I publish these net worth updates to keep us accountable, have others critique our strategy and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

An old neighbour from my childhood neighbourhood (where my parents still live) passed away last month.

I don’t know the exact details but my understanding was that it was very quick (less than 6 months from diagnosis), unexpected and has left a big hole in their family.

The man that passed away was around 10 years younger than my dad.

People always tell you to spend time with your aging parents, but sometimes you need a wake-up call.

A major reason my wife and I came back to country Victoria was to spend more time with our parents and extended family and I’m so happy we did.

My wife and I are so lucky. All four of our parents are still with us and even better still, are fit and healthy to enjoy experiences.

Being able-bodied is so important. What’s the good of living till you’re 100 if you’re hospital-bound from 60? You can still enjoy some experiences but the bulk of them are gone at that stage. It’s one of the biggest lessons I took from reading ‘Die with Zero‘ the other month. Allocate your bucket list items to certain decades throughout your journey because life doesn’t always pan out like a movie. The vast majority of people are not going to retire at 60 and then pursue all their grand plans. You run out of energy. A snow trip to Japan is going to look and feel a hell of a lot different when you’re 50 as opposed to 25.

The entire goal of becoming financially independent is to free up our time to live a happier and more fulfilling life. And one of the greatest joys of claiming our time back is to spend it with loved ones.

My dad asked if I wanted to go with him to the Footy in June. It was an afternoon game on a Sunday at the G and he was heading up to meet some mates and cousins.

I’m pretty sure he asked me to come to a game last year but I just had too much on and was trying to get my freelance business off the ground so I declined.

If I was still working full time, my first instinct would be to think about the 2+ hour train ride and how buggered I’d be for work on Monday morning after getting home late on Sunday.

But I don’t work Mondays anymore 🤘

We headed up together on the train and watched with glee as our beloved Magpies dismantled the ladder leaders, the Melbourne Demons.

You can say what you want about Melbourne, but it has to be one of the best sporting cities on the entire planet! And there’s nothing better than watching a big game at the G!

We made our way down to Swan Street in Richmond for a feed after the game and the atmosphere was electric.

The magpie army had taken over Bruton Avenue as the poor Melbourne supporters were subjected to our famous war cry…

“COOOOOOOOOOLLLLLLLLLLLLIIIIIIIINNNNNNNGGGGGGGGWOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOD”

One of dad’s best mates is a Dee’s supporter which made the victory all that much sweeter.

We ended up at the Corner Hotel in Richmond for a pint and to talk about Collingwood’s path to an inevitable 16th premiership.

And as I was downing my Guinness beer, talking to dad about the game, arguing that De Goey doesn’t do enough or that Cox needs to be more consistent, I couldn’t help but think… this is what it’s all about.

Net Worth Update

Mamma Mia!

All of our assets got crushed in June to give us our second-worst monthly drop of all time. I keep sounding like a broken record but luckily we’re still in the accumulation phase so depressed asset prices are a good thing.

But if the market continues this decline, I’ll have to retract our millionaire status 🙈

We also bought around $2K of Bitcoin in June even though I personally think it’s going to drop further. There are talks about the SEC (Securities and Exchange Commission) in America finally regulating cryptocurrencies. I think this could be a huge step in its adoption. If the SEC (and consequently other commissions around the world including ASIC) come out and say that Crypto is an official financial asset, it will give this new technology legitimacy in the eyes of a lot of people. It could also start the process of consumer protection and eliminate thousands of scams that have infiltrated this technological breakthrough.

I’m a free-market libertarian at heart but I don’t think even the most staunch Bitcoin maxi would advocate for zero regulation.

Our cash holdings are way too high for my liking but I still have a few big tax bills plus we’re saving for a car. Not much I can do about it for now.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

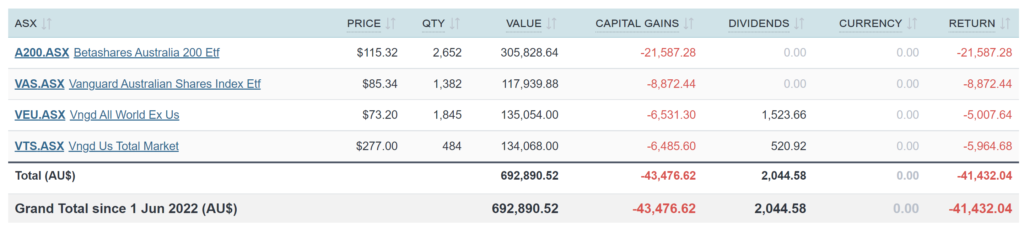

Shares

The above graph is created by Sharesight

Big drops all around.

