graph is created by Sharesight

Fantastic returns across the board!

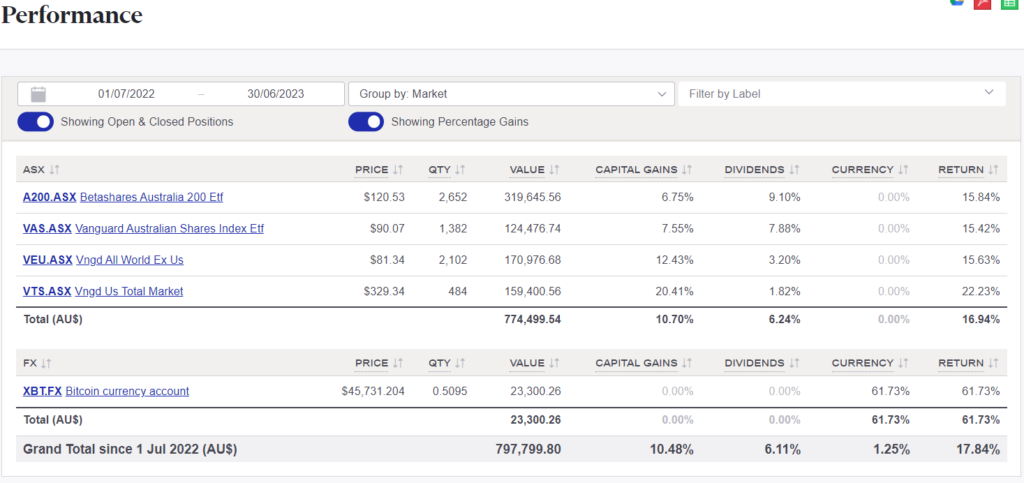

With the fiscal year now concluded, I made the decision to evaluate the performance of my portfolio over the past 12 months, and the results were surprising to me.

Nearly 17% from passive ETF’s!!!

Yeah, I know shares had a big year the previous year but still, pretty cool to see.

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

I hear you on the holiday stuff, after about a week I start getting a bit antsy lol and want to do just a little bit of something productive.

Ripper gains on the portfolio for the FY too!

Country VIC getting its own FIRE event that’s pretty snazzy 😉 I’ll be coming to Vic but it’ll be in early September, we should catch up if you’re around at that time

Cheers boss.

Yep, I made sure Owen added Traralgon to the list haha.

Fo sure mate, message me closer to the date and we can catch up 👌

When available, could you please post a link to the Country VIC FIRE event. I would love to attend and meet like minded people.

Link below.

https://education.rask.com.au/product/rask-roadshow-ticket-traralgon/?fbclid=IwAR0gEM4X7i12CU66aMmysQnmi8QqrUc72smYcdA-rnAhG2Ye7026HRl0MqQ

I am very keen to drive all to Traralgon just for this. But before I do that, can I ask if there are any Vic metro events in the possible near future? 🙂

Thanks Matt as always

There’s a good chance I’ll be coming down to Melbourne later on in the year mate 🙂

Very interested in hearing more on the “why” of Bali- have avoided and headed every where but – you’ve got me curious and hopeful! What is a typical Bali day for you?(not trying to make this trip advisor).

I guess it depends on what you’re after but for me perosnally, Bali scores highly on the areas that are important to us for a get away.

– Weather

– Food

– Beaches (they have cleaned them up a lot since I first went as a kid 20 years ago)

– Good surf

– Only 5.5 hour flight from VIC

– Natural Beauty

– Rich Culture

– Affordable Luxury

– Diverse Activities

This could either be a pro or a con depending on the person but Bali has become a lot more ‘westernised’ over the last 20 years.

My wife appreciated this because there’s now some Aussie cafe’s over there where you can get really good coffee or have an Australian brunch.

The resorts cater for kids really well too. My wife’s sister has two kids and they spent 4 hours a day in the kids center while both parents were either in the pool or reading their books. The center was right next to the pool (glass wall so you could see them) and they absolutely loved it.

I could go on and on but I think you get the idea.

Definitely driving down to Traralgon for this!

Are you buying more BTC? Its been an amazing year for the asset so far, almost 90% up. The halving coming up in APR 2024 and financial institutions filling for ETFs, it would be worth looking into.

Not at the moment. I really would like to see more place accect it. I want to spend my BTC eventually.

Nice…..$46K Cash to give the portfolio a decent bump

Captain FI seems to be having a similar run as yourself with A200, VTS & VEU (total return of $157,371 earned in passive income (dividends and unrealised capital gains) from the FIRE portfolio in the past 12 months and a 17% annualised return in the past year from just passive index investing, bringing the portfolio up to $1.05M

Looking at my own portfolio over the last 12 months (VAS/VTS/VEU) its a 15.10% total return according to sharesight

Great to see how everyone is progressing as the snoball gathers pace

Cheers Baz.

Yep, great year for most of us!

Just curious do you include the business as an asset? It seems as if you may reflect the renewal in your numbers? Is that in cash?

Reason being, I purely record my business interest as an asset based on the valuation at the most recent funding round. I wouldn’t consider it’s cashflow as any form of asset as it’s purely within the business.

I don’t include the company as an asset… yet. Maybe one day if it’s valued.

The cash did come from the business but it’s being paid to me as salary so I included it as part of our cash holdings.

Fair enough – makes sense.

ARR growth seems smart to put your focus into. Good luck with the prospects.

Hey Mate, I’m a long-time reader, love following your journey!

Couple of questions:

– Do you and your wife split shares? Do you purchase in her name at all for tax purposes? Would you recommend for someone starting out to split share purchases with their partner?

