I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

One of the best things about semi-retirement are the new interests and hobbies you’re able to pursue with the extra free time.

2022 has definitely been the year of BJJ (Brazilian Jiu-Jitsu) tournaments for me.

I had always been interested in martial arts growing up. But between footy, gym and the occasional basketball/mixed netball comps, I never had the time to really pursue it. It’s been awesome training and competing with my mates for the last 20 months without sacrificing other areas of my life. Having the free time to discover new hobbies and pursue new interests is a real privilege!

I’ve been on a pretty solid training schedule in 2022 and part of me wanted to know how far I could go competing in the sport, especially since I’m not getting any younger 👴😅.

So with a bit of momentum behind me, I registered to compete in the Australian national Jiu-Jitsu championship in August.

It’s a knock-out style competition (sorta like Mortal Kombat haha) and my group had 16 competitors.

Every match was very difficult and I somehow ended up getting to the final round where I lost to a kimura submission.

I was pretty chuffed taking home the silver tbh.

At 33, I was one of the older competitors and I somehow hurt my back in one of the matches which has been bugging me for weeks.

I think this will be my last comp for a while because my body just doesn’t bounce back like it use to. I almost wish I could start again at 21 and see how good I could have been if I dedicated myself during my athletic prime but such is life, isn’t it. Ya can’t do it all!

At least FIRE has given me the free time to have a decent crack in my 30s which is all I can ask for.

August was pretty busy for me work-wise too. I’ve been heads-down-bum-up building/optimising the data product I’ve sold.

Quick reminder for the Sydney FIRE meetup on the 15th of October too!

We already have over 50 people coming and another 180 interested. I’m really looking forward to meeting the Sydney FIRE community in person 👊

The event is on Facebook here.

Net Worth Update

The big gain from this month came from our PPoR being revalued.

Our mortgage broker had been going back and forth with our bank to get us a better rate. The banks eventually came to the party after they officially revalued the house at $610K. Realestate.com.au actually has it higher but we’ll stick with the official valuation.

We bought the house in April 2021 (settled in July) and the gains are pretty typical of what we’ve been seeing over the last 16 months since. Our home’s value is probably on the way down with all these interest rate rises so I’ll be sure to keep an eye on it.

I gotta admit, it’s been a bit mind-blowing seeing the sold prices of similar homes around our area over the last 6-8 months. I remember thinking we had bought at the peak in April 2021. Never in my wildest dream would I have thought prices would climb to the heights they’re at now.

Once again, savers have been left holding the bag for asset rich/highly leveraged Australians.

The rest of the month was pretty uninteresting with some gains from shares and Super whilst Bitcoin and cash reserved dropped.

Cash continues to be high while we save for a new car. I pray to the gods each month that the second-hand car market returns to some sort of normality soon lol🙏

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Shares

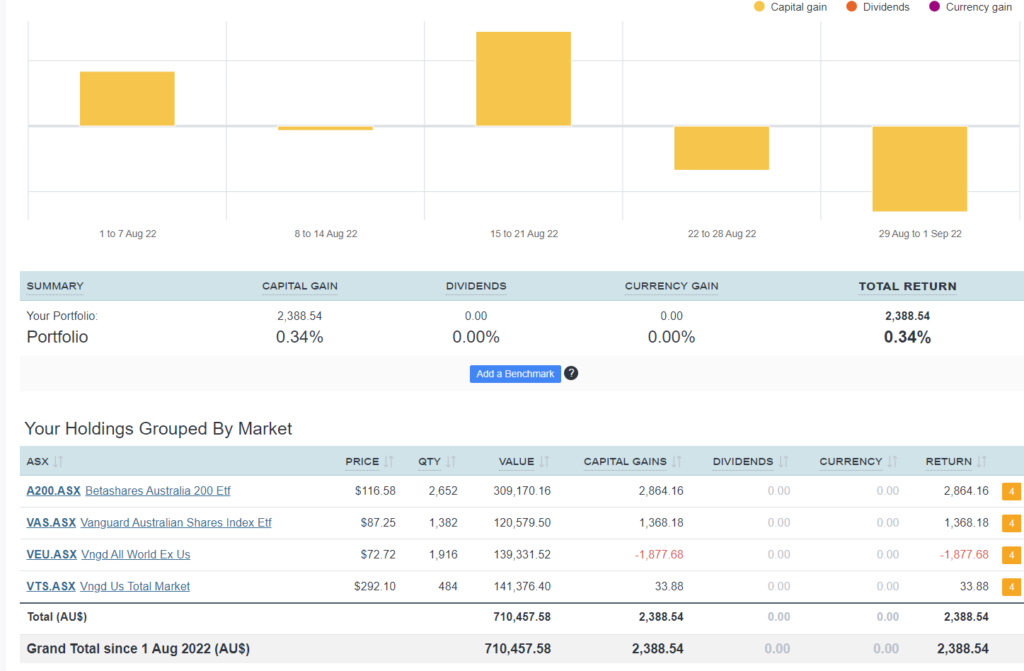

The above graph is created by Sharesight

Not much to report here.

