I publish these net worth updates to keep us accountable, have others critique our strategy, and show that reaching financial independence in Australia is very doable without winning the lotto, having a high-paying job, or inheriting a wad of cash. The formula to be able to retire early is simple, the hard part is being consistent and sticking to a plan for many years. The table at the bottom details our entire journey from being $36K in debt all the way until we reach 🔥

It wasn’t too long ago that I was complaining about my lack of social interaction because I worked from home.

Well, let’s just say I’ve had a change of heart ever since the cold snap set in during July.

There’s nothing better than wearing trackies and a hoodie when it’s freezing outside and enjoying a cuppa/hot Milo during work. Our solar panels provide free electricity during the day so I’m able to run a little heater in my office guilt-free and I try to get all the washing/drying done when the sun is shining.

Mrs. FB, I, and some friends wanted to escape the cold during the holidays so we ended up booking a trip to Bali in July.

Quick PSA too. Mrs. FB needed to renew her passport and the whole process was a nightmare that took over 5 weeks. We had to go down to the Melbourne passport office TWICE! If you’re thinking about traveling soon and need to renew your passport, I’d suggest you start the process ASAP.

We ended up booking a 7-night stay in Legian, Bali.

Below are some of the pics from the trip.

I lot has changed since my first visit there as a 12-year-old with the fam.

My memory of Bali was a dirty, busy, and loud holiday destination that heaps of Aussies went to so they could drink cheap beer.

The island of Bali has had a really interesting transformation in the last 24 months. I couldn’t believe how clean everything was compared to my last visit nearly 20 years ago (damn I’m getting old). I spoke to a few locals about COVID and what happened to the place when all the tourists left.

They told me that a lot of people went back to farming. Either starting their own farms or helping other farmers out during the last 24 months. There was also a big push from the government to clean up the streets and beaches.

I was blown away by how nice the beaches were. I swear they didn’t look like that 20 years ago. I’m not just talking about lack of rubbish either. The quality of the sand and lack of rocks were what stuck out in my mind. Maybe I just went to a few crappy beaches as a kid but Jimbaran Bay, for example, had a world-class beach that would rival most Australian ones. And when you’re eating a seafood banquet on the beach for ~$40pp including cocktails in 27° weather, it’s hard to complain.

I also noticed that the island is becoming a lot more ‘westernised’. There were a lot more cafes and eating spots that cater to Australian tastes more so than Indonesian. This is either a positive or a negative depending on the type of person you are but we thought it was nice to have that option.

My mate and I did a bit of surfing which was awesome. I’d love to dedicate a few weeks to get a decent base because riding across the wave looks like so much fun (I can only do the white water for now).

The wife and I were so impressed by Bali that we’re thinking of heading back during winter again next year. Hopefully for a bit longer that time around. I would love to incorporate some sort of east Asian trip once a year where we live somewhere hot for a few weeks. I’m lucky enough to be able to work out of a laptop so I don’t see why not.

In other news, I sold my first data product in July which is a big reason for the big bump in this month’s net worth.

I can’t go into contractual specifics, but this is a bit of a milestone for my business. It signals a move away from consulting and more into product delivery. I think I’ll always consult to a certain degree, but I’ve had dreams about building this product for years and it was awesome to see there was a demand for it in the market.

I signed a three-year deal with my first customer 🥳

And lastly, I’ve been talking about it for years, but I’m finally coming up to Sydney and I’m going to organise a FIRE meet-up.

I’m heading up to FinFest on the 15th of October so I thought I’d kill two birds with one stone and organise a meetup for that night.

The event is on Facebook here.

All details and updates will be posted there. I’m really looking forward to meeting some of you guys in person 🙂

Net Worth Update

The share market and Bitcoin all had healthy gains in July but it was our cash balance that received an out-of-the-ordinary bump.

The cash injection came from the sale of my first data product being sold on a three-year deal (the first year being paid for in full).

Without going into specifics, I’m basically selling ready to consume data models to the customer. It’s a DaaS (data as a service) business model where I’m taking care of all the data engineering, architecture design, ingestion, modeling, and serving for a fixed cost. The customer receives the models via an endpoint and away they go.

I’ve had this idea for some time now but it wasn’t until I worked in London and dealt with companies there were running this exact business model did I know it was really viable. I’ve been tweaking the product for over a year and it’s really exciting to land this first deal.

The plan is to sell the product to a few more customers so I can have enough recurring revenue to justify hiring someone. I have a dream of running a small Analytics company of 5-8 amazingly talented and fun individuals where we can solve fun problems. I want to foster a similar working environment that I was lucky enough to have experienced overseas. That’s my dream for this decade, work-wise.

Cash is really high atm. It’s a combination of saving for a car and having money on hand for my tax bill. We also purchased around $3K worth of Bitcoin in July.

*Expenses include everything we spend money on to maintain our lifestyle. We do not include paying down our PPoR loan as an expense, only the interest