– I’m not sure if you ever mentioned, I couldn’t find it, do you have a FIRE number you’re looking to get to?

Cheers!

as I understand it, in the fire progress graph, he wants his investment income to consistently (ie. over a 12 month span) exceed his expenses.

Absolutely! Over the past 18 months, we’ve been spending money quite lavishly, ever since I came across “Die with Zero” (lol).

We plan to revert to a more ‘normal’ spending level by the end of this year. Before we left for London four years ago, our average annual spending was $50K. Considering inflation and other factors, it’ll be intriguing to see where we’re at these days.

AF, as a long-time reader also, I just want to share that four years ago, I sent you a message before your trip to London, encouraging you to make the most of the experience, spend money while you were there, and enjoy it to the fullest while you had the energy. I’ve often wondered if your perspective has evolved since then, but you never wrote back. It would be great to hear from you now and see how your views may have changed over time, and what advice you would give to someone that was moving to London in their 20’s but was also diligently working towards FIRE. Unfortunately some (not all) of the best experiences in London / Europe do cost money.

Hi Rob,

I’ve just found and responded to that email, mate. I’m really sorry it took me so long to get back to ya.

You’re right on the money dude. We put our FI dreams on pause during our O/S trip and I loved every minute of it.

I’ve been thinking about doing a life update podcast for a while now. It’s been ages since I did one and so many things have changed.

Watch this space 🙂

Thanks Ben, I’m glad you’re enjoying the blog so far 🙂

1. No we don’t. We buy all our shares through a trust. However, if given another chance, I would prefer a simpler 50-50 split. Trusts tend to complicate matters unnecessarily.

2. $1.25M in income producing assets (our FIRE portfolio).

Wow, nice looking returns AFB 🙂 for FY 23. My top 3 on the ASX were QAN, QBE, NDQ and in the US were Tesla, Amazon and Google which I only invested in few months back when prices went down. Can’t believe how well these have performed this year thus far.

Today (7th July) was the 2nd worst day on the aussie market this year – though had a winner with Lindsay Australia which has had an awesome week on the market up 14.52%.

I had shares in Accenture, which I sold part of my holdings to diversify in the US Market. This was an epic annoyance to transfer from Morgan Stanley to the US Broker on Pearler. Though I have to say Pearler were awesome in helping me sought this out.

One thing to note is ACAT and DTC transfers are not easy to do when dealing with overseas shares and those different policies adopted by local and overseas brokerage firms.

Keeping your porfolio simple is key and you provide great context on this through your portfolio history and investment strategy.

I was pretty happy with my portfolio performance for FY23 – achieved a 7.9% return on investment. I managed to invest $102K into my portflio over the last 12 months which is now 204K and expect the returns to go up after DRPs and compounding (pending the market performance for FY24).

My two investment properties achieved 7.37% return on investment for FY23 (IP1 – 8.70% / IP2 – 6.65% yield). This is only factoring in the returns from rent. After factoring in the management cost both will be positively geared in FY 24 and will start making a passive income. This is only achieved through myself holding IP1 for 14 years and IP2 for 5 years.

Always laugh when property advertisements or propery sales people mention a 10% yield on returns. This is not always true when you do the numbers and the costs that are associated with investing in property.

From my own experience returns are achieved through holding your assets over a duration of time and letting the compounding effect take hold.

Hi,

Do you only have ETF’s? is that just to keep it simple?

Yes and yes 🙂

Hey mate!

Where do you trade your ETF’s and how are the fees? I feel like I’m getting swindled!

I’m unable to disclose the name of my broker I’m afraid, as it could be perceived as influencing, and doing so requires a license from ASIC (Australian Securities and Investments Commission).

Just a suggestion… update your PPoR value quarterly by indexing it to the CoreLogic index, quickest and easiest way to mark to market to get a more accurate view of your net worth.

The unlisted asset space is filled with fund managers not marking to market. It doesn’t matter until it does and you need to liquidate it.

Great tip! I’ll check it out. Thanks

Well done with the balanced approach to building wealth and enjoying life in the process. I just have one question around the PPoR location. Are you concerned in the long term with living in a regional area and the distance to tertiary medical hospitals?

Hi John,

We have a decent hospital (LRH) that’s only 10 minutes up the road.

I know that some people have to be airlifted to Melbourne if it’s really bad, but it’s not something I’ve thought deeply about, to be honest.

I’d love to hear what your main concerns would be if you have any.

Cheers

My concerns are based on hospital distance for major ongoing treatments (hopefully not required, but you never know). I’m biased as my family has a chronic genetic illness (which was unknown until I had a family), which requires close connection with Royal / Monash Childrens.

I’ve moved several times (SE suburbs to North and then back to SE) for hospital treatments and my thinking is biased, but if I were you and possibly planning for a family, at least have a think about the possibility (hopefully not) of needing these hospitals.

Awesome Journey, I haven’t visited your page in a while but awesome to see the journey is still going strong. I’ve always liked the net worth chart and table converter. What tool do you use or recommend for that? viewing on excel just doesn’t cut it for me.

Thanks Jason.

I use Google charts but only becasue I have to embed those charts on this website. I’d just use PowerBI if I were doing it for myself only.

Any reason why you dropped the LICS ? I saw you were investing in them a few years ago.

https://www.aussiefirebug.com/election-results-and-strategy-2-5/

Halfway down that article explains it 🙂

Hey Matt,

Wondering how do you account the $46k cash, is that separate from your savings?

Hi Herman,

What do you mean exactly? I recieved $46K from work. It’s sitting in our offset. I count it as savings.