There was a big drop at the end of the month that wiped out most of the gains. Let’s see what happens in September!

Question: Why do we have A200 & VAS?

Answer: We started buying A200 in August 2018 after Vanguard didn’t lower their MER to match A200. Practically speaking, A200 and VAS are almost identical so it makes sense to go with the lower MER. As an added benefit, I like the fund diversification between Vanguard and Betashares. We decided to hold both after making the switch since it doesn’t have any other impact other than some extra accounting work once a year.

Congratulations on the BJJ result mate, that’s awesome! Gotta say though that if you’re thinking your body doesn’t bounce back in your 30s it gets worse in your 40s unfortunately! All the more reason to stay in shape though.

Nice to see the portfolio up again, the property market is still going strong over my side of the state as well. I have to wonder if/when we’ll see a fall.

PS I’m gonna assume you mean mixed netball rather than mixed network? Not that you can’t have fun at mixed networking, but it usually doesn’t do much for your health in my experience whereas mixed netball can be a lot of fun AND good for your health. Maybe not your knees though!

I still have the strength to roll with the young fellas, little niggles just take way longer to heal haha.

Never slowing down is the key!

Haha yes… I did mean netball (edited now). Although mixed networking does have a ring to it doesn’t it 😂

Fantastic update – always look forward to these dropping in my inbox. I can relate to the “aging” effect on physical performance. Daily mobility to counter the effects of office based work are a stark reality now.

Not sure if it’s been covered previously but I’m always interested in individual’s view on future macro outlook versus FIRE plans/planning – the comment on savers versus highly leveraged is certainly a sticking point with my personal views also. Maybe the prudent will start to reap rewards of their efforts…

Hoping to make it to the Sydney meet up!

Thanks Chris!

It would be great seeing you at the meet up 🙂

I’ve been receiving your newsletters for a few years but only recently I started seriously taking FIRE actions. It’s a shame that I didn’t take concrete actions earlier – I’d be in a quite different position if I did.

Good to know there’s a meetup next month. Will try to make it. I’ll try to convince my wife to go too. she’s still suspicious about the whole FIRE thing so hopefully seeing more people in this community helps a bit.

Awesome dude. I hope you guys can make it 👊

Great update mate. I’ve always been interested in self defence style sport as well, just never had the conviction to actually sign up and give it a go!

Interested to know whether the higher PPOR valuation would result in your arbitrary “FIRE number” also needing to increase? The extra equity is great, but it doesn’t really help the monthly cash flow much (except maybe a lower rate because of the lower LVR?)

Cheers mate.

PPoR increasing won’t effect our FIRE number but it also won’t increase our FIRE portfolio either. It’s a bit meaningless really but I keep an eye on it to give an accurate picture of our entire position.

Dude, just go to a BJJ class. Trust me, you won’t regret it!

Thanks for the update AFB, notice you have added an explanation as to why you hold A200 and VAS given it is a recurring question from readers.

Just a question, why don’t you sell out of your $120k of VAS, pay down your PPoR loan, then debt recycle and redraw $120k to buy more A200?

This reasoning for this strategy can be related to the lower MER for A200.

Not sure of your cost base calculations for VAS but could be an opportune time to sell VAS and minimise CGT?

Let me know if you think firing this strategy up would be effective?

Wow, that’s not a bad idea Rex!

I might seriously look into that once our second loan returns to variable (currently fixed).

I’d love to debt recycle the remaining $200K of our other split loan.

And then all our debt would be recycling which makes accounting a lot easier.

Cheers!

Just wondering: what brokerage do you use for purchasing/holding your share portfolio?

Pearler mate

Hi,

Just a quick question. I notice you haven’t added to your share portfolio for a while and you are letting your cash build up. I realise you are looking to buy a car soon, but are you holding off buying any shares too for some reason? Or are you looking around 90k for your new car?

Or are you thinking share prices will fall later in the year? I couldn’t remember if you normally do regular purchases for dollar cost averaging.

Good spot.

Buying a new car is partly the reason.

But I’m also earning a lot less these days and Mrs FB is slowly winding back the hours too. We’re not sure what she wants to do next year.

With all that said, we feel more comfortable with a higher cash buffer these days.

When I had a normal job for the government I felt like $5K of savings was enough because I could always rely on my next paycheck. It’s a lot different when you’re working for yourself even though we have the portfolio supplementing our income.

Cheers

Thanks for the update. Almost 90k in cash for a car purchase? Are you going for a Tesla??

Haha maybe…

I’m grappling between a sensible second-hand ICE car vs a fancy new EV that can double as a home battery solution.

The 23-year-old AFB would be shaking his head in shame lol.

I’ve also got a few large tax bills yet to be paid plus Mrs. FB might not be working as much next year so having a large cash buffer helps the sleep at night factor.