*Investment income is simply 4% of our FIRE portfolio divided by 12

Shares

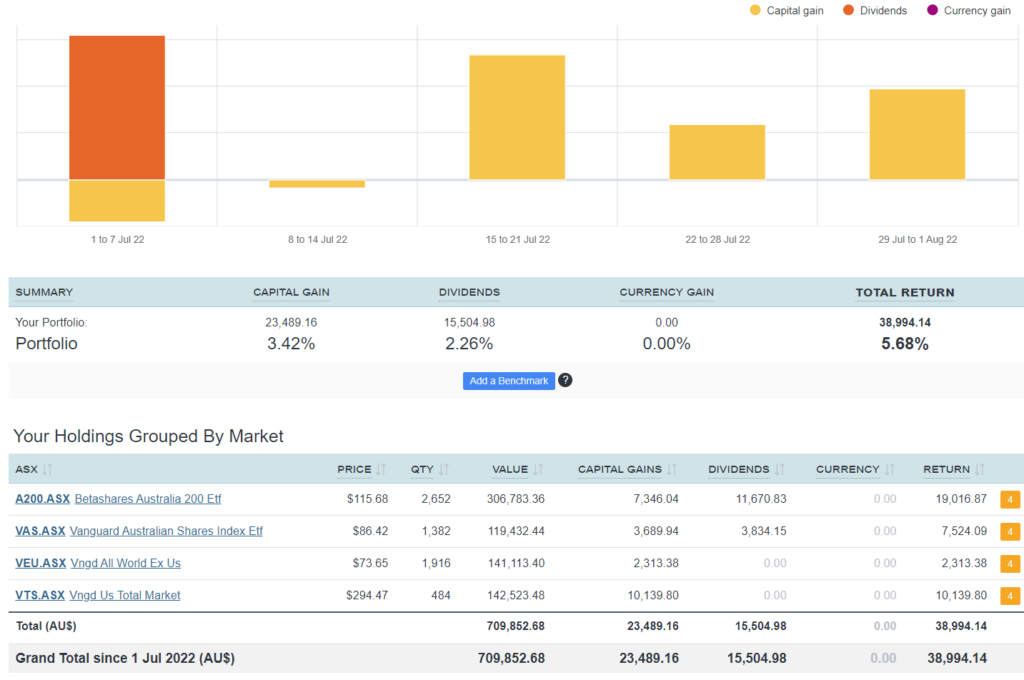

The above graph is created by Sharesight

Ohhhh Eeeeee!

$15.5K of dividends baby, plus some strong growth from our international shares. If only every quarter was as good as this.

Our overall portfolio is still down from the all-time highs at the start of the year so it’s all relative but you’ve gotta celebrate the wins when you get them.

We purchased $5K worth of VEU in July because that was the most underweighted split.

There is no better way to FI than running/building a business. Skimping, saving, scrapping to millions sucks and takes too long.

Love your work.

Well done Aussie Firebug, so happy for u, just thought I’d mention Fiji is a fabulous destination, only 5 hours from Melbourne , we just returned from Plantation Island, just magic and so relaxing. Thanks for all your sharing, I’ve learnt a lot Cheers Margie

I’ll have to check out Fiji one day. Thanks for the tip 🙂

Really exciting about your business, data work seems to be exploding at the moment so sure they’ll be lots more work coming in over the next year or so.

I’m looking to do something similar-ish with a side-hussle business providing Power BI models/packs so would love a podcast on your business if you wouldn’t mind sharing your learnings etc.

That’s awesome! I love PoweBI aswell and have tried to offer it to small business but they don’t seem to have enough data/reason for the data modelling :/ Not sure how to get into that industry, so best of luck and I hope you do well

Thanks Jon,

Funny you mention that. I’ve had a few people ask and I think I’ll do a podcast about careers in data. Seems to be a pretty popular topic atm

Congrats on the first sale of your product, so exciting!

Question re your shares. You have both ASX200 and VAS, both similar ETFs delivering similar returns dividend-wise – any preference for one over the other? In hindsight of having had both for a bit of time now, would you recommend one over the other?

A bit surprised you think 5 weeks is a long time to get a passport renewed? That seems pretty quick really given there has been a worldwide pandemic and now everyone is back travelling and let their passports lapse.

which world you are living in. My native country renewal take 24 hours. New passport takes 2 weeks

Hi Kelly, agree..I remember my last passport took several weeks and that was ‘pre Covid.’ Usually passports are for ten or so years, so you can just plan ahead and get it before you need it. No worries

Well done on your first product deal mate!! It’s onwards and upwards from here…

Also, hoping to catch up with you in Sydney!! Will keep an eye out for further details. Btw, I am in data space as well 😉

Nice!

I’m really looking forward to meeting people in person in October 🙂

Great job! May I ask if you will do a 2021/2022 savings/income post?

Cheers Damian.

I haven’t done a savings/income post in a few years for a number of reasons.

It would be tough for me to do one since Pocketbook shut down. I need to find another expense tracking app. I’m going to try to do one for next year once I find another system.

Pearler is now making one, obvious choice

Have you had a look at Moneybook we’ve been using that for a few years now after transferring from pocket book.

Congratulations on your great achievements to date. I know you are a big fan of Peter Thornhill who is a big advocate of investing in LIC’s which he says are better than ETF’s and managed funds for many reasons. Therefore what are the reasons you decided to choose to invest in ETF’s for your wealth building instead of LIC’s?

LICs can be really dodgy. I had some money in one that kept raising dividends and thankfully i sold out, but today its share price is lower than at inception 7 years ago. Maybe some are good, but the bad ones are really ‘avoid.’ But I don’t personally think it’s good to only invest in ETFs either – taxes are more complicated with them for a start..

Following up on this, I heard Peter Thornhill says he only invests in about 7 of the biggest and safest LIC’s that have been around for a long time (50+ years) and have increased their dividends every year. This ensures a high level of safety of investment.

Hi Muz,

I explain my move in more detail in this article here.

Cheers

Hi AFB,

Curious as to your thoughts on whether you think now is a good time to pay off your remaining HECS debt? As HECS is pegged to CPI would you now view paying this off as worthwhile given that inflation is at 6.1% and the markets are a bit shaky?

Cheers,

We’ll never pay off the HECs debt earlier than we have to. But that’s just us.

If we had paid off all other debts and CPI went through the roof (over 10%)… I’d consider it.