We didn’t purchase any shares in June but I’ll be topping up in July for sure.

The Mighty Pies!

That’s what FIRE is all about. Spending time with your loved ones, when you want.

Everyone’s portfolio has copped a shellacking this month, it looks bad, but in the overall scheme, it’s nothing.

I lost my dad last year. We only had the diagnosis 12 months before he passed so I took redundancy from my work and hubbie went back to work. Best decision I ever made so this post is so special and sweet to me. Your right, friends and family and memories is what its all about! I’ll check out that ‘Die with zero’ reference. Thanks firebug

My pleasure Belinda. Sorry to hear about your dad.

Hey AFB,

Love the updates (except for the Pies).

I lost my dad about 6 years ago, but great to see you having the quality time.

With the net worth, is that just for you or you and your wife combined?

Thanks Will.

It was originally just me and then I joined finances with the wife in 2016 around August I think. I wrote about it in that update if you want to go back and look.

Everything since then has been a combined effort 🙂

Super lucky to have all 5 parents around. My toddler has just 1 living grandparent, you cherish any time you have.

Glad you got to go to a game

Lucky indeed. Hopefully many more games to come!

Hey mate! Long time reader, first time writer. Curious as to why your super balance is so low comparable to what I estimate is a decent combined salary? Assuming you’ve been diverting funds away from super into shares but keen to understand. Thank you!

Cheers Dane.

Is it that low?

I haven’t been contributing to it since 2018 because I’ve been overseas and I now work for myself. I thought it was pretty decent though for a couple that’s 33 & 30 no?

I actually agree… for combined super DINKS seems kind of low? I thought it was just your super and not Mrs FB. I’m no super expert though!

WTF .. mate!? Been following your FIRE journey all this time and it turns out you’re a flipping PIE supporter?!!! This changes everything!!!!

Yep, I’m one of the good guy’s mate 😁

⚪⚫⚪⚫⚪⚫

Hey AFB,

What do you plan on using now that pocketbook is shutting down? Any decision on electric vs non electric for the car?

I’m still figuring out what system we’re going to use. But I’ll have an update on that once I know.

And we haven’t made a decision on the car just yet. Still looking 👀

Hey Mate,

The markets will most likely be smashed even further with further rate hikes. My personal portfolio & Super got a good whack as well ;). However, stay your course and this too shall pass! On Crypto, i will urge you be cautious 🙂

Yep, you’re mostly likely right.

Out Bitcoin holding is so small that it won’t move the needle if it crashes to zero. I’m not losing a wink of sleep over that slice of the pie.

So true on time with parents… I see a Model Y in your future.

Life expectancy is falling sharply. Its foolish to base your life expectancy based on the baby boomers as there were no burnout lifestyles and stressful busy life during their time. My guess is most millenials won’t be able to reach 65 to access their super. Stress, viral diseases, drug side effects, etc will get them much earlier. Its fools paradise to keep saving for a retirement that you won’t be able to even reach.

Geeze, Mark Don, that comment was a bit of a downer!!! Lighten up – life’s too short… especially if what you’re saying turns out to be true. Go out and enjoy yourself while you still can!!!!

Personally, I think that attaining FI as quickly as you can means that you’ll have the freedom to enjoy your life in however many years you’ll have left. I’m 58 and retired a couple of years ago, so I have a reasonable idea of what I’m talking about.

But COLLINGWOOD?!? Urk.

C’mon, what’s wrong with Collingwood Frogdancer 😜

Hey AFB,

Love your quote “we’re still in the accumulation phase so depressed asset prices are a good thing”. It is hard to keep positive during uncertain times.

Keep up the great content and net-worth updates.

Cheers,

Will do Nath 🙂

Hi AFB,

Regarding your PPoR liability $401694, how high will your mortgage interest rate need to get to before it becomes beneficial to pay out the loan rather than pay the interest on the loan?

Would you pay out the loan or just offset it (for redraw) when the interest goes down again?

I appreciate your efforts to help educate/inform us and support the community.

Regards and thanks Mark

Good question.

I’d put it in the offset for starters.

And the interest rate would have to get up to around 5-6% I reckon. At that point, I’d feel more comfortable saving cash and sitting it in the offset. It would also depend on how high inflation was.